Submit your review | |

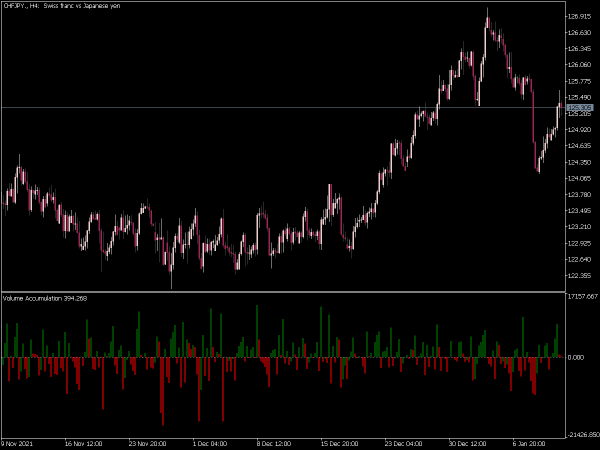

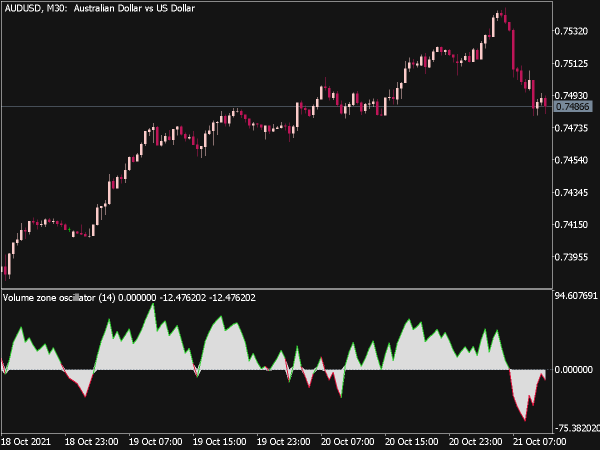

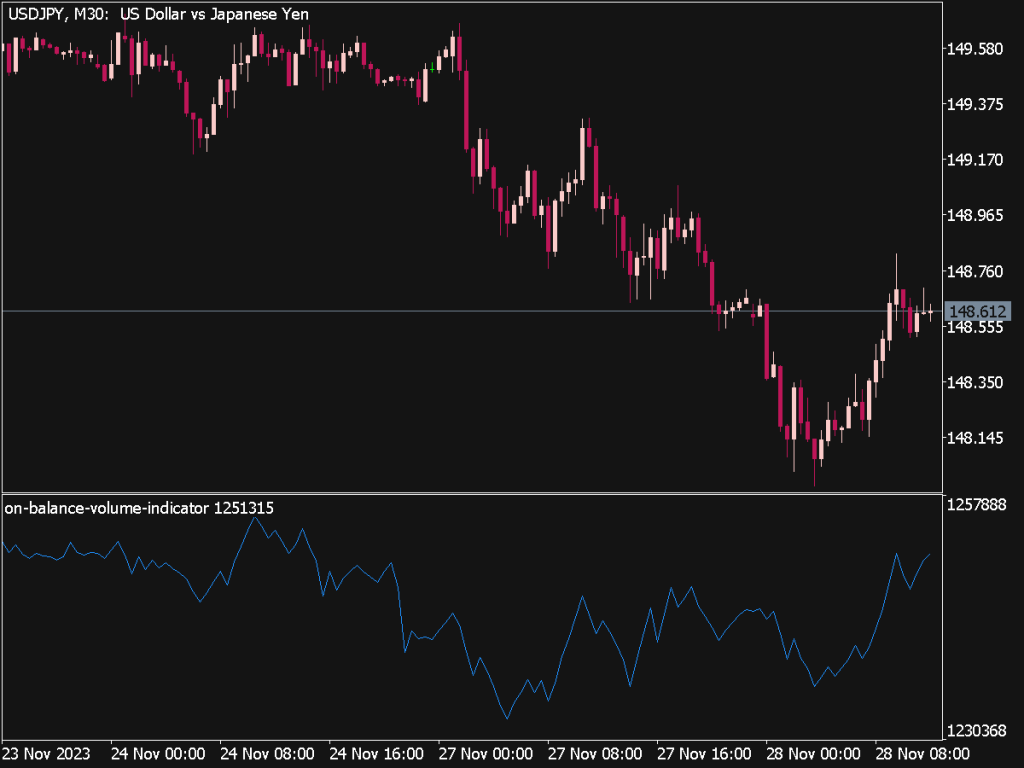

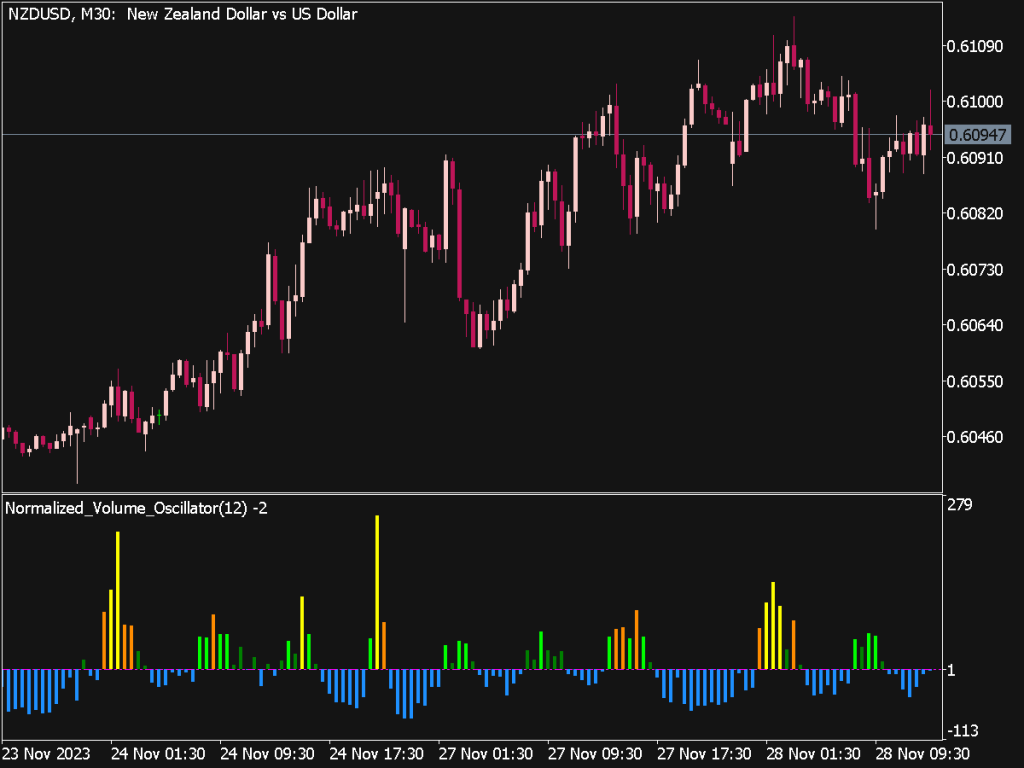

The Volume Profile Indicator is a powerful tool used in technical analysis to visualize trading activity over a specified time period at various price levels. It helps traders identify key support and resistance zones by displaying volume distribution across prices. Here's a comprehensive guide to using the Volume Profile Indicator with practical tips and strategies.

Understanding Volume Profile

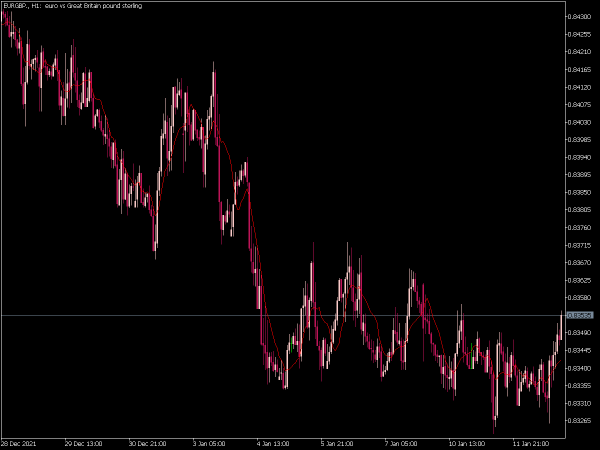

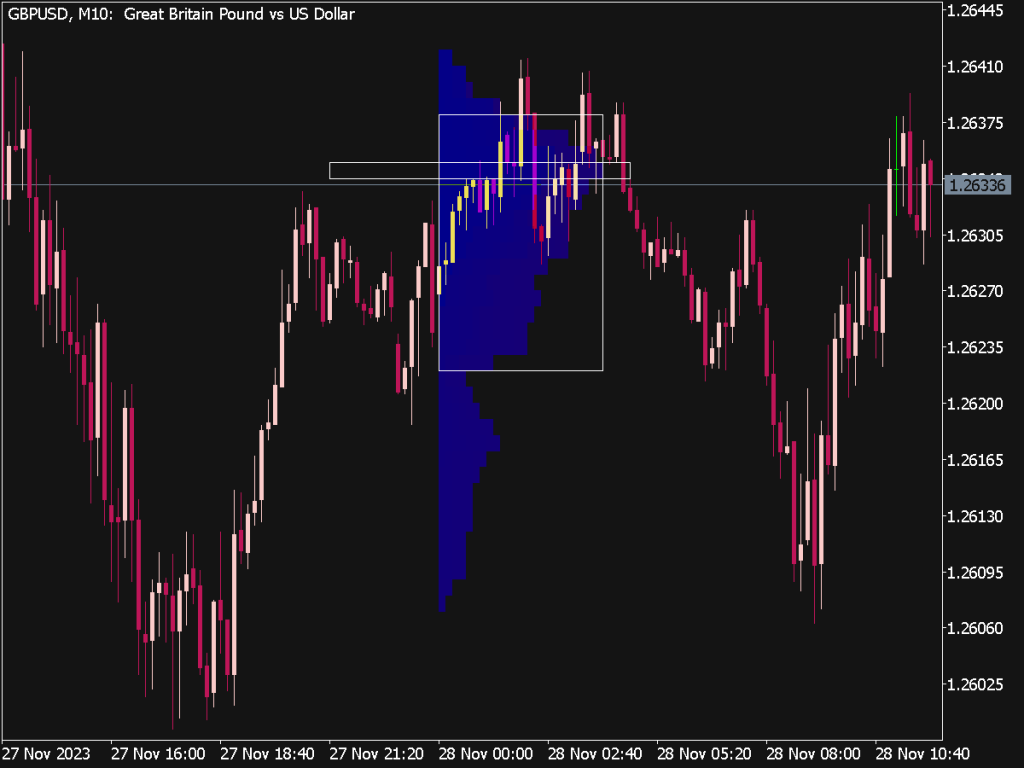

Volume Profile represents the amount of volume traded at each price level rather than over time. This is displayed as a horizontal histogram along the price axis on a chart. The significant components of the Volume Profile include:

• Value Area (VA): This is the range of prices where the majority (typically 70%) of trading volume occurred. It often indicates the fair value of an asset.

• Point of Control (POC): This is the price level with the highest traded volume and serves as the most accepted price during the selected period.

• Low Volume Nodes (LVN) and High Volume Nodes (HVN): LVNs are price levels with significantly lower volume, indicating potential areas of fast movement; HVNs are areas of high trading volume, suggesting strong support or resistance.

Setting Up the Volume Profile

1. Choose the Right Time Frame: For day trading, use lower time frames like 1-minute or 5-minute charts, while swing traders can benefit from daily or weekly profiles.

2. Select Your Volume Profile Type: Most platforms offer different types of Volume Profiles such as Visible Range Profile, Fixed Range Profile, and Session Volume Profile. Choose according to your trading style and needs.

Tips for Using Volume Profile

• Combine with Other Indicators: Use Volume Profile in conjunction with other indicators like Fibonacci retracements, moving averages, or RSI for better trading decisions.

• Pay Attention to Context: Analyze the broader market context (trend, news, economic conditions) while using Volume Profile to filter out potential false signals.

• Look for confluences: When the Price approaches a POC or the edge of the Value Area, observe for additional confirmation from candlestick patterns, momentum indicators, or macroeconomic events.

• Volume versus Price Action: Not just the profile itself, but understanding how volume relates to price action is crucial. Spikes in volume at key price levels can indicate potential reversals or breakouts.

Trading Strategies

1. Trading Reversals: When the price reaches the edges of the Value Area, traders can look for signs of reversal — consider entering a position if the price shows resistance at an HVN.

2. Breakout Trading: If the price approaches high or lows of a past profile (where the volume was diminutive), it may lead to a continuation breakout. This is evident when price surges through a LVN, providing a good entry point.

3. Value Area Trading: Entering trades as the price bounces between the POC and the Value Area boundaries can be a proven strategy. Once the market trades outside this range, consider trend-following approaches.

4. Long-term Investment: Use the Volume Profile to assess long-term zones of value. If the price often oscillates in a certain volume area, consider that price range for potential accumulation or distribution.

5. Market Profile: Integrate Volume Profile with Market Profile (an extension of traditional volume analysis that involves time) to add context to the analysis, especially for intraday trading.

6. Volume Spikes: Large volume spikes during price reversals can signal imminent changes in market direction. Watch for these spikes while analyzing Volume Profile.

Final Thoughts

Successful integration of the Volume Profile Indicator into your trading strategy requires patience and practice. Start by backtesting your strategies to understand how Volume Profile behaves across different market conditions and asset classes. Continuous education through resources like books, webinars, and community discussions can further enhance your skills. Remember, while the Volume Profile Indicator is a potent tool, it’s essential to use it in the context of a comprehensive trading plan that considers risk management and emotional control for long-term trading success.