Submit your review | |

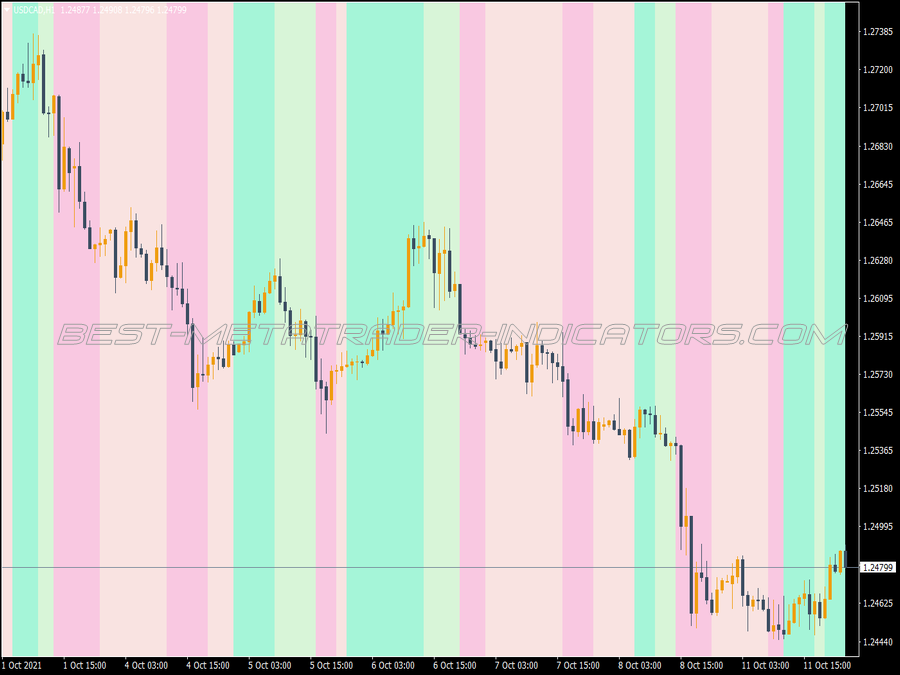

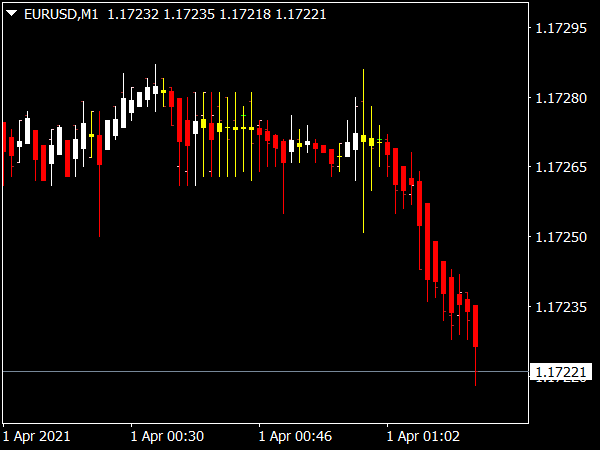

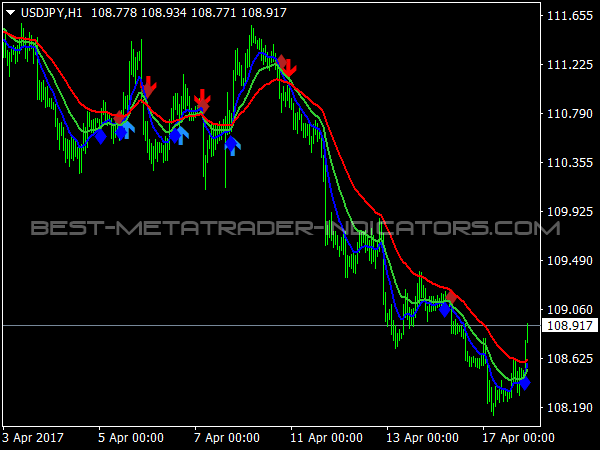

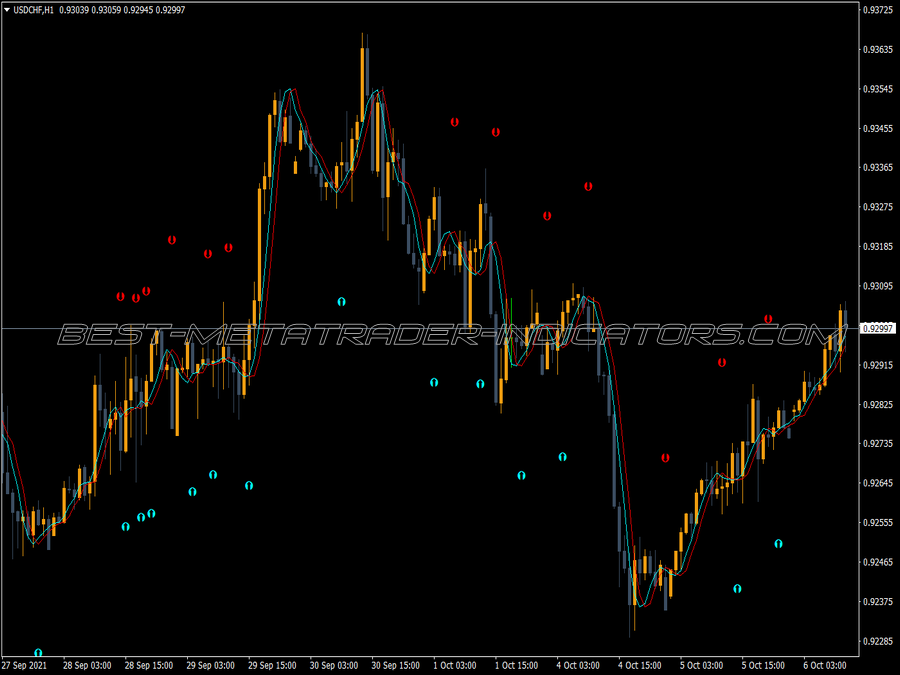

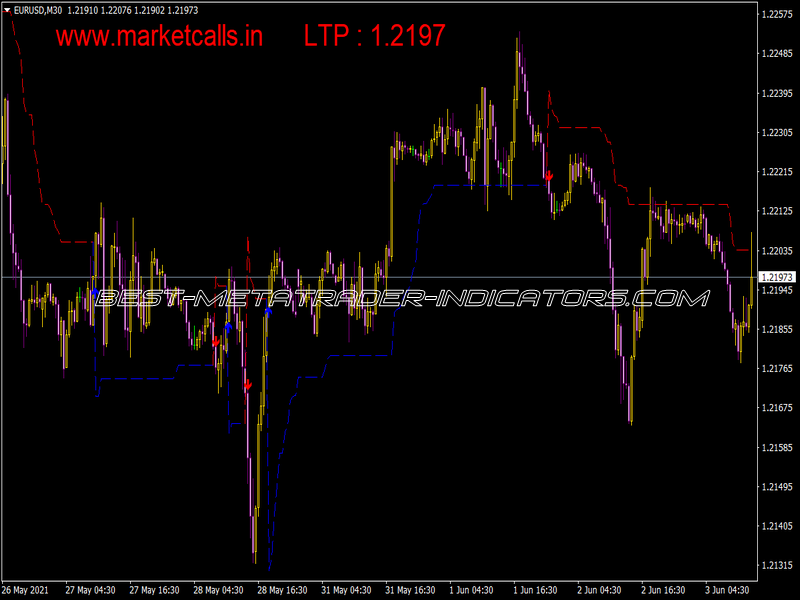

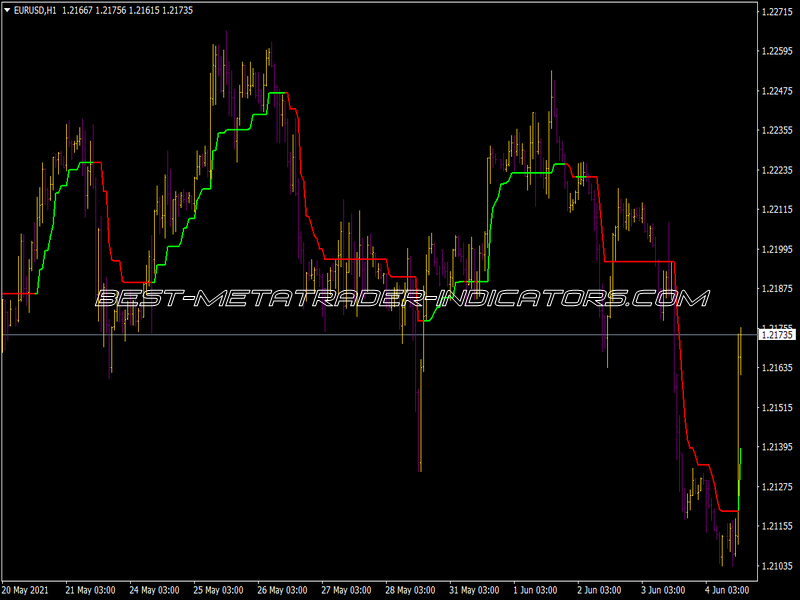

This indicator detects the trends, filters out market noise, does not repaint and gives clean entry signals for strong trends, combining a lot of things to predict the strong trends on forex pairs.

When trading Forex with indicators it is important to differentiate between leading and lagging indicators. This separation is important for a thorough understanding of the markets and trading, and also for ensuring that one is not trading with correlative indicators. Lagging indicators are indicators that follow price direction. After price has confirmed a trend, lagging indicators will alert and give a trading signal. By definition, all trend-following indicators are lagging.

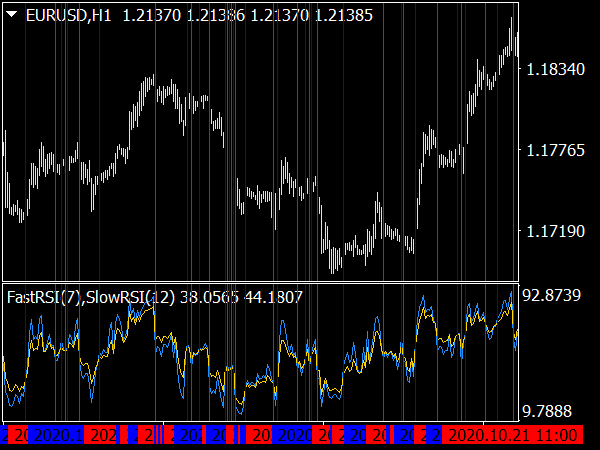

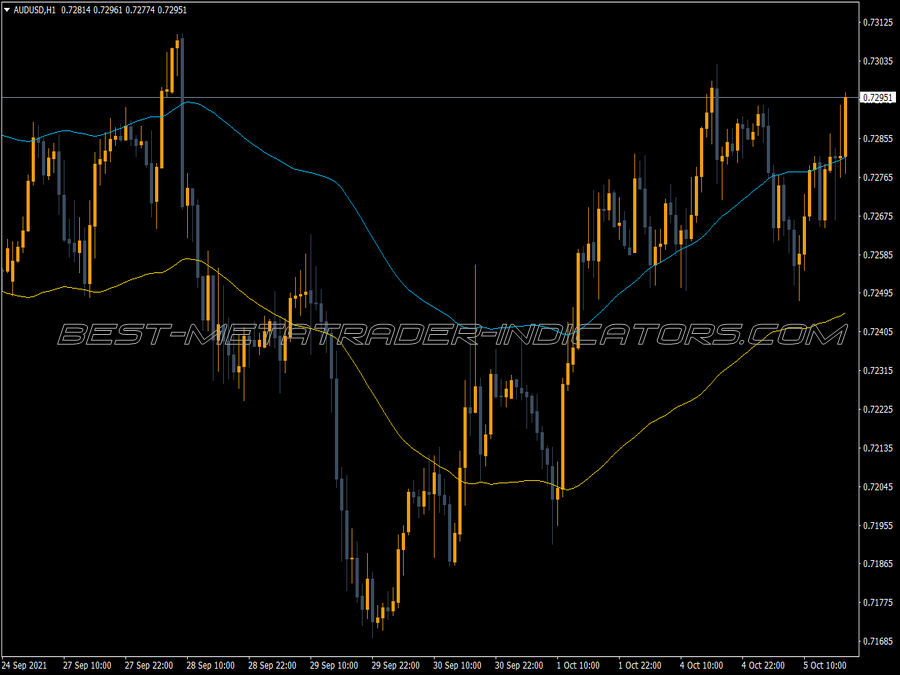

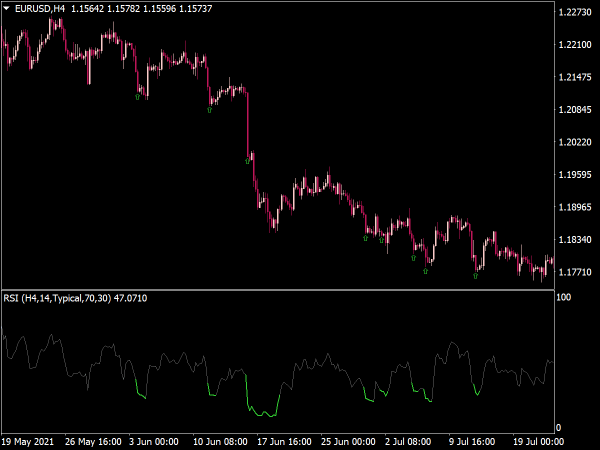

This includes moving averages, the MACD, Supertrend, Alligator, Awesome Oscillator and many more. The main power of lagging indicators are in trends – in currencies with strong trends they produce strong trading signals and give trader opportunity to join a trend relatively early. However, in ranging markets lagging indicators are bound to lose as they produce late signals that are not profitable when the trend is short-termed. on the contrary, leading indicators produce signals before price has confirmed them, in attempt to predict the future movement of price.

Some of them use calculations to identify periods of overbought or oversold prices, to predict a reversal. Some use Support and Resistance to gauge their signals. The most popular leading indicator are the Stochastic Oscillator, Relative Strength Index and Commodity Channel Index.

Lagging Indicators

• Accelerator Oscillator

• Accumulation/Distribution

• Alligator

• Average Directional Movement Index (ADX)

• Awesome Oscillator

• Gator Oscillator

• Moving Averages

• Ichomoku Kinko Hyo

• MACD

• Momentum

• Parabolic SAR

• Supertrend Indicator

Leading Indicators

• Bollinger Bands

• Commodity Channel Index

• DeMarker

• Fractals

• Money Flow Index

• Relative Strength Index

• Stochastic Oscillator

It is of high importance to know precisely what indicators you are trading, and also – how to combine different styles of indicators to achieve the best results. It is crucial that when trading with several indicators one should combine both lagging and leading indicators.

Do not use only lagging indicators as your entries will be late. If you use only leading indicators you may predict reversals too early. It is important to know which of the indicators you trade are lagging and which are leading, and attempt to diversify your trading so you confirm your trades via several technical analysis techniques.