Submit your review | |

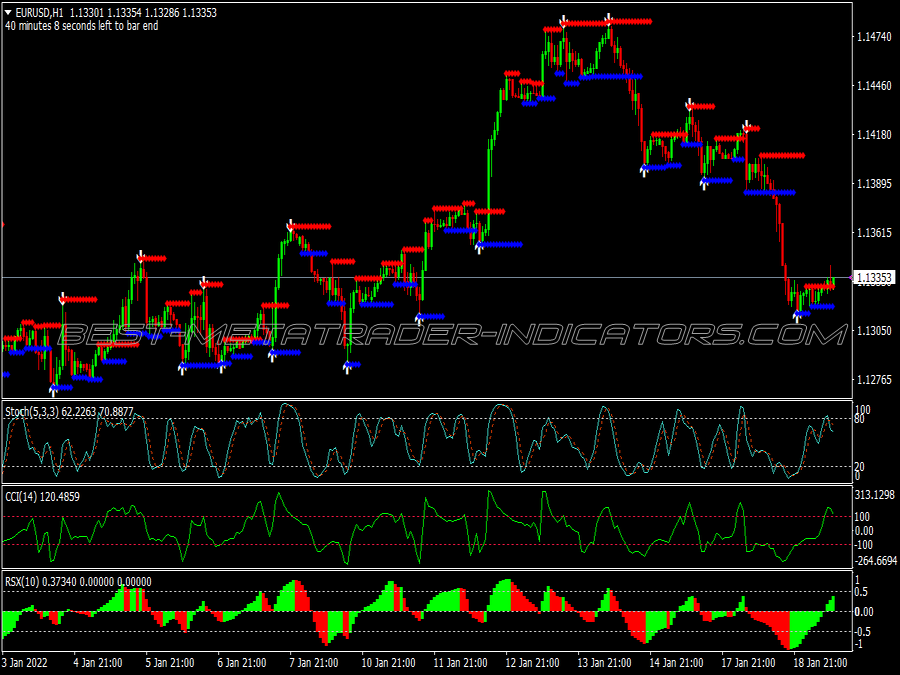

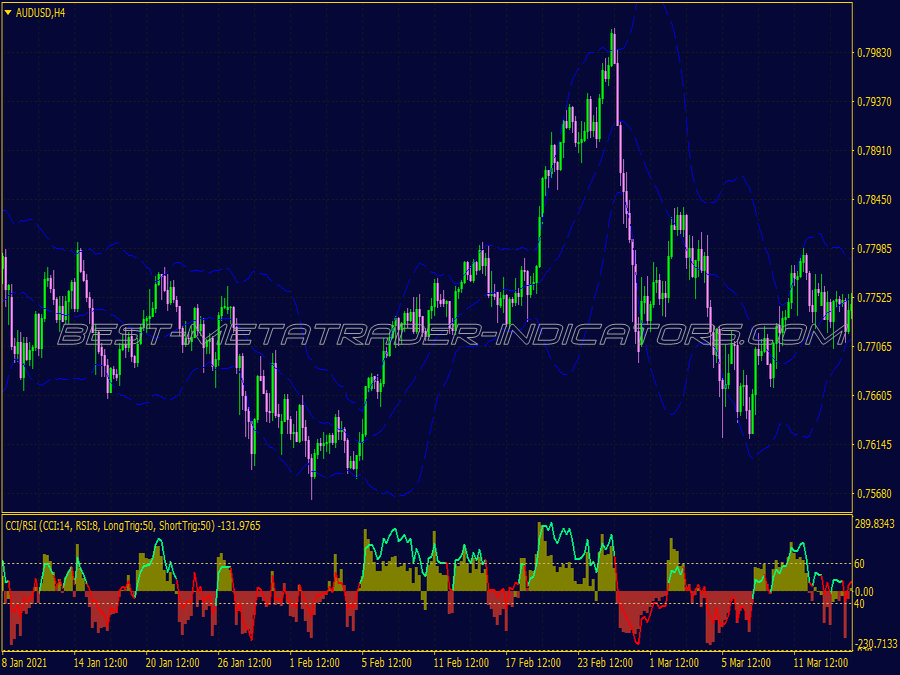

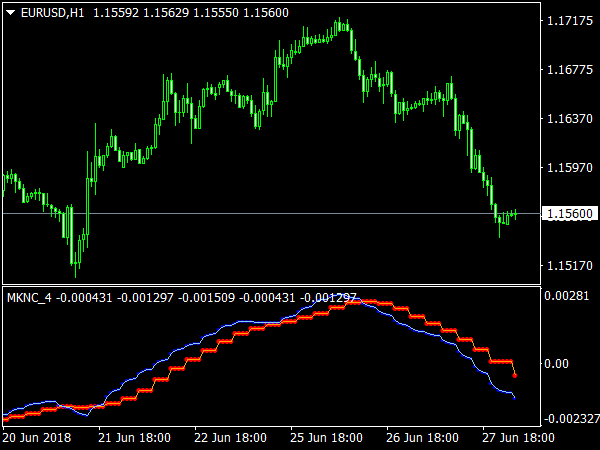

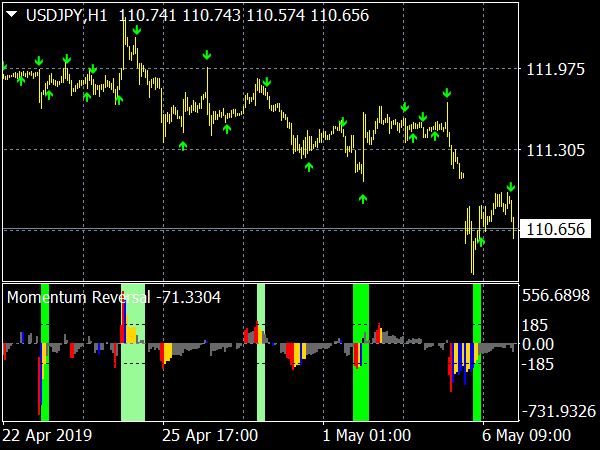

Reversal trading focuses on identifying points where a prevailing trend is expected to change direction, making it a potentially lucrative strategy for traders who can accurately predict these shifts. To successfully implement reversal trading strategies, it is essential to analyze price charts, understand market psychology, and utilize various technical indicators effectively.

Entry Points

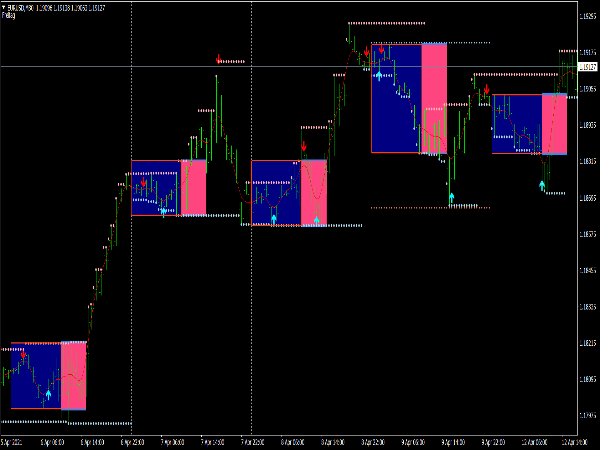

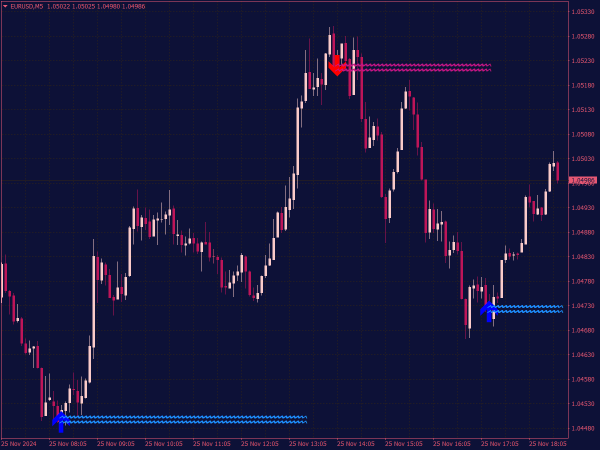

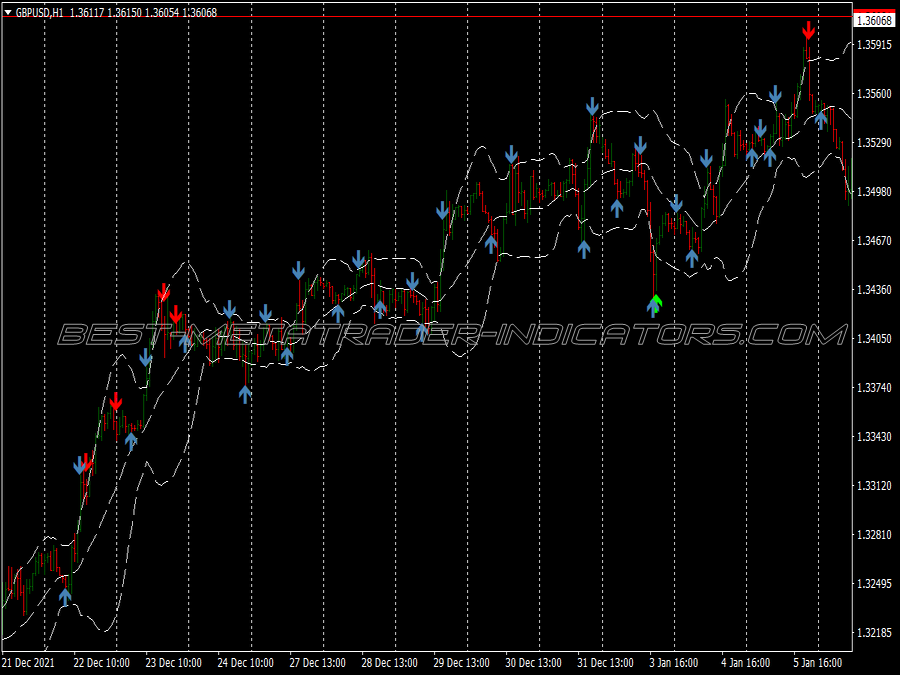

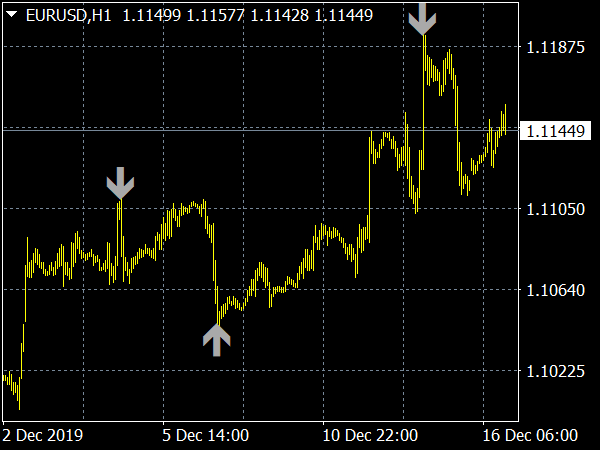

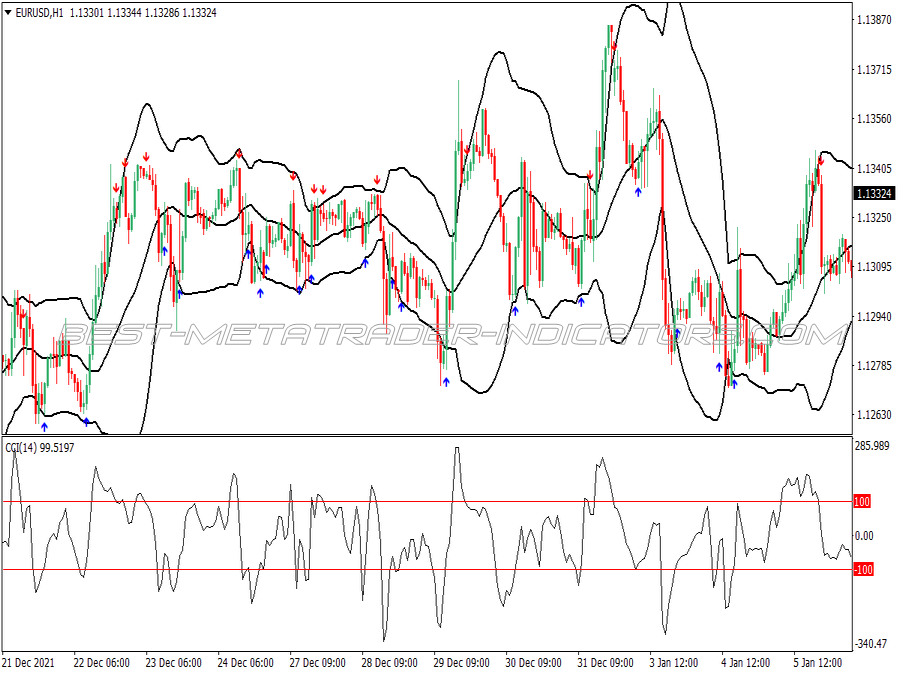

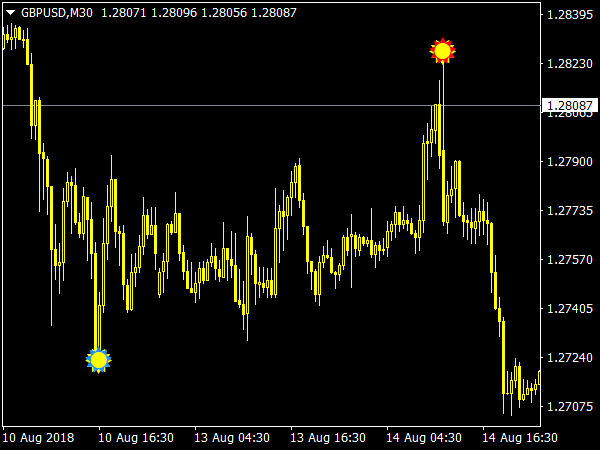

1. Support and Resistance Levels: Traders should begin by identifying key support and resistance levels, where price has previously reversed. A reversal is often more likely at these levels, signaling potential entry points.

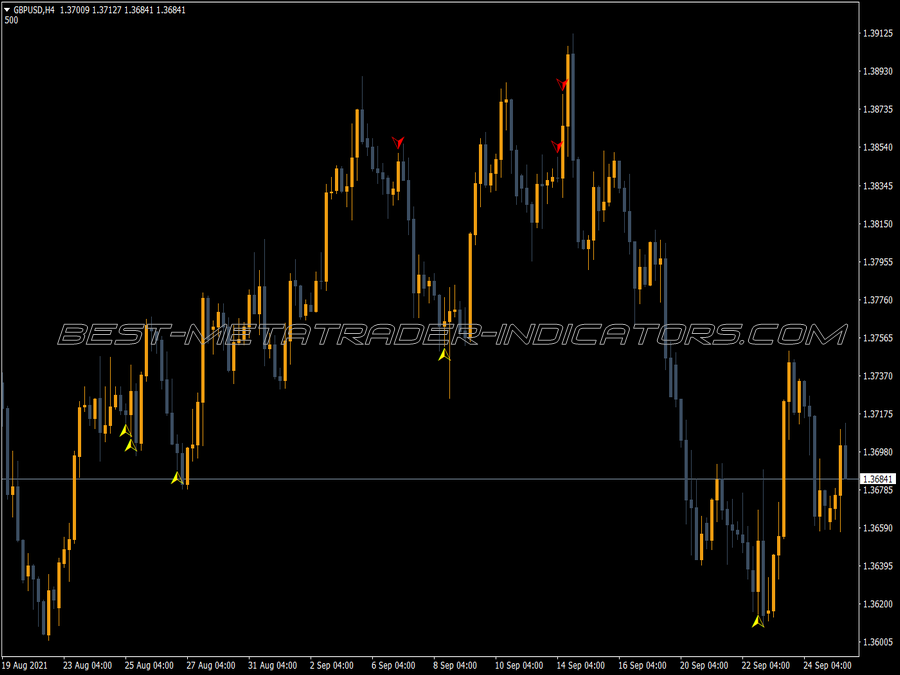

2. Candlestick Patterns: Certain candlestick formations, such as hammers, engulfing patterns, or doji candlesticks, can indicate a reversal. Traders should look for these patterns at key levels to confirm their entry.

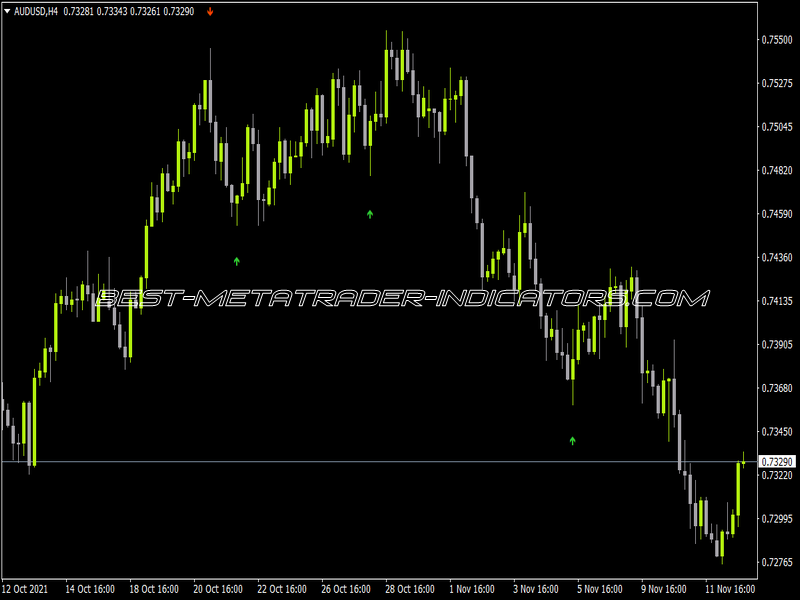

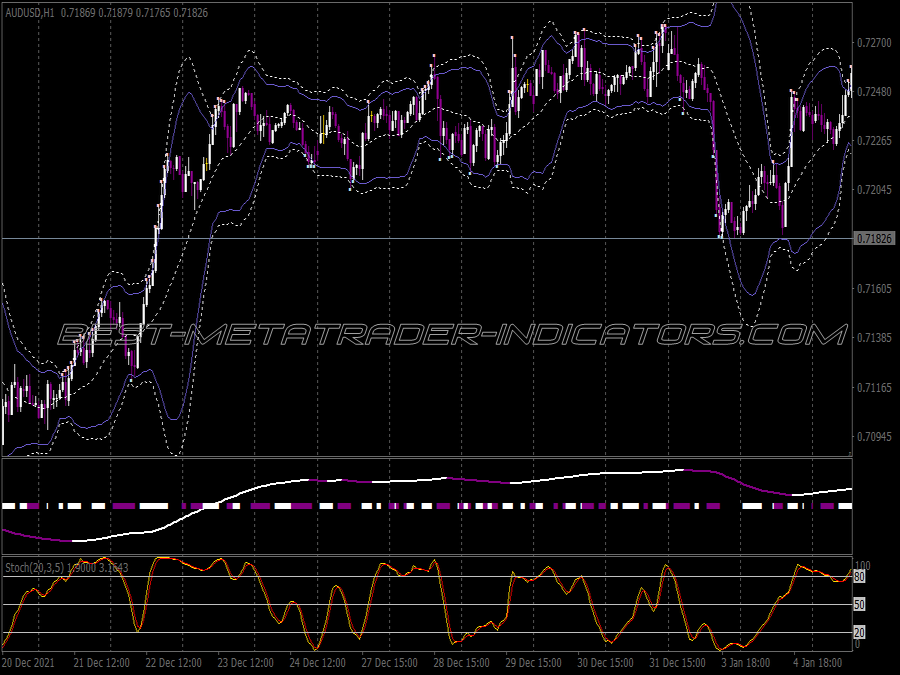

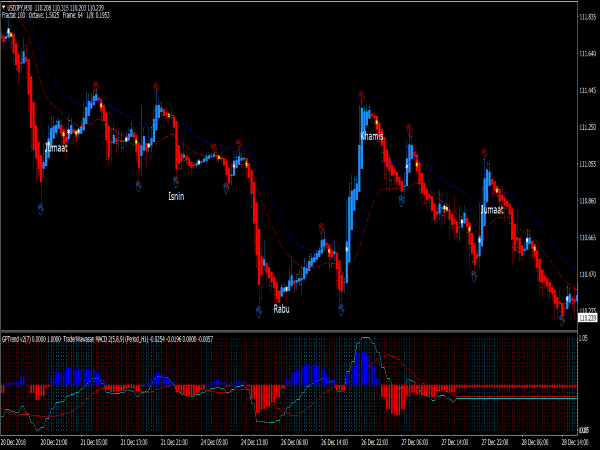

3. Divergence: Divergence between price and indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can suggest a potential reversal. For instance, when prices are making new highs, but the RSI shows lower highs, it may indicate weakening momentum.

4. Fibonacci Retracement Levels: Utilizing Fibonacci retracement levels can help identify potential reversal points in trending markets. Traders often look for reversals at the 61.8% or 38.2% retracement levels.

5. Trendline Breaks: A break of a well-established trendline can signal a potential reversal. Traders should watch for confirming signals like increased volume or candlestick patterns upon the trendline break.

Tips for Successful Reversal Trading

1. Wait for Confirmation:Always wait for confirmation signals before entering a trade. Confirmation can come from observing a follow-through in price action, solid candlestick patterns, or additional indicators aligning with your hypothesis.

2. Risk Management: Implement strict risk management techniques. Set stop-loss orders just beyond the recent high or low, depending on your trade direction, to protect against false reversals.

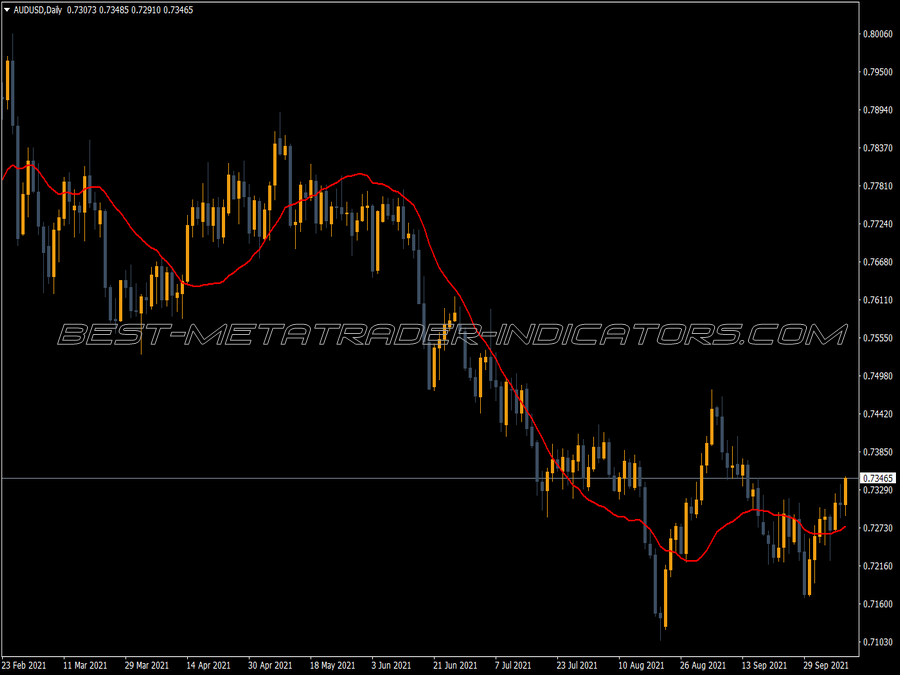

3. Use Multiple Time Frames: Analyze multiple time frames to increase the reliability of reversal signals. For instance, a reversal visible on the hourly chart might be a pullback in a larger trend visible on the daily chart.

4. Market Sentiment: Pay attention to market sentiment and news events that may impact price movements. Traders should be wary of reversals in reaction to significant news, as these can lead to volatile price action that breaks through support and resistance levels.

5. Be Patient: Reversal trading requires patience and discipline. Many traders tend to act too quickly, leading to losses. Wait for the ideal setup that aligns with your analysis before executing a trade.

6. Backtesting Strategies: Before trading with real money, backtest your reversal strategy to evaluate its effectiveness. Analyze historical data to understand how well your indicators and entry points performed over time.

7. Adaptability: Be adaptable to changing market conditions. The market can shift from trending to ranging, so revisiting and adjusting your strategies may become necessary to maintain effectiveness.

8. Psychological Preparedness: Reversal trading can induce significant psychological stress, especially when trades go against expectations. Maintain a disciplined approach, stick to your trading plan, and minimize emotional decision-making.

In conclusion, reversal trading can be profitable when done correctly. It requires a methodical approach to identifying entry points with established techniques like looking for key support and resistance levels, observing candlestick patterns, waiting for divergence, using Fibonacci retracements, and noting trendline breaks. Incorporating risk management, thorough market analysis, and psychological readiness into one’s strategy enhances the potential for long-term success. Remember, while reversal trading presents opportunities, it also comes with risks, so be prepared to adapt as market dynamics shift.

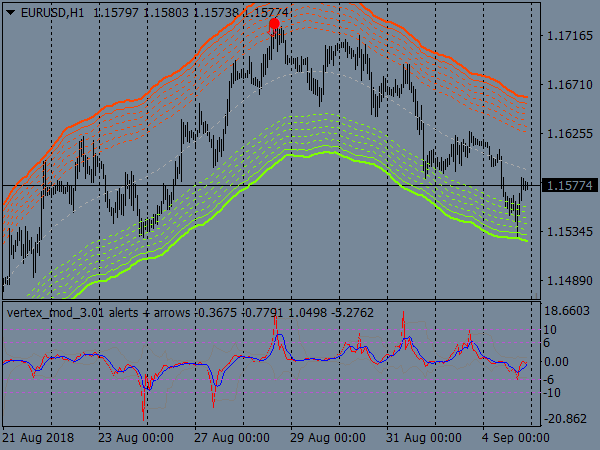

Its good stuff. Yes it repaints, but it's actually good.

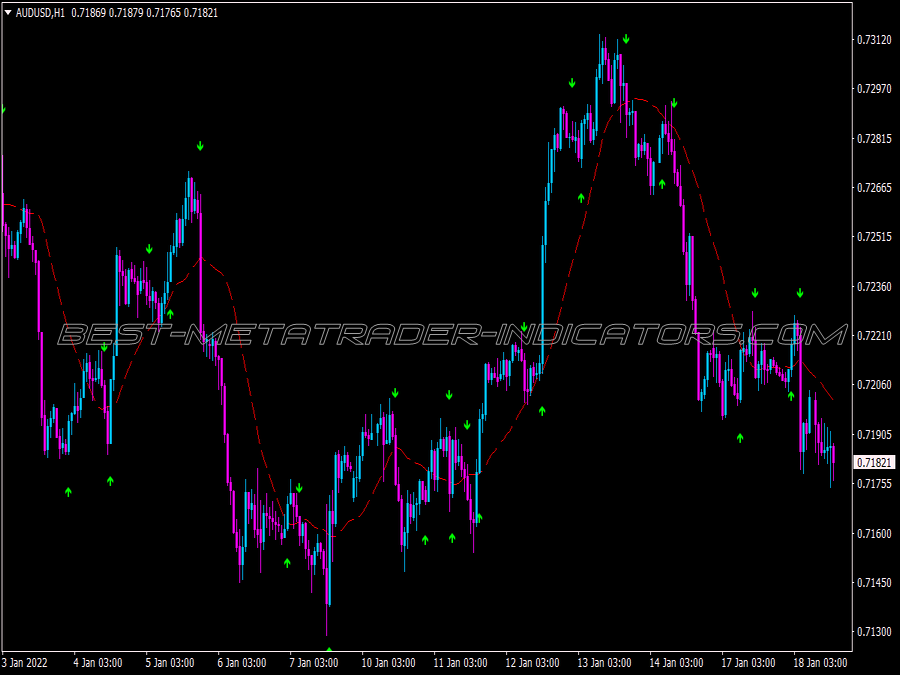

Though it repaints, ensure that you use it with support and resistance, never enter the trade immediately, let the support or resistance hold, the let the trade bounce up or down, the follow the trend up or down.

Who make this indi? It work well and it repaint.

Working perfectly well.... I Love it.

It repaint, be careful.

Mainly trade this on the 15M time frame and any other higher time frame to trade with reversal signal. Typically trade price action confirmation afterwards. Recommend you trade on DEMO first to create strategy. Happy trading =)

it repaint

I am currently trying it on a demo account. But so far i think it is good. It works better to a large extent.