Submit your review | |

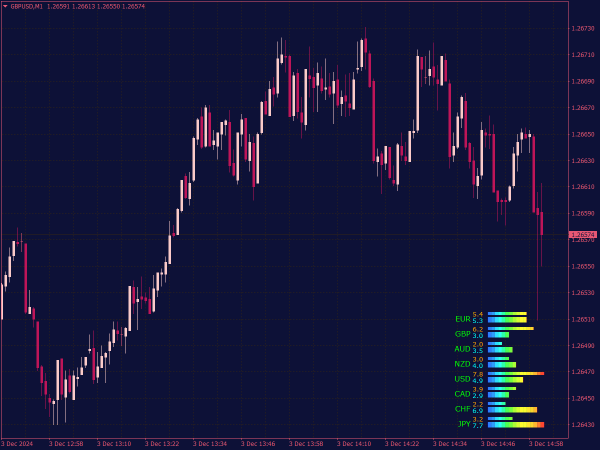

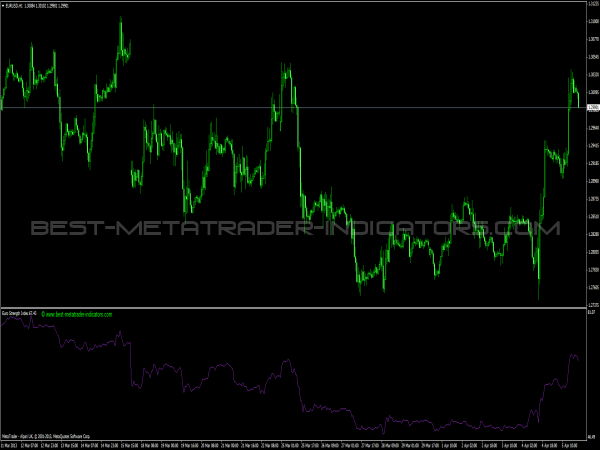

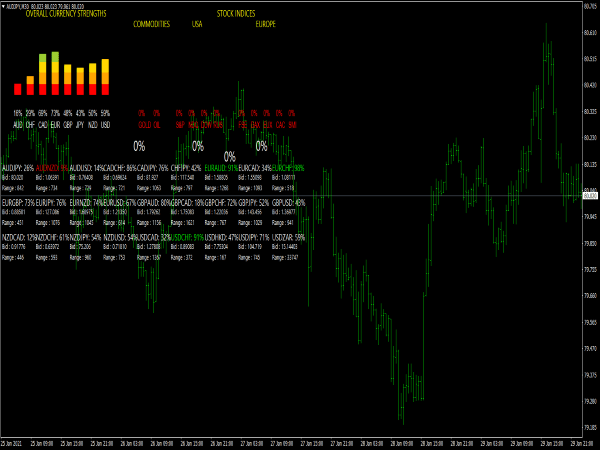

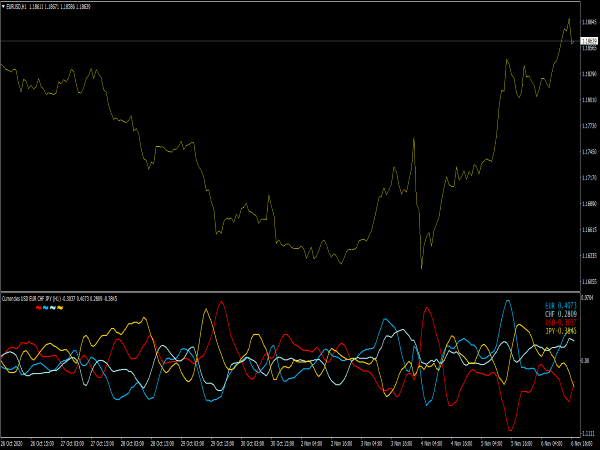

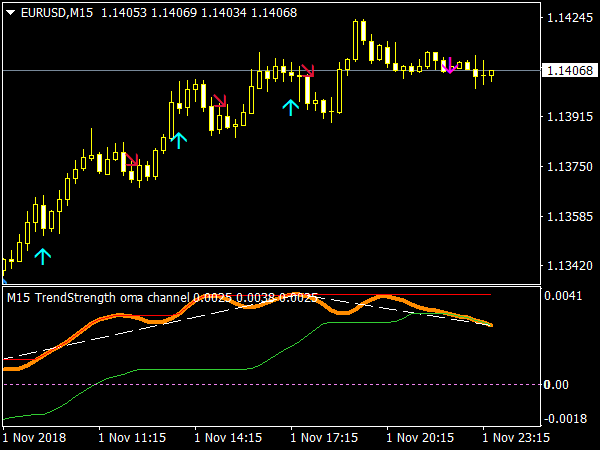

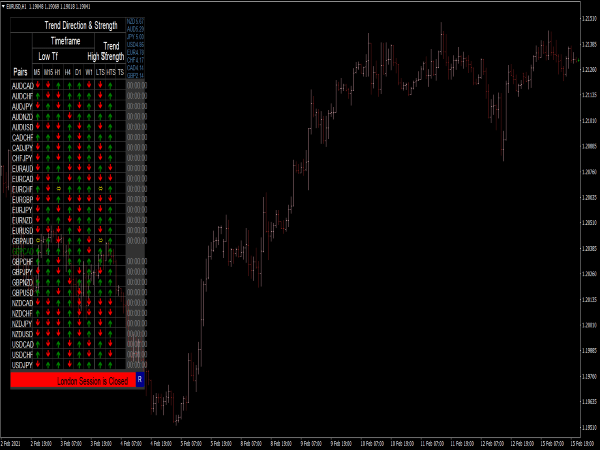

A Currency Strength Indicator (CSI) is a tool used in forex trading to gauge the relative strength of different currencies against one another. These indicators can help traders identify which currencies are strong and which are weak, enabling them to make informed trading decisions. Common types of CSIs include the Currency Strength Meter, which visually represents currency strengths through scores or ranks based on various factors like price movements or volatility.

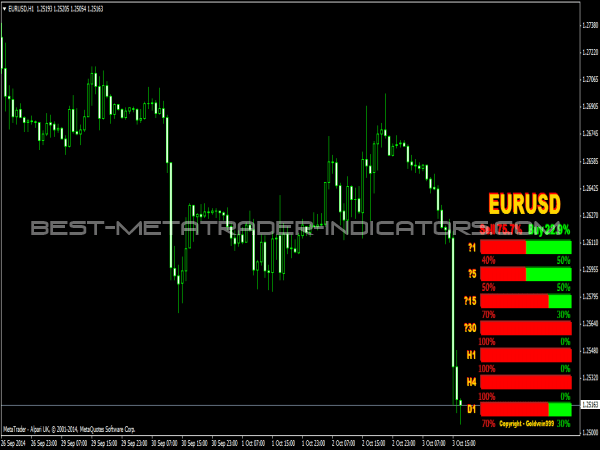

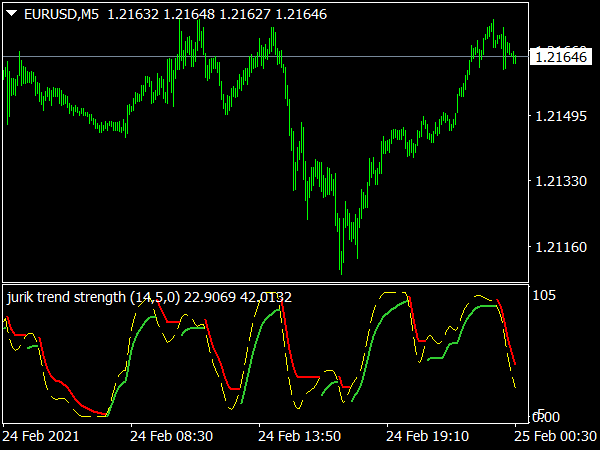

Other indicators may use algorithms or formulas that consider multiple timeframes to assess strength. Traders often combine CSIs with other technical analysis tools, such as trendlines and oscillators, to enhance their trading strategies and optimize entry and exit points in the market.

Here’s a list of some effective trading strategies:

1. Relative Strength Analysis

Relative strength analysis involves comparing the strength of one currency against another. A common approach is to use the Currency Strength Meter, which shows how strong or weak various currencies are relative to each other.

Trading Rules

• Select a Currency Pair: Begin by choosing a currency pair that includes the currency you wish to analyze.

• Monitor the Meter: Using a Currency Strength Meter, identify which currency is currently strong and which is weak.

• Trade in Favor of Strength: Buy the stronger currency while selling the weaker one.

• Timeframe Selection: Use multiple timeframes to confirm the strength signals; for example, consider both daily and hourly charts.

2. Mean Reversion Strategy

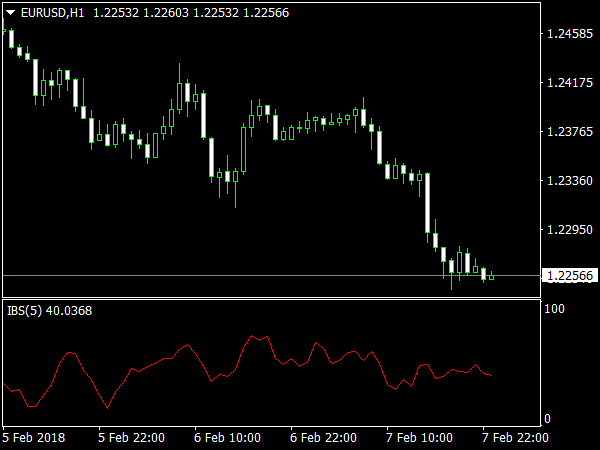

Mean reversion strategies are based on the idea that prices and currency values tend to revert to their historical averages over time. This strategy works well when a currency appears significantly overbought or oversold.

Trading Rules

• Identify Overbought and Oversold Conditions: Use indicators like RSI, stochastic oscillators, or Bollinger Bands to determine when a currency is overextended.

• Set Entry Points: For a currency that has been weak and is expected to strengthen, look for a reversal point after it touches the lower Bollinger Band or shows an oversold RSI reading.

• Establish Risk Management: Define your stop-loss and take-profit levels based on historical levels or price volatility to protect against unexpected market movements.

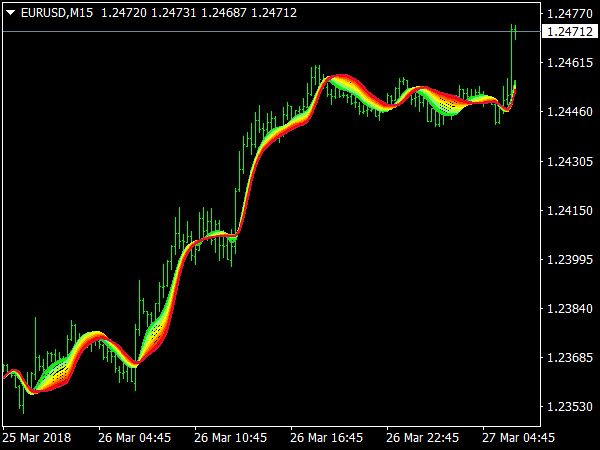

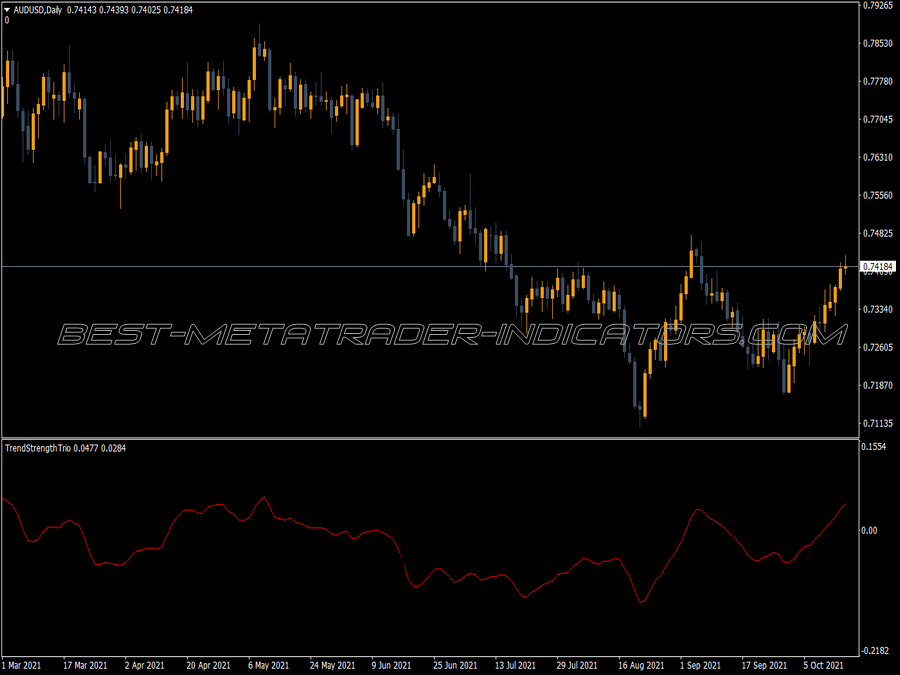

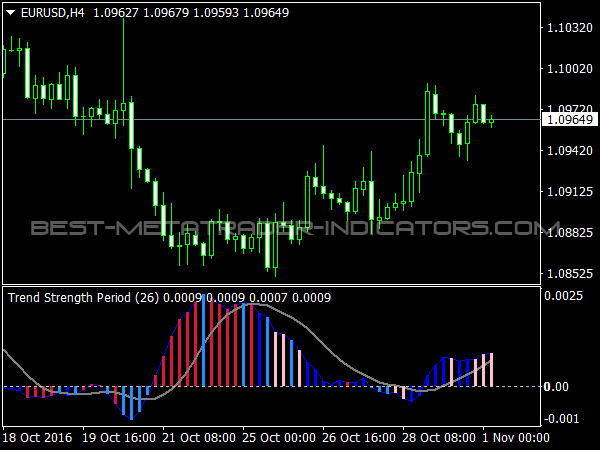

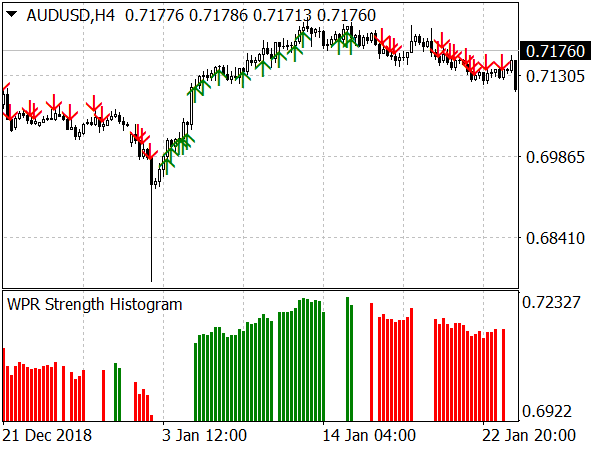

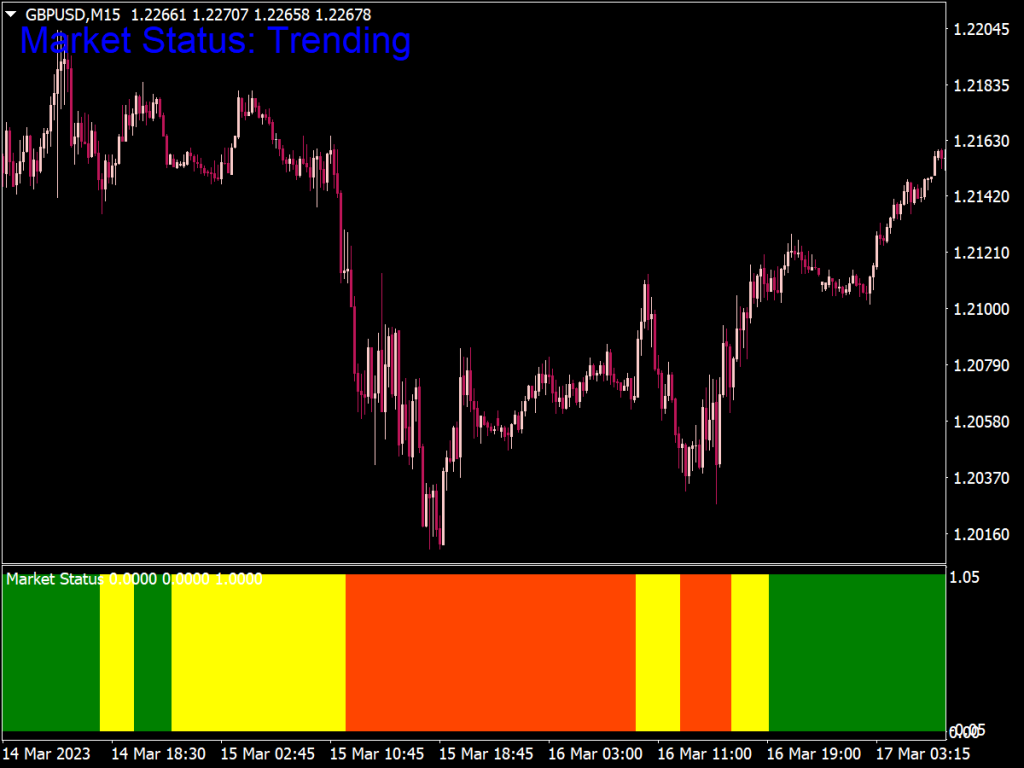

3. Trend Following Strategy

Trend following involves identifying and capitalizing on existing market trends based on currency strength assessments. This strategy relies on the idea that trends typically continue rather than reverse.

Trading Rules

• Identify a Trend: Use moving averages (e.g., 50-day or 200-day) or trendlines to determine whether a currency is in an upward or downward trend.

• Confirm with Strength Indicators: Ensure that the trend direction aligns with your currency strength meter readings — purchase strong currencies when they are in an upward trend.

• Entry and Exit Points: Enter trades on retracements or pullbacks; for instance, if the price retraces to the 50-day moving average during an uptrend. Set targets based on previous resistance levels or Fibonacci retracement levels.

4. News and Economic Event Analysis

Fundamental factors significantly influence currency strength. By closely observing economic indicators (such as GDP growth, unemployment rates, and inflation data), traders can predict currency movements post major economic events.

Trading Rules

• Schedule Economic Releases: Utilize an economic calendar to keep track of upcoming releases such as interest rate decisions or employment reports.

• Analyze Market Expectations: Look at forecasts and consensus estimates prior to major news; trades should be positioned based on whether you believe the actual data will beat or miss expectations.

• Position Accordingly: For instance, if a currency is expected to strengthen due to positive news, go long on that currency against a weaker counterpart.

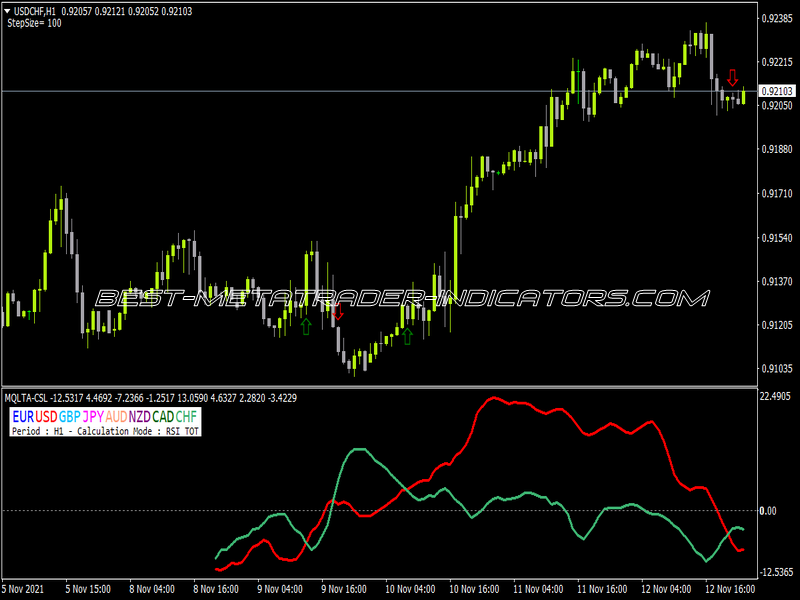

5. Hedge with Correlation

Using currency correlation for hedging strategies can help protect against undesired currency movements. Currencies often move in tandem or inversely, and understanding these relationships can enhance risk management.

Trading Rules

• Identify Correlations: Utilize tools and software to analyze the historical correlation between different currency pairs. For example, EUR/USD often moves inversely with USD/CHF.

• Open Positions: If you are long on a currency that may experience volatility, consider opening a small inverse position in a correlating currency pair to hedge against adverse movements.

• Manage Exposure: Adjust your hedge ratio depending on your risk tolerance and the strength of the correlation, ensuring that it's proportionate to your overall exposure.

6. Multi-Currency Pairs Trading

Traders can monitor multiple currency pairs simultaneously based on the strength of currencies involved. This strategy diversifies risks and enhances opportunities.

Trading Rules

• Select Multiple Pairs: Choose pairs containing strong currencies against weak currencies, ensuring to watch the relative strength of all currencies involved.

• Watch for Divergence: Monitor the performance of selected pairs for divergences in price movements compared to their correlated currency counterparts.

• Execute Trades: Enter trades based on relative strength signals from the selected currency pairs while maintaining a balanced portfolio.

Conclusion

Trading currencies based on currency strength can provide traders with a strategic edge in the forex market. Utilizing diverse approaches, from relative strength analysis and mean reversion to trend following and correlation strategies, allows traders to adapt to varying market conditions.

The key to successful currency strength trading lies in robust risk management techniques, including appropriate stop-loss placements and position sizing, to navigate the inherent volatility of the forex market. Regularly reviewing and refining these strategies ensure their continued effectiveness in a dynamically changing environment.

The trader should use it to trade a cross rate between a hard currency and a soft currency.

The currency strength indicator gives you a brief manual to determine the weak and strong currency.

hell of an indicator, five stars.

amazing! thanks a lot.

What indicates Strength and Weakness. Red means strong or weak?

I didn't get if blue means weak or strong.

Good its make us know the strength of each currency, but can be more better if it also make a line in chart to make more imaginable.

To whom it may concern,

My name is Arpan and I would like to know if you can custom make a strategy for me. My need is to have an inclusive system. From best strategies to analyse the market news and don't search trades on 3 bull news for that particular currency; Using the best currency strength meter similar to the one for the bank so it can help the indicator to be more accurate and avoid the currencies that have similar strength. Don't worry about processing power I'm going to use IBM custom made server.

It needs to analyze the price action by identifying Trends, Reversal, Swing, Breakout, Kombi, Complex, Dynamic, Triangles, and it has to use the indicator to filter the signals provided from price action such as Ichimoku, Emas, Dolly, Solar Wind, MACD, RSI, Bollinger Bands, Fibonacci. The system needs to be able to signals with a success rate of 90% above and the signals need to be 50 pips or more.

I would like to know from you if you can make this strategy for me?

However, you can not sell it or use it even if you change the code. I will make a contract before we start the project. If you could provide me with a rough quotation that would be great.

My one and only gripe. Upon changing where the currency strength indicator appears on the chart ( from upper left corner to lower left corner) the order of the currencies also change - from descending to ascending order). Would much prefer the currency strengths to remain in descending order as opposed to switching to ascending order. I have zero coding skills so I have to make do. Excellent work otherwise.

Absolutely amazing

Big salute for ever shining work.

how to work it?

A very great indicator that can take your trading to a new level. Thanks Team