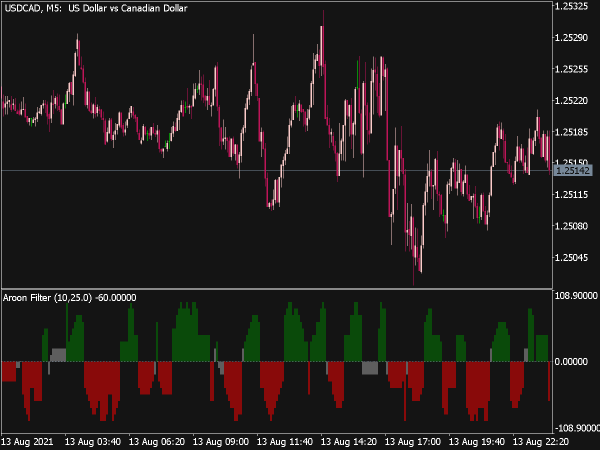

Submit your review | |

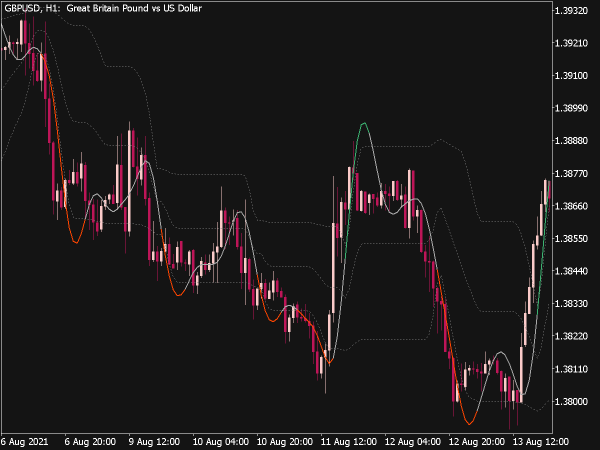

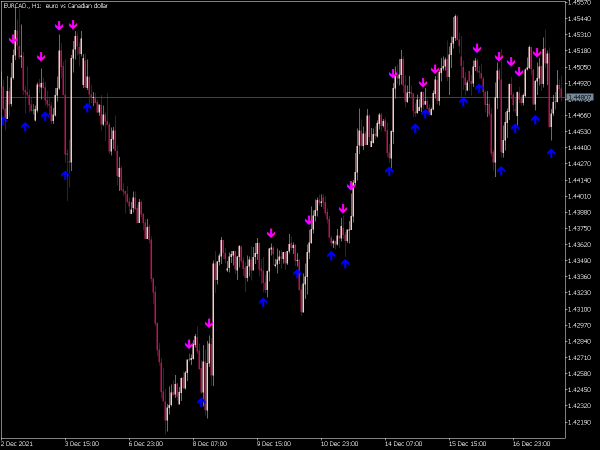

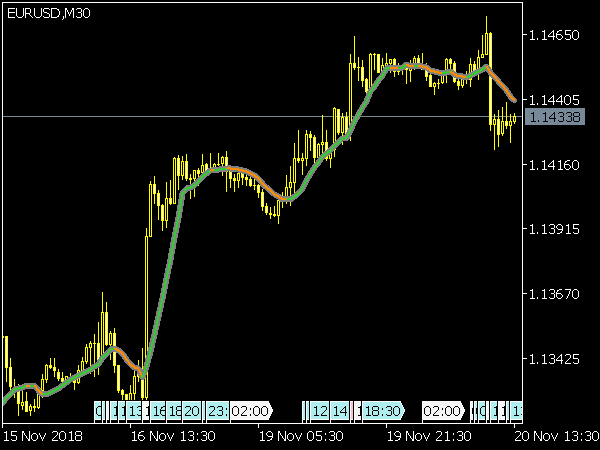

The indicator compares the sum of a one-period ROC with the trading range of a certain period in the default setting 28. It comes from Adam White and is primarily intended to distinguish whether prices are in a trend phase or a non-trend phase, so it is designed by itself as a trend indicator. But it also gives good signals as an oscillator in overbought or oversold situations. Volatility goes into the formula across the trading range.

Like most volatility indicators, it is particularly suitable for profit taking, as it shows when a trend is likely to end. Compared to traditional volatility indicators, such as the standard deviation, it gives much more and better signals. Low values also usually indicate when a new trend begins.