Submit your review | |

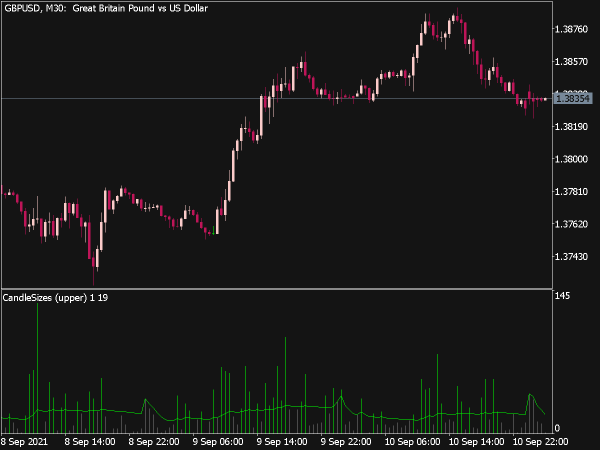

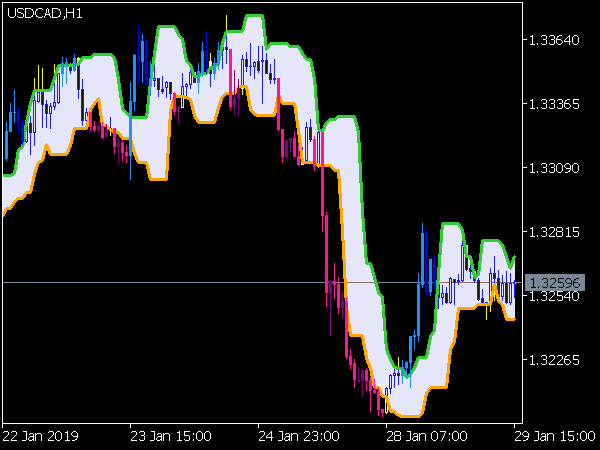

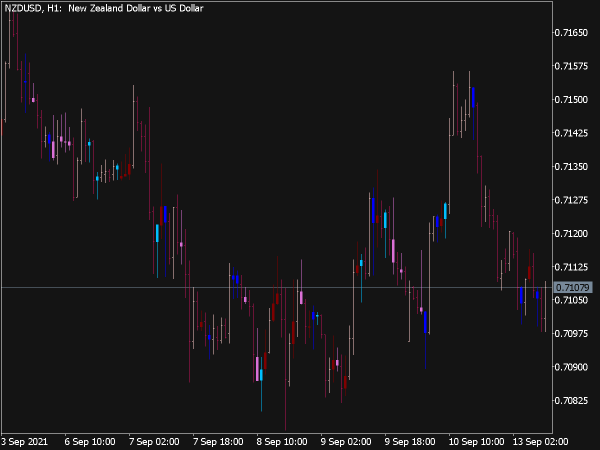

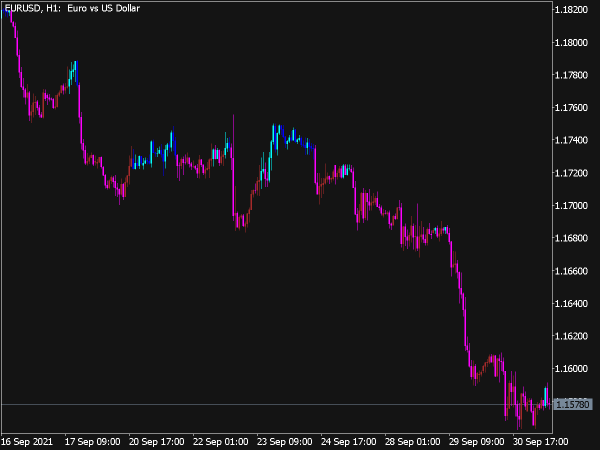

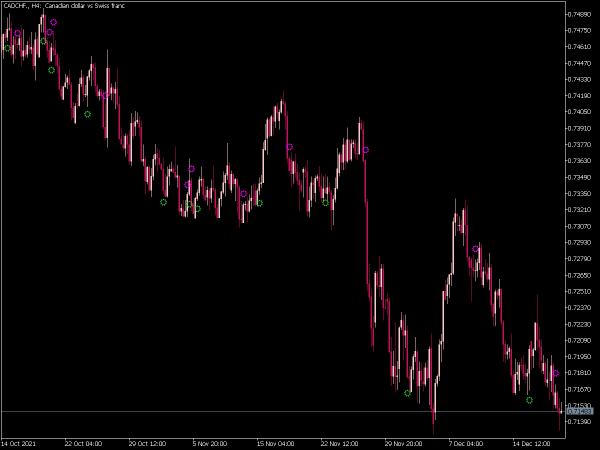

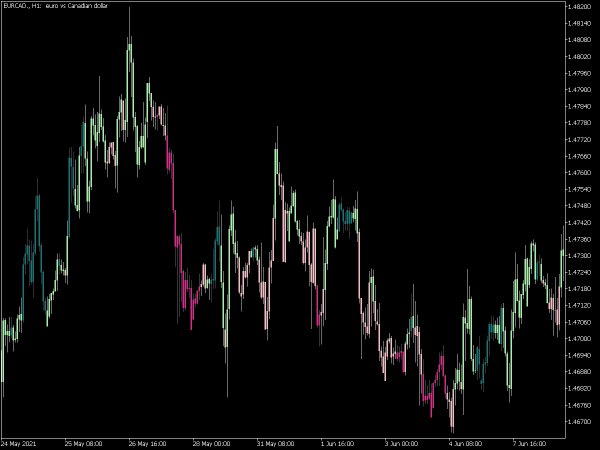

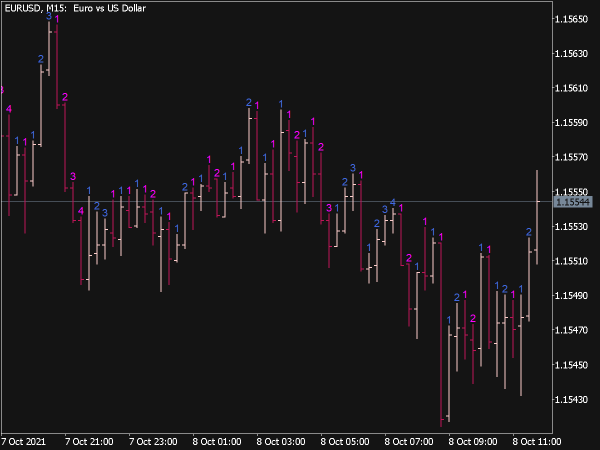

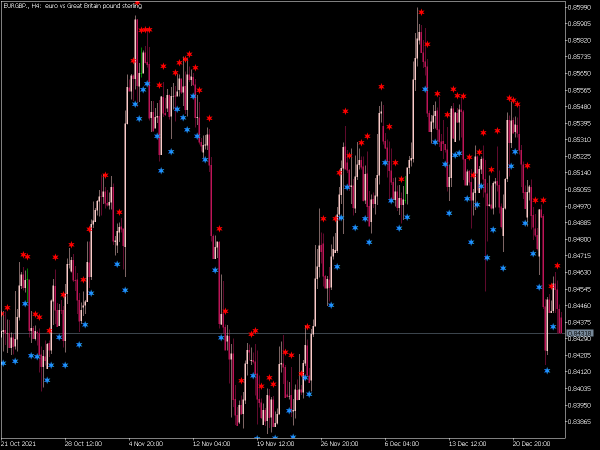

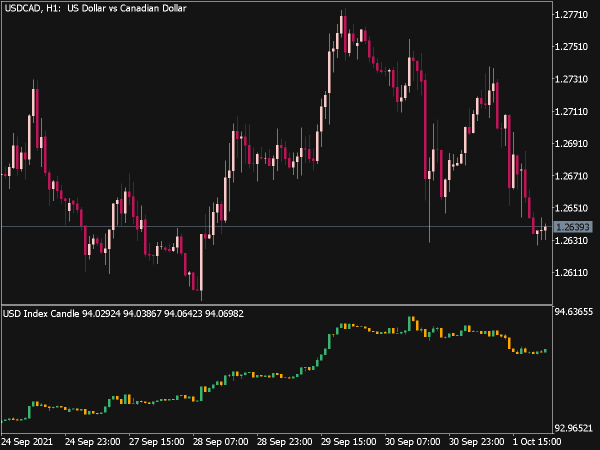

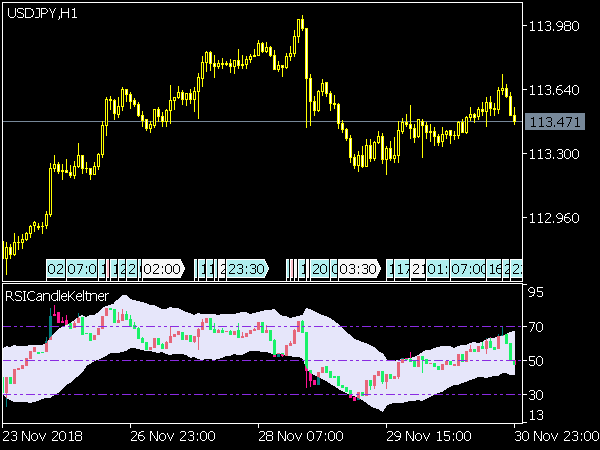

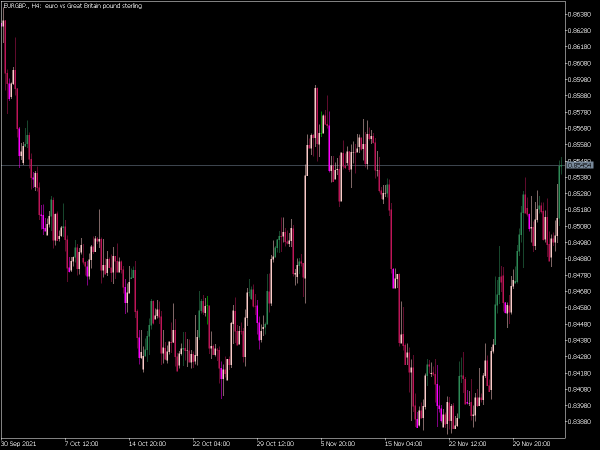

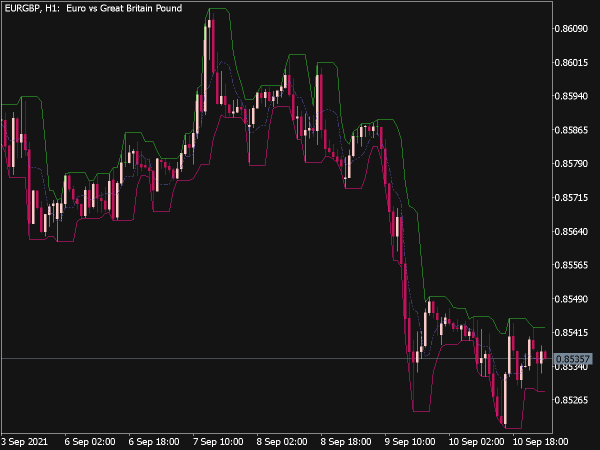

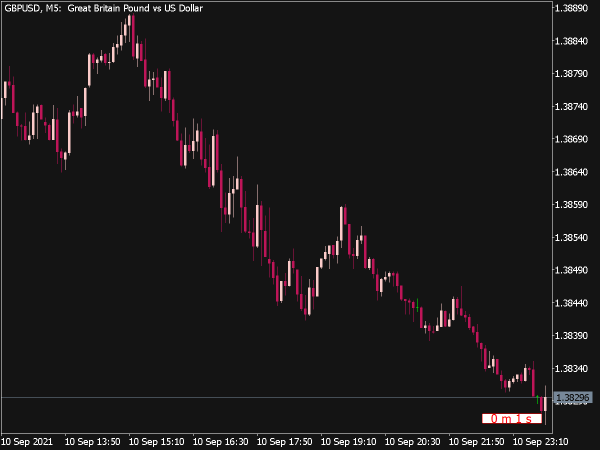

The MTF (Multi-Time Frame) Candle Indicator is a technical analysis tool used in trading that allows traders to view candlestick patterns from multiple time frames on a single chart. By combining data from different time frames, this indicator helps traders identify trends, reversals, and potential entry or exit points, offering a more comprehensive view of market activity. It aids in confirming signals by providing insights from shorter and longer time frames, helping traders to make more informed decisions based on the broader market context.

Here are several trading strategies utilizing the MTF Candle Indicator:

1. Trend Confirmation: Use the MTF Candle Indicator to confirm trend direction. Analyze higher timeframes (e.g., daily or weekly) for the prevailing trend and enter trades on lower timeframes (e.g., hourly) when the direction aligns.

2. Candle Pattern Recognition: Look for reversal or continuation candle patterns across multiple timeframes. For example, if a bullish engulfing pattern forms on the 4-hour chart while the daily chart shows an uptrend, this may signal an optimal buying opportunity.

3. Multi-Timeframe Divergence: Identify divergence between price and the MTF Candle Indicator. If price makes a higher high but the MTF Candle Indicator shows a lower high (or vice versa), it can indicate potential reversals.

4. Support and Resistance Levels: Use the MTF Candle Indicator to spot support and resistance levels on multiple timeframes. A bounce off a support level on the 1-hour chart, confirmed by higher timeframe analysis, may present a buying opportunity.

5. Breakout Trading: Adjust your approach for breakout trading by observing candle closes on multiple timeframes. A breakout confirmed by a close above resistance on the daily chart, followed by a retracement to support on the 1-hour chart, may offer a buying setup.

6. Trend Line Analysis: Draw trend lines on multiple timeframes and look for confluence. If the price bounces off a trend line on both the 4-hour and 1-hour charts, it could signify a strong trading opportunity.

7. MACD Strategy: Combine MTF Candle Indicator with MACD across different timeframes to look for crossovers that align with overall market trends indicated by the candles.

8. Volatility Filter: Use the MTF Candle Indicator to gauge volatility. A narrow range of candles on a higher timeframe may precede significant volume and volatility in shorter timeframes; use this information to anticipate price movements.

9. Risk Management: Implement strict risk management strategies by observing candle patterns. A larger stop-loss may be warranted if a significant reversal pattern appears on higher timeframes.

10. Session Trading: Tailor trading strategies based on the trading session; the MTF Candle Indicator can help identify the best timeframes to trade based on market volatility and liquidity.

11. Fibonacci Retracement Confluence: Use the MTF Candle Indicator to identify Fibonacci levels and look for candle confirmations at these levels, enhancing the probability of a successful trade.

12. Trade with Market Sentiment: Align trading decisions with market news and sentiment while using the MTF Candle Indicator to confirm entry and exit points that align with overall market direction.

13. Exit Strategies: Establish exit strategies based on candle formations. If a bearish candle pattern forms on a higher timeframe at your target level, consider closing your position.

14. Scalping Strategy: For shorter-term traders, use the MTF Candle Indicator to identify quick trades on lower timeframes while validating market direction from higher timeframes.

15. Session High/Low: Monitor the high and low of each trading session as indicated by the MTF Candle Indicator, providing entry and exit points based on price action around these levels.

Each of these strategies can be customized based on personal trading styles, risk tolerance, and market conditions. Combining the MTF Candle Indicator with other technical analysis tools can enhance trading effectiveness and improve overall decision-making.