Submit your review | |

Order blocks are essentially price areas where large orders from institutional traders are concentrated. These orders can be accumulation (buying) orders, often found before a price rally, or distribution (selling) orders, typically seen before a price decline.

These blocks are formed when institutions strategically place orders to manipulate the market or to simply fill large positions without significantly impacting the price. Consequently, the price often reacts when it revisits these areas as the orders are either partially filled, or they are used for price protection.

Identifying Order Blocks

The key to successful order block trading lies in accurately identifying these areas on the price chart. While the exact methodology varies, here's a general approach:

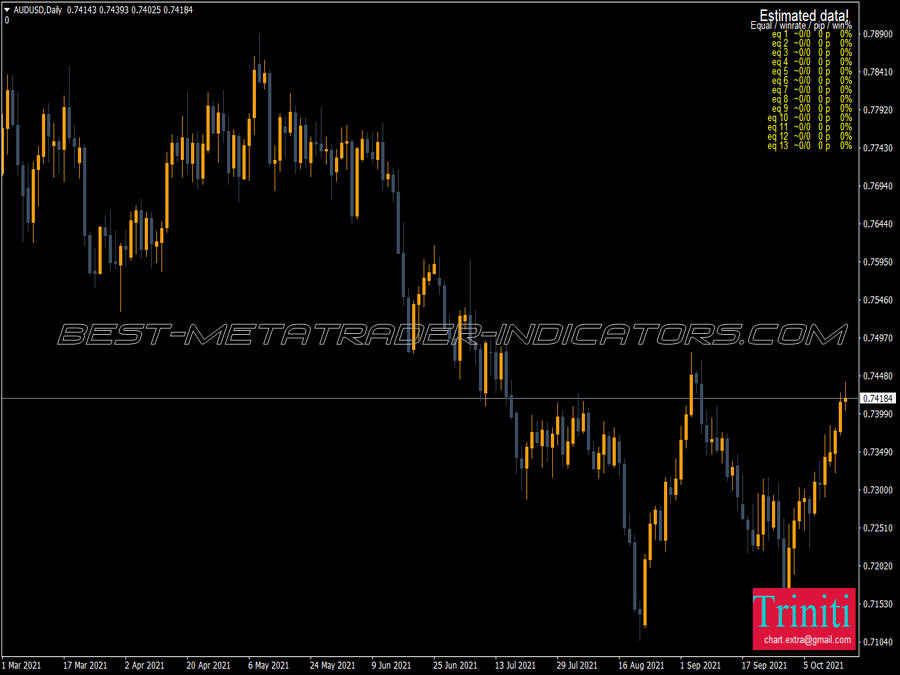

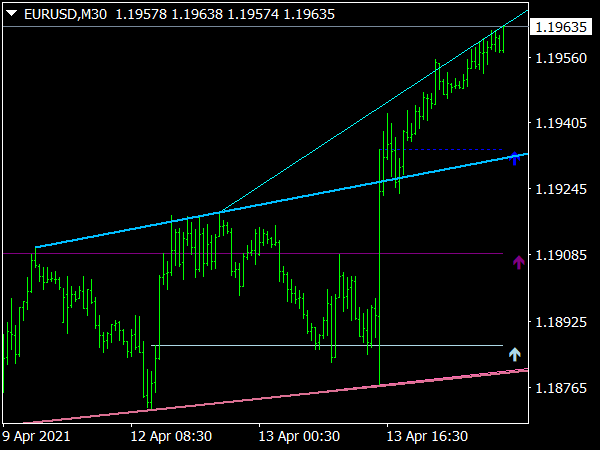

1. Identify Market Structure: Order blocks are best identified within a broader market context. Analyze the trend: is the market bullish (making higher highs and higher lows) or bearish (making lower highs and lower lows)? The order block should align with the overall trend, increasing the probability of a successful trade.

2. Look for Candlestick Patterns: Identify a strong bullish (for buy order blocks) or bearish (for sell order blocks) candlestick pattern or series of candles. Often, an order block is characterized by a candle that precedes a significant price movement, signifying a large accumulation or distribution.

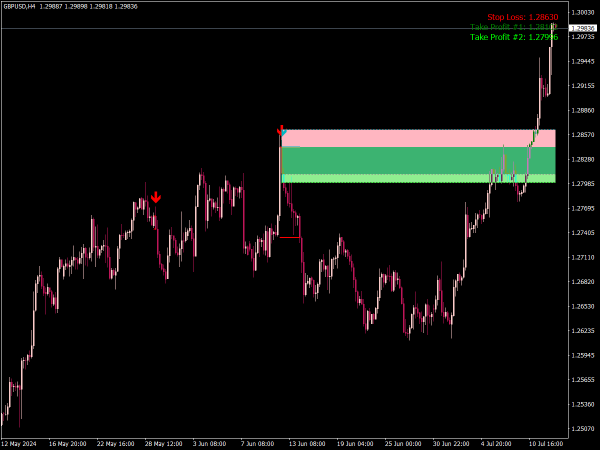

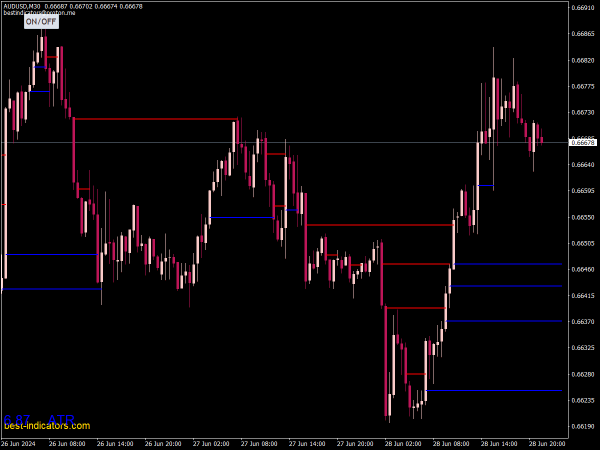

• Bullish Order Block: Look for a candlestick with a large bullish body that immediately precedes a significant upward price movement. The candle's low often represents the support level of the order block.

• Bearish Order Block: Look for a candlestick with a large bearish body that immediately precedes a significant downward price movement. The candle's high often represents the resistance level of the order block.

3. Focus on Key Levels: Look for order blocks near significant support and resistance levels, trendlines, or Fibonacci retracement levels. These confluence areas enhance the probability that the order block will act as a reversal point.

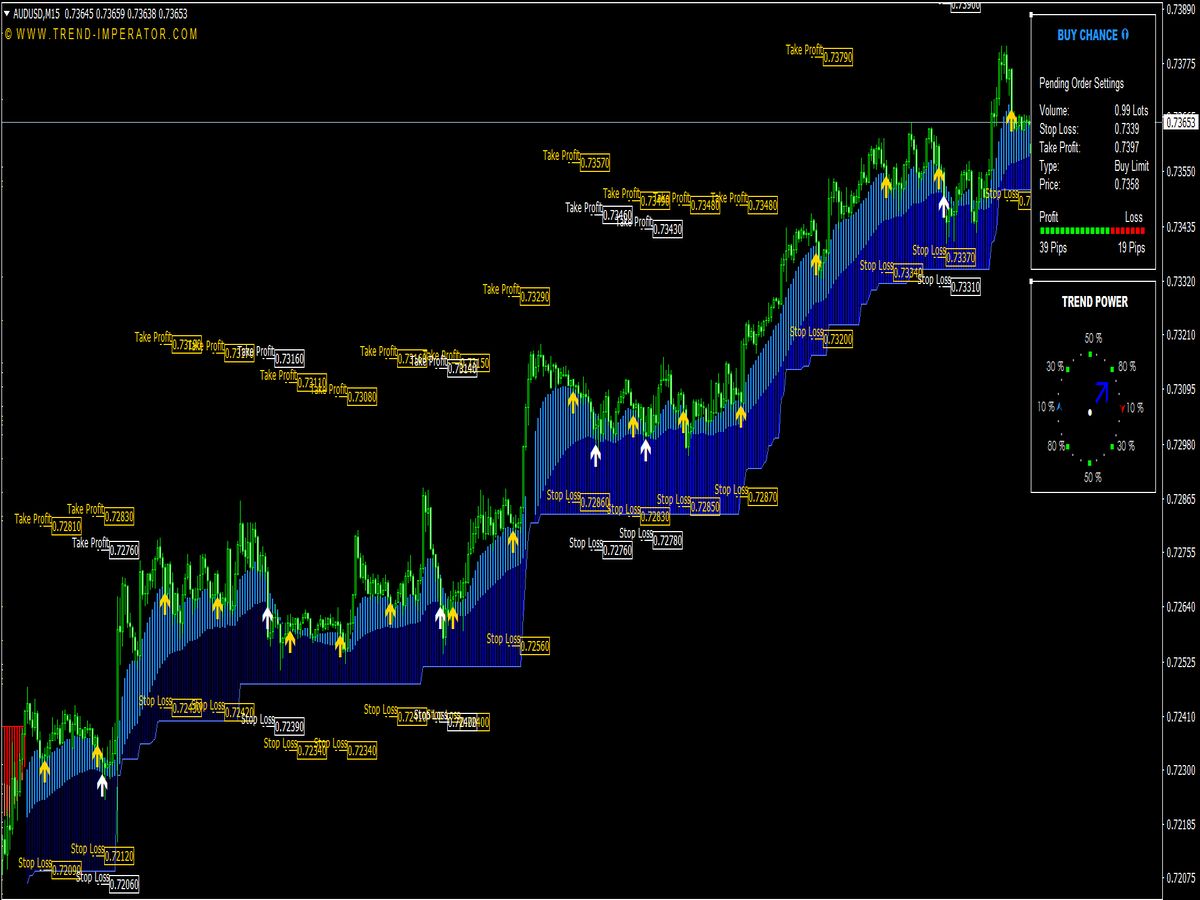

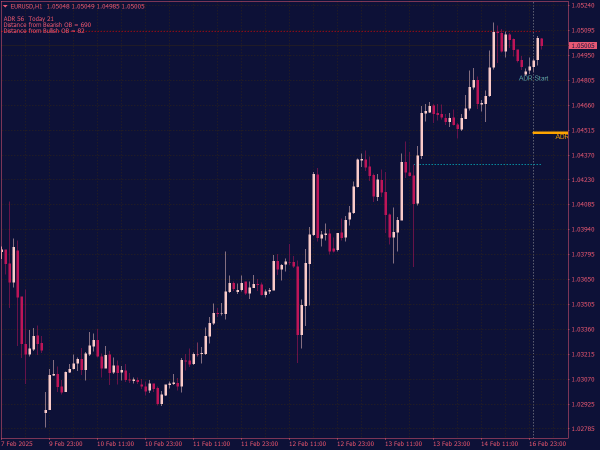

4. Multi-Timeframe Analysis: Use multiple timeframes to identify order blocks. Start with higher timeframes (e.g., daily or weekly) to identify major order blocks, then zoom into lower timeframes (e.g., 1-hour or 15-minute) to refine entry points and find areas of confluence.

5. Consider Institutional Candlesticks: Certain candlestick patterns such as engulfing patterns and pin bars can also point to order blocks. The larger the body of the candle, the more likely it is that significant volume was involved.

Confirming Order Blocks

Identifying an order block is just the first step. Confirming its validity is crucial to avoid taking losing trades. Here are some confirmation techniques:

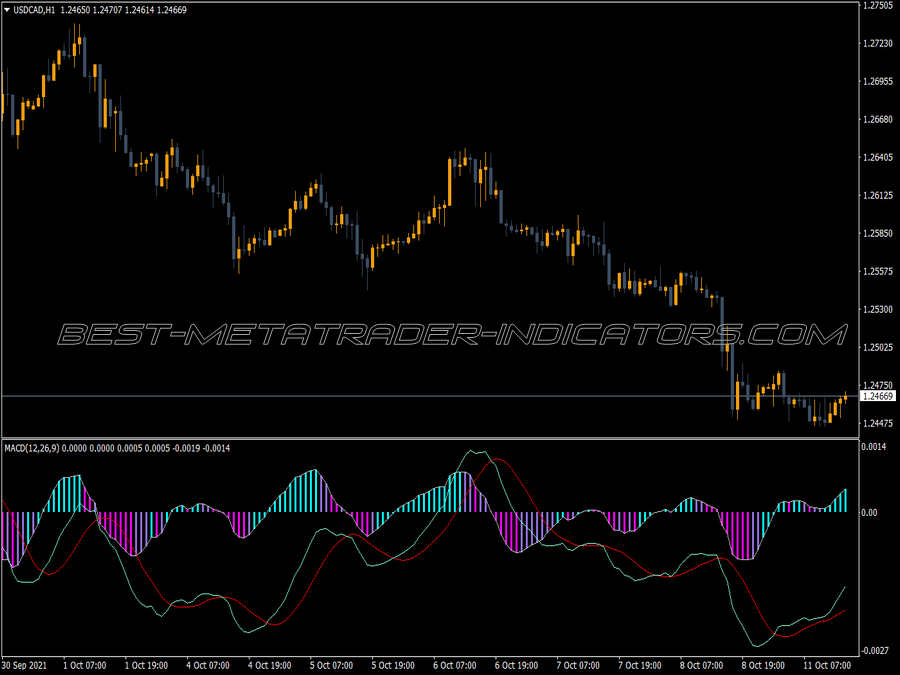

1. Volume Analysis: Analyze trading volume at the order block level. A significant surge in volume at or near the order block can confirm institutional participation. This is especially important in confirming the trend of the order block, a break of an order block would signal a failed order block.

2. Fibonacci Retracement: The order block might also coincide with Fibonacci retracement levels. Traders often look for a retracement to the 50% or 61.8% Fibonacci level to enter a trade.

3. Moving Averages: Identify whether the order block is supported by moving averages. Price bouncing off a moving average near the order block suggests strong support.

4. Break of Structure: Price breaking a previous high for a buy order block or previous low for a sell order block confirms the trend, supporting the order block's strength.

Entry Techniques

Once an order block is identified and confirmed, traders can employ various entry techniques:

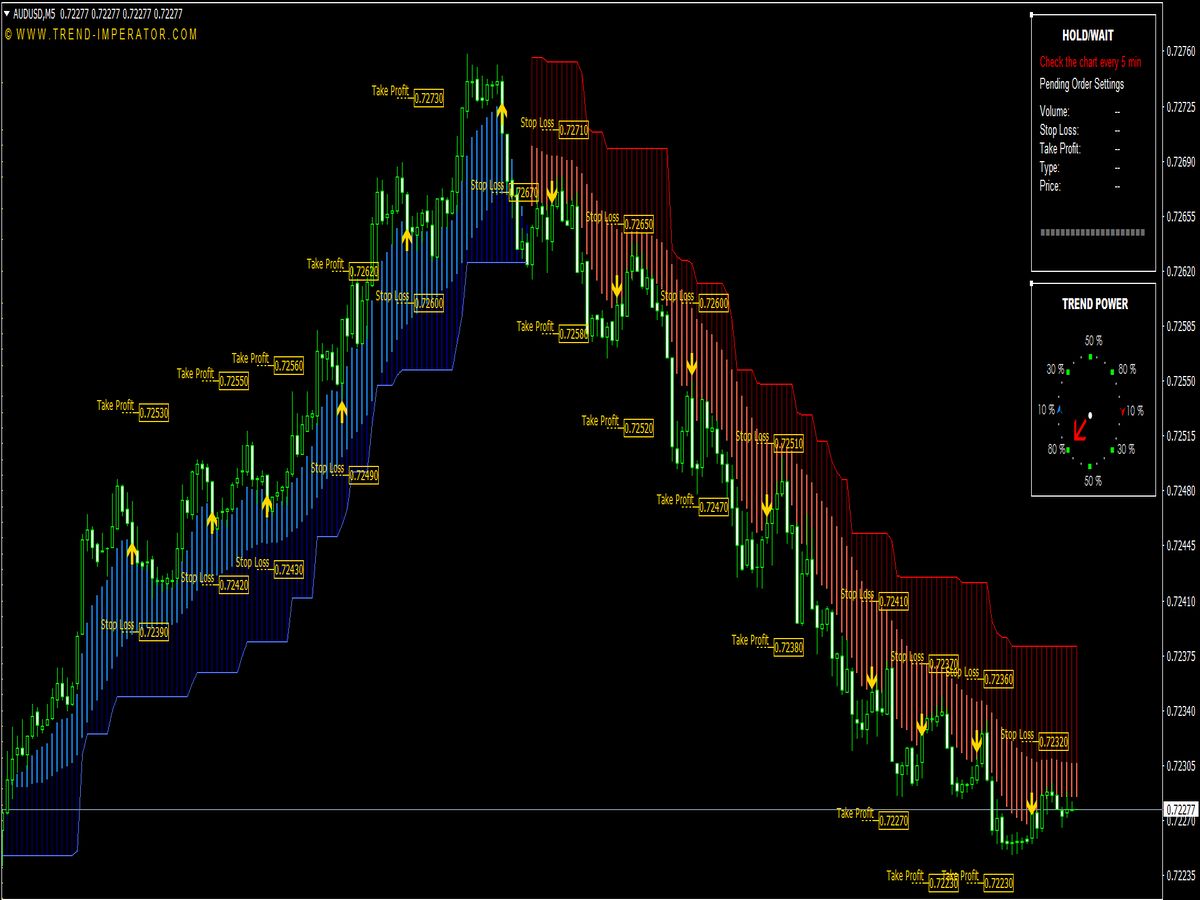

1. Limit Order Entry: This involves placing a limit order at the specific price level of the order block. This approach can be used if the trader anticipates a quick reaction to the order block.

2. Breakout Entry: Traders may wait for a break above a small consolidation zone or a trendline within the order block to signal confirmation of a buy, or a break below to confirm a sell.

3. Candlestick Confirmation: Traders may wait for a candlestick pattern to form at the order block level. This is particularly useful in lower timeframes. A bullish engulfing pattern or a pin bar at a buy order block, or a bearish engulfing pattern or pin bar at a sell order block, is a strong signal.

4. Risk-Based Entry: Based on the risk tolerance, the trader may choose to wait for a retracement and then enter a trade, which may allow for a better risk-reward ratio.

Risk Management

Sound risk management is essential for order block trading. Here are some key considerations:

1. Stop-Loss Placement: Place your stop-loss order strategically. For a buy trade, place the stop-loss below the low of the order block, or a recent swing low. For a sell trade, place the stop-loss above the high of the order block or the recent swing high.

2. Risk-Reward Ratio: Aim for trades with a favorable risk-reward ratio, ideally 1:2 or higher. This means your potential profit should be at least twice your potential loss.

3. Position Sizing: Determine your position size based on your risk tolerance and the distance between your entry price and your stop-loss. Never risk more than a small percentage (e.g., 1-2%) of your trading capital on any single trade.

4. Partial Profit Taking: Consider taking partial profits at key resistance/support levels, or at a pre-determined risk-reward ratio, to lock in gains.

5. Trailing Stop-Loss: Utilize a trailing stop-loss to protect profits and allow the trade to run if the price moves favorably.

Practical Considerations

1. Backtesting: Backtest your order block trading strategy on historical data to assess its profitability and identify potential weaknesses.

2. Paper Trading: Practice order block trading with a demo account before risking real capital.

3. Consistency: Stick to your trading plan and avoid emotional decision-making.

4. Adaptability: The market is constantly evolving. Regularly review and refine your order block identification and entry techniques.

5. Patience: Order block trading requires patience. Don't force trades; wait for the right setups to appear.

Conclusion

Order block trading is a powerful strategy for identifying potential trading opportunities by understanding the behavior of institutional traders. Mastering this strategy requires careful analysis, confirmation techniques, disciplined risk management, and ongoing practice. By diligently applying the principles outlined in this guide, traders can significantly enhance their chances of success in the financial markets.

Good indicator can you make one for MT5 plus have a MTF feature. Where I can set which timeframe order block I want to show on chart while im on current timeframe? Add a alert feature when price trade into OB. Thanks.