Submit your review | |

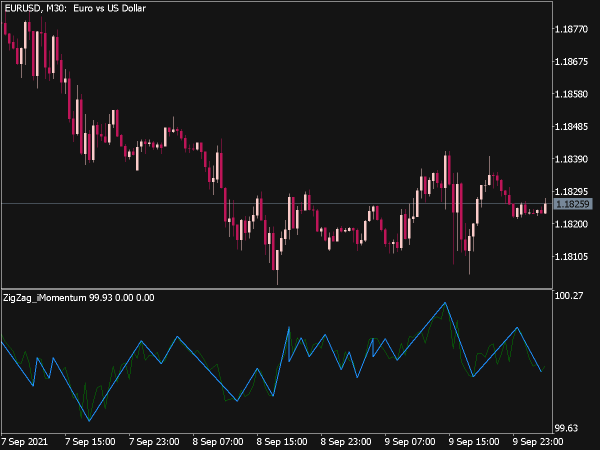

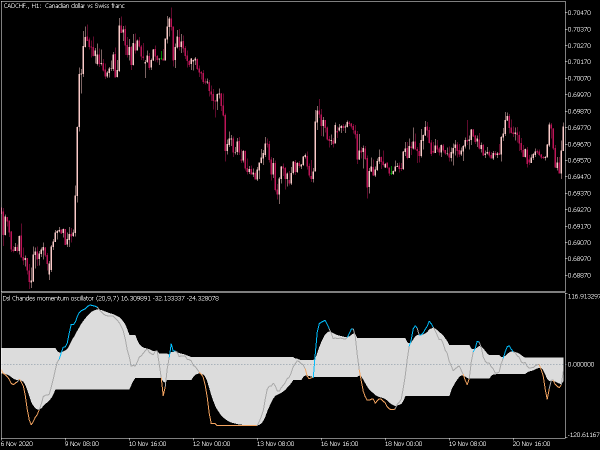

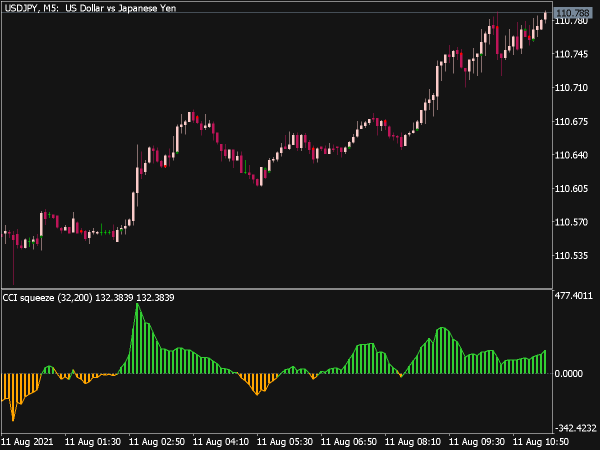

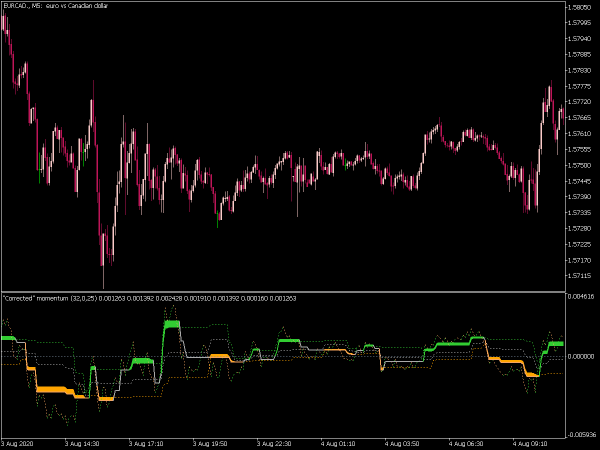

The Squeeze Momentum Indicator is a technical analysis tool that helps traders identify potential breakouts by analyzing volatility and momentum. It is based on the Bollinger Bands and the Keltner Channels; when the Bollinger Bands contract within the Keltner Channels, it signals a "squeeze," indicating a period of low volatility that may precede a significant price movement.

Traders typically look for points where the momentum changes direction after the squeeze, using color-coded histogram bars to gauge bullish or bearish momentum. This indicator is commonly used in conjunction with other technical analysis tools to enhance trading strategies.

Here’s a list of tips and strategies using momentum indicators:

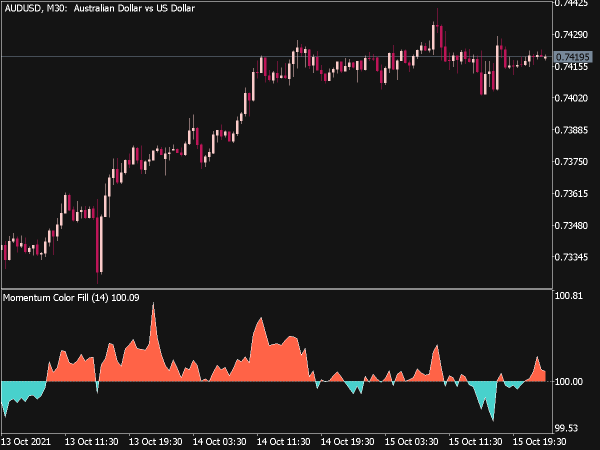

1. Understanding the Momentum Indicator: The momentum indicator measures the rate of price changes over a specified period, helping traders identify the strength of price trends.

2. Setting the Period: Common periods for momentum indicators are 14 or 20 days. Choose a period that suits your trading style, short-term traders may prefer shorter periods while long-term traders might opt for longer ones.

3. Identifying Overbought and Oversold Levels: A momentum reading above 100 can indicate overbought conditions, while readings below 100 suggest oversold conditions. Use these levels to inform buy or sell decisions.

4. Divergence Strategy: Look for divergence between the momentum indicator and price action. If prices make a new high but momentum does not, it could signal a potential reversal.

5. Confirming Signals with Moving Averages: Combine the momentum indicator with moving averages. For example, a momentum indicator crossing above its signal line, along with a price above its moving average, can strengthen the buy signal.

6. Using Multiple Time Frames: Analyze momentum across different time frames to gain a more comprehensive view of market conditions. Confirming momentum direction in both short and long-term charts can improve trade success.

7. Setting Stop Losses: Always use stop losses to manage risk. Position them below recent swing lows for long positions or above swing highs for short positions.

8. Combining with Other Indicators: Implement the momentum indicator alongside other technical indicators like MACD or RSI for enhanced decision-making. This can provide additional confirmation of momentum shifts.

9. Momentum in Trending Markets: Focus on trading in the direction of the prevailing trend. In strong bullish trends, look for buying opportunities when the momentum indicator rises; in bearish trends, look for selling signals when it declines.

10. Risk Management: Diversify your portfolio and never risk more than 1-2% of your trading capital on a single trade. Maintain an appropriate risk-to-reward ratio, ideally aiming for at least 1:2.

11. Backtesting Strategies: Before implementing momentum strategies in live markets, conduct thorough backtesting on historical data to evaluate their effectiveness.

12. Stay Updated on Market News: Economic events can impact momentum. Stay informed about market news and economic indicators that could cause sharp price movements, affecting your trades.

By employing these momentum trading strategies and techniques, traders can enhance their ability to identify and capitalize on market opportunities effectively.

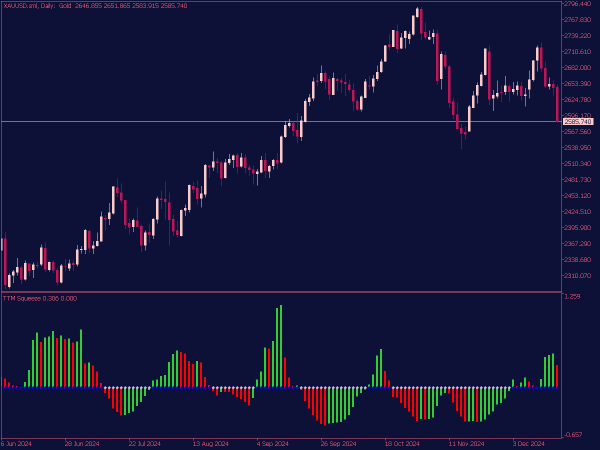

This indicator is working correctly, doesn't match the original code on TOS.

Hi, I downloaded the TTM Squeeze Indicator and noticed that it is not working correctly. It would be nice if you can fix it as I'd like to be able to use your indicator.

Thank you.