Submit your review | |

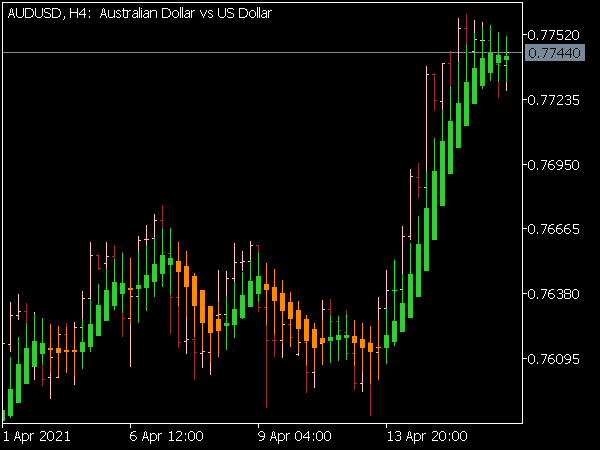

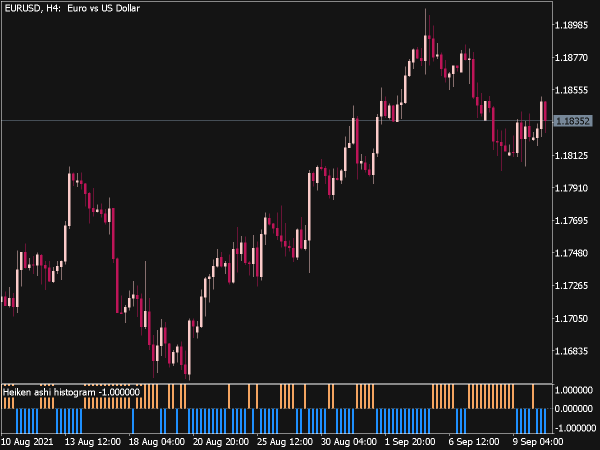

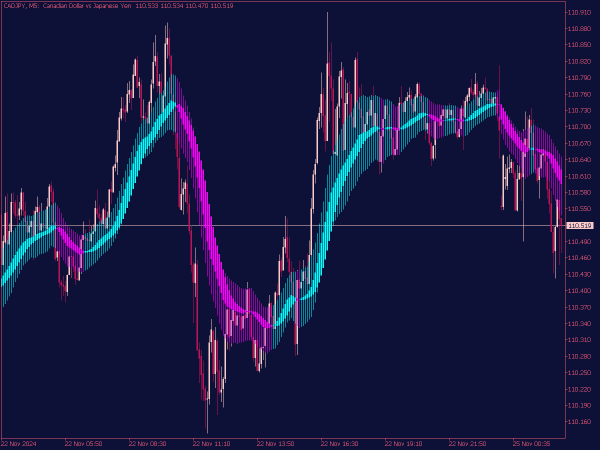

The Heiken Ashi MTF (Multi-Time Frame) Indicator is a trading tool that utilizes the Heiken Ashi candlestick methodology to provide a smoothed representation of price action across multiple time frames. Unlike standard candlesticks, Heiken Ashi adjusts the open, close, high, and low prices to create a more visually appealing and trend-following display, making it easier for traders to identify market trends and reversals.

The MTF aspect allows traders to analyze trends from different time frames simultaneously, enhancing their decision-making process. By overlaying these smoothed candlesticks on standard charts, traders can better gauge market sentiment, filter out noise, and make more informed trading choices.

Here are some effective trading strategies:

1. Trend Following Strategy: One of the most effective strategies using the Heiken Ashi MTF indicator is to trade in the direction of the trend. By analyzing multiple time frames, traders can confirm the overall trend. For instance, if the higher time frame (e.g., daily) shows a bullish trend, traders may look for buying opportunities in lower time frames (e.g., hourly) where the Heiken Ashi candles are also bullish (green). Entry points can be identified when a bullish Heiken Ashi candle closes, especially if it follows a series of bearish candles.

2. Reversal Strategy: The Heiken Ashi MTF can also signal potential reversals. When a series of bearish candles shift to bullish candles, it may indicate a reversal point, especially if this occurs at key support levels or Fibonacci retracement levels. Traders might wait for confirmation through other indicators like RSI or MACD to minimize false signals. Setting stop-loss orders just below the recent swing low can help manage risks effectively.

3. Cross-Time Frame Analysis: To enhance decision-making, traders can employ a cross-time frame analysis. For example, if the weekly Heiken Ashi chart indicates a strong uptrend, and the daily chart is also bullish, traders can look to enter trades on the 4-hour or 1-hour charts when Heiken Ashi candles align in the same bullish direction. This technique increases the probabilities of success by confirming trends across multiple time frames.

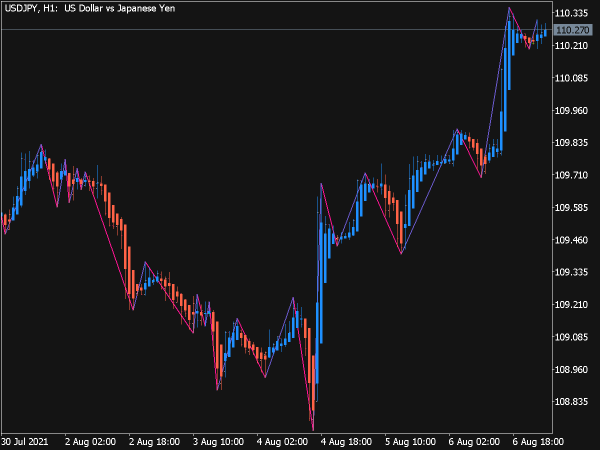

4. Using Heiken Ashi with Moving Averages: Another strategy is to combine the Heiken Ashi MTF indicator with moving averages. For instance, traders might use the 50-period and 200-period moving averages alongside the Heiken Ashi candles. A buy signal can occur when the price is above both moving averages and Heiken Ashi candles are green. Conversely, a sell signal may arise when the price is below both moving averages and the candles are red.

5. Divergence Trading: Divergence between price and the Heiken Ashi indicator can also present trading opportunities. If the Heiken Ashi indicator shows a bullish trend while the price is making lower lows, this divergence may signal an upcoming bullish reversal. Traders can look for confirmation through additional technical analysis tools, such as divergence on the RSI or stochastic oscillator, before entering a trade.

6. Risk Management and Stop-Loss Levels: It's critical to implement sound risk management strategies when using Heiken Ashi MTF indicators. Traders should set stop-loss orders based on volatility, utilizing the average true range (ATR) to determine suitable levels. A common approach is placing a stop-loss just below the last swing low for buy trades and above the last swing high for sell trades.

7. Time Frame Alignment: Consider selecting time frames that align with your trading style. Short-term traders may use 5-minute, 15-minute, and hourly charts, while long-term traders might prefer daily, weekly, and monthly charts. The key is to maintain consistency in time frame analysis to avoid conflicting signals.

8. Combining with Fundamental Analysis: While technical indicators are essential for guiding trading decisions, integrating fundamental analysis can enhance the effectiveness of the Heiken Ashi MTF strategy. Monitoring economic news, earnings reports, and geopolitical events can help traders avoid entering positions during high-impact news releases, which might negate the trends indicated by the Heiken Ashi candles.

In conclusion, the Heiken Ashi MTF indicator offers a versatile foundation for trading strategies across various market conditions. By combining trend analysis, reversal identification, moving averages, and risk management techniques, traders can enhance their decision-making processes. As with any trading approach, continuous learning and practice are key to mastering these strategies, allowing traders to adapt to changing market dynamics and improve profitability over time.