Submit your review | |

The Supply and Demand Indicator is a technical analysis tool that helps traders identify potential reversal points in the market based on the relationship between supply and demand. When demand outstrips supply, prices tend to rise, while an excess of supply can lead to price drops. Traders use this indicator to spot significant price levels where buyers or sellers have previously entered the market, often leading to future price movements.

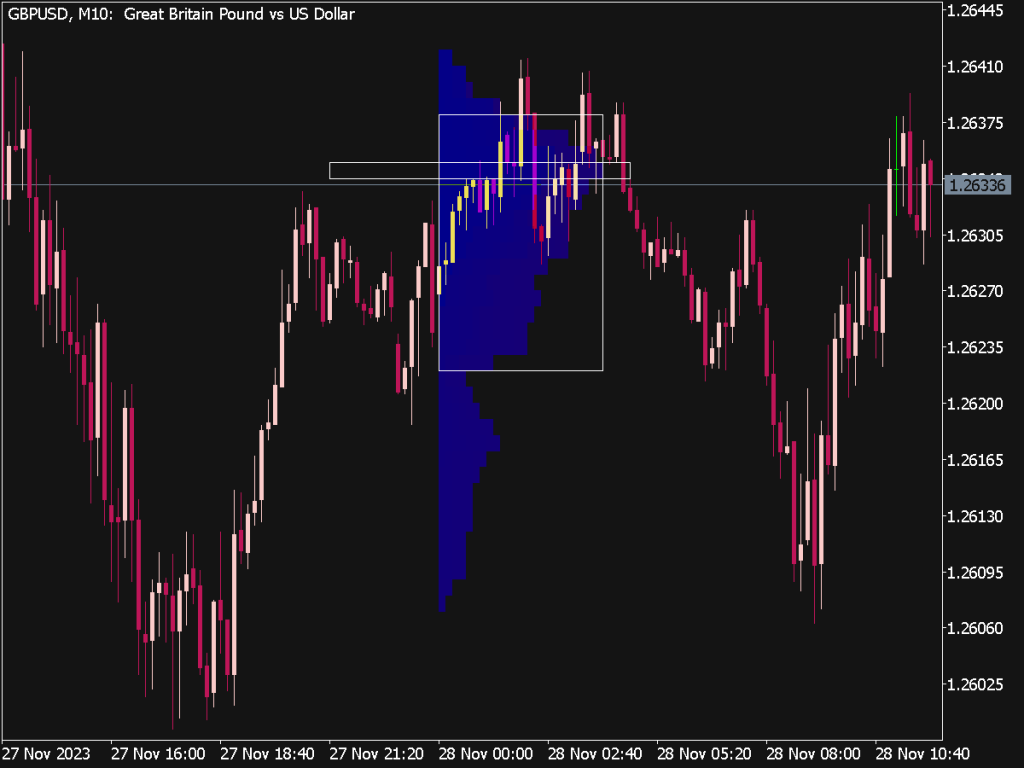

1. Identifying Supply and Demand Zones:

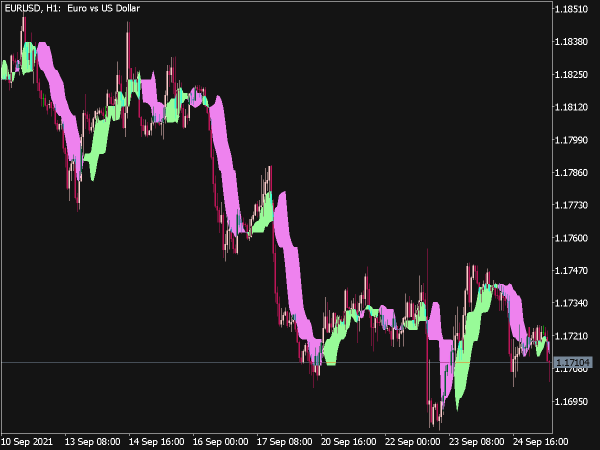

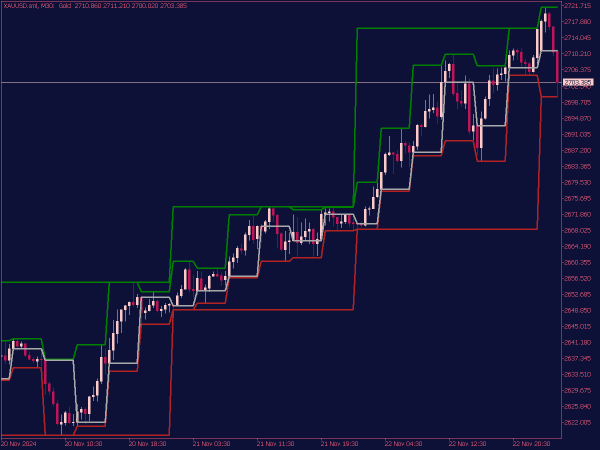

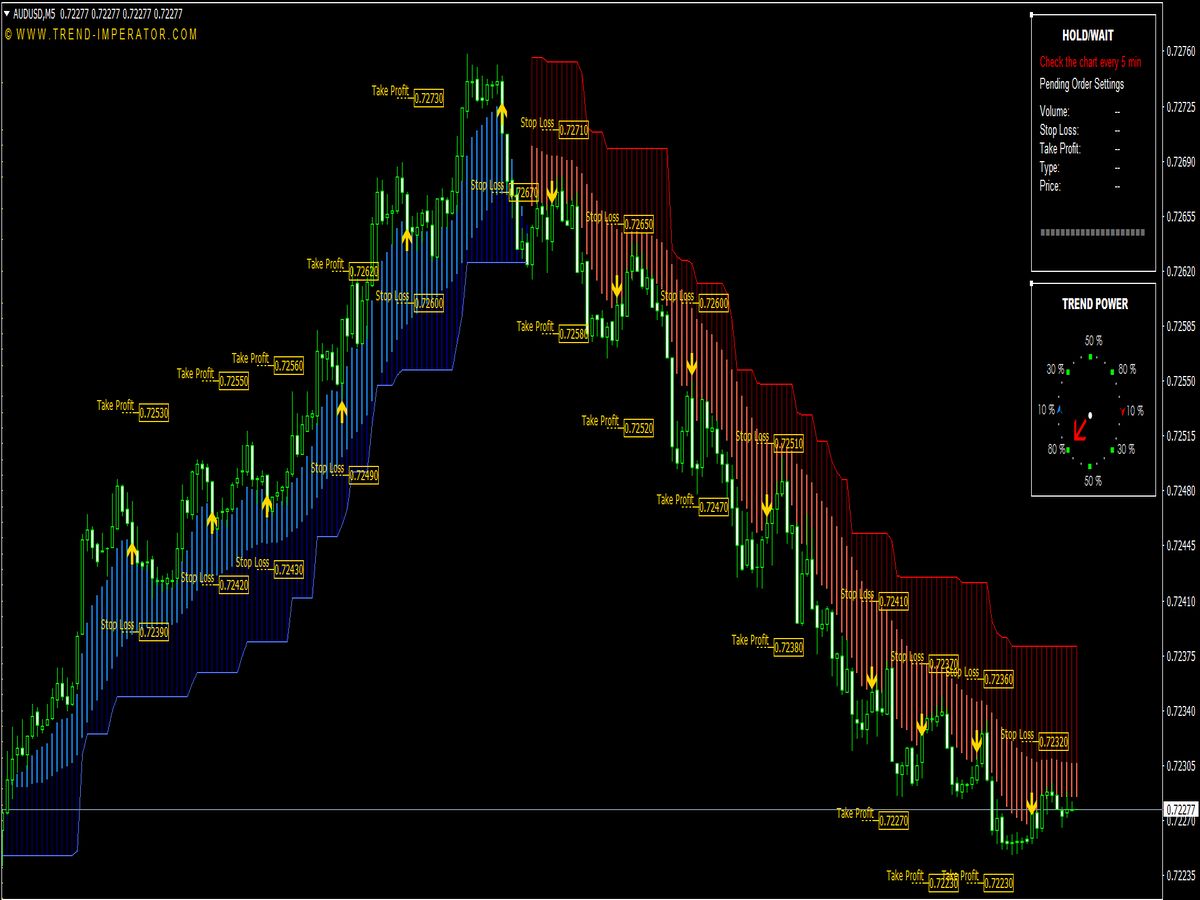

To use the Supply and Demand Indicator effectively, traders begin by identifying key supply and demand zones on their charts. A demand zone is a price level where buyers have previously stepped in, leading to an increase in price, while a supply zone is where sellers have entered the market in significant quantities, causing price declines. Look for areas with significant price movement; flat areas may not indicate strong interest.

2. Price Action Confirmation:

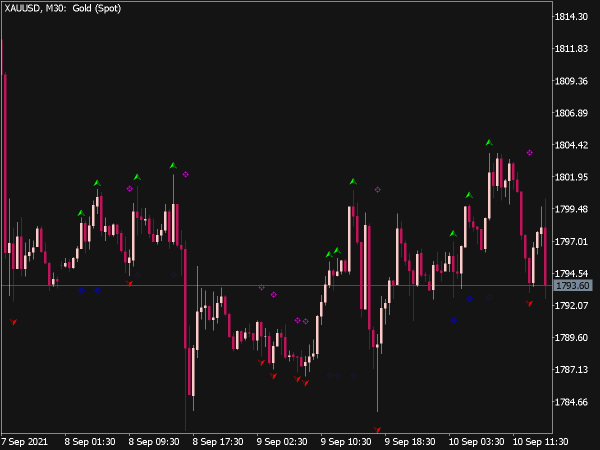

Once potential supply and demand zones are identified, traders wait for price action confirmation before entering trades. This can involve observing candlestick patterns, such as pin bars or engulfing candles, which indicate a reversal at these levels. A bullish reversal pattern in a demand zone might signal a buying opportunity, while a bearish pattern in a supply zone could indicate a selling opportunity.

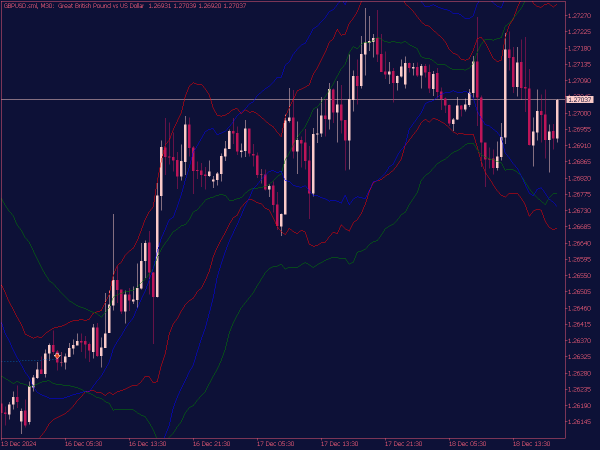

3. Timeframe Considerations:

Different timeframes can yield different supply and demand zones. For longer-term trading strategies, it's essential to analyze daily or weekly charts, as these provide a broader perspective on market trends. Conversely, day traders may utilize smaller timeframes, like 5-minute or 15-minute charts, but should consider the potential for noise and false signals.

4. Risk Management:

Proper risk management is crucial when employing supply and demand trading strategies. Traders should define their risk tolerance, ideally risking no more than 1% to 2% of their capital on a single trade. Placing stop-loss orders just beyond the supply or demand zone can help protect against adverse movements while allowing for potential price fluctuations.

5. Multiple Confluence Factors:

Incorporating additional indicators or tools can enhance the effectiveness of supply and demand strategies. For example, traders might look for confluence with Fibonacci retracement levels, moving averages, or trend lines that coincide with identified supply and demand zones. This overlapping support or resistance can add weight to the validity of a trade setup.

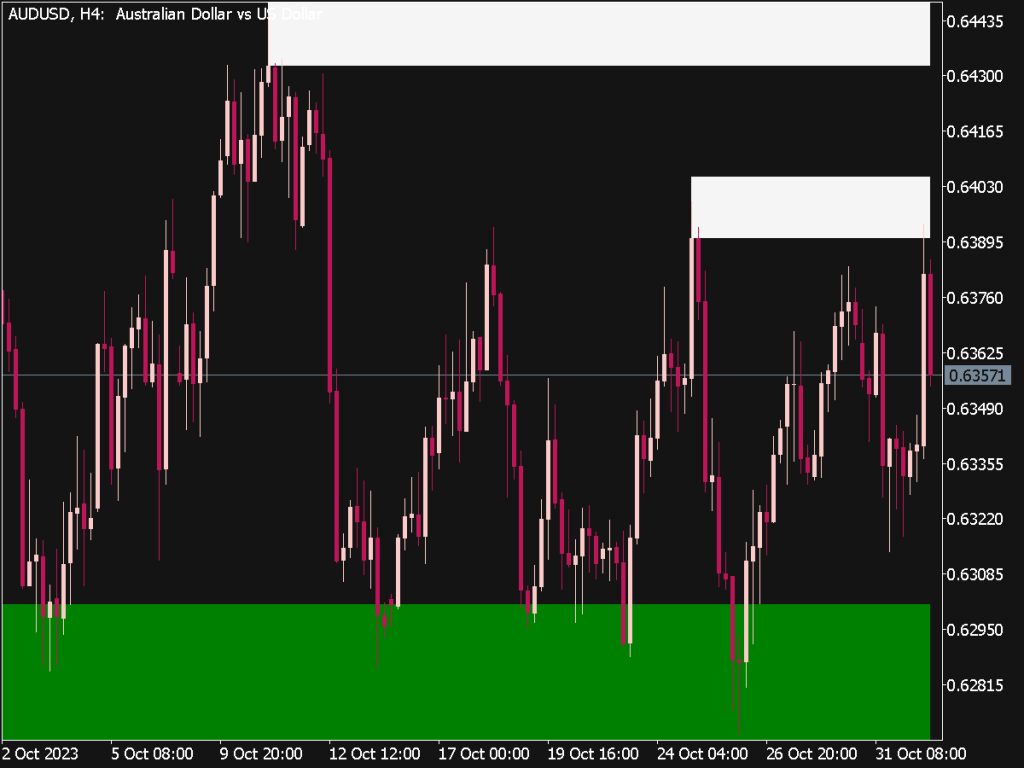

6. Breakout Strategies:

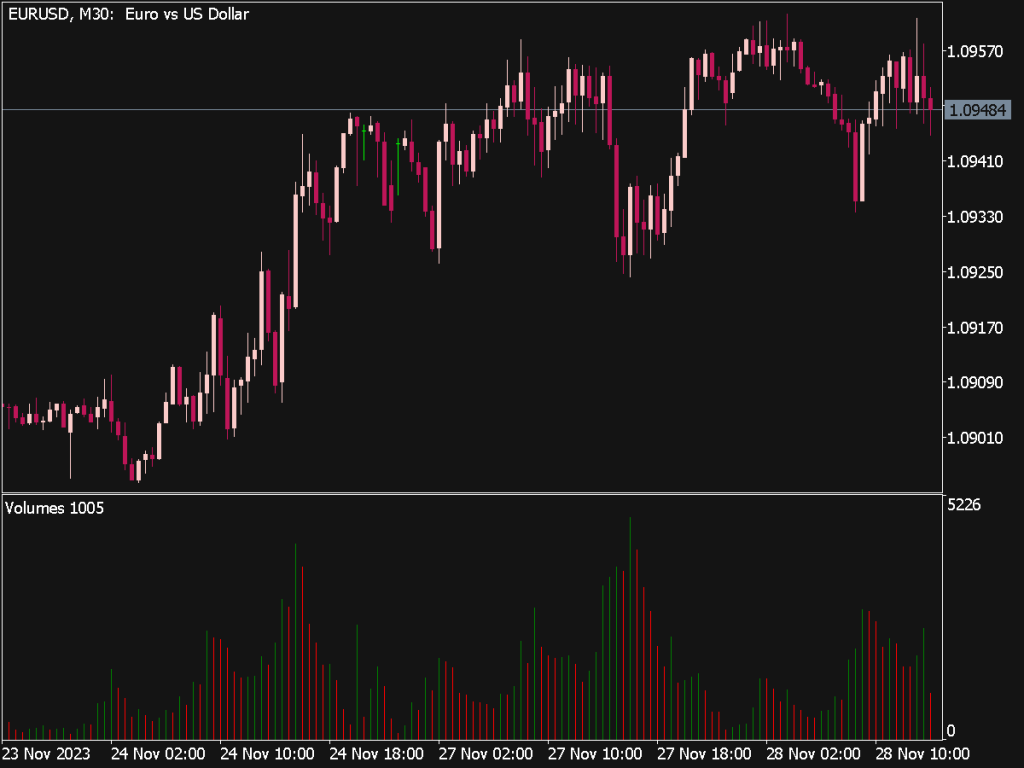

When price breaks through a clearly defined supply or demand zone, it can signal a strong movement in the direction of the breakout. Traders can enter trades in the direction of the breakout, placing stop-loss orders just below the breached demand zone or above the supply zone. However, it's essential to confirm breakouts with volume analysis, ensuring the move is supported by significant trading activity.

7. Range Trading:

In markets where price typically oscillates between defined supply and demand zones, range trading can become a strategy. Traders can buy at demand zones and sell at supply zones, capturing smaller price movements. This strategy is effective in sideways markets but requires vigilant monitoring, as breaks from the established range can occur abruptly.

8. Swing Trading Opportunities:

Supply and demand levels can provide excellent opportunities for swing traders looking to capture larger price movements. By identifying well-established zones on their charts, traders can enter positions with a medium-to-longer-term view. Ideal entry points occur when price revisits a significant demand zone for a potential bounce or a supply zone for a potential decline.

9. News and Economic Indicators:

Macroeconomic news and events can impact supply and demand dynamics significantly. Traders should be aware of scheduled news releases that may lead to increased volatility or shift supply and demand. Understanding the broader economic context can help in adjusting strategies and trading decisions accordingly around these events.

10. Backtesting Strategies:

Before committing real capital to any supply and demand trading strategy, traders should backtest their strategies using historical data. This can reveal how well the strategies would have performed in the past and help identify potential weaknesses. Efficient backtesting can also assist in refining entry and exit criteria to improve overall trading performance.

11. Continuous Learning and Adaptation:

Markets are constantly evolving, and strategies that worked well in the past may not yield the same results in the future. Traders should commit to continuous education to stay updated on market trends, new trading techniques, and evolving economic factors. Adaptation to changing market conditions is vital for long-term success.

Utilizing the Supply and Demand Indicator, traders can develop a robust framework for making informed trading decisions. By combining these strategies with sound risk management and ongoing education, traders can enhance their ability to navigate complex markets effectively.

Can I get .ex5 file please?

This indicator is super nice and it's just what i've been looking for to complete my ICT strategy. However, i would love t have this indicator for mt4. Can you please the mt4 variant. Thanks

Hello, I would like to have Supply Demand indicator coded for NinjaTrader platform. Or to at least receive the logic for MT4/5 Supply Demand. Can you please help with that? Thank you in advance for your support.

Best regards,

Jan

Dear Jan, we do not offer any programming service. We are a small team and our time is limited. We only concentrate on our trading positions management and the further development of our systems. We are sorry if it seems uncomfortable for you.

Здравствуйте. Пользуюсь Вашим замечательным сайтом с Вашими некоторыми индикаторами. Спасибо Вам.

Хотел бы уточнить у Вас, подскажите пожалуйста. Я скачал Индикатор для МТ4, называется supply-and-demand-zones.ex4. У меня на моем МТ4 всё работает и выдает сигналы тоже. А вот знакомым тоже его отдал для использовании, но у них Индикатор показывает, но без сигналов, Алертов нет. Какая это может быть причина? И что нужно сделать, чтобы посоветовать мне друзьям, чтобы они исправили бы эту проблему и работали бы Алерты, сигналы. Спасибо.