Submit your review | |

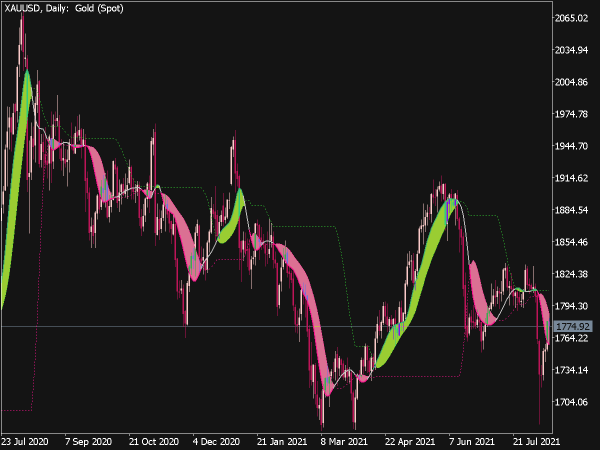

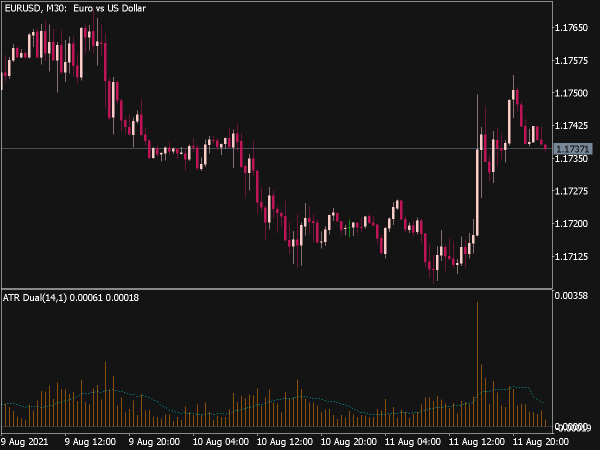

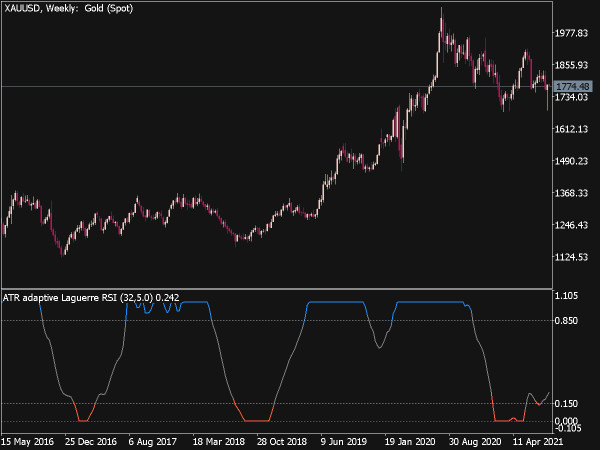

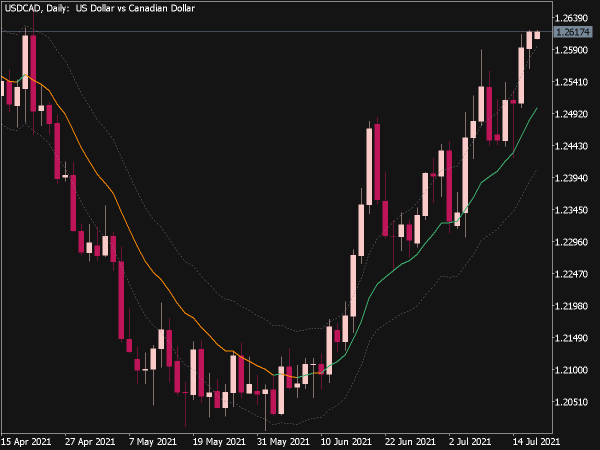

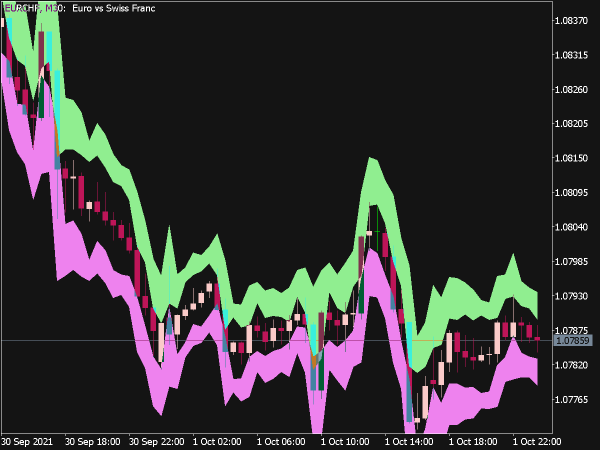

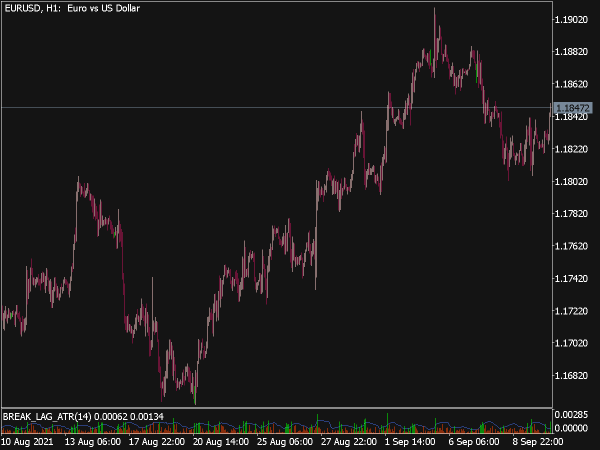

The Multi ATR Bands Indicator is a technical analysis tool that utilizes the Average True Range (ATR) to create dynamic support and resistance levels. By plotting multiple bands above and below a central moving average or price level, it helps traders identify potential breakout points and volatility ranges.

The bands adjust according to market volatility, making them useful for trend-following strategies and for setting stop-loss levels. Traders can customize parameters such as period length for the ATR and moving average, providing flexibility to suit different trading styles and market conditions.

Here are several strategies you might consider:

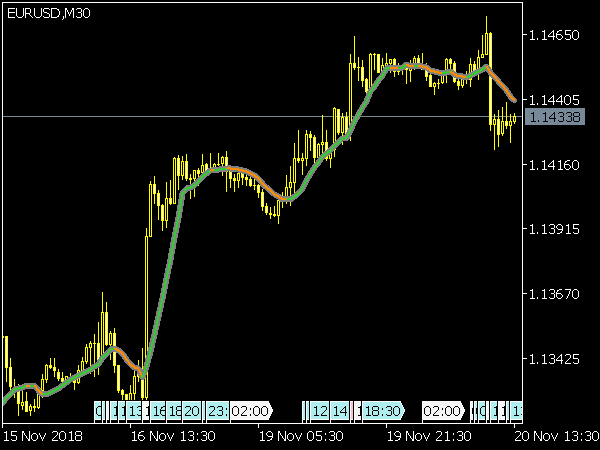

1. Trend Following Strategy

A popular approach with Multi ATR Bands is to trade in the direction of the trend. Begin by identifying the overall market trend using higher timeframes (like the daily or weekly chart) before switching to a lower timeframe (such as the 4-hour or 1-hour chart) for entry signals.

Entry: Initiate long positions when prices above the middle band are indicative of an uptrend. Initiate short positions if prices are below the middle band, suggesting a downtrend.

Exit: Set take-profit levels at the upper or lower bands, respectively, while employing stop-loss orders beyond the opposite band to minimize risk.

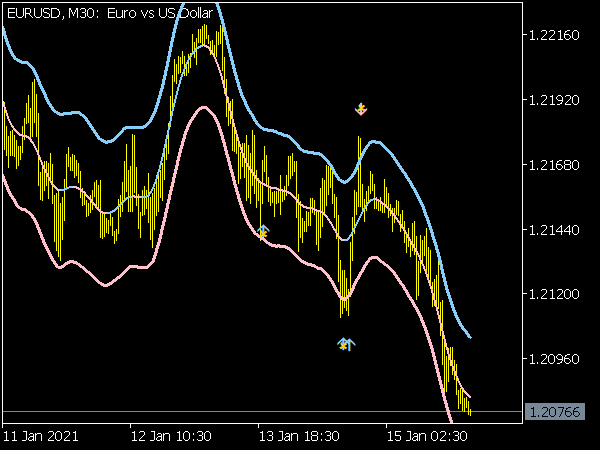

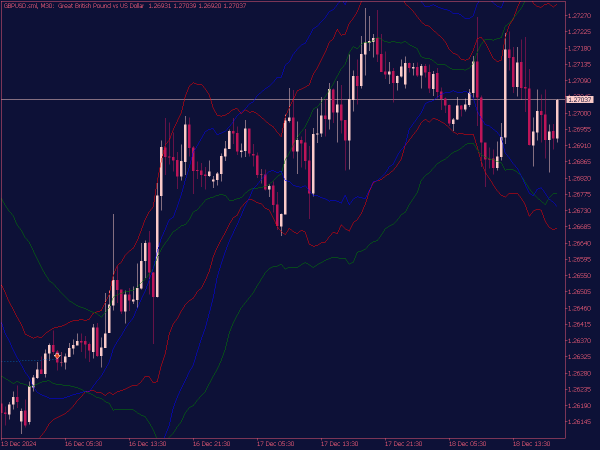

2. Bounce Trading Strategy

Leveraging the intrinsic support and resistance levels indicated by the ATR bands can be particularly effective.

Entry: Look for price retracements toward the lower band for long trades in a bullish market or toward the upper band for short trades in a bearish market. A confirmation candle, such as a bullish engulfing pattern at the lower band or a bearish engulfing at the upper band, can enhance entry reliability.

Exit: Set take-profits at the middle band or the opposite band, allowing for some volatility while maintaining a favorable risk-reward ratio.

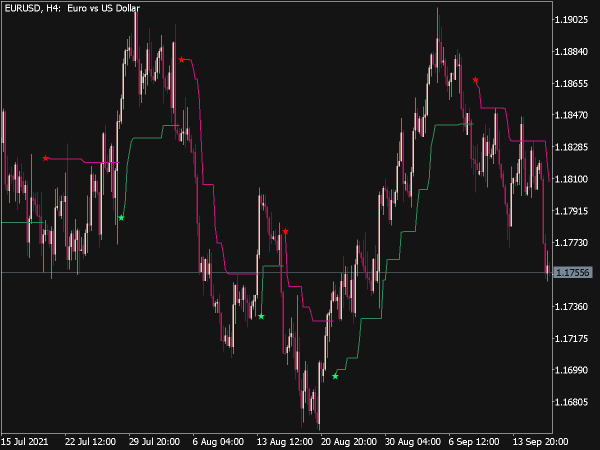

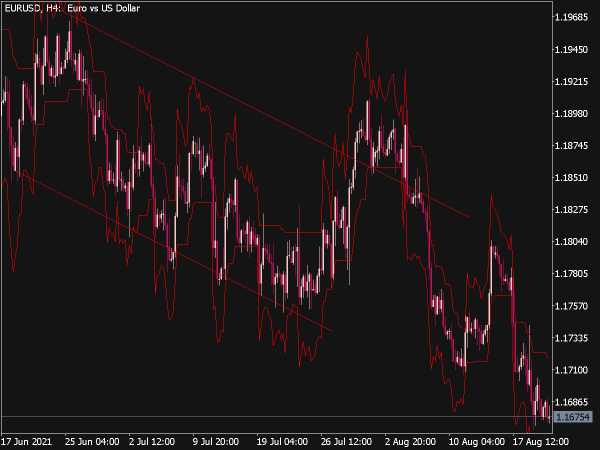

3. Breakout Trading Strategy

Another effective strategy is to utilize the Multi ATR Bands in identifying potential breakouts.

Entry: Watch for significant price movements that close above the upper band for long entry points or below the lower band for short entry points. Confirm breakout strength with volume or a momentum indicator, like RSI or MACD, to validate the signal.

Exit: Set take-profits at the next resistance or support level or use a trailing stoploss to capture further price movements.

4. Volatility Squeeze Strategy

Utilize the Multi ATR Bands to trade periods of low volatility that may precede significant price movements.

Entry: When the bands narrow significantly, indicating a consolidation period, wait for a breakout in either direction and enter trades accordingly.

Exit: Use the wider bands as targets for take-profit orders and place stop-loss orders just inside the bands to protect your position from false breakouts.

5. Multi-Timeframe Strategy

Enhance your trading strategy by analyzing Multi ATR Bands across multiple timeframes to identify key support and resistance levels.

Entry: Synchronize trades across timeframes, entering positions in the direction of the trend identified at a higher timeframe.

Exit: Execute orders following the same principles of take-profits and stop-losses indicated above.

These strategies can be tailored based on individual risk tolerance and market conditions, making the Multi ATR Bands a versatile tool for traders. Always backtest strategies and maintain risk management for consistent results.