Submit your review | |

Price action trading strategies focus primarily on the movement of price rather than relying on complex indicators. However, incorporating oscillators can enhance these strategies by providing additional confirmation and insight into market momentum.

This blend enables traders to make well-informed decisions grounded in both price behavior and momentum dynamics. Below are several effective price action trading strategies that utilize oscillators.

Understanding Price Action Trading

Price action trading involves analyzing historical and current price movements to identify patterns, trends, and potential reversals without the clutter of many indicators. Traders can gauge market sentiment, strength, and potential turning points through candlestick patterns and pricing formations. Pairing this approach with oscillators can help in confirming trends or pointing out potential divergences, offering a more rounded trading strategy.

Popular Oscillators in Price Action Trading

Several key oscillators are frequently used in conjunction with price action trading strategies:

• Relative Strength Index (RSI): This oscillator measures the speed and change of price movements and ranges from 0 to 100. Typically, an asset is considered overbought when the RSI is above 70 and oversold below 30.

• Stochastic Oscillator: This compares a particular closing price of an asset to its price range over a specified period, highlighting overbought and oversold conditions. The values range from 0 to 100, commonly using 20 as oversold and 80 as overbought levels.

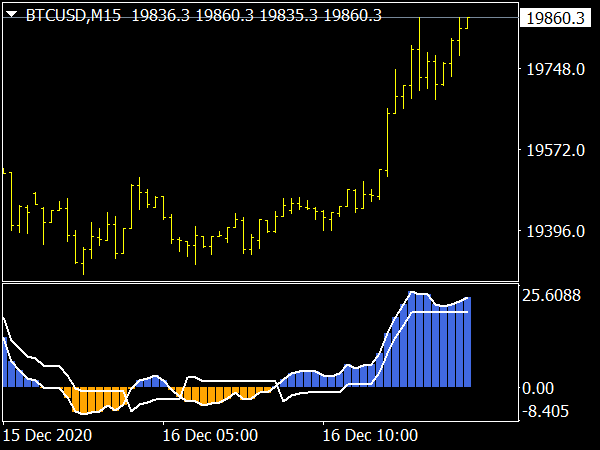

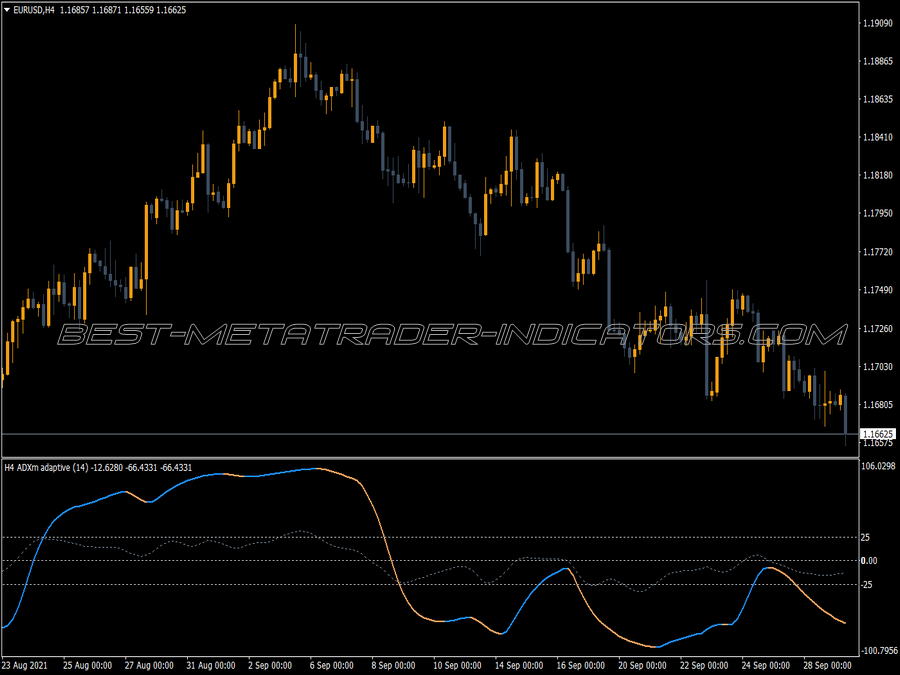

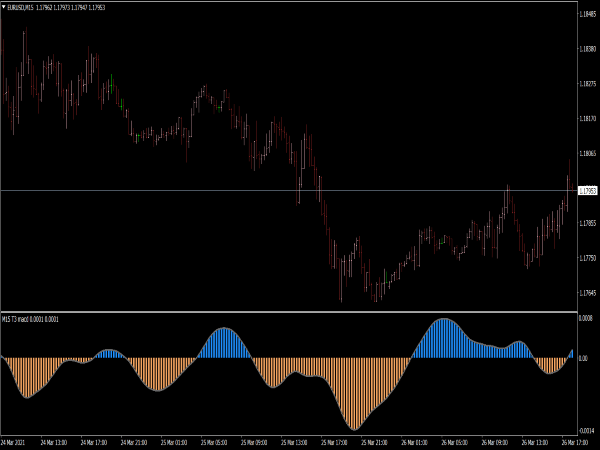

• MACD (Moving Average Convergence Divergence): While not a traditional oscillator, the MACD is often included due to its dual nature of indicating momentum and trend direction. It helps identify potential buy and sell signals through crossover points.

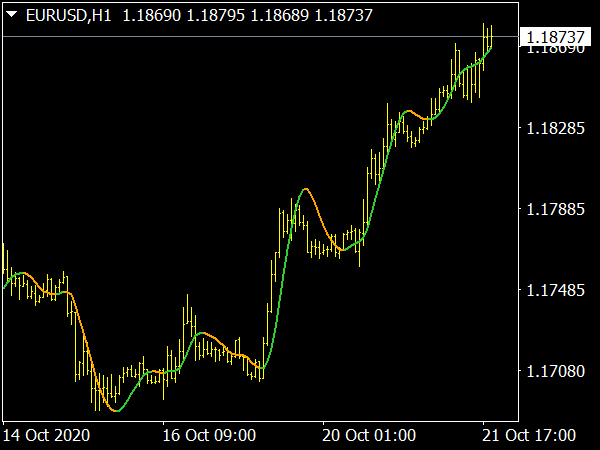

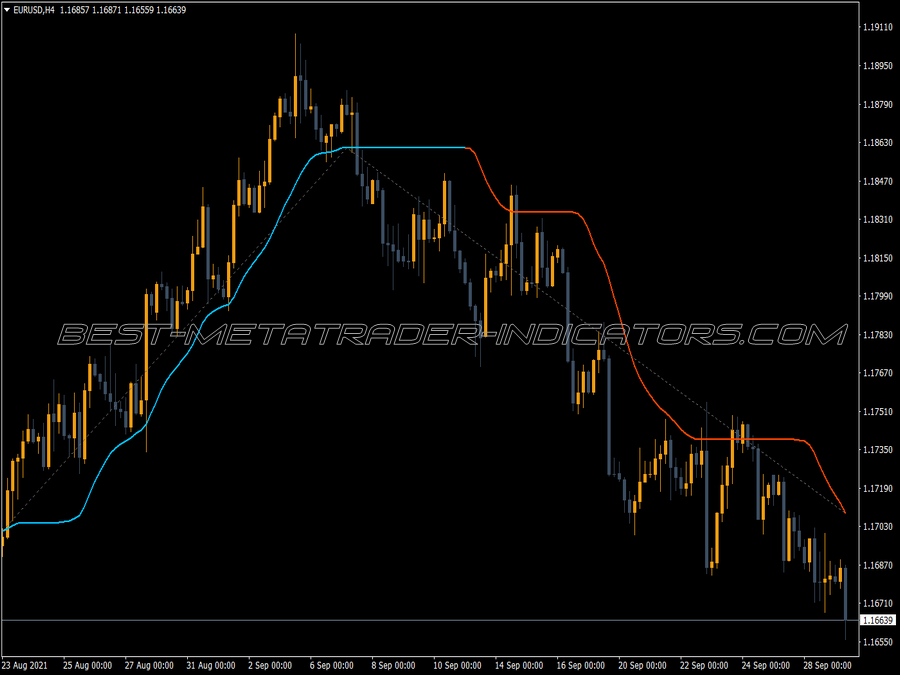

1. Trend Continuation Strategy with RSI

Setup:

• Identify a strong trend using price action (e.g., higher highs in an uptrend).

• Wait for a pullback to a significant support level.

• Use the RSI to gauge momentum, looking for a reading above 40 in an uptrend.

Execution:

• Once the price shows signs of reversal at the support, enter a trade in the direction of the trend.

• Set stop-loss orders just below the recent swing low or the last major support level.

• Target levels can be previous highs or based on risk-reward ratios, ideally 1:2 or more.

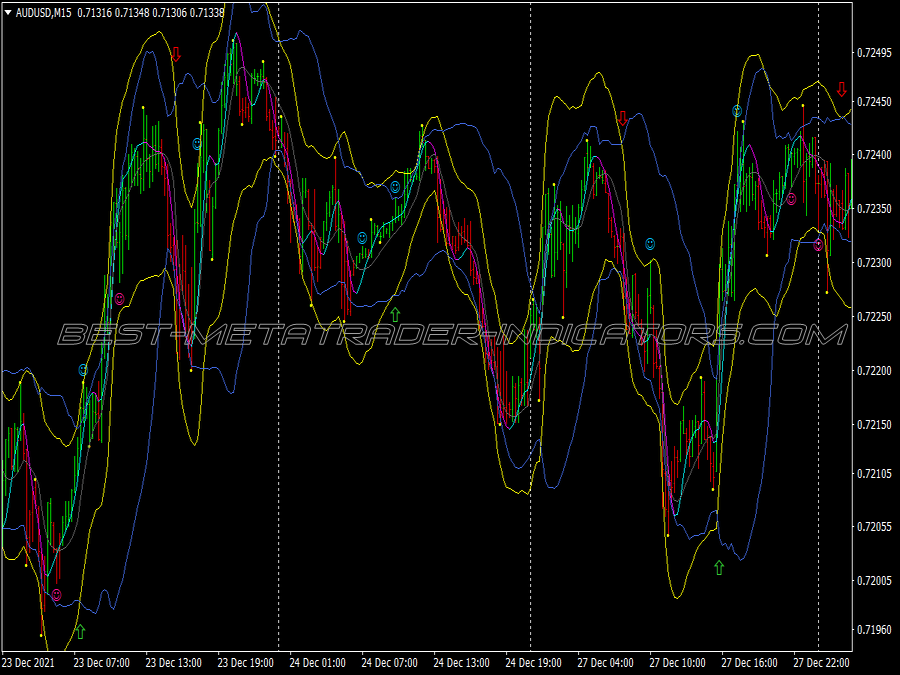

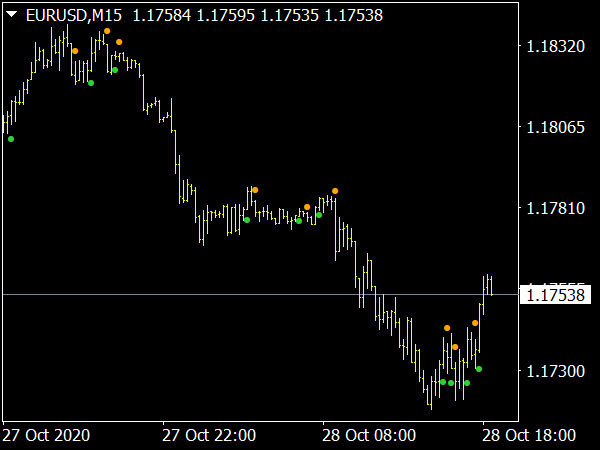

2. Divergence Trading with Stochastic Oscillator

Setup:

• Identify price peaks or troughs using candlestick patterns.

• Look for divergence between the price action and the stochastic oscillator; for instance, if the price is making higher highs while the stochastic displays lower highs, this indicates weakening momentum.

Execution:

• Confirm the divergence with a candlestick pattern signaling a reversal (e.g., a bearish engulfing or a pin bar).

• Place a trade in the direction of the anticipated move, using a stop-loss above the most recent swing high.

• Consider taking profits at key support/resistance levels or when the price action shows signs of exhaustion.

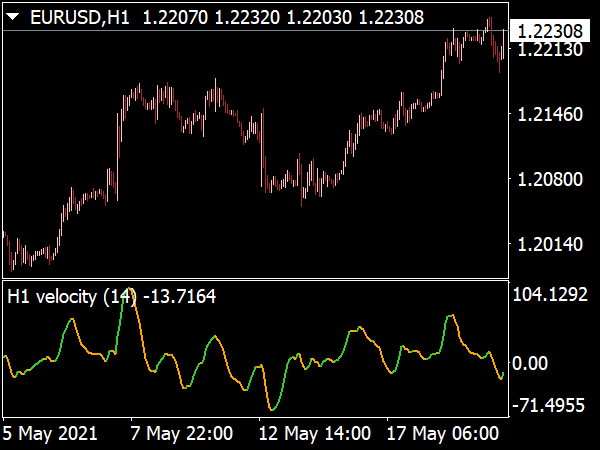

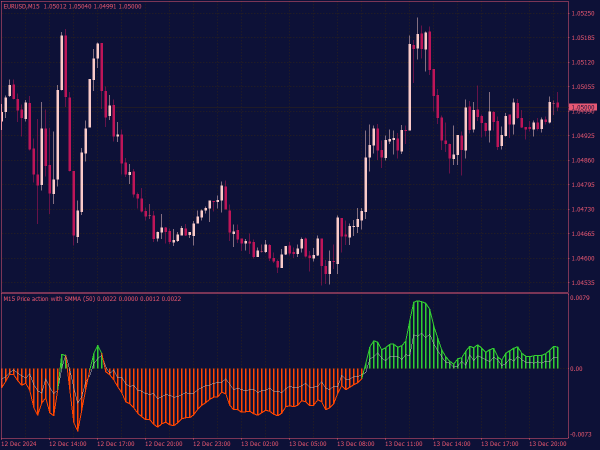

3. MACD Crossover Strategy with Price Action Confirmation

Setup:

• Identify a moving average crossover using the MACD. A bullish crossover occurs when the MACD line crosses above the signal line, while a bearish crossover happens in the opposite scenario.

• Confirm the MACD signal with a price action pattern such as a break above resistance or a bullish engulfing candle.

Execution:

• Enter the trade once you've confirmed price action aligns with the MACD signal.

• Use a stop-loss below the recent swing low for a buy trade or above the swing high for a sell trade.

• Watch for price targets at the nearest resistance or support areas, or consider trailing stops to lock in profits.

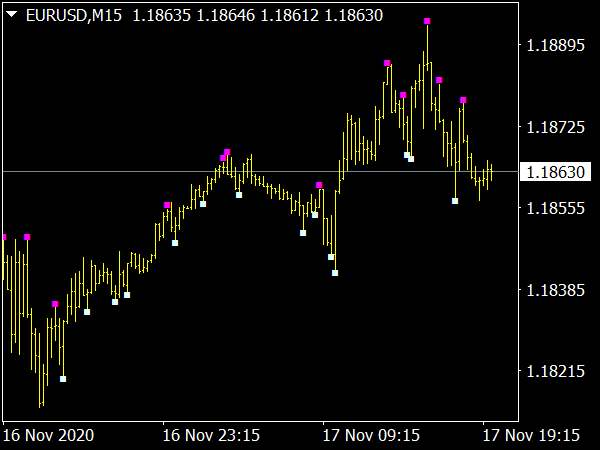

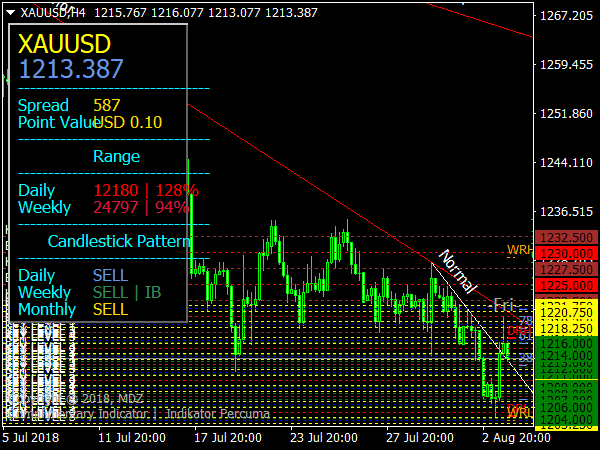

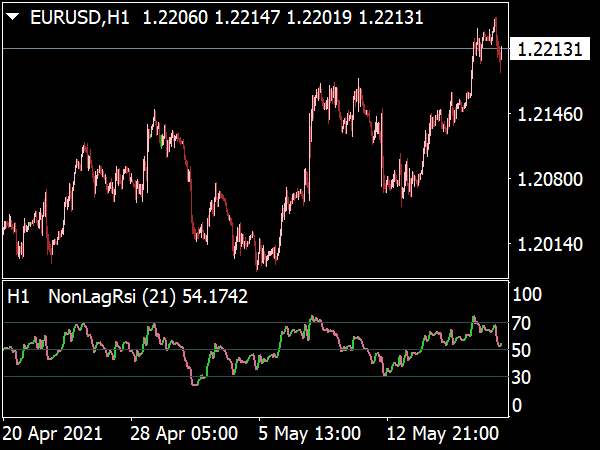

4. Strategy for RSI Overbought/Oversold Reversals

Setup:

• Monitor the RSI for overbought (above 70) or oversold (below 30) conditions.

• Check for price action patterns indicating reversals around these levels, such as double tops/bottoms or pin bars.

Execution:

• Once an overbought/oversold condition is confirmed through price action, execute a trade in the opposite direction.

• Set your stop-loss above the last swing high, which prevents unnecessary drawdown in an overheated market.

• Target a risk-reward ratio that satisfies your trading style, ensuring clear exit rules are in place.

Conclusion

Incorporating oscillators like RSI, stochastic, and MACD into price action strategies allows traders to gain deeper insights and confirmation on entry and exit points. While price action trading provides a strong foundation by emphasizing the importance of price movement, oscillators can serve as valuable tools for identifying momentum shifts, divergences, and overbought/oversold conditions.

By combining these elements, traders can create a robust trading plan that enhances their decision-making process, ultimately improving their chances of success in the markets. Remember that proper risk management, including setting stop-loss orders and position sizing, is crucial for long-term success, regardless of the strategies employed.