Submit your review | |

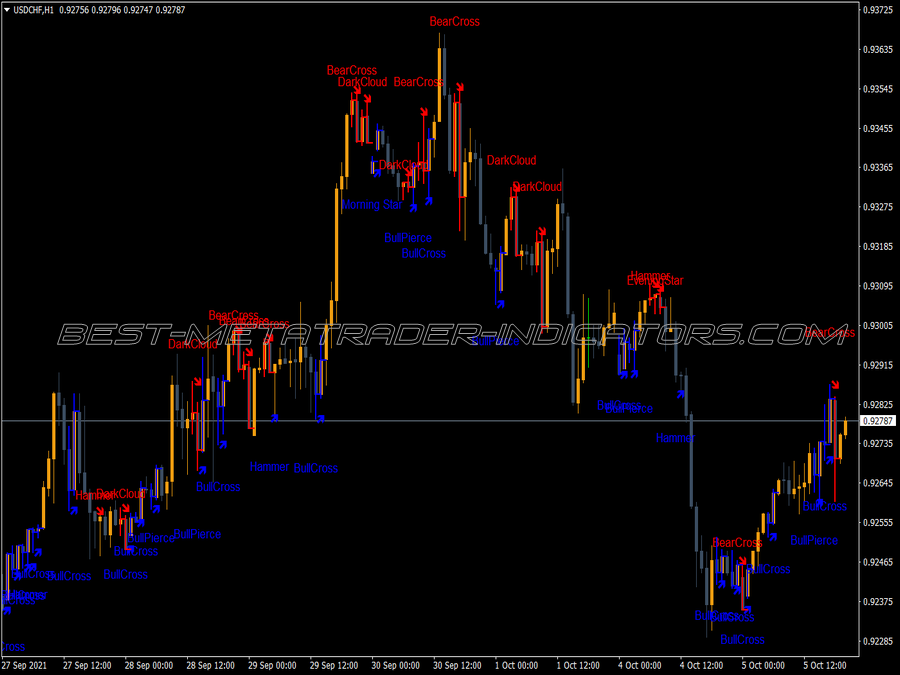

The Engulfing Indicator is a powerful candlestick pattern used in technical analysis that signals potential trend reversals. It occurs when a smaller candle is fully engulfed by the next larger candle, indicating a shift in market sentiment. Traders can utilize this indicator by following some essential tips for effective trading.

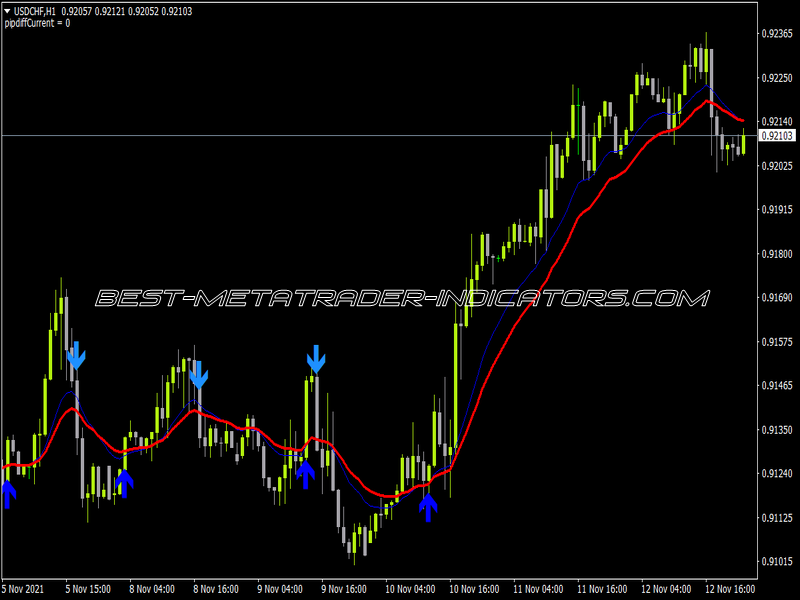

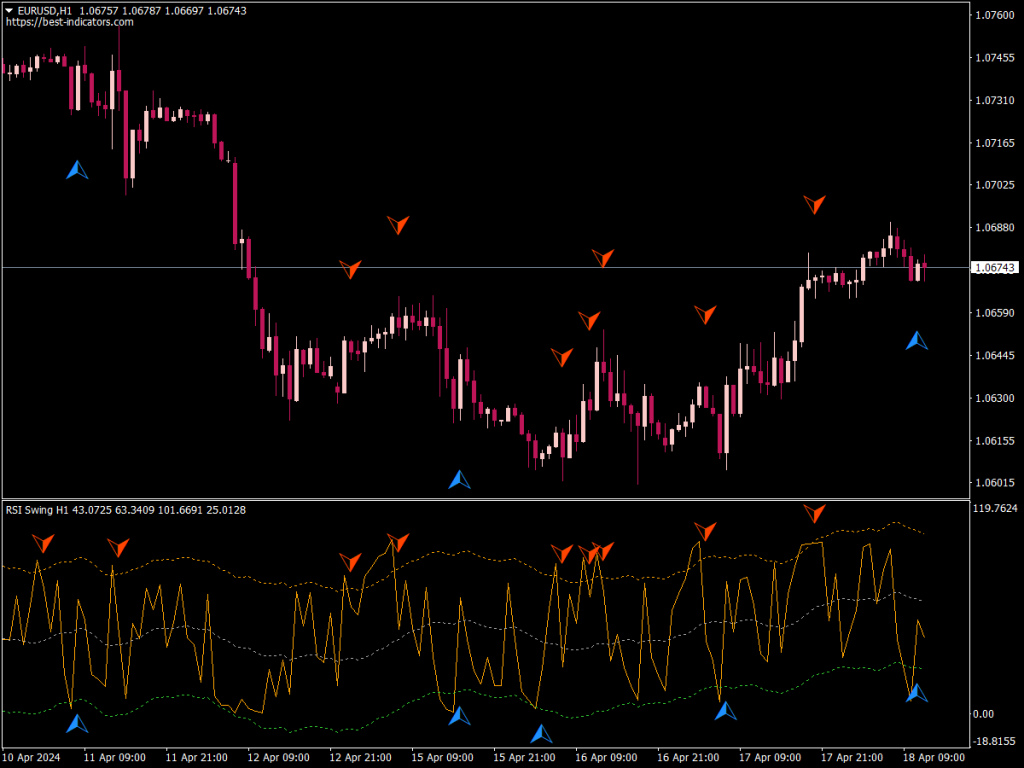

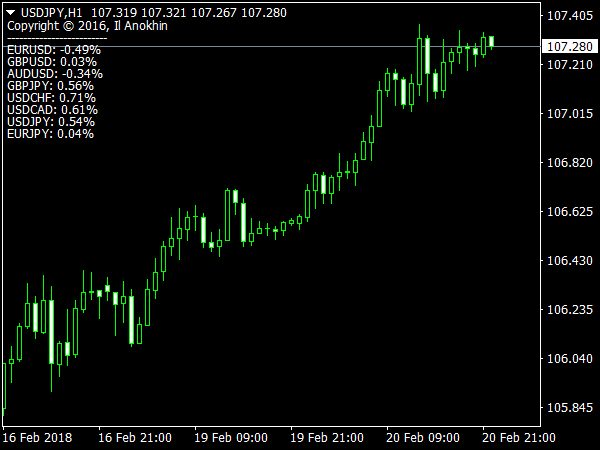

Firstly, confirm the pattern with other technical indicators, such as moving averages, RSI, or MACD, to increase the reliability of the signal. An engulfing pattern appearing at a support or resistance level can also strengthen its validity. For instance, a bullish engulfing pattern following a downtrend suggests a potential upward reversal, while a bearish engulfing pattern after an uptrend indicates a potential downward reversal.

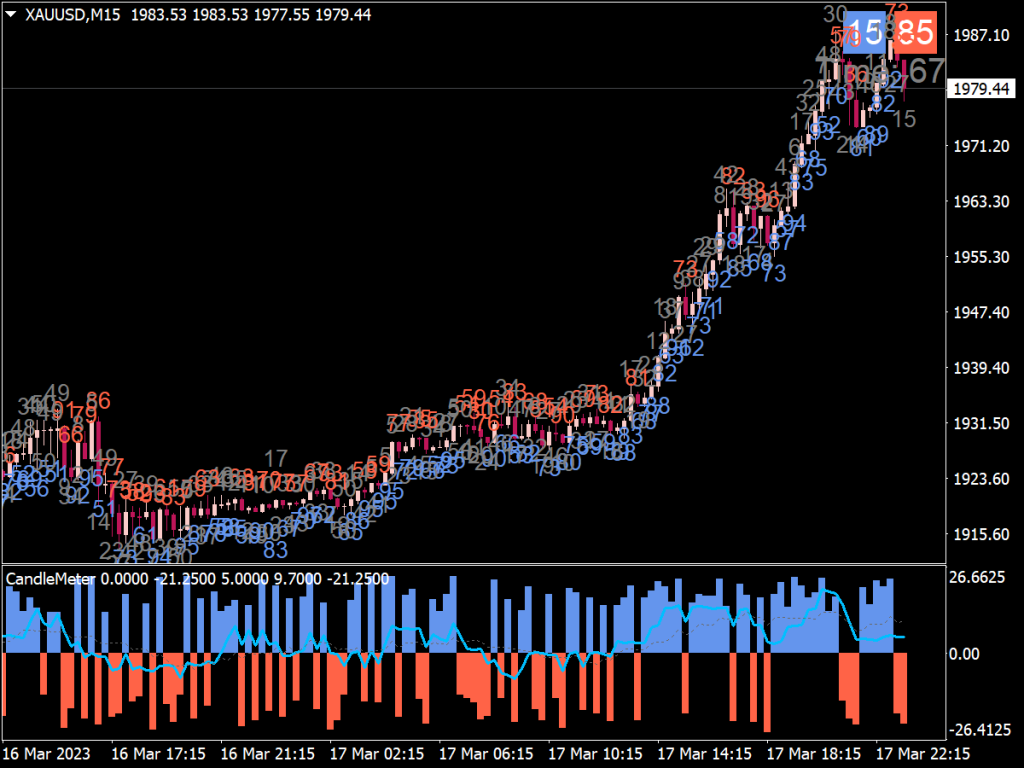

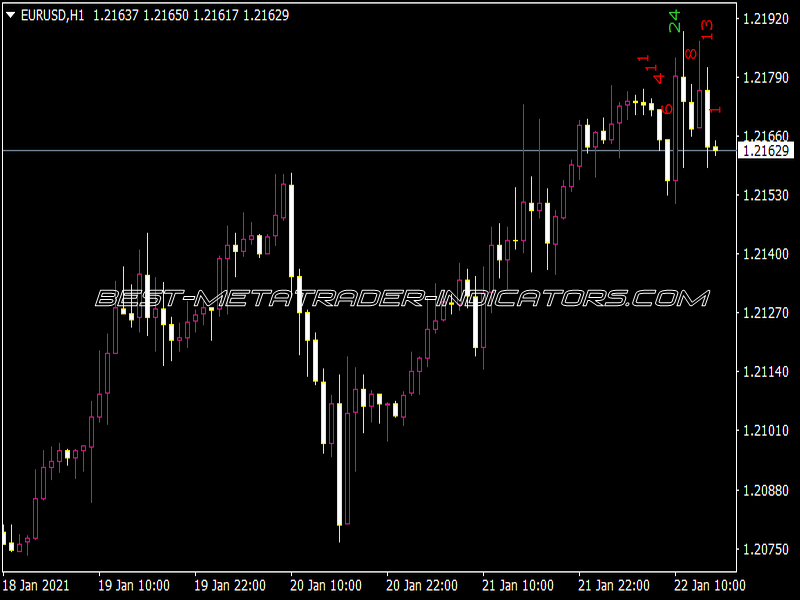

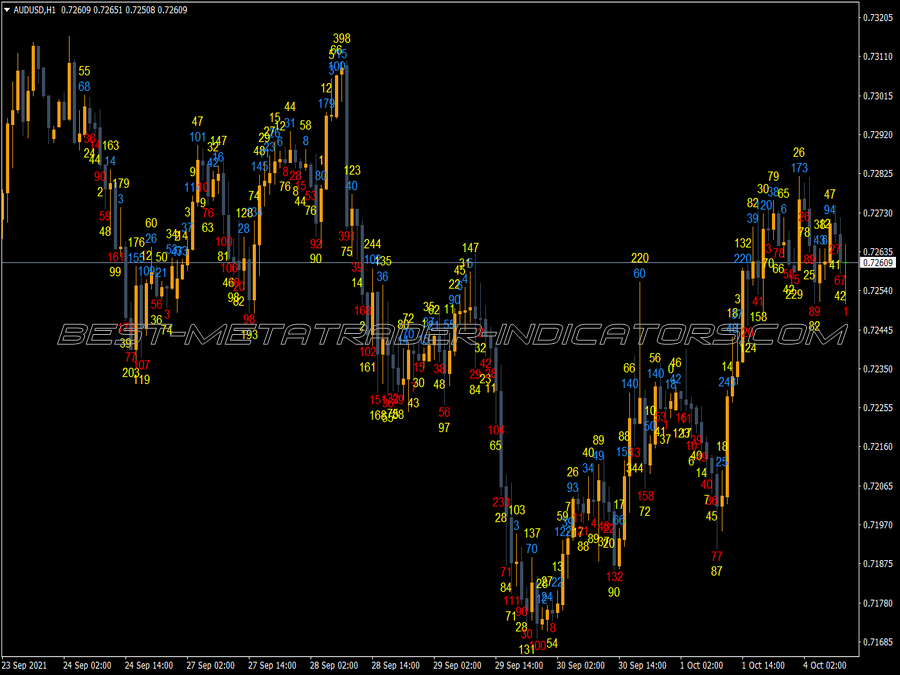

Secondly, consider market context. Engulfing patterns are most effective in trending markets. Thus, identifying the prevailing trend before trading the pattern enhances decision-making. For example, if a bullish engulfing candle forms after a series of lower lows, the likelihood of a reversal becomes higher. Similarly, ensure that the engulfing candle has significant volume to indicate strong participant interest.

When trading, it's crucial to set stop-loss orders to manage risk effectively. Positioning a stop-loss just below the low of a bullish engulfing pattern or above the high of a bearish pattern can help protect capital in case the trade goes against you. Additionally, define clear profit targets based on previous swing highs or lows, which can provide a structured exit plan.

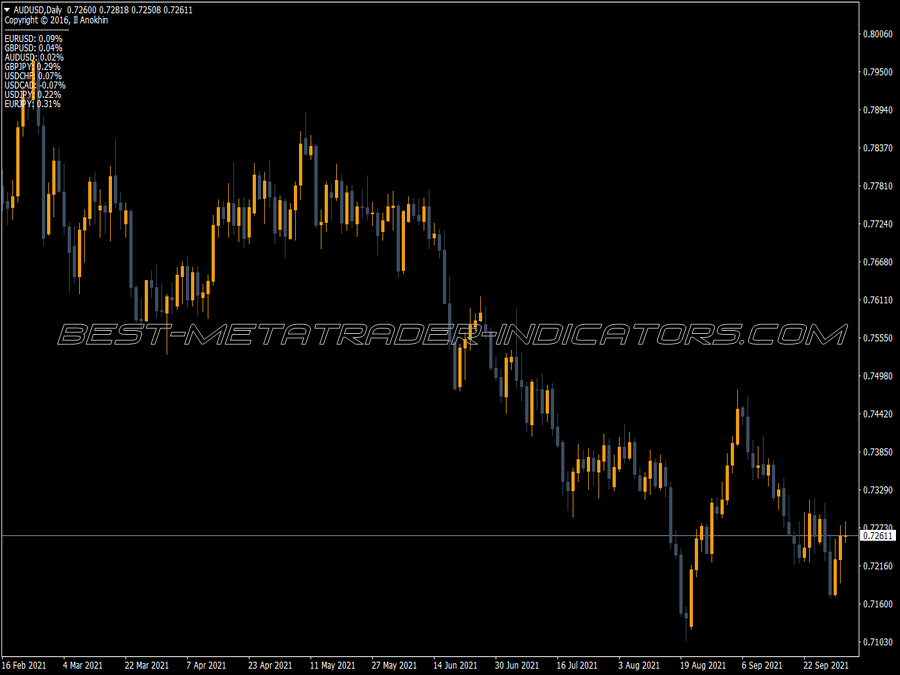

Moreover, discipline is vital. Wait for the confirmation of the engulfing pattern before entering a trade, as impulsive decisions can lead to unnecessary losses. Trading on lower timeframes can work for scalpers, while swing traders may focus on daily or weekly charts to capture larger moves.

Lastly, keep emotions in check. The market can be volatile, and it's essential to stick to your trading plan rather than react impulsively to market fluctuations. Consistent application of the Engulfing Indicator in conjunction with sound risk management strategies can lead to long-term trading success. Always conduct thorough research and backtesting to refine your strategy, ensuring that you're well-prepared for various market conditions.

ℹ️ What are Bullish and Bearish Engulfing Patterns?

Engulfing pattern is a reversal candlestick pattern. This pattern is composed of two candles with opposite color bodies. The reason behind the engulfing pattern is fairly simple. An engulfing pattern occurs when the bulls (or bears) are running out of steam during the first candle, and the opposite side of the market makes a strong move during the second candle.

There are two types of engulfing pattern:

• Bullish engulfing pattern

• Bearish engulfing pattern

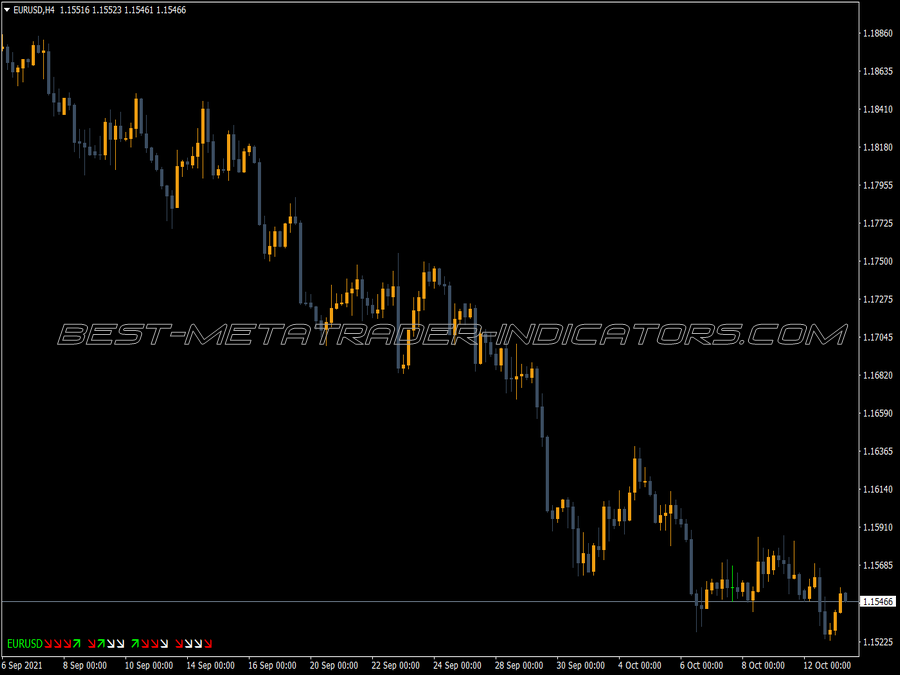

Bullish Engulfing Pattern

A bullish engulfing pattern occurs in a downtrend and consists of a white candle (bullish candle) whose body completely engulfs the body of the previous down candle (bearish candle).

We can see that the second candle's body is bigger than the previous candle. The second candle engulfs the first bearish candle. This suggests that the bulls have taken control of a pair's price movement from the bears. This suggests that pair's downtrend has finished and an uptrend or a correction should now occur.

Trade using Bullish Engulfing Pattern

On confirmation of bullish engulfing pattern we can enter a long position. Stop loss can be placed just below the bottom of the formation. Engulfing patterns in general have no inherent take profit level. So take profit orders should be placed according to results of other analyses.

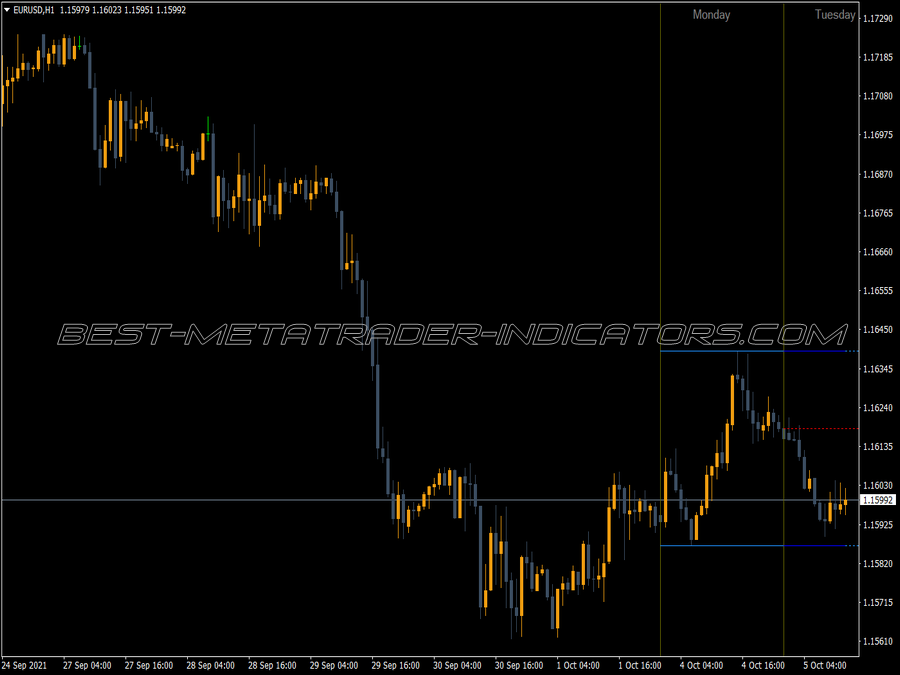

Bearish Engulfing Pattern

A Bearish Engulfing Pattern is the exact opposite of bullish engulfing pattern; it occurs in an uptrend and consists of a down candle (black candle) whose body completely engulfs the body of the previous up candle (white candle).

We can see that the second candle's body is bigger than the previous candle. The second candle engulfs the first bullish candle. This suggests that the bears have taken control of a pair's price movement from the bulls. This suggests that pair's uptrend has finished and a down trend or a correction should follow.

Trade using Bearish Engulfing Pattern

On confirmation of bearish engulfing pattern that is when the second candle closes, we can enter a short position. Stop loss can be placed just above the bottom of the formation. While trading this pattern we should know that this pattern sometimes does not result in an actual reversal of the trend, but can often result in a consolidation or a retrace instead.

The buying/selling pressure that causes the engulfing candle may occur due to spontaneous events such as large non-speculative flows, or profit taking near a significant support or resistance level.