Submit your review | |

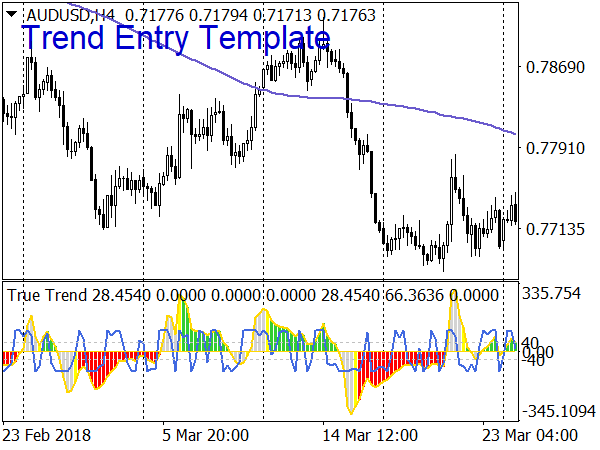

Trend following indicators are essential tools for traders looking to capitalize on the momentum of market movements. To effectively implement trend following strategies, it's vital to use a combination of indicators and techniques that help identify, confirm, and ride trends while managing risk. Below are several key trading tips and strategies that leverage trend following indicators.

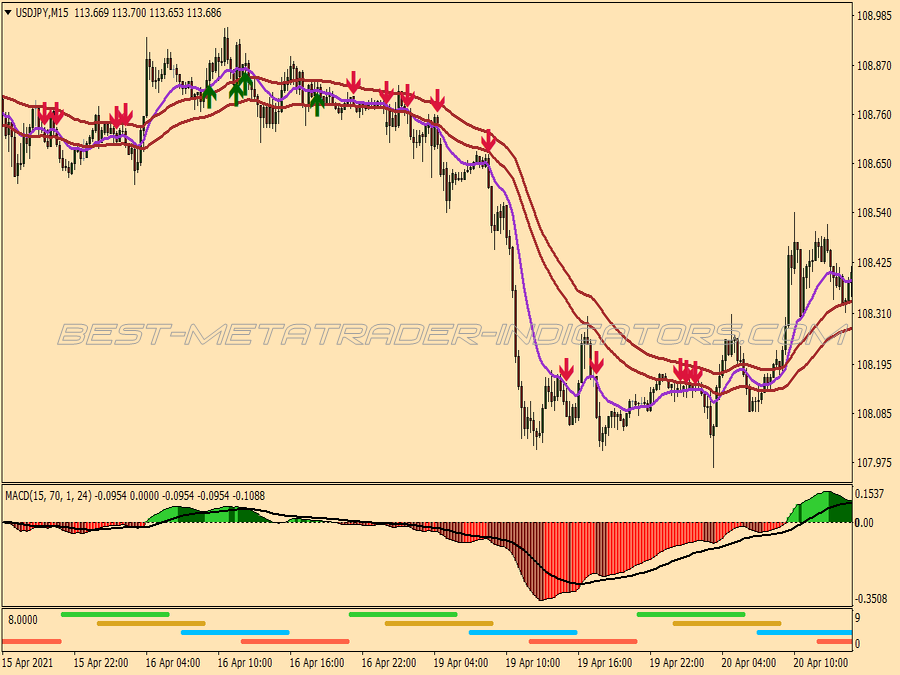

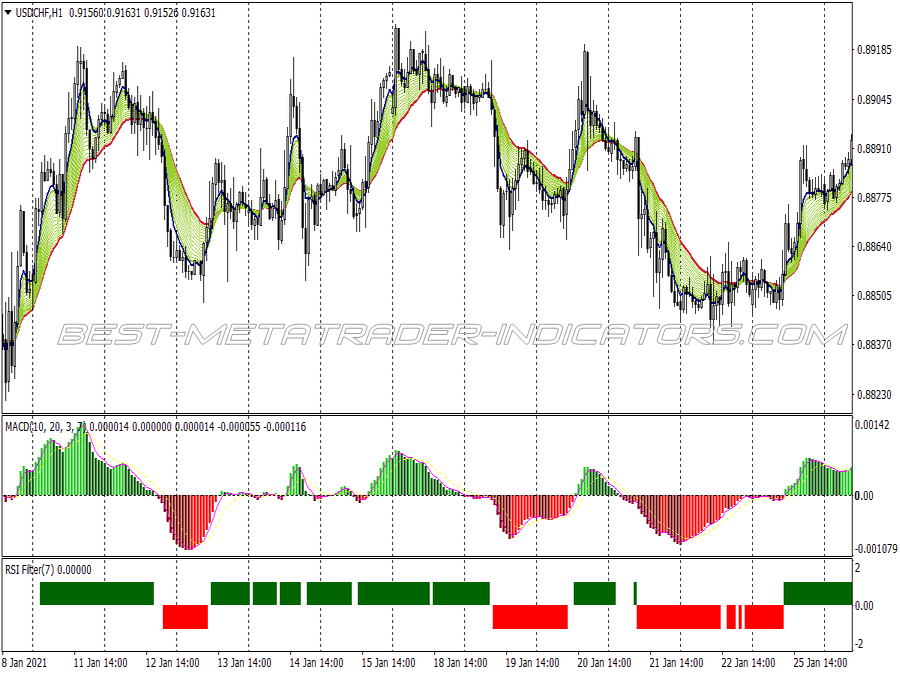

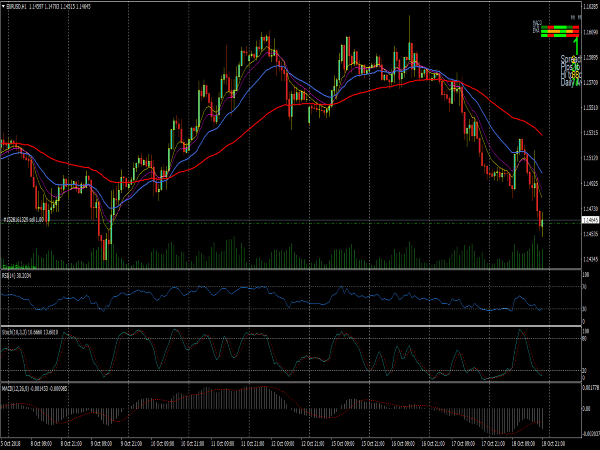

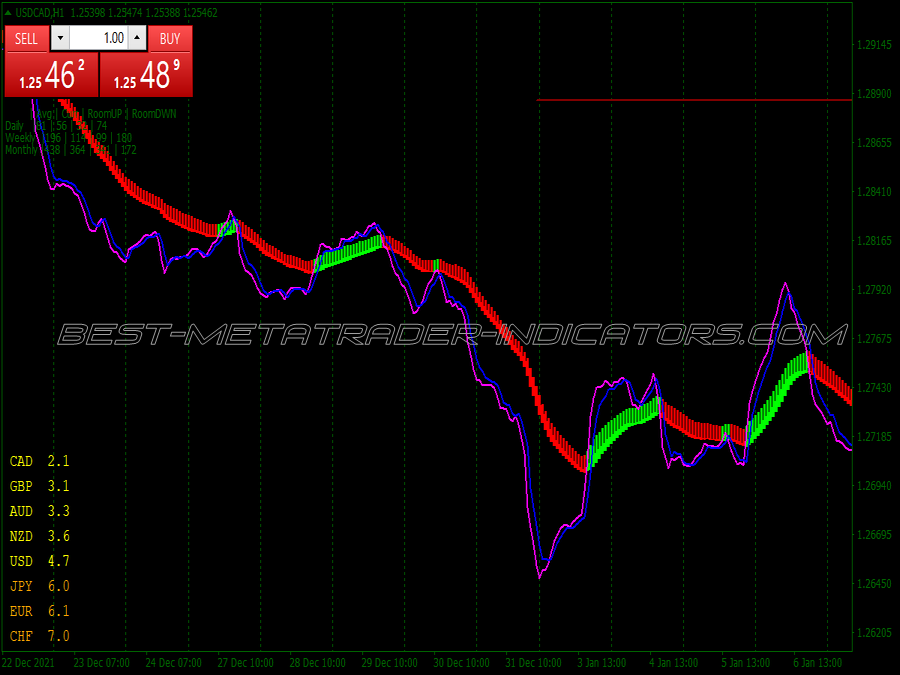

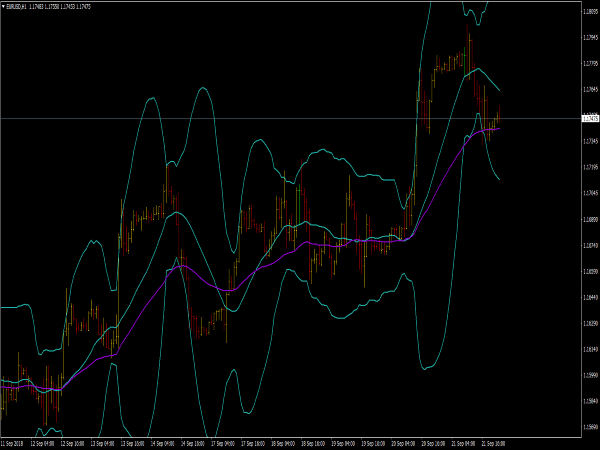

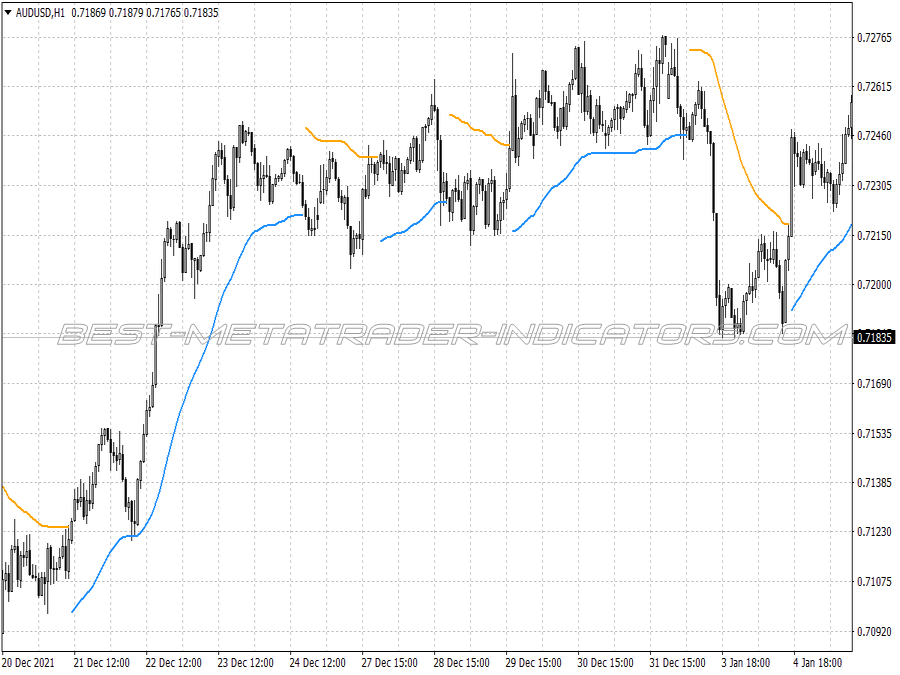

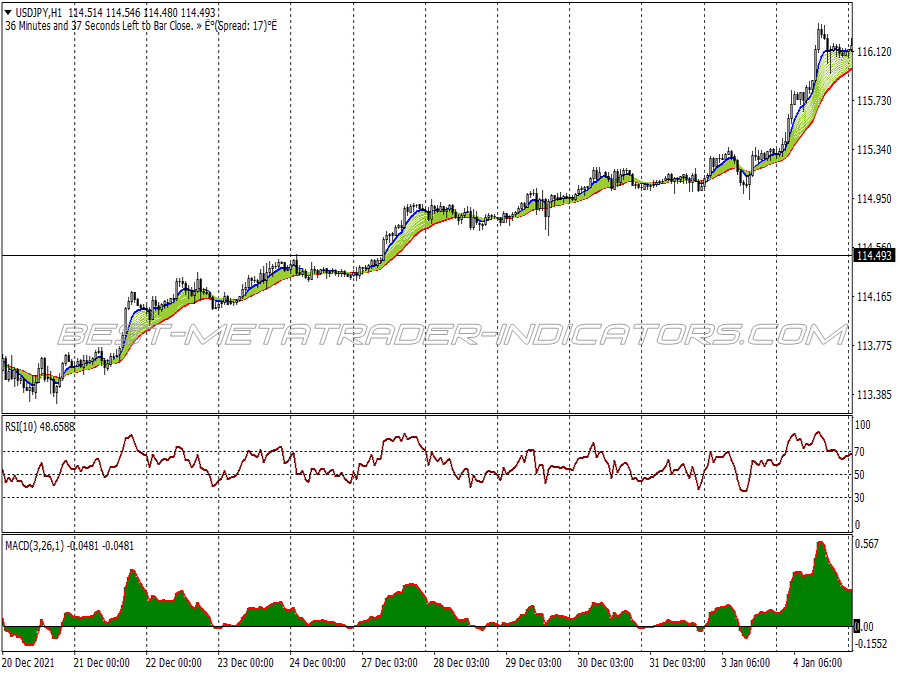

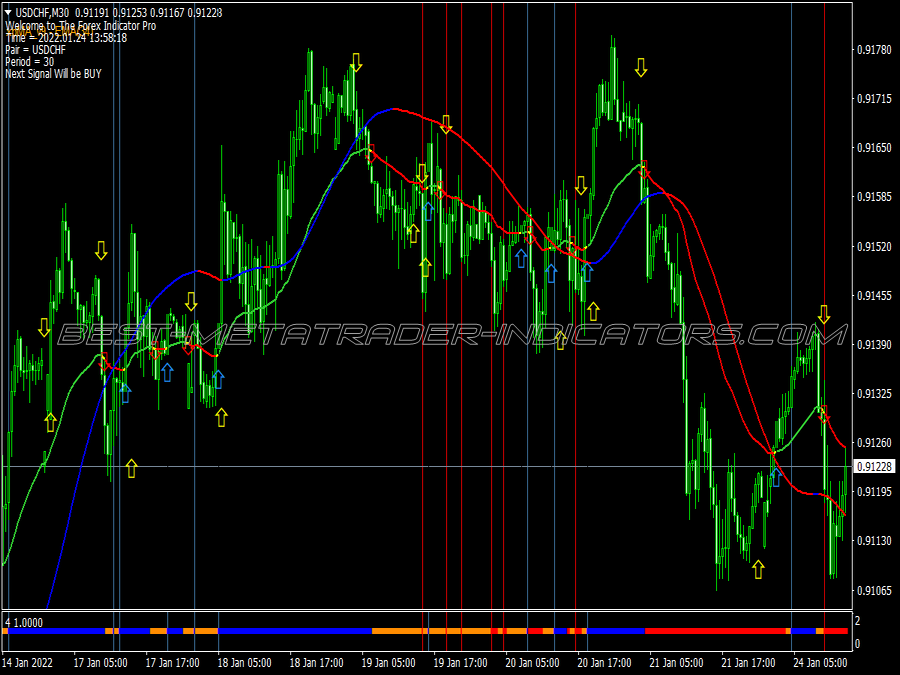

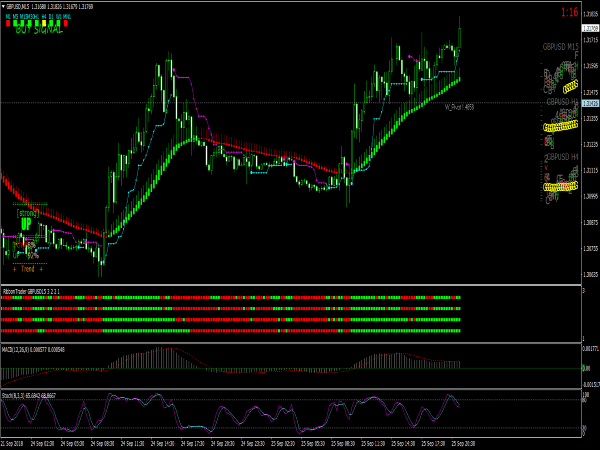

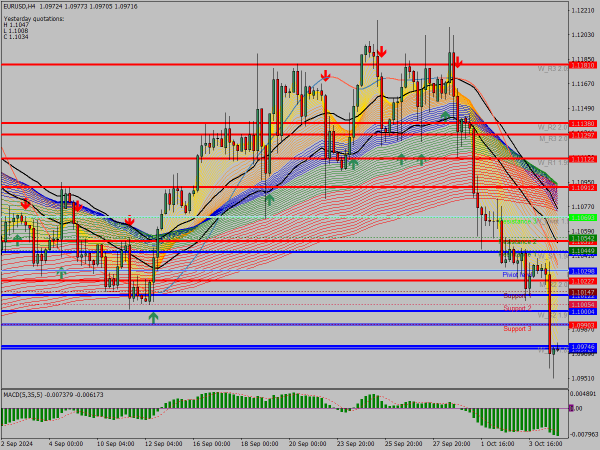

Firstly, the Moving Average (MA) is a fundamental trend following indicator. Traders often use the Simple Moving Average (SMA) and Exponential Moving Average (EMA) to identify the direction of the trend. A straightforward strategy involves entering a long position when a shorter-term moving average crosses above a longer-term moving average (a golden cross) and entering a short position when the reverse occurs (a death cross). Enhance this strategy by considering the slope of the moving averages—when they are both rising, it signals a strong uptrend, while if both are falling, it indicates a strong downtrend.

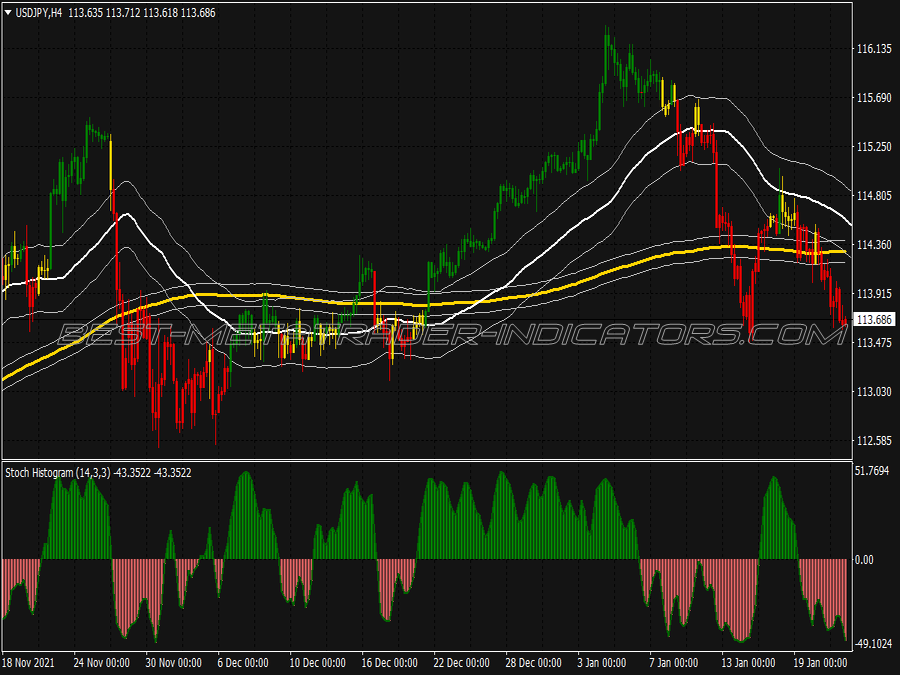

Another popular indicator is the Average True Range (ATR), which measures market volatility. When combining ATR with moving averages, traders can set more informed stop-loss and take-profit levels. For example, during a bull trend, use ATR to ensure that stop-loss levels are set below the recent swing low, accounting for volatility, thereby reducing the risk of premature exits from trades.

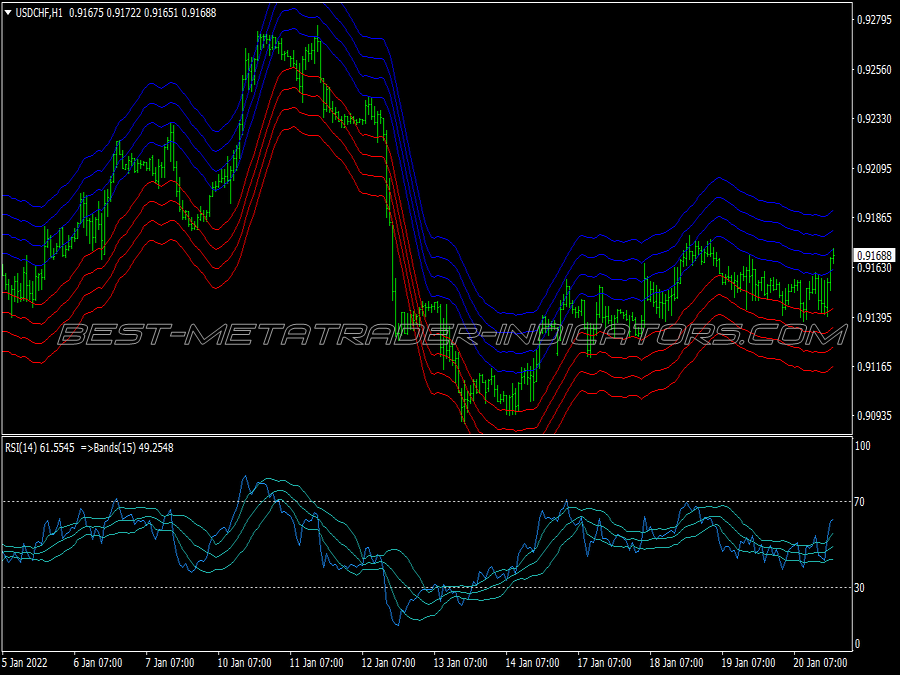

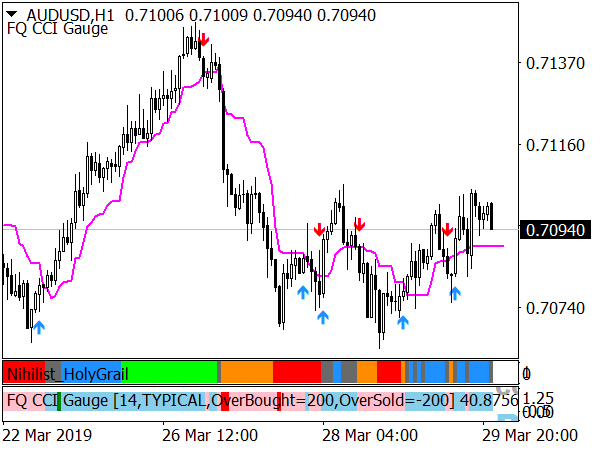

The Relative Strength Index (RSI) is also prevalent among trend followers. While primarily used to identify overbought and oversold conditions, RSI can be employed to confirm trend direction. A reading above 50 typically indicated an uptrend, while a reading below 50 suggests a downtrend. Consider using divergence in the RSI as an additional confirmation tool; if the price is making new highs while RSI is not, it may indicate a weakening trend.

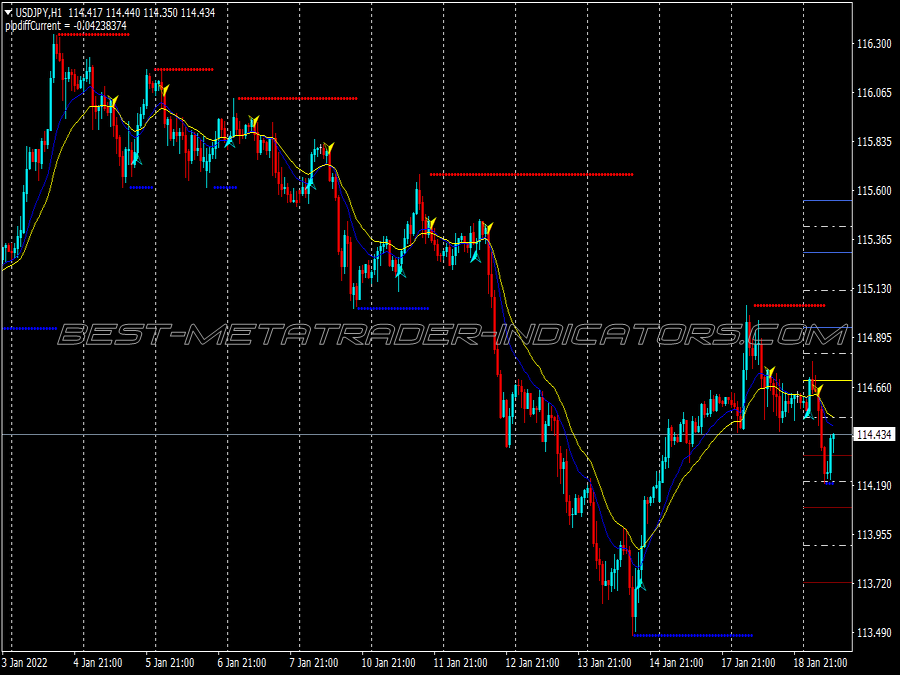

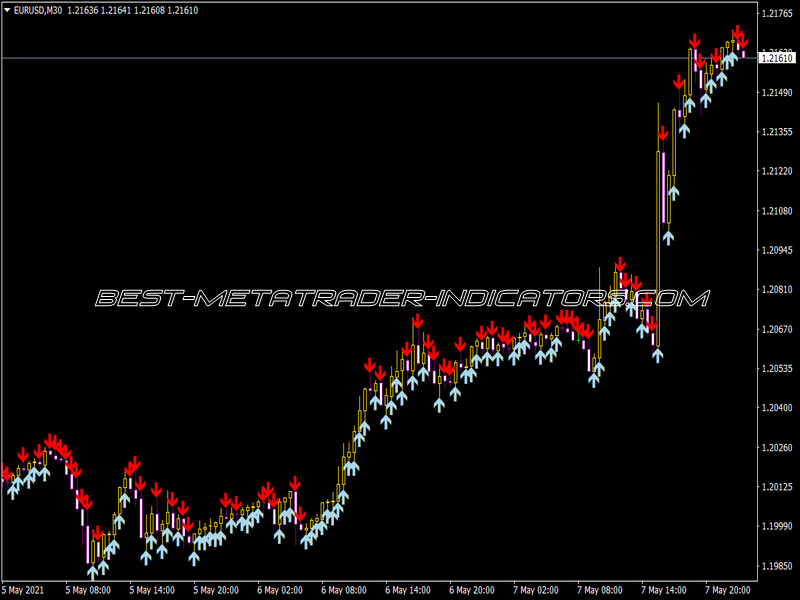

Incorporating the Parabolic SAR (Stop and Reverse) can further bolster a trend following strategy. This indicator helps determine potential reversal points in the market. Traders should enter a long position when the price is above the SAR, and consider exiting or reversing the position when the price falls below the SAR, providing an automated way to manage trade exits.

Using a combination of these indicators can strengthen your trend following strategy. For instance, use a moving average crossover to enter a trade, confirm the trend with RSI, and manage exits with the Parabolic SAR and ATR. Additionally, maintaining a trading journal helps document the effectiveness of your strategies and refine your approach over time.

Risk management is paramount in trend following. It’s advisable to determine position size based on account size and risk tolerance. A commonly used rule is the 1% rule, which states that no more than 1% of your trading capital should be risked on a single trade. Setting trailing stops can help lock in profits as a trend progresses without needing to constantly monitor trades.

Continuously backtesting your trading strategies with historical data can ensure their validity. By simulating past trades, you can identify patterns and potential pitfalls in your strategy, optimizing it for future trades. Trading platforms often provide tools for backtesting, allowing you to refine parameters effectively.

Consider market conditions when trading. Trend following strategies tend to work well in trending markets but can incur losses during sideways or choppy markets. It’s prudent to implement filters, such as only trading when the market is trending based on lower time frames, or avoiding trades during major economic news releases that create unpredictable volatility.

Maintaining a disciplined approach is crucial for successful trend following. This includes adhering to your trading plan, managing emotions, and staying patient. Trends can last for extended periods, allowing ample time to capitalize on price movements if you remain committed to your strategy.

Lastly, staying updated with market news and events is vital. While trend following leans heavily on technical analysis, external factors can significantly impact market directions. Understanding these influences helps contextualize the trends identified by your indicators, leading to better-informed trading decisions.

In conclusion, combining various trend-following indicators and employing robust trading strategies can significantly enhance your trading effectiveness. By carefully selecting indicators, managing risk, and maintaining a disciplined approach, traders can effectively capitalize on market trends. Remember to continuously evaluate and adapt your strategies based on market conditions and personal performance to drive long-term success.