Submit your review | |

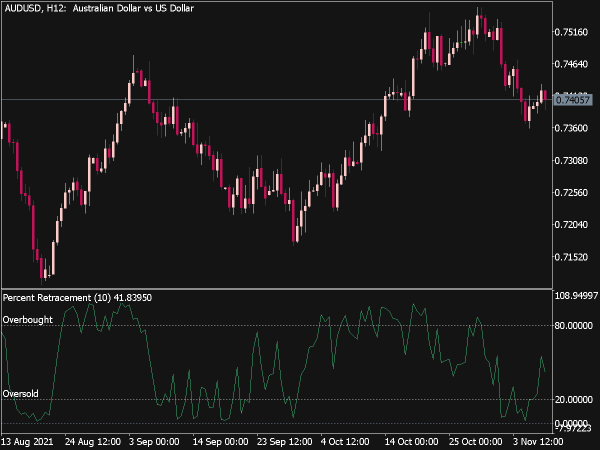

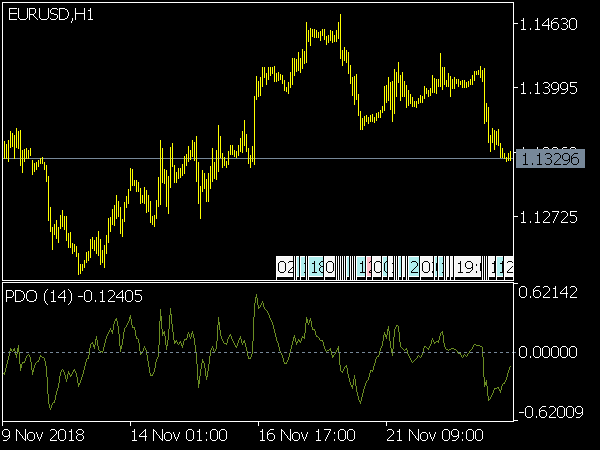

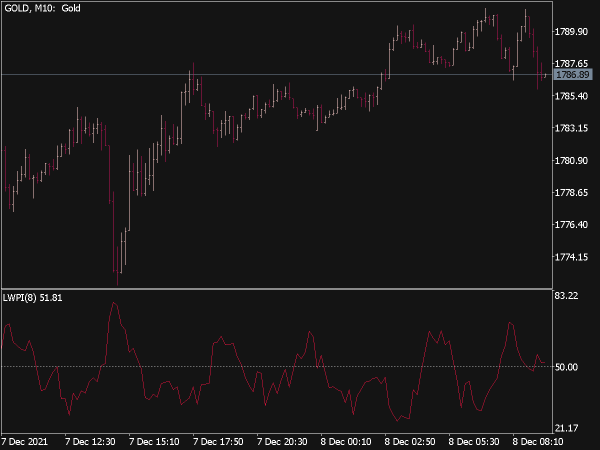

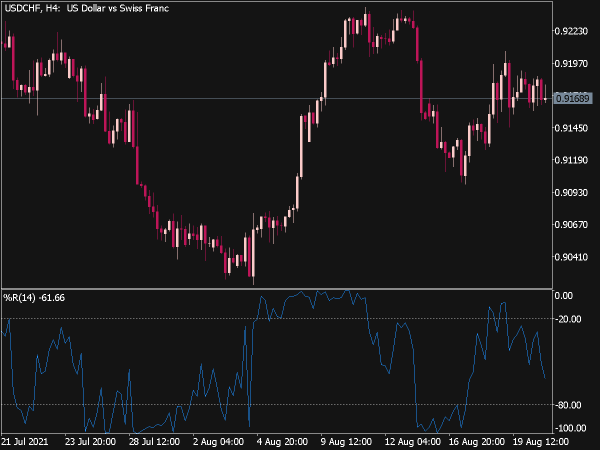

The Williams %R indicator, invented by Williams measures momentum in a market. This indicator was devised in the year 1973. It is a version of the fast stochastic oscillator and consists of the difference between the highest high price of a predetermined number of days and the current closing price. The Williams %R indicator generally oscillates between -100 and 0. The readings which are above -20 are called overbought while the readings below -80 are called oversold.

Williams %R helps a trader to identify the best trading opportunity in forex market as well. The ability of the Williams %R indicator to anticipate a reversal in the basic instrument's price is very good. Williams %R usually creates a fall and turns upwards a few days before the instrument's price moves upwards. Also very often, the indicator reaches a high and turns down a few days before the security’s price follows suit. So, you need to be really careful while figuring out such trends.