Submit your review | |

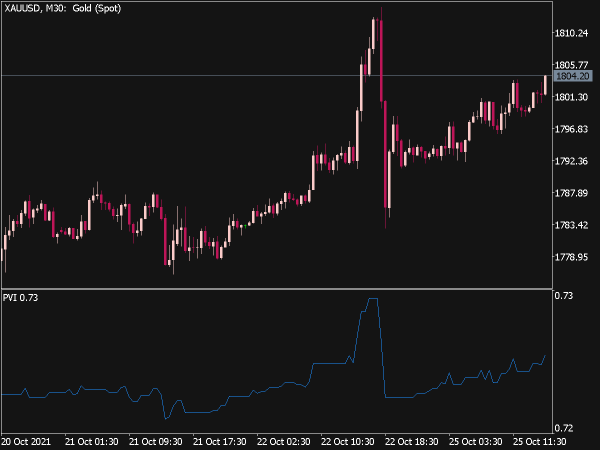

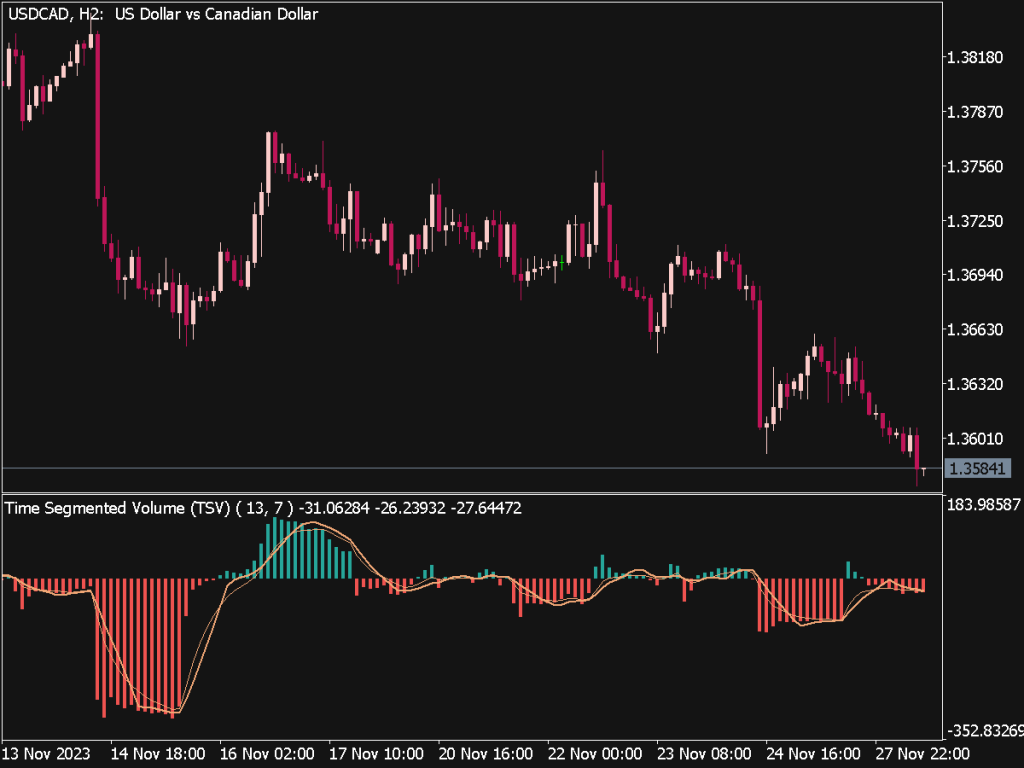

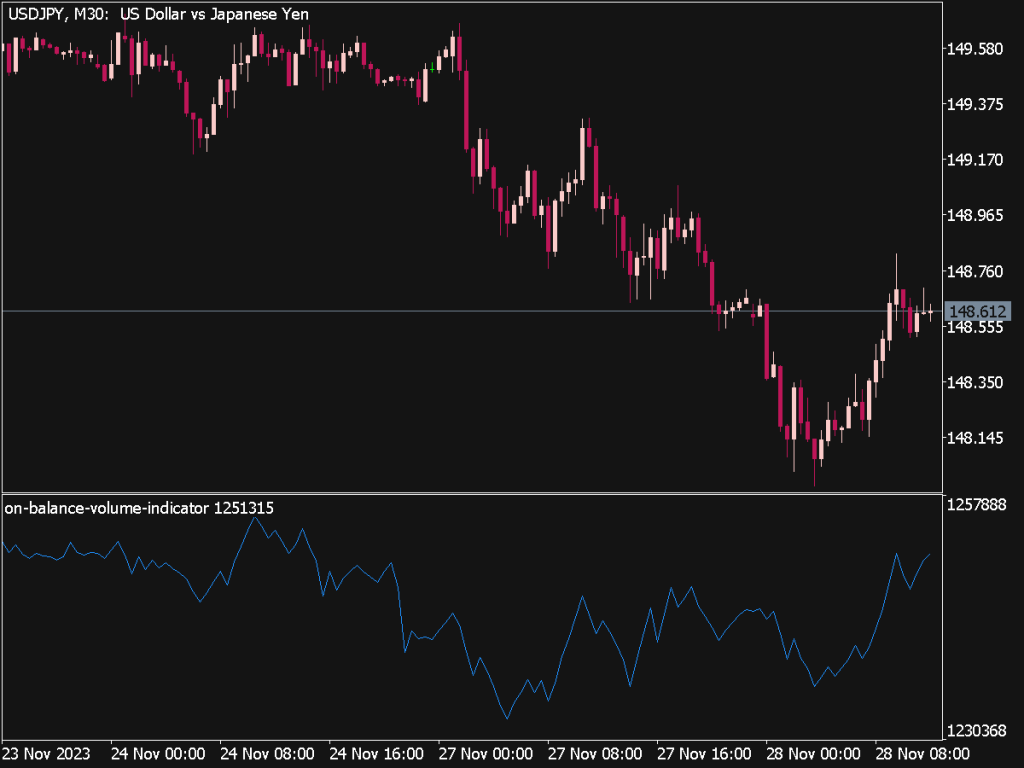

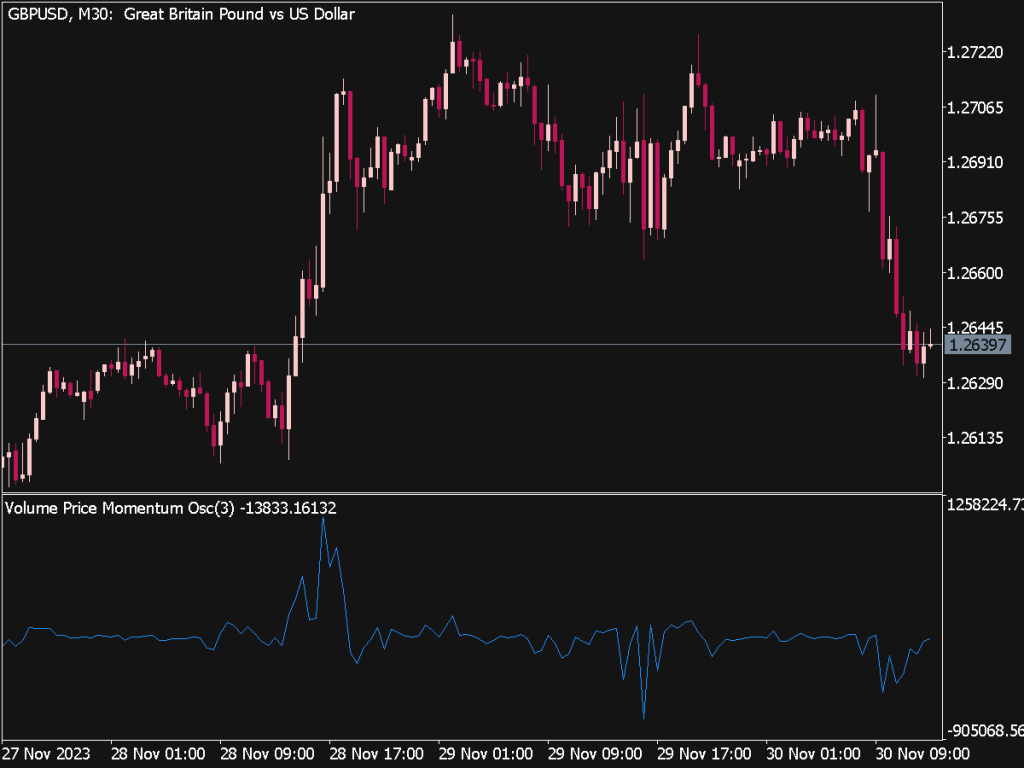

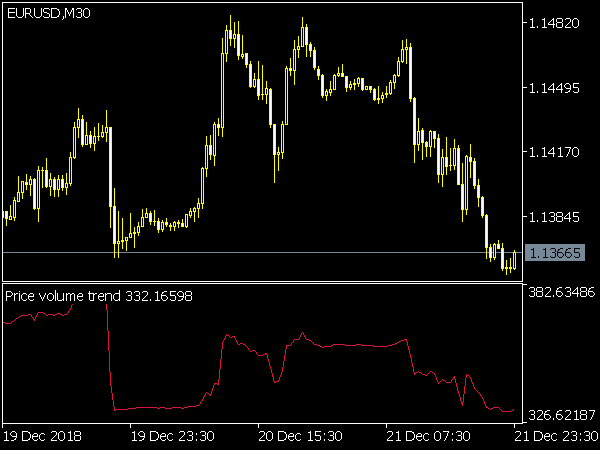

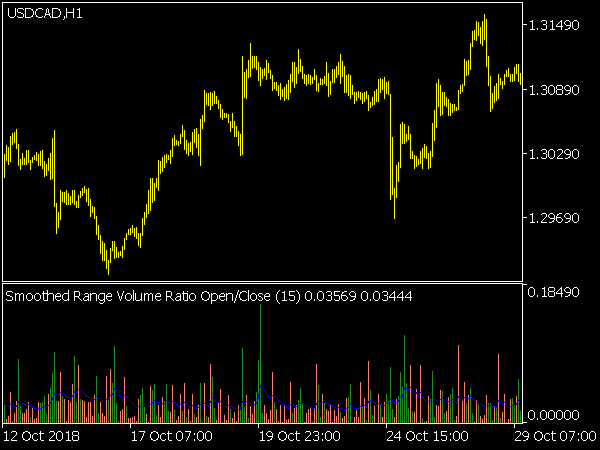

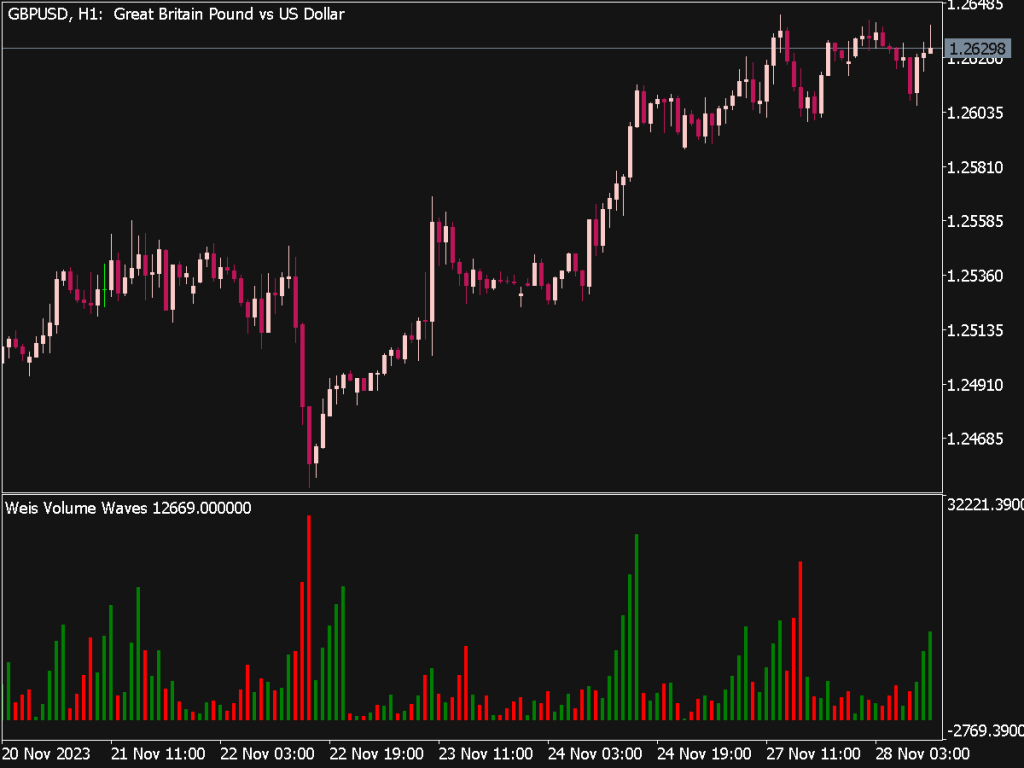

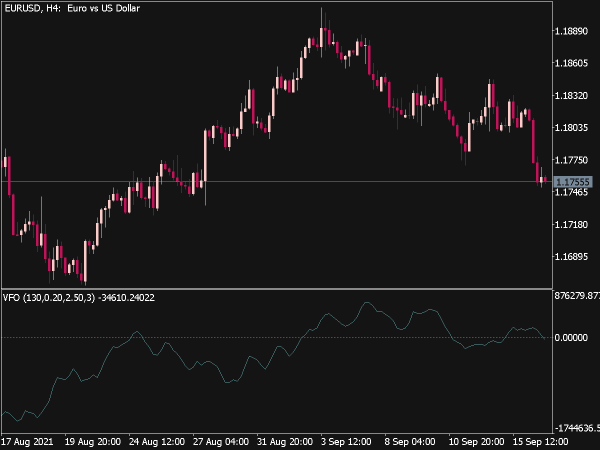

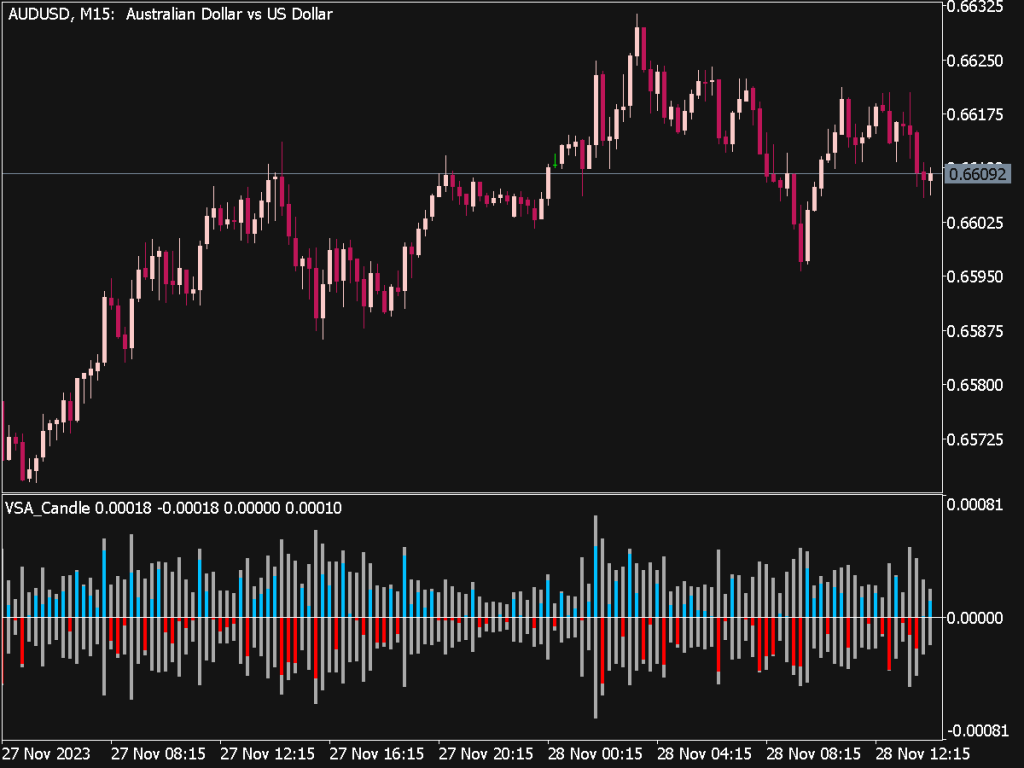

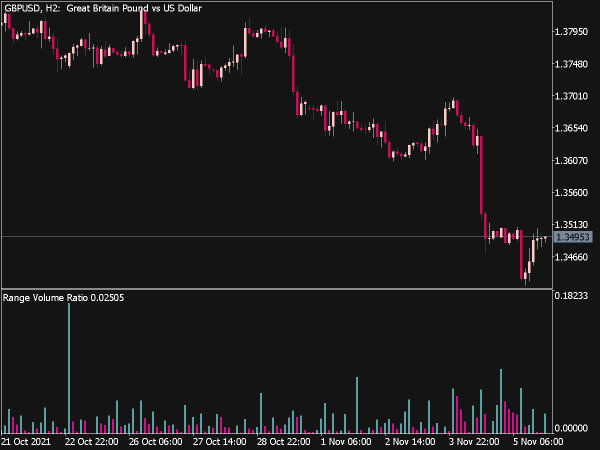

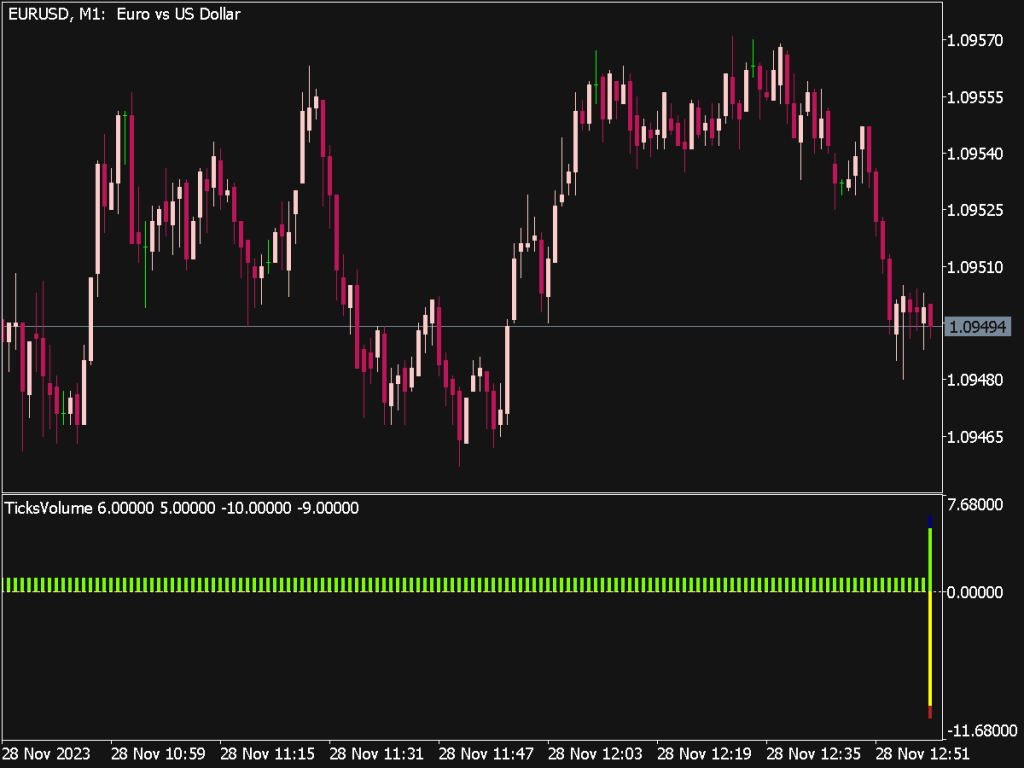

The Tick Volume Indicator is a powerful analytical tool used by traders to understand market activity by measuring the number of price ticks (up or down) within a specific timeframe rather than the conventional trading volume. Unlike traditional volume indicators that may reflect the number of shares traded, the Tick Volume provides insights into market sentiment and potential price movements based on how frequently prices change, offering a clearer picture in markets where actual volume data may be less accessible.

Benefits of Tick Volume Indicator

1. Market Sentiment Insights: Provides an indication of the strength of price movements. High tick volume during a price rise suggests strong buying interest.

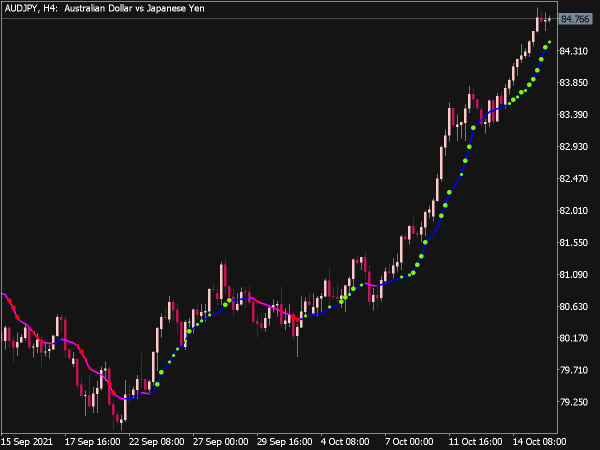

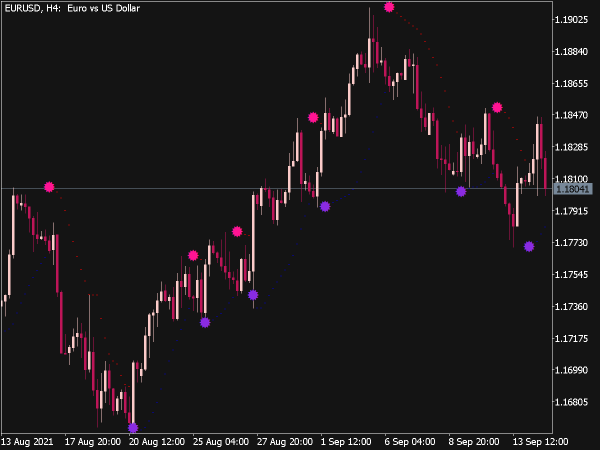

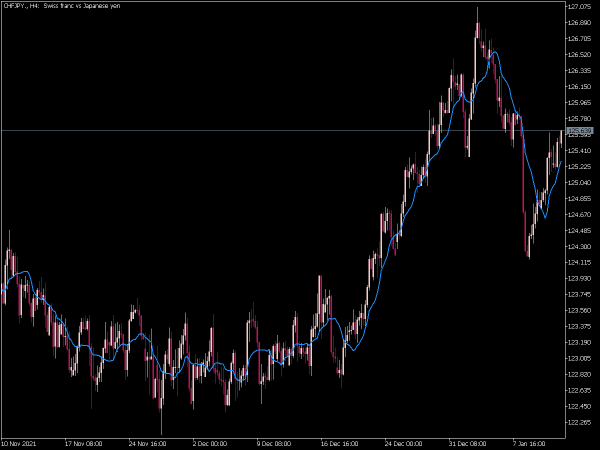

2. Trend Confirmation: Helps confirm existing trends by correlating price movements with tick volume fluctuations.

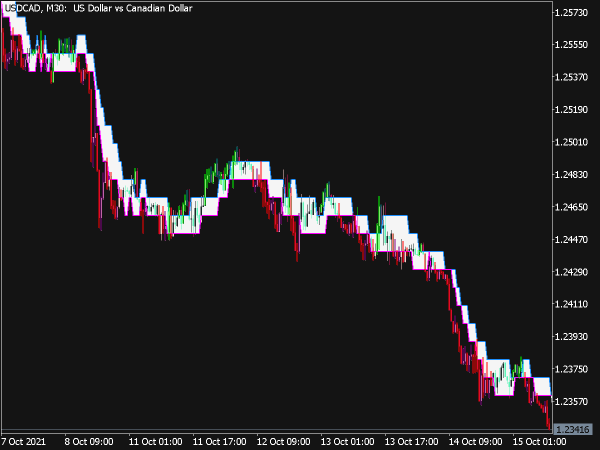

3. Useful in Low Volume Markets: Particularly effective in Forex and cryptocurrency markets where traditional volume data may not be reliably available.

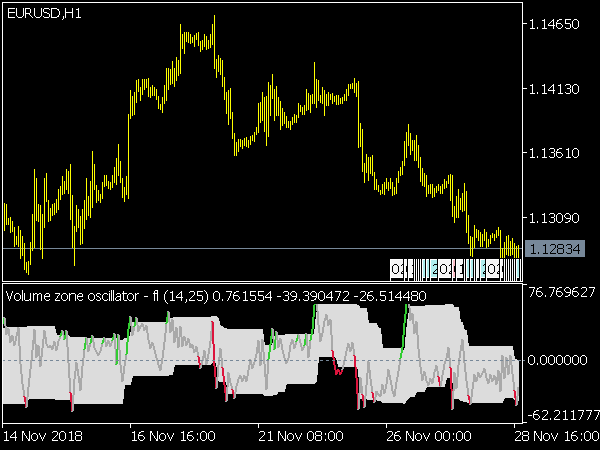

4. Divergence Analysis: Allows traders to spot divergences between price trends and tick volumes, signaling potential reversals or consolidations.

5. Noise Reduction: Offers a clearer indication of price movement by filtering out misleading signals that can occur in low-volume times.

Tips for Using the Tick Volume Indicator

1. Combine with Other Indicators: Use tick volume alongside other technical indicators (e.g., RSI, MACD) for better decision-making.

2. Set Appropriate Time Frames: Adjust the tick volume indicator to different time frames based on your trading style (day trading vs. swing trading).

3. Monitor Market Conditions: Be aware of news events or major announcements that could impact tick volume and market movement.

4. Identify Breakouts: Look for significant increases in tick volume during price breakouts to confirm the strength of the breakout.

5. Volume Spikes: Watch for sudden spikes in tick volume that may indicate a potential reversal or continuation of a trend.

6. Analyze Historical Data: Backtest tick volume against historical price movements to understand its effectiveness in various market scenarios.

7. Use Trendlines: Draw trendlines based on tick volume changes to help visualize potential support and resistance areas.

8. Keep an Eye on Trends: Continuously monitor tick volume trends. Consistent growth or decline can signal underlying market changes.

9. Adopt a Risk Management Strategy: Always implement a solid risk management strategy; high tick volume does not guarantee profit.

10. Practice Patience: Allow for small corrections and fluctuations instead of acting impulsively on every tick volume change.

By leveraging the Tick Volume Indicator, traders can gain valuable insights into market dynamics, improve their trading strategies, and make more informed decisions.