Submit your review | |

The MACD (Moving Average Convergence Divergence) Divergence Indicator is a popular tool among traders for identifying potential trend reversals in the market. This guide will explore how to utilize MACD divergence effectively, offering tips and strategies for maximizing your trading success.

Understanding MACD Divergence

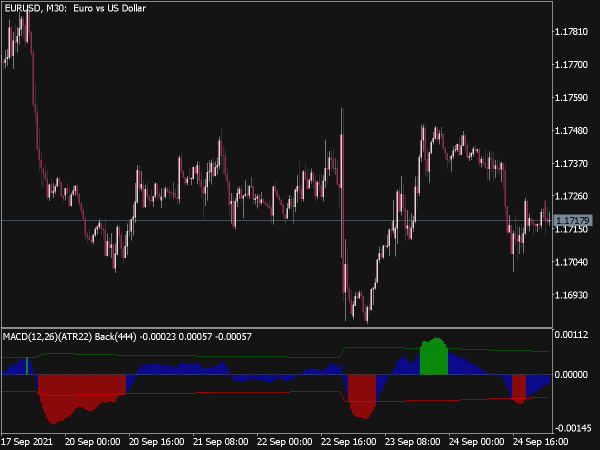

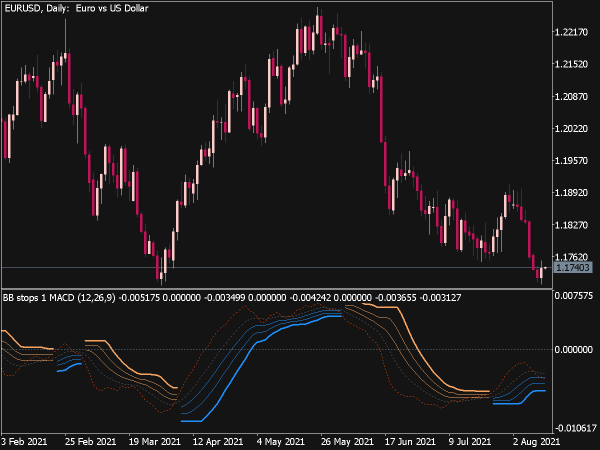

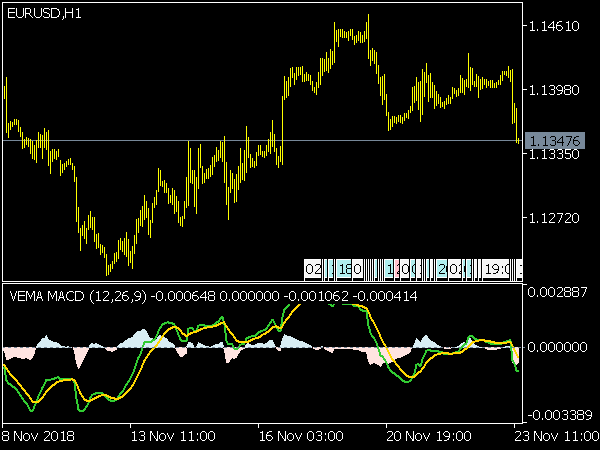

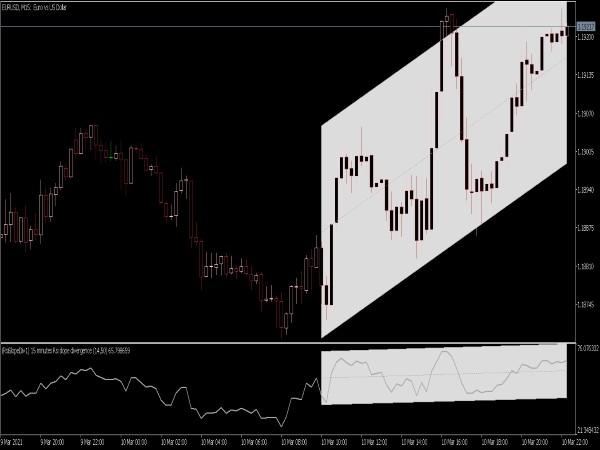

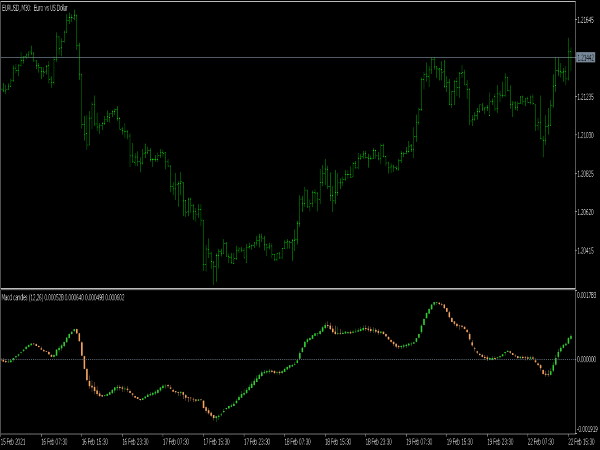

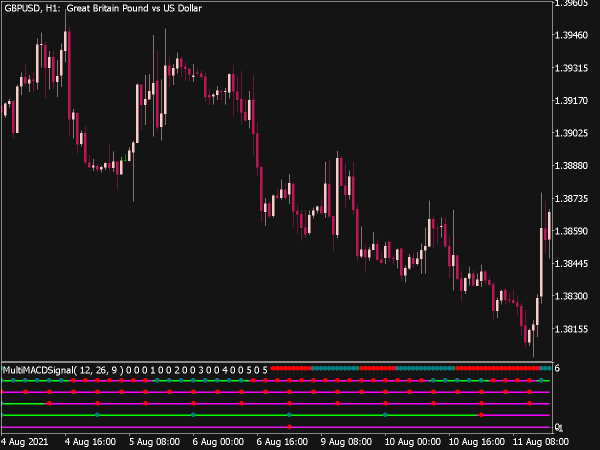

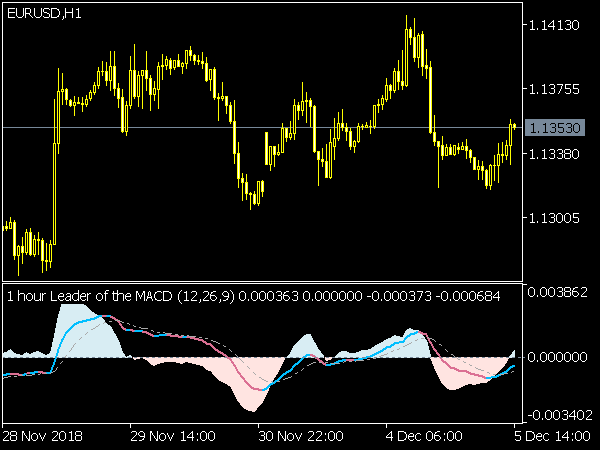

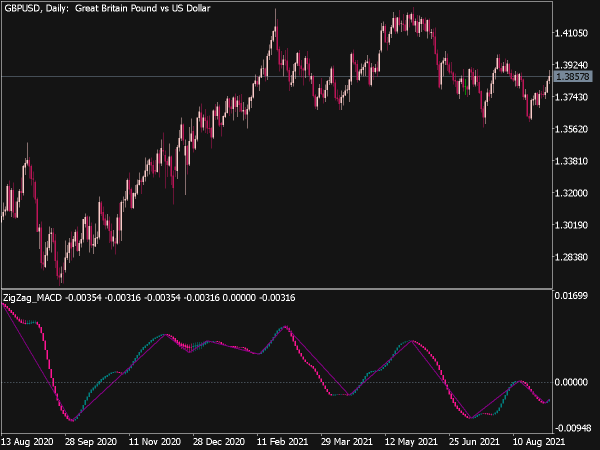

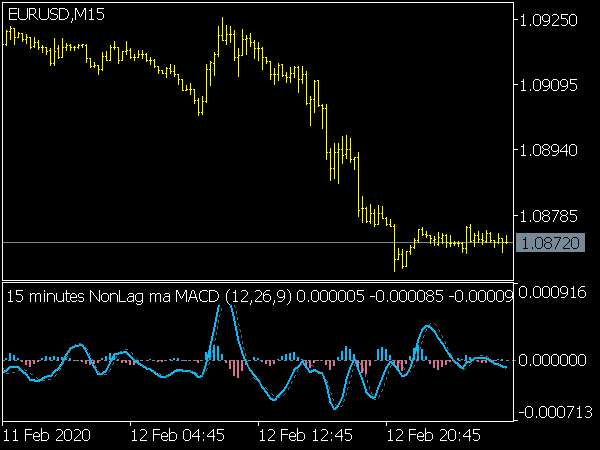

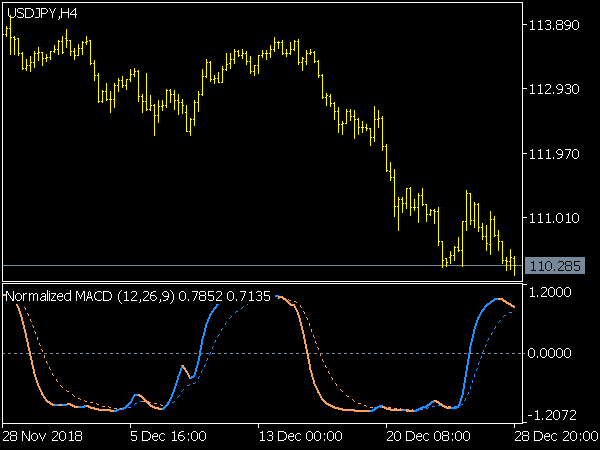

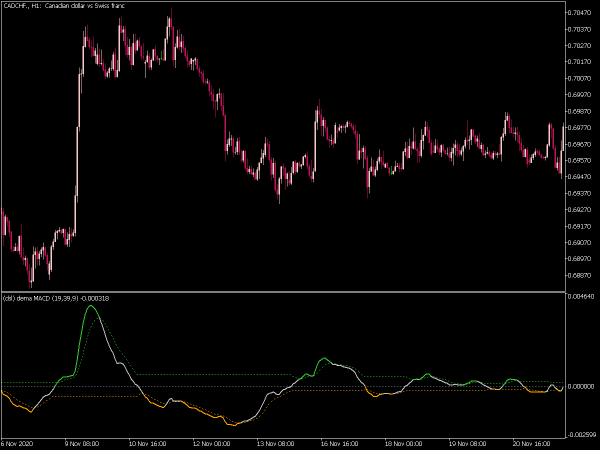

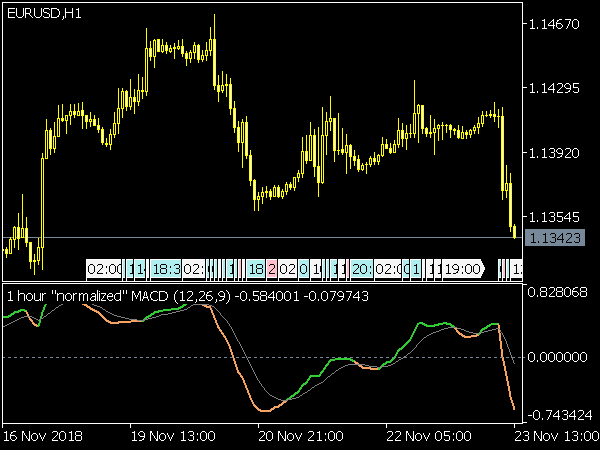

MACD is a momentum indicator that shows the relationship between two moving averages of a security's price, typically the 12-day and 26-day exponential moving averages (EMAs). It consists of the MACD line (the difference between the two EMAs), the signal line (the 9-day EMA of the MACD line), and the histogram (the difference between the MACD line and the signal line). Divergence occurs when the price of an asset moves in the opposite direction of the MACD, signaling that the current trend may be losing momentum and a reversal might be imminent.

Types of Divergence

1. Bullish Divergence: This occurs when the price makes a lower low while the MACD forms a higher low. It suggests that while the price is declining, the momentum behind the sell-off is weakening, indicating a potential upward reversal.

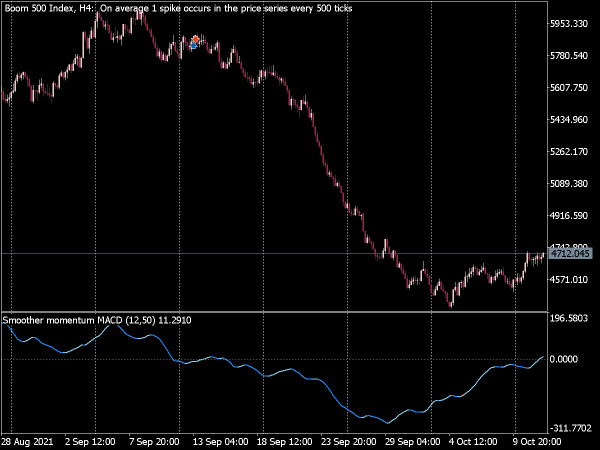

2. Bearish Divergence: Conversely, this happens when the price makes a higher high while the MACD forms a lower high, indicating a weakening bullish momentum and suggesting a potential downward reversal.

Trading Tips

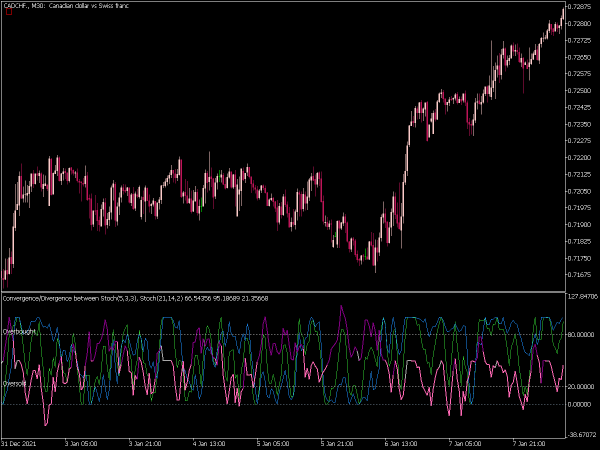

1. Confirm Divergence with Other Indicators: It's essential to use MACD divergence in conjunction with other technical indicators such as RSI, Stochastic Oscillator, or support and resistance levels. This can enhance the reliability of your signals.

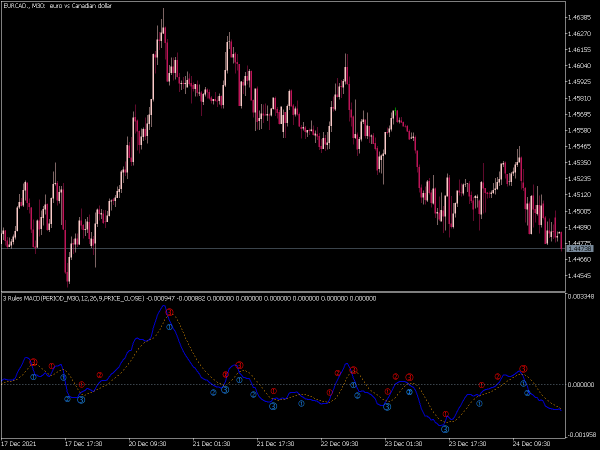

2. Wait for Confirmation: Before entering a trade based on divergence, wait for confirmation, such as a bullish or bearish candlestick pattern, break of a trendline, or a crossover of the MACD line above or below the signal line.

3. Use Stop Loss Wisely: Always incorporate stop-loss orders to manage risk. Place stops just beyond critical support/resistance levels to protect your capital.

4. Determine Your Risk/Reward Ratio: Establish a clear risk/reward ratio before entering a trade. A common guideline is to aim for at least a 1:2 ratio, which means you’re willing to risk $1 to potentially make $2.

5. Timeframe Consideration: Divergence can appear on multiple timeframes. Shorter timeframes may provide more frequent signals, while longer timeframes tend to yield more reliable and significant patterns. Adjust your trading strategy according to your preferred timeframe and risk tolerance.

Strategies for Trading MACD Divergence

1. Divergence Trading Strategy: Identify MACD divergence on a price chart and after confirming a valid divergence, look to enter a trade in the direction indicated by the divergence (buy for bullish divergence, sell for bearish). Use the MACD crossover and price action as your confirmation for entry.

2. Utilizing Multi-Timeframe Analysis: Analyze divergence across different timeframes. If a bullish divergence is spotted on a daily chart, check the 4-hour or 1-hour charts for additional confirmation, which can provide more opportunities for a successful trade.

3. Integration with Trend Following: Even though divergence often suggests a reversal is coming, it can be integrated into a trend-following strategy. For instance, use MACD divergence to identify exhaustion points in an existing trend and plan entry points for new trades in the same direction after confirmation of the reversal.

4. Fade the Divergence: Experienced traders might consider fading the divergence—trading against the divergence. This strategy suits high-volatility environments where price action can revert quickly.

Final Thoughts

Mastering the MACD Divergence Indicator requires practice and patience. Developing an understanding of the underlying principles of divergence, combined with efficient risk management, can significantly improve your trading decisions. Analyze your trades to see what works for you, adjust your strategies accordingly, and continually educate yourself on market dynamics. By following these tips and strategies, traders can harness the power of MACD divergence to enhance their market understanding and trading effectiveness.