Submit your review | |

Repaint, not bad!

This order block indicator is very good. Just follow the simple rules strictly and you will make a lot of pips. Thanks so much guys.

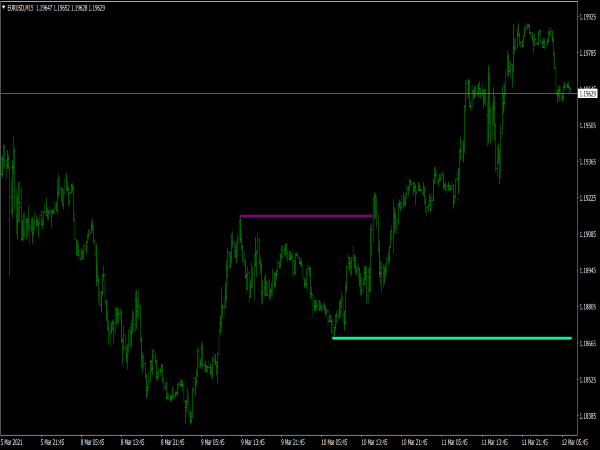

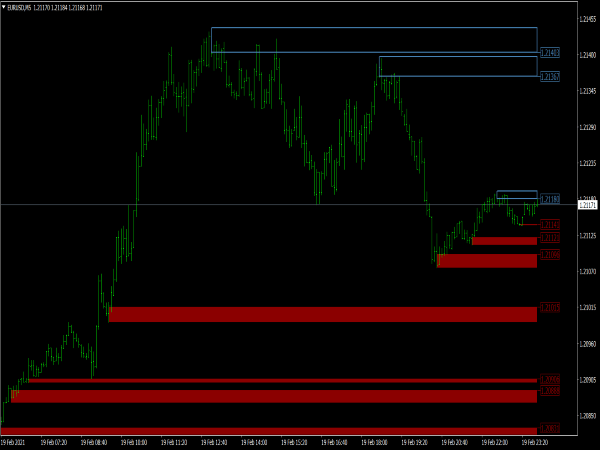

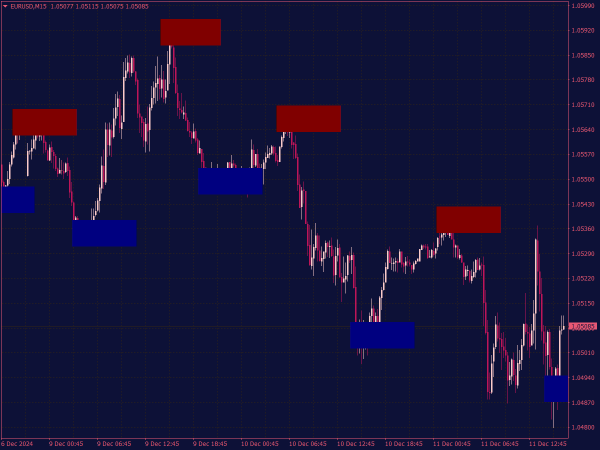

The Order Block Breaker Indicator is a technical analysis tool used by traders to identify potential reversal zones in financial markets. It highlights "order blocks," which are areas where significant buying or selling has occurred, often leading to strong price movements.

When the price breaks through these order blocks, it can signal a continuation or reversal of the trend, helping traders make informed decisions about entry or exit points. This indicator is particularly popular among Forex and futures traders for its ability to provide insights into institutional trading behaviors.

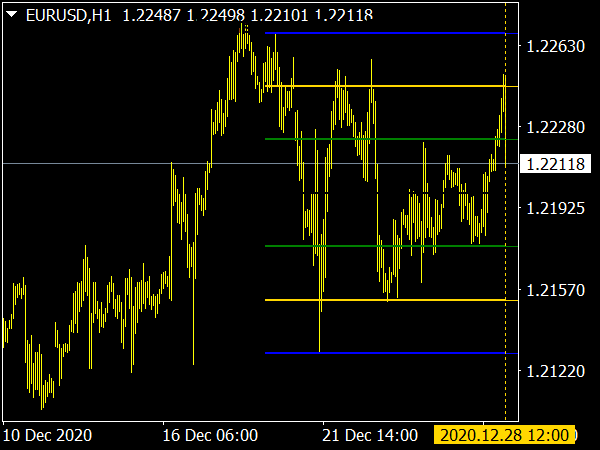

Breakout Trading Strategy

One of the simplest yet effective strategies using the Order Block Indicator is breakout trading. In this approach, traders look for price to break out of an identified order block.

1. Identify the Order Block: Use the Order Block Indicator to find bullish or bearish order blocks on the chart.

2. Wait for Confirmation: Once an order block is identified, wait for the price to test the block and then break above it (in the case of a bullish order block) or break below it (for a bearish order block).

3. Entry Point: Enter a trade once the breakout is confirmed, typically utilizing candlestick patterns such as a close above/below the order block.

4. Setting Stops and Targets: Place stop-loss orders just outside the order block to minimize risks. Set profit targets based on the size of the order block or use a risk-reward ratio of at least 1:2.

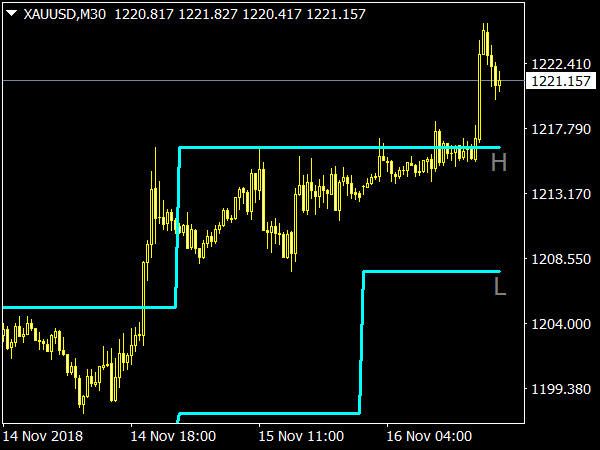

Reversal Trading Strategy

Order blocks are not only useful for breakout strategies but also for identifying potential reversal points.

1. Locating Key Order Blocks: Identify significant order blocks on the chart where the price has reversed in the past. These are typically located where there was a marked shift in buying or selling pressure.

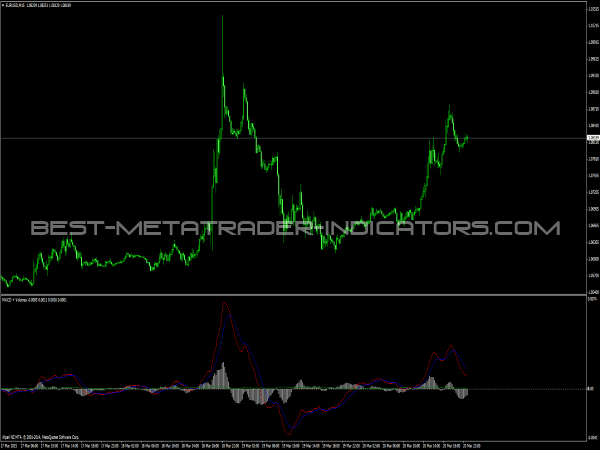

2. Look for Divergence: Consider using additional indicators like the Relative Strength Index (RSI) or MACD to detect divergence at the order block level, confirming potential reversal signals.

3. Entry Point: Enter a long position when prices bounce from a bullish order block, or a short position when there’s a rejection from a bearish order block. Confirmation via candlestick formations, such as pin bars or engulfing patterns, can strengthen your entry decision.

4. Setting Stops and Targets: Similar to the breakout strategy, place stop-loss orders just outside the order block. Profit targets can be established at previous resistance or support levels.

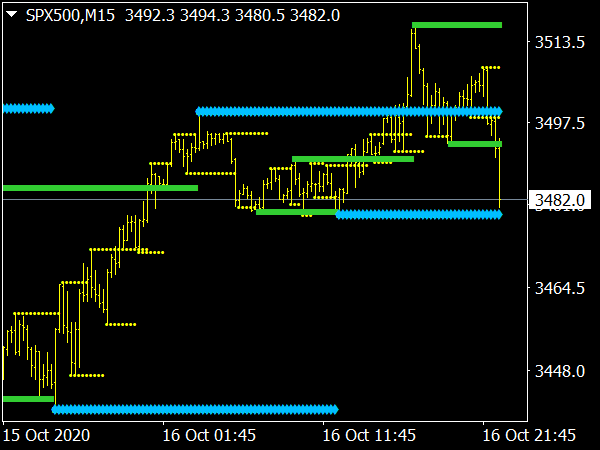

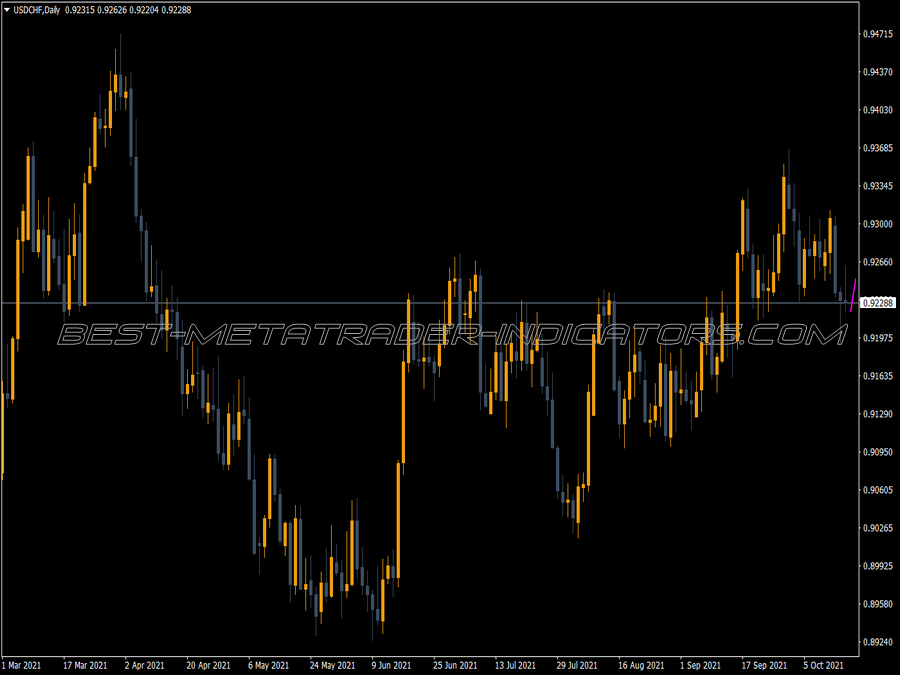

Trend Continuation Strategy

Often, order blocks can act as dynamic support and resistance levels, making them useful for trend continuation strategies.

1. Identify the Trend: Begin by determining the overall market trend—upward or downward. Use moving averages or trend lines to assist in this identification.

2. Identify Order Blocks in the Trend Direction: Look for bullish order blocks in an uptrend or bearish order blocks in a downtrend. These typically indicate where the trend is likely to continue.

3. Entry Point: Enter a trade when the price retraces to the identified order block and shows signs of resuming the trend. Look for confirmation signals like bullish or bearish candlestick patterns.

4. Setting Stops and Targets: Stop-loss orders should be placed below the order block for an uptrend or above it for a downtrend. Profit targets can be adjusted based on the preceding swing highs or lows.

Time Frame Consideration

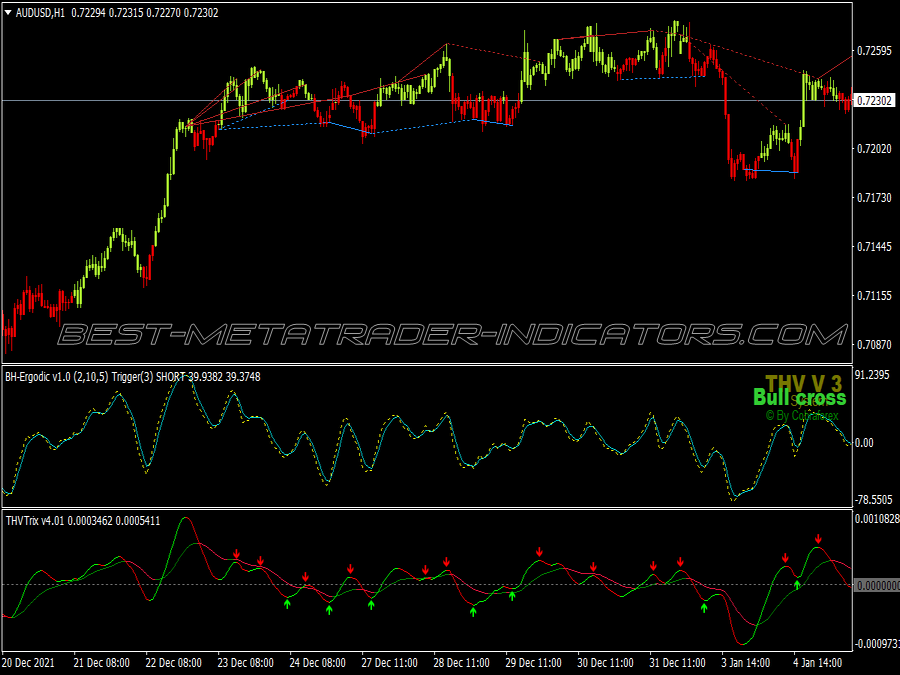

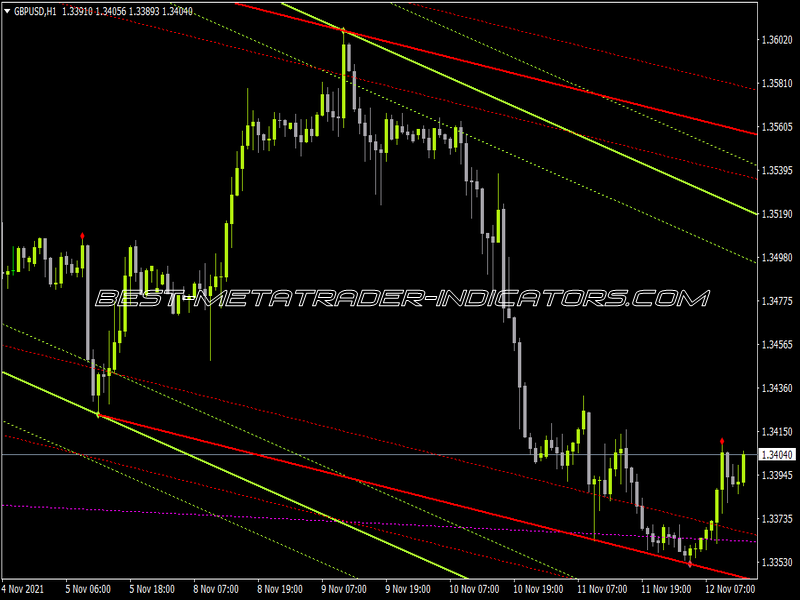

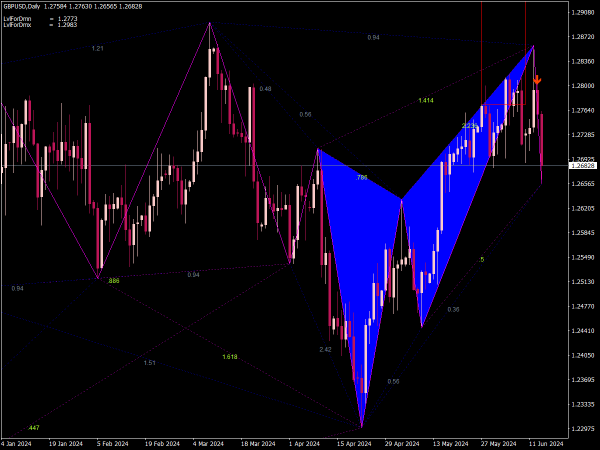

Different time frames can yield varying results when using the Order Block Indicator. It’s beneficial to incorporate multiple time frames into your trading strategy.

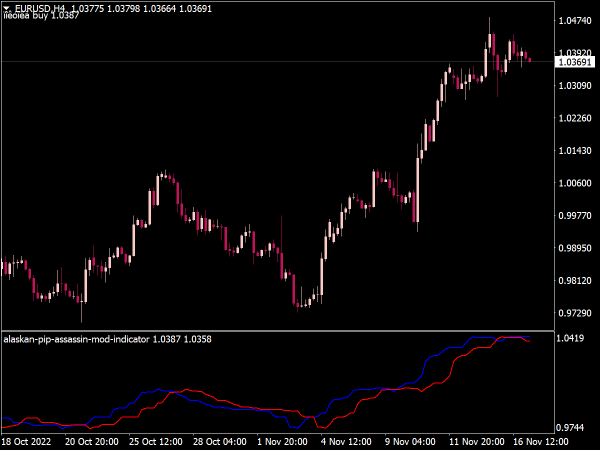

1. Higher Time Frame Order Blocks: Start by identifying order blocks on higher time frames (daily or weekly). These typically represent stronger levels of support or resistance.

2. Lower Time Frame Confirmation: Once you’ve identified a higher time frame order block, switch to a lower time frame (hourly or 15-minute) to find entry and exit points.

3. Entry Point: On the lower time frame, look for price action setups or signals that confirm a reaction at the higher time frame order block.

4. Setting Stops and Targets: Use similar stop-loss placement as previous strategies, but consider adjusting your profit targets according to the context provided by the higher time frame analysis.

Additional Tips for Using the Order Block Indicator

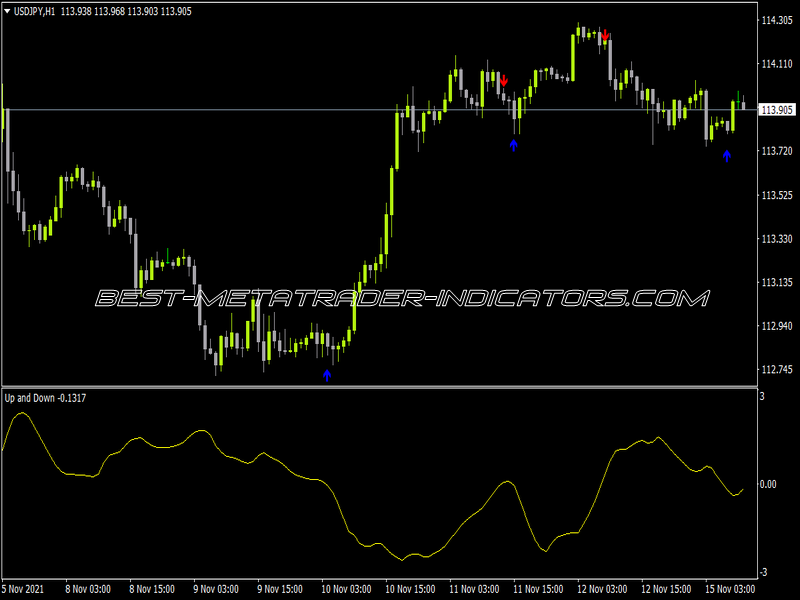

• Combine with Other Indicators: While the Order Block Indicator is informative on its own, combining it with additional technical indicators, such as volume analysis or oscillators, can enhance the reliability of signals.

• Keep an Eye on News Events: Be aware of economic news releases or significant geopolitical events, as these can cause volatility that may disregard the order block analysis temporarily.

• Maintain a Trading Journal: Document your trades, especially those based on the Order Block Indicator, to analyze your success rates, refine strategies, and improve over time.

Conclusion

The Order Block Indicator is a powerful tool that can greatly enhance a trader’s approach to the markets. By employing breakout trading, reversal trading, trend continuation, and effective time frame consideration, traders can harness the power of order blocks to make more informed decisions.

Like all trading strategies, it’s crucial to practice proper risk management and continuously refine your approach based on experience and market conditions. By integrating these strategies into your trading plan, you can work toward achieving greater consistency and success in your trading endeavors.

Good morning, I downloaded the order block indicator. I must say it is probably one of the best indicators I have seen. Yes sure it does repaint in a strong trend, but that's not the end of the world. This indicator has changed my trading so much.

Not order block strategy, just another repainting indicator.

Would love to see improvements to increase my ratings.

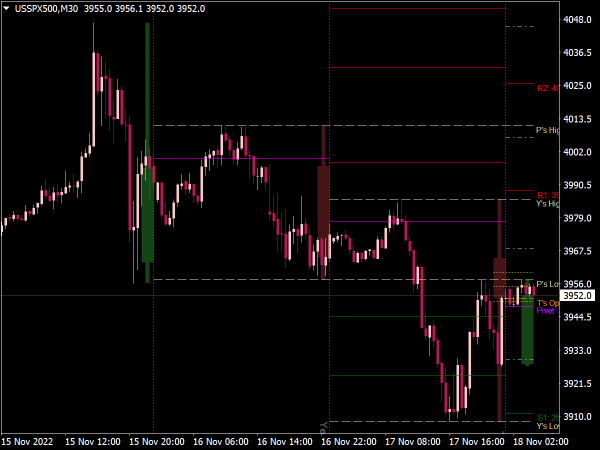

1. Make the indicator have MTF feature where if im on current M15 timeframe I can select to set indicator to show H4 OB.

2. Let the order block appear once the candle in question get engulfed and form a candle break.

3. Have a pivot point or ADR feature also.

Is it available for mq4?

Thank you very much for the indicator. Please anyone can help with a little bit of explaination for entry and target?

I have downloaded Order Block Breaker Indicator to build my EA. I couldn't find source file in the zip. Could you pls send me the copy of it, I need to tweak the indicator a bit to fit in my EA. I don't have money to pay, but surely after I build my EA in 3 days, I can send you a copy and you can make revenue out of it.

Kindly help in this regards.

Hi, nice indicator. Would be great to have the block size and color on the indicators tabs so it can be save, they are a bit to large and don't allow for opaqueness.

Was just wondering if:

1) We can fix the order blocks in a way that it doesn't block the candles in the chart?

2) Add an option to adjust how far back we see the order blocks on?

3) Add an option to show order blocks based on the timeframe, we're at/only show order blocks from the timeframe of choice no matter which timeframe we go to?

Thanks in advance! I'm an ICT based trader and I can already see how good the order blocks placements are... Just need some additional improvements to work way better.

The width of the indicator keeps resetting to default after changing timeframes, please fix it.

Thank you for the order the order block breaker. It works well, but the SELL blocks always appear long afterwards after candles are far away. The BUY blocks work fine and some form with three to six candlesticks. None of the SELL blocks form together with candlesticks. Can rectify that?

Works well, but the SELL blocks always appear afterwards after candles are far away. The BUY blocks work fine and some form with three to six candlesticks.