Submit your review | |

The Boom and Crash Spike Hunter Indicator is a popular tool among traders in the Boom and Crash markets, which are characterized by sudden price spikes and crashes. Here are some trading tips and rules to enhance your trading strategy using this indicator:

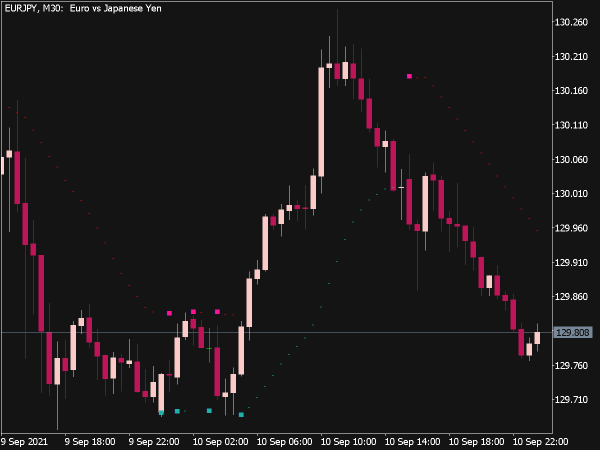

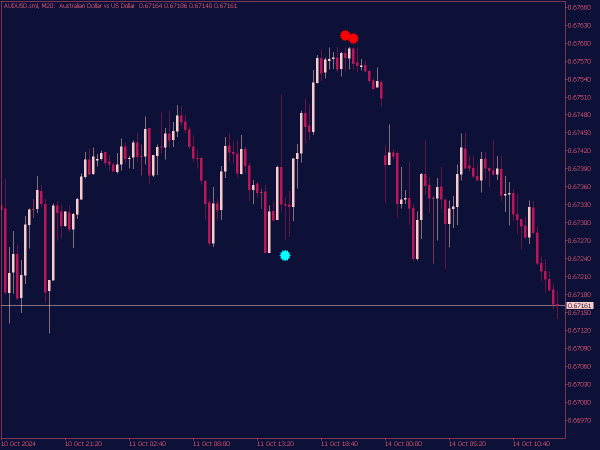

1. Understand the Market: Familiarize yourself with the dynamics of Boom and Crash markets. Boom markets typically rise, while Crash markets fall. Understanding market behavior will help in better interpreting indicator signals.

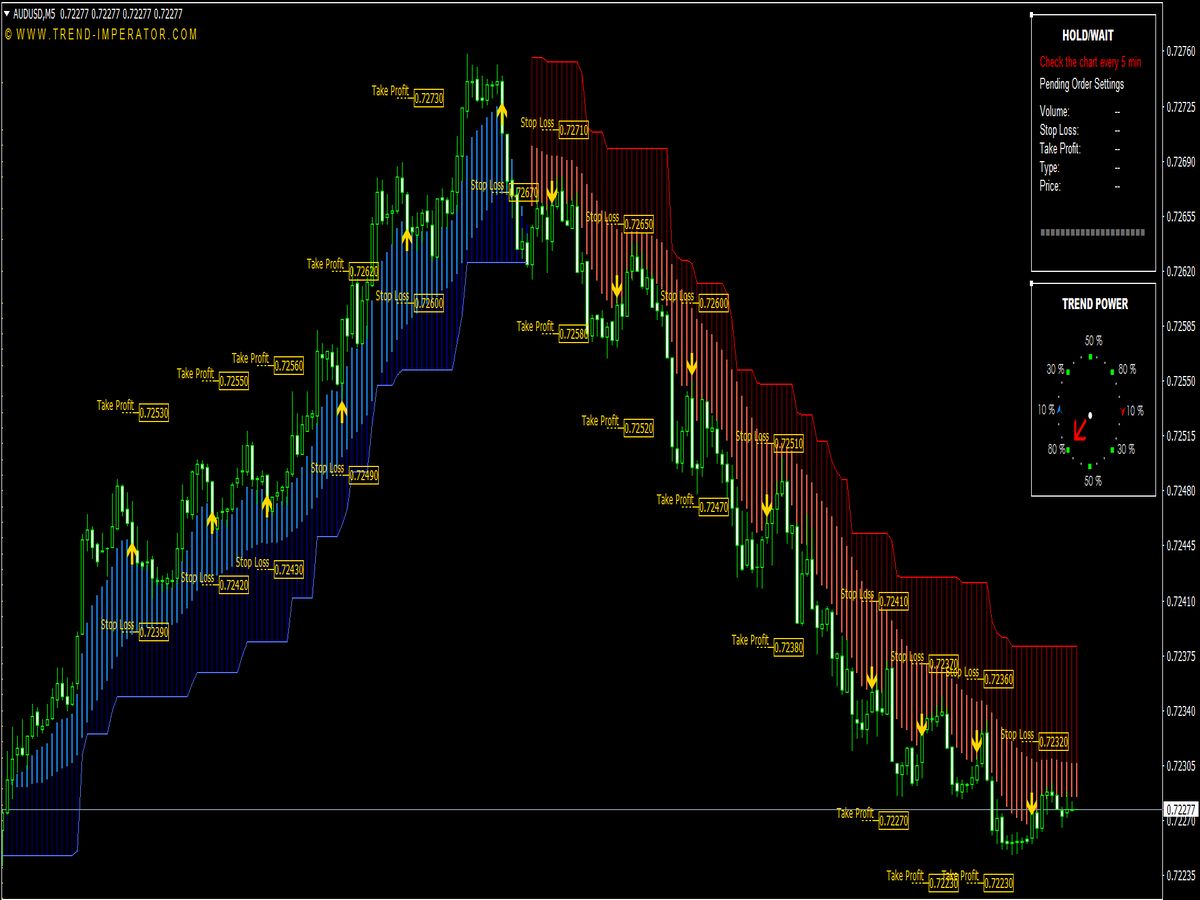

2. Use the Right Time Frame: Choose an appropriate time frame for your trades - scalping may require lower time frames (M5 or M1), while swing trading could benefit from H1 or H4.

3. Set Up the Indicator: Ensure that the Spike Hunter Indicator is correctly installed and configured. Adjust settings based on your trading style and risk tolerance.

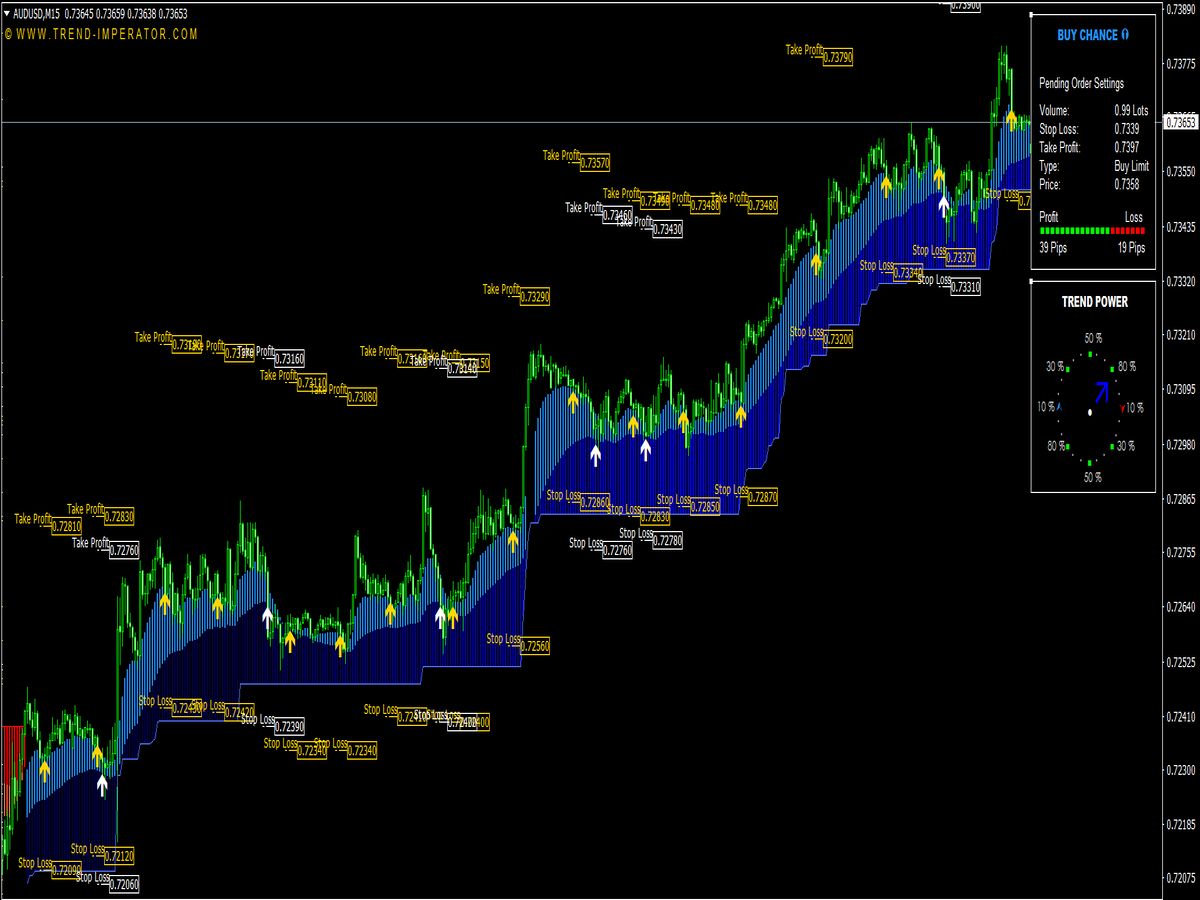

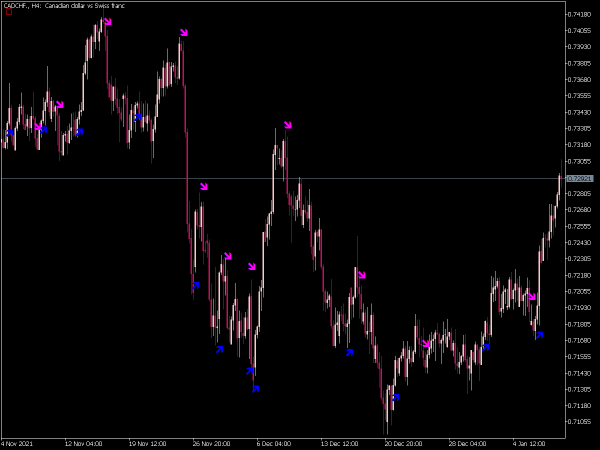

4. Identify Entry Points: Look for divergence between price action and the indicators. A spike in the indicator can signal a potential reversal or continuation, allowing traders to enter at advantageous points.

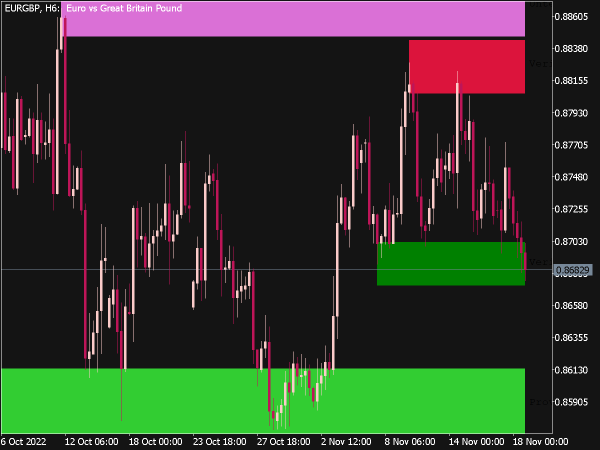

5. Confirm Signals: Use additional confirmation tools like candlestick patterns and support/resistance levels before entering a trade. This helps to filter out false signals.

6. Set Stop Losses: Risk management is crucial. Always set stop losses to limit potential losses, ideally a few pips away from the last swing high/low or at a technical level.

7. Take Profit Levels: Determine take-profit targets based on previous support and resistance levels or set them according to a fixed risk-reward ratio, such as 1:2 or 1:3.

8. Avoid Overtrading: Stick to your strategy and avoid the temptation to trade frequently. Quality over quantity is essential for sustaining profitability.

9. Monitor Market News: Economic news releases can influence market movements. Be aware of scheduled news events that may affect the Boom and Crash markets and plan your trades accordingly.

10. Backtesting: Test your strategy with historical data to see how the Spike Hunter Indicator performs in different market conditions. This can help refine your approach.

11. Stay Disciplined: Emotions can cloud judgment. Stick to your trading plan and resist the urge to modify your strategy impulsively based on recent trades.

12. Adapt to Market Conditions: Flexibility is key. If the market is trending, you may want to avoid counter-trend trading. Adjust your strategies according to changing market conditions.

13. Journaling: Keep a trading journal to document your trades, including entries, exits, and reasons for the trades. Analyzing past trading behavior can provide valuable insights for improvement.

14. Risk Management: Only risk a small percentage of your trading capital on each trade, typically between 1-3%, to protect your account from significant losses.

15. Focus on Higher Probability Trades: Only take trades that meet all your criteria for entry. Avoid the urge to chase the market, which often leads to unplanned trades.

16. Network with Other Traders: Engage with other traders using the Spike Hunter Indicator to share insights and strategies. Community support can enhance your trading experience.

17. Continuous Learning: Markets evolve, and so should your strategies. Keep learning about new trading techniques, tools, and market analysis methods.

18. Avoid Micromanaging Trades: Once you set a trade with a stop loss and take profit, avoid the impulse to alter your plan due to short-term market movements.

19. Use Alerts: If possible, set up alerts to notify you when the Spike Hunter Indicator generates a trading signal. This can help you stay focused on other tasks while trading.

20. Stay Updated: Be aware of changes to the Spike Hunter Indicator and any updates that may improve its functionality or accuracy.

By following these tips and rules, you can enhance your effectiveness when trading the Boom and Crash markets using the Spike Hunter Indicator. Remember that consistent practice and patience are vital for long-term success in trading.