Submit your review | |

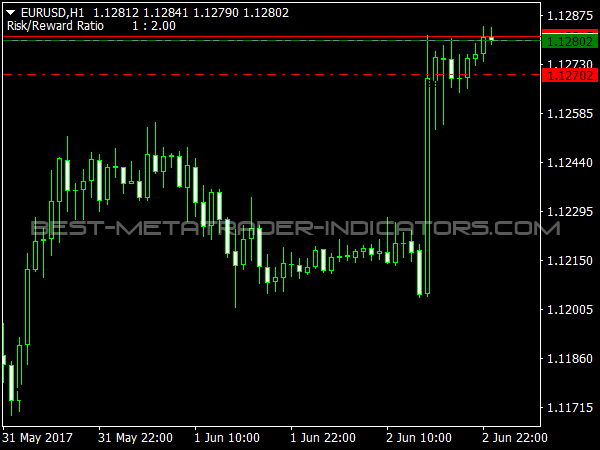

The Risk-Reward Ratio (RRR) is a crucial concept in trading and investing that helps assess the potential profit of a trade relative to its risk. Understanding RRR can significantly enhance decision-making and trade management.

Here’s a list of tips to effectively utilize the Risk-Reward Ratio Indicator:

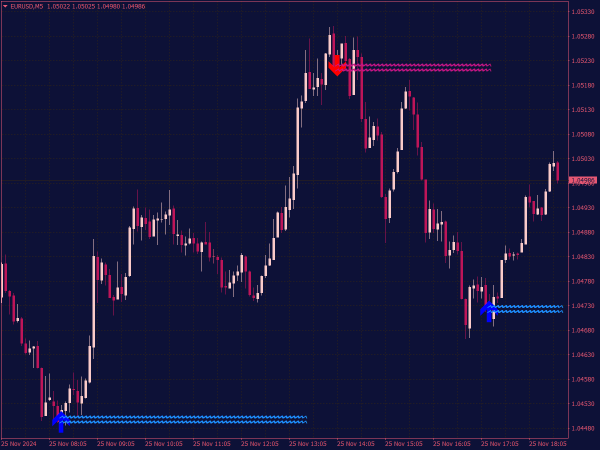

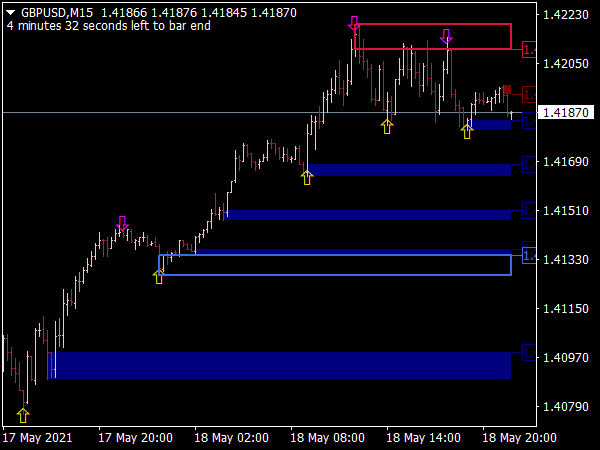

1. Define Your Risk: Establish how much you’re willing to lose on a trade before entering, often expressed in percentage terms of your total capital.

2. Set Profit Targets: Determine your target profit level before you enter a trade. This helps create a concrete basis for calculating the RRR.

3. Calculate RRR: Use the formula RRR = (Expected Profit) / (Potential Loss). Aim for a ratio of at least 2:1 or 3:1, meaning for every dollar risked, you aim to make two or three dollars.

4. Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses. This enforces discipline and protects your capital.

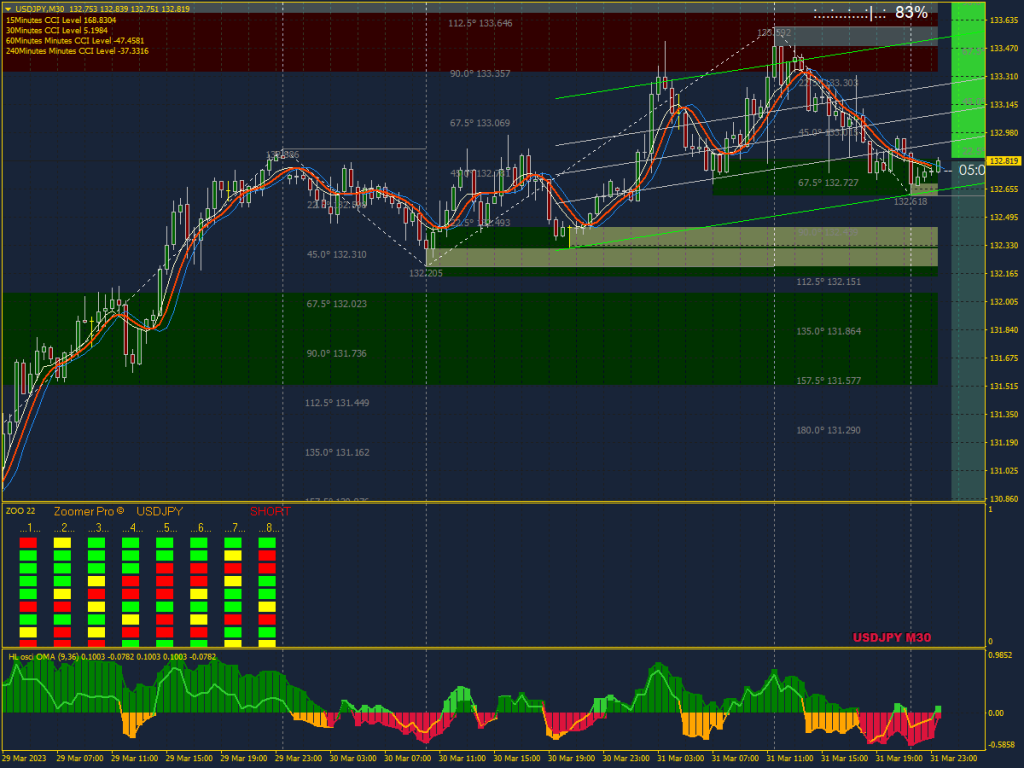

5. Consistent RRR Evaluation: Regularly evaluate the RRR for all trades, especially before entry, to ensure alignment with your trading strategy.

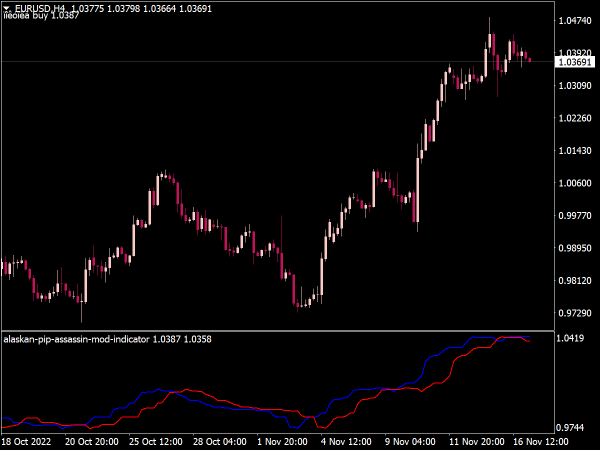

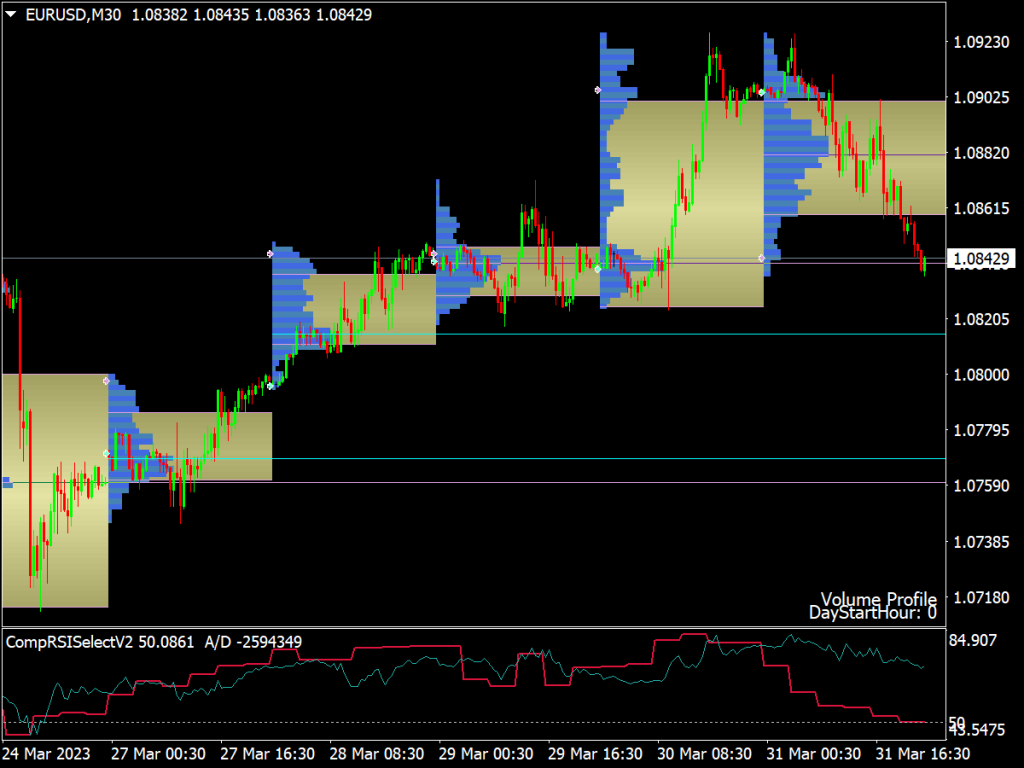

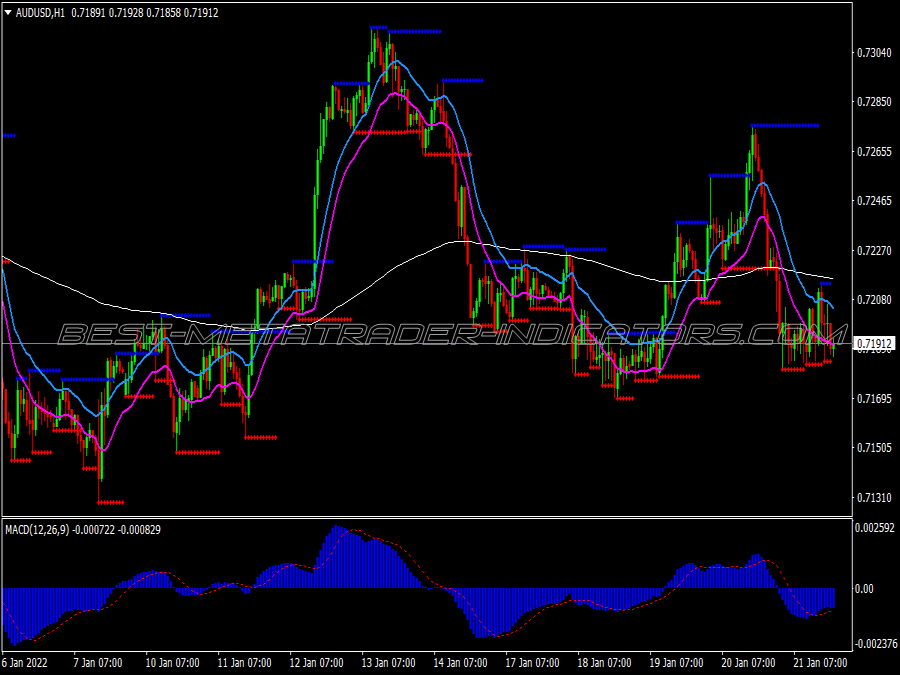

6. Incorporate Other Indicators: Combine RRR with technical indicators (like moving averages or RSI) to improve entry and exit points.

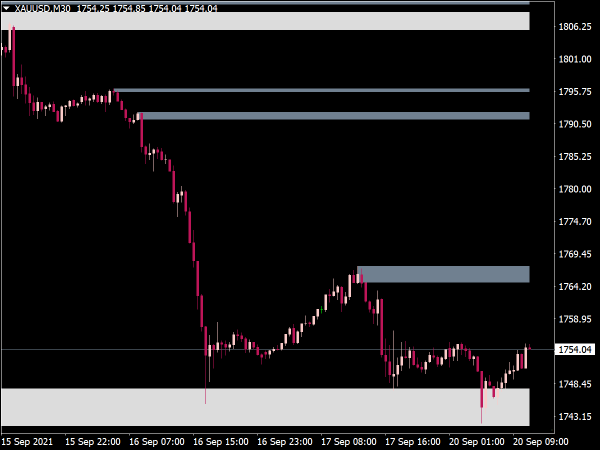

7. Adapt to Market Conditions: Adjust your RRR expectations based on market volatility. In more volatile markets, consider wider stop-loss and target levels.

8. Review Past Trades: Analyze past trades to understand which RRRs led to successful outcomes and which didn’t. Learn from both winning and losing trades.

9. Maintain a Trading Journal: Document every trade, including the RRR, to track performance and make data-driven adjustments to your trading strategy.

10. Avoid Overtrading: Resist the urge to enter trades with poor risk-reward setups, as this can lead to significant losses.

11. Psychological Preparedness: Be mentally ready to accept losses based on your defined risk, which helps maintain emotional discipline.

12. Stay Informed: Keep abreast of market news and events that may affect your trades and RRR expectations.

13. Practice Good Money Management: Allocate only a small percentage of your trading capital to any single trade, which helps mitigate the impact of losses.

14. Use Risk-Reward Analysis in Position Sizing: Determine the amount of capital to risk on a trade based on your RRR and stop-loss distance, optimizing position sizes accordingly.

By incorporating these tips, traders can better manage risks and rewards, improving their overall trading performance and capital preservation.

🛠️ If this indicator is broken,

🛠️ If this indicator is broken,