Submit your review | |

The Moving Average (MA) indicator is a foundational tool in technical analysis, widely used by traders to identify trends, smooth out price data, and generate signals for buying or selling. Understanding how to effectively apply MAs can significantly enhance your trading strategies. Here’s a comprehensive guide that covers the types of MAs, their applications, various strategies to utilize them, and some best practices.

Types of Moving Averages

1. Simple Moving Average (SMA): The SMA is the most basic type of MA, calculated by taking the arithmetic mean of a given set of prices over a specified number of periods. For example, a 10-day SMA sums up the closing prices of the last 10 days and divides the total by 10. This average smooths out price fluctuations, providing a clearer signal of the overall trend.

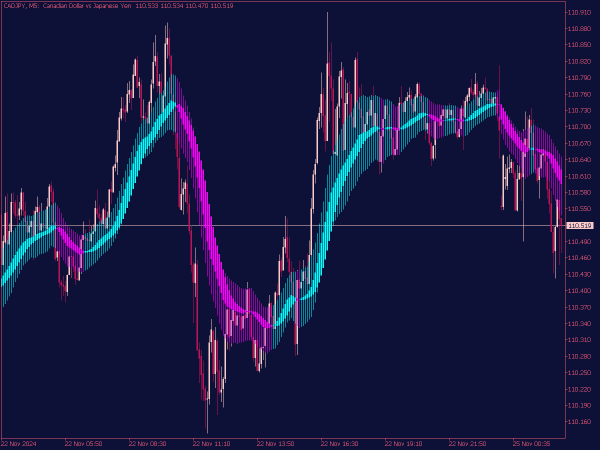

2. Exponential Moving Average (EMA): The EMA gives more weight to recent prices, making it more responsive to price changes compared to the SMA. This characteristic allows the EMA to react more quickly to price increases or decreases, which some traders prefer for generating signals.

3. Weighted Moving Average (WMA): The WMA assigns different weights to prices within the selected period, where more recent prices have higher weightings. This helps highlight more recent price movements while still acknowledging older prices.

Applications of Moving Averages

Moving averages are versatile and can be applied in various ways to assist traders in making informed decisions:

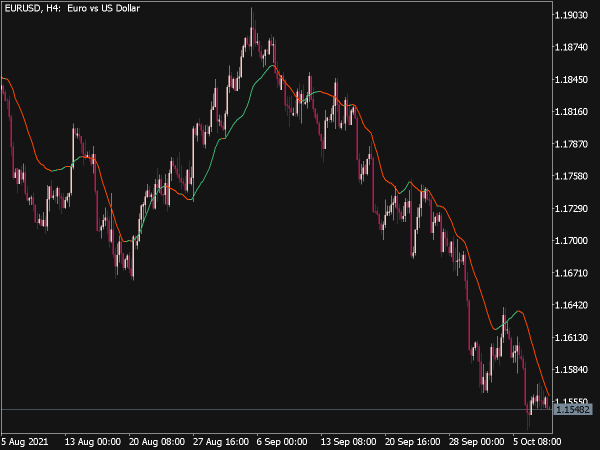

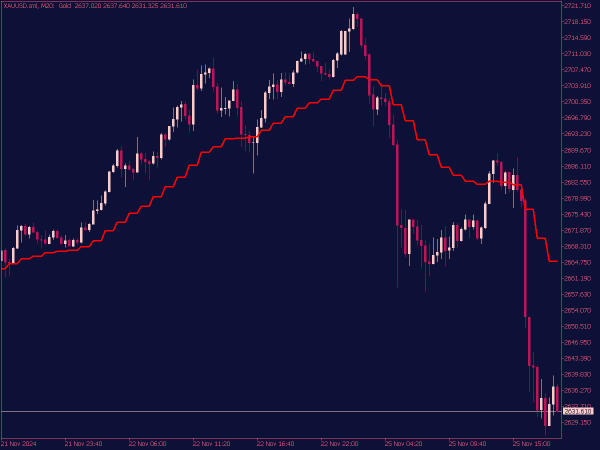

1. Trend Identification: MAs help traders determine the direction of the market. When the price is above the MA, it indicates an uptrend; when it’s below, a downtrend. This allows traders to align their strategies accordingly.

2. Support and Resistance Levels: MAs, especially longer-term ones, frequently act as dynamic support and resistance levels. When the price approaches a significant MA, it may bounce off or reverse, providing potential trade setups.

3. Signal Generation: By using strategies like crossovers, traders can generate buy and sell signals based on the interaction of different MAs.

Popular Moving Average Strategies

1. Crossover Strategy: This is one of the most popular MA strategies. Traders often use two MAs - a short-term (like the 10-day MA) and a long-term (like the 50-day MA). A buy signal occurs when the short-term MA crosses above the long-term MA (a bullish crossover), while a sell signal is triggered when the short-term MA crosses below the long-term one (a bearish crossover). This strategy allows traders to catch trends early.

2. Moving Average Bounce: In trending markets, many traders watch for price retracements to a moving average. A bounce off a moving average can signal a continuation of the trend, providing a potential entry point. For example, if the price retraces to a 50-day MA and bounces back up, it may be considered a buying opportunity.

3. Mean Reversion: This strategy hinges on the idea that prices will return to their average over time. When the price strays significantly above or below a moving average, traders may look for opportunities to capitalize on a return to the mean. This method often involves entering trades at extremes and using the MA as a guide for the target price.

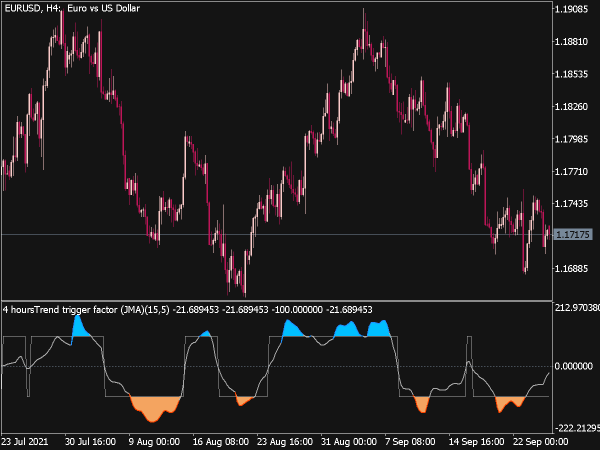

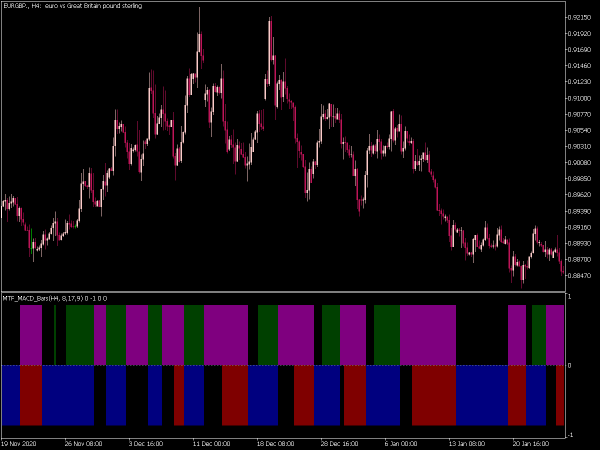

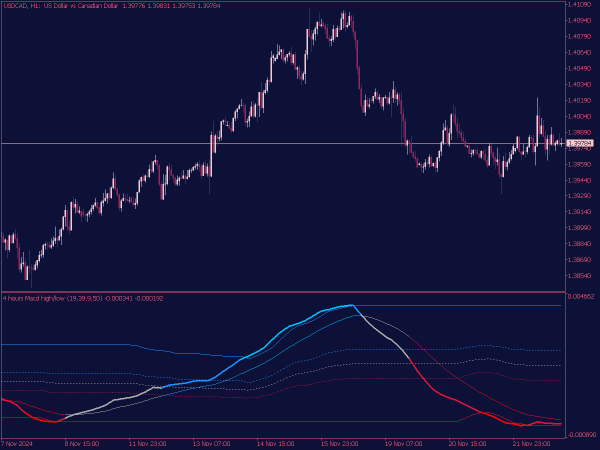

4. MACD (Moving Average Convergence Divergence): This is a popular momentum indicator that utilizes MAs. The MACD line is derived from the difference between the 12-day and 26-day EMAs. Traders look for crossovers with the signal line (a 9-day EMA of the MACD) as buy or sell signals.

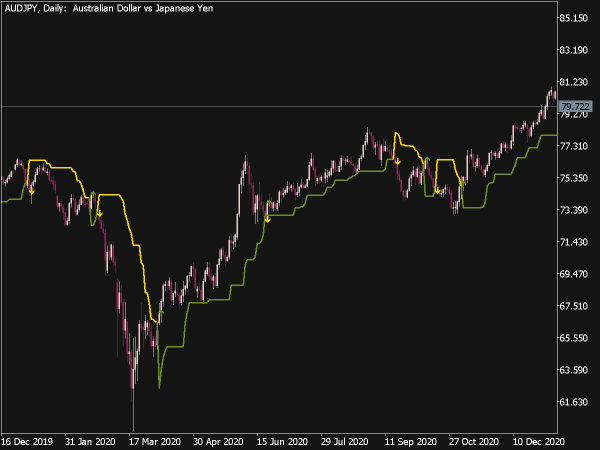

5. Golden Cross and Death Cross: The Golden Cross occurs when a short-term MA crosses above a long-term MA, indicating potential bullish momentum. Conversely, the Death Cross occurs when a short-term MA crosses below a long-term MA, signaling bearish momentum. These patterns are often used by long-term investors as a part of a broader strategy.

Best Practices for Using Moving Averages

1. Select the Right Period: The effectiveness of a moving average depends on the period chosen. Shorter periods (like 10 or 20 days) are useful for short-term trades, while longer periods (like 50 or 200 days) are better for trend analysis.

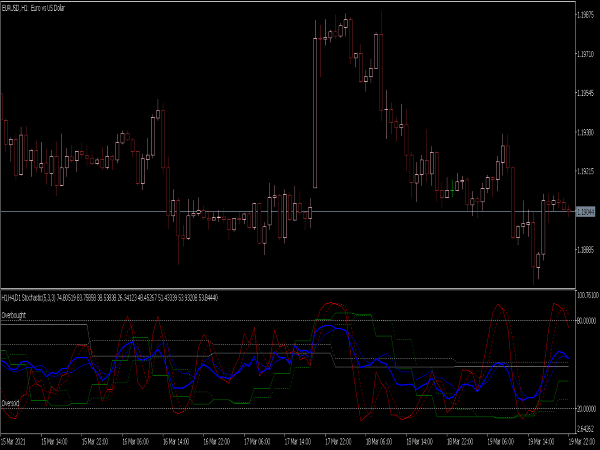

2. Combine with Other Indicators: MAs work best in conjunction with other indicators such as the Relative Strength Index (RSI), Fibonacci retracements, or volume analysis to confirm signals and enhance the likelihood of successful trades.

3. Adapt to Market Conditions: Different market environments, whether trending or ranging, can influence MA performance. Be aware of market conditions and adjust your strategies accordingly.

4. Use Stop-Loss Orders: Protect your capital by using stop-loss orders. Placing them above or below the moving average can help minimize losses in case the market moves against your trade.

5. Analyze Historical Data: Test your MA strategies using historical data to understand their effectiveness over various market conditions. Backtesting can provide insights into potential future performance.

6. Stay Informed: Market dynamics can change rapidly. Keep abreast of financial news, economic indicators, and market sentiment that could influence price movements and your moving average strategies.

Conclusion

The Moving Average is a powerful tool for traders, offering clear insights into market trends and potential entry and exit points. By understanding the different types of MAs, their applications, and various strategies, traders can significantly enhance their decision-making process.

However, like all trading tools, MAs are not foolproof, and combining them with sound risk management practices and additional technical indicators can bolster their effectiveness. Always remain adaptable and responsive to changing market conditions to maximize your trading success.