Submit your review | |

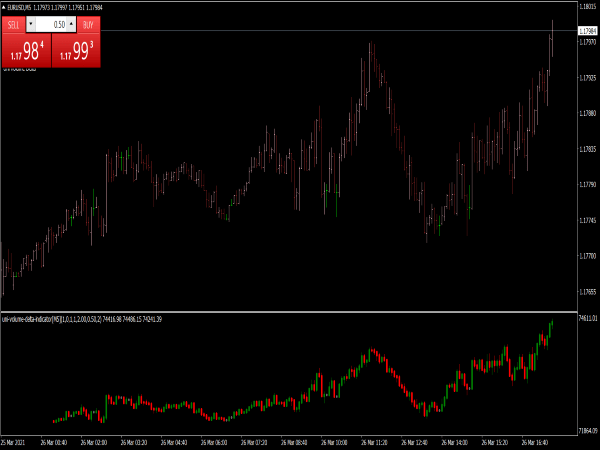

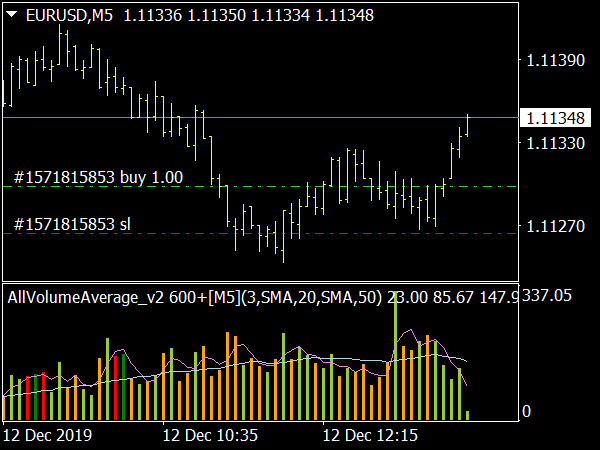

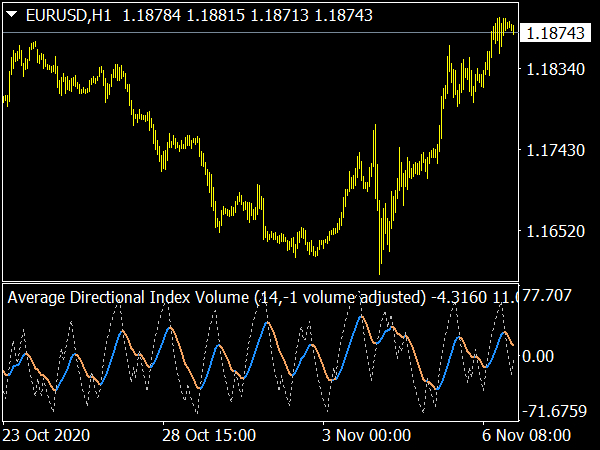

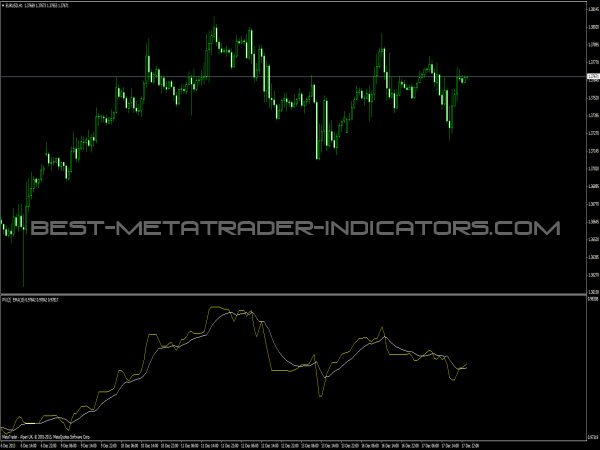

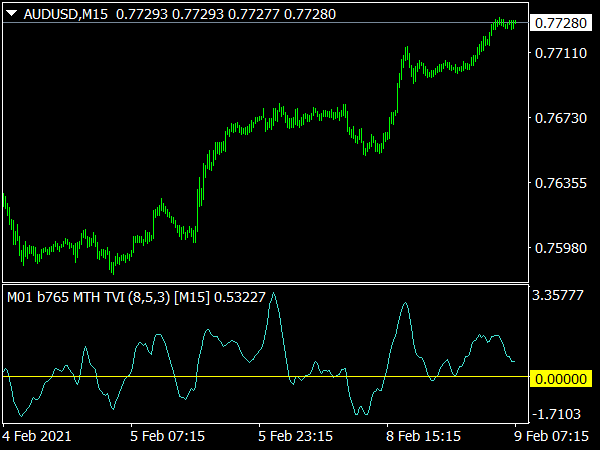

Volume is a very powerful indicator for evaluating trend strength and predicting the continuation and reversal of trends. Compared to indicators that are calculated using price and therefore act after price, the volume indicator precedes price and therefore can produce very strong trading signals and analysis.

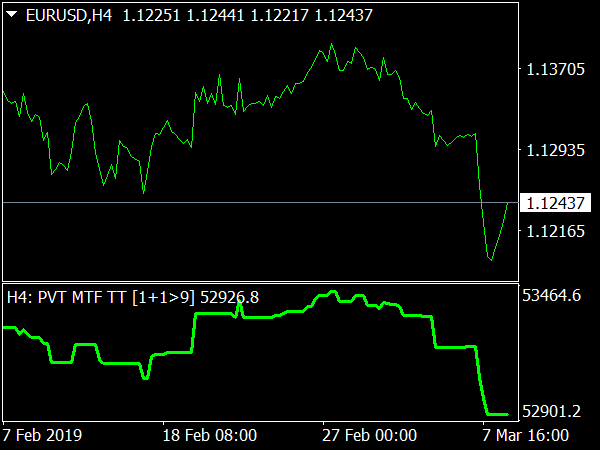

In Forex the volume is not as precise as in other commodities, because trading is taking place at many brokers and not centralized at one location. Having said that, accurate volume can be reached in more sophisticated charting software. The drawback is that they are not free as MetaTrader is. Nevertheless, volume in MetaTrader can also be useful for gauging the market action level.

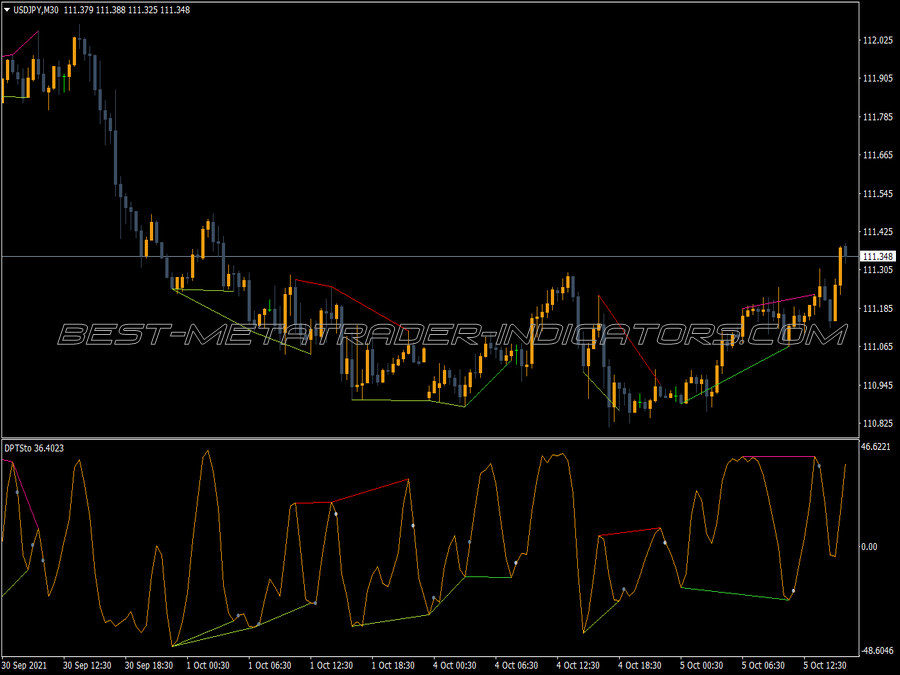

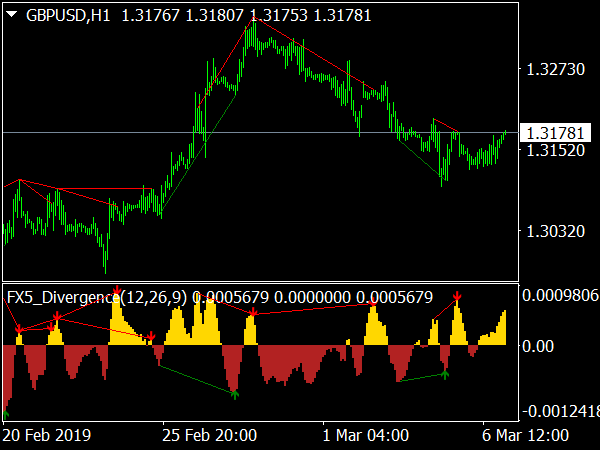

The first principle of trading with volume is that a rising volume indicates a strength of market, and weakening volume indicates a weakness at the market. The implications of volume depend on the trend of the market. A bullish trend with rising volume – This is the most positive scenario. It shows that the buyers are gaining strength and the buyers are accumulating. This indicates a bullish strength.

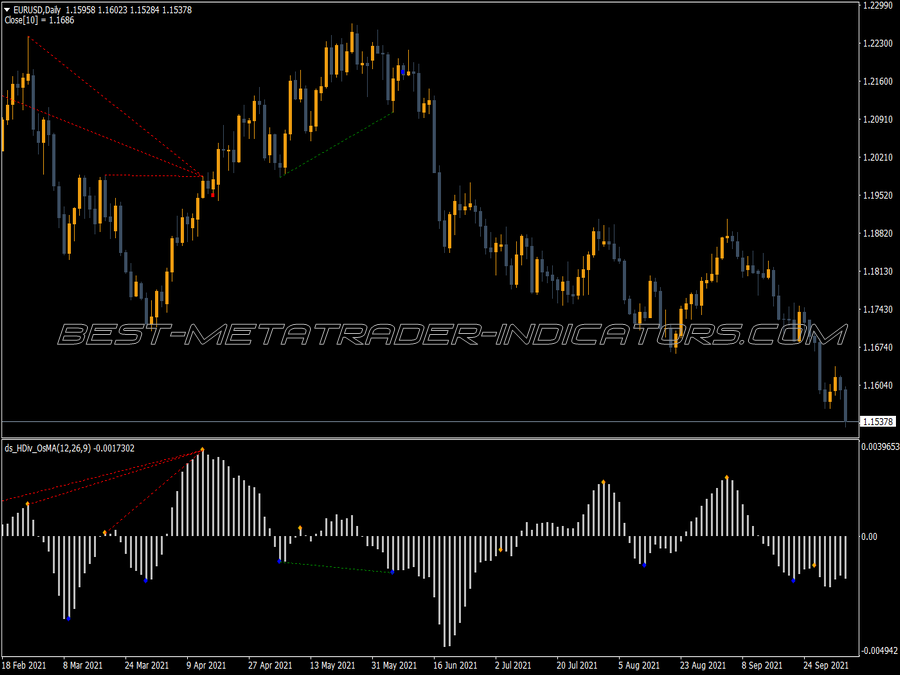

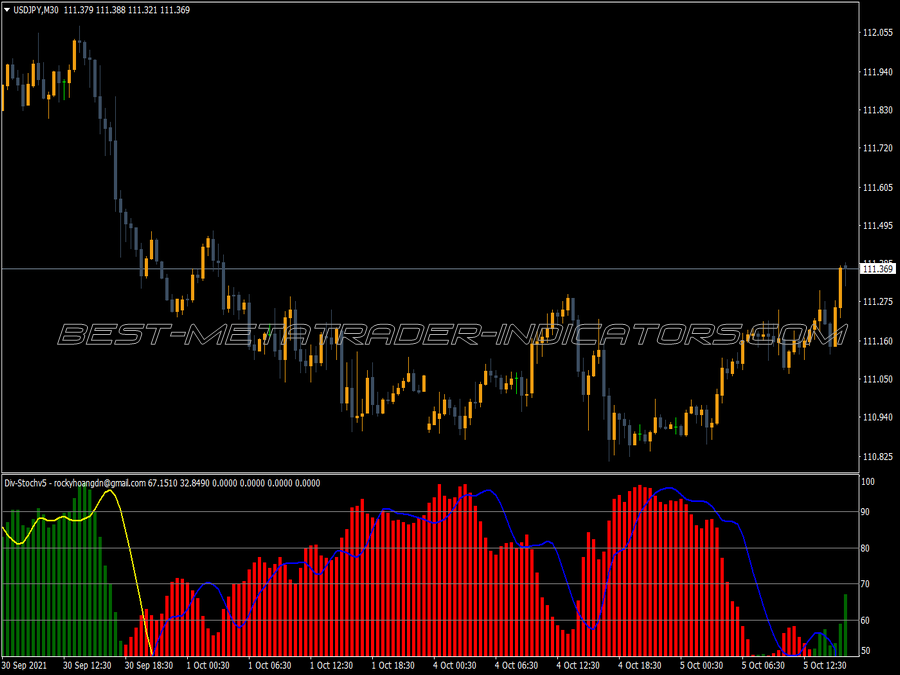

A bullish trend with weakening volume – This is not a normal scenario and suggests that the buyers are losing strength. In such case, the trader can expect a reversal and end of the bullish trend. Volume is the fuel behind trends, and a bullish trend without fuel is prone to reverse. Note that the volume usually weakens before the trend actually ends so it is required to seek a trigger for entering short trades (support or resistance, Stochastic signal, etc.).

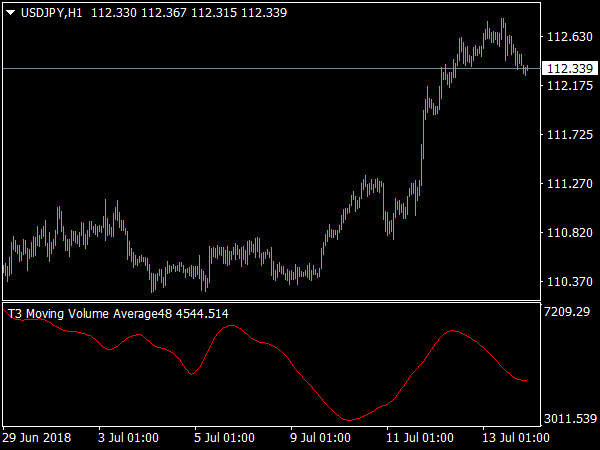

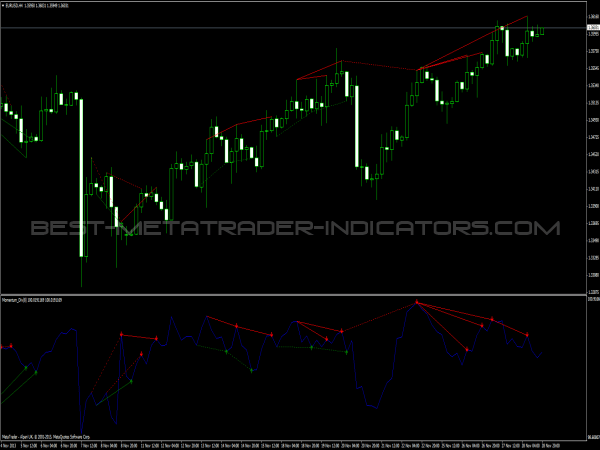

A bearish trend - The bearish trends slightly differs from bullish trends in their relation to volume. While it is highly recommended that bearish trends are accompanied with rising volume, bearish trends can advance even without volume(!). The market trends down easier than it trends up, and therefore the volume needs not be as rising for a bearish trend to continue.

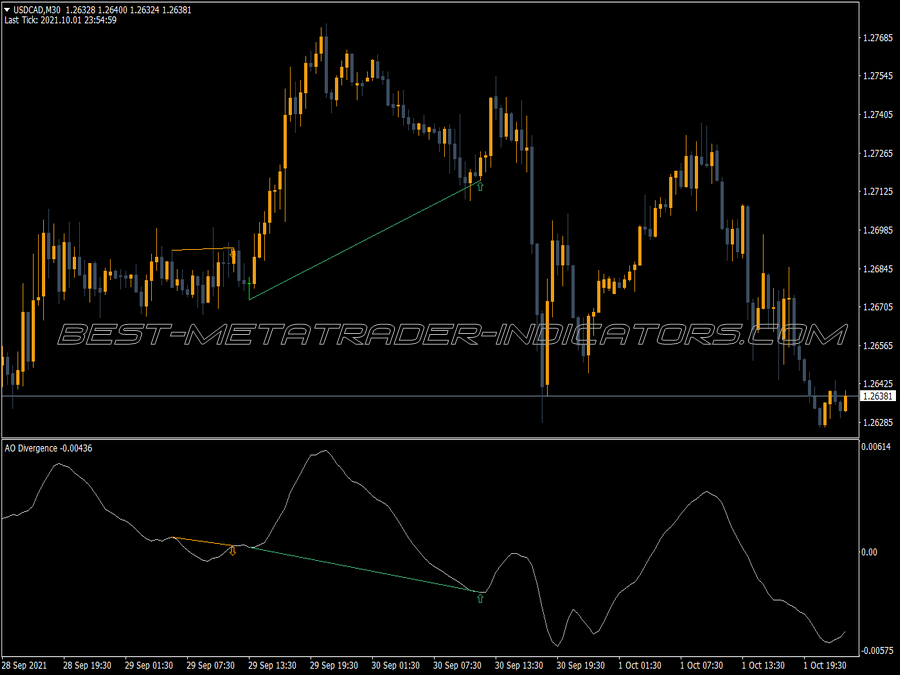

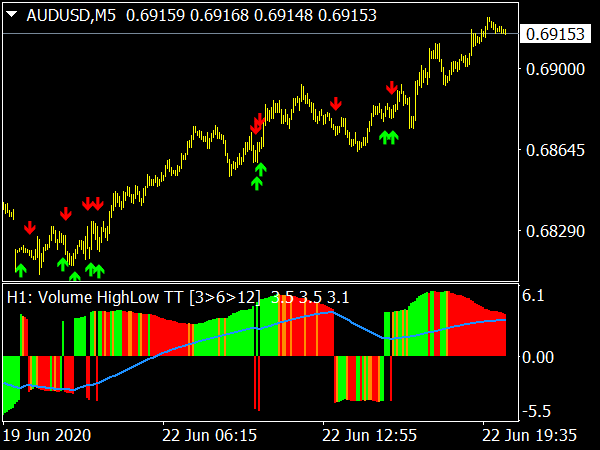

A practical use of volume in Forex trading is to predict breakouts of support and resistance levels. As we have mentioned, volume is a good indicator of the strength of trend in a Forex pair. The stronger the trend, more likely it is to break a support or resistance level. Therefore, when volume is rising towards a psychological level it can be a good sign of a future breakout.

On the contrary, weakening volume can suggest a failure to break a psychological level and the likelihood of price to bounce and reverse on such level. Low volume indicate weakness of market participants that will not suffice to break a strong level. Volume can be a very insightful indicator over price-action, sometimes more powerful than standard indicators, as it precedes price and not calculated after price. Using Volume in your trading and analysis can highly increase your performance.