Submit your review | |

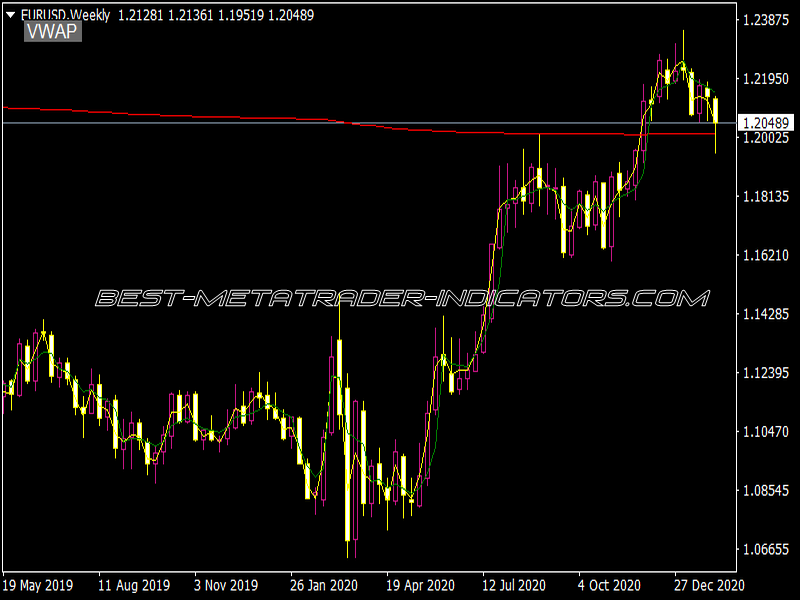

The Volume Weighted Average Price (VWAP) is a technical trading indicator that provides an average price a stock has traded at throughout the day, weighted by volume. It is commonly used by traders to assess the trend and determine entry and exit points, thereby aligning trades with the broader market direction.

To effectively use VWAP in trading, consider the following rules:

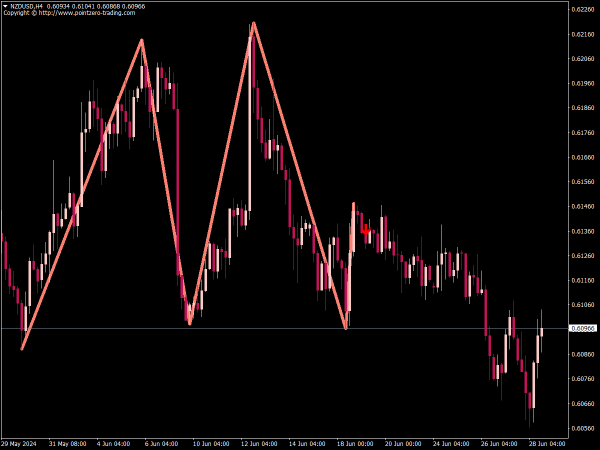

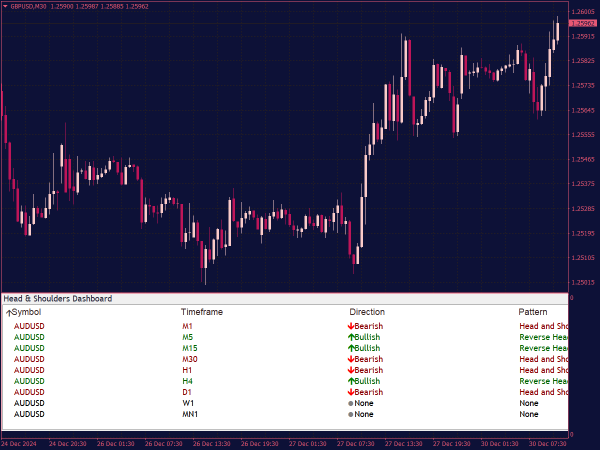

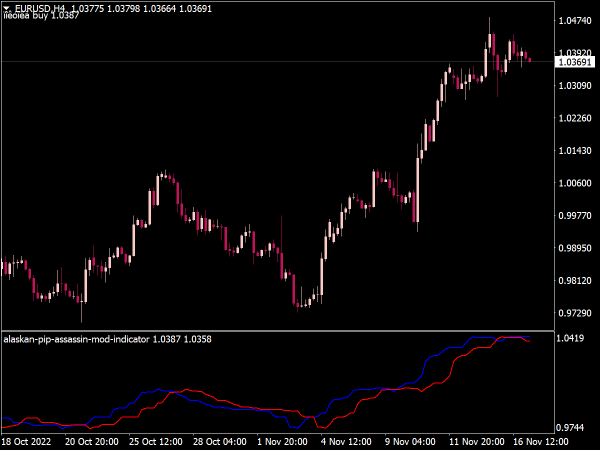

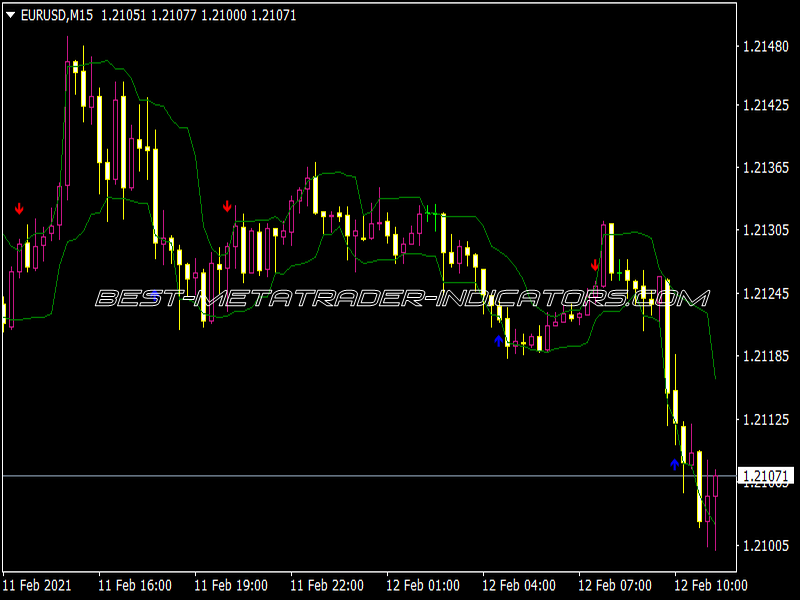

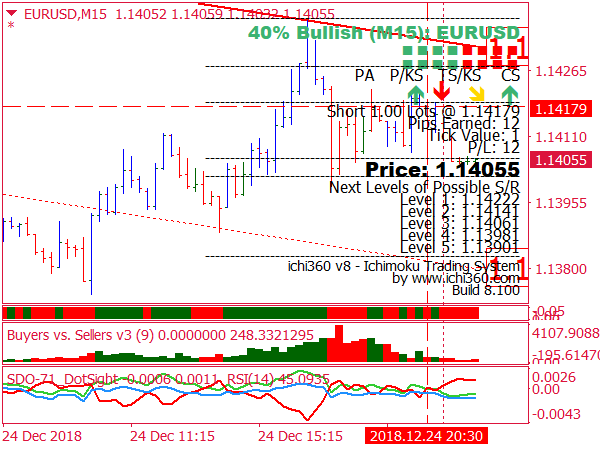

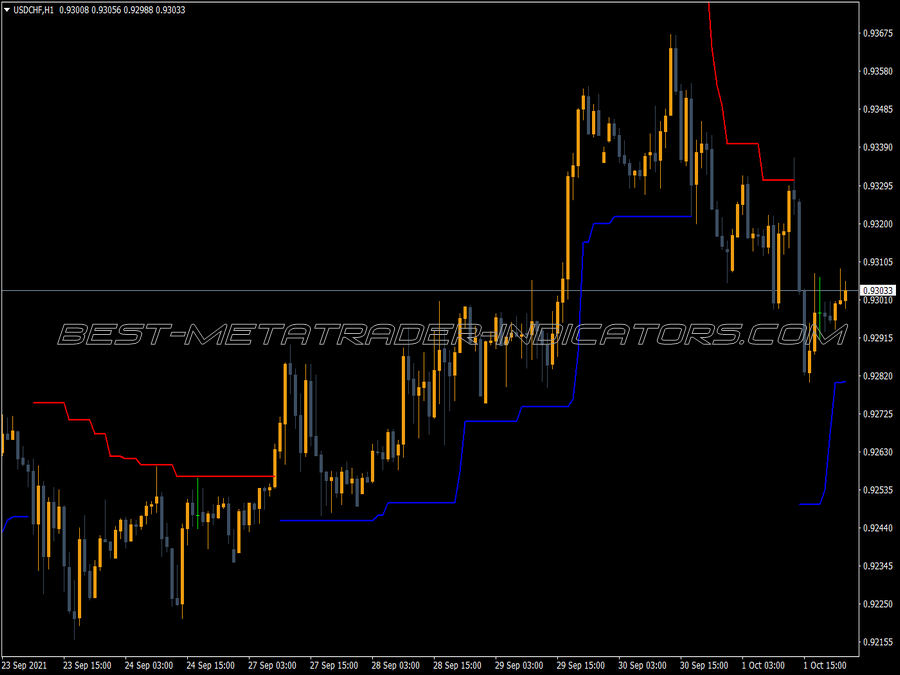

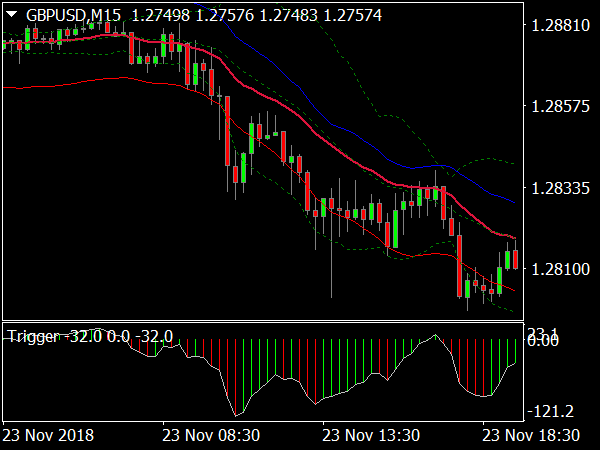

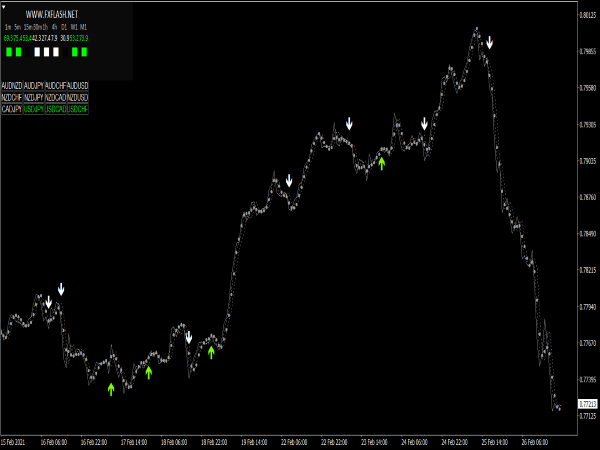

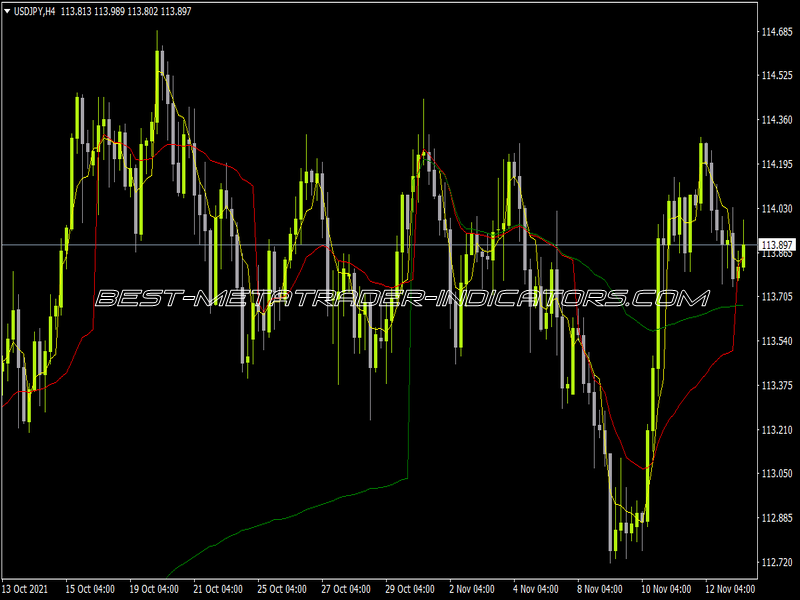

1. Identify the Trend: A key rule is to look at the VWAP's position relative to the price. When the price is above VWAP, it indicates an upward trend, and when it's below, it suggests a downward trend. Traders often enter long positions when the price crosses above VWAP and short positions when the price crosses below it.

2. Confirm Entry Signals: Use additional indicators like Moving Averages, RSI, or MACD to confirm the trend indicated by the VWAP. This reduces false signals and increases the probability of successful trades.

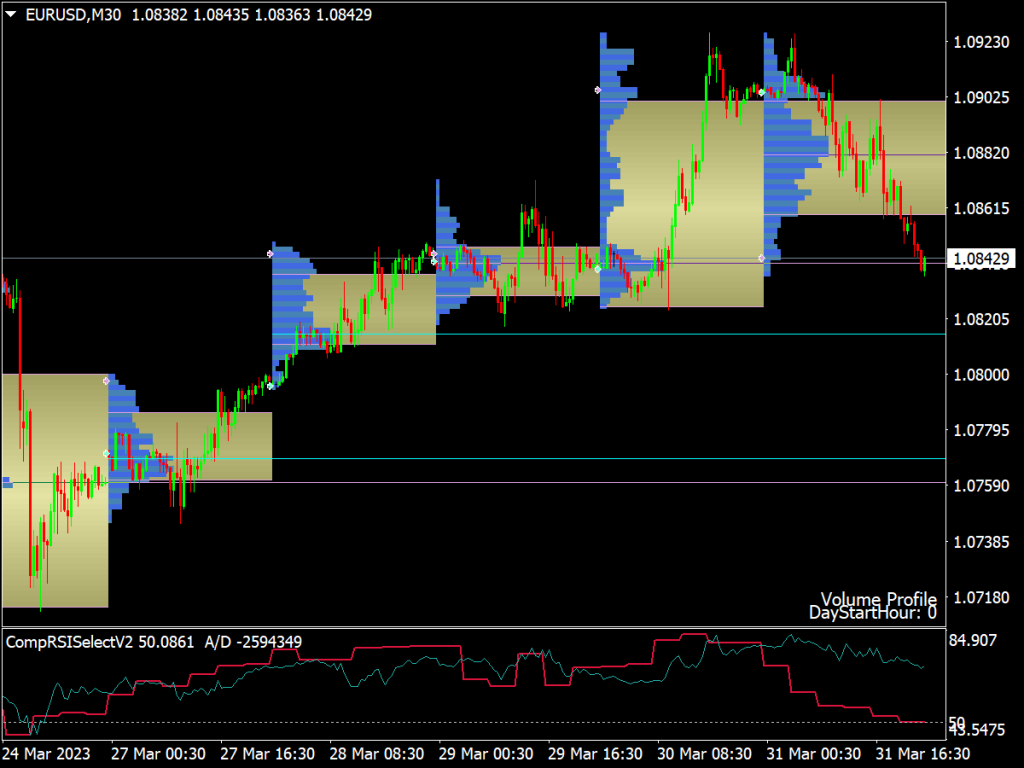

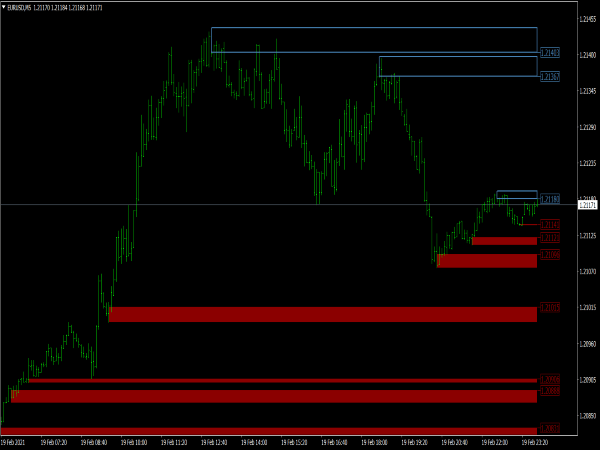

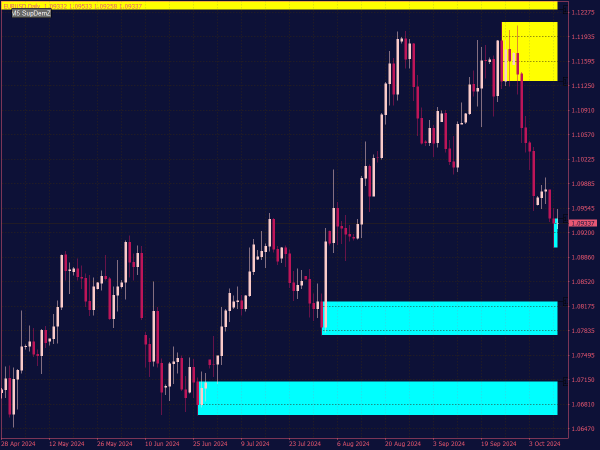

3. Use VWAP as Support and Resistance: VWAP levels often act as dynamic support or resistance. In a strong trend, if the price retraces to the VWAP, it may present a good buying opportunity in an uptrend or a shorting opportunity in a downtrend.

4. Time Frames: VWAP is primarily used on intraday charts, and its significance can vary with different time frames. Short-term traders may prefer 1-minute or 5-minute charts, while swing traders might use 15-minute or hourly charts, adjusting their strategy accordingly.

5. Trade Size: Since VWAP is a measure of average price, traders often adjust their position size based on their distance from VWAP. When the price is far from VWAP, they may reduce position sizes to mitigate risk.

6. Avoiding Trap Zones: Avoid trading when the price oscillates closely around VWAP with little direction. Such zones usually indicate consolidation rather than a clear trend and can often lead to whipsaws.

7. End-of-Day Strategy: On the final hours of trading, price action near VWAP can provide fireworks as large traders (institutional) enter or exit positions. Watching how price reacts around VWAP in the last hour can give insights into market sentiment.

8. Exit Strategies: Set profit targets and stop-loss orders based on typical price action against VWAP. If prices rise significantly above VWAP, consider trailing your stop to lock in profits, or vice versa for short positions.

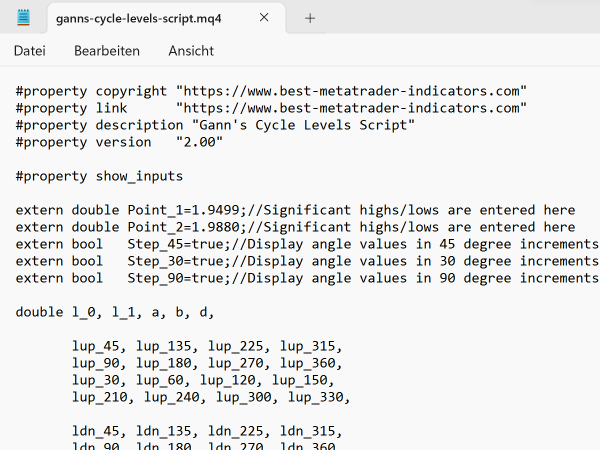

9. Backtesting: Before employing VWAP in live trading, backtest strategies on historical data to assess effectiveness. Understand its interaction with other indicators and market conditions.

10. Combining with Other VWAP Variants: Some traders also look at multiple VWAP calculations, such as the anchored VWAP, which starts from a specific date or event. This can provide context for longer-term trends.

Incorporating VWAP effectively requires understanding its strengths and limitations, alongside maintaining disciplined risk management practices. Adapting strategies depending on market conditions and the trader's overall plan is crucial for maximizing VWAP's potential in trading.