Submit your review | |

ℹ️ How to Build a Trading System

Building a successful trading system is not an easy work. Whether the strategy you’re using is your own or someone else’s, it is critical that you have a thorough understanding of it. However we strongly recommend that you develop your own trading strategy, so that it will fit your trading style.

A complete trading system should cover every aspect, such as entry strategy, exit strategy, stop-loss strategy, trade management, risk management. We will cover all these aspects in this trading tip.

Entry Strategy

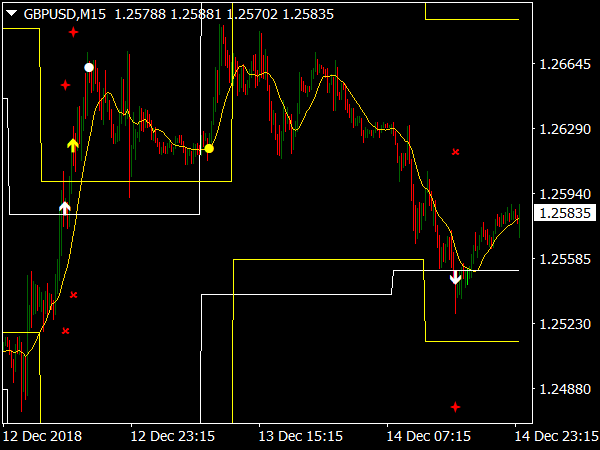

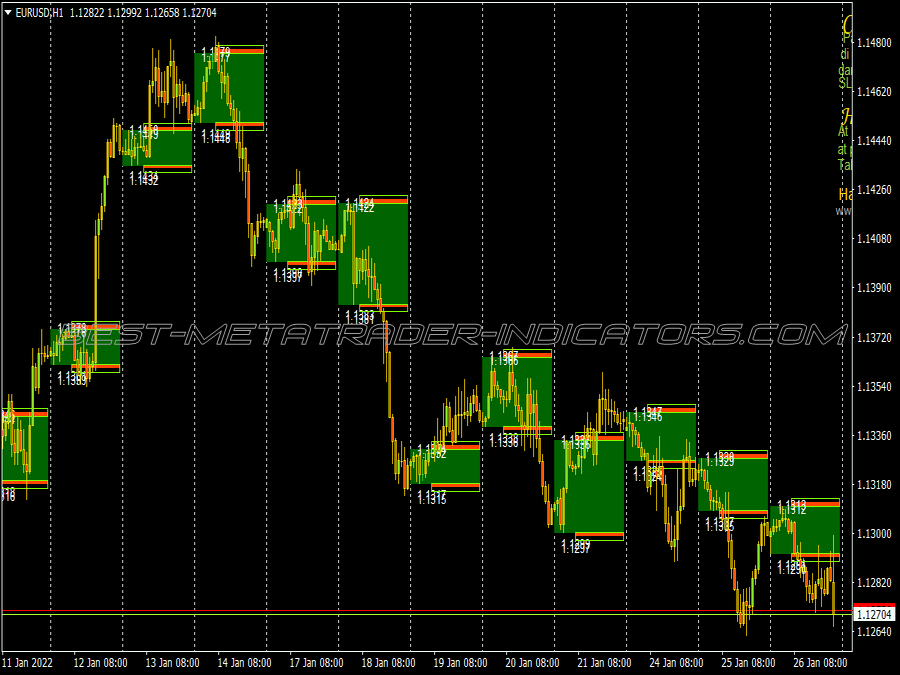

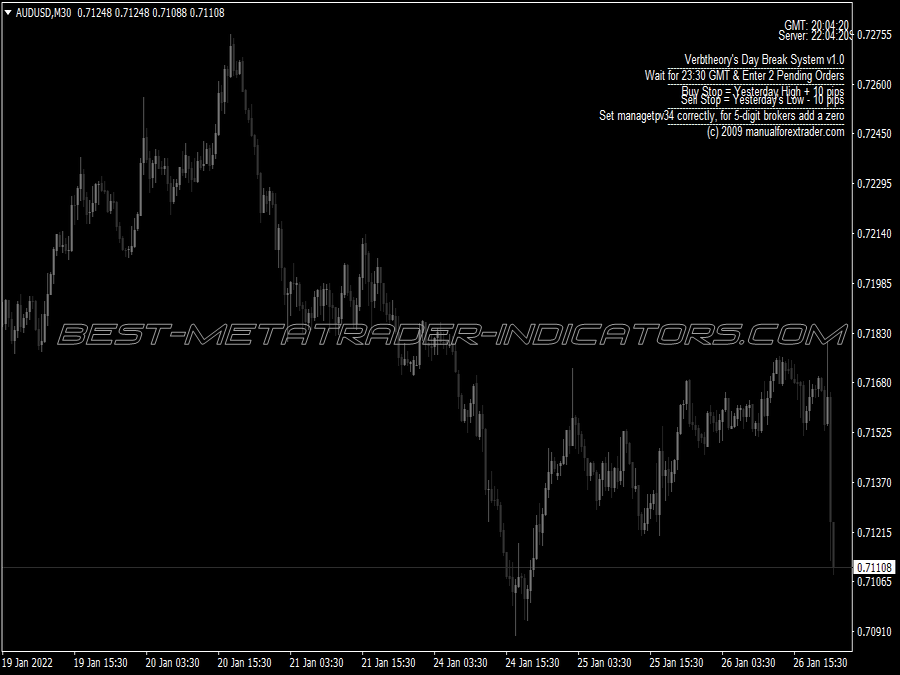

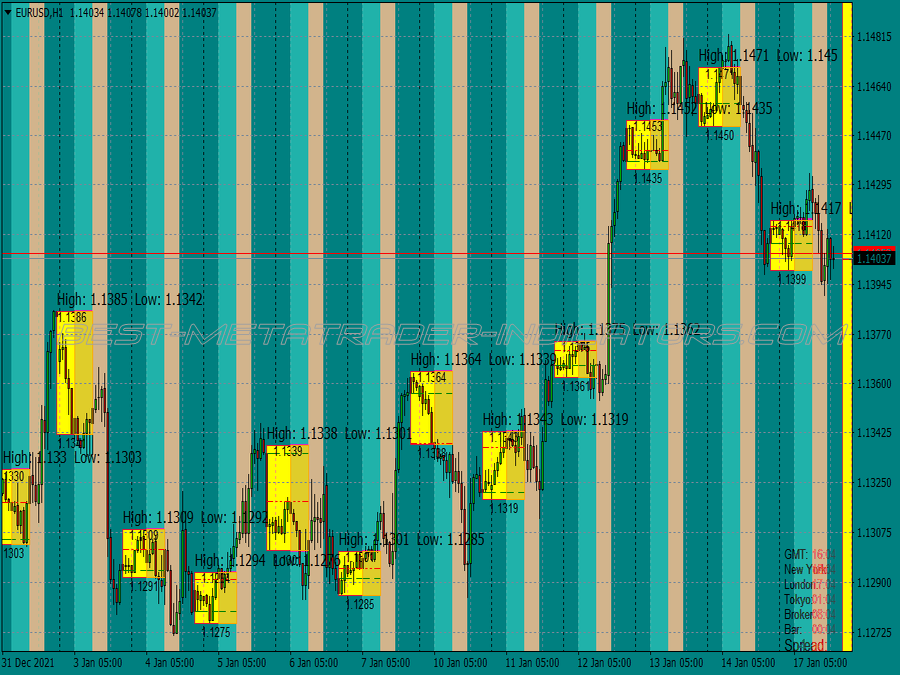

Entry strategy should be totally objective. Every trading system should have specifically written rules for entering a trade. Rules may be anything such as averages, candlesticks, volatility breakouts, Fibonacci retracements or any other entry strategy.

You should have a thorough analysis of market before entering a trade. You should have a definite reason whenever you enter a trade, meaning you should only open a position when the entry criteria are matched.

Stop-Loss Strategy

Entering a trade without having a stop-loss is like riding a motorcycle at high speed in a dark night without headlights and without helmet. It is possible, but it amplifies the chances of losing your whole account.

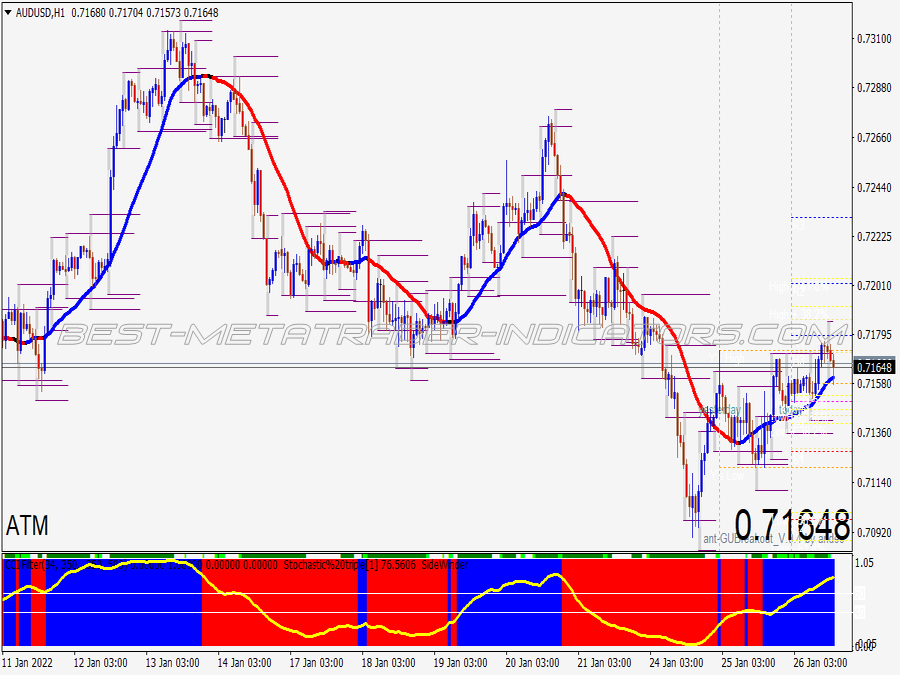

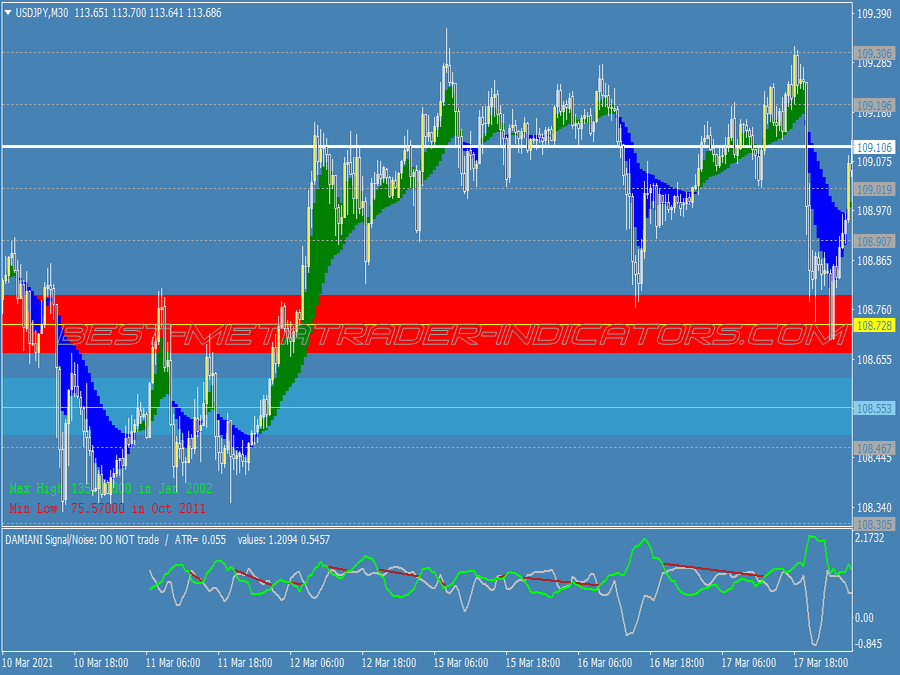

Thus every complete trading system should have a well thought stop-loss strategy. Stop-loss should be placed at strategic position, not too far and not too close either. Various methods like ATR, support and resistance levels can be used to identify the correct stop-loss.

Exit Strategy

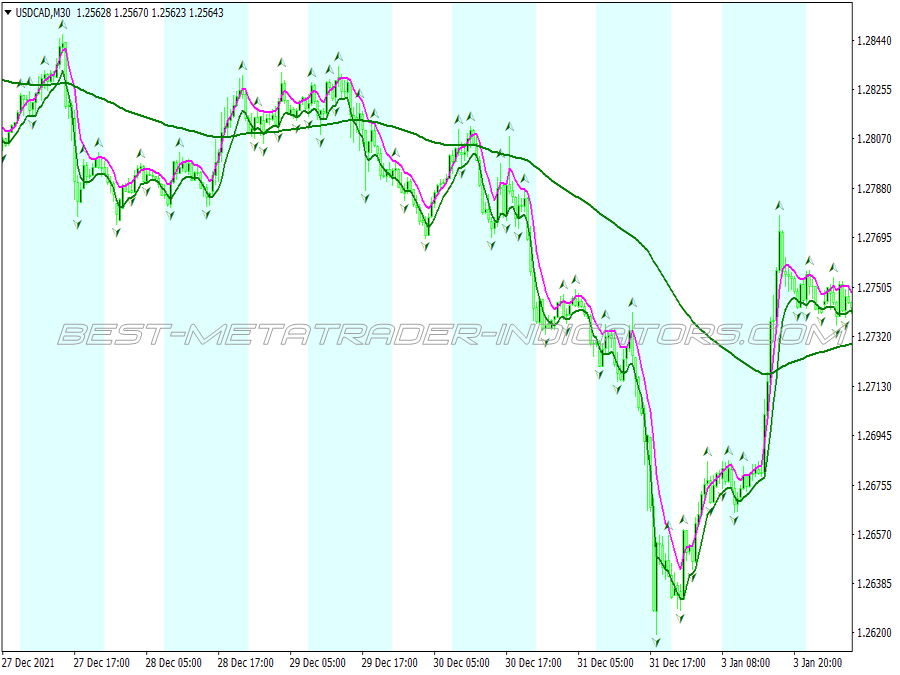

Entering a trade at the right time is crucial but exiting a trade at proper time is even more important, because we can earn profit only when we exit our trades. Exit strategy can vary depending on the system, some systems may have defined profit target levels for exiting a trade, some may have "let trailing stop hit" strategy.

No matter what your strategy is, it should be designed in such way that it will capture most of the trend.

Risk management

You need to define, how much percentage of your account you are willing to risk on every trade. Most experienced traders risk 1-4% of their account balance on each trade. This may look too low to the new forex traders, but will definitely help you avoid big losses. It will keep you in the market for long time in order to get the necessary experience.

It is very important is to have a positive percentage of winning trades compared to losing trades, and a positive average profit compared to the average loss ratio. For example, if your average loss is two times your average profit that means you need to make 10 profitable trades to cover 5 losing trades.

Manage your positions

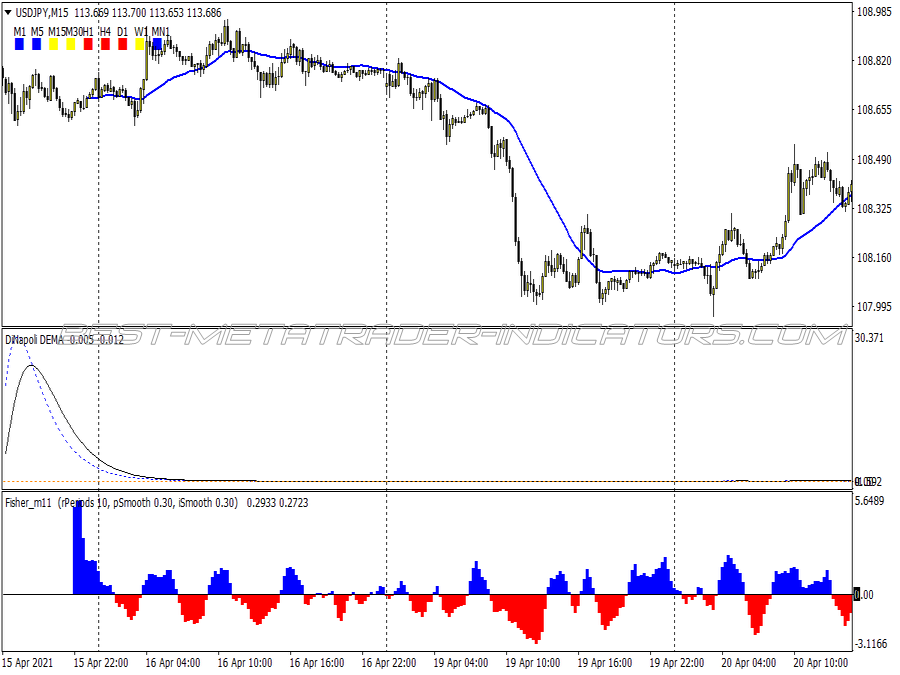

Your trading strategy should consist of rules that will tell you when to move the stop-loss, when to add to the current position (pyramiding), and when to scale down. It is important to manage your positions in order to enhance the profit potential of your trading system.

A complete Trading System

It is time to make sure that every aspect of your trading system is covered. Once you are sure that the system is ready, it is time to test the system. There are a lot of software’s available that have their own programming language so that we can code our trading system into those software and we can back test our system on historical data.

Without back testing, a lack of confidence arises and usually forces traders to question their own trading systems. Thorough testing will built up the necessary confidence needed to successfully trade the system you have developed. Testing also gives an idea about which forex pairs and timeframes will suit properly to your trading system. It will also allow you to modify the system if needed in order to make it more profitable.