Submit your review | |

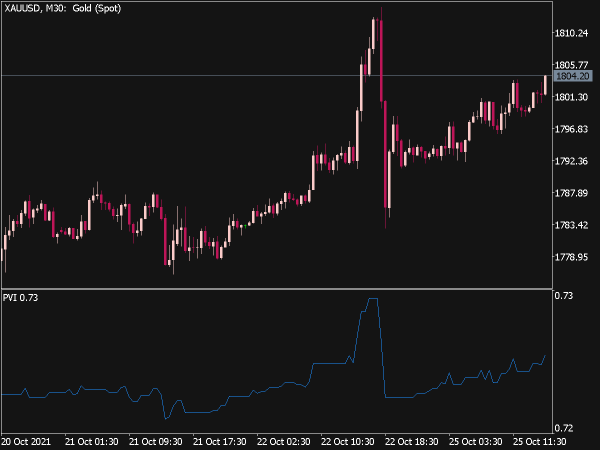

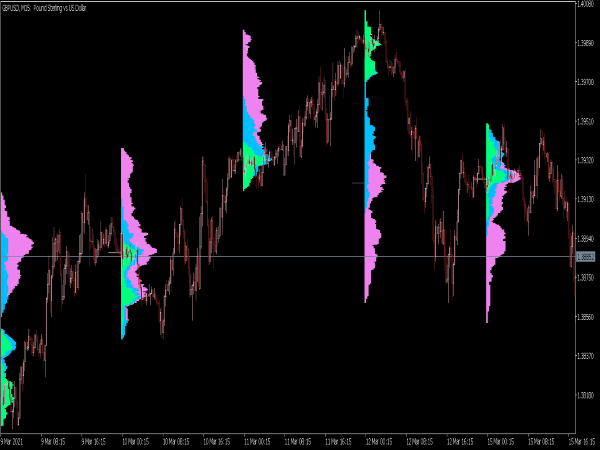

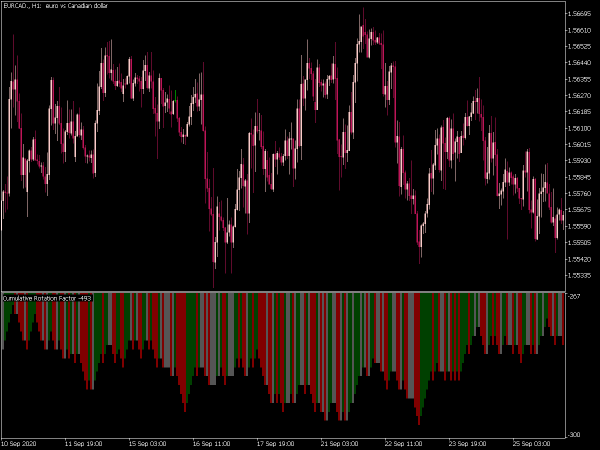

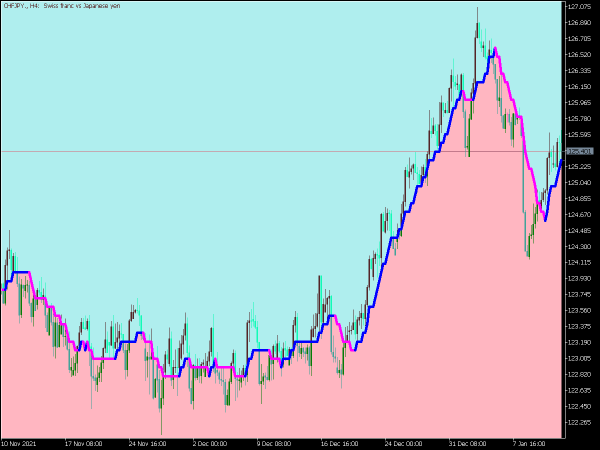

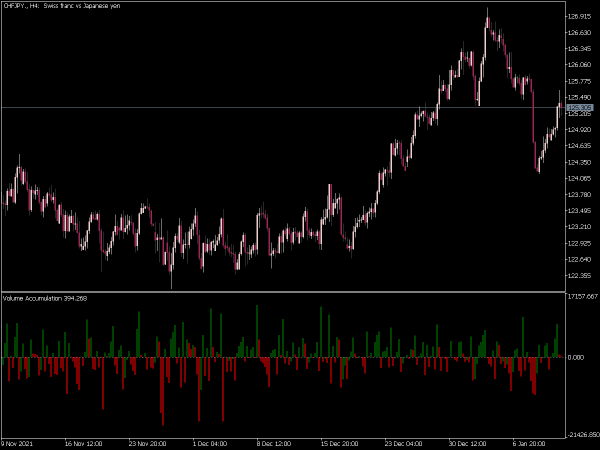

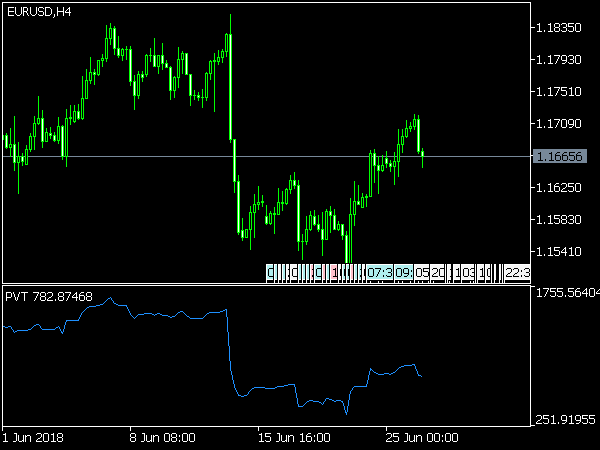

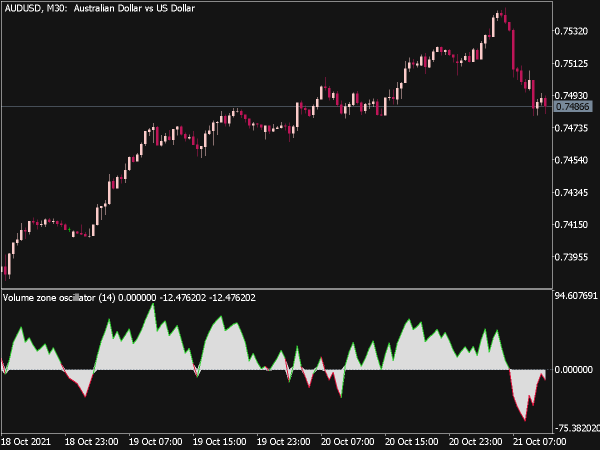

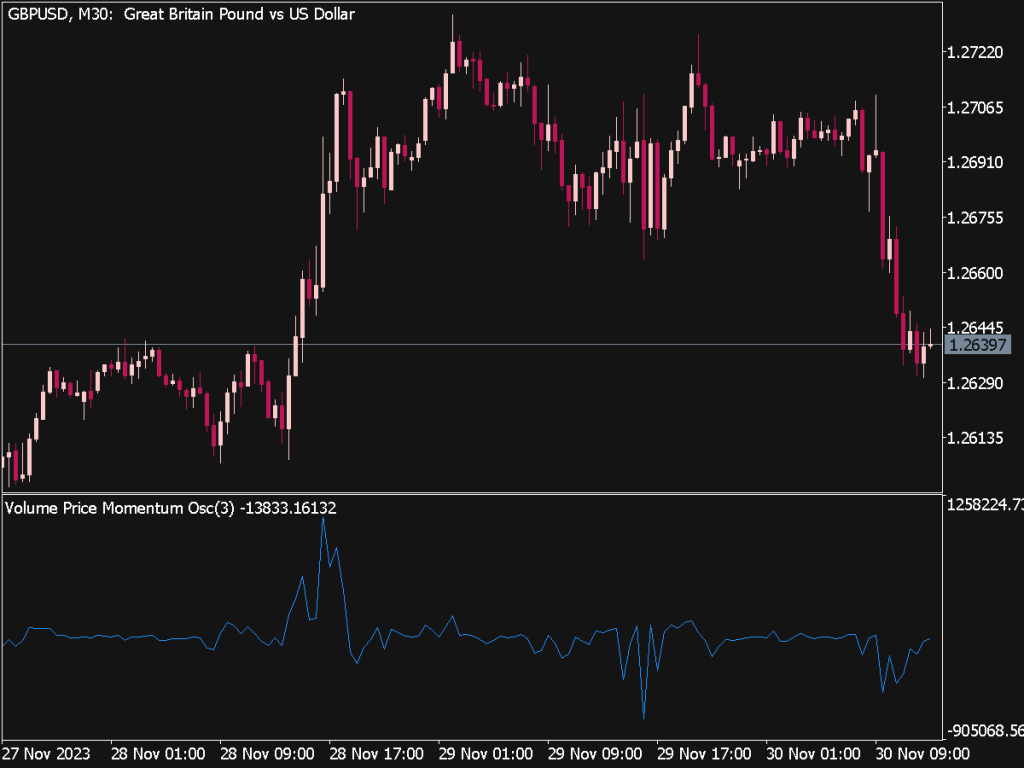

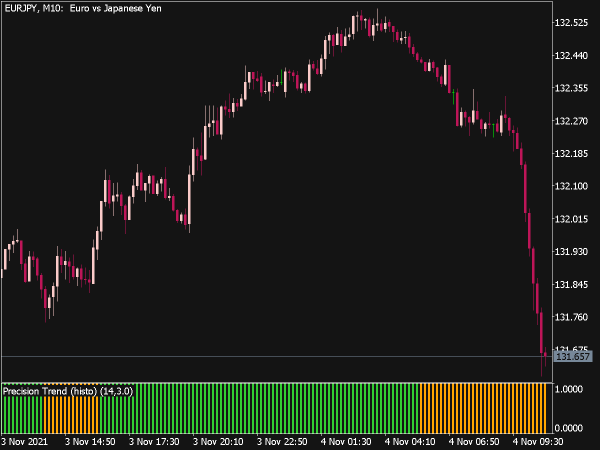

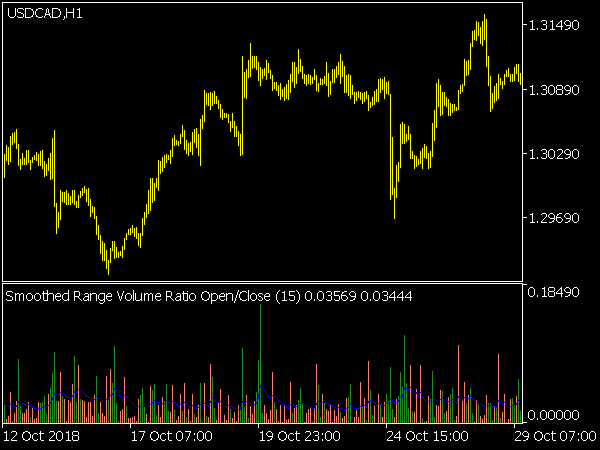

The Cumulative Volume Indicator (CVI) is a technical analysis tool that tracks the net buying and selling pressure in a market by accumulating volume over certain periods. To effectively trade using the CVI, traders can implement several rules and strategies.

Understanding the Cumulative Volume Indicator

The CVI is calculated by summing the volume for each period, adjusting for whether the closing price was higher or lower than the previous close. An increasing CVI indicates bullish sentiment, while a decreasing CVI suggests bearish sentiment.

Basic Trading Rules

1. Volume Confirmation: Always use the CVI in conjunction with price action. When a price breakout occurs, confirm it with increased volume according to the CVI. For example, if a stock breaks above resistance with an increasing CVI, it reinforces the strength of the move.

2. Divergence Analysis: Look for divergences between price action and the CVI. A bullish divergence occurs when prices make lower lows while the CVI makes higher lows, signaling a potential reversal. Conversely, a bearish divergence is when prices make higher highs while the CVI registers lower highs, indicating a possible trend reversal.

3. Trend Confirmation: Use the CVI to confirm existing trends. An uptrend should be supported by a rising CVI, while a downtrend should correlate with a falling CVI. If prices move against the trend but the CVI supports it (e.g., a price drop with rising CVI), this can signal a potential false breakout or pullback.

Advanced Trading Strategies

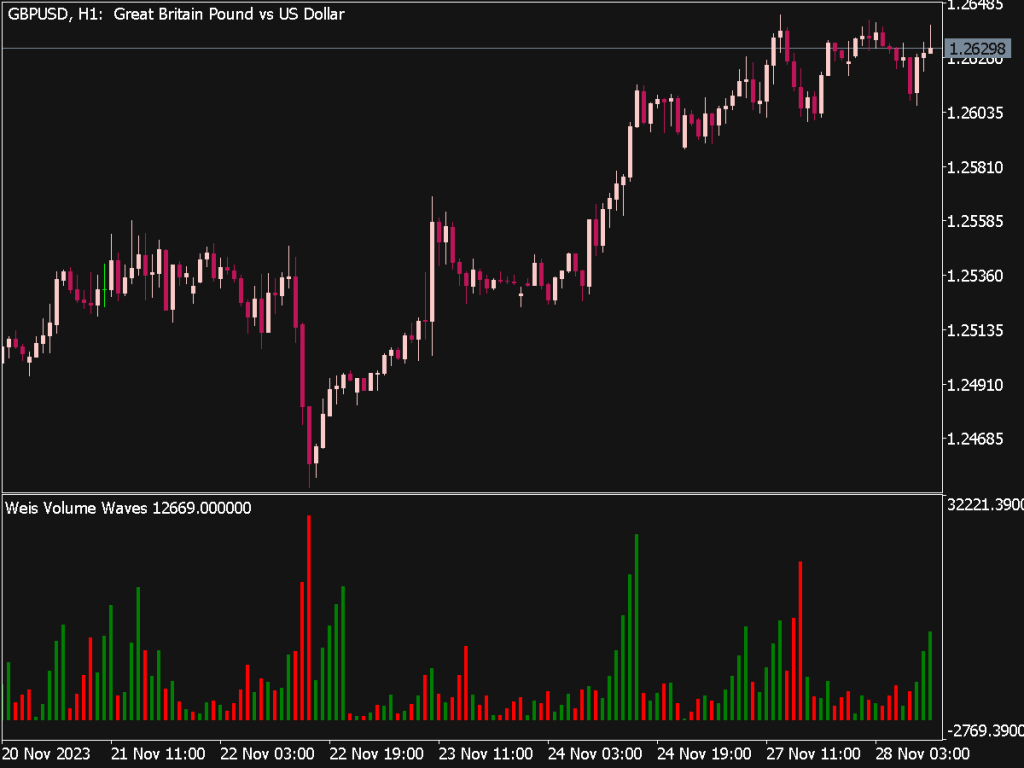

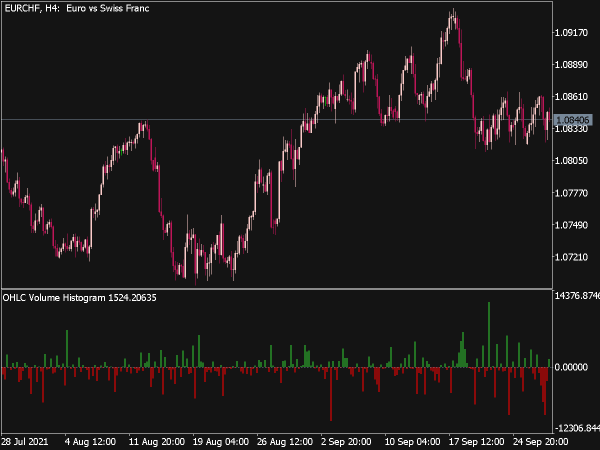

1. CVI Crossovers: Traders can set specific thresholds for the CVI. For example, a crossing above or below a specific moving average of the CVI can signal potential entry or exit points. A bullish signal can occur when the CVI crosses above its moving average, while a bearish signal can arise from a downward crossover.

2. Range Trading: In a sideways market, the CVI can help identify the stronger side of the range. If the CVI rises while the price remains in a range, it indicates underlying buying pressure, suggesting that a breakout to the upside may occur. Conversely, if the CVI drops while price is contained, this may suggest impending downward pressure and a breakout below the range.

3. Quantitative Filters: Incorporate the CVI into algorithmic trading strategies by establishing quantitative filters. For instance, traders can create long positions when the CVI exceeds a certain level alongside other indicators (like RSI or MACD) to ensure that trades are implemented under favorable conditions for volume and price momentum.

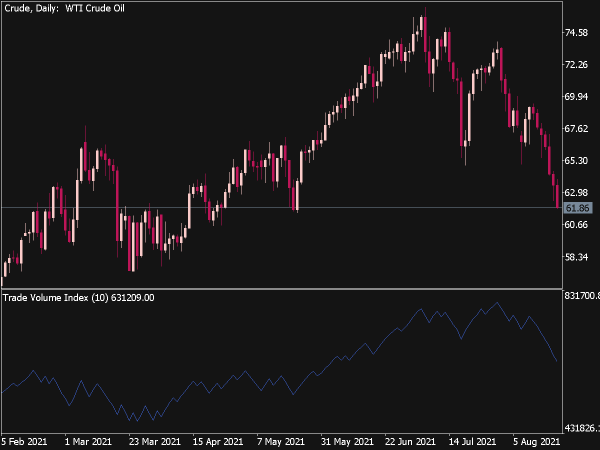

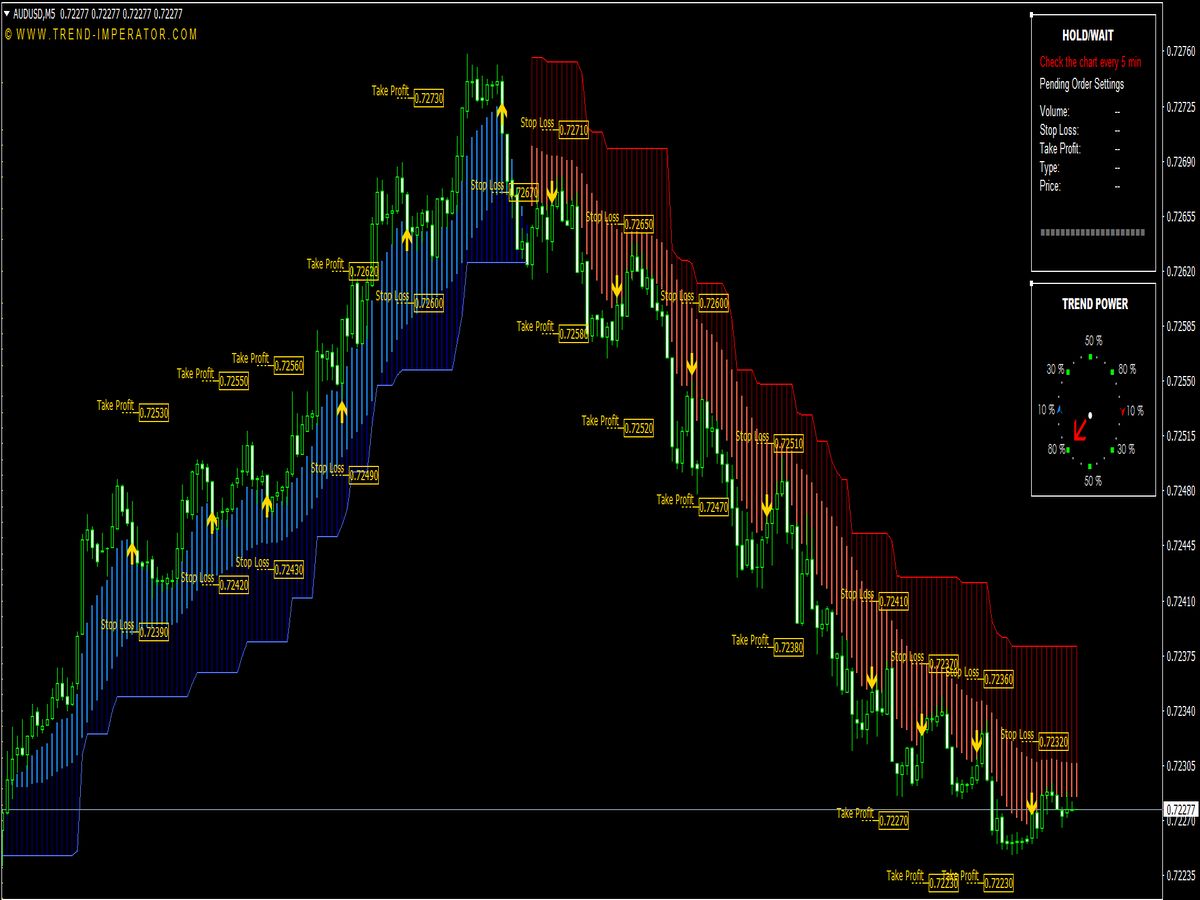

4. Stop-Loss and Take-Profit Levels: When entering trades based on CVI signals, use it to determine stop-loss and take-profit levels. If the CVI starts to show signs of weakening after an entry point, it can serve as a signal to exit or adjust your position.

5. Time-frame Analysis: Employ the CVI across multiple time frames for more nuanced insights. Use a higher time frame (daily or weekly) to assess the overall market sentiment while looking at a lower time frame (hourly or 15-minute) for precise entry and exit points.

Backtesting and Optimization

Before implementing any CVI-based strategy, conduct thorough backtesting using historical data. This will help assess the strategy's effectiveness and optimize parameters to fit specific market conditions. Consider variables such as market volatility, asset classes, and different trading hours.

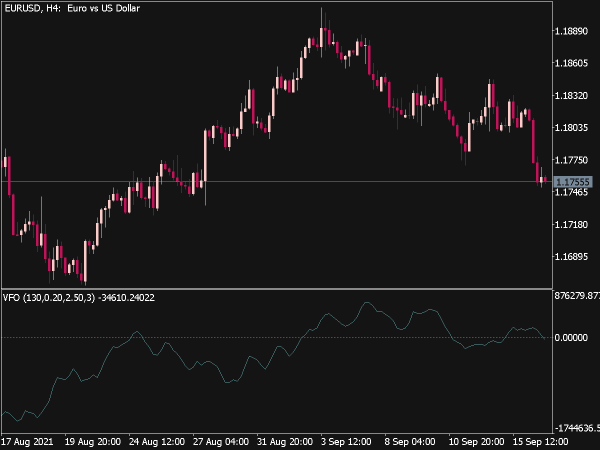

Risk Management

As with any trading strategy, effective risk management is crucial when using the Cumulative Volume Indicator. Determine position sizing based on your risk tolerance and ensure that stop-loss orders are in place to mitigate potential losses. Balancing risk and reward through proper management adds to the sustainability of trading profits.

Conclusion

The Cumulative Volume Indicator is a powerful addition to a trader’s toolkit, offering insights into market momentum through volume analysis. By following the aforementioned trading rules and strategies, traders can make informed decisions based on the underlying volume dynamics of a security. However, it is essential to combine the CVI with other indicators and to maintain careful attention to risk management for successful trading outcomes. Continuous learning and adaptation will ensure the effectiveness of strategies that incorporate the CVI in various market conditions.