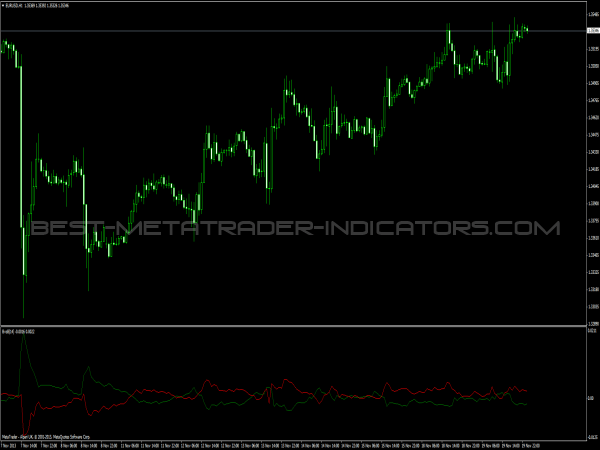

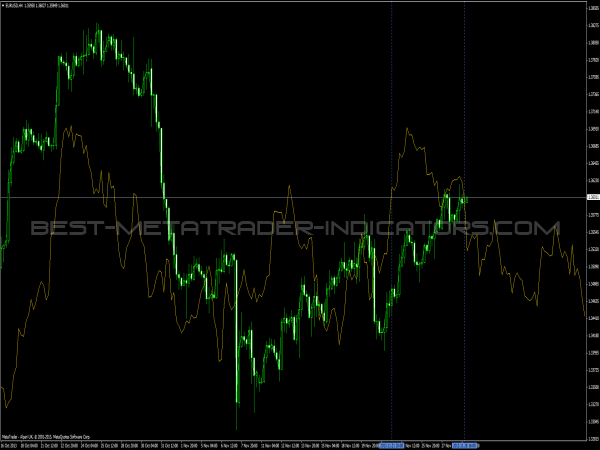

Non-repainting and repainting indicators are terms used primarily in technical analysis of financial markets, particularly in trading strategies.

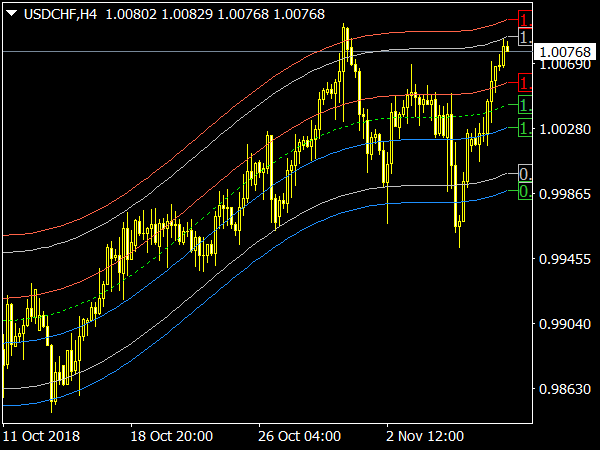

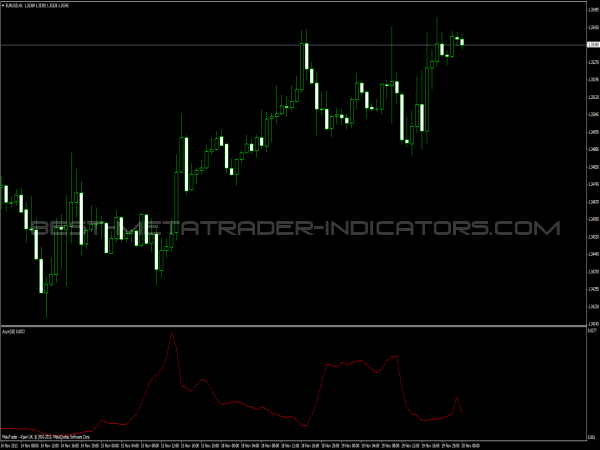

Non-Repainting Indicators

These indicators provide signals based on data that does not change retrospectively. Once a signal is generated, it remains consistent and is not altered by future price movements. For example, if a non-repainting indicator indicates a buy signal at a certain price point, that signal will not disappear or change to a sell signal later, regardless of how the price moves.

This reliability makes non-repainting indicators more trustworthy for traders since they can make informed decisions based on past signals without the risk of losing a signal due to price fluctuations. Common non-repainting indicators include moving averages and the Relative Strength Index (RSI) when used correctly.

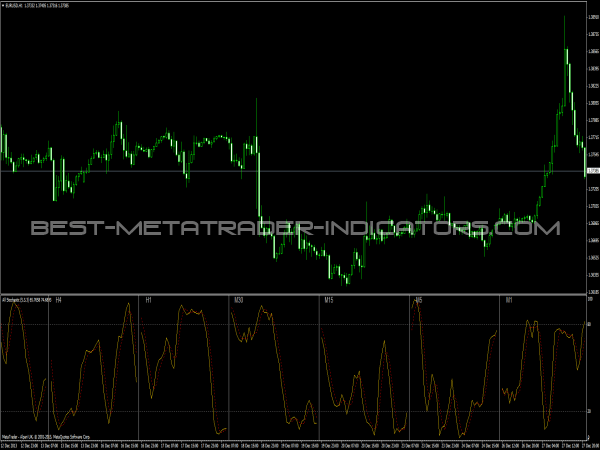

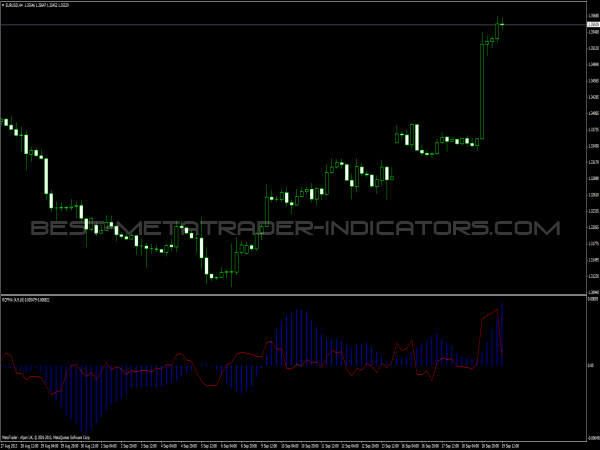

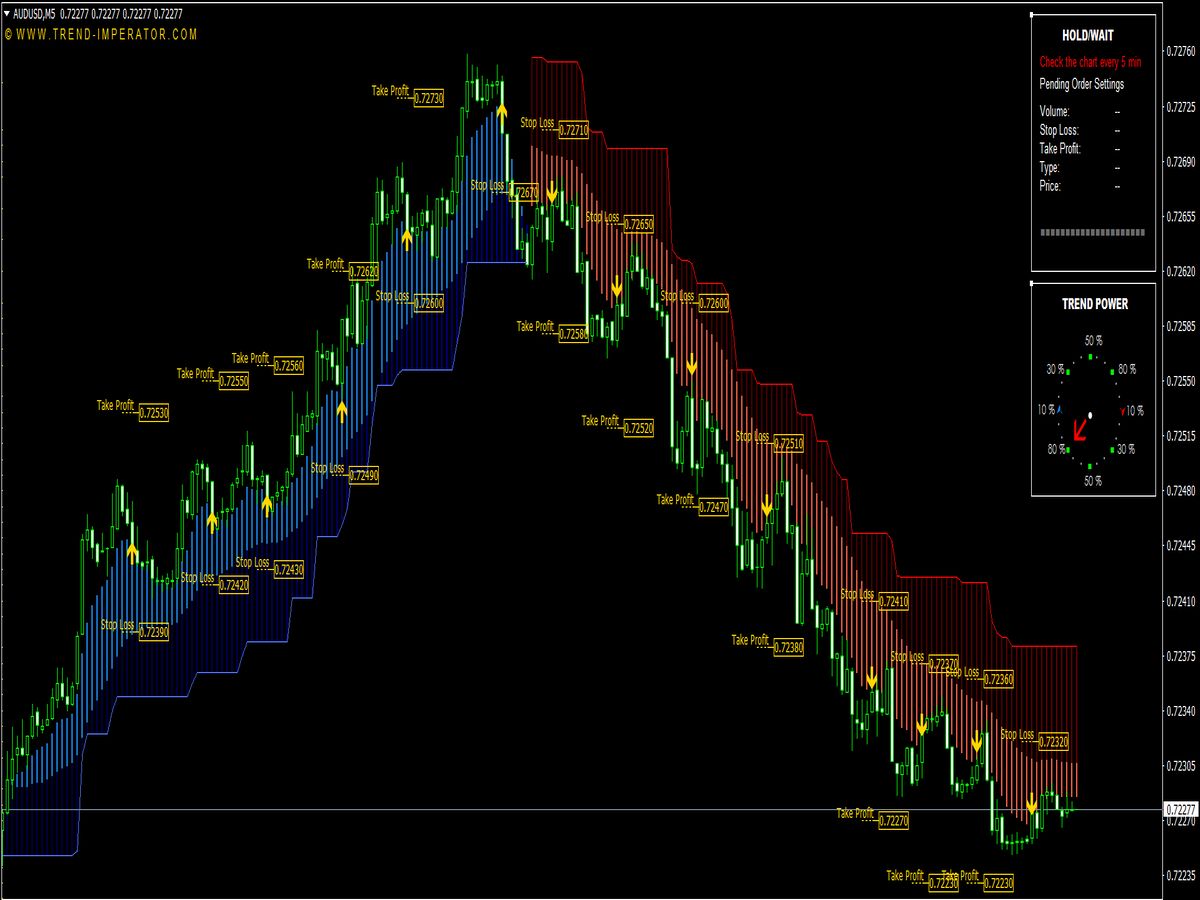

Repainting Indicators

In contrast, repainting indicators have the tendency to modify past signals based on new price data. These indicators may show a buy or sell signal that can disappear or change when the price moves, creating confusion for traders. For instance, a repainting indicator might initially signal a buy when a price reaches a certain level but later change that signal to a sell as the price trends downwards. This can lead to erroneous trading decisions since traders may believe they have a valid signal when, in fact, it is subject to change. One common example of a repainting indicator is the traditional momentum oscillator, where new price data can alter past signals.

Advantages of Non-Repainting Indicators

1. Reliability: Traders can trust the signals since they remain consistent.

2. Backtesting: Non-repainting indicators are easier to backtest, providing an accurate historical performance analysis.

3. Clarity: They offer clear visual cues for trading decisions without confusion over changing signals.

Disadvantages of Non-Repainting Indicators

1. Lagging Nature: Often, these indicators can be lagging, resulting in delayed signals that might cause missed opportunities.

2. Possible Whipsaws: In volatile markets, relying solely on non-repainting indicators can lead to false signals or whipsaws.

Advantages of Repainting Indicators

1. Real-Time Adjustments: They adapt to current market conditions dynamically, potentially providing more accurate signals based on the latest data.

2. Early Entry Points: Repainting indicators may highlight trends earlier, giving traders a chance to enter the market before changes become apparent.

Disadvantages of Repainting Indicators

1. Confusion: Signals can change retroactively, leading to confusion over the validity of past decisions.

2. Risk of Loss: Traders may act on signals that disappear, leading to potential losses.

3. Challenges in Backtesting: Testing these indicators can be deceptive since the signals today might not resemble the signals from the past.

In conclusion, while non-repainting indicators offer stability and reliability, repainting indicators provide adaptability and responsiveness to current market fluctuations. Traders must carefully assess their trading style and market conditions when choosing between these two types of indicators, considering the balance between reliability and responsiveness to optimize their trading strategies effectively. Understanding these concepts is integral for making informed trading decisions.