Submit your review | |

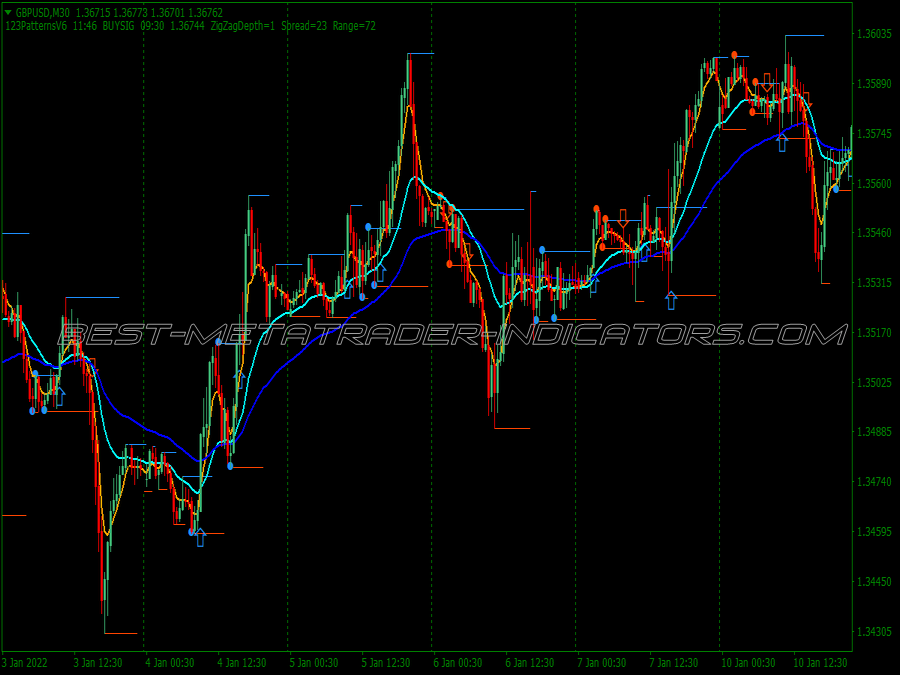

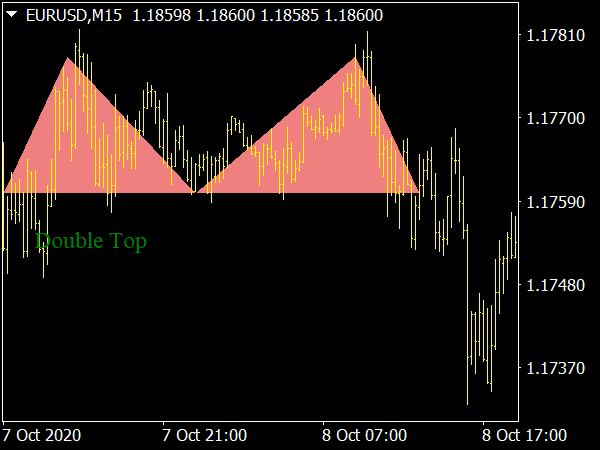

It has been proved beyond a reasonable amount of doubt that harmonic patterns have been very successful in over 70% of predictions when it comes to identifying price patterns in the forex market. It goes without saying that the main purpose of being in the in the forex market is to make some good profits by trading on currencies that are expected to move up over a period of time.

This particular method of predicting movement of foreign exchange by recognizing price patterns is so powerful that it is becoming hugely popular amongst a large section of those dealing in foreign exchange and in stocks and futures. It gives investors and market players, a very good idea about the entry and exit point as far as the price is concerned.

Though it could be used in various prices structures, it has been found to be effective specifically in Fibonacci Extensions and also in Fibonacci Retracement. The biggest problem when it comes to trading in foreign exchanges is the element of guesswork that creeps in. This can be avoided to a great extent by employing forex harmonic patterns.

This happens because the price patterns are usually fixed based on the time tested Fibonacci numbers. The use of these forex harmonic patterns also helps a lot in determining the reversal points where the probability is quite high. This works reasonably well because through this method of harmonic patterns, it is assumed that the trading patterns will be repeated over a period of time.

The main point which makes these price patterns so much sought after is because they seek to educate the investor to either open or close a position when the likelihood of a historic price ranging repeating itself is quite high. The principles on which harmonic pattern theory works is based on the Elliot Wave and also on Simple Geometry price structures.

The calculations of these Harmonic Patterns are based on the Fibonacci Calculations. These patterns help the investor to accurately predict when the turning points of a particular currency or stock is likely to occur. There are different types of forex harmonic patterns and each one is a big subject on its own. Though they basically deal with price patterns, each one has its own uniqueness and different way of calculating and predicting currency movements.

The most commonly known patterns are Bat Patterns, Butterfly Patterns, Crab Patterns and the most commonly used pattern that is known as Gartley Pattern.

Butterfly Harmonic Pattern

Butterfly is one of the reversal harmonic patterns. It is a very strong reversal signal. This pattern was discovered by Bryce Gilmore and Larry Pesavento. According to these guys, this pattern is nearly 80% accurate.

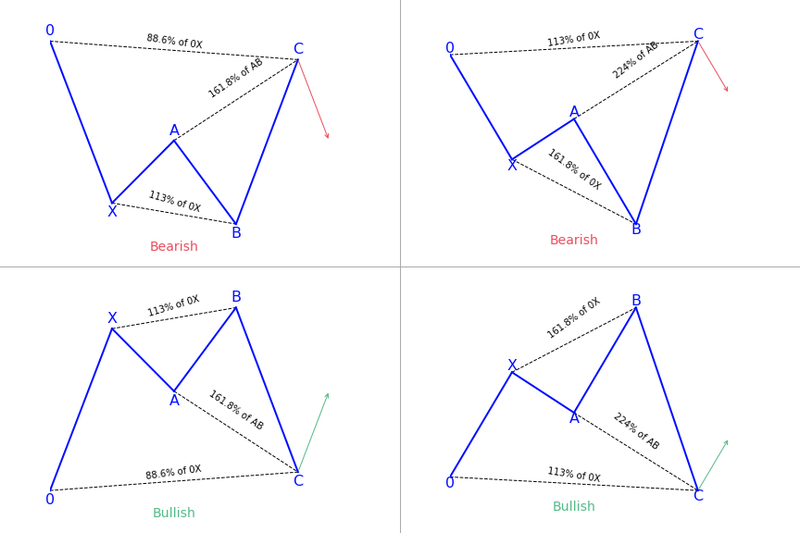

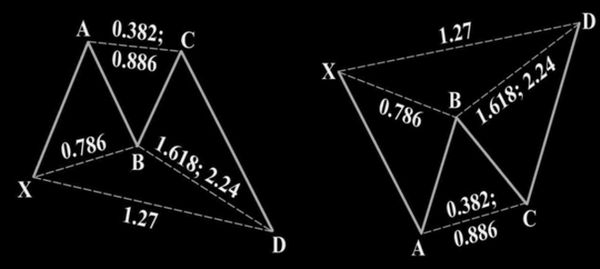

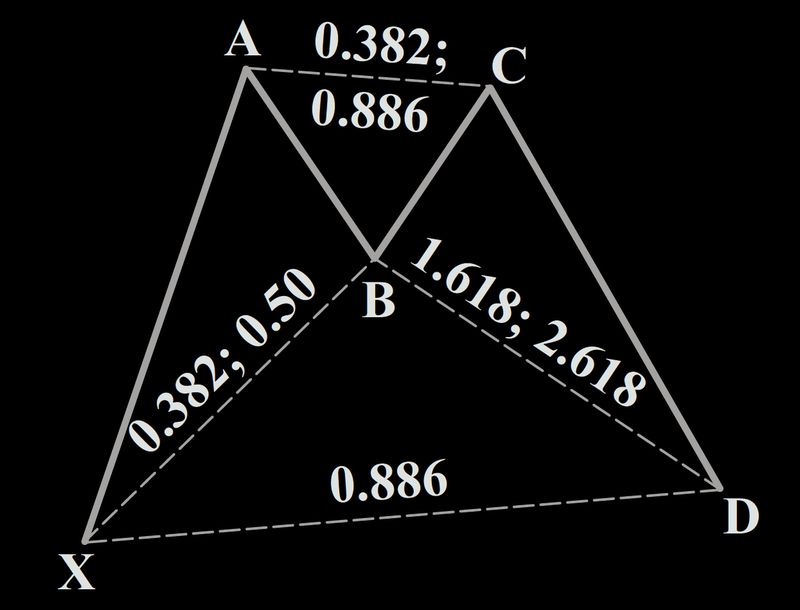

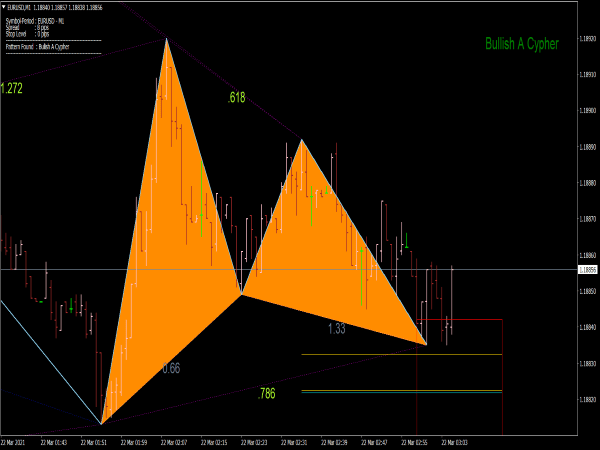

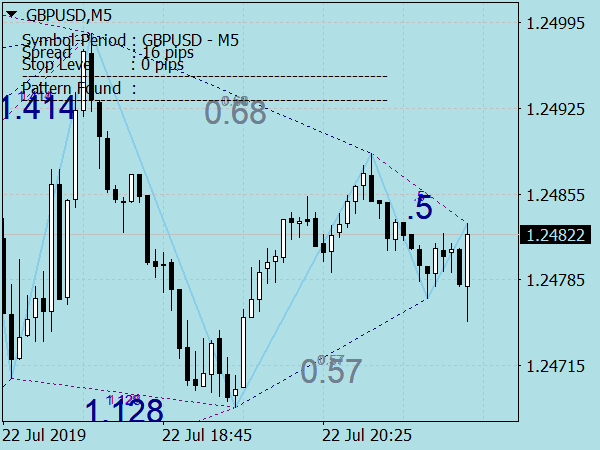

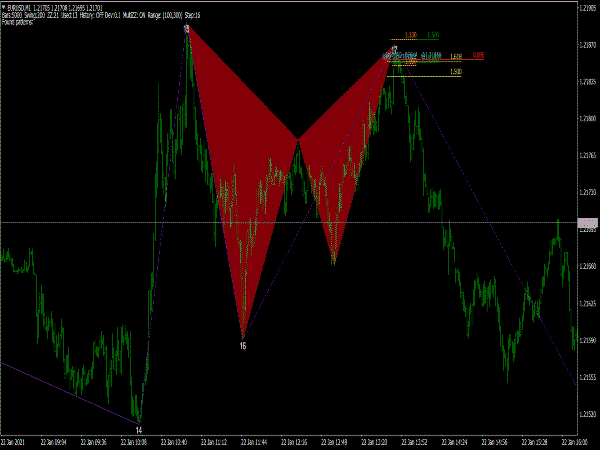

The below image shows the two variants of Butterfly pattern. This pattern may look like Gartley pattern but it is not the same, there is a difference. In Butterfly pattern the final leg (CD) is the longest and the strongest.

Fibonacci Ratios for Butterfly Pattern

The point B should be formed at 78.6% retracement of the leg XA, point C should either 61.8% or 78.6% retracement of leg AB. Point D should be 161.8% retracement of leg BC and 127.2% or 161.8% retracement of leg XA.

Bullish Butterfly Pattern

The Bullish Butterfly pattern begins at point X with an initial move up to point A, the highest point in the pattern. Then the price makes point B at 78.6% of leg XA then point C is formed at 61.8% or 78.6% of the leg AB, the point C should not exceed point A. the most critical aspect of a bullish Butterfly is the completion of point D. This point should be the lowest point (below all the other points). This is one of the most distinguishing elements of a Butterfly versus a Gartley.

Trading Bullish Butterfly Pattern

Just like Gartley pattern this pattern is also an reversal pattern so upon completion of point D, we can open up a long position and stop-loss can be put one or two ticks below point D. we are not putting the stop below X this time as point D is lower than point X, this will ensure a proper stop-loss placement.

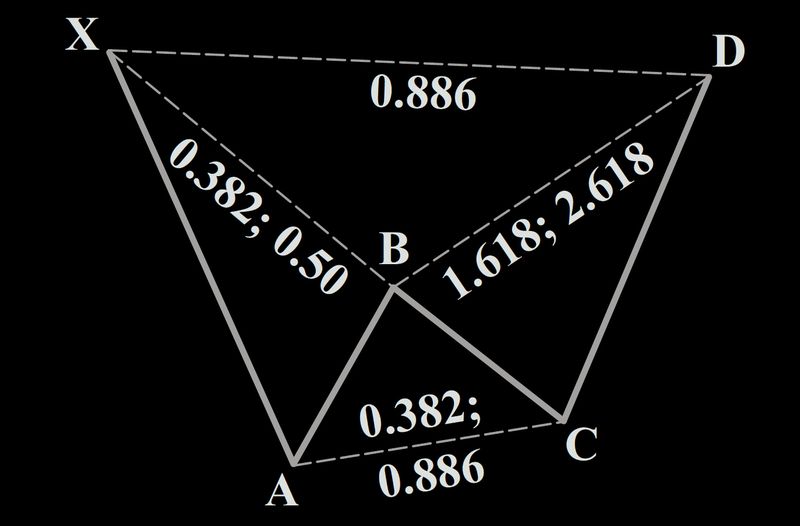

Bearish Butterfly Pattern

Figure 3 shows, Bearish Butterfly pattern, similar to bullish butterfly pattern the points must be aligned properly to define a valid Butterfly pattern. Point D in this case is above all of the other points. As figure shows the XA is a rising leg. Again in this case too point C should not exceed below point A. the leg CD will be longest leg in the pattern and point D will be the highest point in the pattern.

Trading Bearish Butterfly Pattern

In bearish butterfly pattern, a short trade can be opened after formation of point D, make sure the pattern is valid by checking all the ratios properly. Stop loss should be put above point D, since point D is the highest point in the pattern.

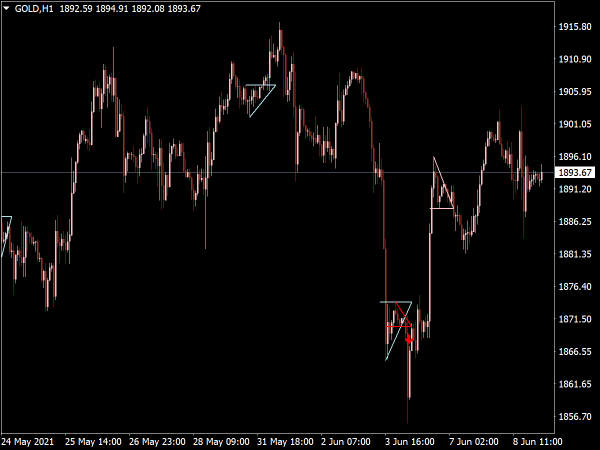

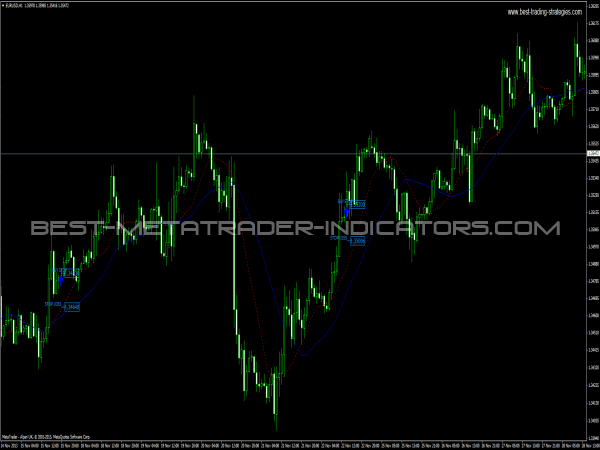

Bat Harmonic Pattern

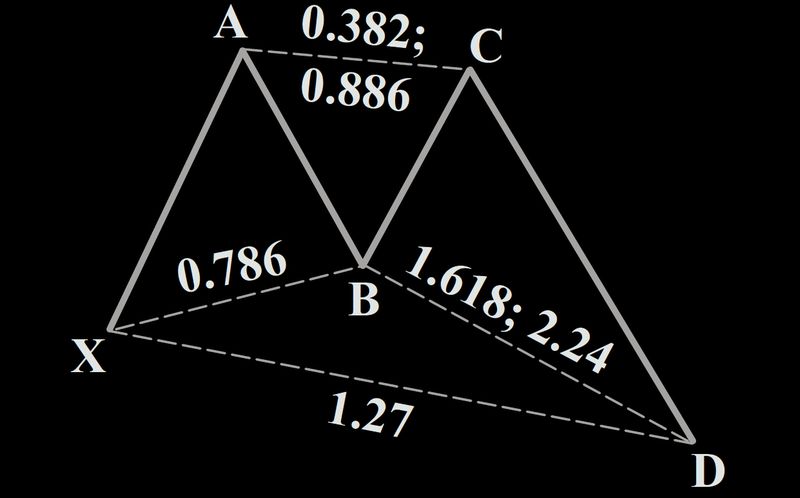

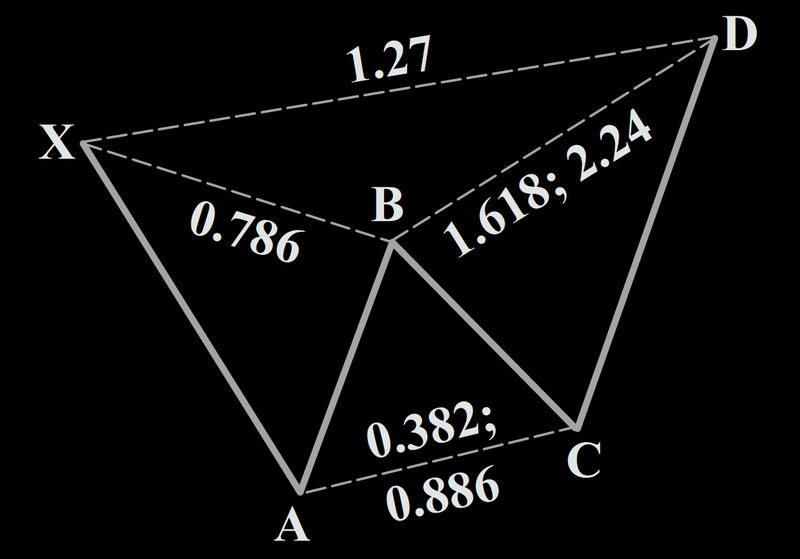

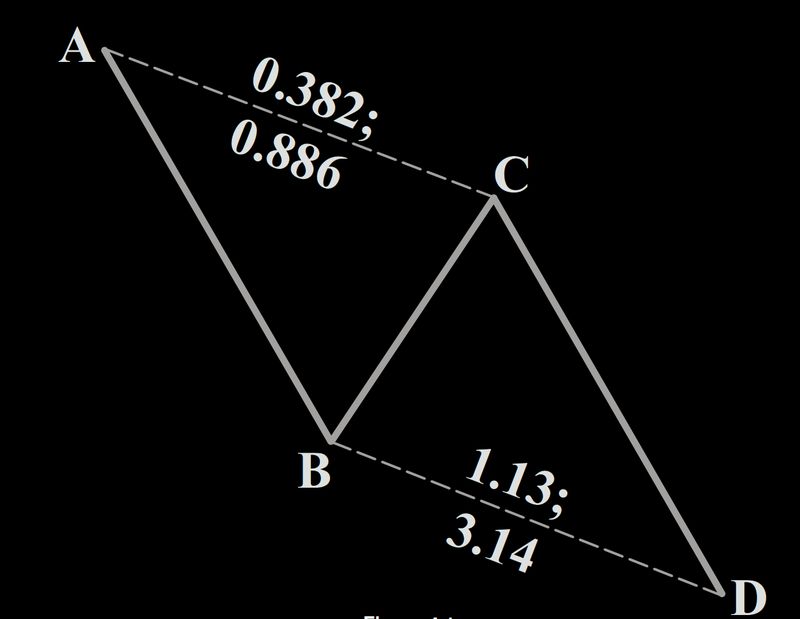

Bat harmonic pattern is a fairly recent pattern it was discovered by Scott Carney in 2003. Bat pattern is one of the reliable reversal harmonic patterns. This pattern is distinguished from other pattern by its Fibonacci ratios.

Bat pattern has point B at 38.2% retracement of the XA leg, point C is at 38.2% or 88.6% retracement of AB leg and point D is at 88.6% retracement of the XA leg and 161.8% or 261.8% retracement of BC leg. Remember, for this pattern to qualify as the Bat pattern the point D should not exceed point X otherwise the pattern will be called as Crab pattern and not the Bat pattern. There are two types of Bat Pattern: Bullish and Bearish Bat Pattern.

Bullish Bat Pattern

In Bullish Bat pattern the XA leg is the longest leg in the pattern it is a rising leg, point B is usually at 38.2% retracement of the leg XA, and sometimes it may extend to 50%, in which case the pattern is still valid. Point C should be at 38.2% or 88.6% retracement of the leg AB. Leg CD in this pattern is shorter than leg XA and its length should be of 88.6% retracement of the leg XA. The position of point D is important in this pattern; it should not be below the point X otherwise the pattern will be called as Crab pattern.

Trading Bullish Bat Pattern

Bullish bat pattern can be a good place to have a long trade as the ratios in the pattern suggests a reversal. Upon formation of the point D, we can open a long position. The stop-loss for this trade will be put one or two ticks below point X as it is the lowest point in the pattern.

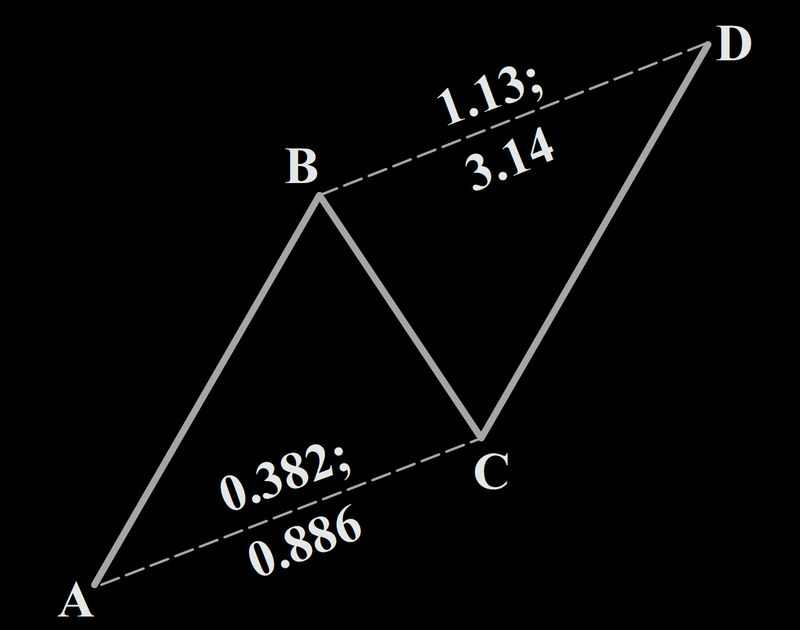

Bearish Bat Pattern

In Bearish Bat pattern the XA leg is the longest leg in the pattern it is a falling leg, point B is usually at 38.2% retracement of the leg XA, and sometimes it may extend to 50%, in which case the pattern is still valid. Point C should be at 38.2% or 88.6% retracement of the leg AB. Leg CD in this pattern is shorter than leg XA and its length should be of 88.6% retracement of the leg XA. Again the position of point D is important in this pattern; it should not be above the point X.

Trading Bearish Bat Pattern

Upon formation of the point D, we can open a short position. The stop-loss for this trade will be put one or two ticks above point X as it is the highest point in the pattern.

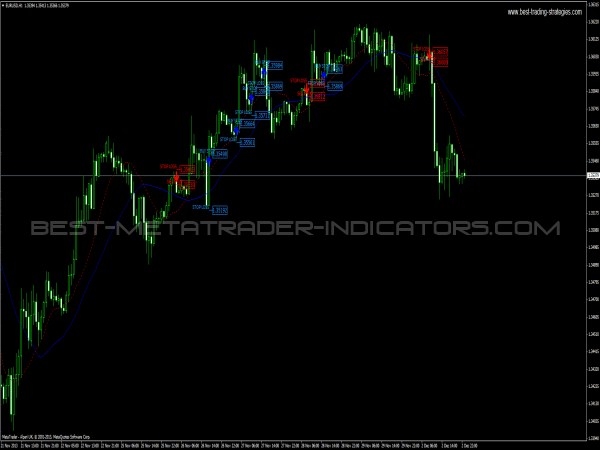

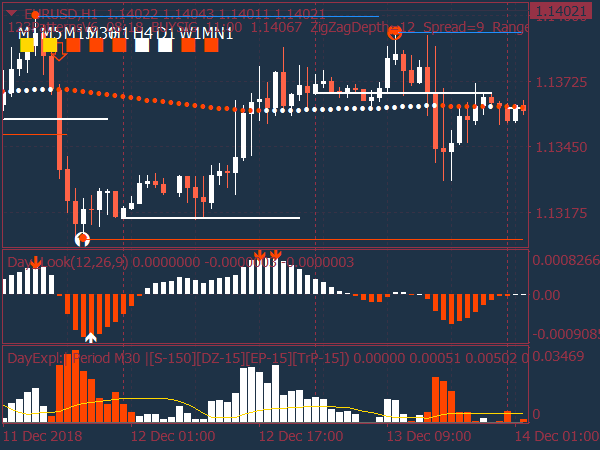

AB=CD Harmonic Pattern

AB=CD harmonic pattern is one of the many harmonic patterns that are extensively used to come out with a possible pattern of movement of currencies over a certain period of time. The main purpose of this particular Harmonic trading pattern is to enable the investor to move in and move out at the right time so that he or she is able to maximize his/her profits. It goes without saying that the main purpose of being in the forex market is to make some decent profit taking advantage of the movement of currencies.

It indeed helps traders and investors to formulate a very well planned trading and investing strategy that can cut down on losses and maximize profits. The concept of AB=CD harmonic pattern was discovered and offered to the financial world by Larry Pesavento. This formation clearly explains how the whole pattern is based on the theory that prices in financial markets would follow a certain pattern when it comes to reverse from an upward movement or a downward movement.

Hence, there is a definite pattern that will emerge, if a historical analysis of such movement is made. The main purpose of such Harmonic trading pattern is to ensure that the customer gets to enjoy the maximum benefit by being inside at the right time and coming out at the right time. This rallying and retracing usually happens twice over a period of time and that is when a uniform channel AB = CD is formed. It could be termed as the ideal percentages, both in the bullish and bearish direction. The following image will make the whole situation a bit clearer.

Bullish AB=CD Pattern

Bearish AB=CD Pattern

From the above pictures, it is quite evident that an ideal AB=CD harmonic pattern is one where the each of the price leg is equal. Hence, it is quite clear the ideal Fibonacci numbers must always have an occurrence at the specified points. The ideal AB=CD Fibonacci percentages is between the ranges 1.27 or 1.618. Alternately, stop loss percentages should be around 0.618 and 0.786. Hence, there is no doubt that a properly formed AB=CD pattern will make the whole job of prediction that much easy for traders and investors.

This will not only go a long in way in evolving the right kind of strategies as far as the future is concerned, but will also help in minimizing losses to the maximum extent possible. Arriving at the right pattern could be indeed confusing in the initial stages and therefore, it would be ideal to gather more information on how the whole concept works before trying to implement it.

Doesn't work

I dont get template files.

I decided to do a little investigation. It turned that when I changed the colours in the indicator settings which were black by default to the same colour a window popped up with a message patterns and they appeared in colours I did not select. All in all, great job spreading wisdom! I appreciate that!

Good afternoon, I would be grateful if you could upload templates file into the harmonic-pattern-scanner.zip that is to be downloaded, thanks to your generosity.

Best regards,

Wojciech

Doesnt work for me ... keeps telling me to email some email.

Dear Kurt Cobain, our colleague will test this indicator next week and upload a new version if necessary. At the moment my time is limited. We are working hard to release new versions of our premium systems.

This indicator file is broken.

I just checked and it works for me. There's a similar indicator here: https://www.best-metatrader-indicators.com/mt4-harmonic-pattern-scanner-indicator/

Good indicator

How does one use this indicator?

Doesn't work.

Just checked, it's working for me on latest MT4 build. Our installation guide can be found here: https://www.best-metatrader-indicators.net/setup/

This indicator is not active for me, how can I get the activated version from you?

Bug fixed, it works again.

Completely useless repainting indicator.

Nice indicator, i will love it if i can be able to install on my system.

I use with sell limit & buy limit orders. I use the stop lose given and the first TP target given. And leave the charts alone for the day 👍

Awesome!

It's not showing all the time frames in some of the currency pairs.

This is very good harmonic pattern scanner for the beginners.

Where can I get the .mq4 file for this?

THIS LOOKS GOOD BUT IT WOULD BE GREAT WITH MQ4 EXTENSION.

its the best of all