Submit your review | |

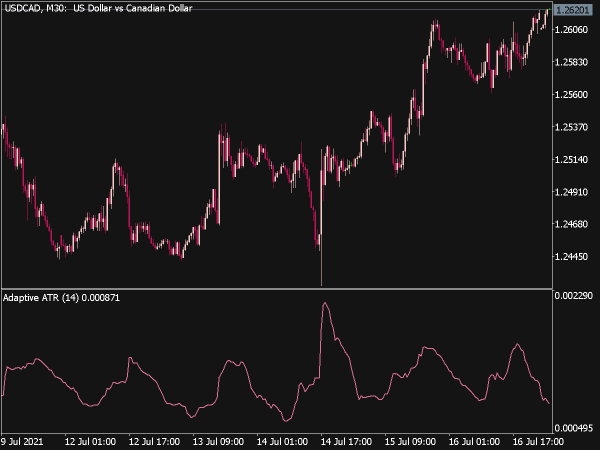

Average True Range (ATR) is a technical indicator which measures volatility of a market instrument. Volatility is the relative rate at which the price of a market instrument moves up and down. ATR was developed by J. Welles Wilder, Jr. in June 1978 for commodities but it can be applied in stocks, forex, futures. ATR by itself never produces buy or sell signals nor does it show trend direction or trend duration. It is a helping indicator for a well-tuned trading system. Actually ATR is an n-day exponential moving average of the true range values.

And when we say 'True Range', we do not mean just the difference between high and low. The calculation of true range extends to yesterday's closing price too. Here is the formula for true range:

True range = max (high, prev. close) – min (low, prev. close)

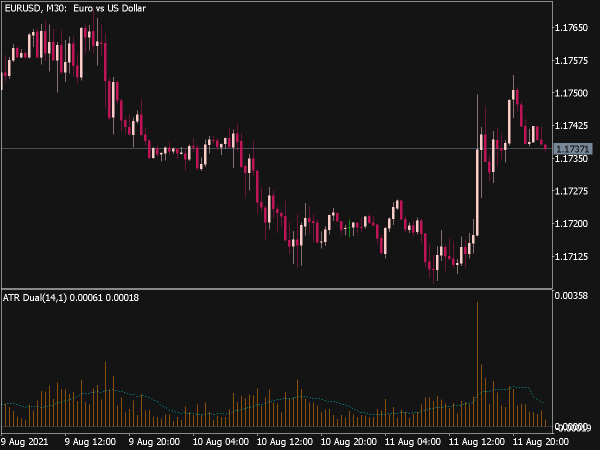

The involvement of the "previous close" in the formula calculates the today's range relative to yesterday's range. An n-day (Wilder recommended 14) exponential moving average is applied to the calculated true range and then ATR is plotted on the graph. We can change the value of "n" depending on our trading preferences. Bigger value of "n" means longer time frame, thus will be slower and will likely lead to fewer trading signals, while smaller value of "n" means shorter time frames will increase trading activity.

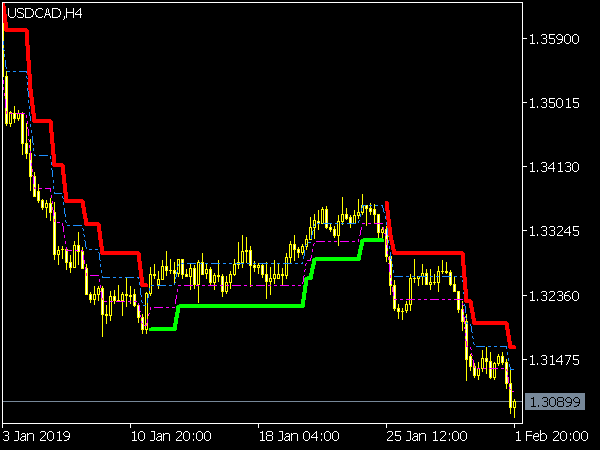

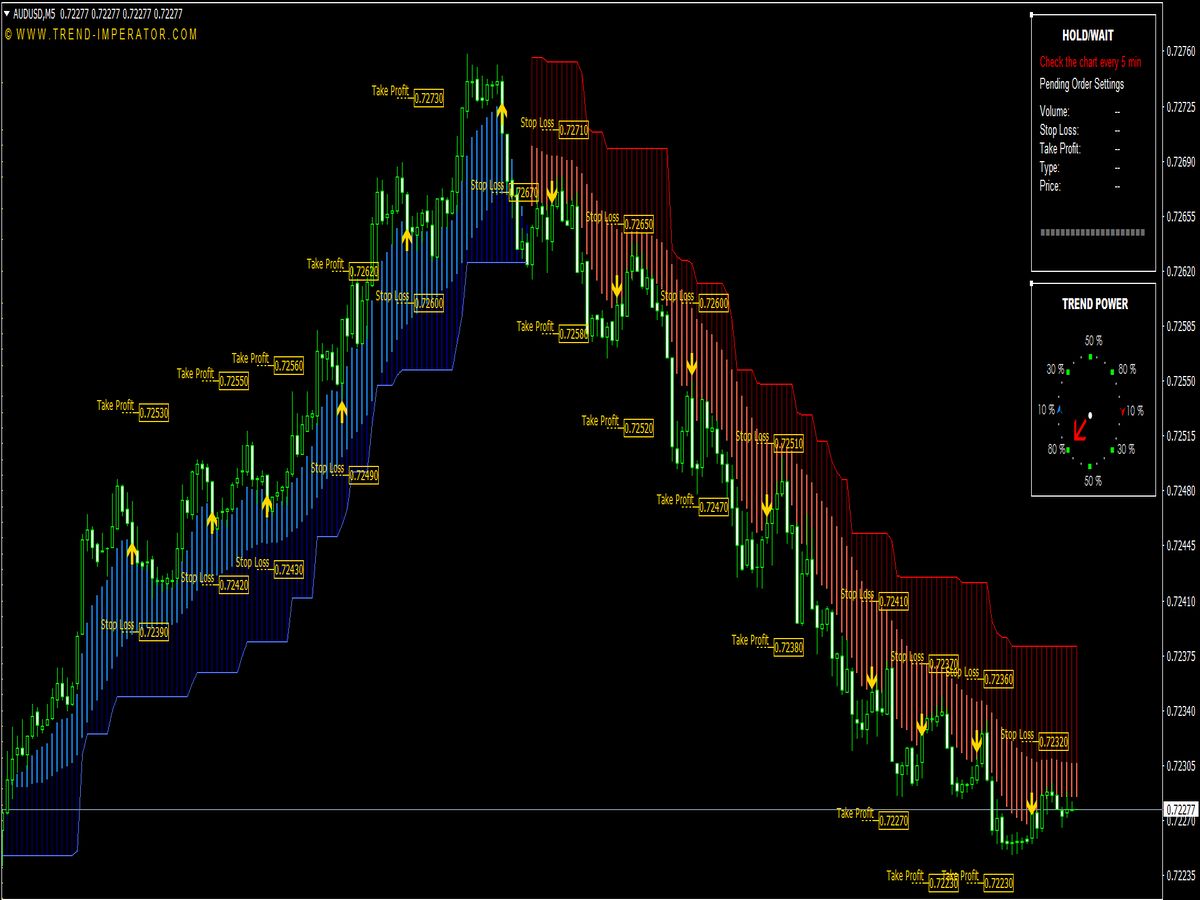

ATR can be used to recognize stop-loss levels, one way to put stop-loss using ATR would be for long trades, current ATR value is subtracted from the entry price which gives us our stop-loss and for short trades current ATR value is added to the entry price to get our stop-loss level.

Using ATR to put stop-loss makes much more sense because when the market is volatile, traders look for wider stop-losses in order to avoid being stopped out of the trading by some random market noise. And when the volatility is low, there is no reason to set wide stop-loss; traders then focus on tighter stop-losses in order to have better protections for their trading positions and accumulated profits.