Submit your review | |

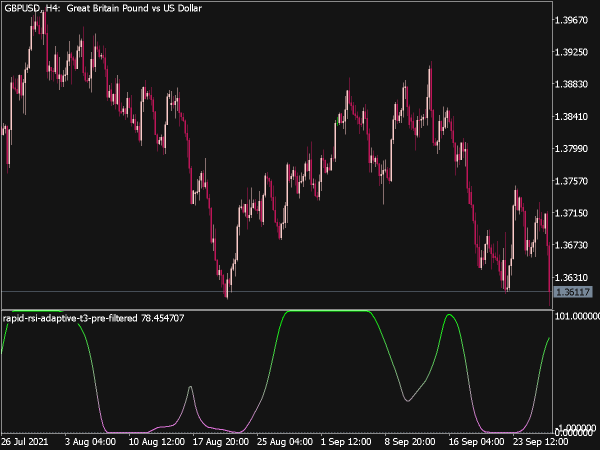

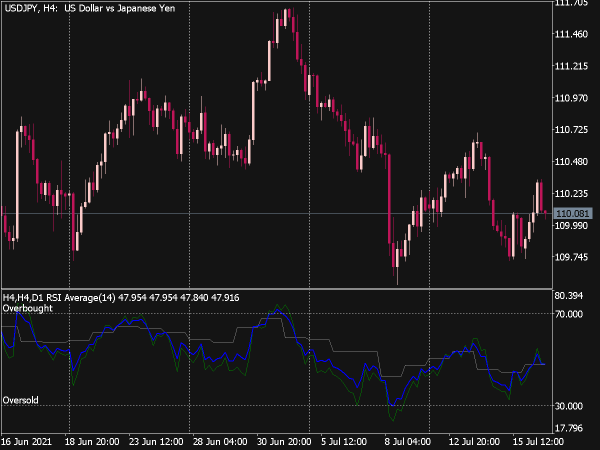

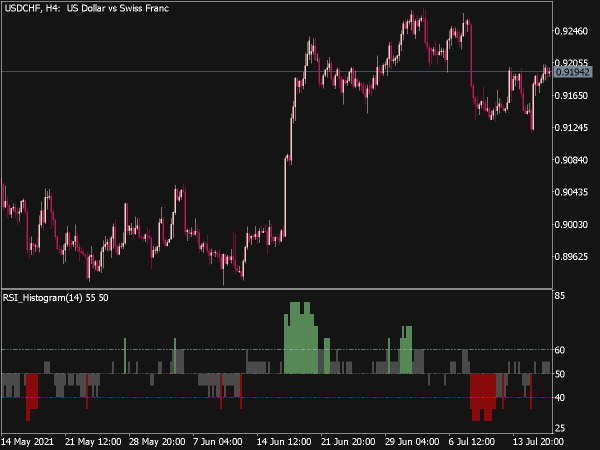

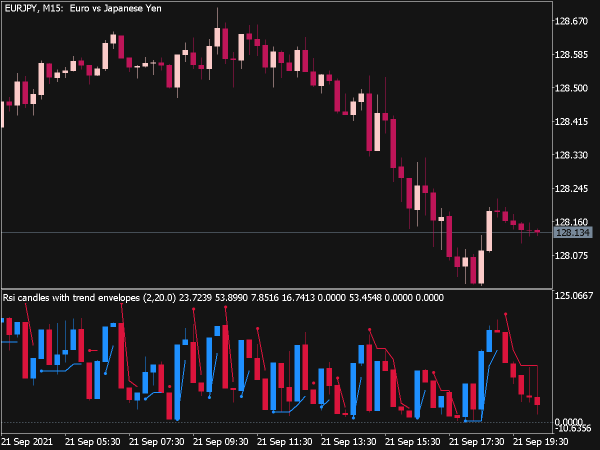

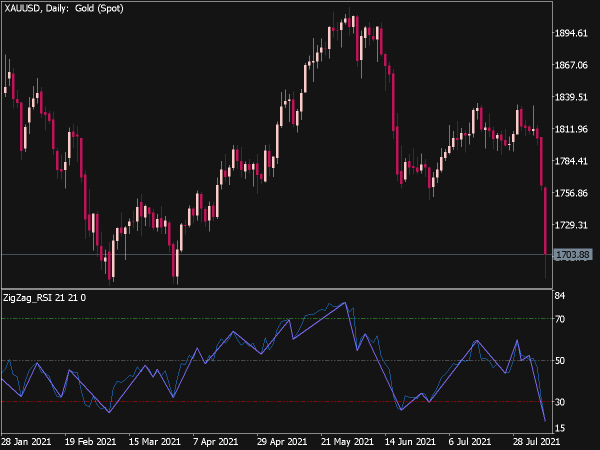

Relative Strength Index (RSI) divergence can be a useful tool for traders using MetaTrader 5 (MT5). This concept revolves around identifying discrepancies between the RSI and price action, which can signal potential trend reversals or continuations. To understand and apply both hidden and regular divergence, you should first familiarize yourself with the RSI indicator. Set it to a standard period of 14 or adjust it according to your trading strategy.

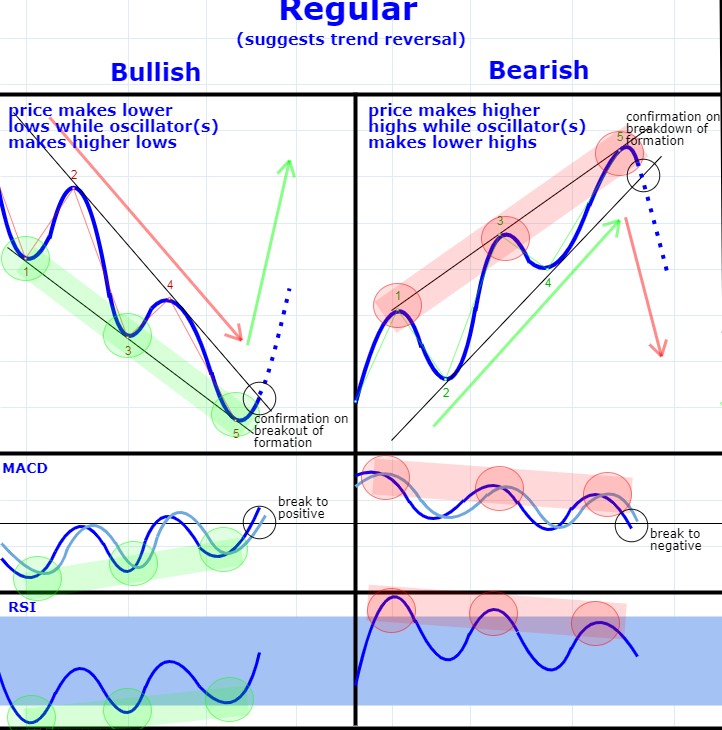

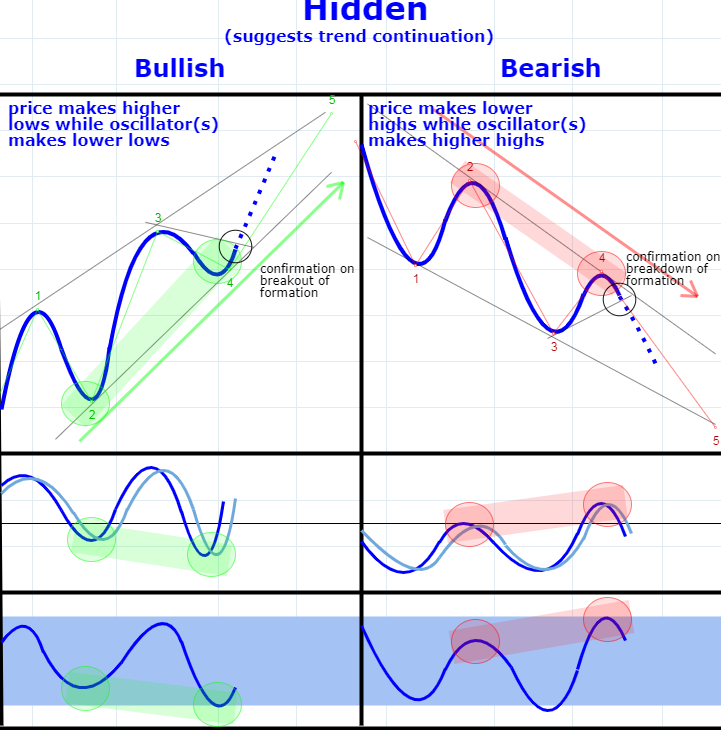

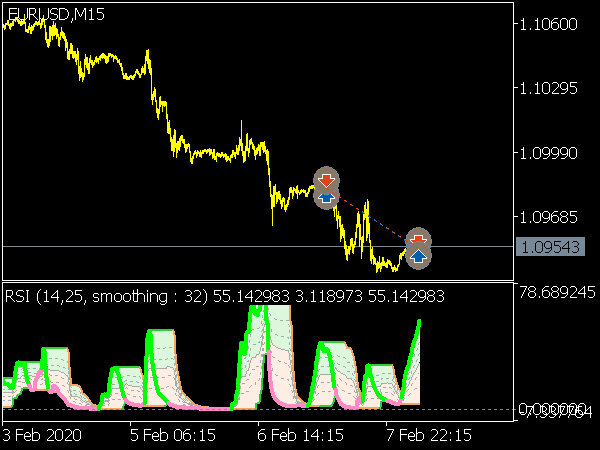

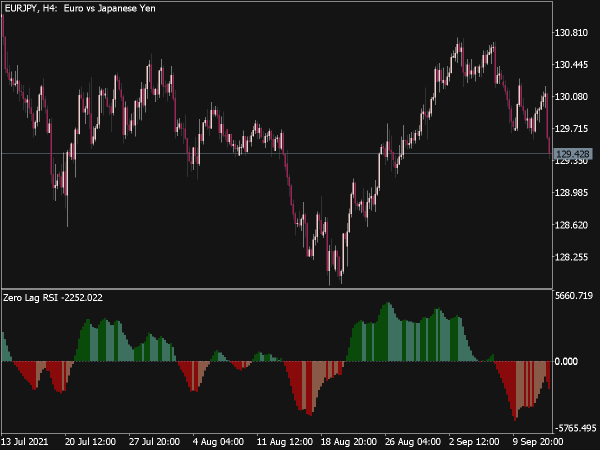

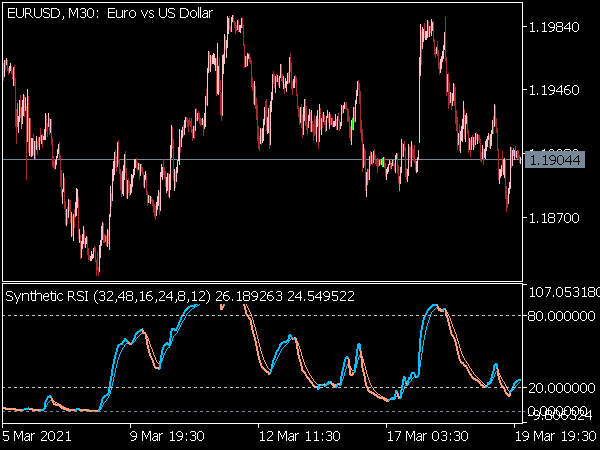

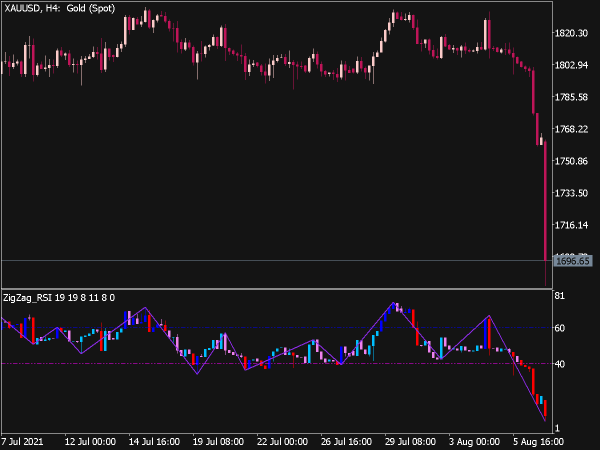

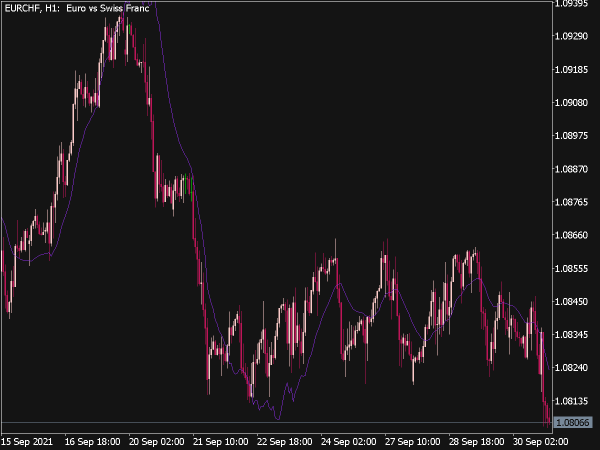

Identifying Regular Divergence: Regular divergence occurs when the price makes higher highs, but the RSI shows lower highs (bearish divergence), or vice versa (bullish divergence). To trade regular divergence, wait for a confirmed price reversal at these points. For instance, in a bullish divergence scenario, when the price hits a lower low, the corresponding RSI should create a higher low. Traders can enter a buy position once the price clearly closes above the previous high post-divergence.

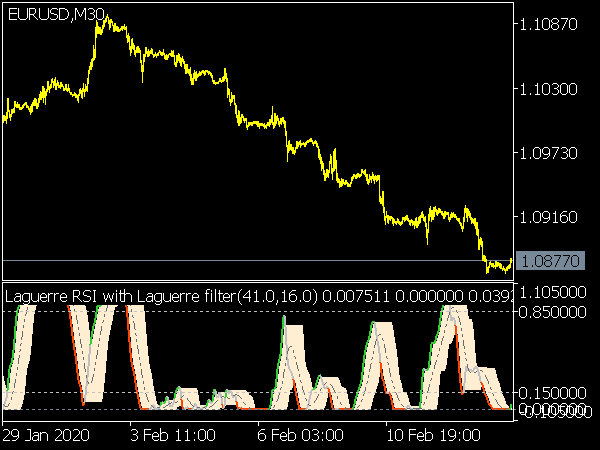

Using Hidden Divergence: Unlike regular divergence, hidden divergence is used to identify potential continuation of the current trend. This happens when the price makes lower highs during a downtrend and the RSI creates higher highs (bullish hidden divergence) or higher lows during an uptrend while the RSI shows lower lows (bearish hidden divergence). In a bearish hidden divergence situation, traders can look for a short entry when the price retraces while the RSI fails to reach the previous high, indicating weakness in the rally.

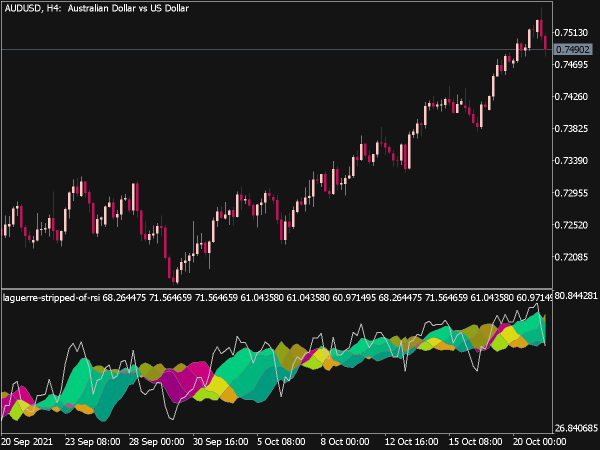

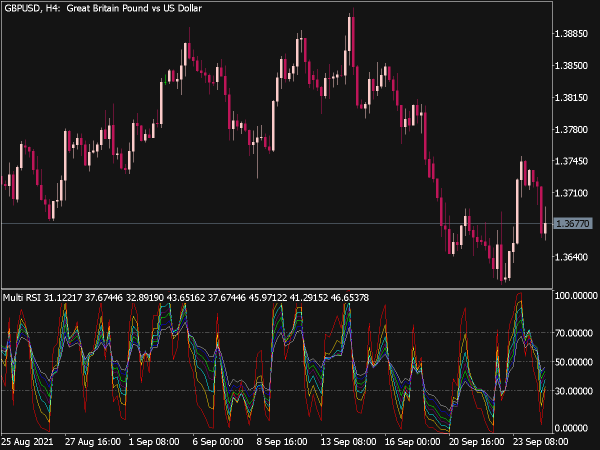

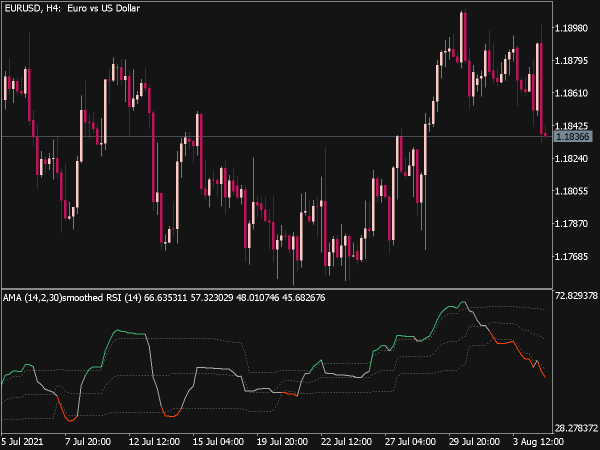

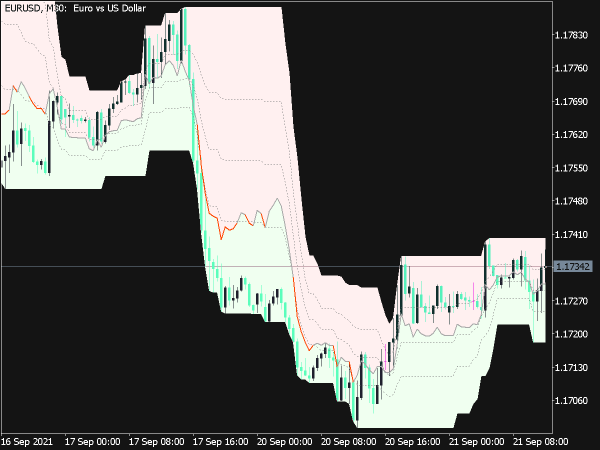

Combining Divergence with Other Indicators: Enhancing the effectiveness of divergence by combining it with other technical indicators can increase your success rate. For example, using moving averages to identify the overall trend helps validate divergence signals. Entering trades in the direction of the trend adds an extra layer of confirmation. Additionally, utilizing candlestick patterns can provide further confirmation regarding price reversals and entries.

Setting Stop-Loss and Take-Profit Levels: As with any trading strategy, risk management is vital when trading RSI divergence. Placing stop-loss orders slightly above the previous high in a bearish divergence trade or below the recent low in a bullish divergence trade can help protect your capital. For take-profit, consider setting targets based on the average true range (ATR) or previous support and resistance levels to maximize potential profits.

Optimize Your Timeframe: The effectiveness of RSI divergence can vary across timeframes. Scalpers may find shorter timeframes more challenging due to noise, while swing traders typically benefit from higher timeframes where divergence signals are cleaner and more reliable. Test your strategies on different timeframes before committing to a live account.

Backtest Your Strategy: Before trading with real money, backtesting your RSI divergence strategy using historical data in MT5 is crucial. Analyze different scenarios to understand how effective the divergence signals were in identifying turning points. Backtesting can help improve your entry and exit strategies based on past performance.

Keep Market Context in Mind: Market conditions affect the reliability of divergence signals. In a strongly trending market, for instance, divergence might lead to false signals or whipsaws. Understanding the current market regime—whether it’s trending or consolidating—is key to interpreting RSI divergence accurately.

Utilizing Alerts for Divergence Detection: MT5 allows traders to set alerts for specific indicators, which can be incredibly helpful in detecting RSI divergences without needing to scrutinize charts constantly. Setting alerts helps traders stay informed of potential trade opportunities, allowing for timely entries.

Regularly Review and Adjust Strategy: The trading environment is dynamic; therefore, regularly reviewing and adjusting your RSI divergence strategy is essential. Factors such as changing market volatility or new market conditions may necessitate tweaks to your approach, risk parameters, or indicator settings.

By mastering both regular and hidden divergence through the RSI on MT5, traders can position themselves to capitalize on potential market movements. However, remember that divergence signals should never be used in isolation; always consider other market factors, use sound risk management practices, and continuously develop your trading skills for sustainable success.

Is there any way to move the arrows slightly away from the RSI line? Unable to see the RSI line to confirm that it is a divergence.

Posible to add alerts when OB OV levels?

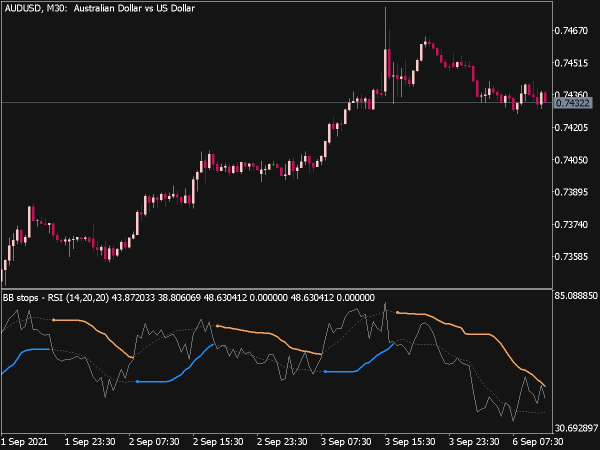

Hi guys, I would like an EA to automate my forex trading strategy. It is relatively simple, in a sense that it only uses the RSI and a Bollinger Band. Do you already have something similar or can you code this? I do have some other details which I will discuss later if the coding is possible, such as detecting RSI divergence and position size etc. Any help is most welcome.