Submit your review | |

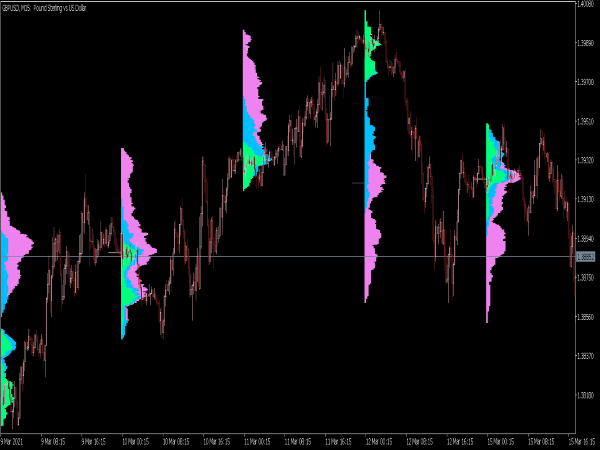

The Shved Supply and Demand Indicator is a trading tool that focuses on the principles of supply and demand to identify potential price reversals and continuations in the financial markets. Developed by Vadim Shved, this indicator is designed to highlight zones where buying or selling pressure may increase, thus helping traders make informed decisions.

Understanding the Indicator

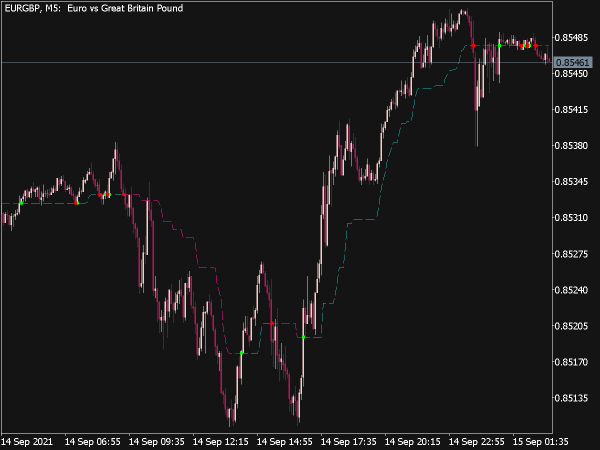

The Shved Supply and Demand Indicator plots areas on a price chart where significant supply or demand levels exist, indicated by shaded zones. When price approaches these zones, traders anticipate potential reversals. The indicator operates on the premise that price tends to react to these zones, allowing traders to capitalize on future price movements.

Trading Strategy Basics

To effectively utilize the Shved Supply and Demand Indicator, traders should follow a systematic approach:

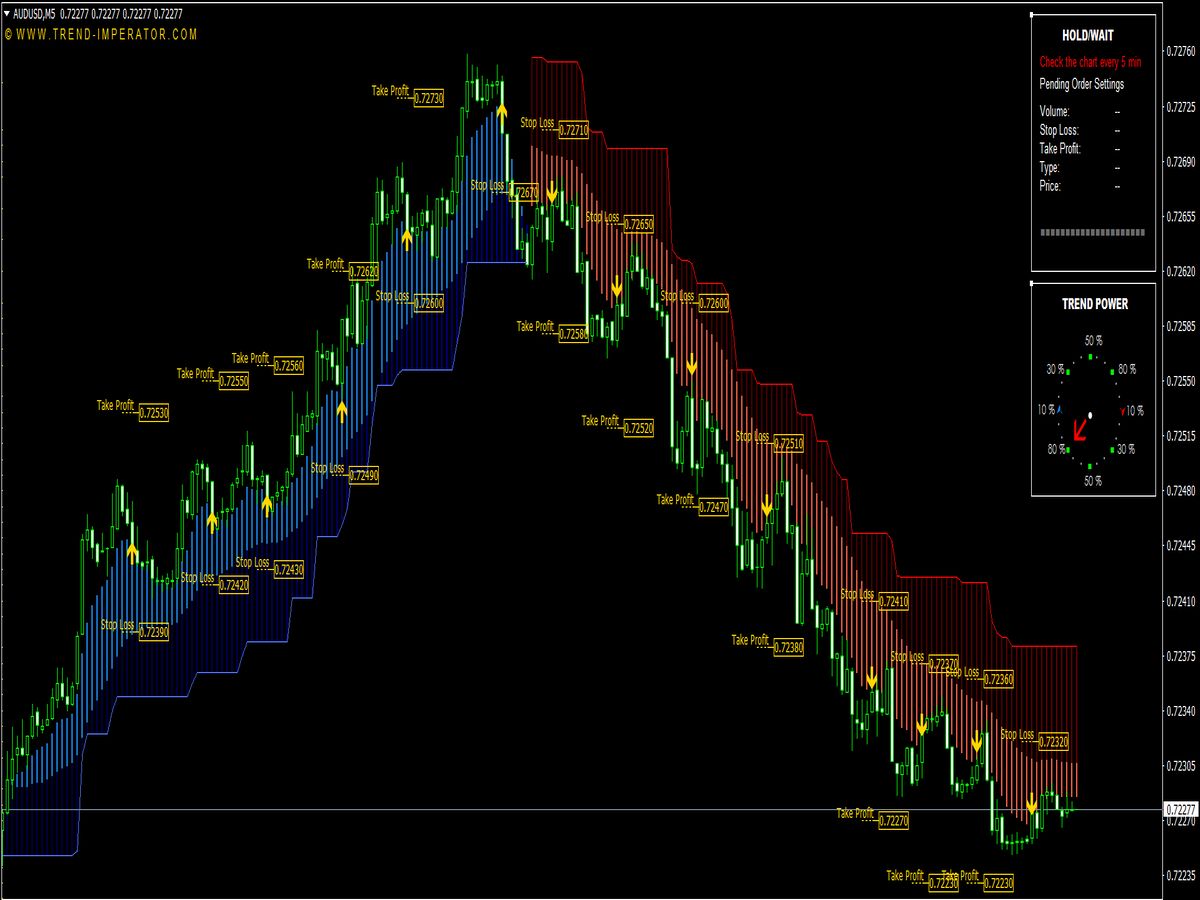

1. Identify Supply and Demand Zones: Use the indicator to highlight where these zones are located on the chart. Look for higher timeframes (such as daily or weekly) to establish major supply and demand levels.

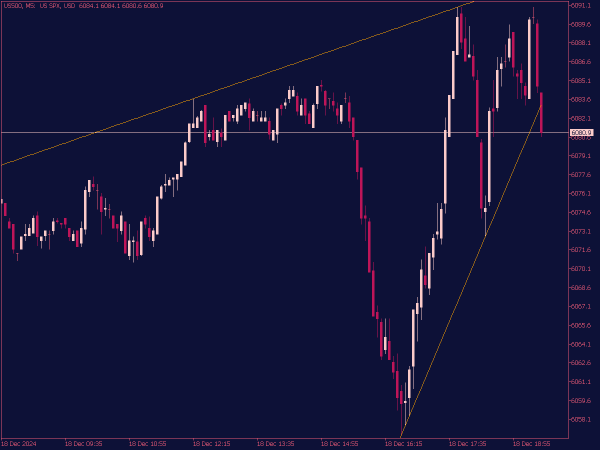

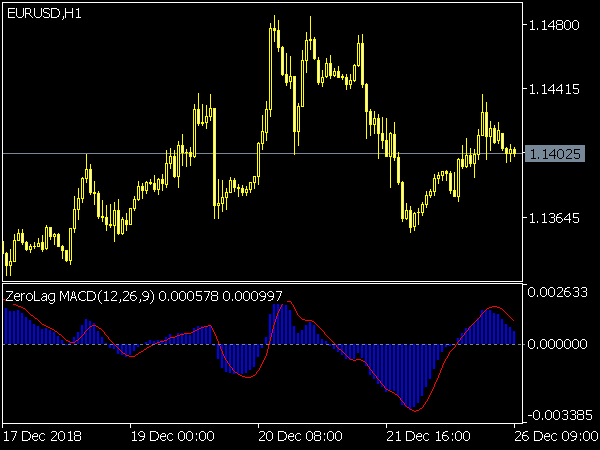

2. Patience and Confirmation: Wait for price to approach these zones before making any decisions. Look for confirmation signals such as candlestick patterns (e.g., pin bars, engulfing candles) or additional indicators (e.g., RSI, MACD) to support your trade decision.

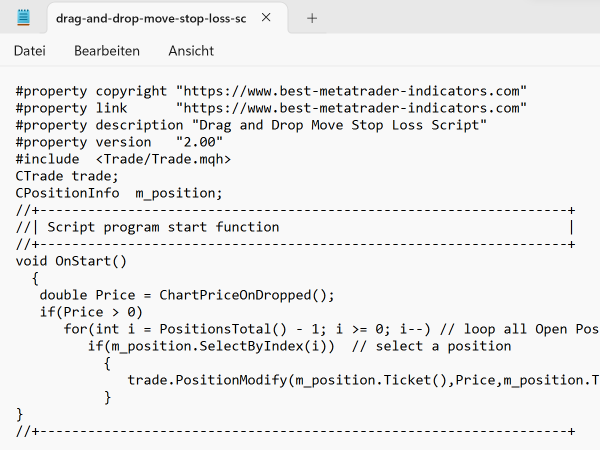

3. Entry and Exit Points: For long trades, consider entering near the demand zone with a stop loss just below the zone. For short trades, enter near the supply zone with a stop loss just above. Set profit targets based on key levels, such as previous highs/lows or Fibonacci retracement levels.

4. Risk Management: Always adhere to strict risk management principles. This involves determining the amount you are willing to risk on a trade and adjusting position sizes accordingly. A common rule is to risk no more than 1-2% of your trading capital on a single trade.

Advanced Trading Tips

1. Multiple Time Frame Analysis: Examine supply and demand zones across different time frames. A zone that appears on a daily chart may have more significance compared to one on a 15-minute chart. This multi-timeframe approach helps confirm the strength of the identified zones.

2. Volume Analysis: Combine the indicator with volume analysis. High volume at a particular price level can signify stronger supply or demand, making those zones more significant and increasing the potential for price action.

3. Market Context: Always consider the broader market context. Economic news releases, earnings reports, and geopolitical events can significantly influence market behavior. Be aware of these factors when trading near supply and demand zones.

4. Avoid Choppy Markets: The Shved Supply and Demand Indicator is most effective in trending markets. If the market is choppy or lacks clear direction, it may lead to false signals. Aim to trade during periods of volatility and clear trends.

5. Practice with a Demo Account: Before risking real capital, practice your strategies using a demo account. This will allow you to gain experience with the indicator and refine your approach without financial risk.

Common Pitfalls to Avoid

1. Overtrading: Traders may become overly eager and enter trades too frequently. Stick to your trading plan and focus on quality setups rather than quantity.

2. Ignoring Risk Management: It’s easy to become emotionally attached to a trade, leading to poor risk management. Always use stop losses and adhere to your risk-reward ratio.

3. Failing to Adapt: Market conditions are constantly changing. Be flexible and willing to adapt your strategy if you notice that the markets are responding differently to supply and demand zones.

4. Chasing the Market: Do not enter trades simply because the price moved away from a supply or demand zone. Wait for clear setups to avoid chasing entries and potentially increasing losses.

Conclusion

The Shved Supply and Demand Indicator can be a powerful tool for traders looking to identify key price levels based on supply and demand dynamics. By understanding how to use the indicator effectively, combining it with other analysis techniques, and adhering to risk management principles, you can enhance your trading strategy. Remember to remain patient, stay disciplined, and continually refine your skills to adapt to changing market conditions.