Submit your review | |

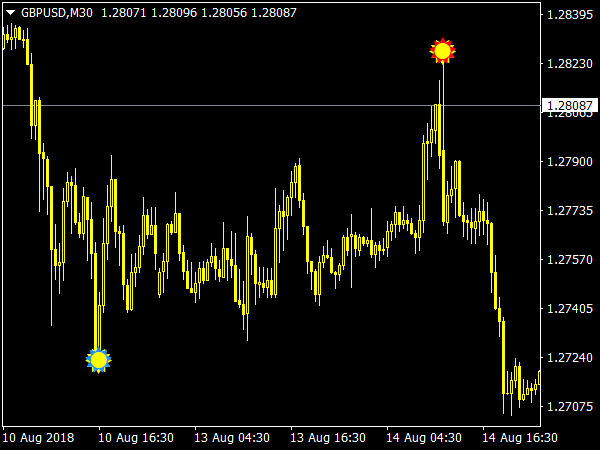

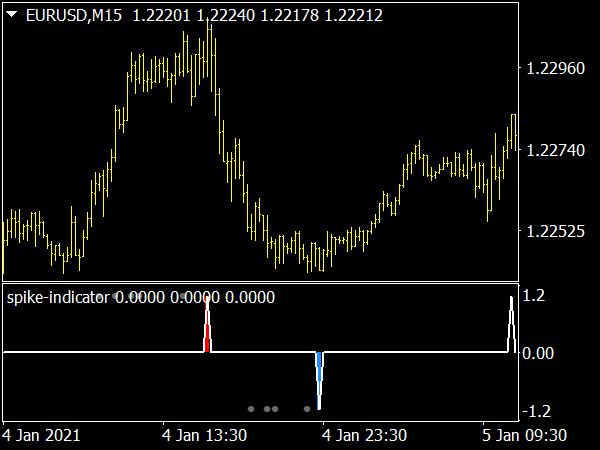

The Reversal Spike Detector Indicator is a robust trading tool designed to identify potential reversal points in tandem with sudden price spikes, which are often precursors to significant market shifts. Traders can effectively utilize this indicator by incorporating it into a broader trading strategy that focuses on recognizing market momentum, understanding market sentiment, and managing risk.

Understanding the Indicator

The Reversal Spike Detector typically looks for rapid price movements accompanied by increased volume. These spikes often occur at key support or resistance levels, indicating that the market may be changing direction. The indicator might use algorithms to analyze price patterns, candlestick formations, and trade volume, providing signals that help traders identify potential entry and exit points.

Entry Points

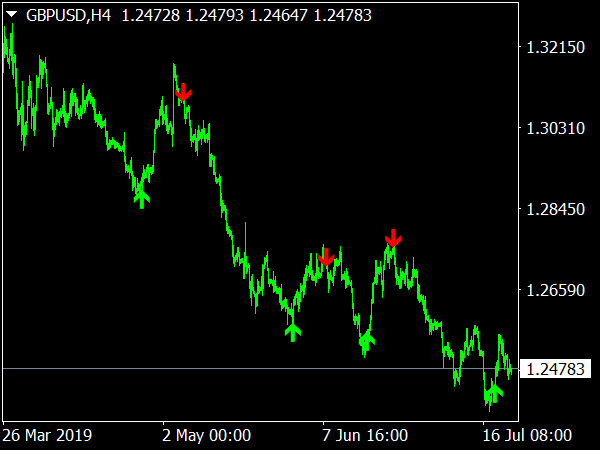

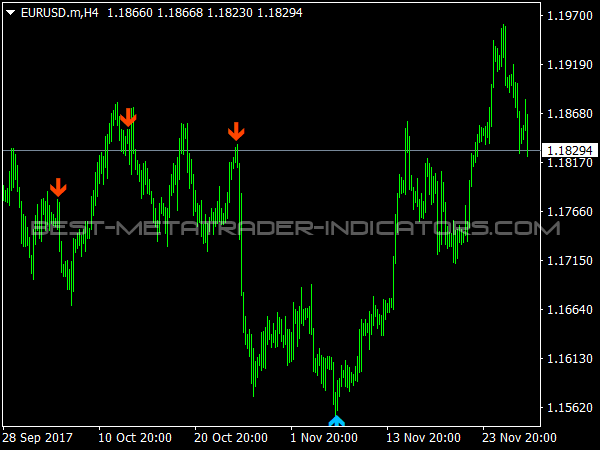

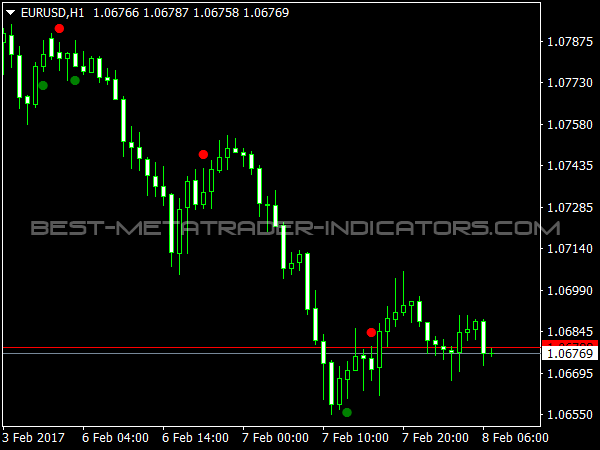

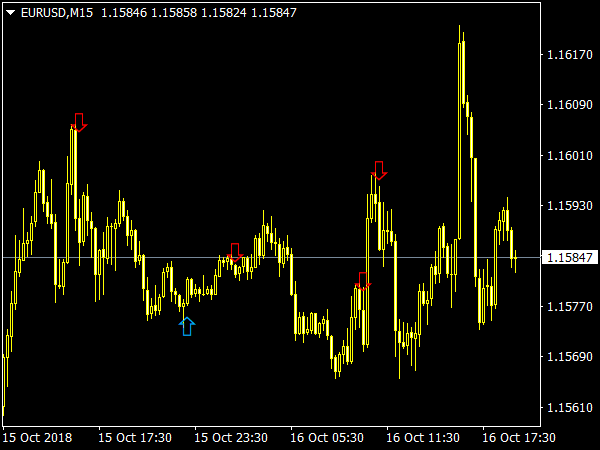

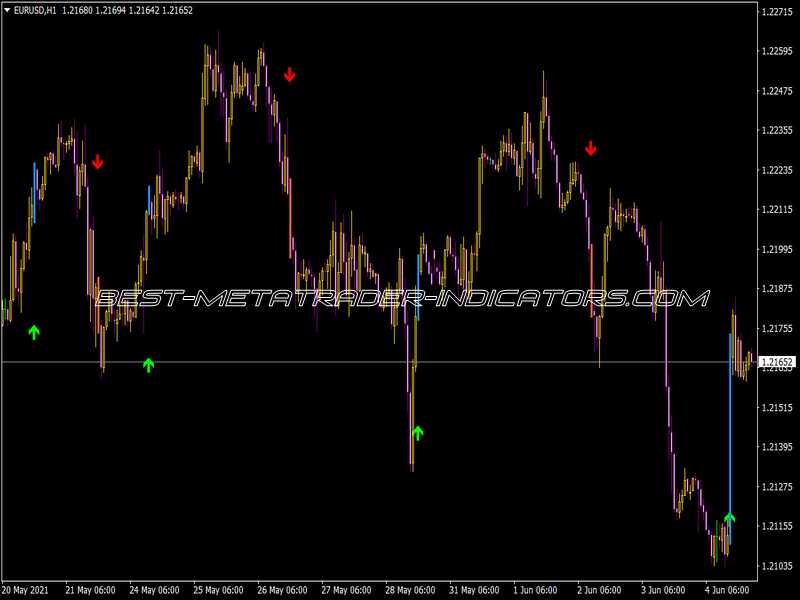

1. Identify Reversal Zones: Look for areas on the chart where price has repeatedly reversed in the past (support/resistance levels). The Reversal Spike Detector will give signals near these zones, suggesting a potential reversal.

2. Volume Confirmation: Before entering a trade, check if the spike in price is supported by increased trading volume. High volume indicates strong interest and can validate the reversal signal generated by the indicator.

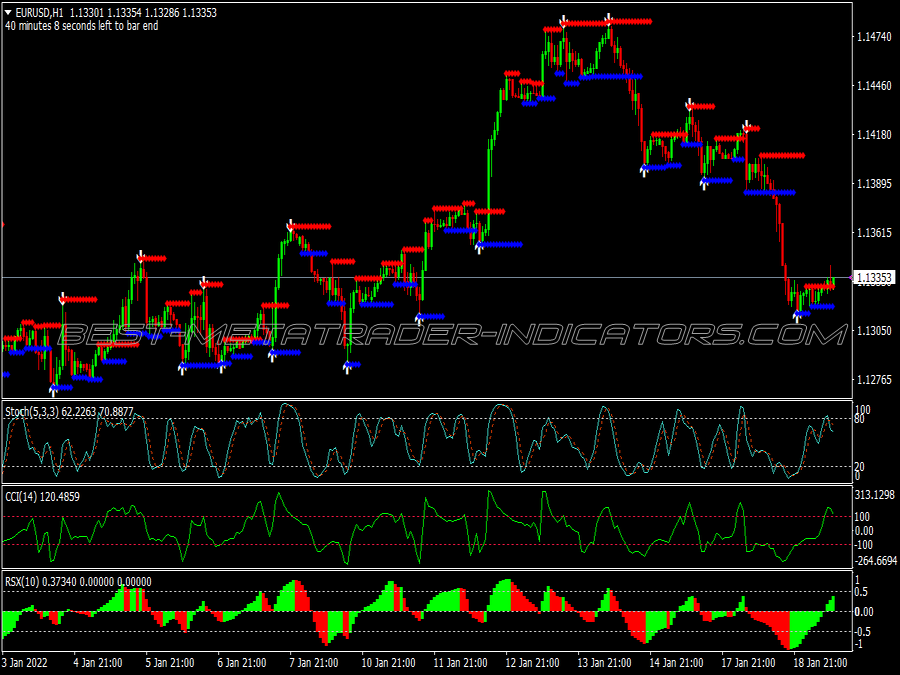

3. Candle Patterns: Look for candlestick patterns that typically signify reversals, such as engulfing patterns or hammer candles that reinforce the signals provided by the Reversal Spike Detector.

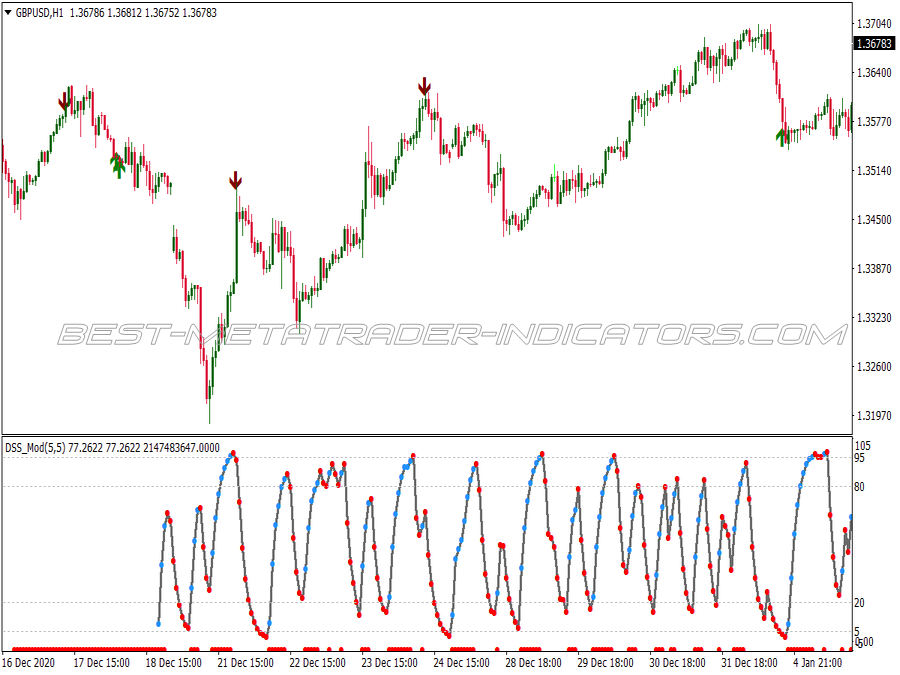

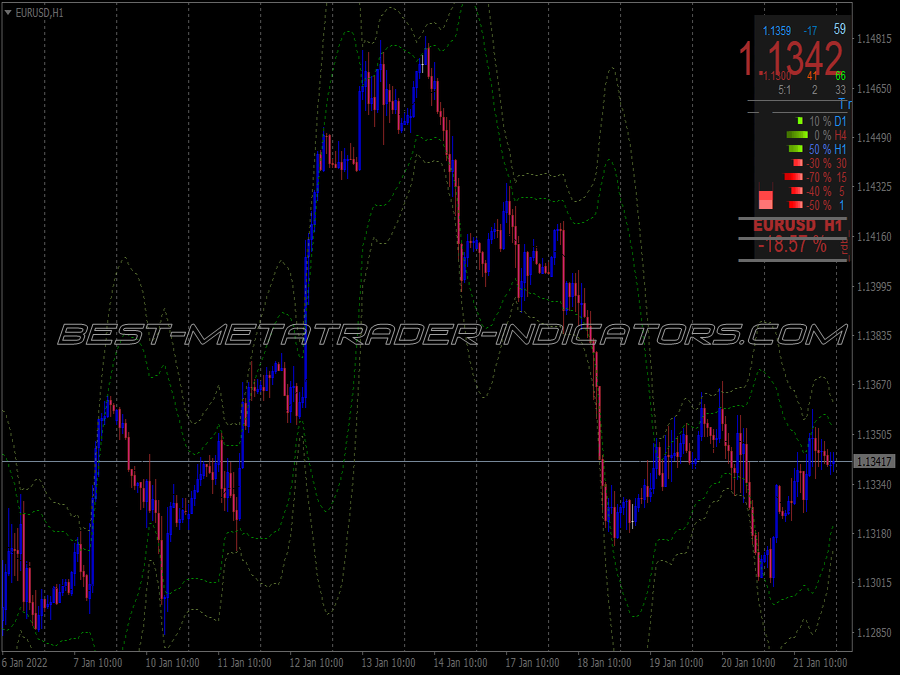

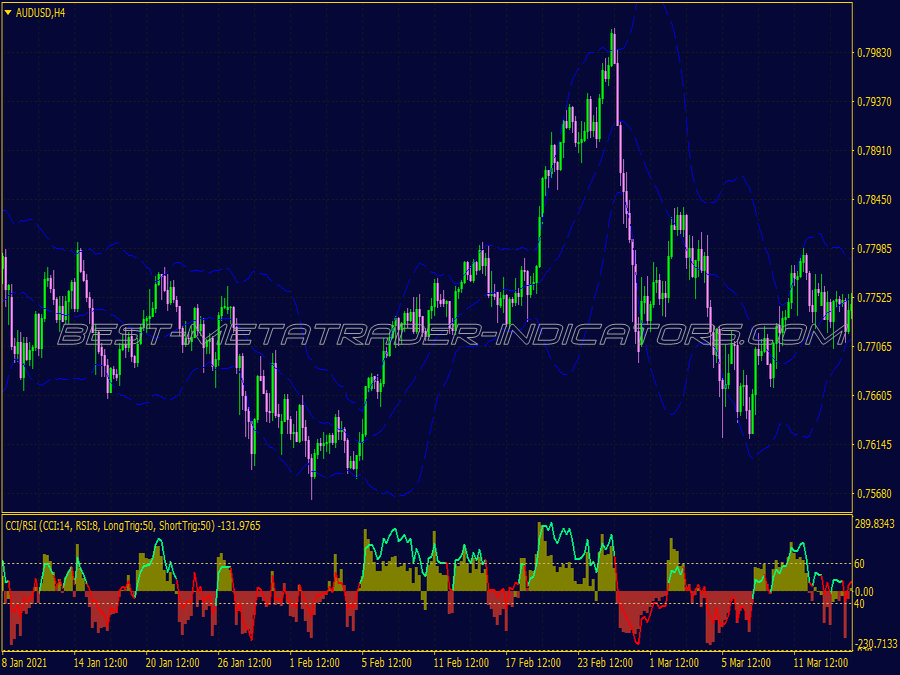

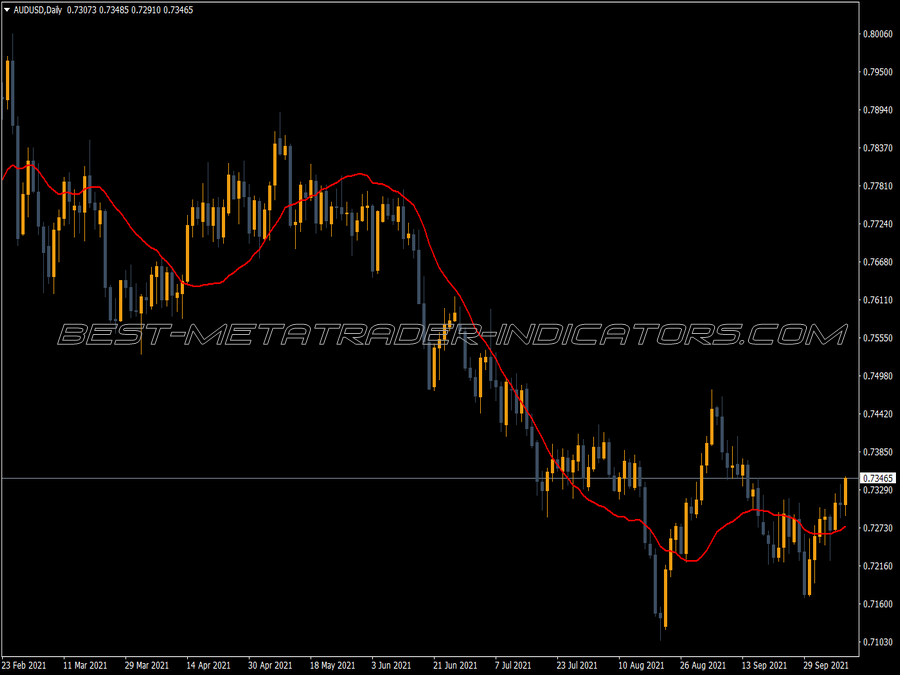

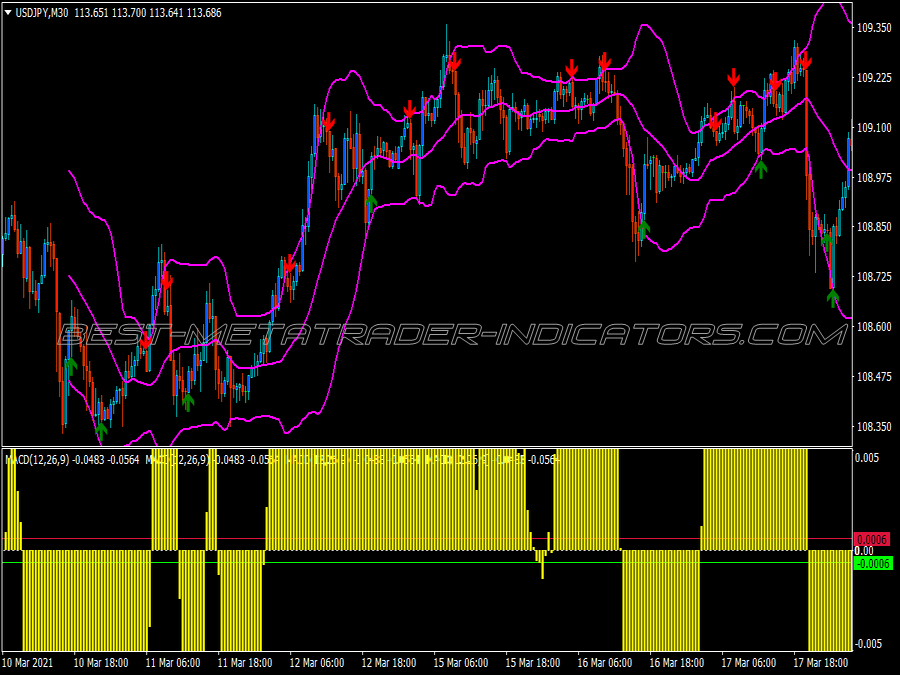

4. Divergence Analysis: Use divergence between price movement and a momentum indicator (like RSI or MACD). If you observe a price spike without corresponding momentum strength, it could be a strong indication of a potential reversal.

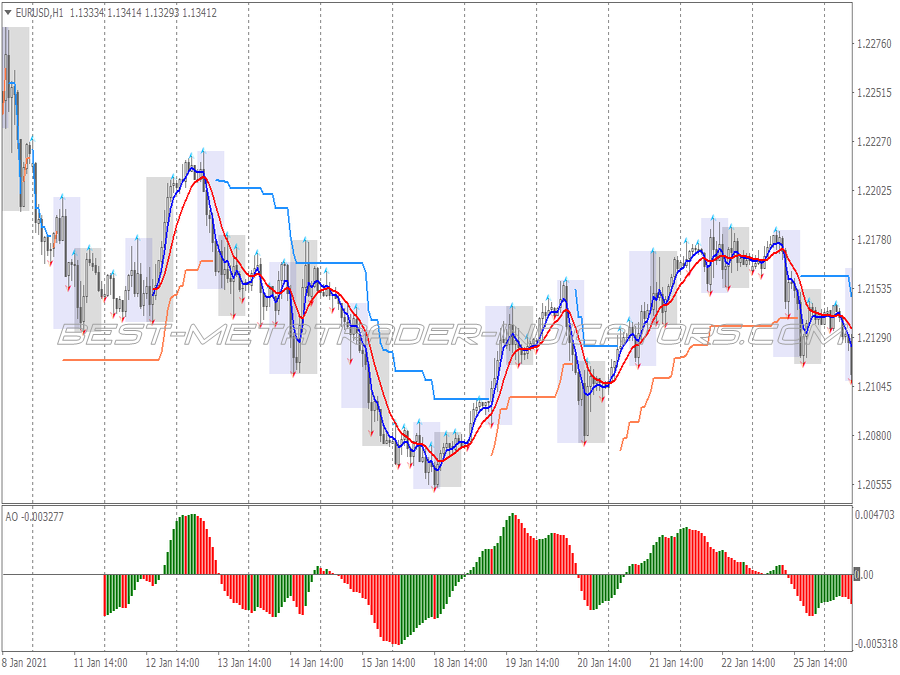

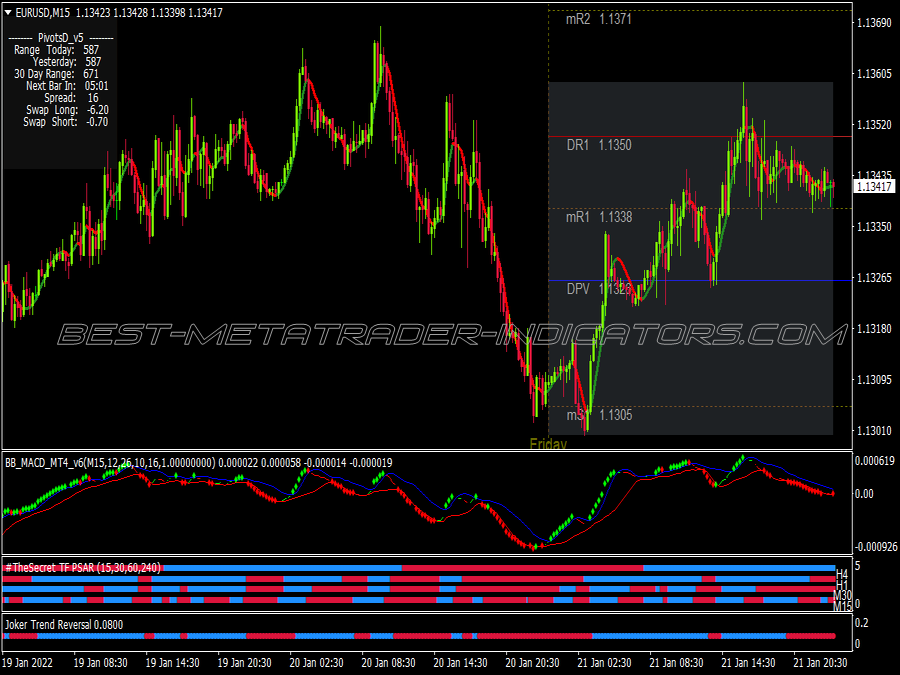

5. Time Frame Alignment: It’s crucial to align your strategy across multiple time frames. For example, if the Reversal Spike Detector shows a reversal signal on the 1-hour chart, check the 4-hour and daily charts to ascertain that the trend is indeed reversing.

6. News Awareness: Be cognizant of macroeconomic news or events that could trigger volatility. Spikes can sometimes be reactions to news, and understanding the context can help you decide whether to act on the signal.

Strategy 1: The Spike and Stagger Approach

• Entry: Enter the trade on confirmation of a spike signal and a subsequent candle that closes in the direction of the anticipated move.

• Stop-Loss: Place a stop-loss just beyond the recent swing high or low to minimize risk.

• Take Profit: Set a take-profit target at a good reward-to-risk ratio, ideally 2:1.

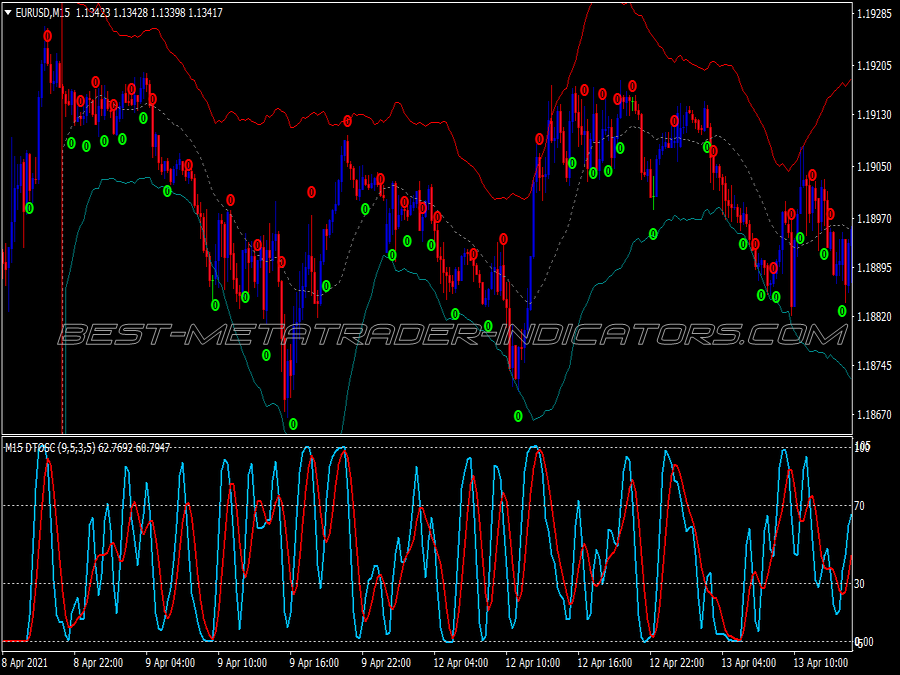

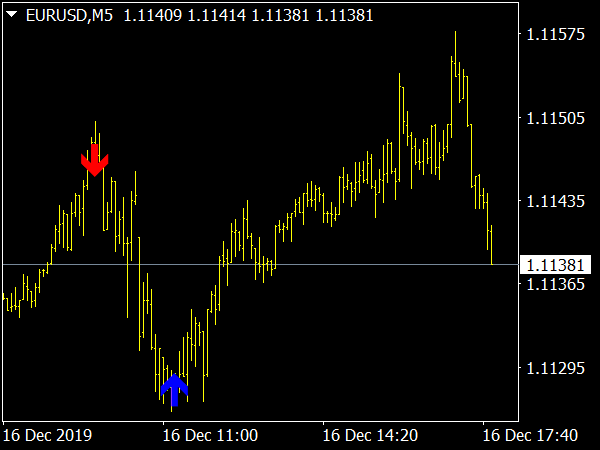

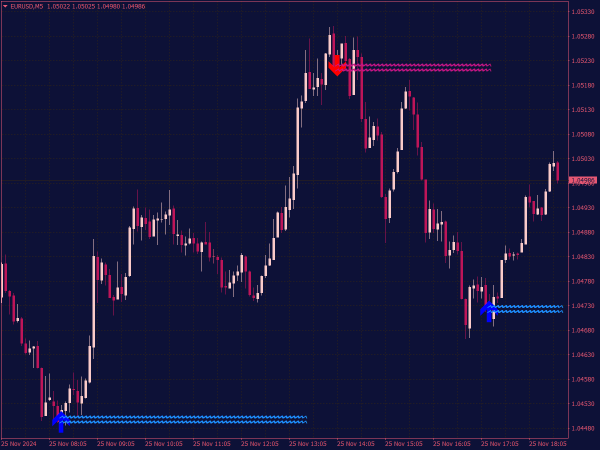

Strategy 2: Scalping with Spikes

• Entry: For short-term trades, enter on a confirmed spike signal within a 5 or 15-minute chart.

• Exit: Utilize tight stop-losses (5-10 pips) and aim for small but consistent profits (5-15 pips).

• Volume Tracking: Always check volume, as spikes without volume can lead to false entries.

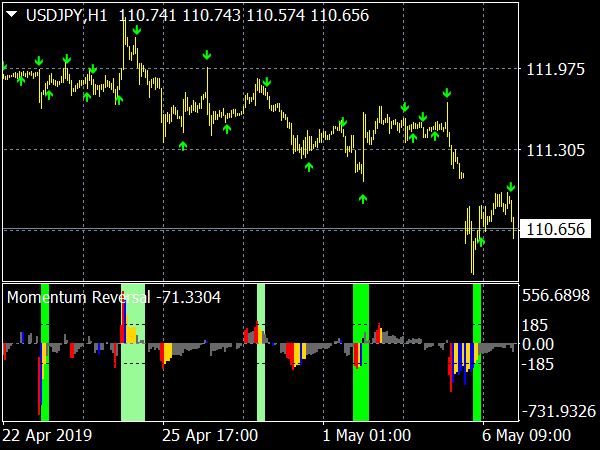

Strategy 3: Trend Reversal Confirmation

• Entry: Wait for multiple confirmation signals (a spike alongside a strong divergence on the oscillator).

• Risk Management: Employ wider stop-losses in volatile markets, adjusting them based on average true range (ATR).

• Position Sizing: Use a fixed ratio or a percentage of your trading capital to determine trade size based on confidence levels from the indicator.

Tips for Effective Trading

• Consistent Backtesting: Regularly backtest the Reversal Spike Detector on past market data to fine-tune your trading strategies and identify the most effective patterns that align with the indicator.

• Maintain a Trading Journal: Document every trade, including the reasoning behind entry and exit points, performance of the Reversal Spike Detector, and adjustments made based on market conditions. This will refine your strategy over time.

• Avoid Over-Reliance: While the Reversal Spike Detector provides valuable insights, avoid making decisions based solely on its signals. Always integrate other technical analysis tools and fundamental analysis for well-rounded decision-making.

• Psychological Preparation: Understand the psychological elements of trading. Reversal Spikes can evoke strong emotional reactions. Maintaining discipline and sticking to your trading plan is crucial for long-term profitability.

• Market Conditions: Know the current market environment (bullish, bearish, or sideways) since spike patterns and their reliability can vary significantly across different market conditions.

In conclusion, the Reversal Spike Detector Indicator can be a powerful ally in a trader's toolkit when used correctly. Identifying strong entry points, confirming signals through volume and candlestick patterns, and employing sensible risk management strategies will enhance the likelihood of trading success. Always remember to adapt strategies to changing market conditions, continuously learn and evolve your tactics for optimal performance.

If you are smart you'll never use this indicator alone to predict reversals. You need 3 or more good trend oscillators plus this indicator to filter out manipulation and stop hunts. You find those oscillators you have a 80%-85% winning system that trades on the 15min chart and beyond. Remember that price doesn't stay bullish forever or bearish. Finding that reversal with 80-85% strike rate defeats smart money concepts, ICT...Supply and Demand etc.

Sometimes it works well. Most of the time it repaints and you will blow your account over and over before you have to let it go. Don't do it bro.

Hi,

is it possible to create a indicator for binary like V75, V10 and others, am using Deriv as a broker to trade and its only offer MT5.

Kind Regards,

Fredrick