Submit your review | |

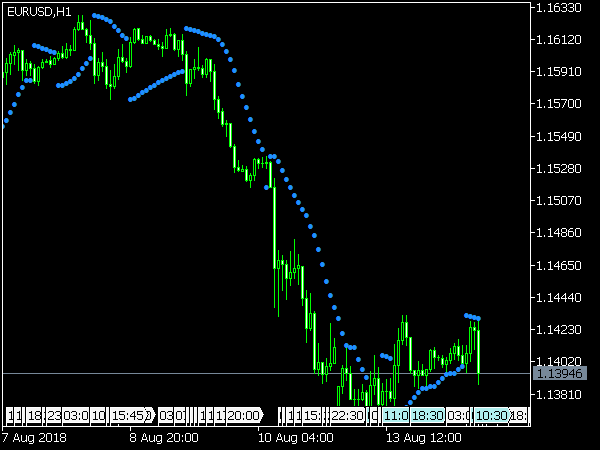

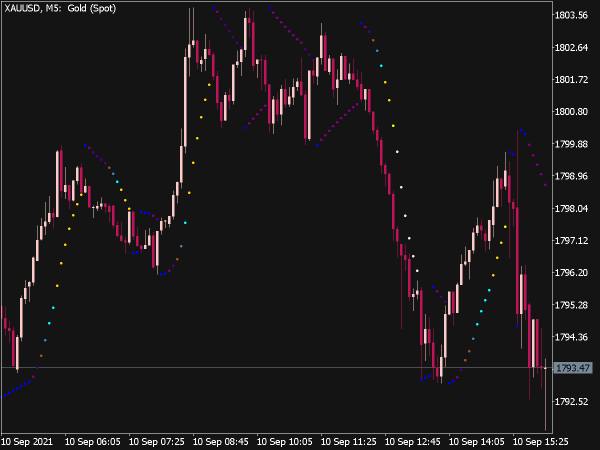

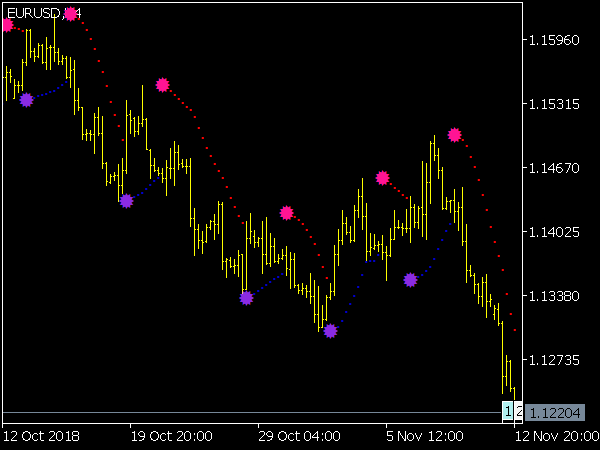

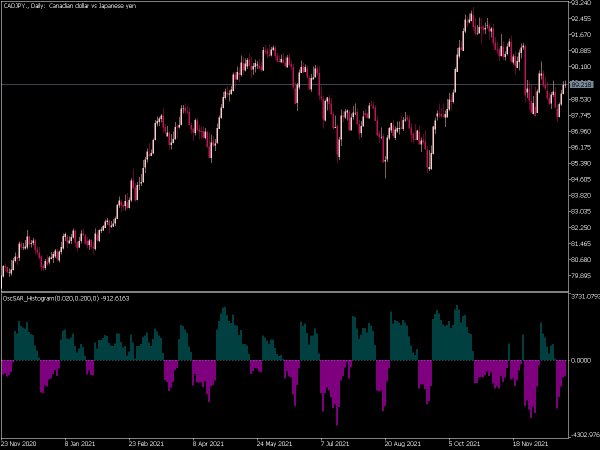

The Parabolic SAR (Stop and Reverse) MTF (Multi-Time Frame) indicator is a technical analysis tool used in trading to identify potential trend reversals and set stop-loss levels. By allowing traders to analyze the parabolic SAR across multiple time frames simultaneously, it provides a more comprehensive view of market trends and potential entry and exit points. This indicator plots dots above or below price action, signaling potential support and resistance levels, which can help traders make informed decisions based on the strength and direction of the prevailing trend.

Here are several trading strategies that utilize this indicator:

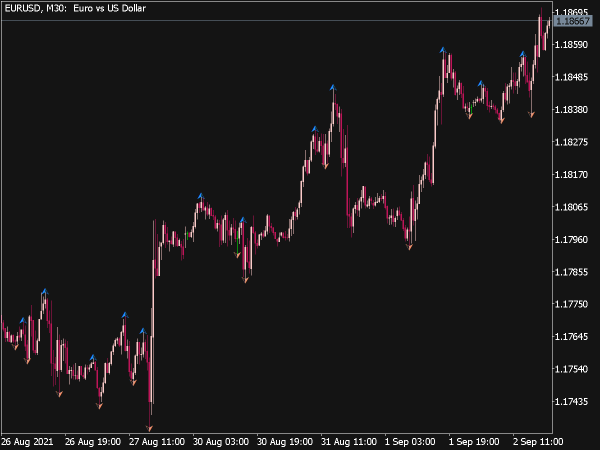

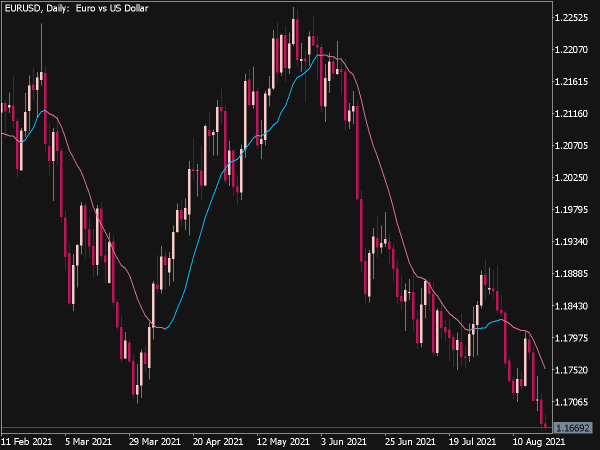

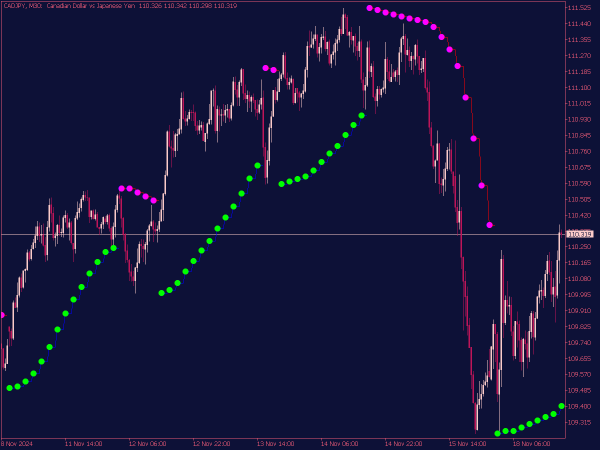

1. Trend Identification: Traders can use the MTF Parabolic SAR to identify which direction to trade. By analyzing multiple time frames (like daily, 4-hour, and 1-hour), traders can confirm the trend direction. If the SAR dots are below the price across multiple time frames, it signals a bullish trend, while dots above signal a bearish trend.

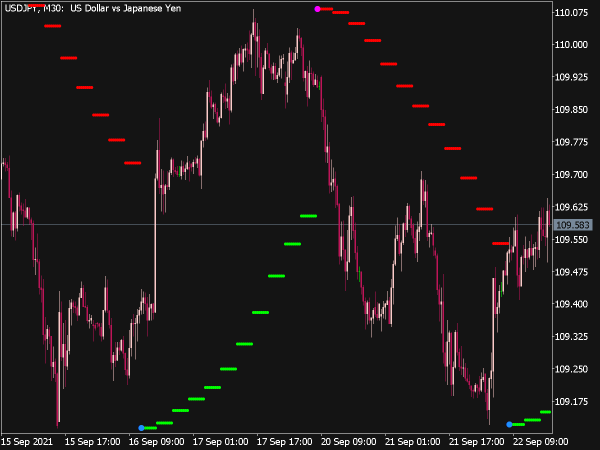

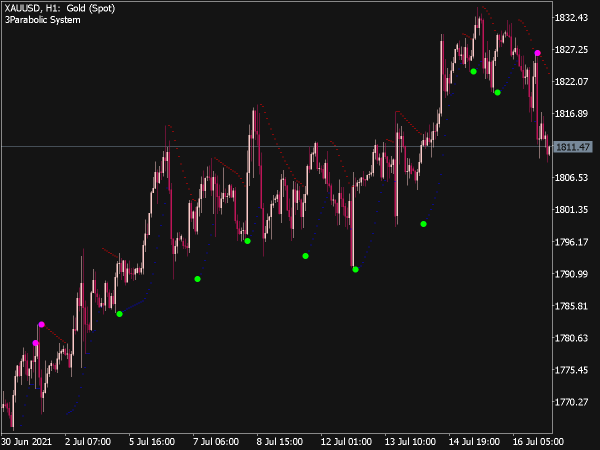

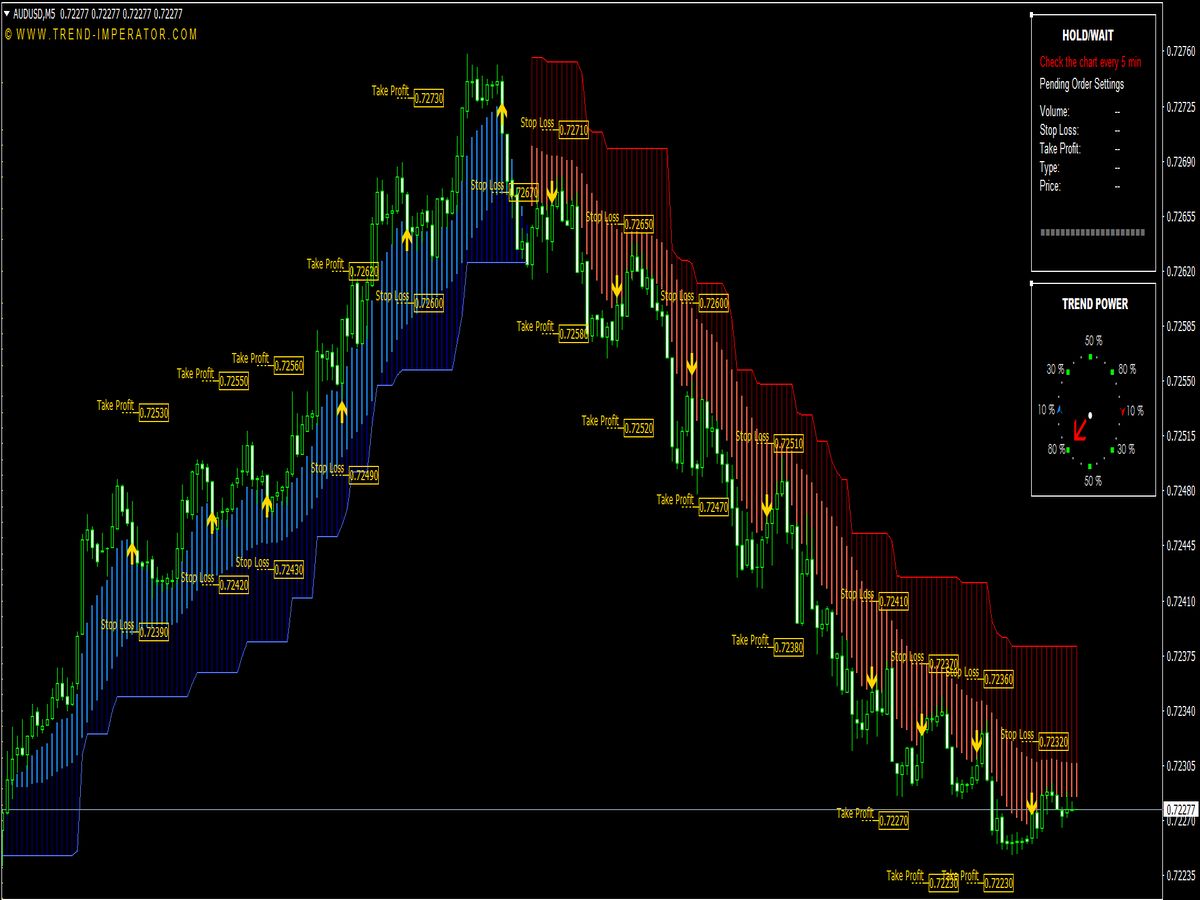

2. Entry and Exit Points: When the SAR dots flip from being above the price to below it, it may indicate a buy opportunity. Conversely, if the dots switch from below to above pricing, it could be a sell signal. Additionally, the most recent SAR dot can act as a dynamic support or resistance level.

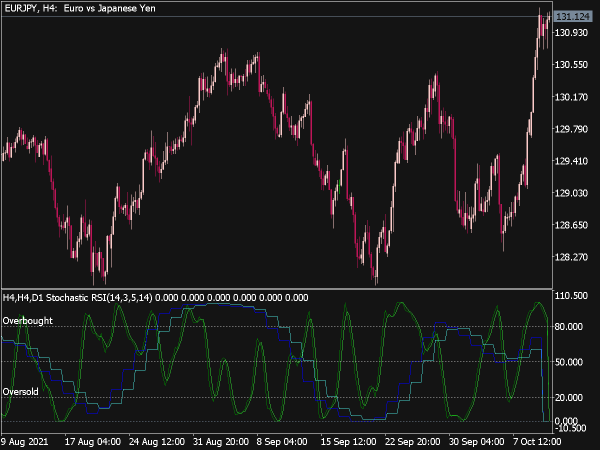

3. Combining with Other Indicators: To enhance the reliability of signals generated by the Parabolic SAR, traders can combine it with other indicators such as Moving Averages or the Relative Strength Index (RSI). For example, entering a buy position when the SAR signals a buy and the RSI is above 50 could increase the probability of success.

4. Time Frame Alignment: This strategy involves aligning short and long-term analysis. If the daily chart signifies an uptrend while the 1-hour chart indicates a pullback, traders can capitalize on the pullback for potential buy entries, using the SAR as a guide.

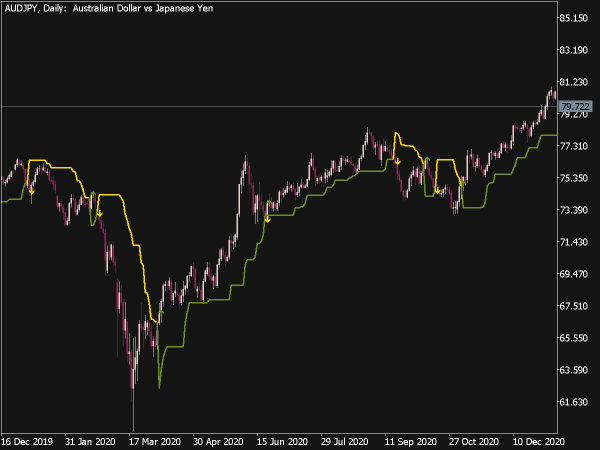

5. Risk Management: The Parabolic SAR can be used to determine stop-loss positions effectively. Traders can place their stop-loss just below the most recent SAR dot in a long position or just above in a short position, allowing for a disciplined approach to managing risk.

6. Breakout Strategies: Traders can look for breakout opportunities when the price approaches significant support or resistance levels, confirmed by the MTF Parabolic SAR. A breakout above resistance with the SAR dots turning bullish might present a strong buy signal.

7. Swing Trading: Utilize the Parabolic SAR in a swing trading strategy by entering trades at the beginning of a new trend identified across multiple time frames. Traders should look for the SAR to turn in their favor after a pullback to increase the likelihood of capturing the trend.

8. Scalping Opportunities: In a scalping strategy, traders can use the Parabolic SAR to identify short-term trends in lower time frames (like 5-minute or 15-minute charts). Fast intraday trades can be executed when the indicator flips, targeting small gains with quick exits.

9. Reversal Trading: Look for scenarios where the price action shows signs of reversal at significant support or resistance levels, while the SAR indicator confirms the reversal. This strategy works best in conjunction with volume analysis to validate the strength of the reversal signal.

10. Adjusting Settings for Volatility: To adapt to varying market conditions, traders may need to adjust the setting of the Parabolic SAR (the acceleration factor). In highly volatile markets, a smaller value may be appropriate to avoid false signals, whereas a larger value may work better in stable trends.

11. Momentum Confirmation: Prior to entering a trade based on the SAR signal, traders can check if momentum indicators like MACD or Stochastic are also supporting the same direction. A strong bullish momentum in conjunction with bullish SAR dots strengthens the buy signal.

In conclusion, the Parabolic SAR MTF indicator offers various trading strategies that traders can tailor to their style and market conditions. By combining trend following, reversal trading, and multi-time frame analysis with a strong focus on risk management, traders can enhance their chances of success in the markets.