Submit your review | |

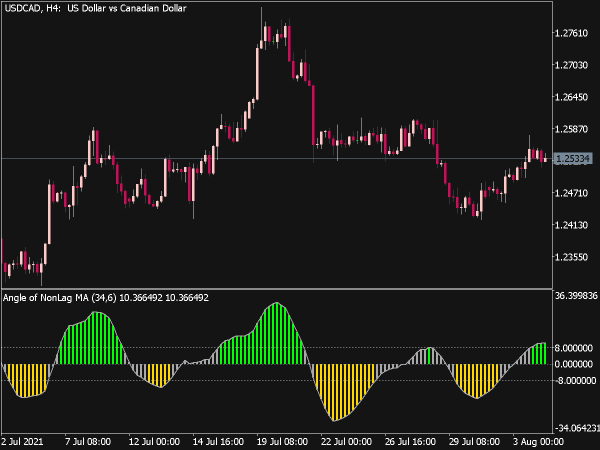

The MTF Moving Average (Non Lagging) Indicator is a technical analysis tool designed to provide smoother and more accurate representations of price trends across various time frames without the typical lag associated with traditional moving averages. By incorporating data from multiple time frames, it allows traders to identify trends more effectively, making it easier to spot entry and exit points. This indicator calculates moving averages based on current price action while minimizing delay, thus helping traders respond swiftly to market changes. It's commonly used in Forex, stocks, and other trading markets to enhance decision-making and improve trade timing.

Here’s a list of effective trading strategies for this indicator:

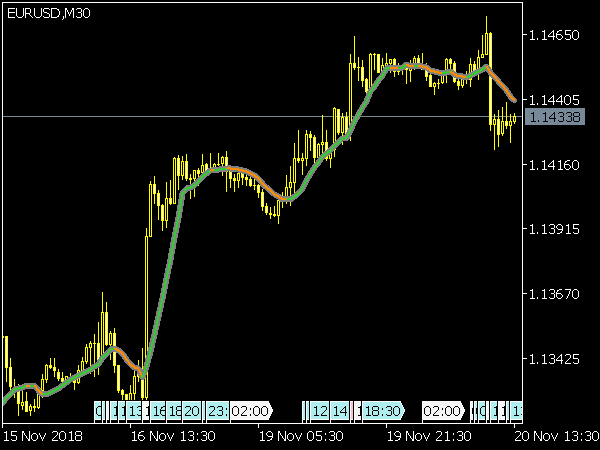

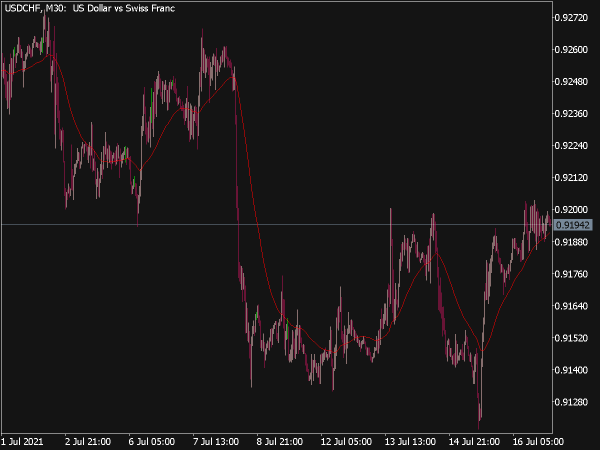

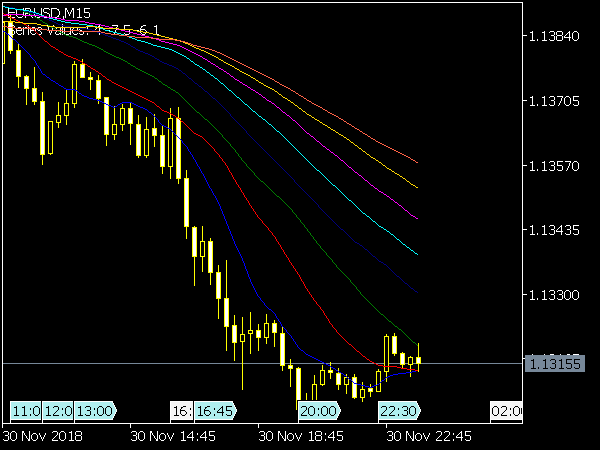

1. Trend Following Strategy: This strategy involves identifying the prevailing trend by analyzing the MTF Moving Averages across different time frames. Traders look for alignment across multiple MAs (e.g., 50-period and 200-period) where shorter MAs are above or below longer MAs, indicating bullish or bearish trends, respectively. Entry signals can occur when a shorter-term MA crosses a longer-term MA in the direction of the trend.

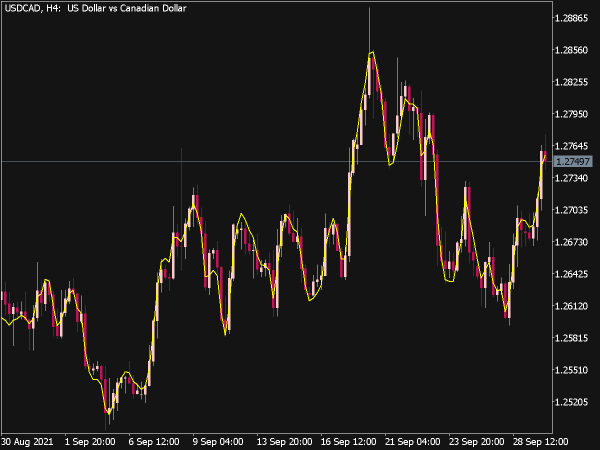

2. MA Crossovers: Similar to the trend-following strategy, the MA crossover approach relies on the interaction between two or more Moving Averages on different time frames. Traders may employ longer MAs on daily charts and shorter MAs on hourly charts. A bullish signal occurs when a shorter MA crosses above a longer MA, while a bearish signal occurs when it crosses below.

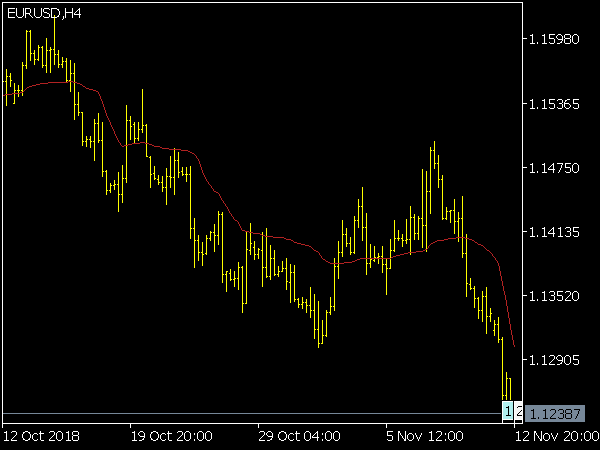

3. Support and Resistance: MAs can act as dynamic support and resistance levels. In this strategy, traders observe where MTF Moving Averages converge or provide support/resistance at key price levels. Entries can be sought when the price approaches an MA that has previously acted as support or resistance, combined with price action or confirmation from other indicators.

4. Price Action Confirmation: To enhance the reliability of MTF Moving Averages, some traders use price action patterns, such as candlestick formations or chart patterns, as confirmation for their entries. For example, if a price forms a bullish engulfing pattern at a supportive MTF MA, it serves as a stronger confirmation to enter a long trade.

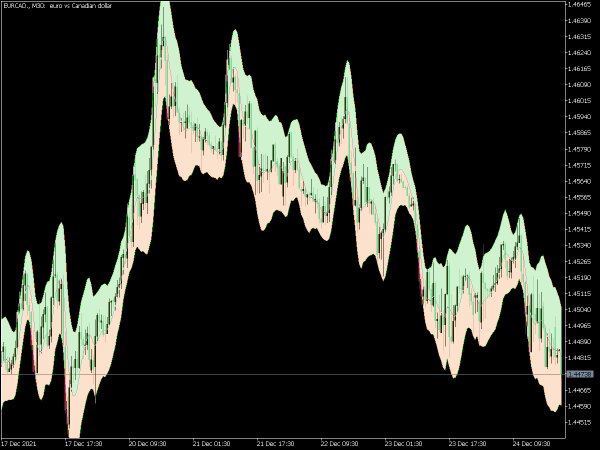

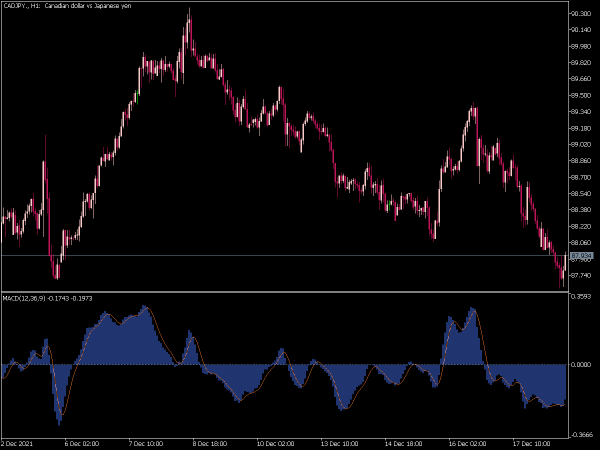

5. Divergence Trading: When price action diverges from the MTF Moving Averages, it can indicate potential reversals. Traders watch for instances where the price makes new highs or lows, but the MAs do not confirm this movement, often suggesting weakening momentum. Divergence can be a signal for entry or exit points.

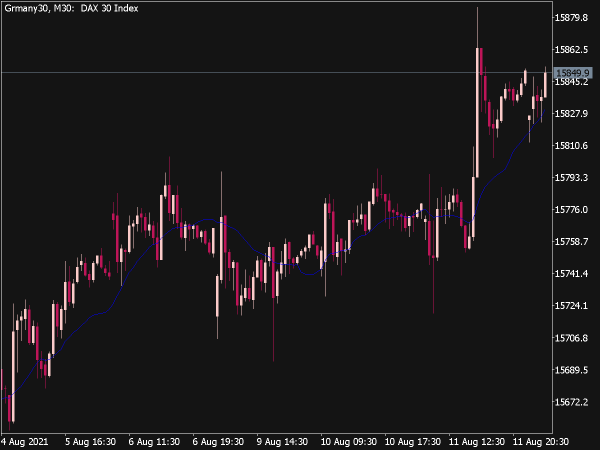

6. Convergence Trading: This strategy focuses on the convergence of price and MTF Moving Averages. If the price is approaching an MA while the MA is flattening, or both are moving together, traders can look for breakout opportunities in the direction of the stronger trend once the price breaks out of this convergence.

7. Using Multiple MTFs for Confirmation: By analyzing three or more time frames (e.g., 1-hour, 4-hour, and daily), traders can gain clearer insights on potential market moves. A signal observed on the 1-hour chart that aligns with a bullish trend on the 4-hour and daily charts can offer a high probability trade.

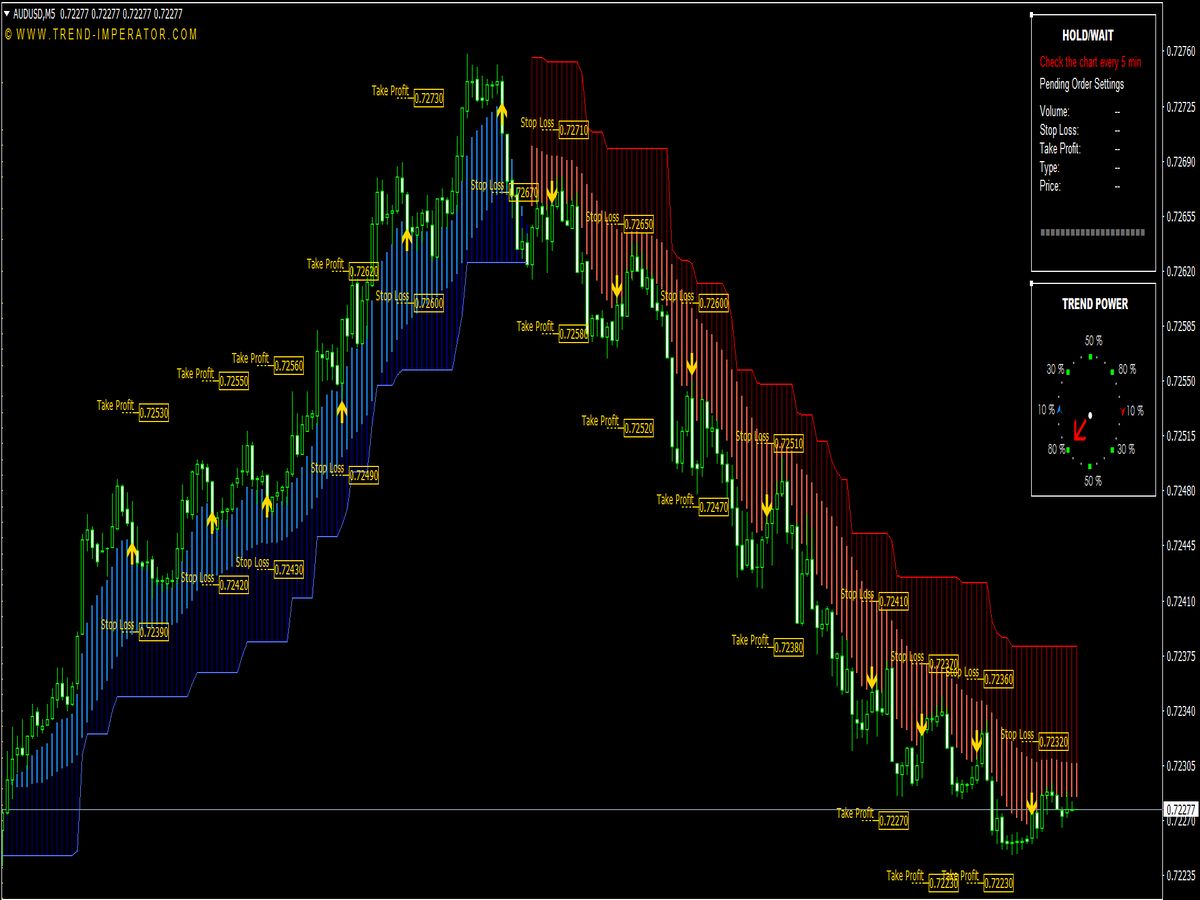

8. Scalping with MTF MAs: In scalping strategies, traders can use shorter MTF Moving Averages on very low time frames (like 1 minute) to identify quick entry and exit points while confirming the trend on higher time frames. This strategy relies on quick reactions and tight stop-loss orders.

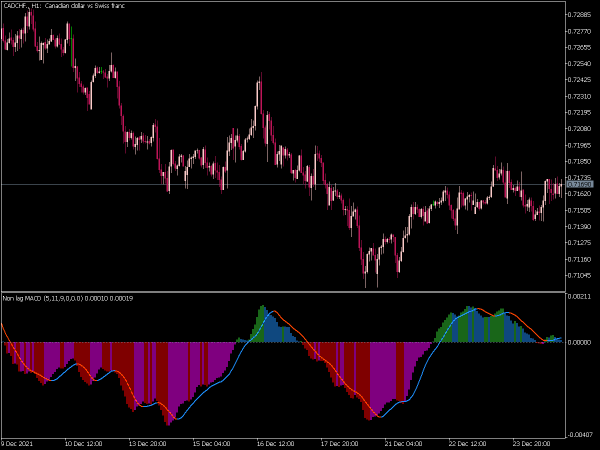

9. Combining MTF MAs with Other Indicators: Enhancing MTF Moving Average strategies with additional indicators like RSI or MACD can provide further insights. For example, confirmation from RSI showing overbought or oversold conditions alongside MTF MA signals can strengthen trade setups.

10. Whipsaw Avoidance: MTF Moving Averages can help filter out whipsaw conditions in choppy markets. Utilizing a longer time frame for main trend analysis and a shorter one for timing entries allows traders to avoid false breakouts and reversals.

11. Reversal Trading: Look for scenarios where the price has moved significantly from the MTF Moving Averages. When the price retraces to touch the MAs, it may provide an opportunity to enter a reversal trade, especially if accompanied by volume increase or candlestick patterns indicating weakness in the current trend.

Incorporating MTF Moving Averages into trading strategies can refine decision-making processes, ensuring traders make more informed choices. Nonetheless, it’s critical to manage risk properly, utilize stop losses, and confirm signals with other indicators or analysis methods for a stable trading approach.