Submit your review | |

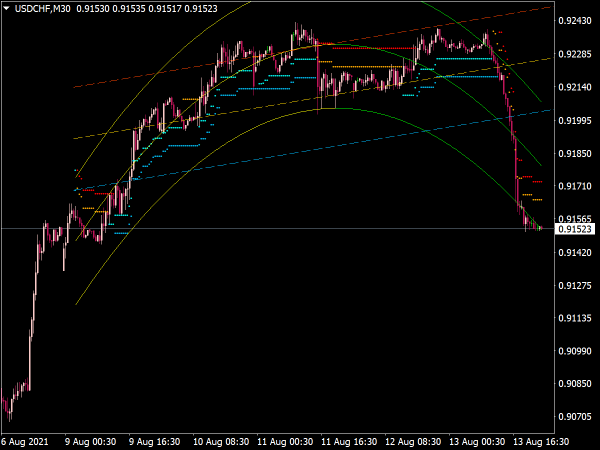

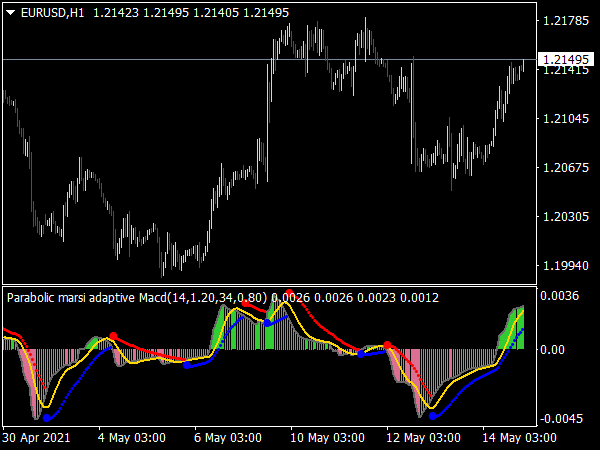

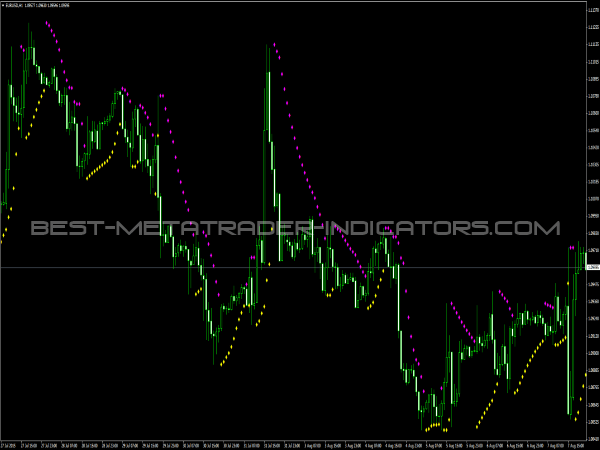

The Parabolic SAR is a technical indicator invented by the famous technical analyst, J. Welles Wilder. It was first presented at the popular book, New Concepts in Technical Analysis (1978) and is included in almost all trading platforms. Its main feature is that is takes time into account in calculation – which was a revolutionary concept at that time. The basis behind the Parabolic SAR is the following truth: the longer the price trends, the higher the probability of the trend to end.

Therefore, as price advances, the parabolic is trailed to it in increasing steps, until price reverses and a new trend begins. Parabolic has two parameters, Step and Maximum. Step parameter represents the speed in which the Parabolic is increasing to match price. Higher step will result in a more sensitive Parabolic and more signals – as well as early signals. The parabolic is generally used in several popular methods, which are the following.

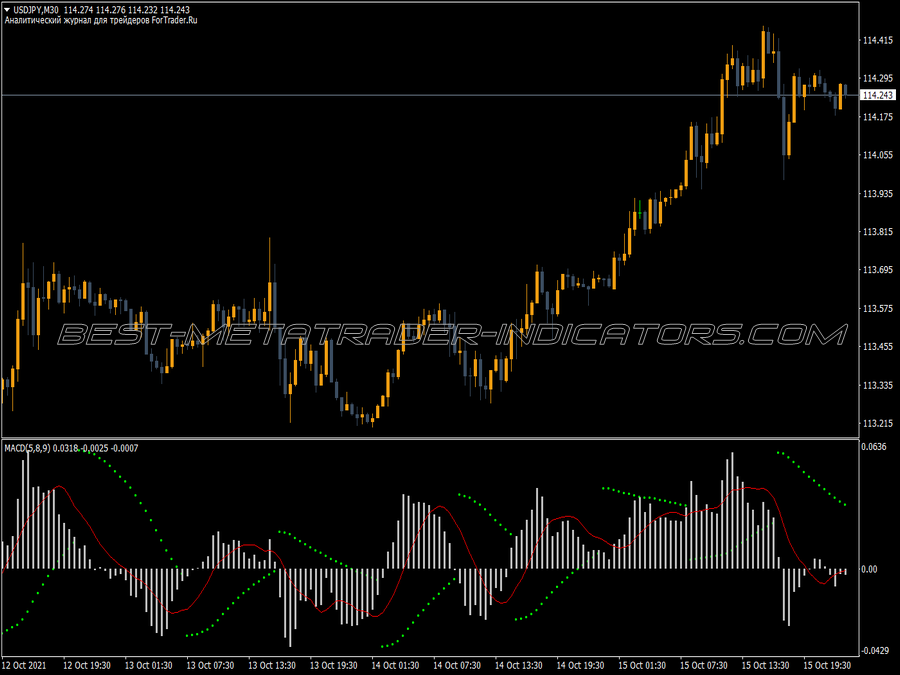

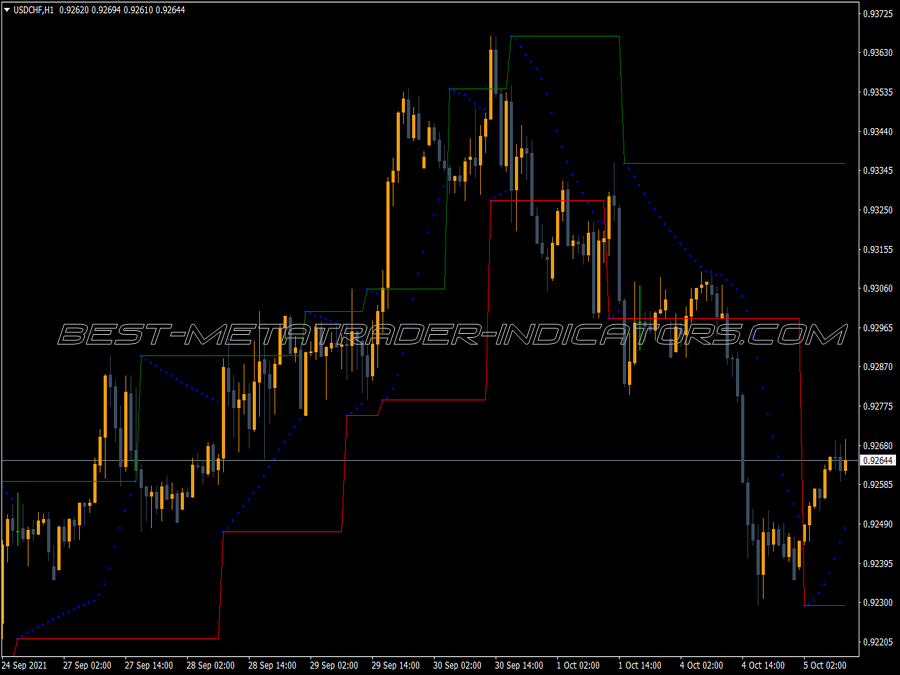

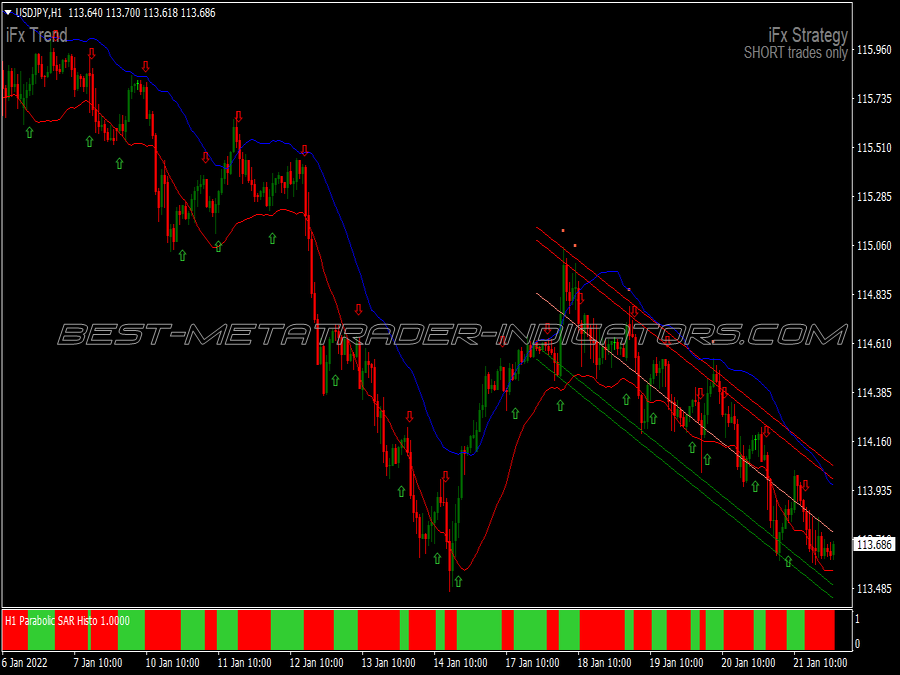

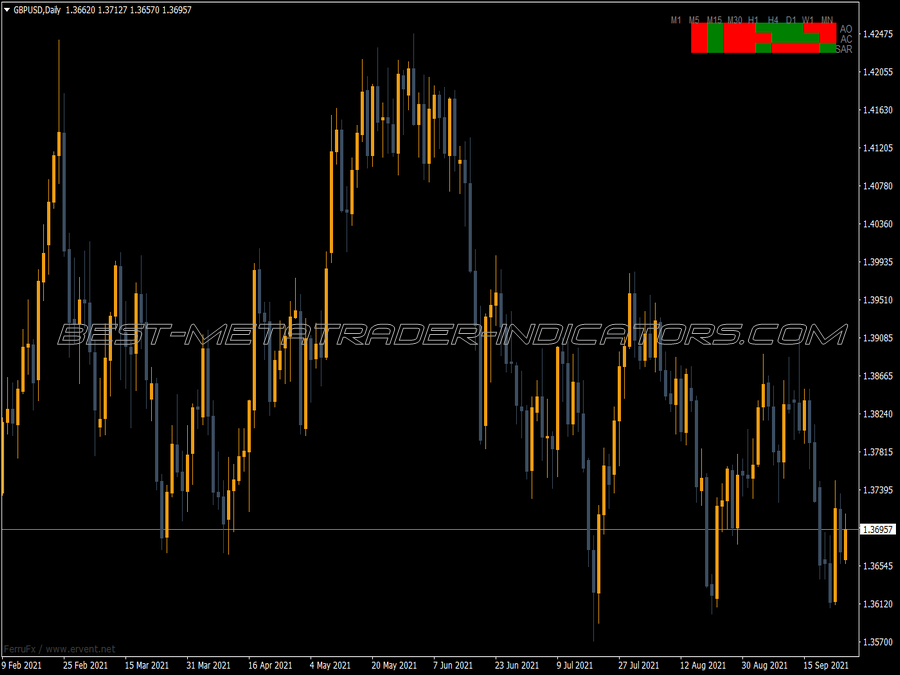

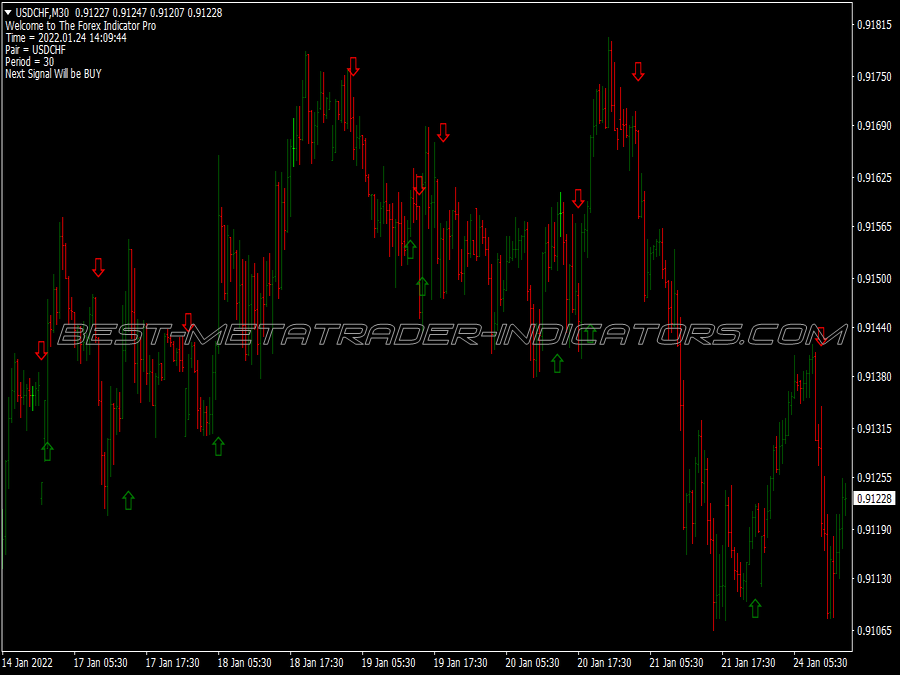

Trading Method 1 – Normal BuySell

This method uses Parabolic SAR as a simple buysell indicator, entering long trades when the SAR is below price and short trades when SAR is above price. This is a trend-following approach that is usually lagging in entry. It performs well in trending markets and currencies like the GBPJPY and GBPUSD but leads to losses in ranging markets. It is advisable to use it with a trend filter, which is installed in the next trading method.

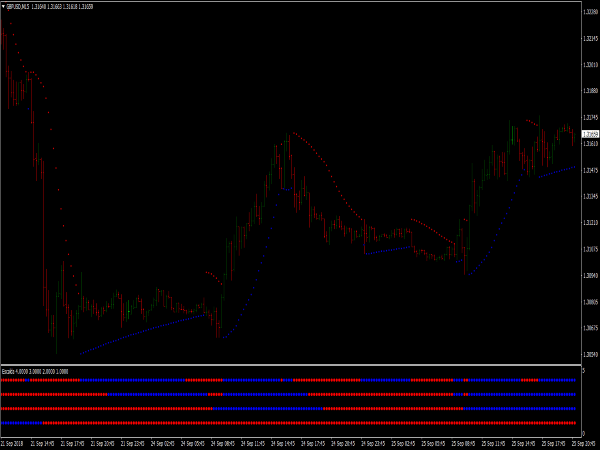

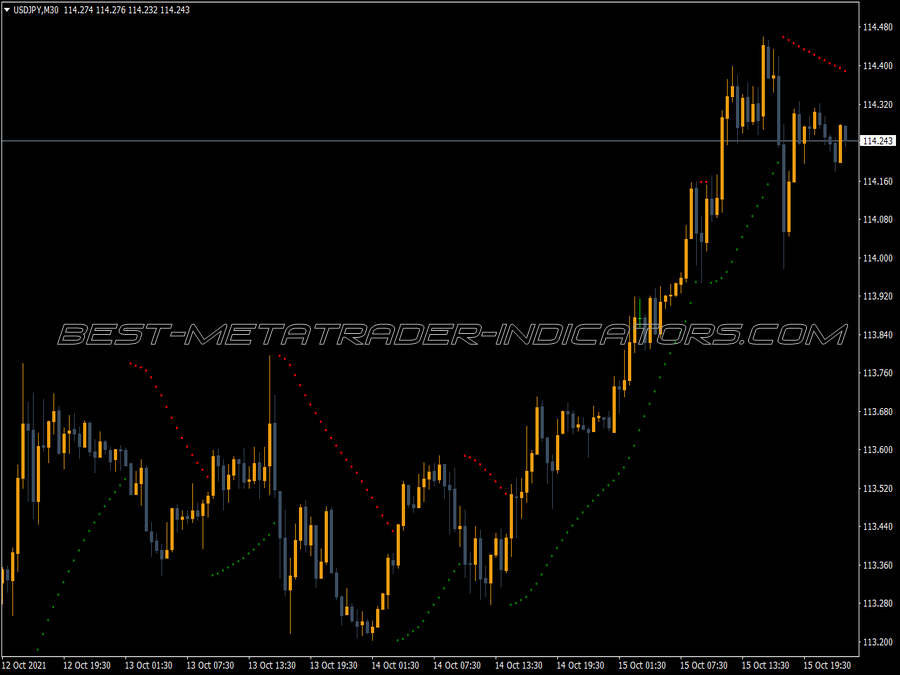

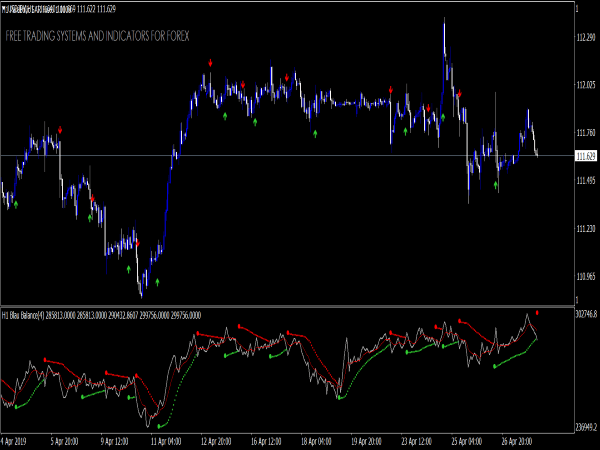

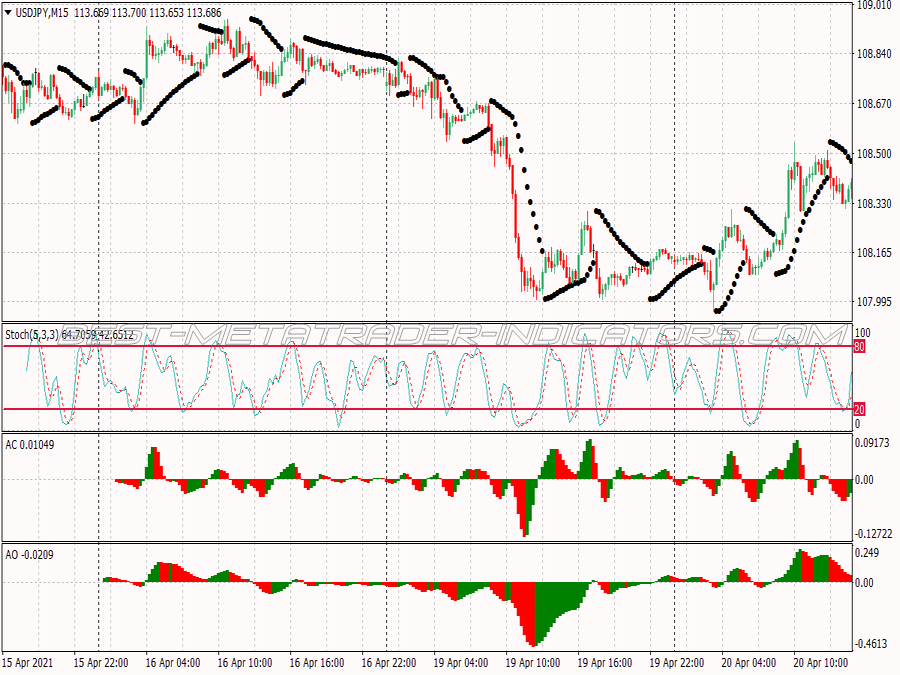

Trading Method 2: Stop Method

The stop method is a known method of filtering ranging periods and ensuring that the prevailing trend is strong. It is used in the basis of the Bunny Girl method and its main element is to use a Stop order to enter trades, instead of Market orders. For example: After the Parabolic SAR signaled a long entry, place a stop order 20 pips above current price. This ensures that the trend has strength and that the trading signal is reliable. This method leads to a higher win rate and more profitable trades. The simple stop order filters many whipsaw signals and helps avoiding signals that are the result of noise rather than actual trend. Note that the number of distance between price and stop order should be determined by volatility – in volatile pairs, use greater distance.

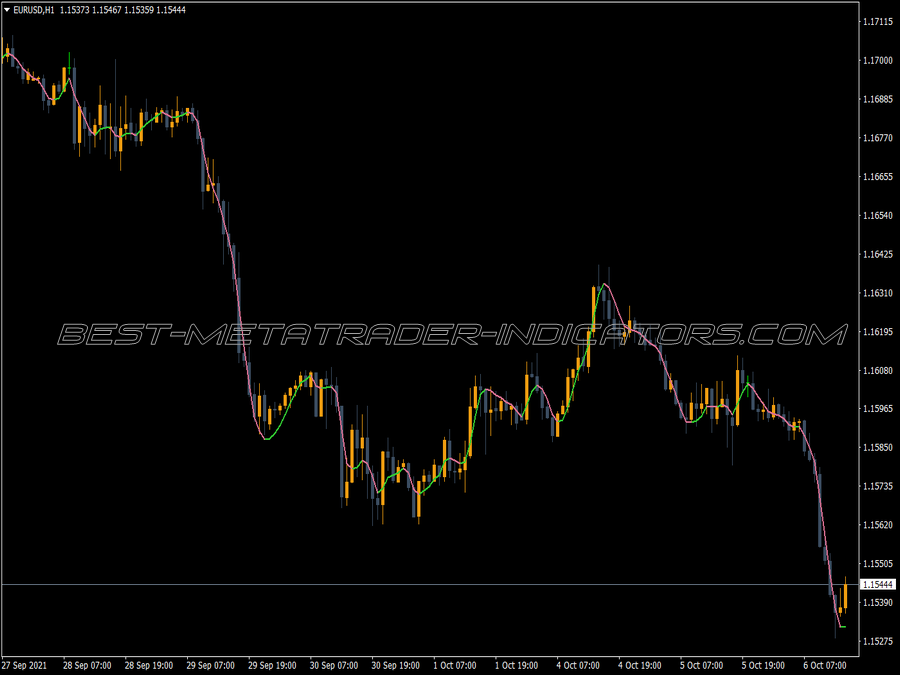

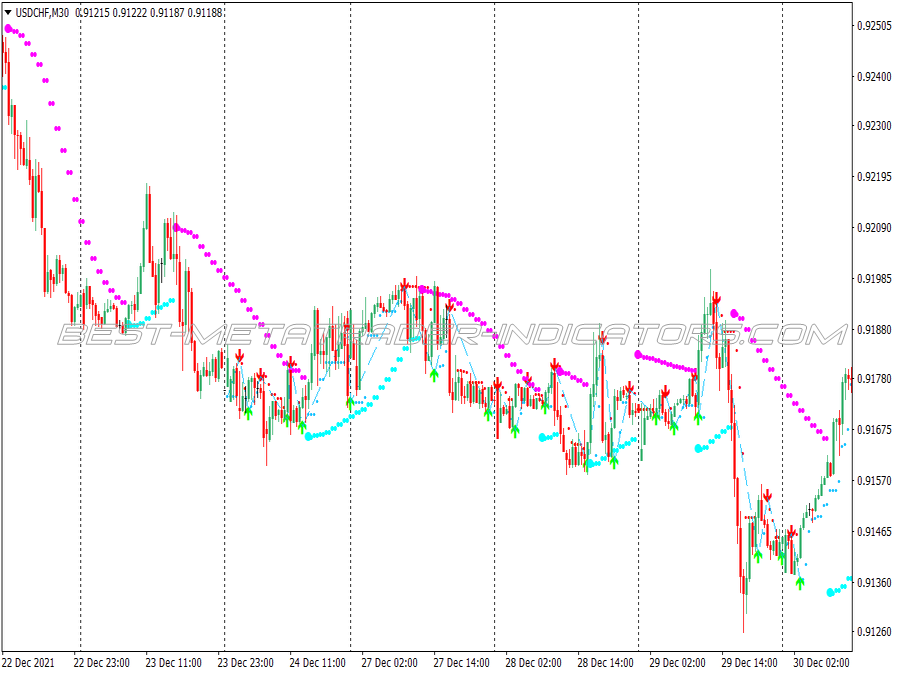

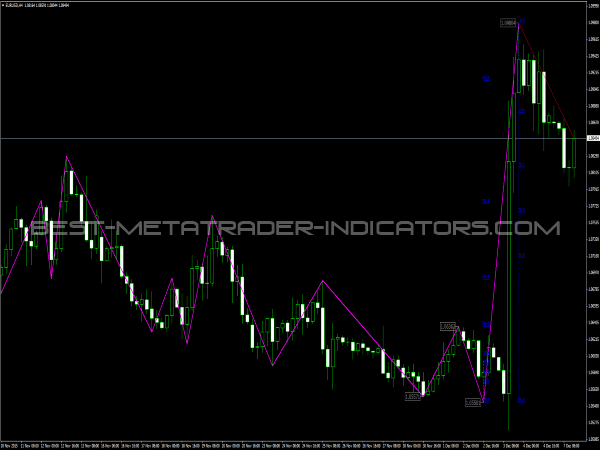

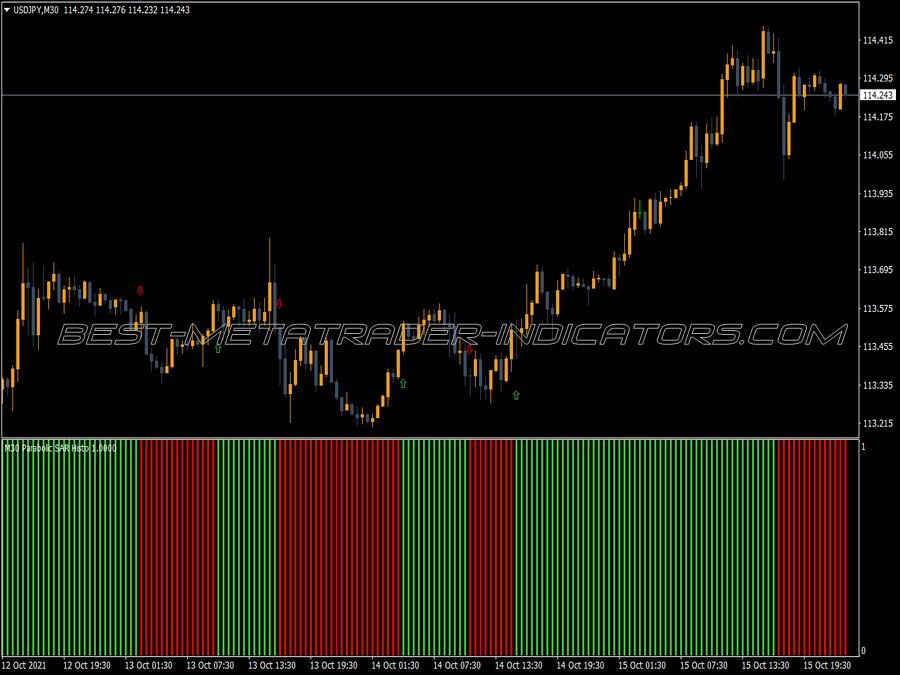

Trading Method 3: Trailing Stop

Another popular use of the Parabolic is as trailing stop. The problem of exiting trades is a difficult one which can be the difference between winning or losing. The Parabolic is a good solution for exiting trades. When the parabolic is above price, exit any long trades and when the parabolic is below price, exit short trades. Because of the fact that both volatility and time are taken into account, this indicator can be used on any currency without any major changes needed at parameters. It automatically fits the changing volatility and leads to great exits.