Submit your review | |

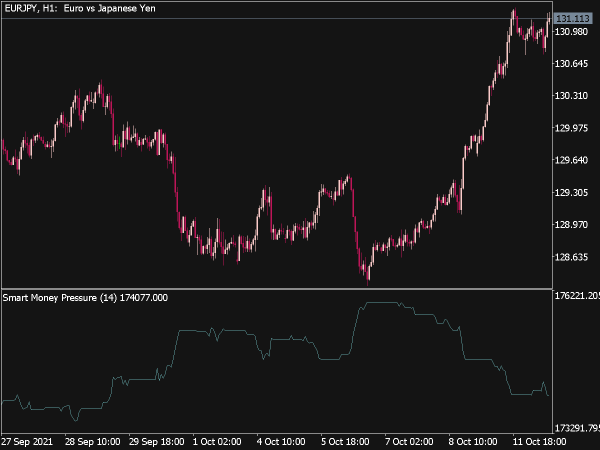

You determine the net change of the Dow for the first hour and multiply it by -1. Then you determine the net change of the last hour, this is added unchanged to the initially found value. The values are added continuously, so it is a summation index.

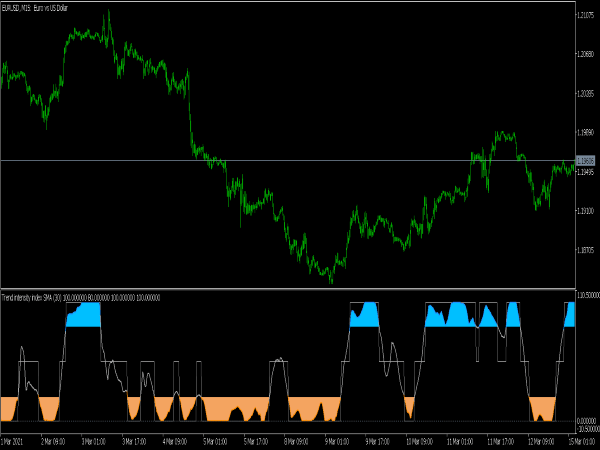

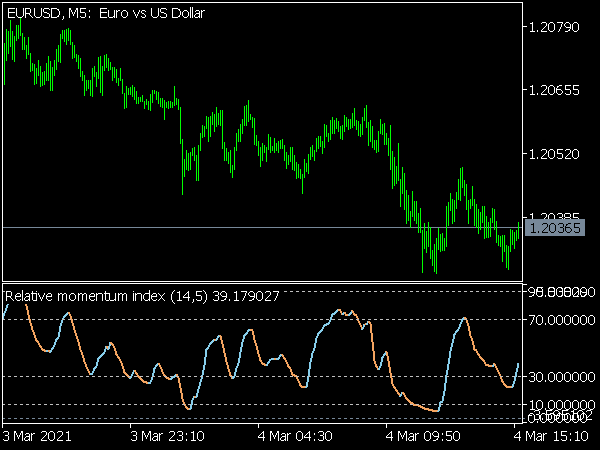

In the idea pursued here, however, this is not used, but only the value for one day: if the daily result is greater than 20, you go to the buyer's side the following day, it is below 20, to the seller's side. On average, there are four to five signals per month.

Trading Rules

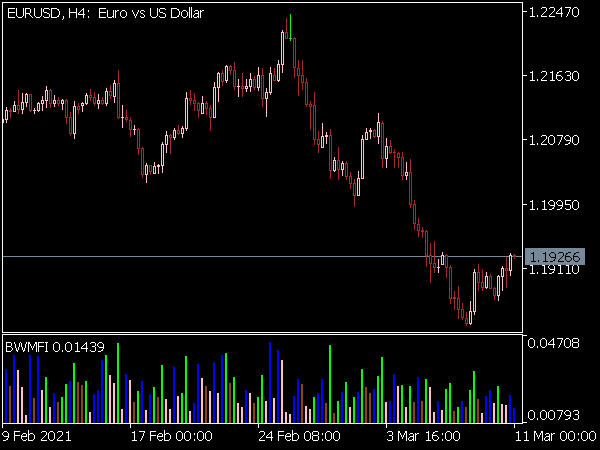

The smart money index was originally used for longer-term trading, that is, for the accumulated sum to identify longer-term tops and bottoms. The idea is that the change of the last hour is determined by professionals, while in the first half the wide audience can be chased into the box horn.

In general, it is the case that, regardless of this index, one should follow the movements of the last hour and one should beware of emotionally motivated wrong decisions in the first. As for the one-day values in the index, the higher the value, the more likely a trend reversal is.

Tip

Although the Smart Money index was developed for the Dow, it is not a typical stock market indicator. It works in all markets where the funds have a strong influence. Since these essentially determine the last hour and in the short term also the direction of the stock market or the market where they operate, although in the longer term they are of course wrong.