Submit your review | |

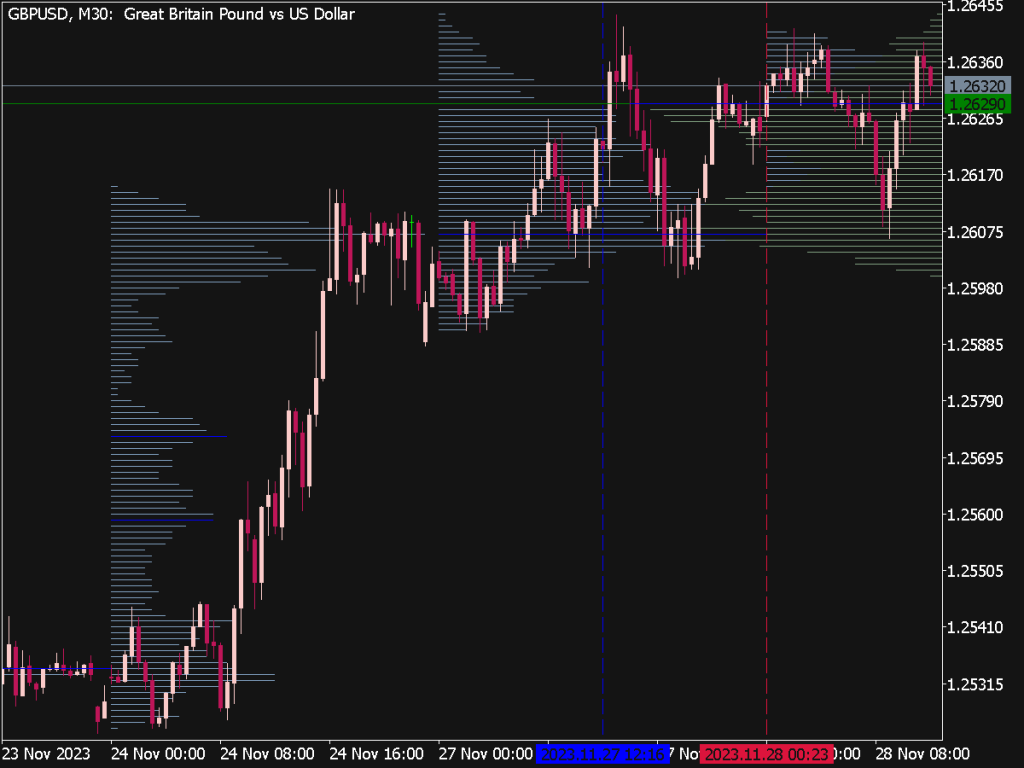

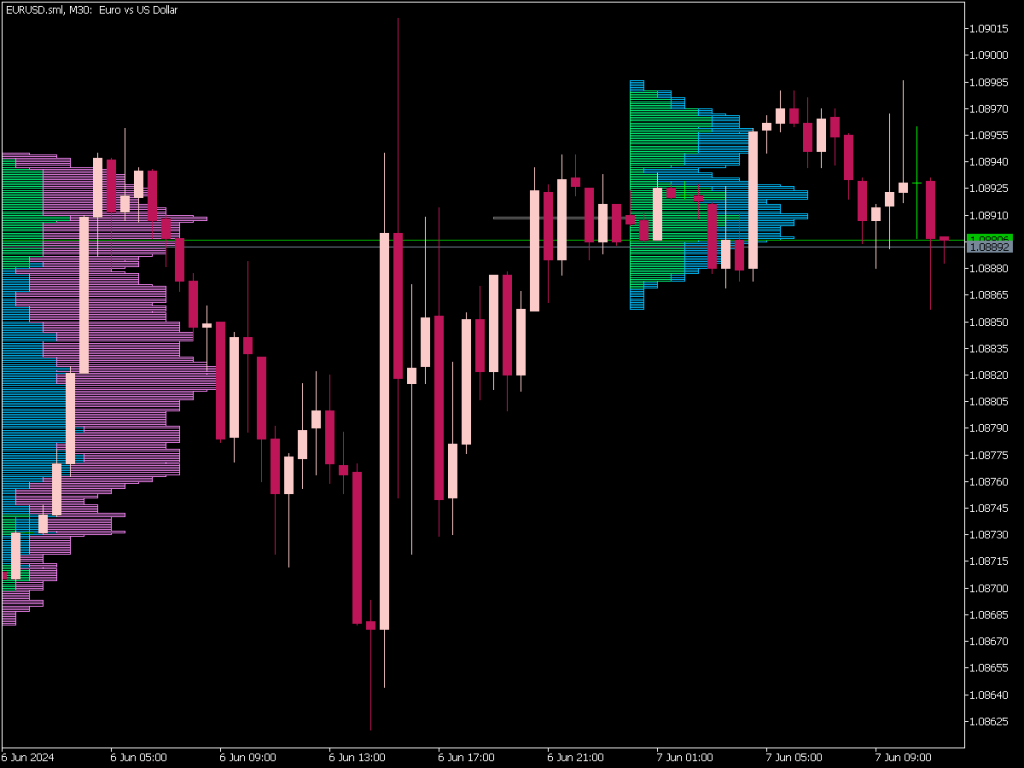

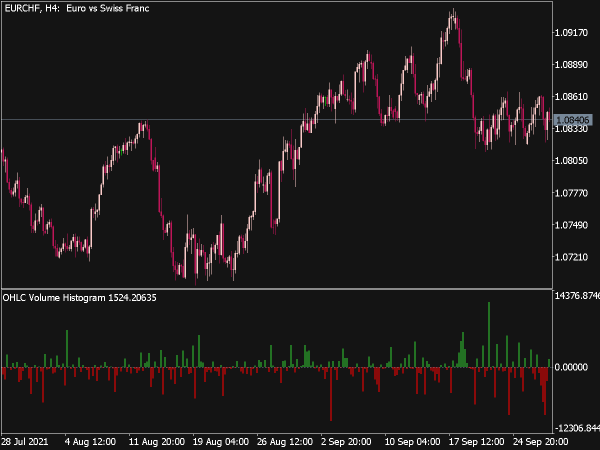

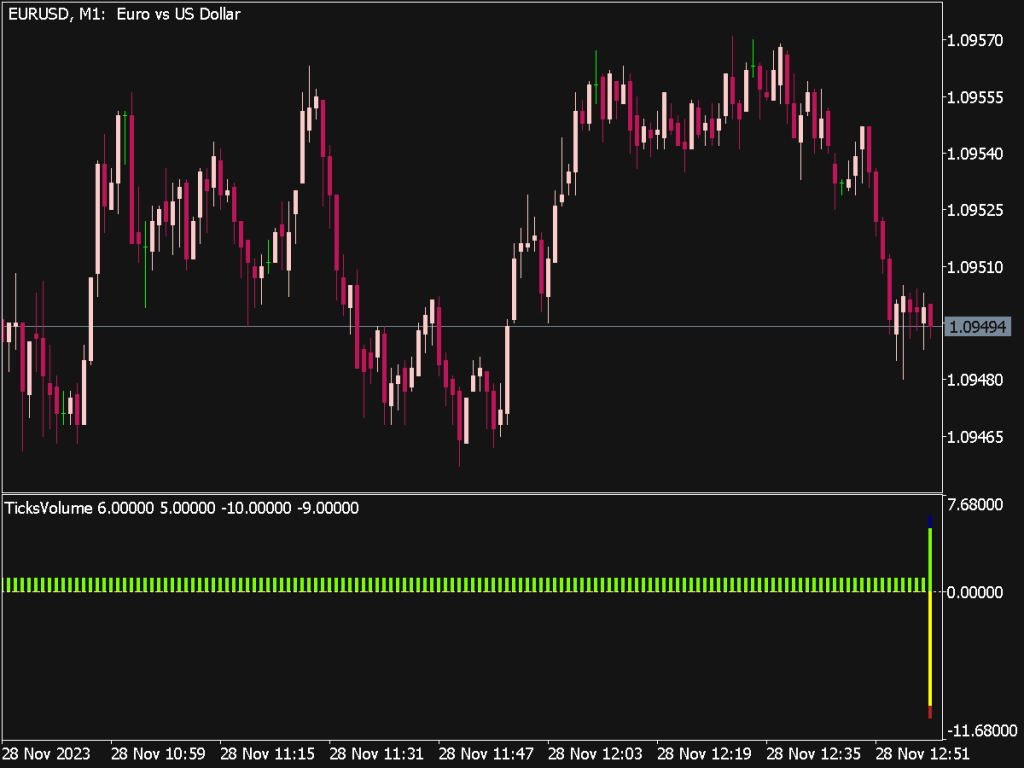

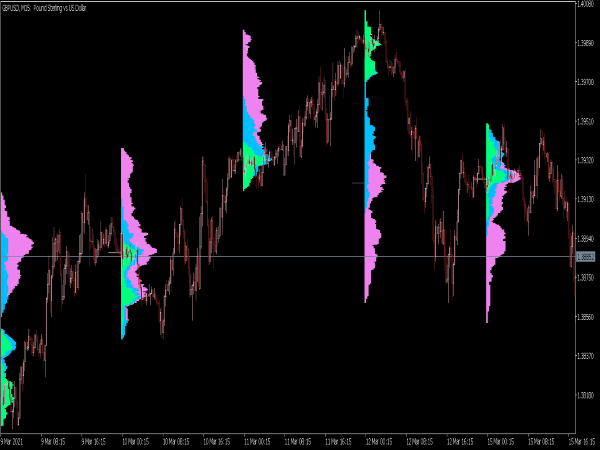

The Market Volume Profile Indicator is a powerful tool that displays trading activity over a specified time period at various price levels, visualizing where volume has accumulated. It presents a histogram on the price axis, highlighting significant price levels based on trading volume, typically known as the Point of Control (POC), Value Area (VA), and High/Low Value Areas. Traders use the Volume Profile to identify key support and resistance levels, gauge market sentiment, and make informed trading decisions.

Description

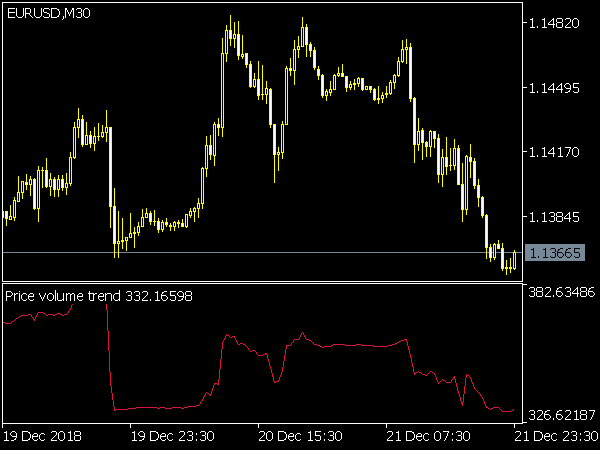

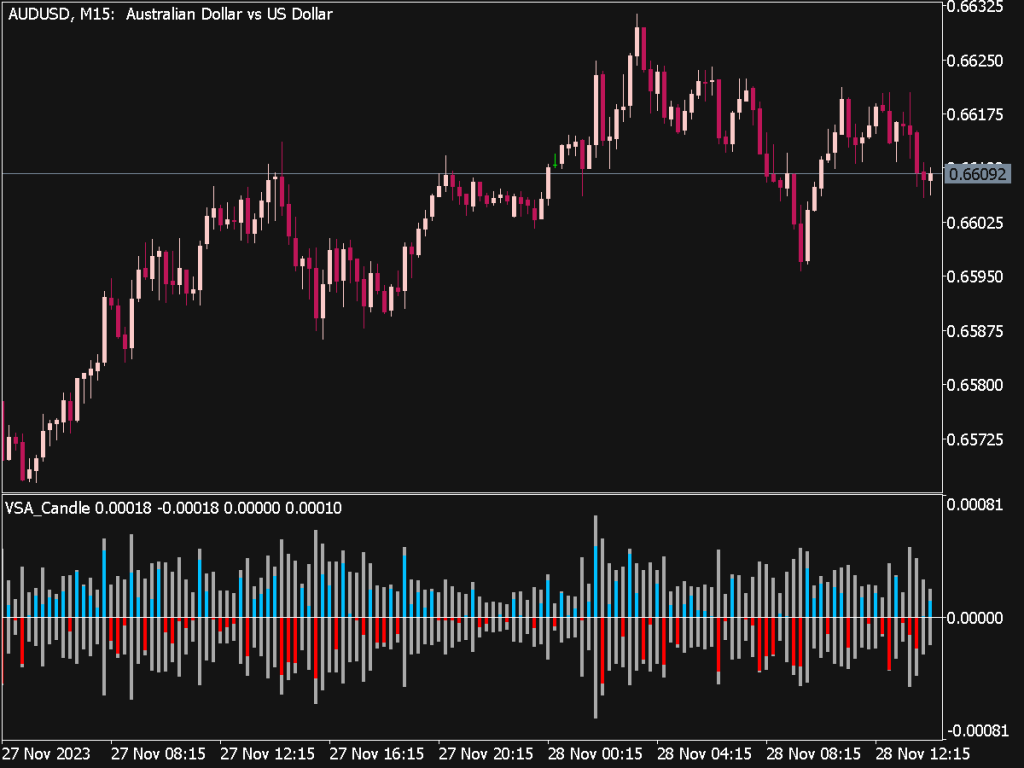

The Volume Profile is distinct from traditional volume indicators as it aligns volume with price rather than time, making it more relevant for assessing price levels where most trades occurred. The POC represents the price level with the highest traded volume during the set period, while the Value Area encompasses the range where most volume occurred, typically 70% of total volume. High and low value areas indicate potential zones of buying or selling pressure. This dynamic visualization helps traders understand where market participants have placed their bets, unveiling areas of interest for potential entry or exit points.

Trading Tips

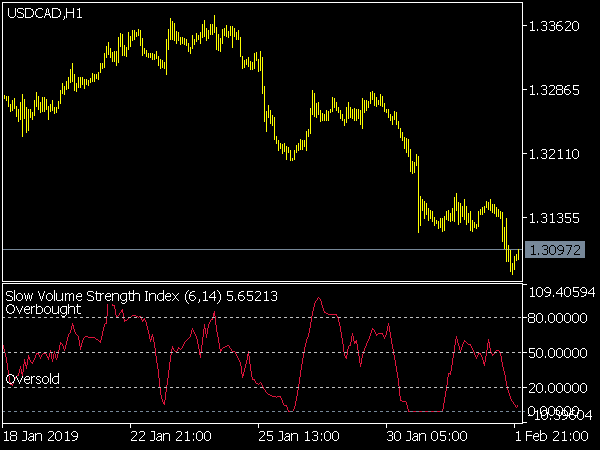

1. Identify Key Levels: Before trading, analyze the POC and Value Areas to determine potential areas of support and resistance. Prices frequently react around these levels, which can help in setting profitable trades.

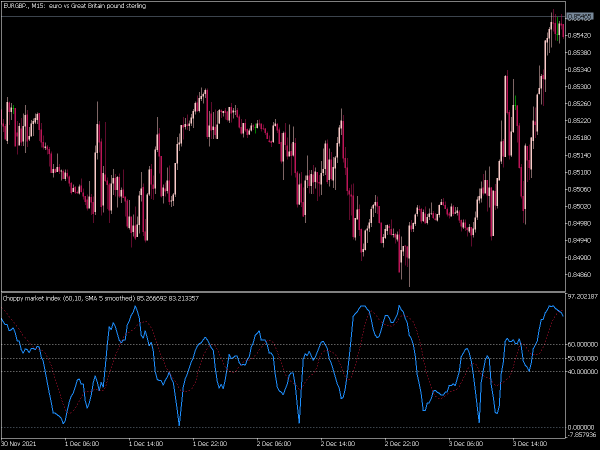

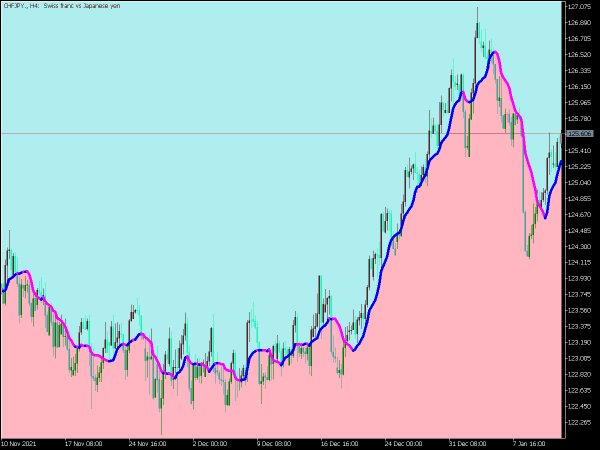

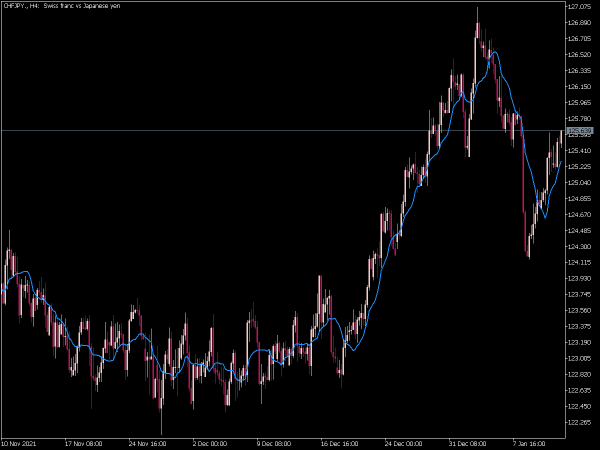

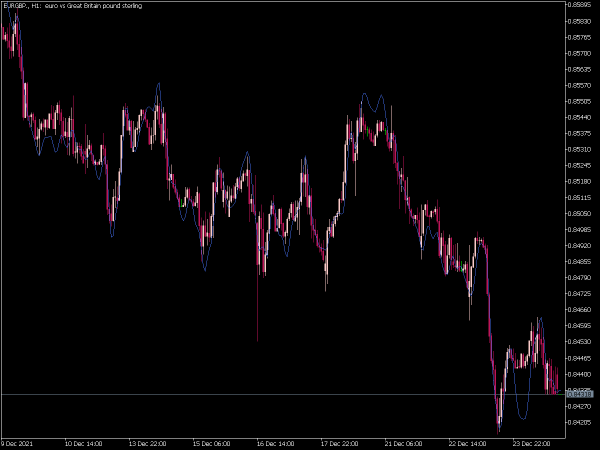

2. Combine with Other Indicators: Use Volume Profile in conjunction with other technical indicators like moving averages, RSI, or Fibonacci retracement levels. This combination can provide further confirmation for your trading decisions and improve accuracy.

3. Timeframes Matter: Utilize the Volume Profile across different timeframes. A daily Volume Profile may provide insights for day traders, while weekly or monthly profiles can offer broader perspectives for swing or position traders.

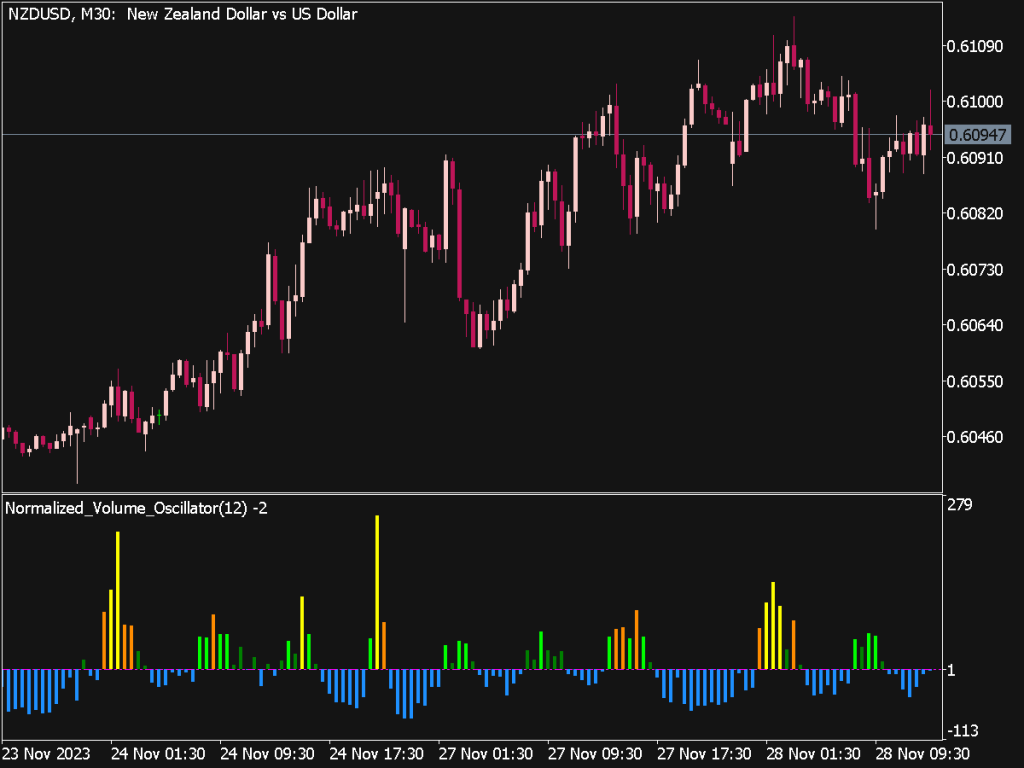

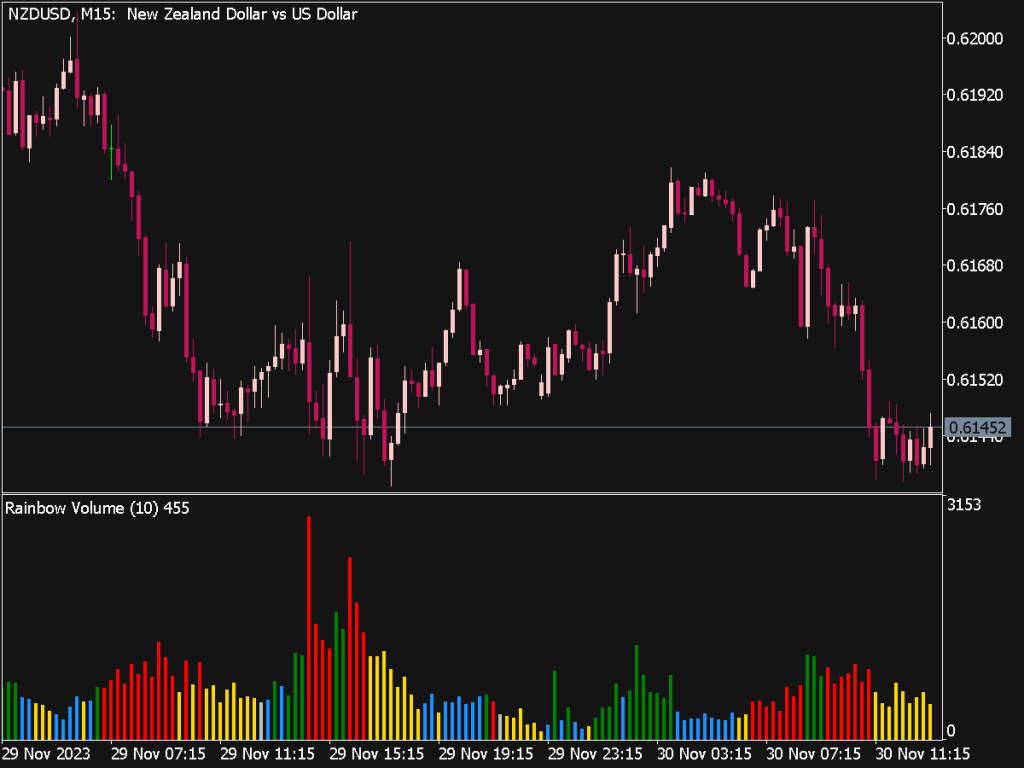

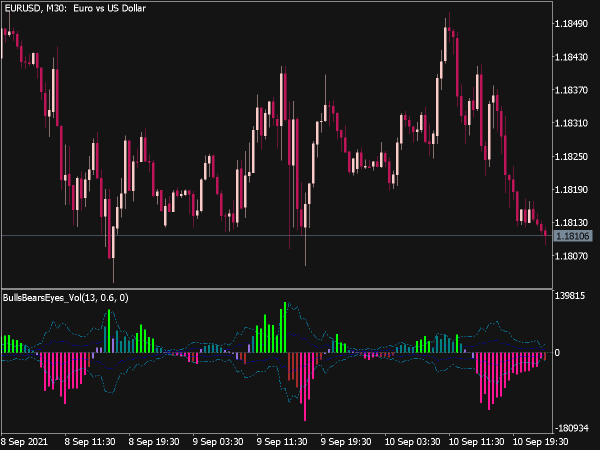

4. Watch for Volume Spikes: Significant changes in volume can indicate potential reversals or continuations. A sudden spike in volume at key levels can signify strong market interest and may provide lucrative trading opportunities.

5. Look for Breakouts and Retests: After a breakout from high or low value areas, wait for the price to retest these areas before entering a trade. This can confirm the strength of the breakout and decrease the risk of false signals.

Strategies

1. Range Trading Strategy:

In a ranging market, identify the Value Areas. Buy near the lower Value Area and sell near the upper Value Area. Volume Profile helps in detecting the boundaries of the range, allowing for high-probability trades.

2. Trend Following Strategy:

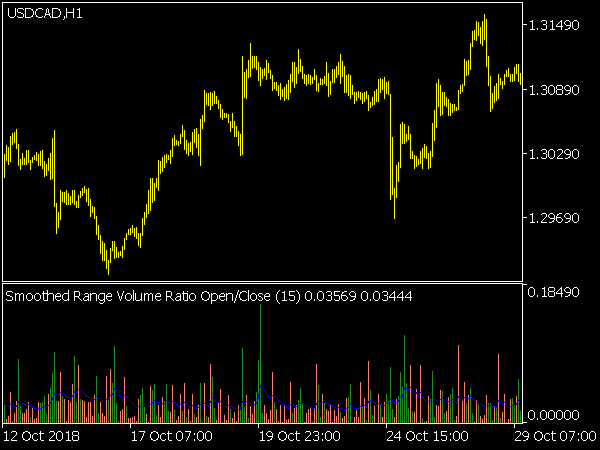

In trending markets, focus on the direction of the trend to make entries in line with the trend direction. When prices reach the POC or get extended from the Value Area in the trend's direction, consider entering trades. Typically, volume increases on higher prices during bullish trends or lower prices during bearish trends.

3. Reversal Strategy:

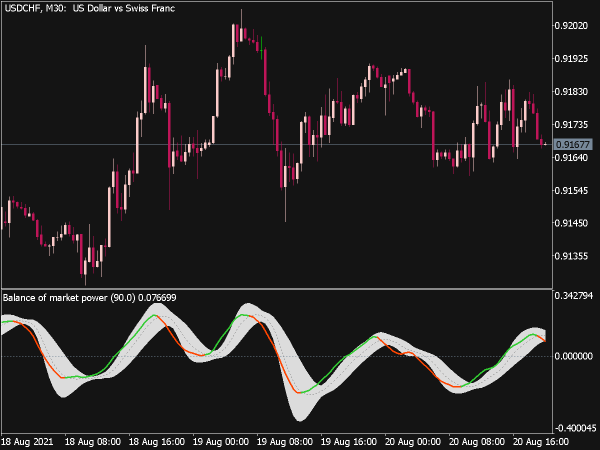

Look for price action near significant volume levels showing signs of reversal, such as candlestick patterns like hammers or engulfing bars at the POC. A reversal might indicate a bounce-back from these price levels, offering opportunities to capitalize on short-term trades.

4. Volume Profile with Order Flow:

For advanced traders, combining Volume Profile with order flow analysis can yield insights into market dynamics. Knowing where buyers or sellers are likely to step in can enhance your timing and decision-making.

5. Adjusting Stops and Targets:

Use the Volume Profile to set your stop-loss and take-profit levels effectively. Place stops just below the low Value Area when entering long positions or above the high Value Area for shorts. Targets can align closely with previous POCs or observed extreme price levels.

Conclusion

Incorporating the Market Volume Profile Indicator into your trading toolkit can enhance your market awareness and sharpness in identifying price levels with significant trading interest. By utilizing its insights into market sentiment and participation, traders can make more informed decisions, align trades with the overall market structure, and increase their odds of successful trade outcomes. Regardless of the strategy adopted (whether range trading, trend following, or reversal trading) recognizing the importance of volume at price can elevate trading effectiveness in various market situations.