Submit your review | |

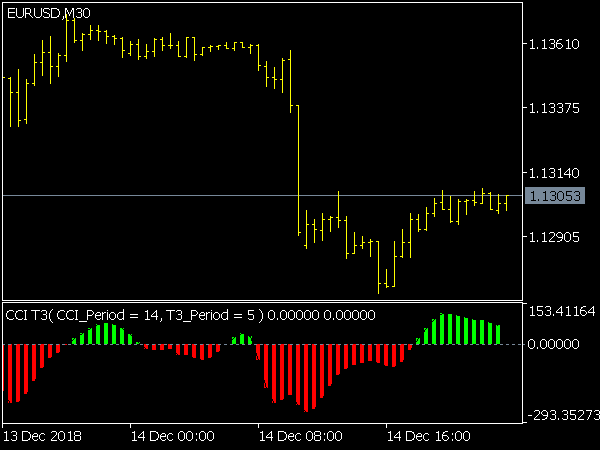

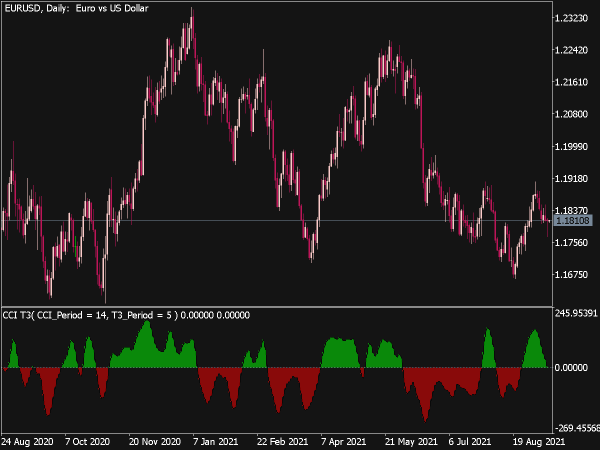

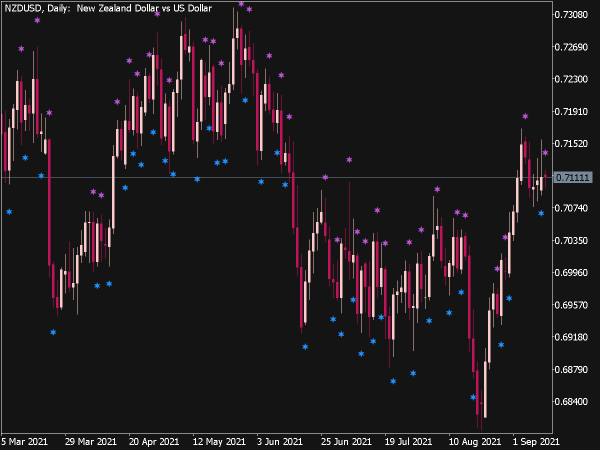

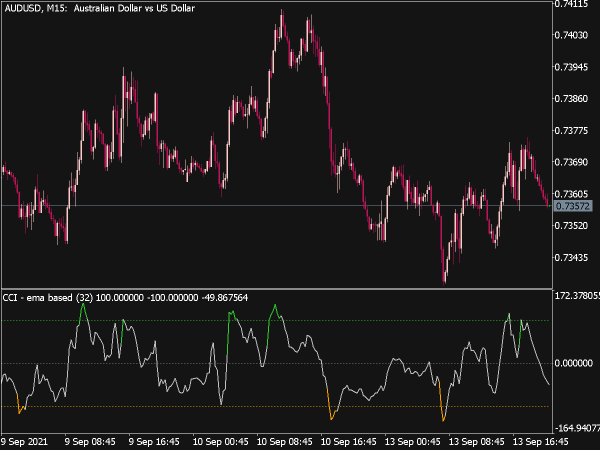

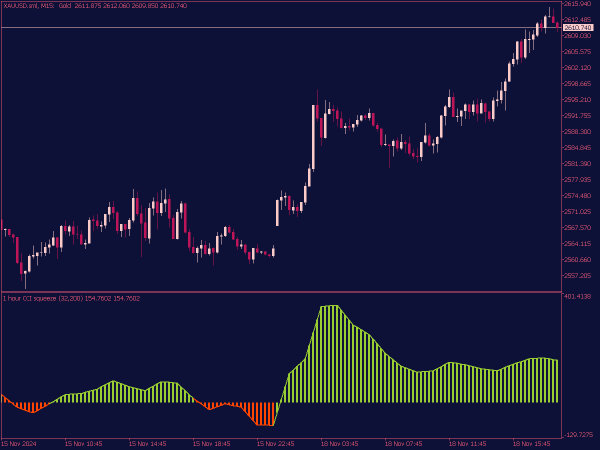

The CCI Squeeze MTF (Multi-Time Frame) Indicator is a technical analysis tool used by traders to identify potential market breakouts by analyzing the Commodity Channel Index (CCI) across multiple time frames. It focuses on periods of low volatility where the CCI indicates a squeeze, suggesting that price may soon make a significant move. When the indicator shows a squeeze, it alerts traders to monitor closely for subsequent breakouts, helping them to make informed decisions about entry and exit points in their trading strategy. This type of indicator is especially useful for capturing momentum trades after periods of consolidation.

When formulating trading strategies using the CCI Squeeze MTF Indicator, it's essential to leverage multiple time frames to get a comprehensive view of market dynamics. Here's a breakdown of a few effective strategies:

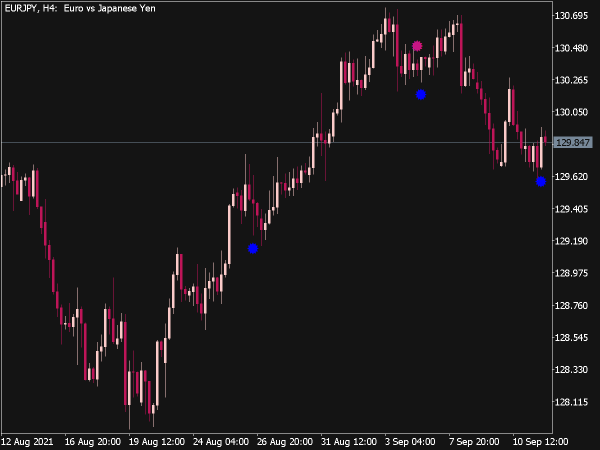

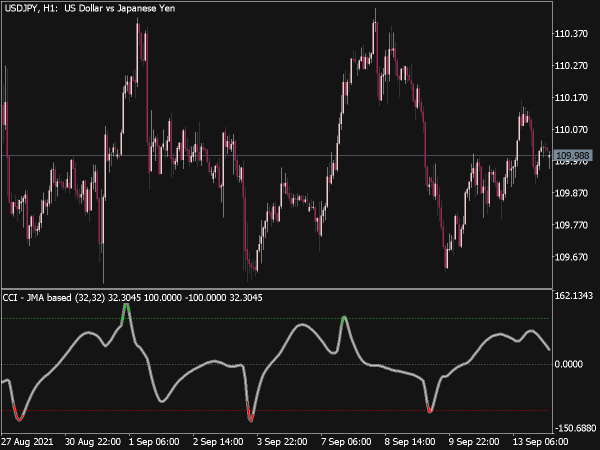

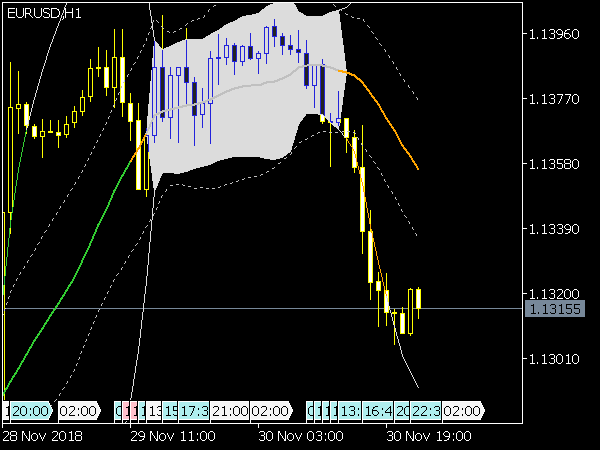

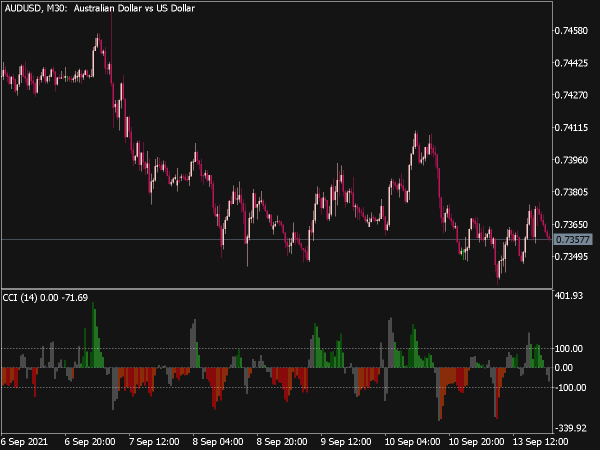

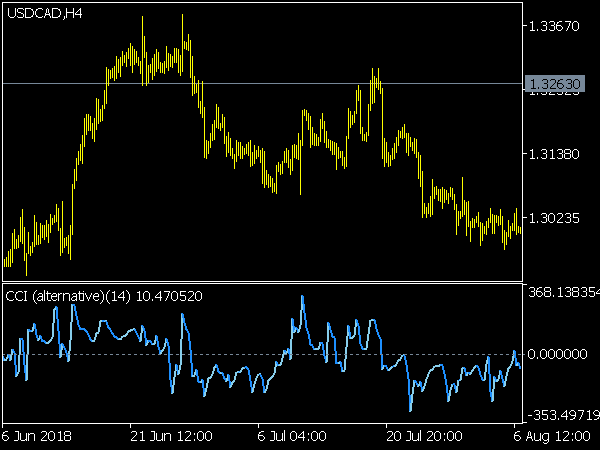

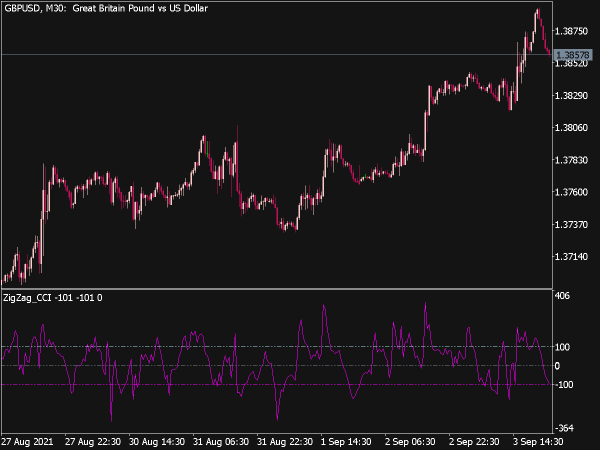

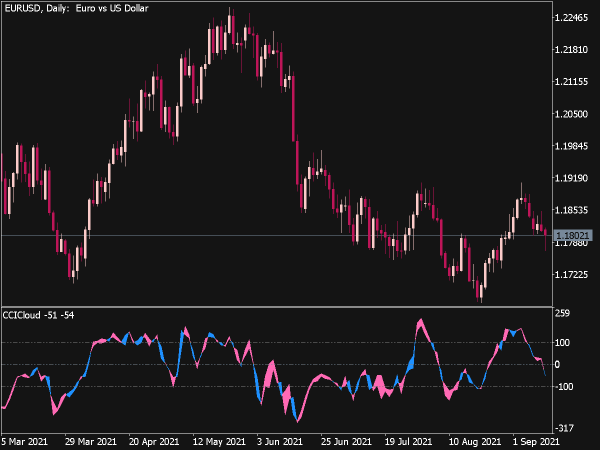

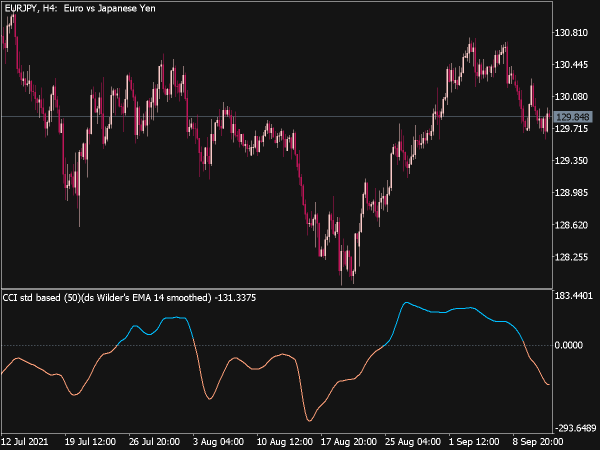

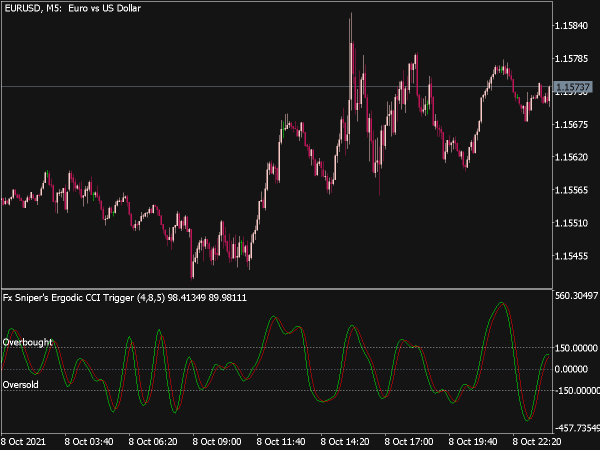

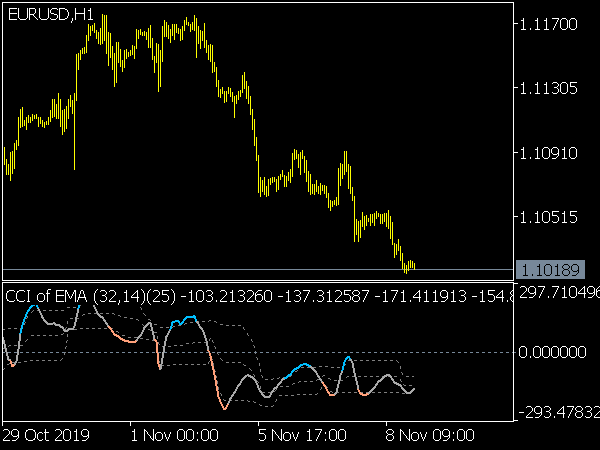

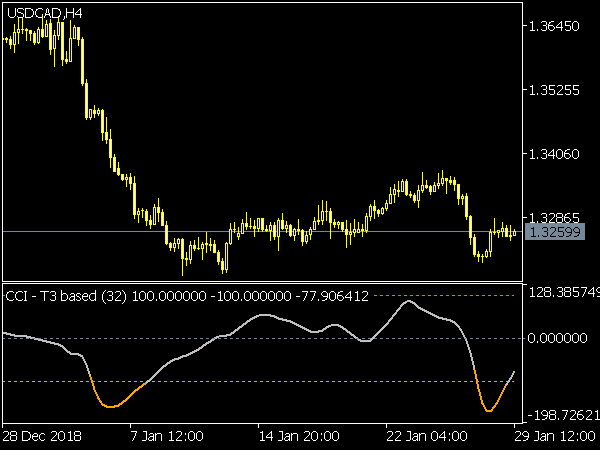

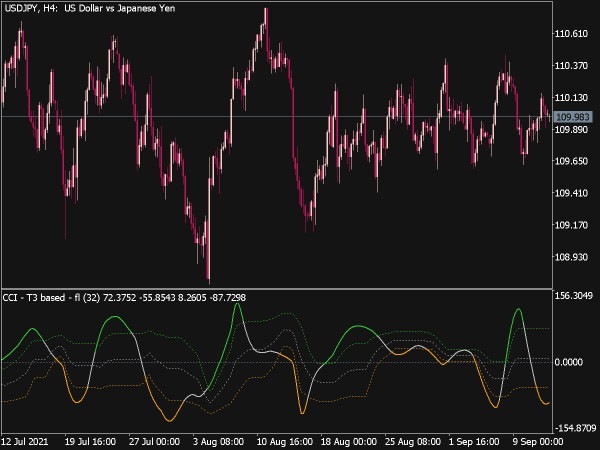

1. Breakout Strategy: Identify periods when the CCI indicates a squeeze on the higher time frame (like the daily or 4-hour chart). When the price subsequently breaks out of this squeeze (typically suggests reduced volatility before a major price movement), traders should look for confirmation through the CCI crossing above +100 (for a bullish breakout) or below -100 (for a bearish breakout) on a lower time frame (like the hourly chart). Entry points can be established using stop orders just above the high or below the low of the breakout candle.

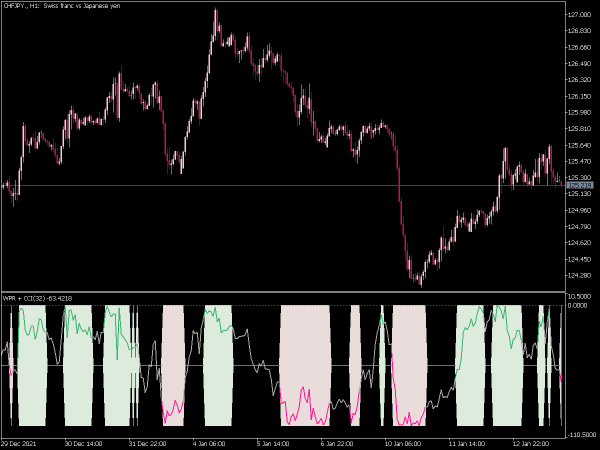

2. Momentum Strategy: Utilize the CCI Squeeze Indicator alongside other momentum indicators, such as the RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence). Look for a squeeze setup where the CCI moves towards the zero line with low volatility, combined with bullish or bearish divergence between the momentum indicators and price. This can signal the potential for a strong momentum move in either direction. Enter trades when the CCI begins to diverge strongly and moves into overbought/oversold regions.

3. Reversal Strategy: In scenarios where the market is trending, traders can use the CCI Squeeze MTF Indicator to spot potential reversals. If the CCI shows a squeeze while the market is trending, monitor for signs of trend exhaustion as the CCI approaches extreme levels (+100 or -100). This could signify an imminent reversal, especially when combined with candlestick patterns or support/resistance levels. Entry points would ideally align with failure swings or other reversal signals once the CCI shows signs of weakness against the trend direction.

4. Confirmation with Volume: Volume can be a significant factor when relying on the CCI Squeeze Indicator. A strong breakout from a squeeze that is supported by increased volume lends more conviction to the trade. Conversely, low volume might indicate that a breakout is less likely to sustain. Make it a practice to assess volume levels as a confirmation tool, giving preference to trades that align with high-volume spikes.

5. Risk Management: Regardless of the strategy chosen, incorporating sound risk management techniques is critical. Set stop-loss orders according to your risk tolerance, ideally placing them just outside the squeeze or previous swing highs/lows. Use a favorable risk-reward ratio of at least 1:2 to ensure profitability over time, and adjust position sizes to account for market volatility.

6. Backtesting and Continuous Learning: Finally, it's essential to backtest any strategy implemented using the CCI Squeeze MTF Indicator. Analyze historical data to understand the effectiveness of the strategy and refine your approach continuously. Join trading communities or utilize resources that provide insights into the indicator’s performance under different market conditions.

In conclusion, the CCI Squeeze MTF Indicator can serve as a robust foundation for various trading strategies. Whether focusing on breakouts, momentum plays, or reversal setups, the key is to remain flexible and adapt to changing market conditions, utilizing proper risk management and corroborating your trades with additional analysis tools for the best results.