Submit your review | |

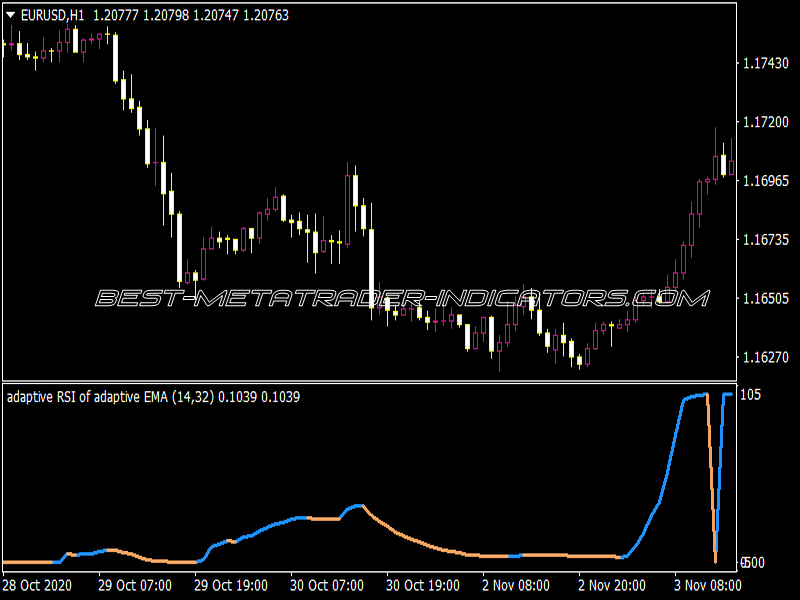

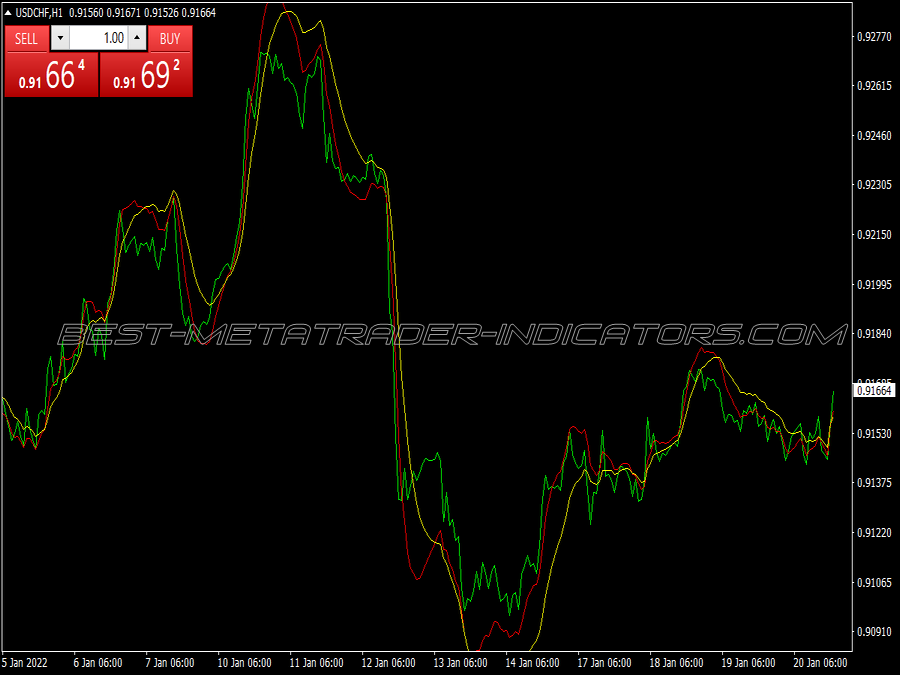

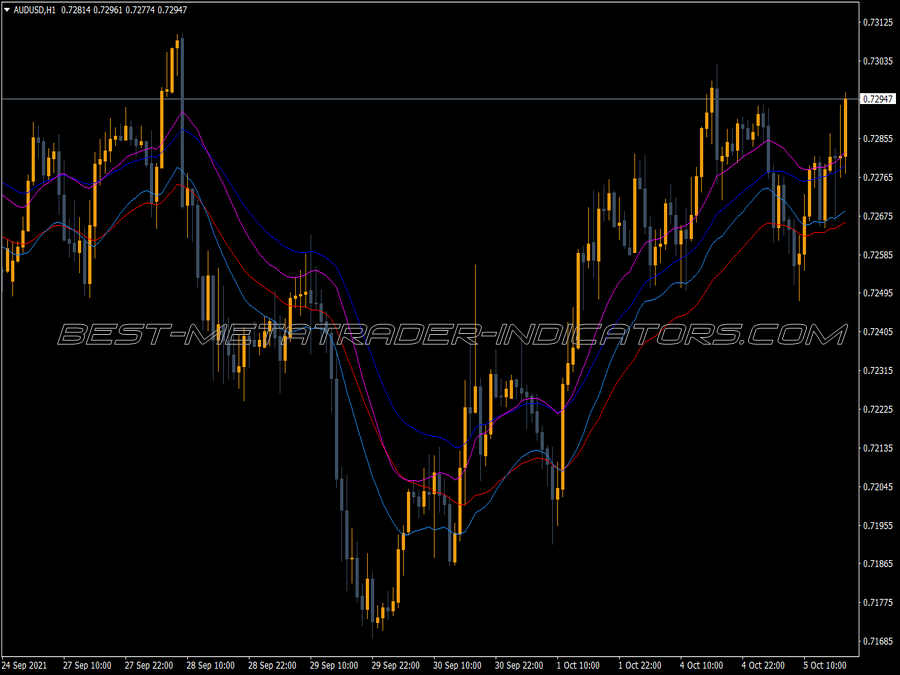

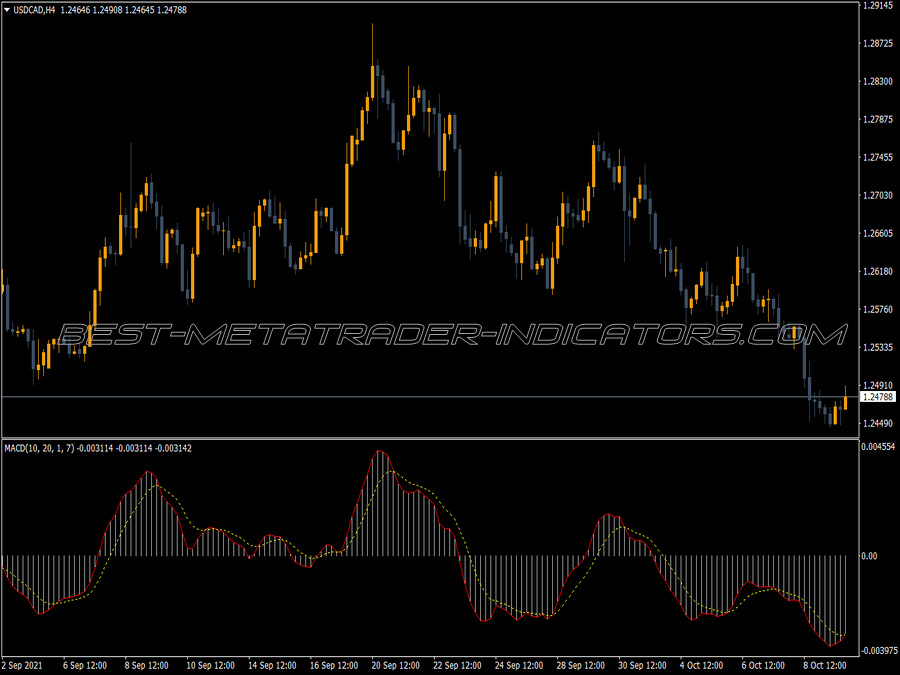

The EMA is a weighted MA, whereby the youngest courses are weighted more heavily, the older ones are weaker. In general, this is seen as an improvement over the MA concept, because the MAs are closer to the current courses. However, this can also have disadvantages. Often, for example, the MAs are the better resistance and support lines than the EMAs. The EMAs are used for smoothing in many indicators.

Also popular are the variable EMAs, also called variable MAs, these are MAs that automatically adapt to the volatility of the market in terms of their length. Objectively speaking, the EMAs do not bring many improvements, they are simply closer to the courses, which has advantages for some applications, disadvantages for others. However, since most future traders use EMAs, it makes sense to look at them as well, but the MAs usually work better for stocks.

many tnx

good

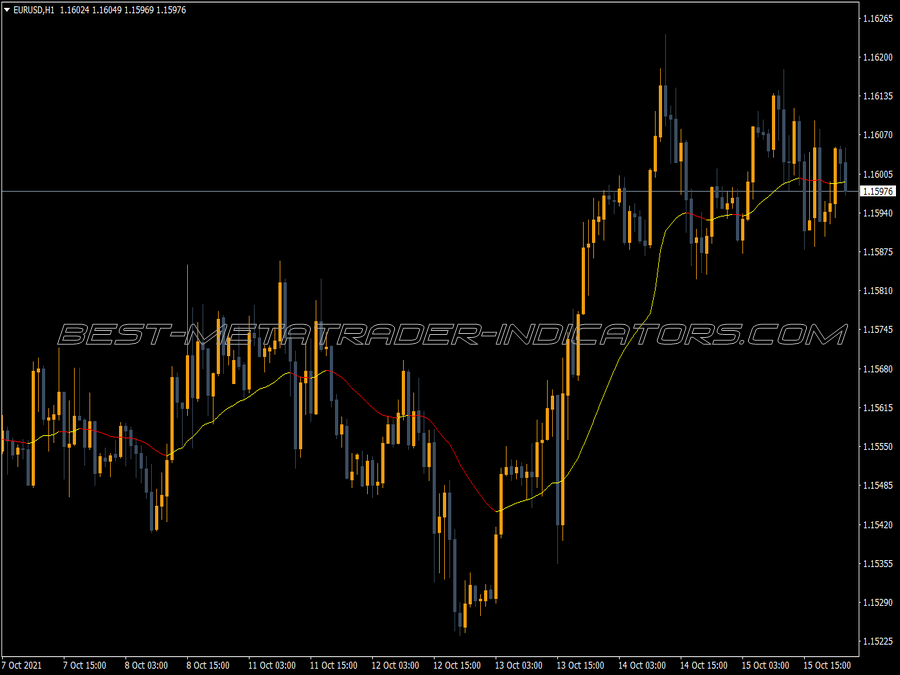

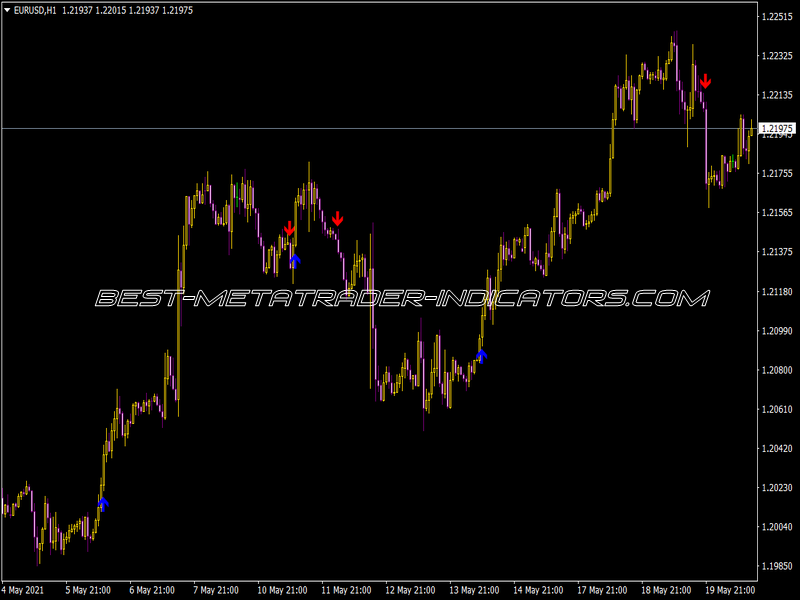

Thank you for providing this EMA. Works perfectly, easy to set up

Exellent graph..