Submit your review | |

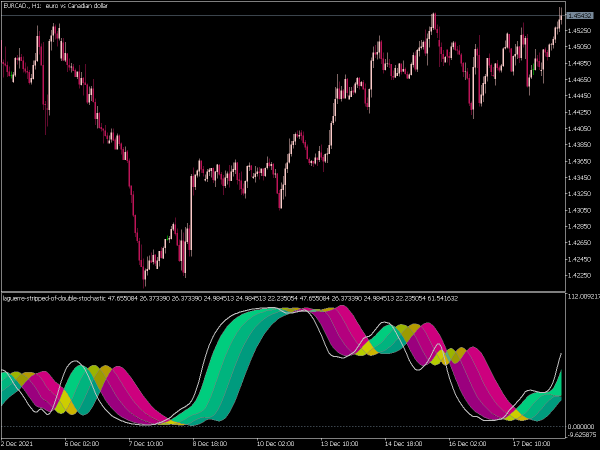

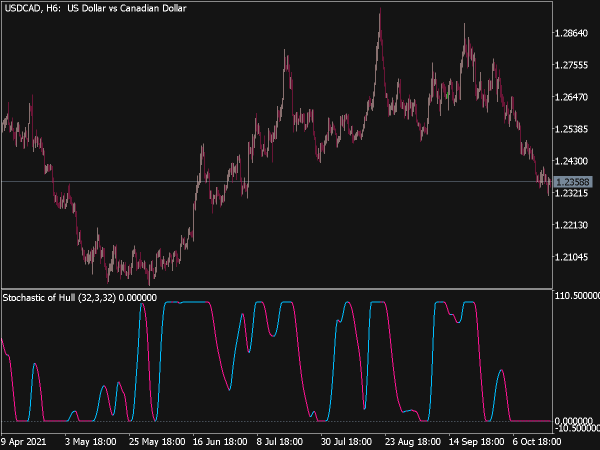

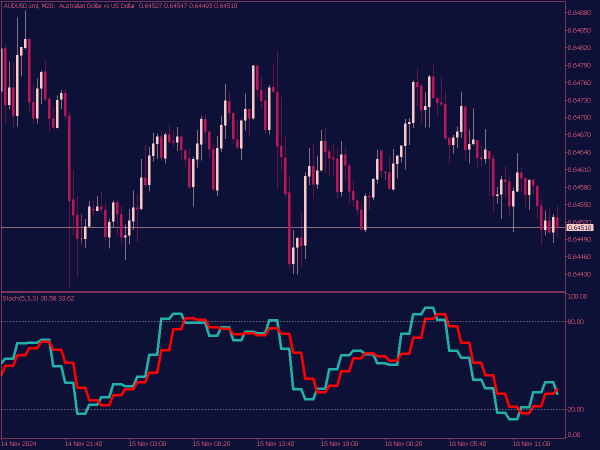

The Stochastic MTF (Multi-Time Frame) Indicator is a technical analysis tool that combines the Stochastic Oscillator with multiple time frames to provide traders with insights into market momentum and potential reversal points. By analyzing the Stochastic readings from different time frames (such as the daily, hourly, and 15-minute charts) traders can gain a more comprehensive view of price movements and identify confluences or divergences that may signal entry or exit points. This indicator helps traders make more informed decisions by integrating short- and long-term market trends.

Here is a comprehensive list of trading strategies:

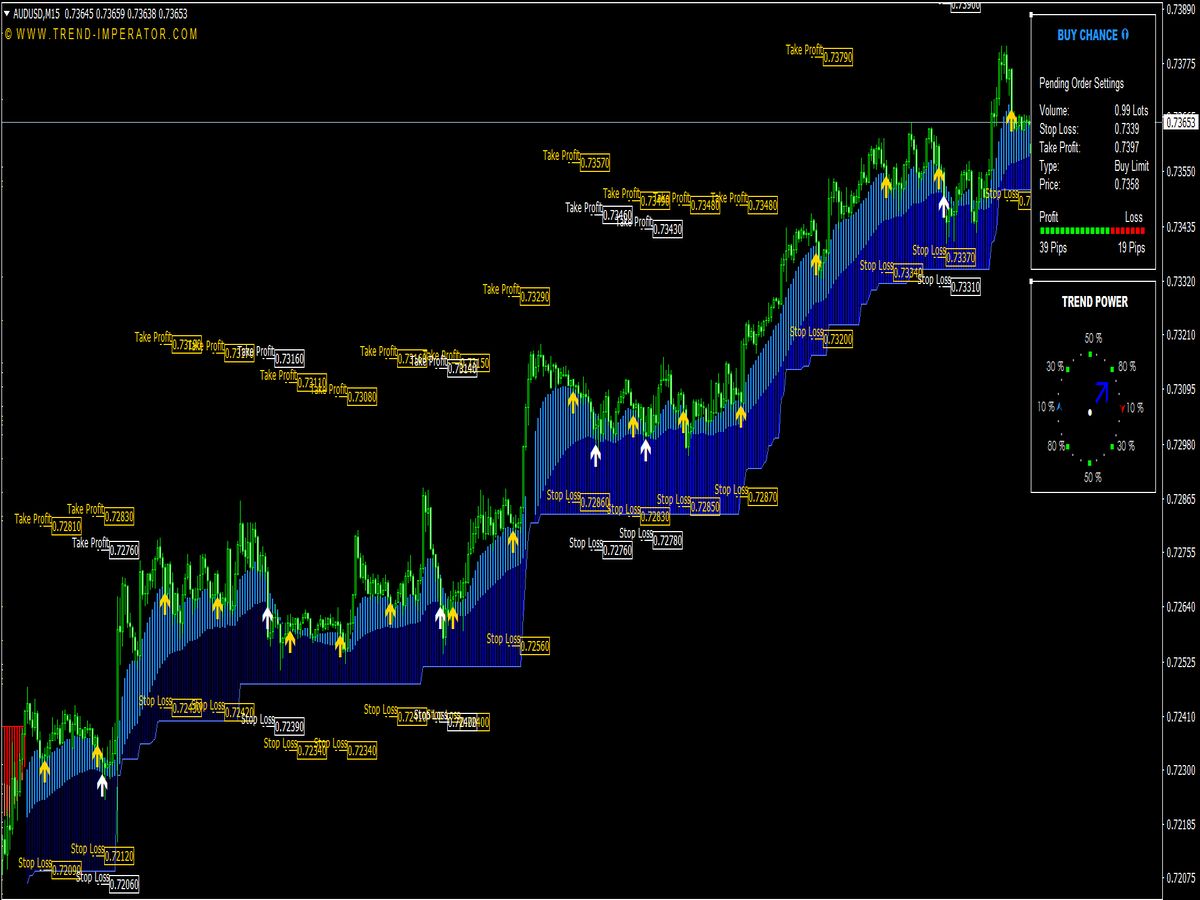

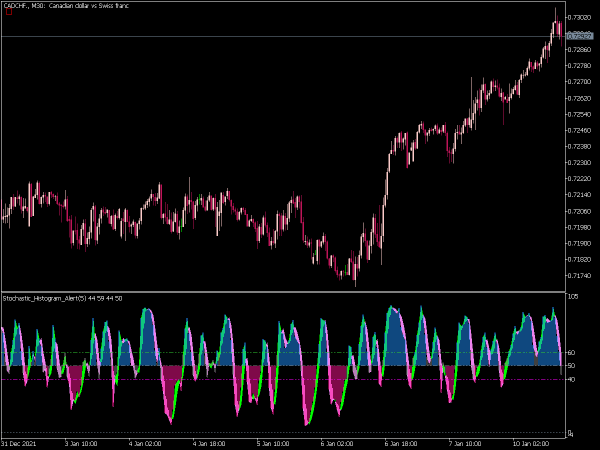

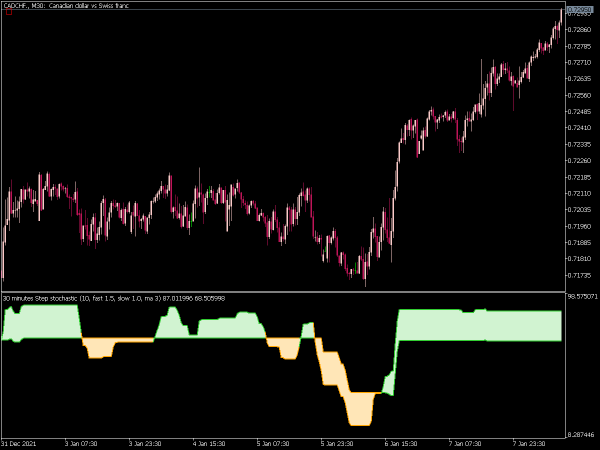

1. Trend Confirmation Strategy: This strategy incorporates the Stochastic indicator on multiple time frames (e.g., daily, four-hour, and hour charts) to confirm the prevailing market trend. Buy signals arise when the Stochastic is above 20 in both higher time frames and the lower time frame, indicating upward momentum. Conversely, sell signals emerge when the Stochastic is below 80 across these time frames, signaling downward movement.

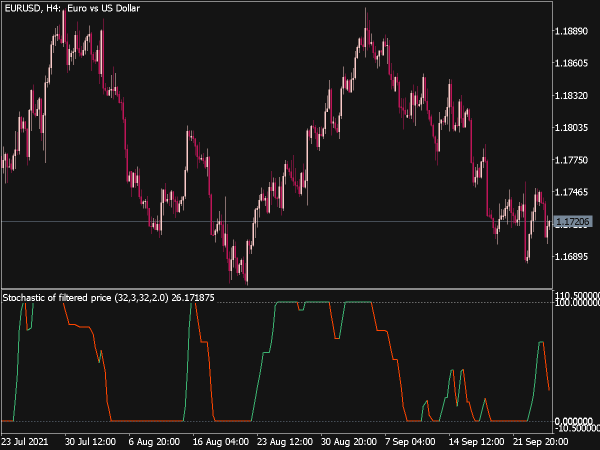

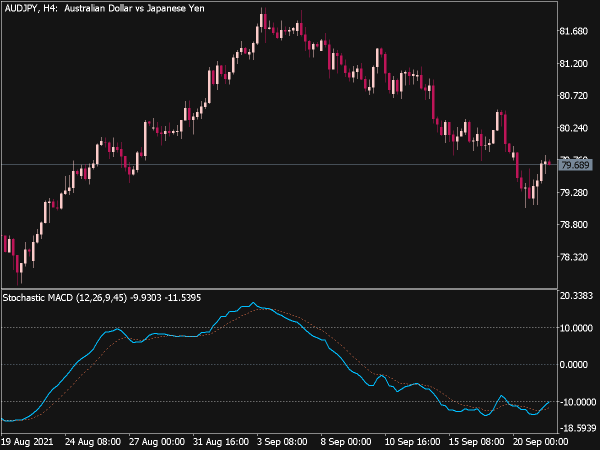

2. Divergence Trading: Traders look for divergences between price action and the Stochastic MTF. A bullish divergence occurs when the price makes lower lows while the Stochastic indicates higher lows, suggesting a potential reversal. Conversely, a bearish divergence happens when the price achieves higher highs while the Stochastic shows lower highs, hinting at a possible reversal to the downside.

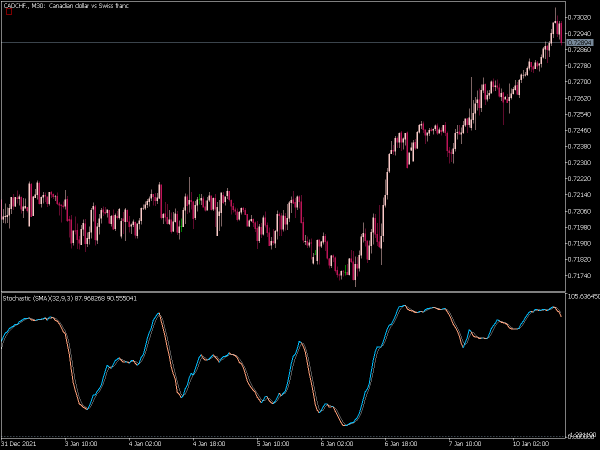

3. Cross-Over Strategy: This strategy uses the fast and slow lines of the Stochastic indicator on multiple time frames. A buy signal is generated when the fast line crosses above the slow line on a shorter time frame aligned with a bullish trend on a higher time frame. A sell signal occurs when the fast line crosses below the slow line while the higher time frame shows bearishness.

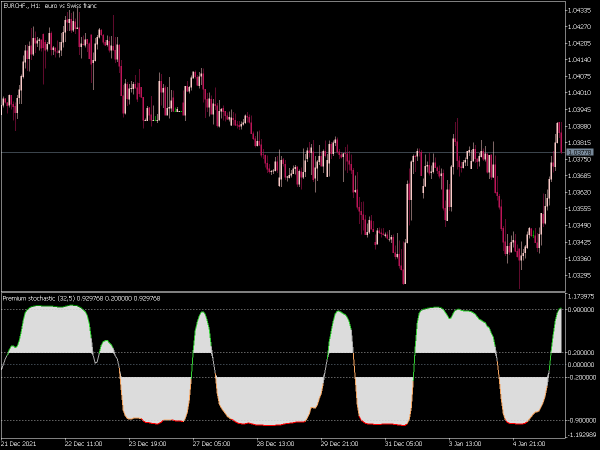

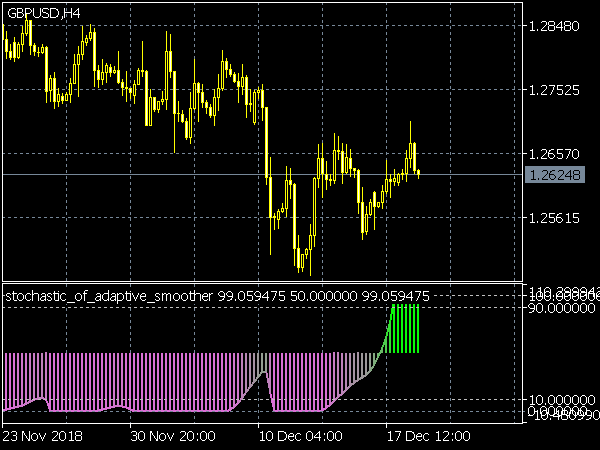

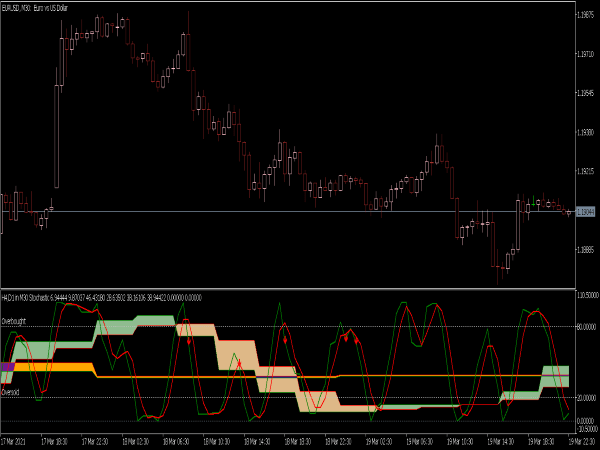

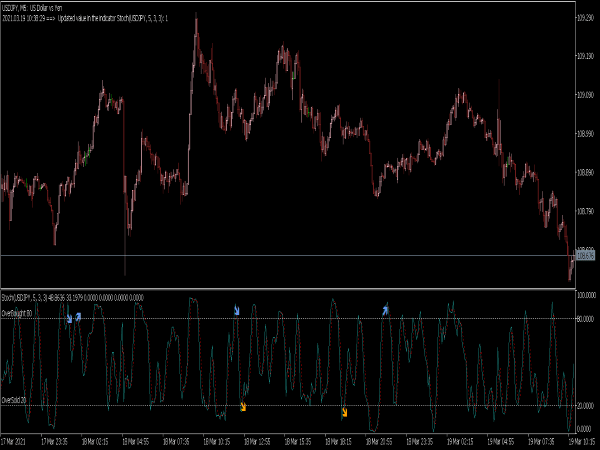

4. Overbought/Oversold Conditions: Implementing Stochastic MTF involves using overbought (>80) and oversold (<20) levels to indicate potential reversals. When the indicator enters the oversold zone on both the higher and lower time frames, buy opportunities are considered. Conversely, when it hits the overbought zone, traders might look to sell, especially if both time frames support the signal.

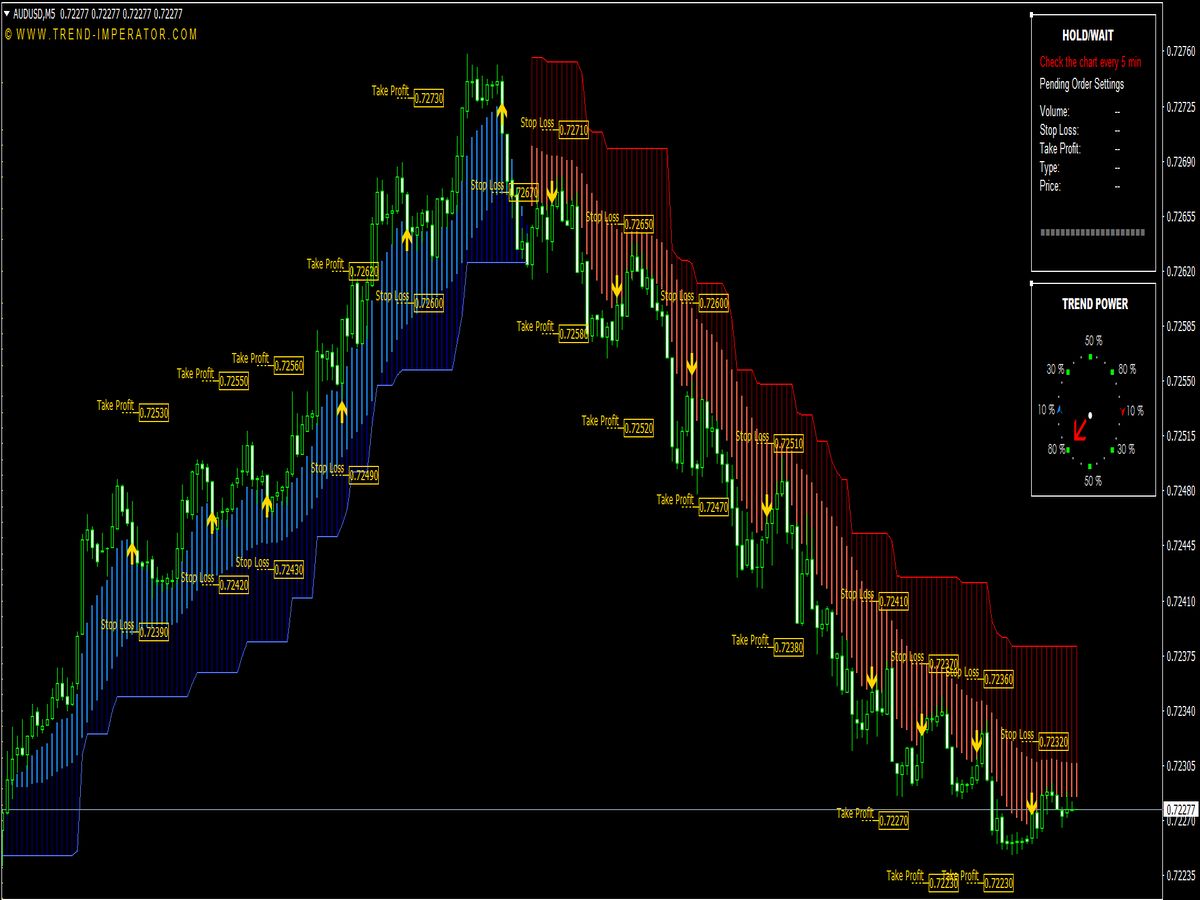

5. Breakout Strategy: Using the Stochastic to confirm breakouts is effective for trend continuation trading. Traders observe the Stochastic for momentum leading into a breakout. A breakout from a key resistance level confirmed by a rising Stochastic can signal a strong bullish move, while a confirmation of a breakout from support accompanied by a falling Stochastic suggests a bearish outlook.

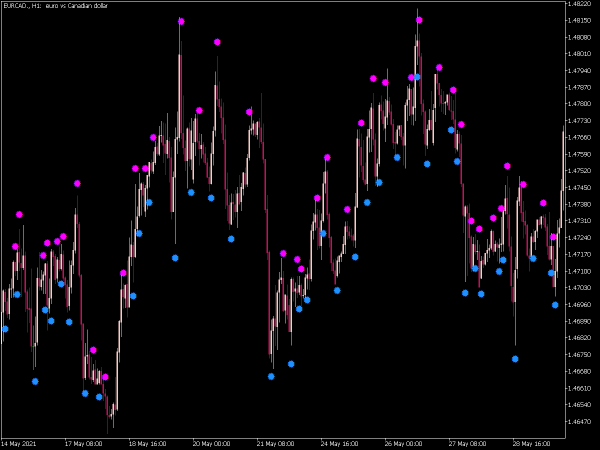

6. Reversal Patterns: Traders can utilize the Stochastic indicator in conjunction with chart patterns (like head-and-shoulders or double tops/bottoms). If the Stochastic confirms the pattern (such as oversold conditions at a double bottom), this can lend further credibility to the trade setup.

7. Range Trading Strategy: In sideways markets, the Stochastic can assist in identifying range-bound trading opportunities. Traders can buy when the Stochastic drops below 20 and sell when it rises above 80, ideally confirming multiple time frames align with these signals.

8. Moving Average Confluence: Enhance Stochastic MTF strategies by integrating moving averages. Enter buy positions when both the Stochastic is in the oversold region (below 20) and the price is above a longer-term moving average. Reverse the setup for sell positions (overbought and below the moving average).

9. Time Frame Alignment: Ensure alignment of signals across multiple time frames, looking for the Stochastic to provide a consistent narrative. For example, a buy signal on the daily chart that coincides with bullish signals on the four-hour and hourly charts can enhance the probability of a successful trade.

10. Stop Loss and Take Profit: Establish clear risk management rules, placing stop losses just below the most recent swing low for buys and above the swing high for sells, while taking profits at predefined resistance/support levels or using a trailing stop strategy as the trade moves in your favor.

When implementing these stochastic MTF strategies, it is crucial to backtest them in different market conditions and remain patient for high-probability setups. Additionally, consider combining stochastic indicators with other technical analysis tools, such as RSI or Fibonacci retracements, to enhance decision-making and improve overall trading performance.