Submit your review | |

The Buy-Sell Volume Indicator is a powerful tool for traders looking to make informed decisions based on market momentum and trading activity. To effectively utilize this indicator, it’s crucial to understand its components — the buy volume signifies the amount of shares purchased, while sell volume indicates the shares sold. Here are some strategies and tips for using the Buy-Sell Volume Indicator effectively:

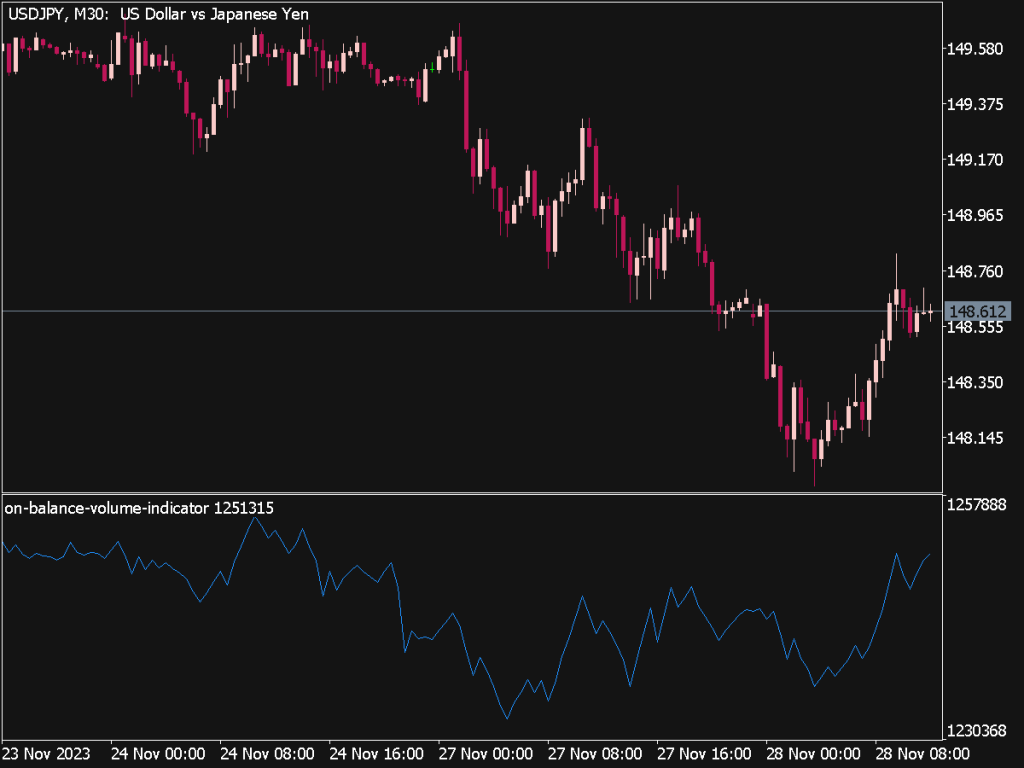

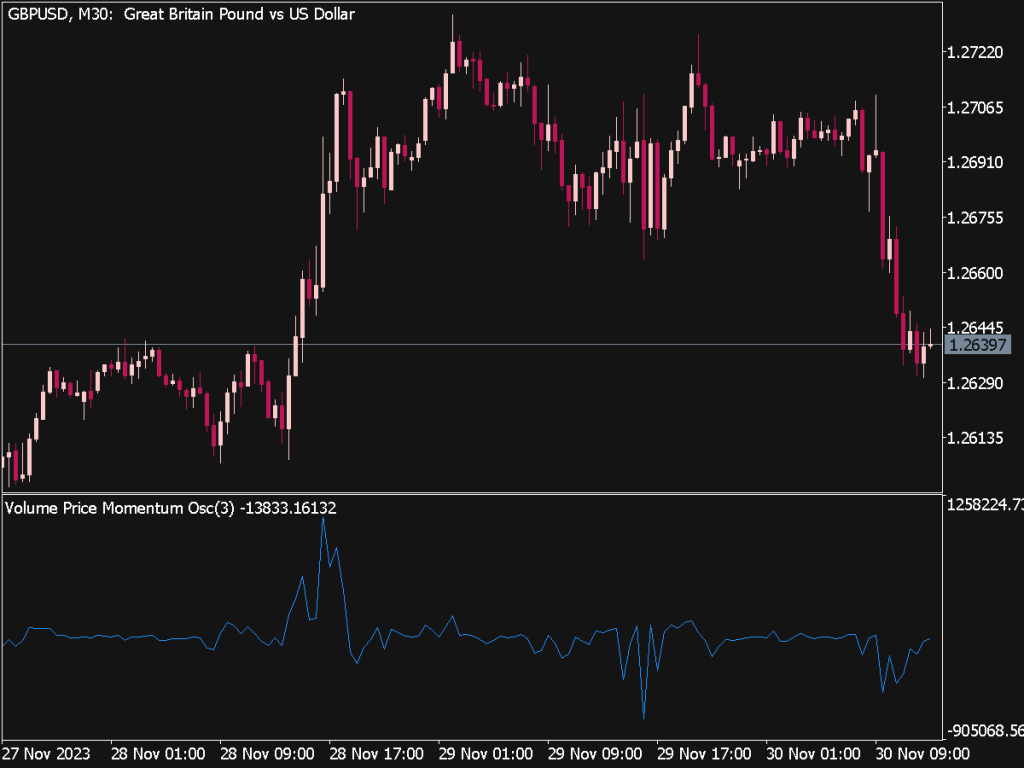

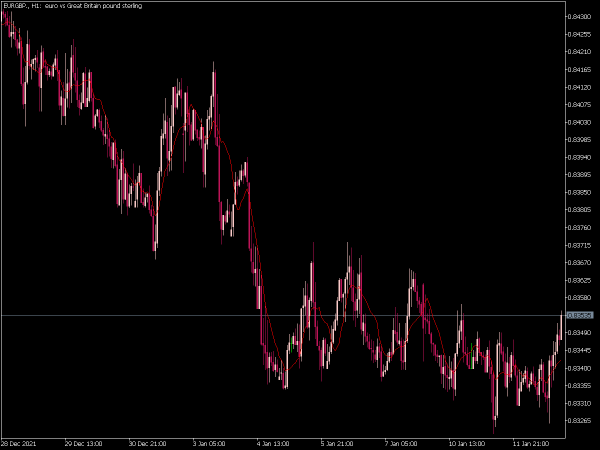

1. Identify Trends: Use the indicator to confirm existing trends. For instance, if both buy volume and the price are rising, it suggests a strong uptrend. Conversely, if the price rises but buy volume decreases, it may indicate a potential reversal or weakening momentum.

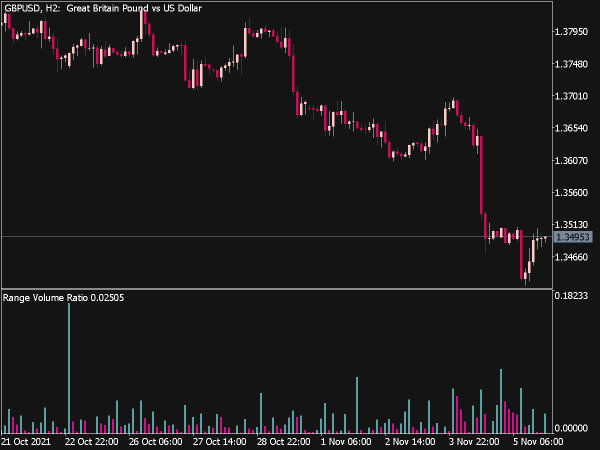

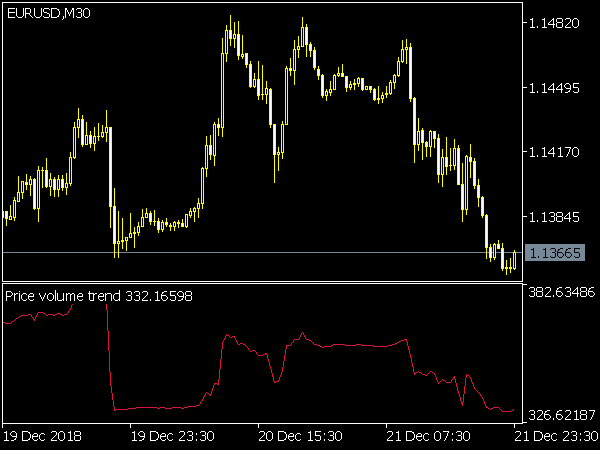

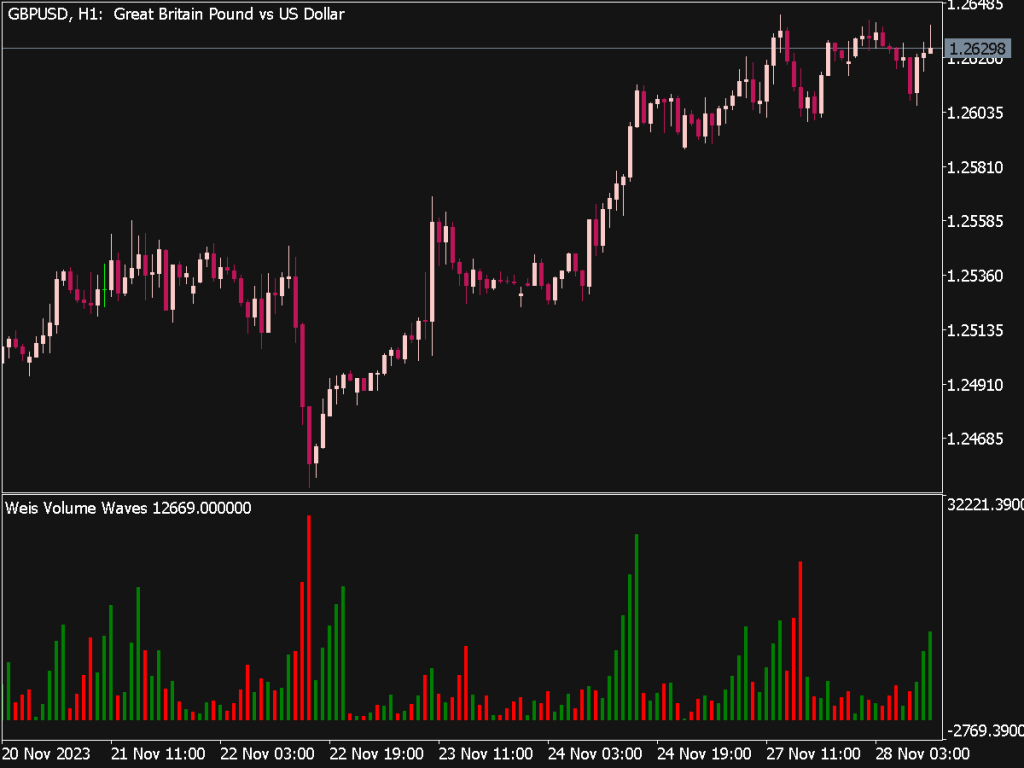

2. Volume Spikes: Look for unusual spikes in either buy or sell volume, as this can signal the beginning of significant price movements. A sudden increase in buy volume may indicate strong bullish sentiment, while a spike in sell volume could signal profit-taking or a change in market sentiment.

3. Divergence Analysis: Use divergence between price action and volume to anticipate reversals. If prices are making new highs but buy volume is declining, this could signal a potential reversal. Similarly, if prices hit new lows while sell volume diminishes, this might indicate a bearish trend losing momentum.

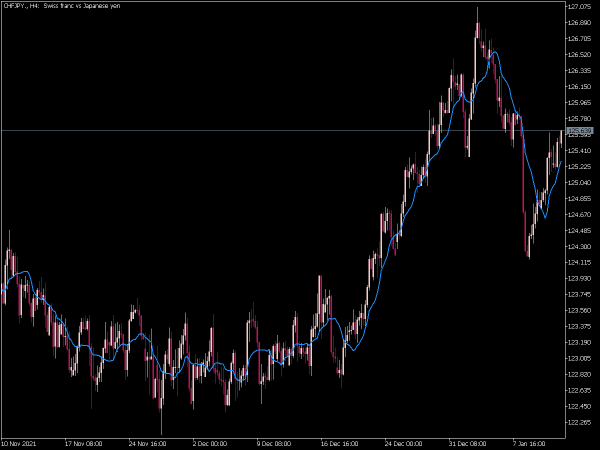

4. Combine with Other Indicators: The Buy-Sell Volume Indicator is most effective when used in conjunction with other technical indicators such as Moving Averages, Relative Strength Index (RSI), or MACD. This layered approach can provide better confirmation before entering trades.

5. Support and Resistance: Use volume to confirm support and resistance levels. High volume at a specific price point may indicate strong support or resistance, suggesting potential entry or exit points for trades.

6. Risk Management: Incorporate volume analysis into your risk management strategy. If you’re entering a trade based on volume signals, set protective stop-loss orders to manage your risk in case the market moves against you.

7. Market Context: Always take market context into account. Be aware that economic news, earnings reports, or overall market trends can influence volumes. During major events, volatility can increase, affecting the reliability of the volume indicator.

8. Time Frame Alignment: When trading, ensure that the time frame of your volume analysis matches your trading strategy. Short-term traders should focus on intraday volume patterns, while long-term investors might pay attention to weekly or monthly volume trends.

9. Backtesting: Before implementing volume-based strategies, backtest them using historical data. This helps gauge how effective a particular approach has been in the past, providing insights for future trades.

10. Emotional Discipline: Volume trading can create excitement, but it's essential to maintain emotional discipline. Stick to your trading plan and avoid impulsive decisions based on sudden volume changes without proper analysis.

In summary, the Buy-Sell Volume Indicator is a versatile tool that can enhance trading decisions when combined with careful analysis, market context, and solid risk management strategies. Successful trading involves not just recognizing signals but also understanding the broader market dynamics at play. Always remain adaptable and ready to adjust your strategies as market conditions change.

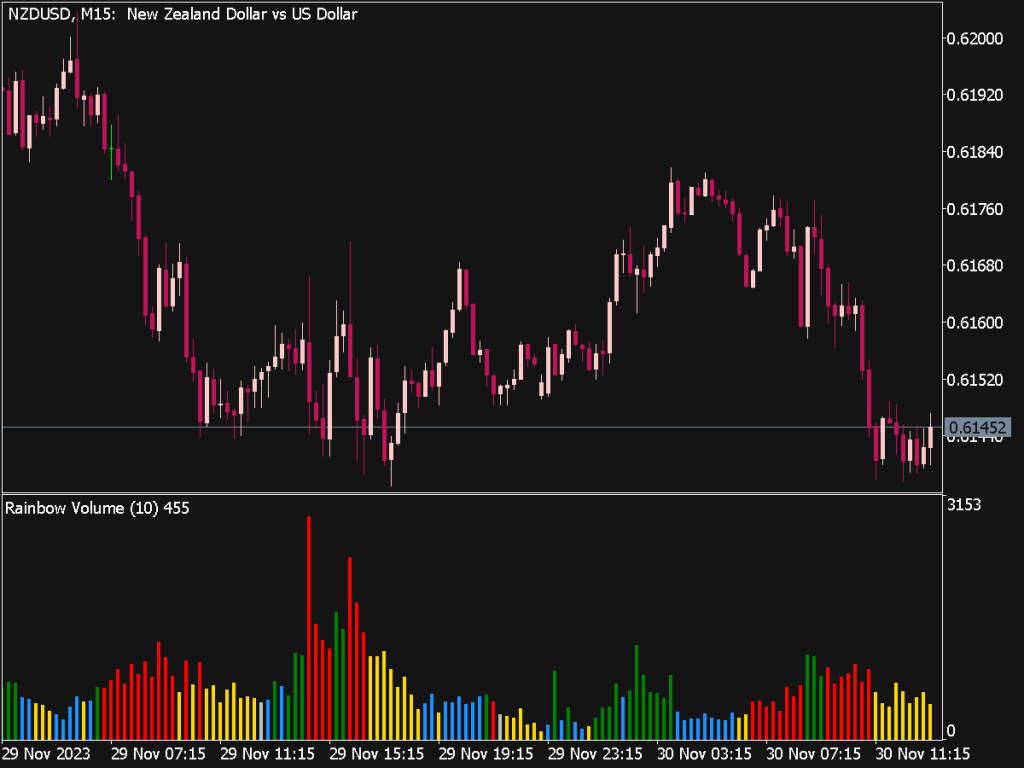

Hello,

I am searching for an indicator with the following parameters: 180 period SMA of tick volume. I am trying to create a line on the volume histogram, so that ultra high and very low volume bars, "visually" stand out. Are you aware if something like this exists? Could someone build this for me?

I look forward to hearing from you.

Best regards,

Greg