Submit your review | |

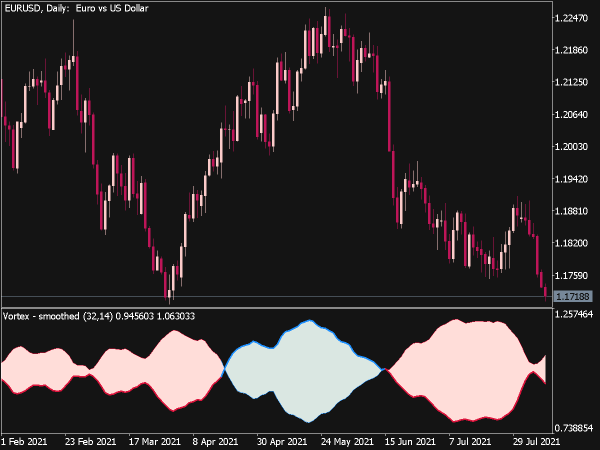

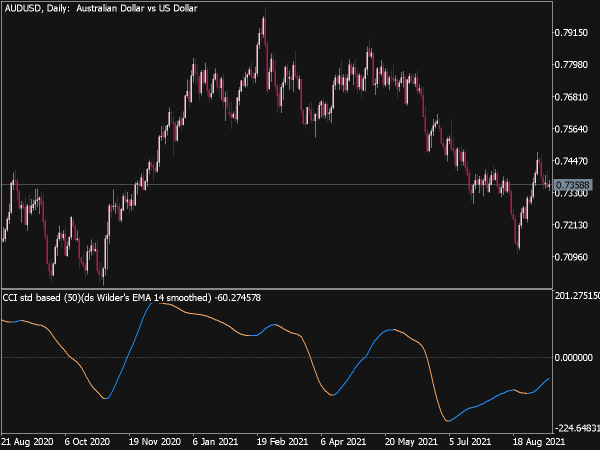

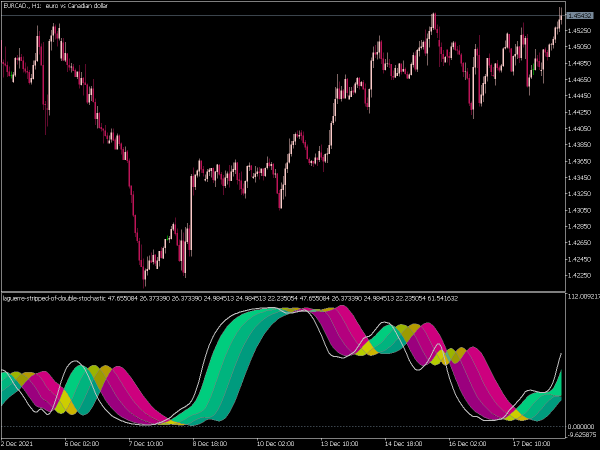

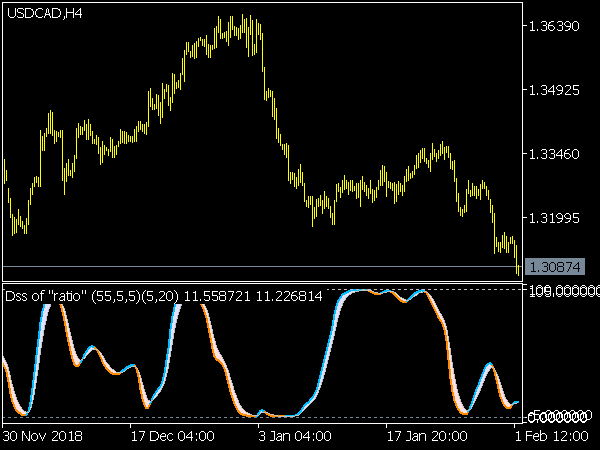

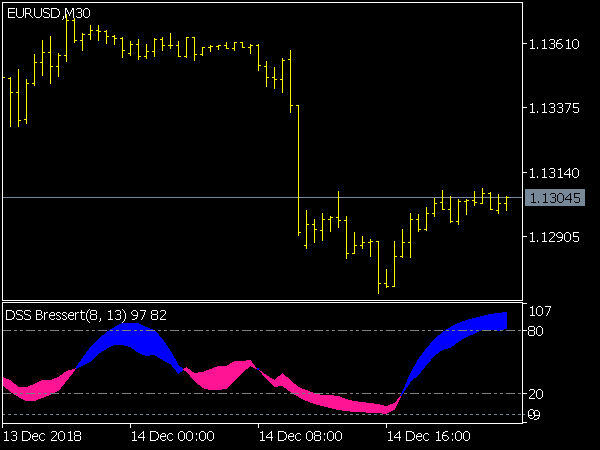

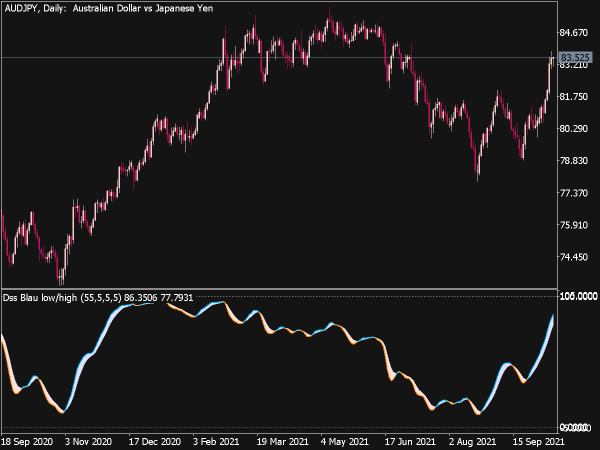

There are two variants of this, the improved variant by Walter Bressert is recommended. The whole thing is essentially a highly smoothed stochastic. DSS is the abbreviation of Double Smooth Stochastic. EMAs are used for smoothing. It gives very clear signals, clearer than the stochastic and often reaches the opposite extreme range even in trend phases, so that good signals result in the direction of the trend afterwards. Therefore, it is one of the best oscillators we have at the moment.

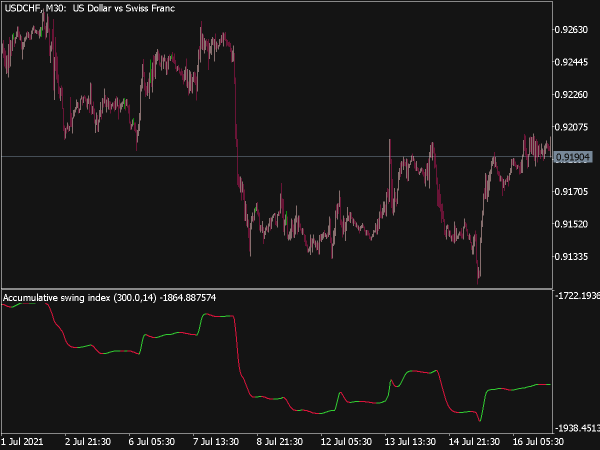

It is not suitable for sideways movements (however, it is still much better than the other oscillators) and also not for very fast trend reversals. One can significantly improve the Double Stochastic if one applies the zone analysis. It also gives good signals for market exits.

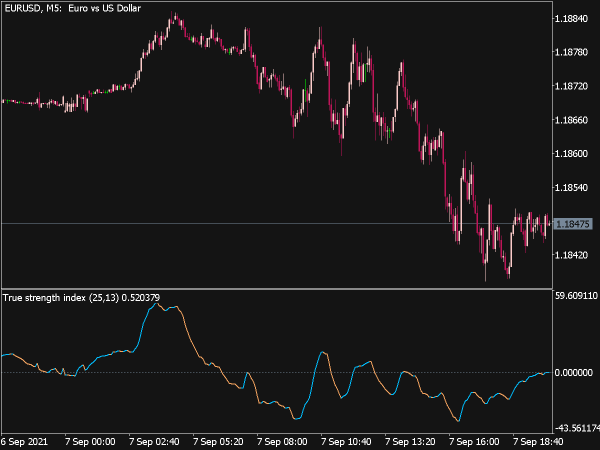

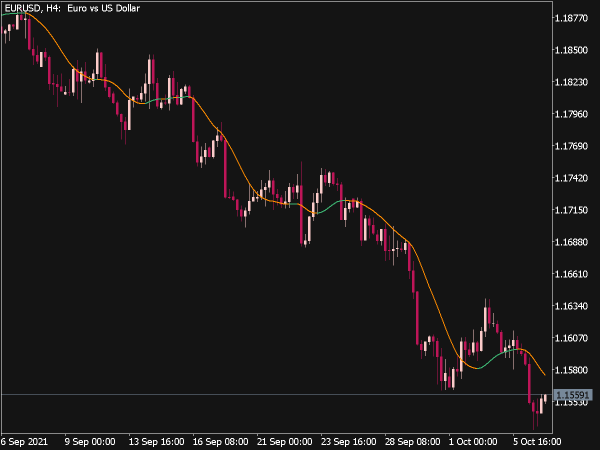

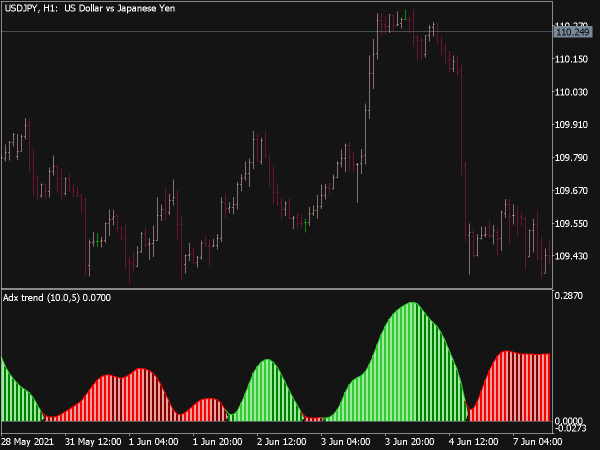

You can significantly reduce the false signals by taking into account the MAs of the double Stochastic and using a trend indicator as a filter. All in all, this oscillator has the best signal expression of all other oscillators, especially in terms of speed and uniformity of movements. Even in strong trend phases, the other extreme is reached, so that a lot of good entry signals result in a running trend.

Moreover, this stochastic usually applies at the same level, especially in longer time frames. Especially with upper trend reversals, a value just below 100 is almost always reached. This makes it much easier to find tops and, in some cases, bottoms. With the help of zone analysis, the whole thing can be significantly improved.

As with all other oscillators, false signals result in sideways movements and rapid trend reversals. However, these can be greatly reduced if trend indicators are switched in advance as filters. Furthermore, it is recommended to calculate an MA on the DSS and to take the crossovers as signals.