Submit your review | |

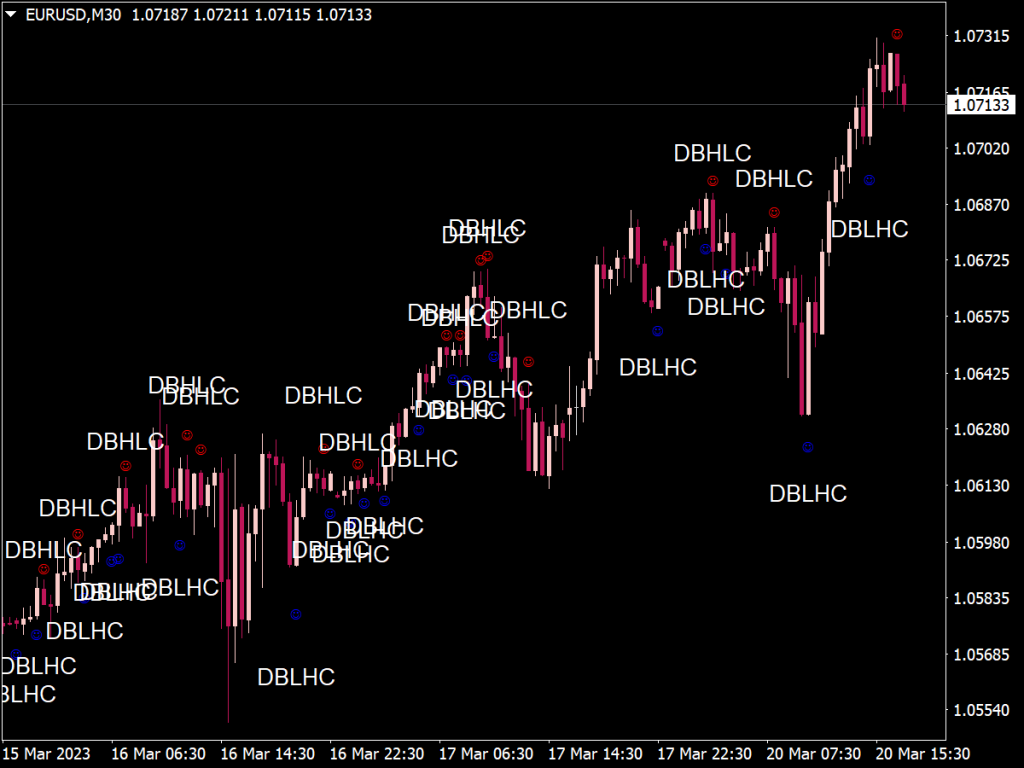

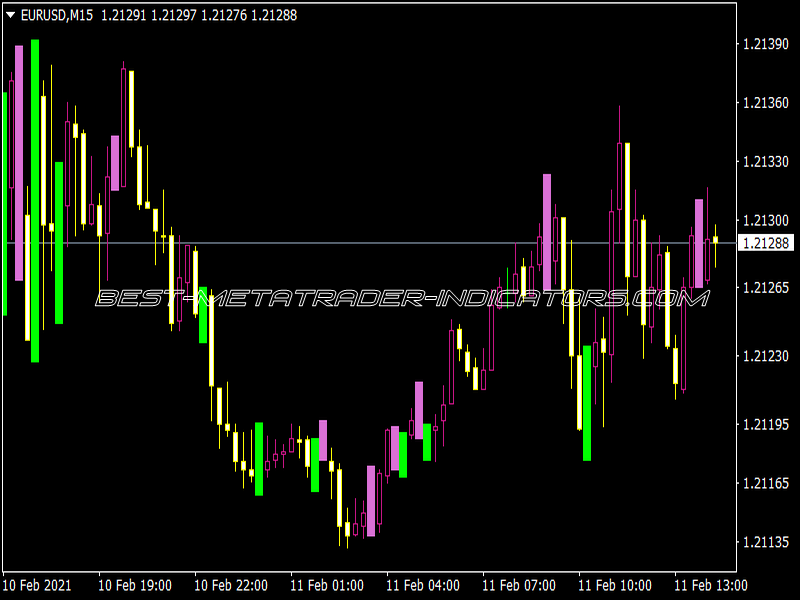

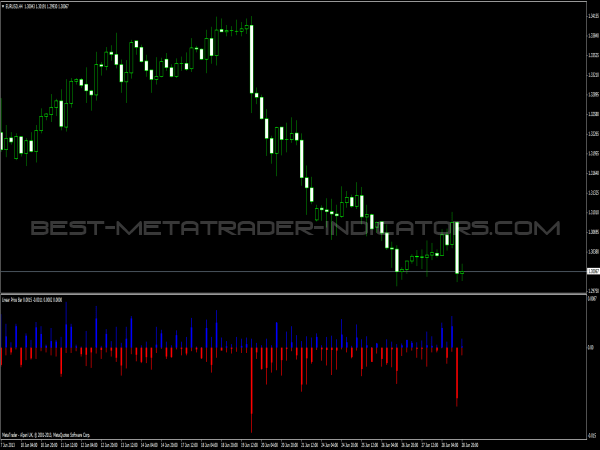

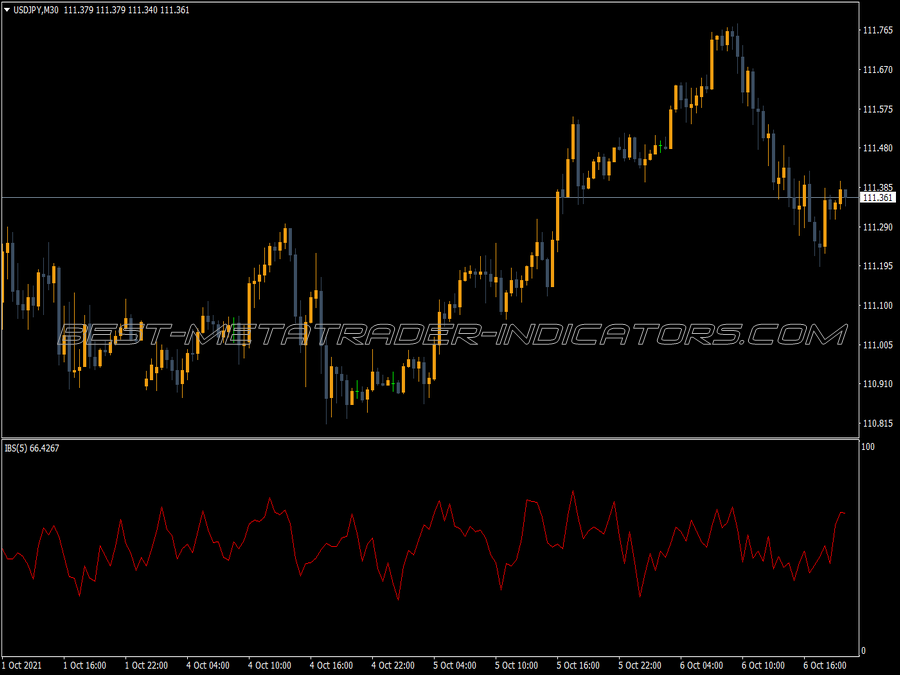

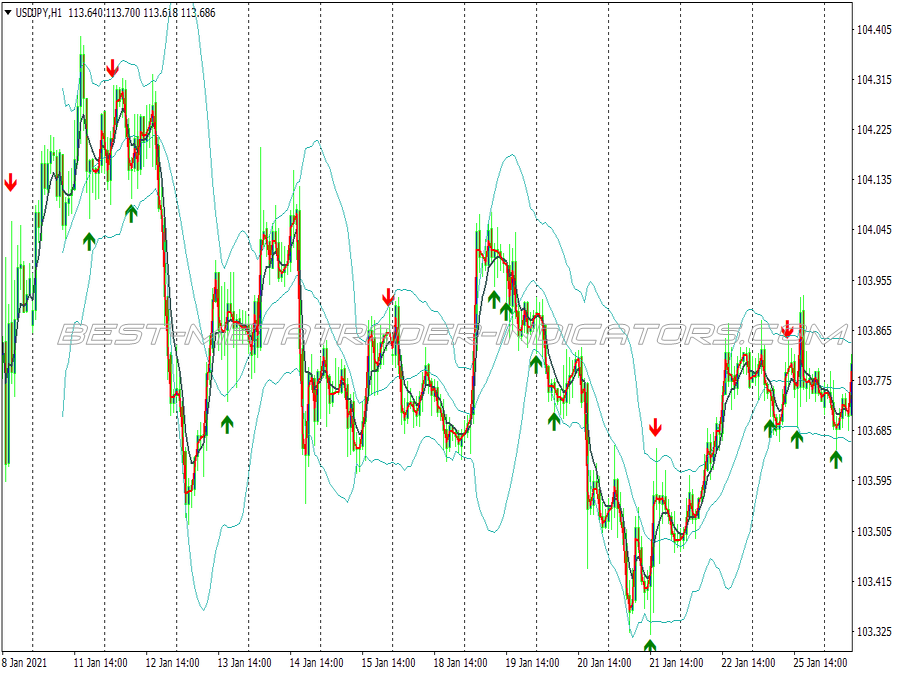

A pin bar indicator, recognizable by its long wick and small body, serves as a powerful reversal signal in trading. Here’s a list of essential tips and strategies for effectively utilizing pin bars in trading:

1. Understanding Pin Bar Characteristics: Ensure the pin bar has a long wick (indicating rejection of price), a small body (which should ideally close in the opposite direction of the wick), and that the wick is at least twice the length of the body.

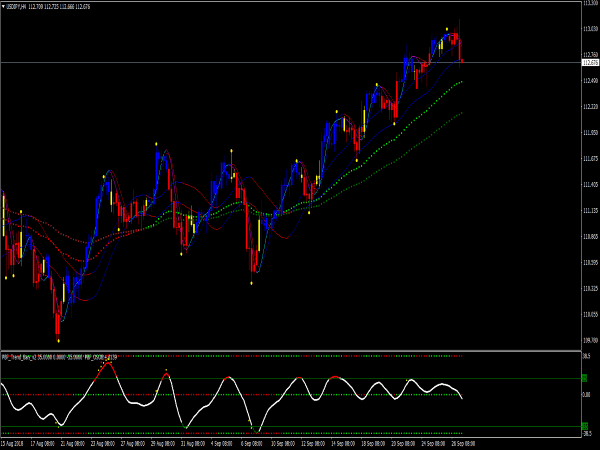

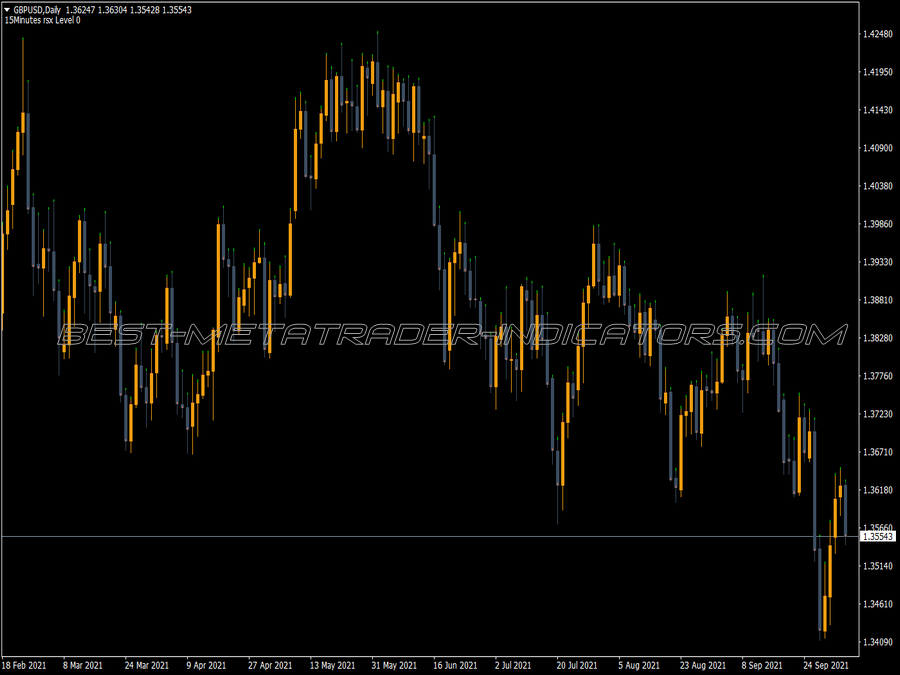

2. Context is Key: Always analyze the broader market context. Pin bars can indicate potential reversals, but they should be used in conjunction with the prevailing trend to avoid false signals.

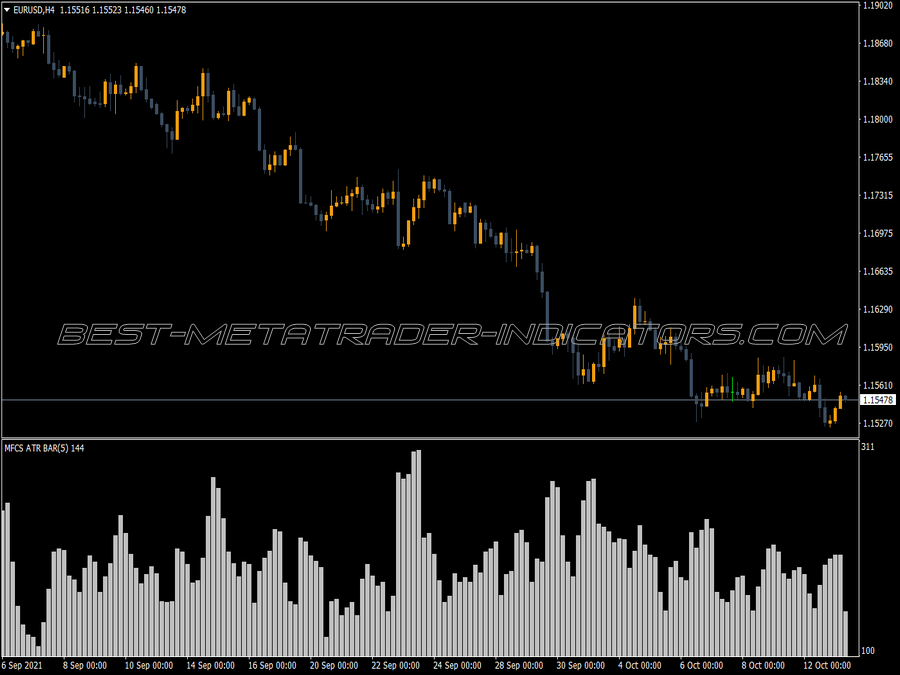

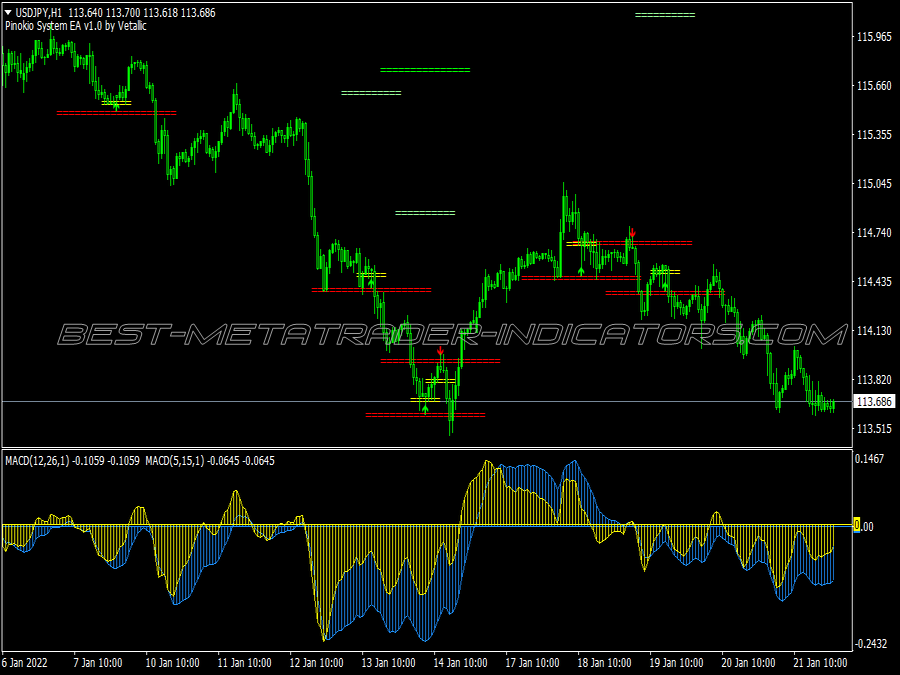

3. Identify Key Support and Resistance Levels: Pin bars are more effective when they form near significant support or resistance levels, indicating a higher probability of price reversal at these points.

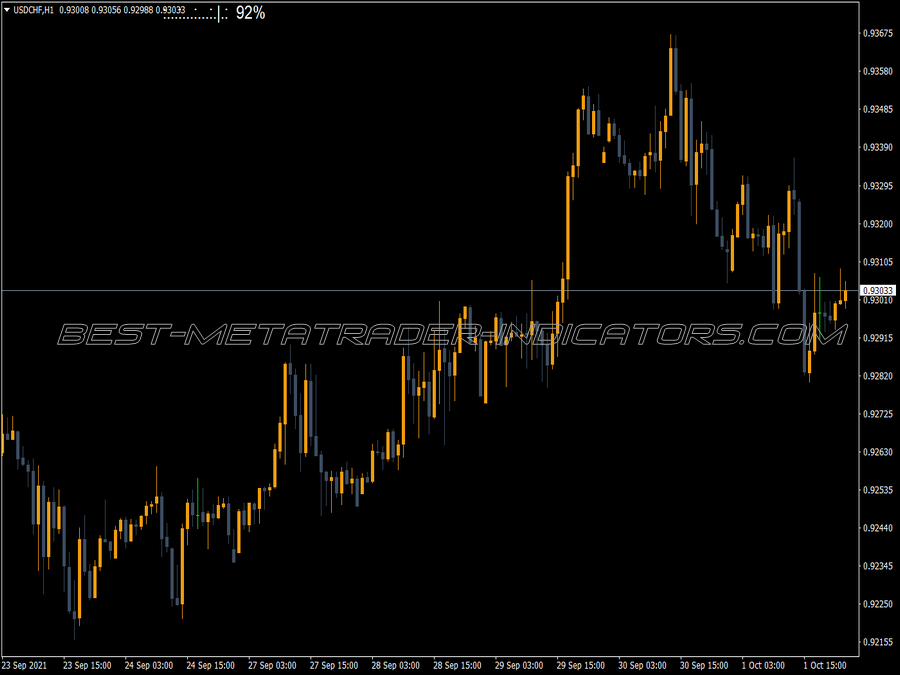

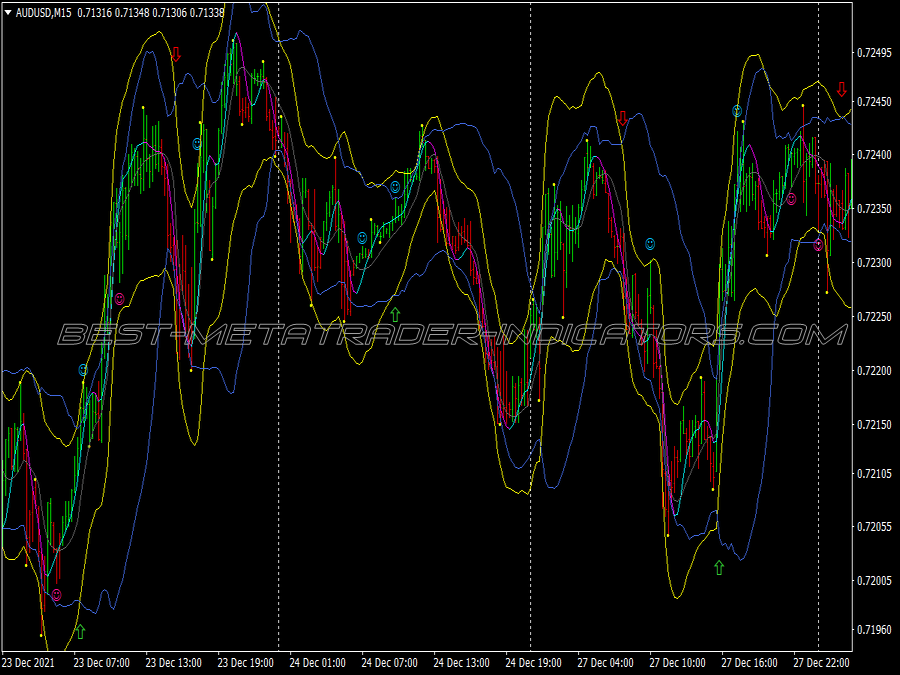

4. Use Multiple Timeframes: Employ a multi-timeframe analysis. Look for pin bars on higher timeframes (daily or weekly) for more reliable signals and confirm them with lower timeframes (hourly or 15-minute) for entry.

5. Confirmation is Crucial: After identifying a pin bar, wait for confirmation from subsequent price action (e.g., a close above or below the pin bar’s body), avoiding premature entries.

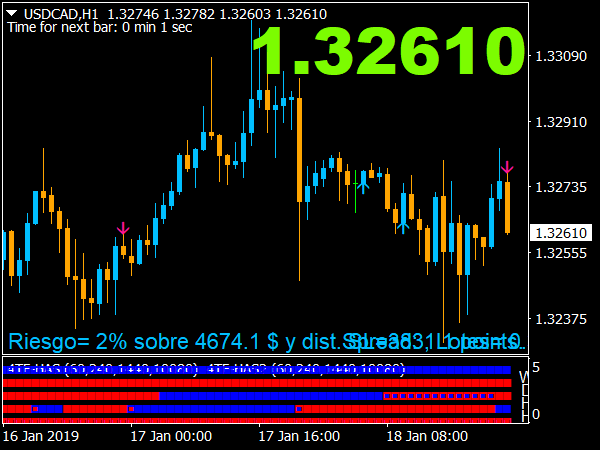

6. Implement Proper Risk Management: Always use stop-loss orders just beyond the opposite side of the pin bar to limit potential losses. Never risk more than a small percentage of your trading capital on any single trade.

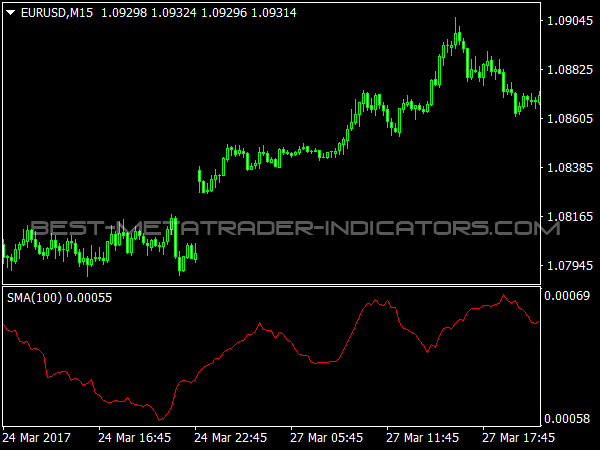

7. Combine with Other Indicators: Use technical indicators such as moving averages, RSI, or MACD in conjunction with pin bars to increase the likelihood of successful trades and filter out false signals.

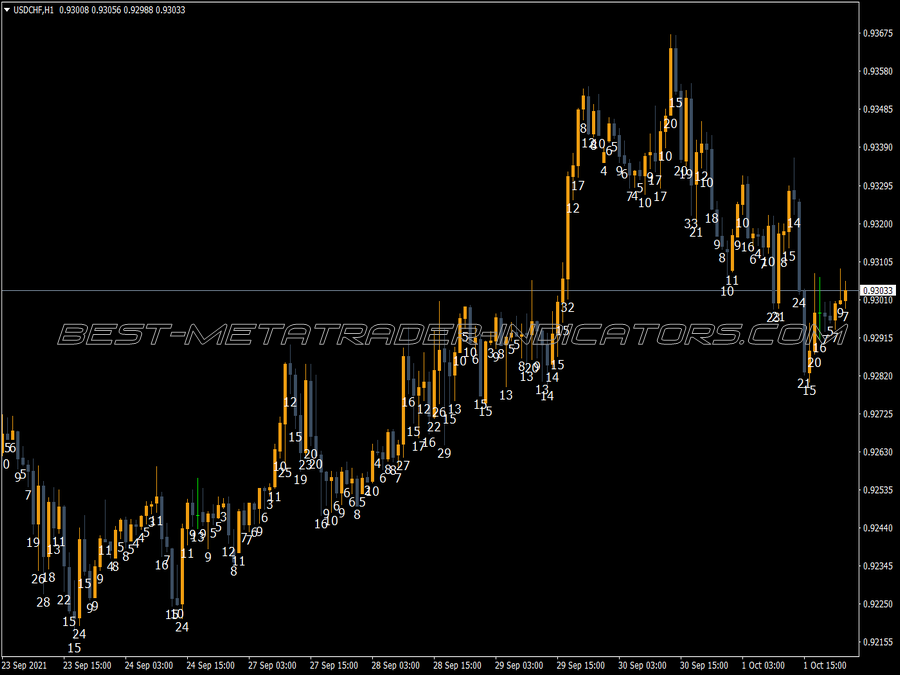

8. Consider Volume Analysis: Higher trading volume on the day a pin bar forms adds validity to the reversal signal. Look for pin bars that occur during increased volatility in the market.

9. Trade with the Trend: While pin bars can indicate reversals, trading with the trend often leads to higher success rates. Look for pin bars against the trend on retracement levels for potential continuation trades.

10. Avoid Trading During News Events: Be cautious about trading pin bars leading up to major economic news releases or events that can lead to unpredictable price movements.

11. Optimize Your Entry and Exit: Use the pin bar's high and low to set precise entry and exit points. An entry just above a bullish pin or below a bearish pin can enhance profitability.

12. Keep a Trading Journal: Maintain a detailed record of your trades involving pin bars. This will help you analyze patterns in your trading behavior, identify what works, and refine your strategy over time.

13. Practice Patience: Wait for the ideal conditions and setups. Avoid forcing trades; pin bars may not form frequently, but maintaining discipline can lead to more successful outcomes.

14. Learn to Recognize False Signals: Not all pin bars lead to reversals. Be vigilant for market conditions that may indicate a continuation pattern instead of a reversal.

15. Time Your Trades Wisely: Consider trading during active market hours when liquidity is higher. This often leads to clearer price movements and can help validate the pin bar signal.

16. Use a Risk-to-Reward Ratio: Aim for trades with a favorable risk-to-reward ratio, ideally 1:2 or greater, especially when the pin bar aligns with a more considerable trend direction.

17. Be Aware of Market Psychology: Understand the market sentiment and psychology that influences price movements, as this can help gauge the effectiveness of a pin bar signal.

18. Backtest Your Strategy: Before applying a pin bar trading strategy with real money, backtest it on historical data to determine its effectiveness and understand potential pitfalls.

19. Limit Distractions: Focus on a few currency pairs or assets you understand best. This allows for better analysis and reduces information overload that can lead to poor decision-making.

20. Keep Learning: Stay updated on market trends, educational resources, and trading techniques involving pin bars and price action strategies to enhance your trading skills over time.

By applying these strategies and tips thoughtfully, traders can improve their chances of successful trading using pin bar indicators. Always remain adaptable and willing to refine your approach based on market conditions and personal experiences.

It's broken if you could fix this. Thanks.

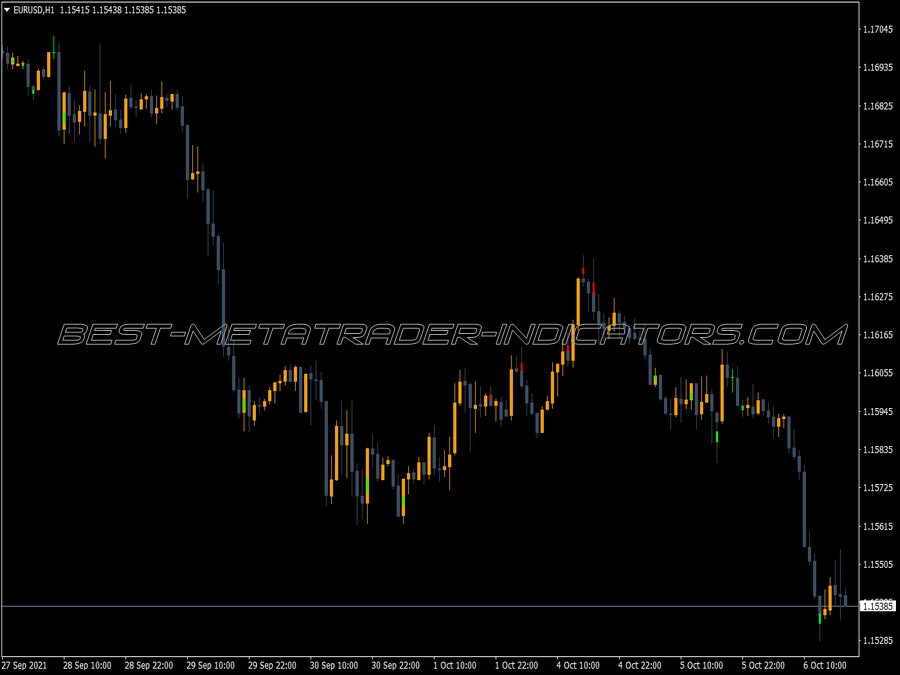

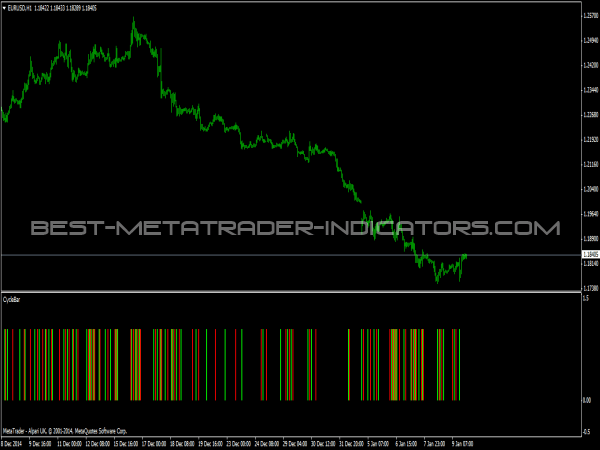

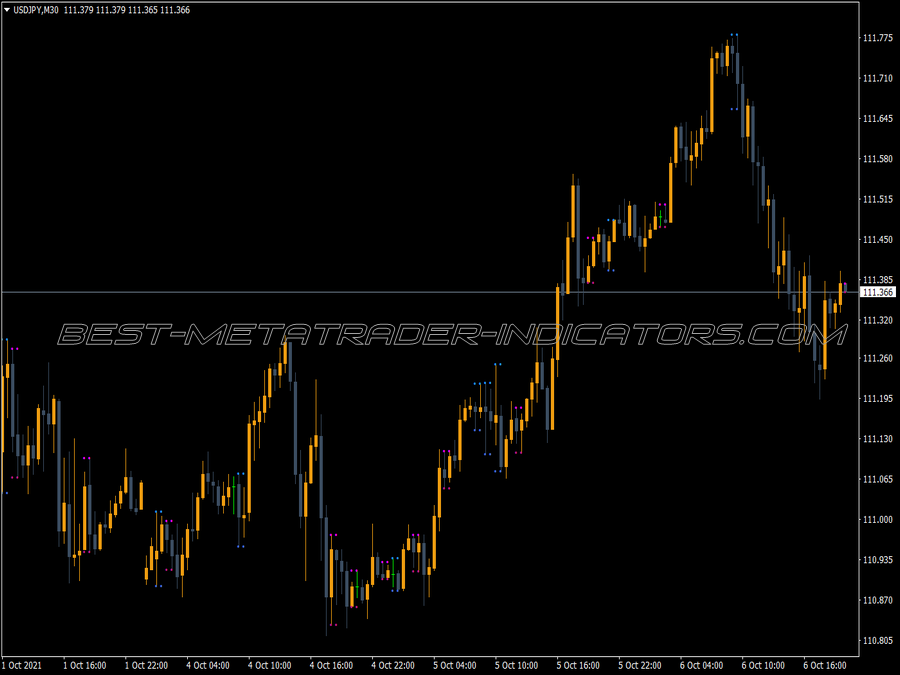

This indicator works, see the screenshot above 😉

Pin bars are excellent, let me see how I can include this in my EA.