Submit your review | |

ℹ️ How to Trade Forex Market Using Moving Averages

To trade in forex market, at some points, is easy as long as a trader can optimize a good trading strategy. One of the most used forex trading strategies is developed based on moving averages. Moving averages are nothing but series of means plotted sequentially on a graph. Moving averages can be very useful in our trading. In this trading tip we will learn about different techniques of trading moving averages, we will also learn about golden cross and dead cross.

The strategies we are going to learn in this tip are created using one, two and three moving average.

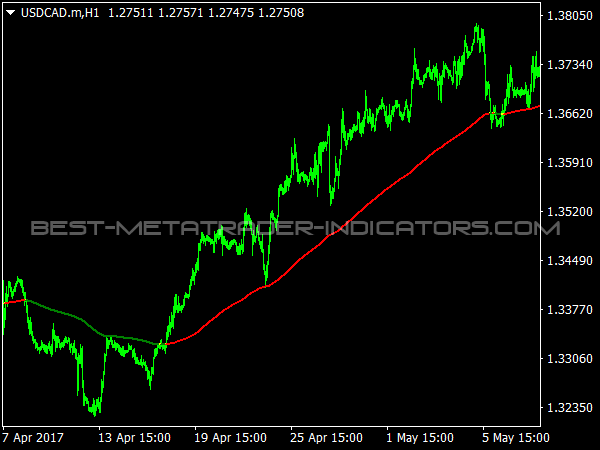

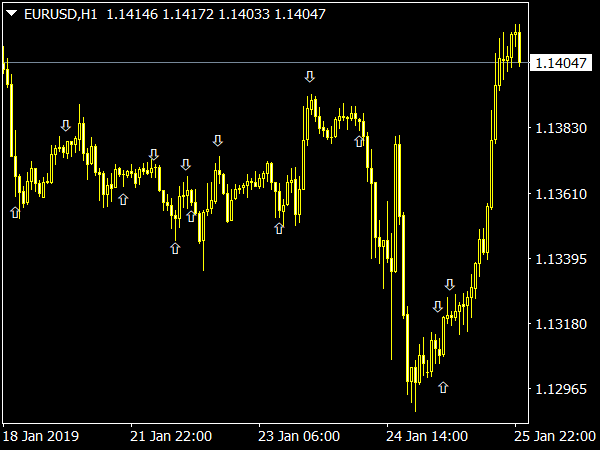

Trading Single Moving Average

This strategy is dead simple and very easy to understand. We will use only one moving average. We buy when the price crosses and closes above the moving average, and we sell when the price crosses and closes below the moving average. This strategy performs better if used on longer time frames such as on daily and weekly charts. By using this strategy you can catch long trends.

Trading Dual Moving Average

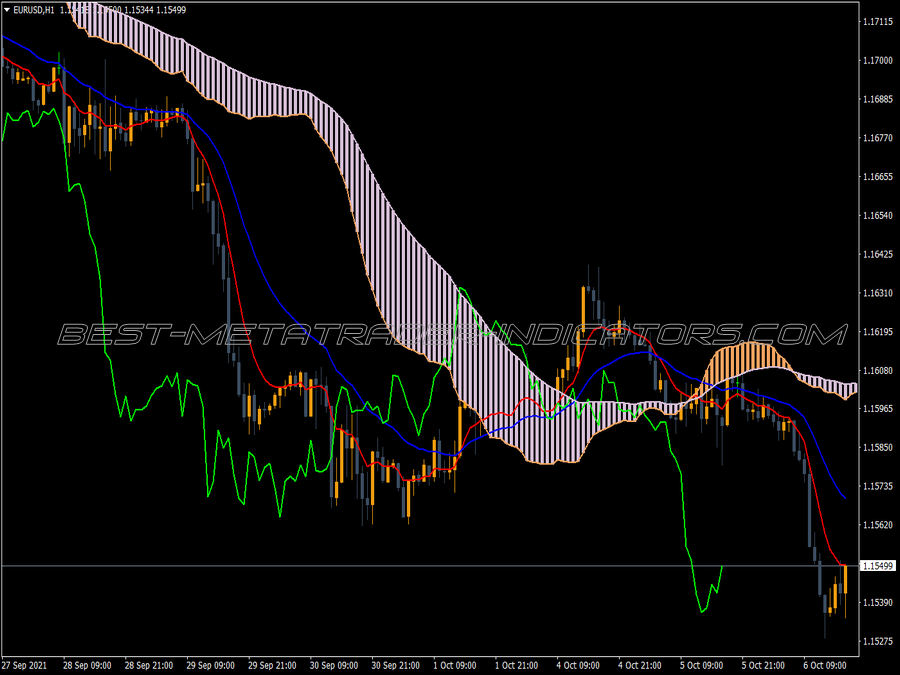

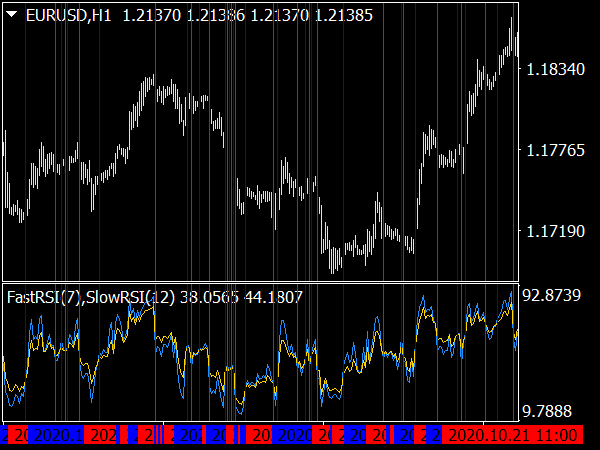

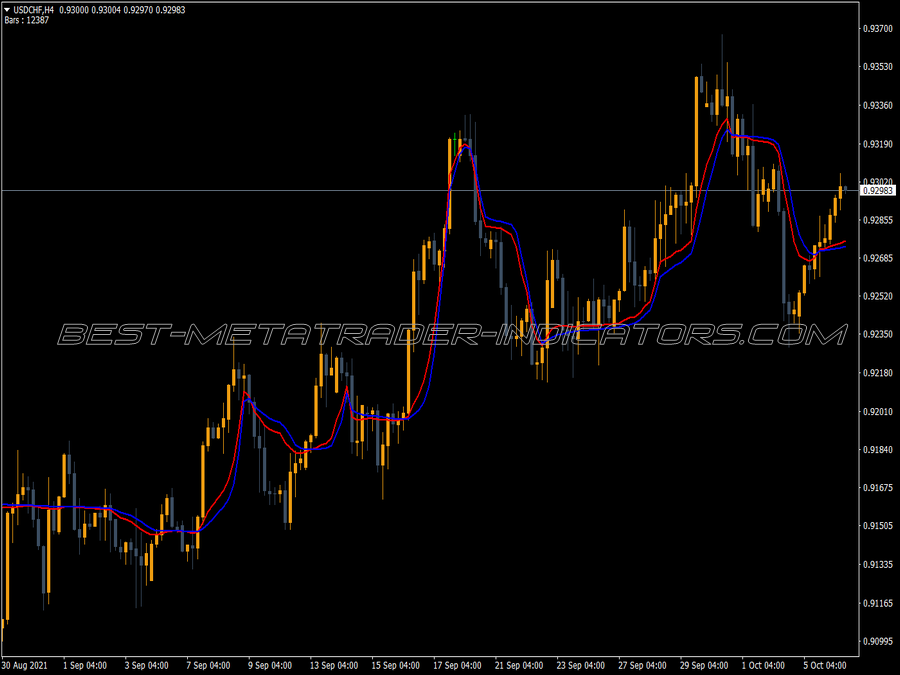

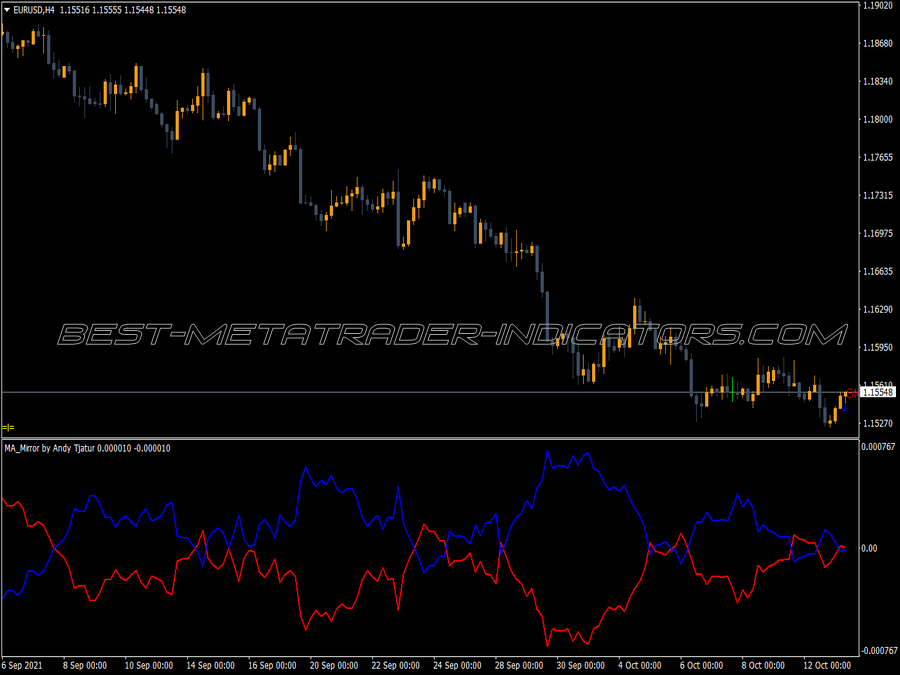

In this strategy we will make use of two moving averages, one will be a short term moving average (faster, e.g. 20-SMA) and the other will be a longer term (slower, e.g. 50-SMA) moving average. This strategy can be used on any time frame.

Buy set-up: We buy when the faster moving average crosses above the slower moving average. Price will be already above both the moving averages as MAs are lagging indicator (i.e. they follow the price).

Sell set-up: We sell when the faster moving average crosses below the slower moving average.

Exit set-up: We exit when both moving average crosses again in the opposite direction after we enter the trade.

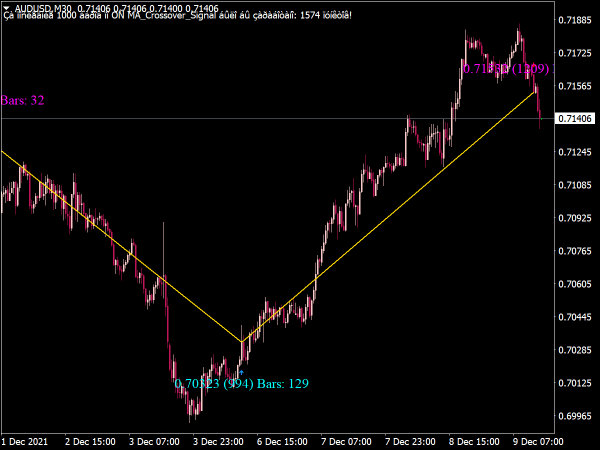

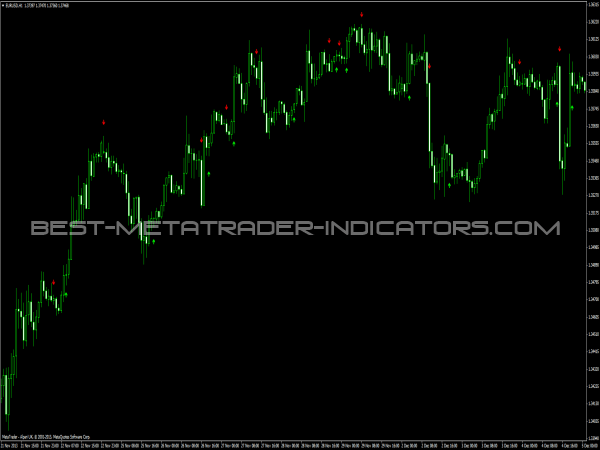

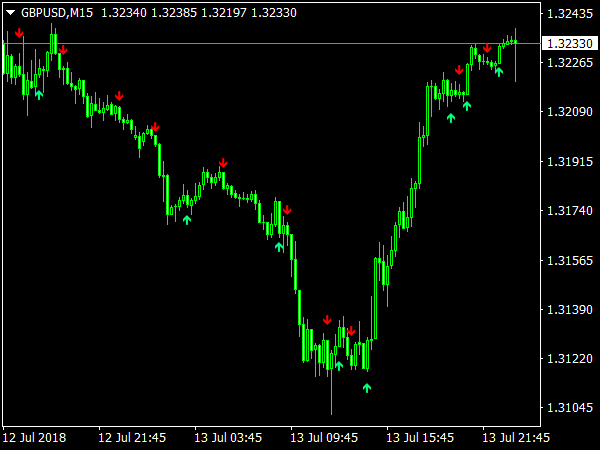

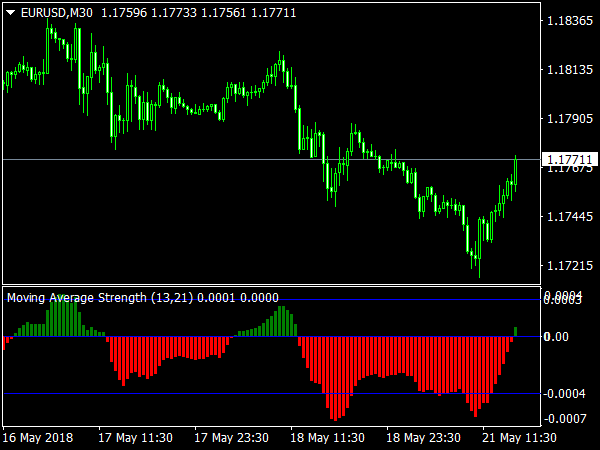

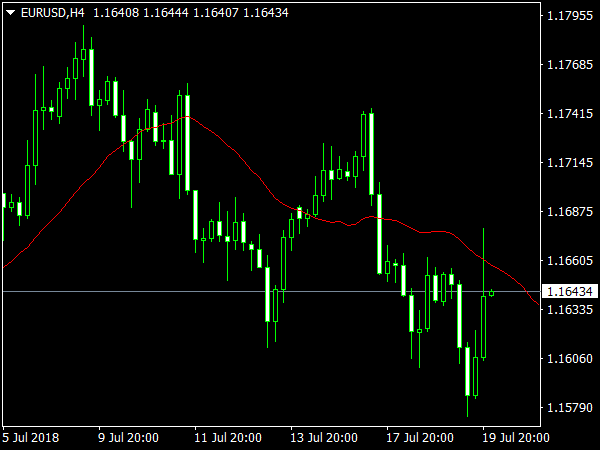

The screenshot above shows the working of this strategy. First crossover is when the faster line (20-SMA) crosses below the slower line (50-SMA), this cross over is also called as “Dead Cross” or “Death Crossover” as the price is expected to fall after this crossover. Thus we sell whenever a dead cross occurs. The faster line crosses over the slower line (second crossover in figure 2) and we exited our position.

When the faster line (20-SMA) crosses above slower line (50-SMA), the crossover is called as “Golden Cross” or “Golden Crossover” as the price is expected to rise after this crossover, thus we enter a long position and exited when next crossover occurs afterwards. This way we always have one or other position open.

This strategy does not perform well when markets are choppy (sideways).

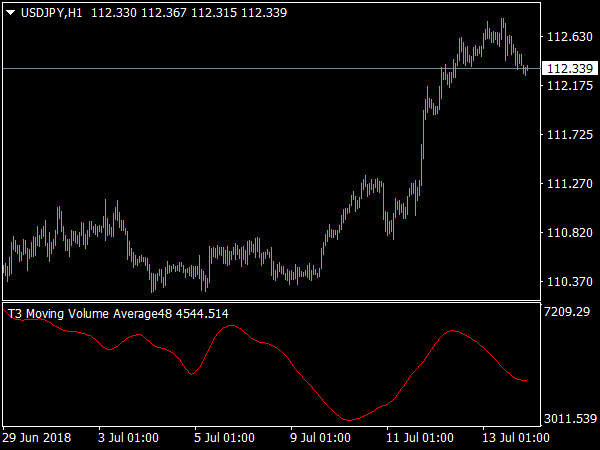

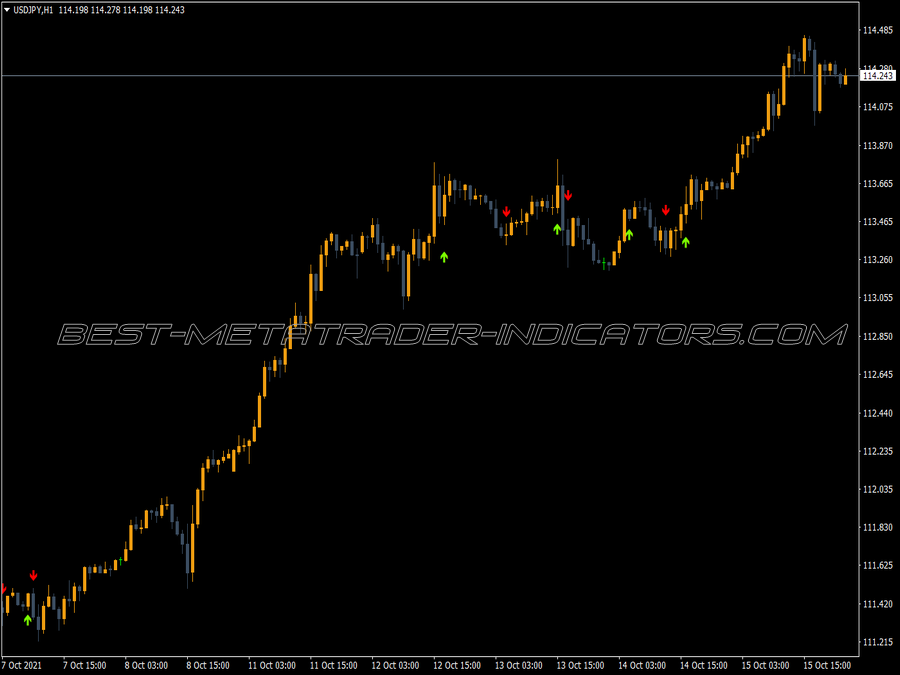

Trading Triple Moving Average

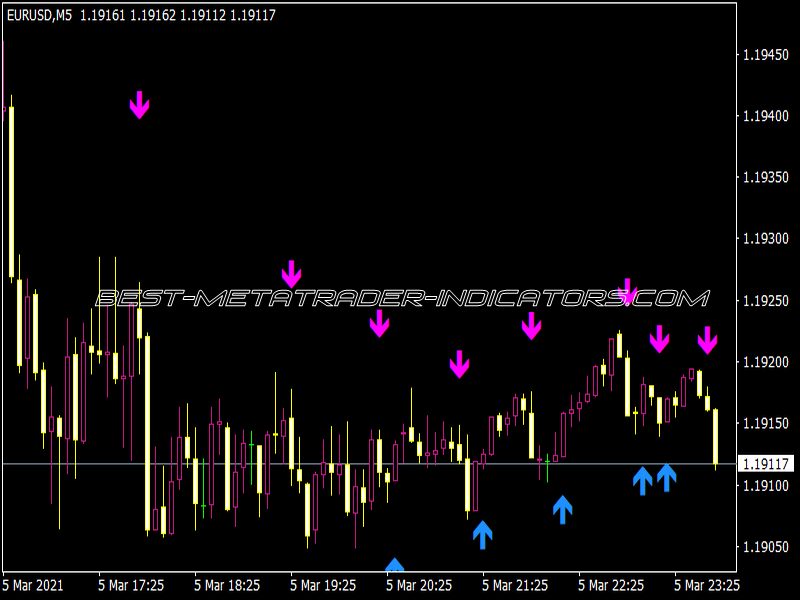

This strategy uses three moving average viz. short term (fastest), medium term and long term (slowest). When a shorter (20-SMA) moving average crosses a medium term (50-SMA) moving average, and the medium crosses over longer moving average (100-SMA), a bullish or bearish signal is generated depending on the direction of the crossovers.

This strategy works best when a market is trending and it is advisable to avoid using this strategy when a market is choppy.