Submit your review | |

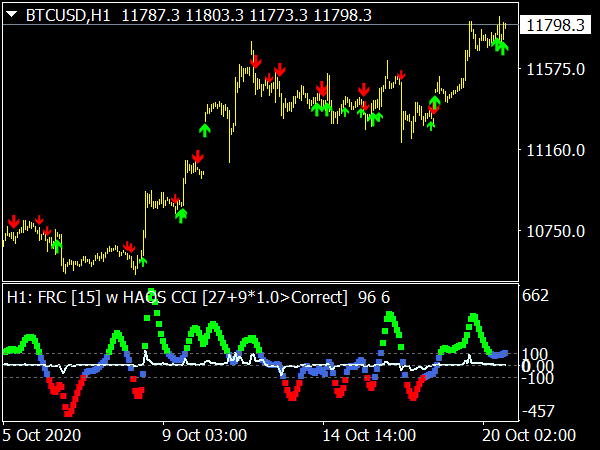

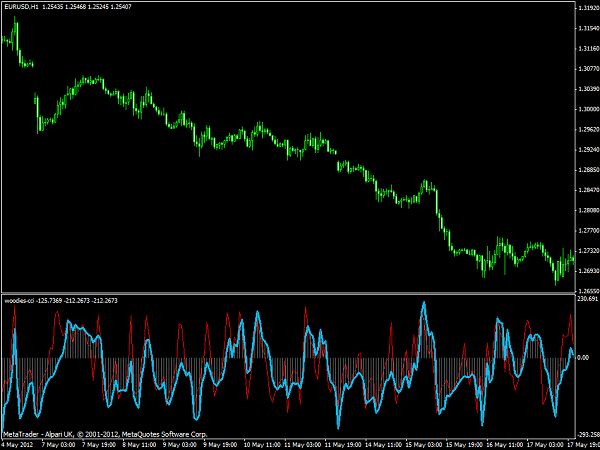

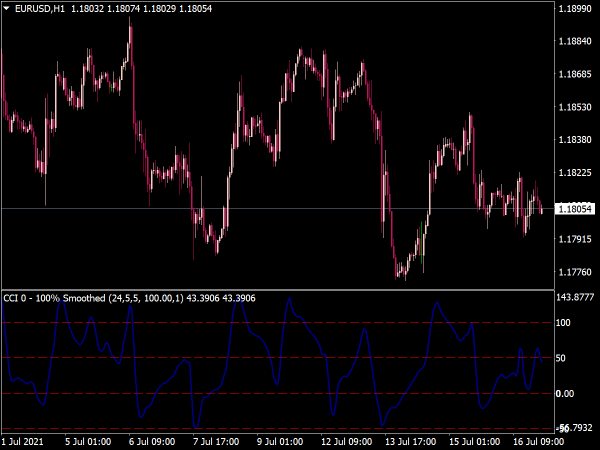

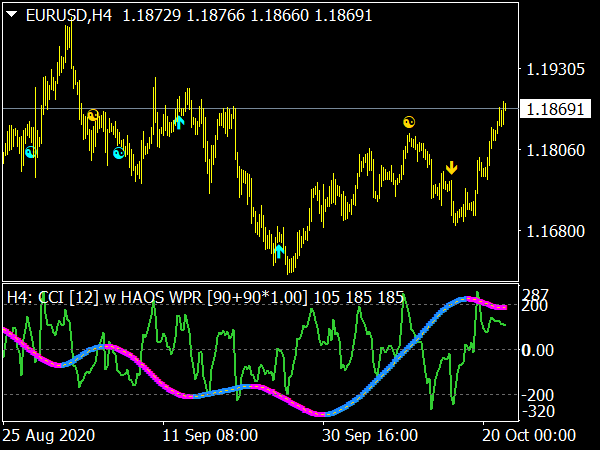

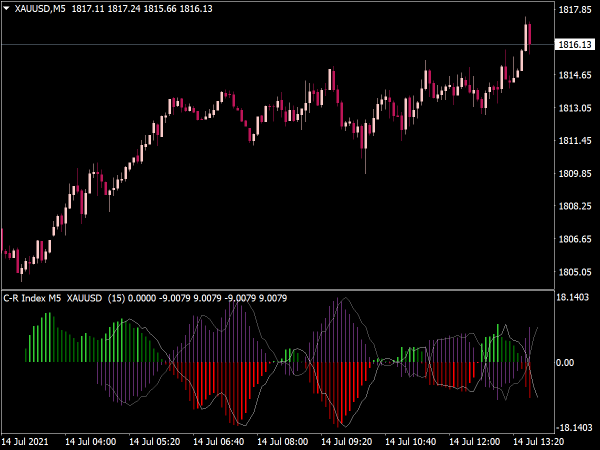

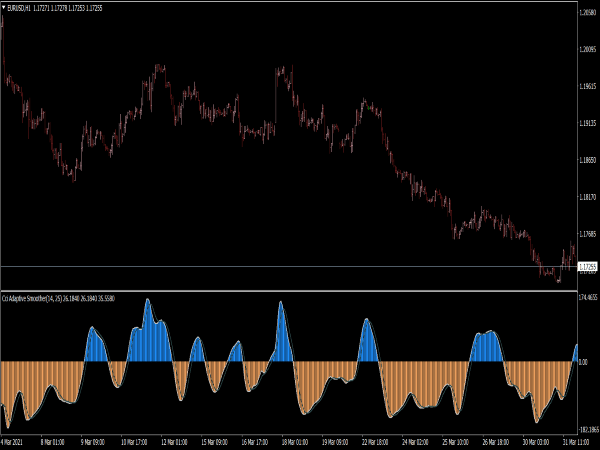

The CCI MTF (Commodity Channel Index Multi-Time Frame) Indicator is a technical analysis tool used to evaluate the price movements of a security across different time frames. It combines the classical Commodity Channel Index (CCI) with multi-time frame analysis, allowing traders to identify overbought or oversold conditions more effectively. By analyzing the CCI values from various time frames, traders can gain insights into potential price reversals or continuations, ultimately helping to inform their trading decisions. This multi-dimensional approach provides a more comprehensive view of market trends and dynamics.

Here are some common strategies that traders might use with the CCI MTF:

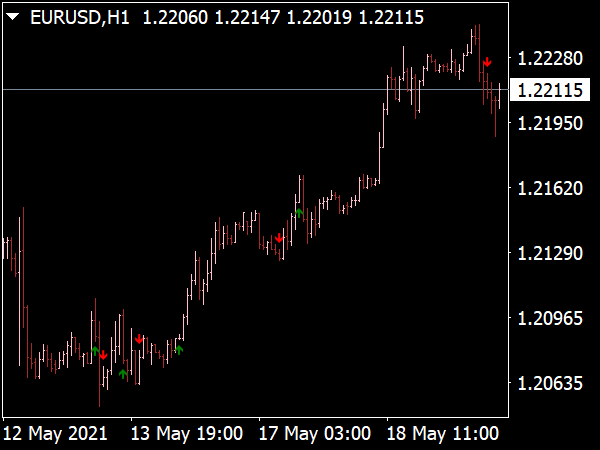

Strategy 1: Trend Following Entry

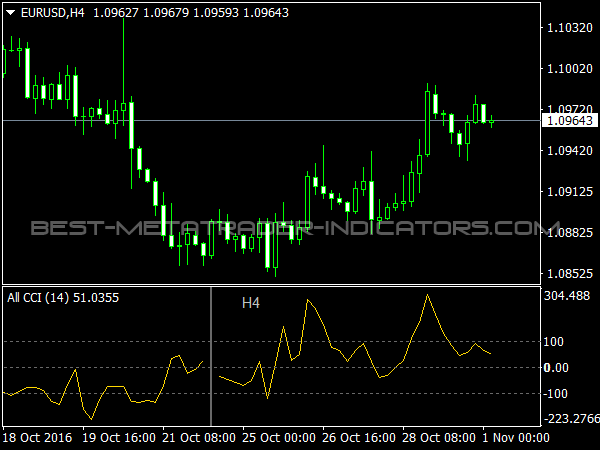

1. Identify the Trend: Start by examining the daily chart. Look for a consistent upward or downward trend. Ideally, the CCI should be above +100 for bullish trends or below -100 for bearish trends.

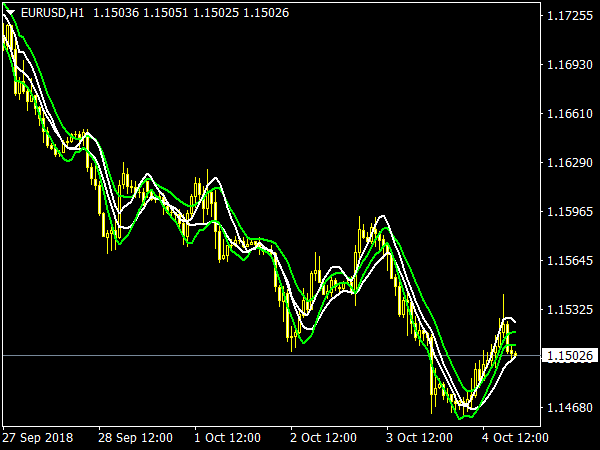

2. Confirm on Intermediate Time Frame: Move to the hourly chart. Again, check if the CCI confirms the trend direction — this is the second level of verification. The CCI should also be trending above +100 for buys or below -100 for sells.

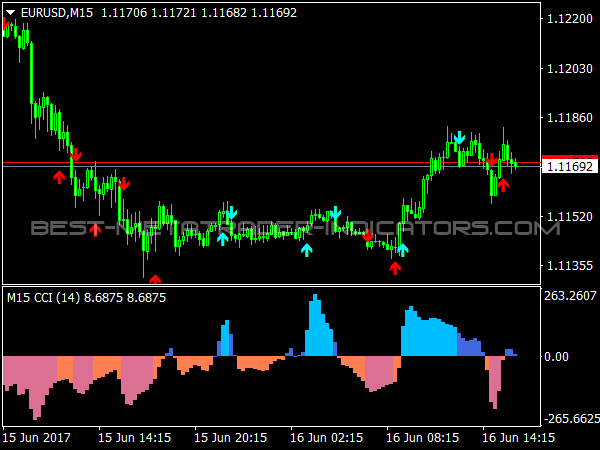

3. Hunt for Entry Signals on Lower Time Frame: Transition to the 15-minute chart. Look for instances where the CCI crosses the zero line after reaching an extreme level. A bounce off an oversold CCI level (-100) in an uptrend is a potential buying signal, while a drop from an overbought level (+100) in a downtrend could indicate a selling opportunity.

4. Entry Point: Place a buy order as soon as the 15-minute CCI crosses above -100 and other criteria align. For sells, enter when the CCI crosses below +100 in a downtrend.

5. Stop-Loss and Take-Profit Levels: Position stop-loss orders just beyond recent swings or use a fixed risk-reward ratio, such as 1:2, to set profit targets.

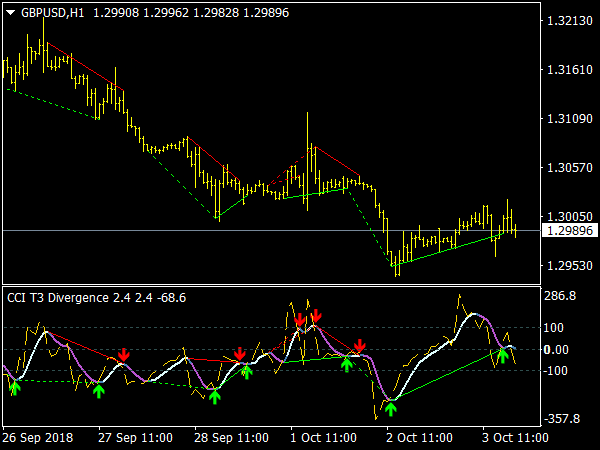

Strategy 2: Divergence Trading

1. Monitor Divergence: On the daily chart, look for divergence between price action and the CCI. For example, if the price makes a new high but the CCI makes a lower high, this is a bearish divergence signaling possible trend reversal.

2. Validation on Hourly Chart: Check the hourly chart for confirmation of the divergence. If the hourly CCI also shows signs of divergence, it strengthens the case for a potential entry.

3. Entry Point on 15-Minute Chart: Once confirmed, switch to the 15-minute chart to look for further divergence or a CCI level signaling an impending correction. Enter the trade when the CCI crosses the zero line back towards the trend direction after the divergence.

4. Stop-Loss and Take-Profit Levels: Similar to the trend-following strategy, use swing points or a calculated risk-reward ratio for managing exits.

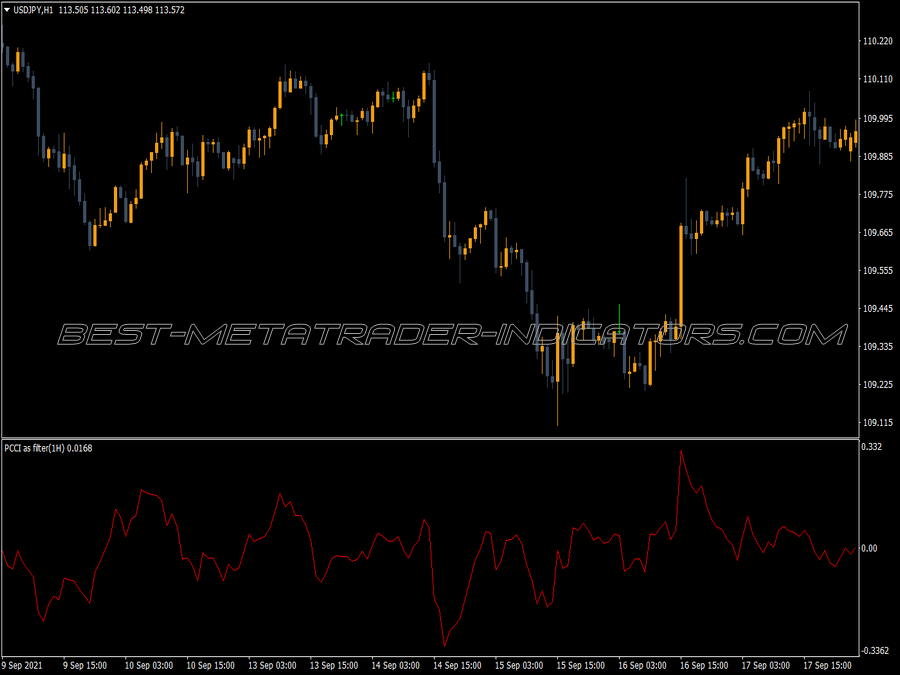

Strategy 3: CCI Breakout Strategy

1. Identify Consolidation Periods: On the daily chart, look for periods of low volatility where price is moving sideways. This typically precedes breakouts.

2. Watch CCI Levels: During consolidation, observe the CCI. If it moves towards ±100, prepare for a potential breakout.

3. Confirmation on Lower Time Frames: Check the hourly and then 15-minute charts. Look for price to break above resistance or below support levels, coinciding with the CCI moving above +100 for a buy or below -100 for a sell.

4. Entry Point and Execution: Upon a confirmed breakout (price crossing key levels), enter the trade according to the CCI signals. This could be: buy when price breaks past resistance with a corresponding CCI move above +100, and similarly for selling.

5. Stop-Loss and Take-Profit Levels: Manage risk by placing stop-loss orders slightly below breakout levels and setting take-profit orders at previous highs or specific Fibonacci extension levels.

Conclusion

The CCI MTF Indicator trading strategies can be a trader’s best friend when combined with proper risk management and adherence to market principles. Using multiple time frames helps in confirming signals, leading to higher probability trades. Always ensure that your entry points align with the overall trend revealed by the higher time frames while utilizing lower time frames for precision entries. By mastering these techniques, traders can harness the full potential of the CCI MTF Indicator to navigate the markets confidently.