Submit your review | |

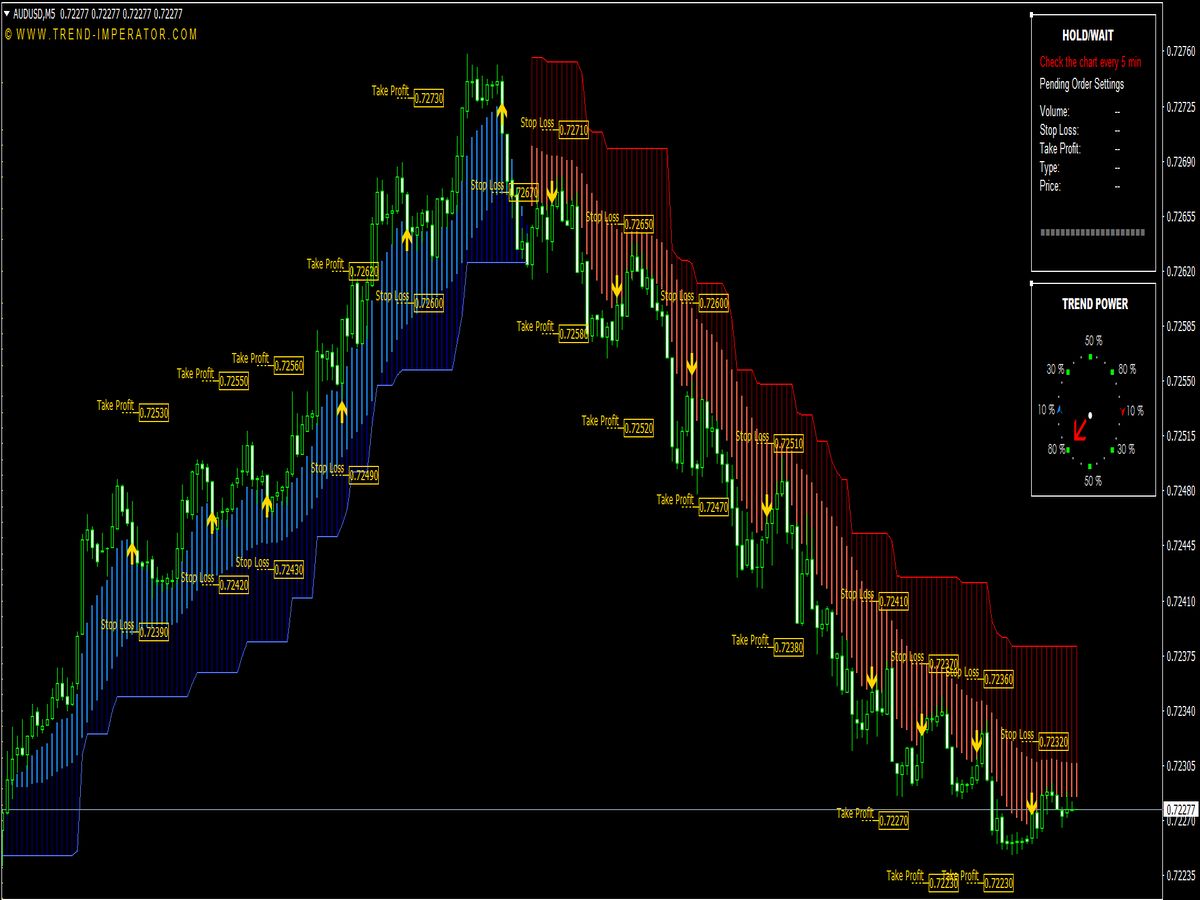

Scalping trading is a short-term trading strategy that focuses on making quick profits from small price movements in highly liquid markets. Traders known as scalpers enter and exit positions rapidly, often holding assets for just seconds to minutes, capitalizing on minor fluctuations in price.

This technique requires quick decision-making, a clear understanding of market dynamics, and a disciplined approach to managing risk and execution, often relying on advanced trading tools and real-time data. While scalping can be profitable, it also involves high transaction costs and requires significant time and focus.

Scalping Trading Systems

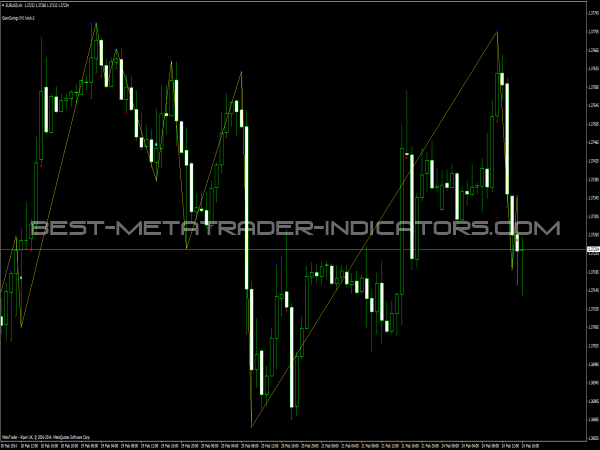

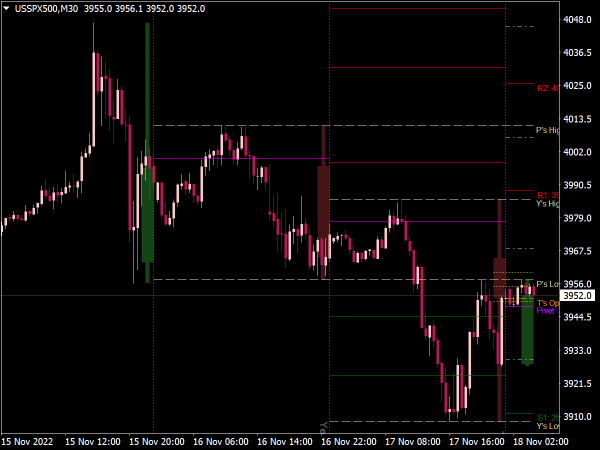

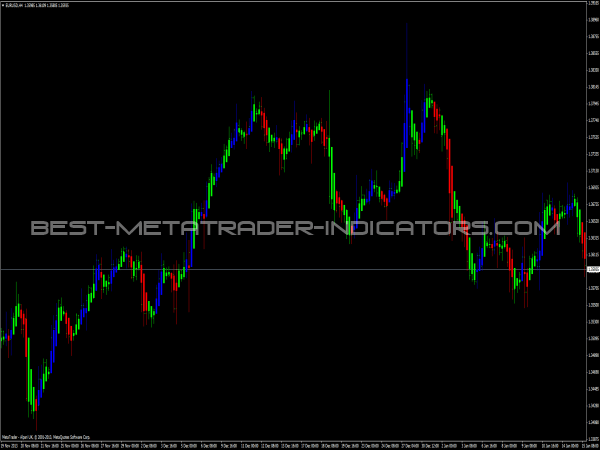

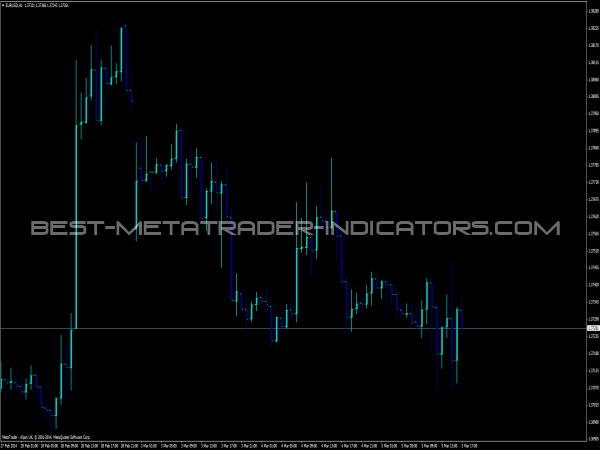

1. Price Action Trading Systems: This system relies on interpreting price movement through candlestick patterns and chart formations. Scalpers using this method look for key support and resistance levels to identify potential entry and exit points.

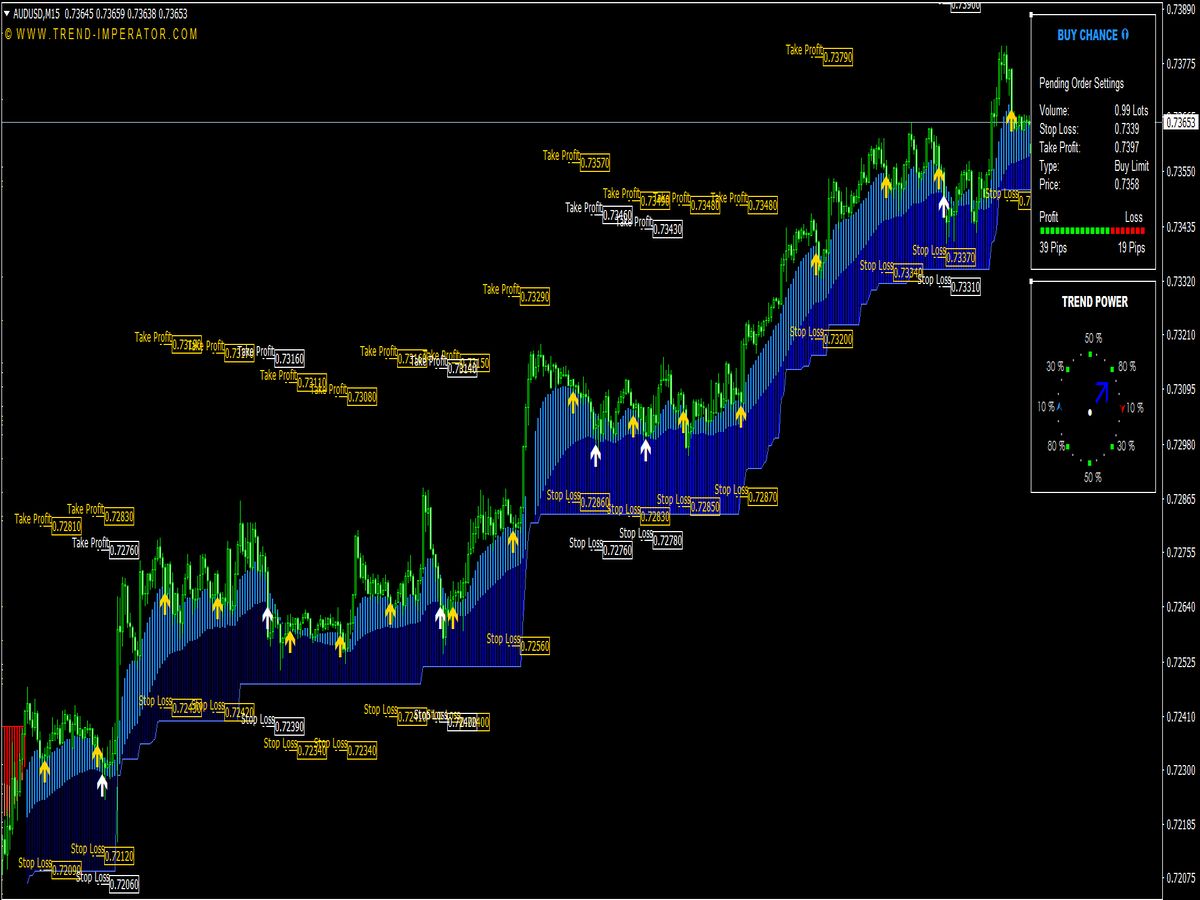

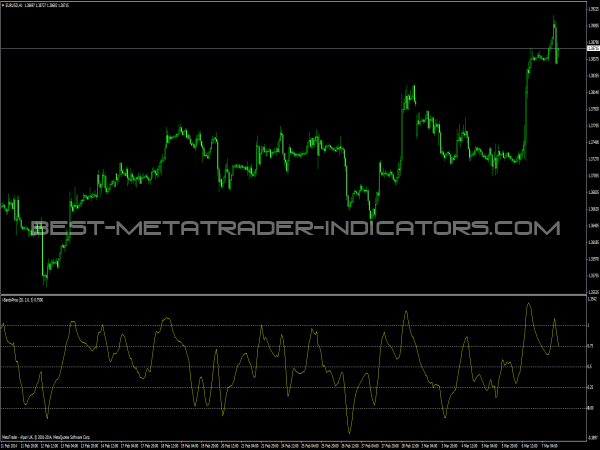

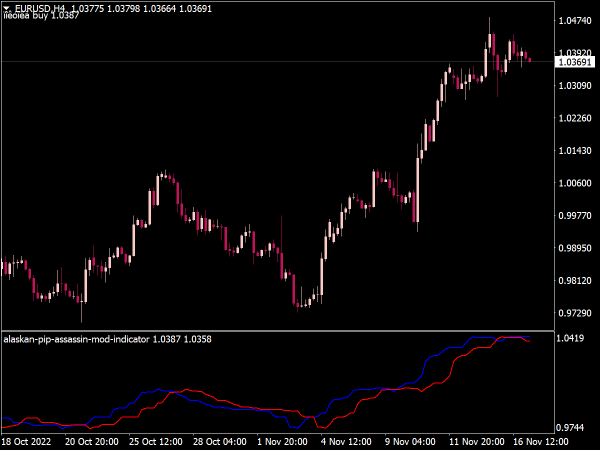

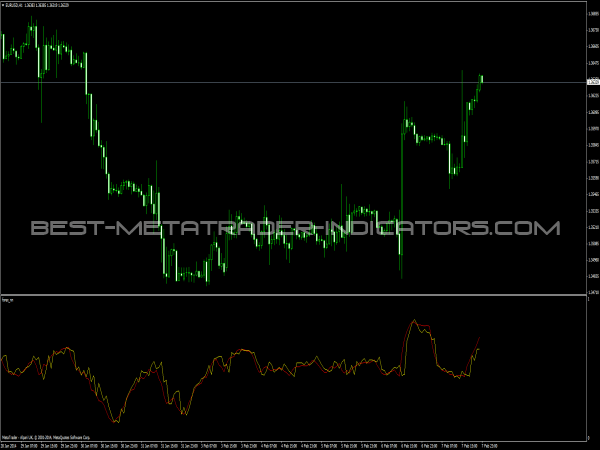

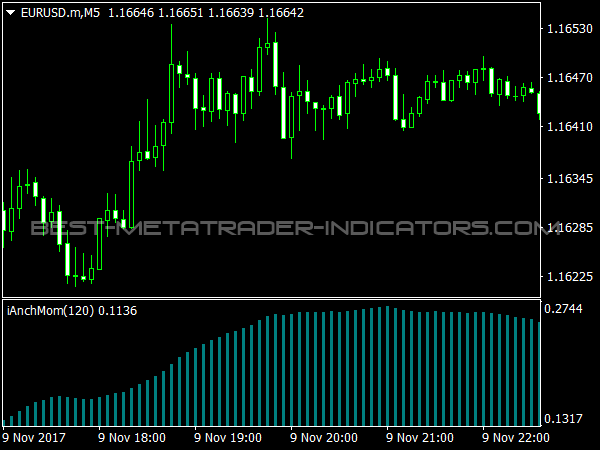

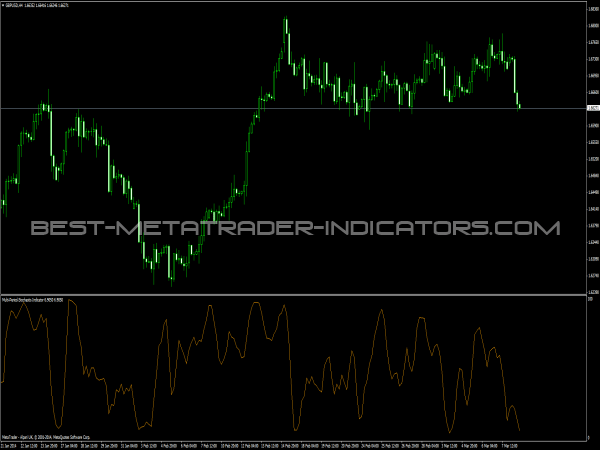

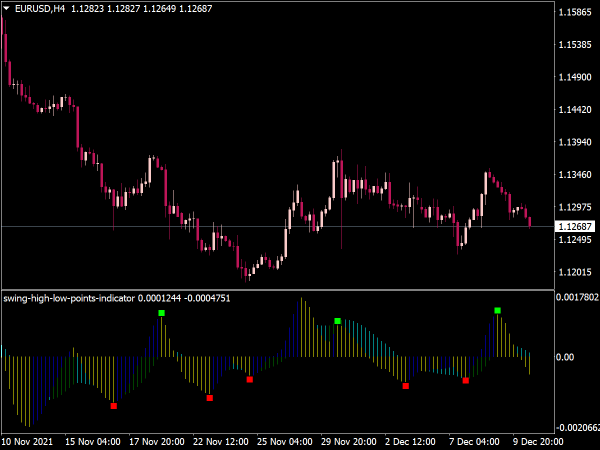

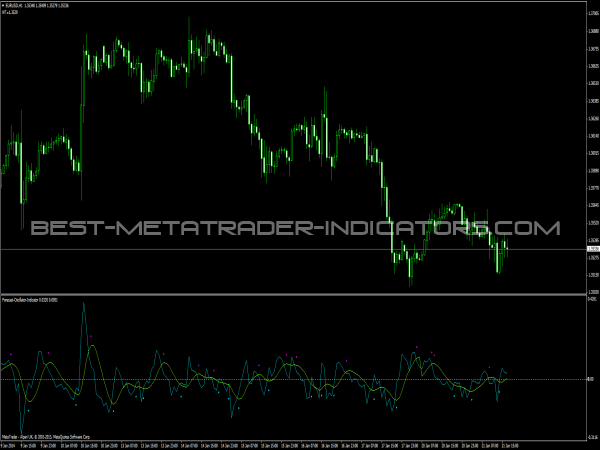

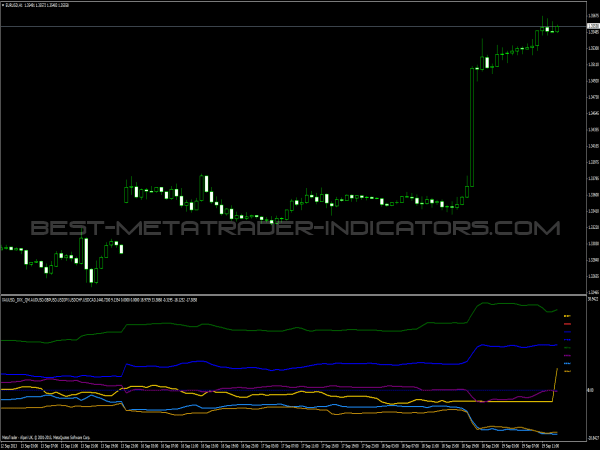

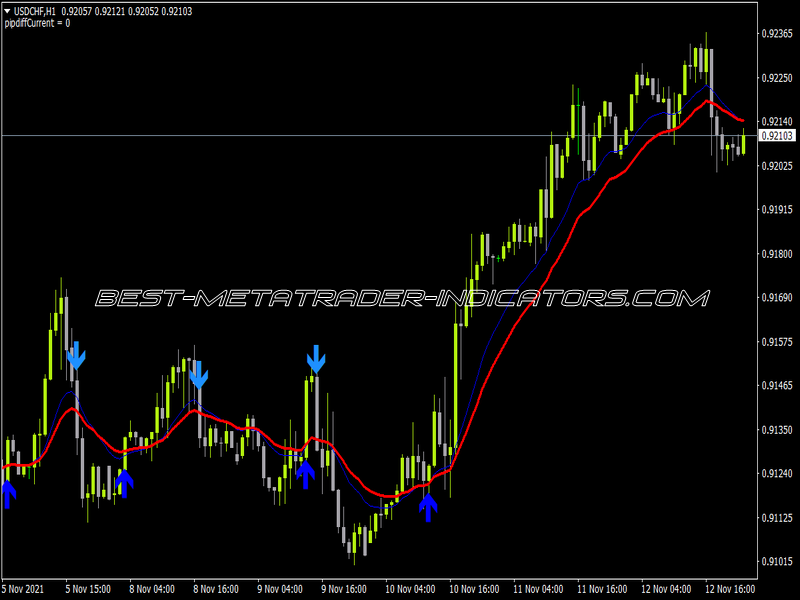

2. Technical Indicator Systems: Many scalpers use indicators such as Moving Averages, Relative Strength Index (RSI), Bollinger Bands, and Stochastic Oscillator to inform their trading decisions. For example, a common approach is to use a combination of a fast-moving average and a slow-moving average to identify trend changes.

3. Algorithmic Trading Systems: Some advanced traders develop algorithmic systems that automatically execute trades based on predefined criteria. These systems can analyze market data faster than a human, providing an edge in identifying profitable trades.

4. Volume-based Systems: Scalpers often rely on volume analysis to gauge market momentum. By focusing on assets with high trading volumes, scalpers can ensure sufficient liquidity, allowing them to enter and exit trades without significant slippage.

Scalping Trading Strategies

1. Scalping with Support and Resistance: Identifying key support and resistance levels is vital. When price approaches these levels, scalpers can enter trades expecting a bounce or breakout. This strategy relies on high probability trades, focusing on where price is likely to turn.

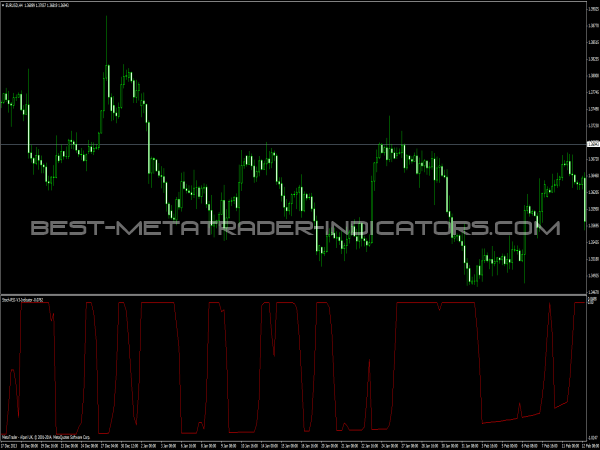

2. Breakout Scalping: This strategy involves entering trades when the price breaks out of a defined range. Traders can set buy orders above resistance levels or sell orders below support levels, aiming for quick profits once the breakout occurs. It requires fast execution as breakouts often lead to rapid price movements.

3. News Scalping: Traders can capitalize on market volatility created by economic news releases. By anticipating price reactions to news, scalpers enter trades quickly after the announcement, aiming for short-term gains as prices adjust to the news.

4. Five-Minute Scalping: This strategy involves trading exclusively on the five-minute chart. Traders look for setups like pin bars, engulfing patterns, or other reversal signals, allowing for precise entries and exits within that timeframe.

5. Fading Strategy: This involves trading against the prevailing trend after a price spike. Scalpers look for moments when the price has risen or fallen sharply and enter trades expecting a reversal. This strategy relies heavily on timing and market psychology.

Tips for Successful Scalping

1. Choose the Right Broker: Select a broker that offers tight spreads and low commissions, as high transaction costs can erode profits from small price movements. Make sure the broker provides a reliable and fast trading platform, as speed is paramount in scalping.

2. Manage Risk: Always use stop-loss orders to limit potential losses. Scalpers should avoid risking more than 1-2% of their trading capital on a single trade. Having a solid risk management strategy is crucial for long-term success.

3. Develop a Trading Plan: Before diving into scalping, traders should create a comprehensive trading plan that outlines their goals, preferred markets, risk tolerance, and trading strategies. This plan serves as a guide to maintain discipline during trading.

4. Stay Informed: Understanding market conditions, economic indicators, and planned news events can provide an edge in scalping. Knowledge of the factors influencing asset prices helps scalpers make informed decisions.

5. Practice Discipline: Scalping requires quick decision-making, but emotions like greed and fear can lead to poor trading choices. Traders should stick to their strategy and avoid overtrading or deviating from their plan.

6. Use Demo Accounts: Before committing real money, practicing scalping strategies on a demo account can help traders refine their approaches and gain confidence without the risk of financial loss.

7. Keep a Trading Journal: Maintaining a journal to record trades can help identify successful strategies and areas for improvement. Reviewing past trades allows traders to learn from their mistakes and successes.

8. Limit Distractions: Scalping demands intense focus and concentration. Try to create a conducive trading environment that minimizes distractions to make quick, informed decisions.

Conclusion

Scalping can be a highly rewarding trading strategy when executed effectively. By understanding various systems and strategies, employing sound risk management, and maintaining discipline, traders can enhance their chances of success in this fast-paced environment. Continuous learning and adaptation to market conditions are vital, ensuring that scalpers remain effective in their approach amidst ever-changing market dynamics.