Submit your review | |

Reversal trading strategies aim to exploit moments when the price of a security shifts direction, signaling a potential reversal point after a trend. Here’s a comprehensive list of strategies and tips for effective reversal trading:

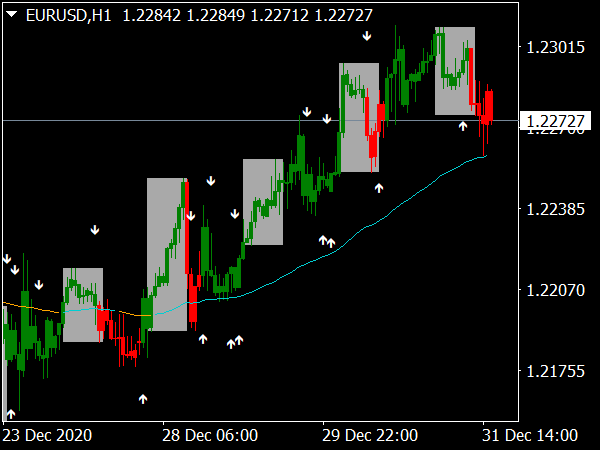

1. Identify Trends: Begin by thoroughly analyzing the market to identify prevailing trends. Look for prolonged uptrends or downtrends, as reversal strategies typically work best when there's significant price movement.

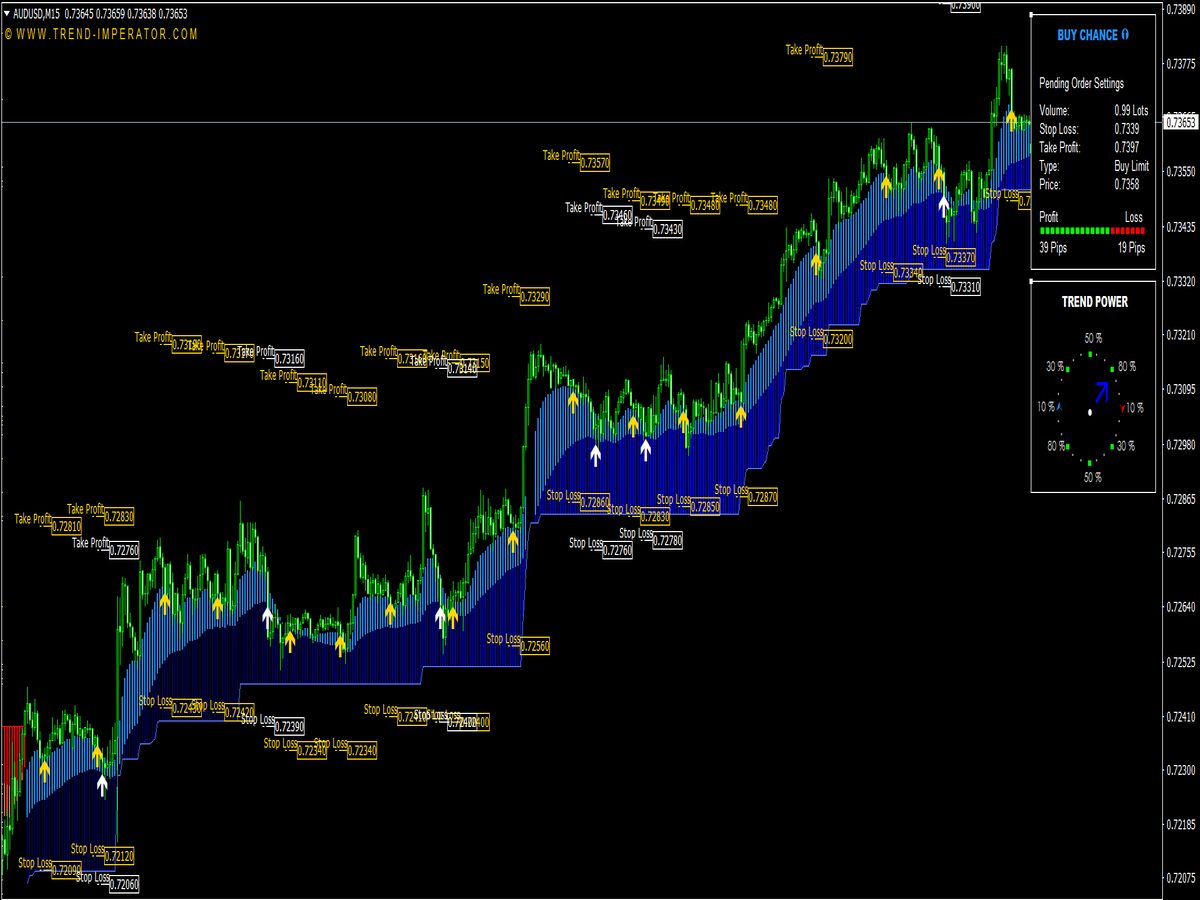

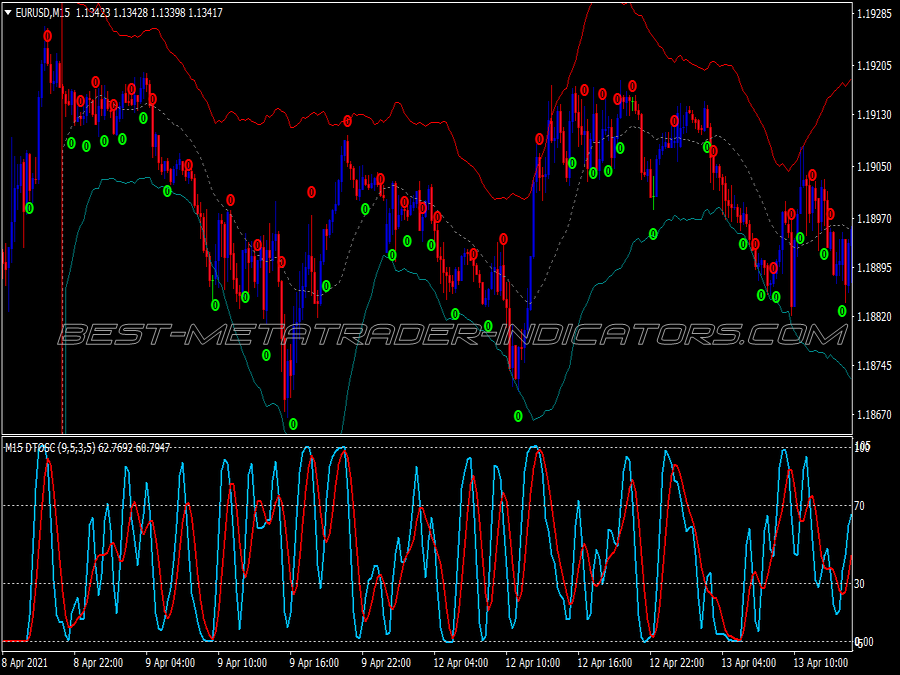

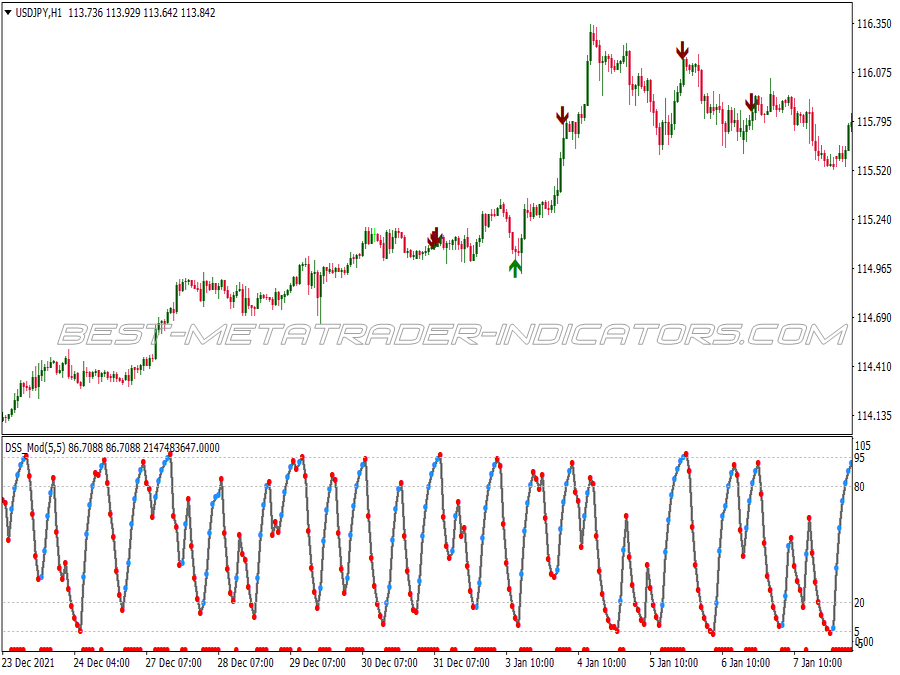

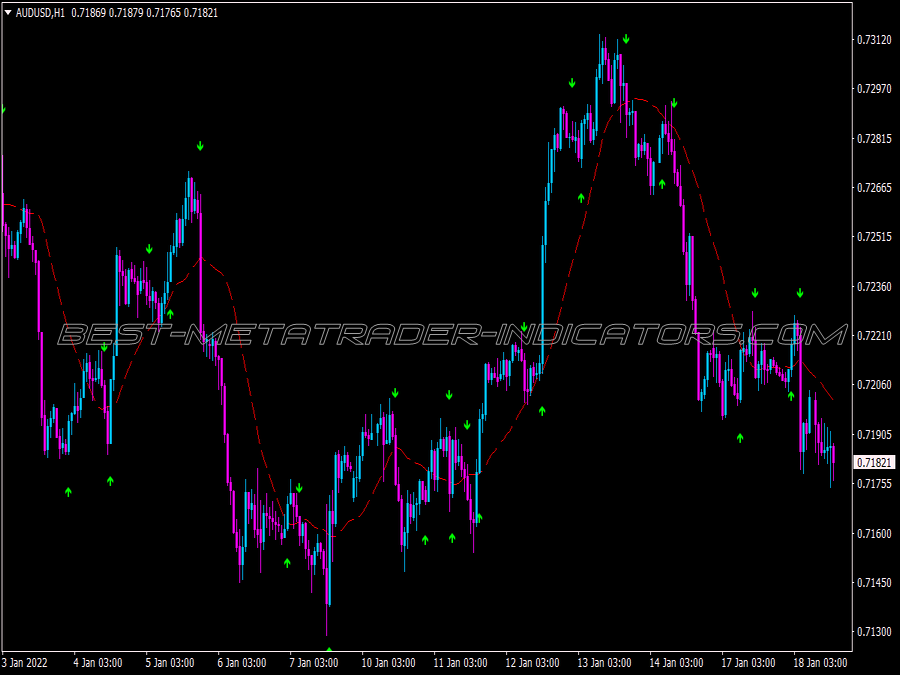

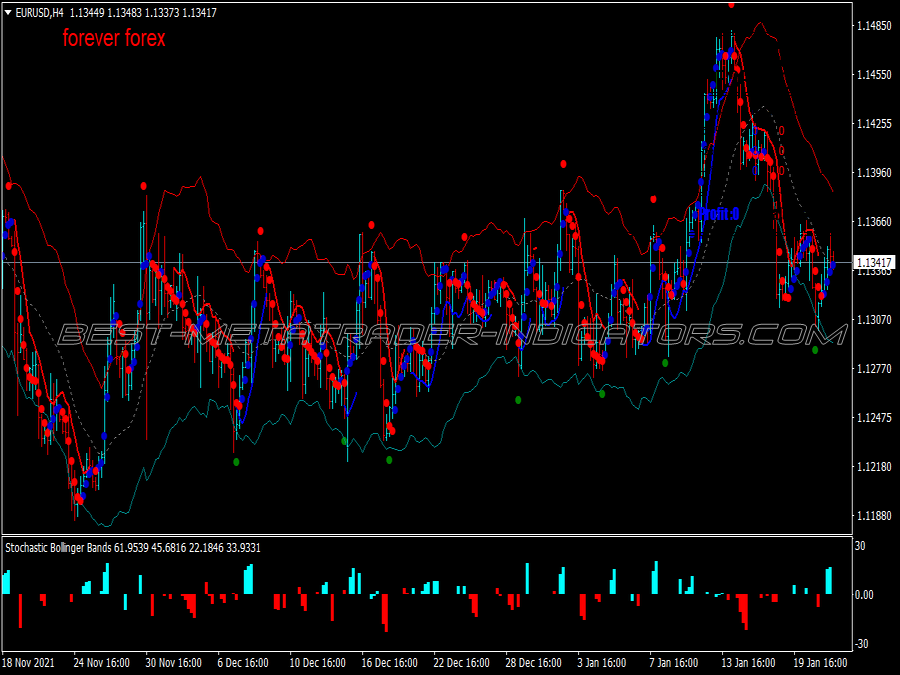

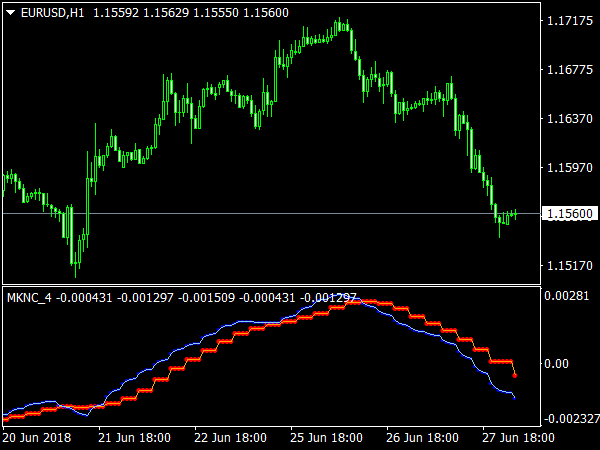

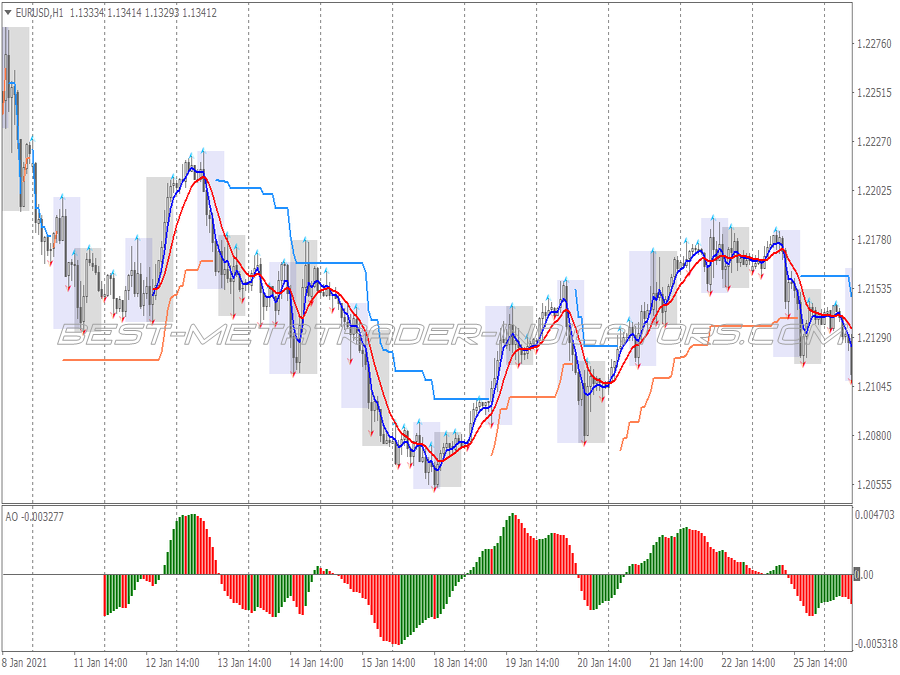

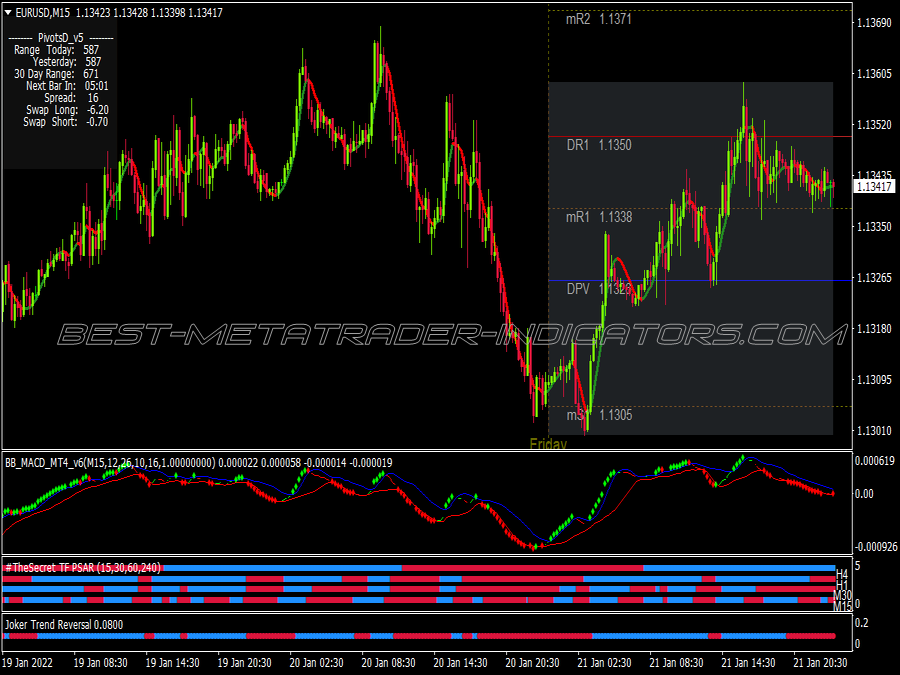

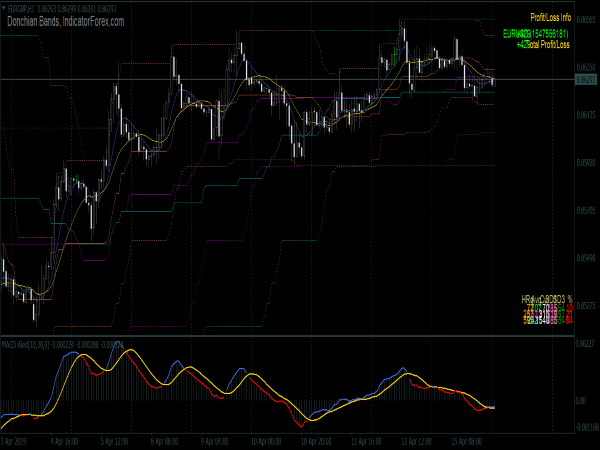

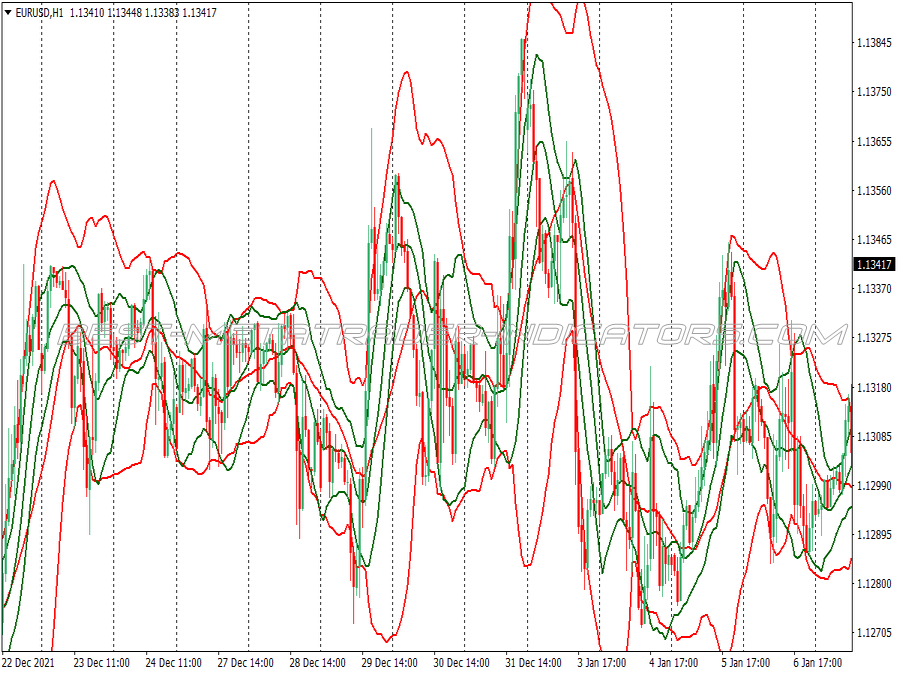

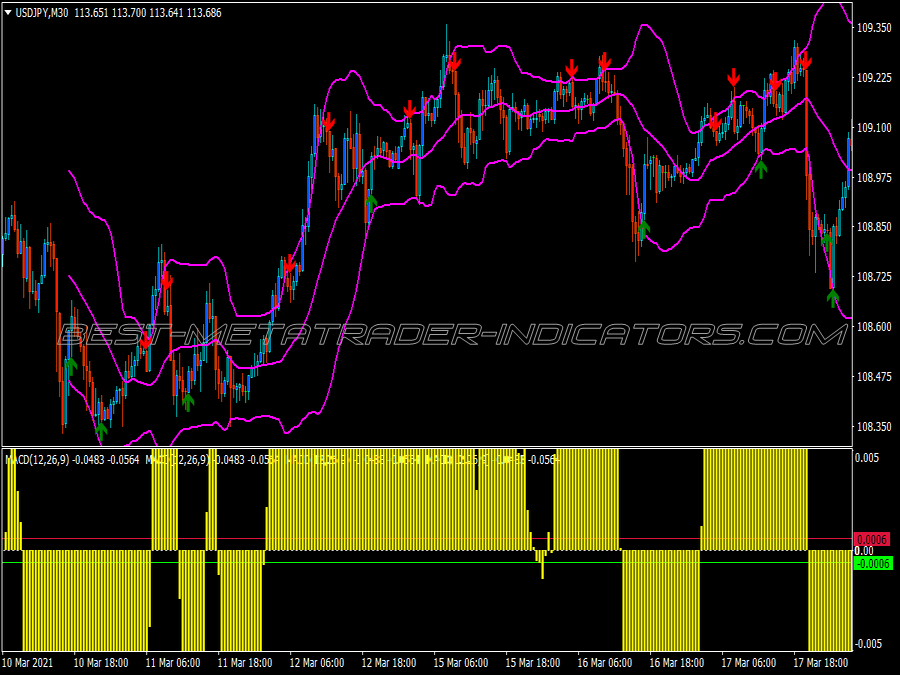

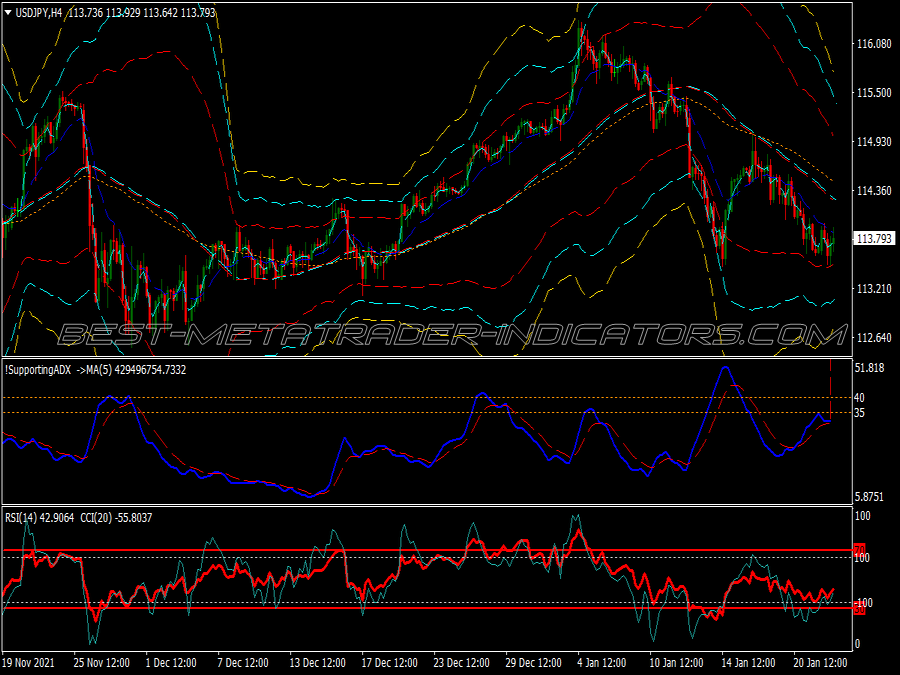

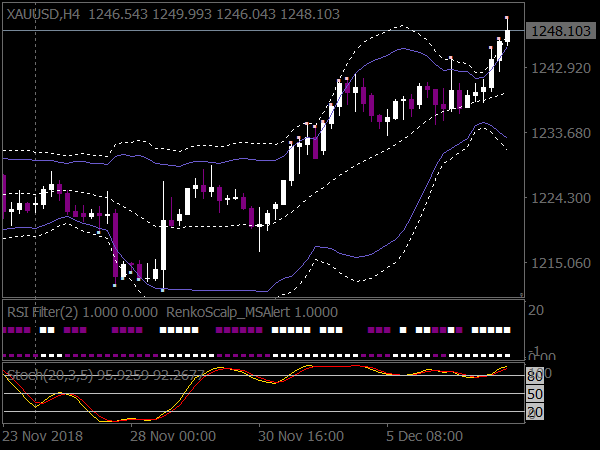

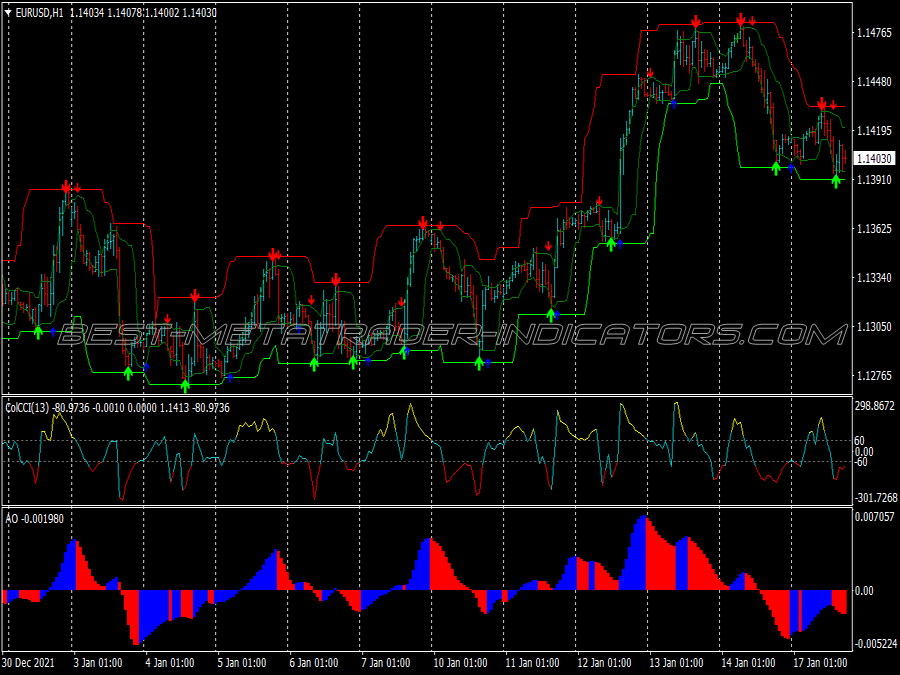

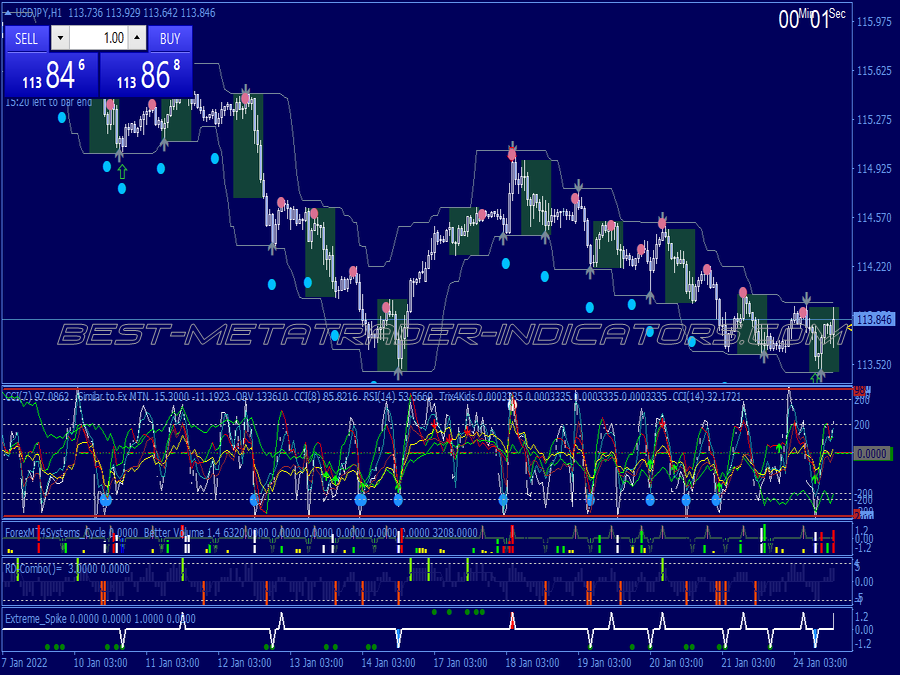

2. Use Technical Indicators: Implement indicators such as the Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD) to gauge overbought or oversold conditions. An RSI above 70 may indicate a reversal in a bullish trend, while below 30 suggests a bearish shift.

3. Candlestick Patterns: Study candlestick patterns like Doji, Hammer, and Engulfing patterns. These formations can signal potential reversals when they appear at key support or resistance levels.

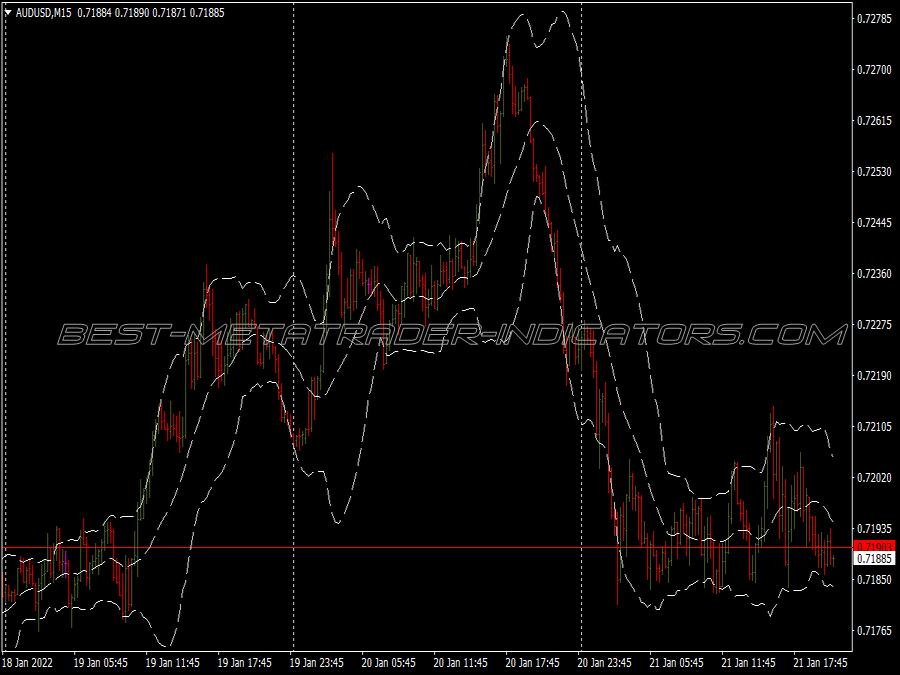

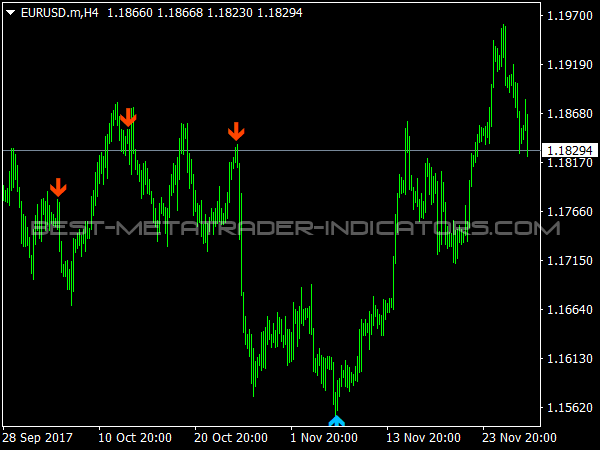

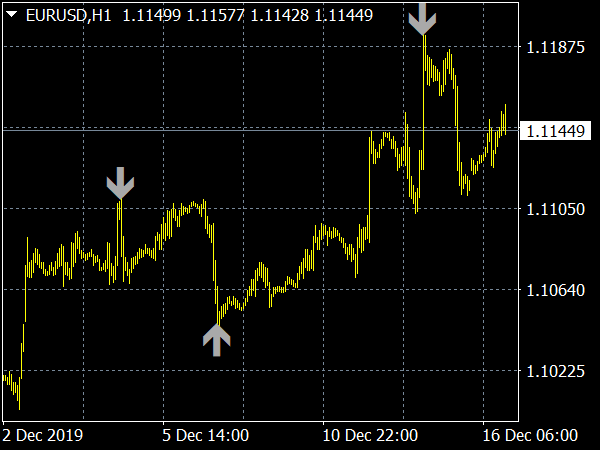

4. Support and Resistance Levels: Identify strong support and resistance levels on the chart. Price typically reverses at these levels, providing ideal entry and exit points for traders.

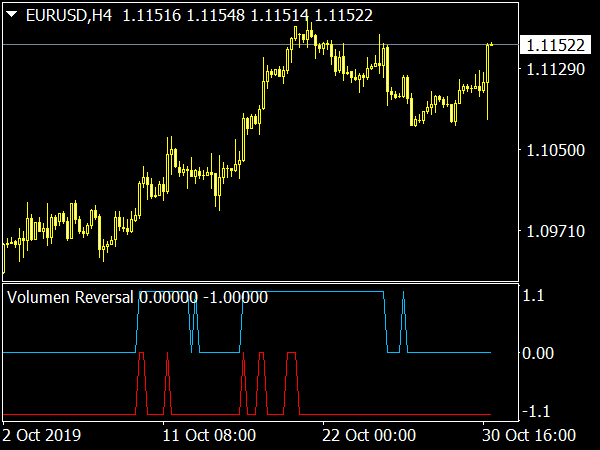

5. Volume Analysis: Monitor trading volume closely. A reversal accompanied by strong volume indicates increased conviction in the move, enhancing the probability of a successful trade.

6. Divergences: Look for divergences between price movement and indicators like RSI or MACD. For example, when prices set new highs while the indicator fails to, it may signal an impending reversal.

7. Market Sentiment Analysis: Gauge market sentiment through news, economic indicators, and social media. Often, reversal trends coincide with shifts in investor sentiment, allowing traders to position themselves ahead of price changes.

8. Fundamental Analysis: Incorporate fundamental analysis to identify underlying factors affecting price. Sudden changes in earnings reports, economic data, or market conditions can lead to reversals.

9. Timeframes: Experiment with different timeframes. Short-term traders may focus on minute or hourly charts, while longer-term traders analyze daily or weekly charts to identify potential reversal points.

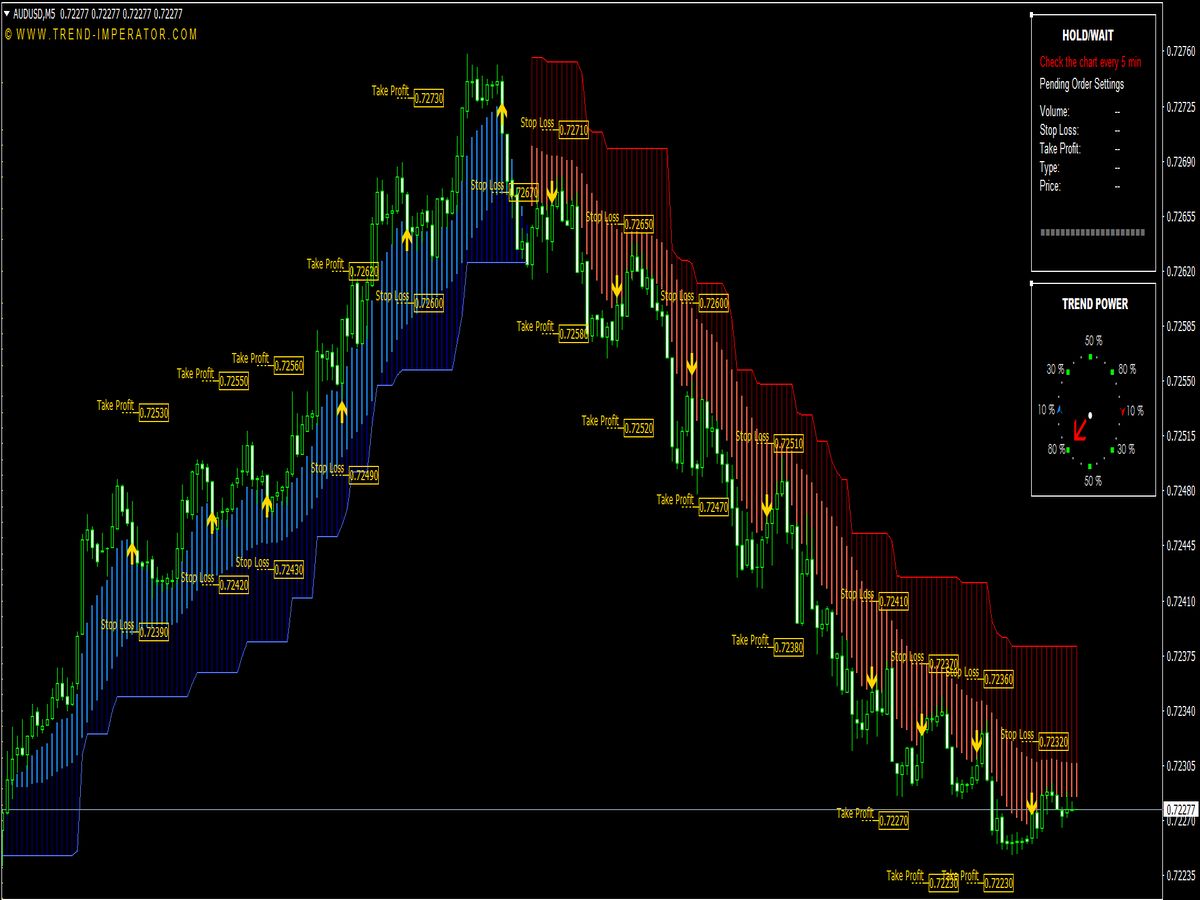

10. Place Stop Loss Orders: Implement stop-loss orders to manage risk. Set them just below support (for bullish reversals) or above resistance (for bearish reversals) to protect against unexpected price movements.

11. Take Profit Targets: Determine exit targets based on key support or resistance levels, or use a risk-reward ratio to set profit targets that justify your risk.

12. Be Cautious with News Events: Be wary of trading during major news events, as volatility can lead to unexpected price behavior that may trigger stop losses or lead to false signals.

13. Combine Strategies: Use a combination of different strategies. Pair technical analysis with fundamental insights, or use multiple technical indicators to confirm reversal signs.

14. Journaling: Maintain a trading journal to track your reversal trades, noting what worked and what didn’t. Analyzing past trades helps refine your strategy and improve future performance.

15. Emotional Discipline: Stay disciplined and avoid emotional trading. Stick to your plan and avoid chasing prices. Emotional reactions can lead to poor decision-making and increased risk.

16. Practice Risk Management: Never risk more than a small percentage of your trading capital on a single trade. Effective risk management helps protect your account from significant losses.

17. Adapt to Market Conditions: Be flexible and adapt your strategy as market conditions change. Reversal patterns that work in a trending market may not perform well in a sideways market.

18. Continuous Learning: Stay informed about new strategies and market conditions. The financial markets are always evolving, and successful traders keep learning and adapting.

19. Use Algorithmic Trading: Consider using algorithmic trading systems, which can help identify and execute trades based on predefined criteria and reduce emotional bias.

20. Patience is Key: Finally, exercise patience. Reversal trading can involve waiting for the right setups, and jumping in too early can lead to losses. Wait for confirmation before placing trades.

In conclusion, successful reversal trading requires a blend of technical analysis, risk management, and emotional discipline. By employing these strategies and tips, traders can improve their chances of identifying and profiting from market reversals.