Submit your review | |

Swing trading is a popular trading strategy that involves holding positions for a few days to weeks to capitalize on expected price moves. Below is a list of indicators, strategies, and tips for successful swing trading.

Indicators for Swing Trading:

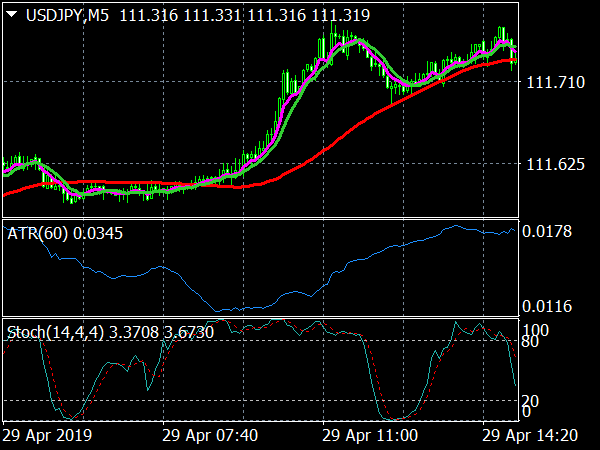

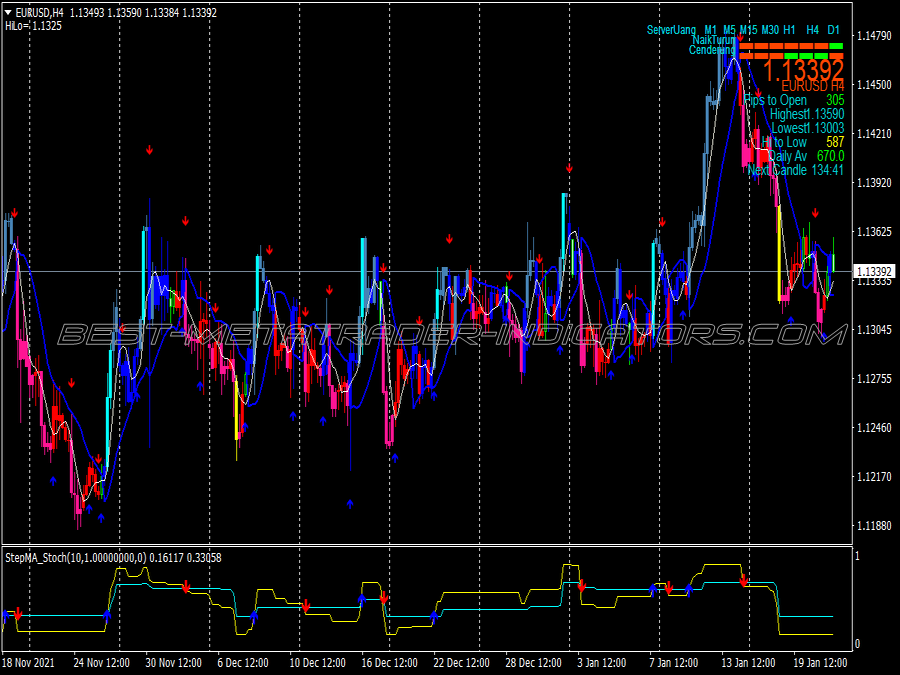

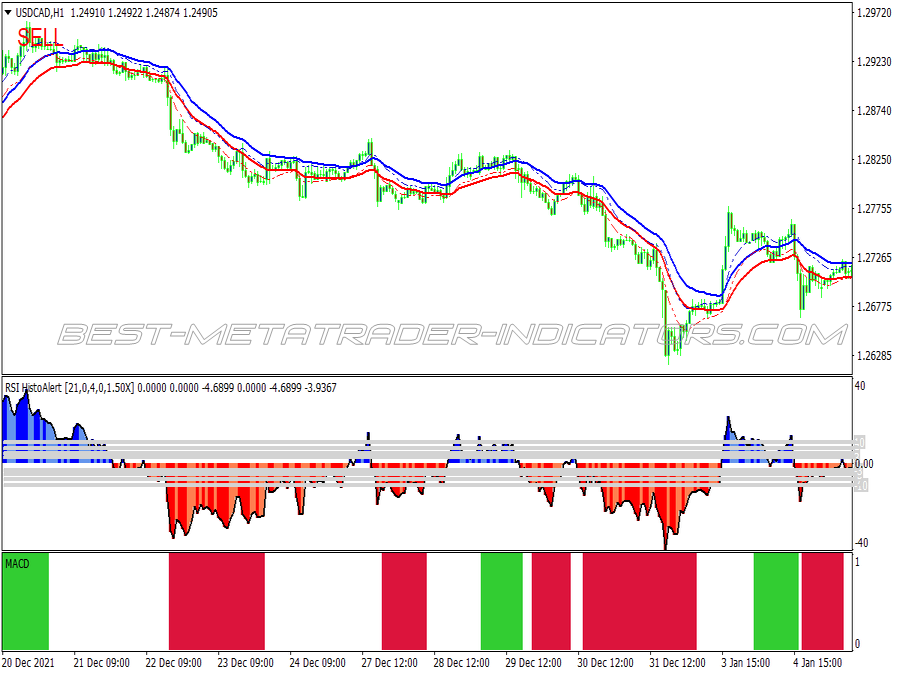

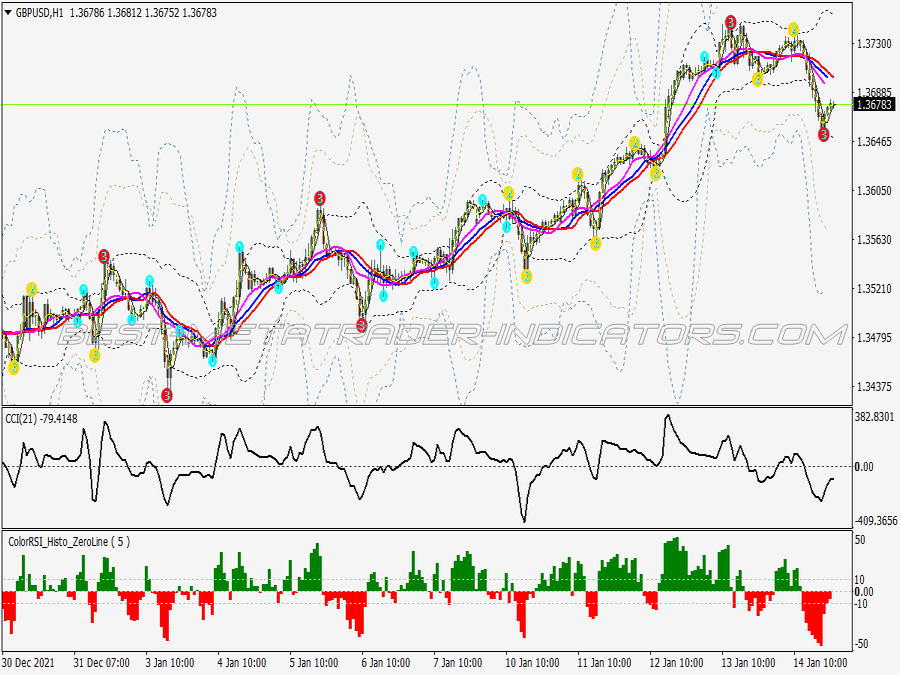

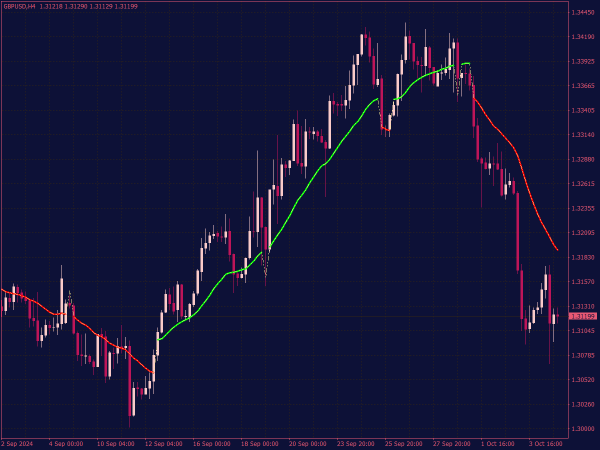

1. Moving Averages: Use Simple Moving Averages (SMA) or Exponential Moving Averages (EMA) to determine trend direction. A common strategy is the crossover method, where traders look for a bullish signal when a short-term EMA crosses above a long-term EMA, and vice versa for bearish signals.

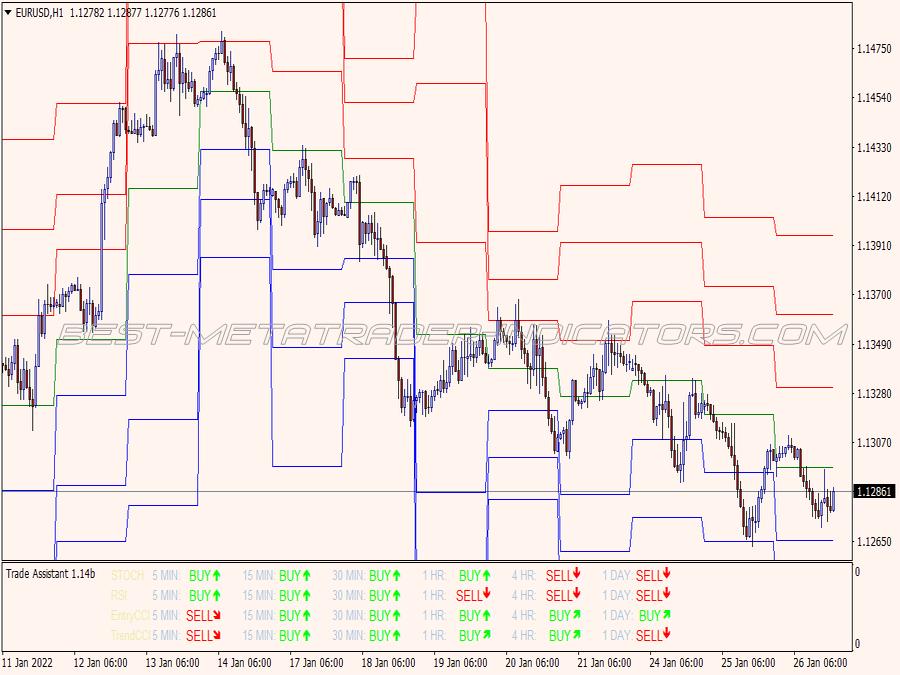

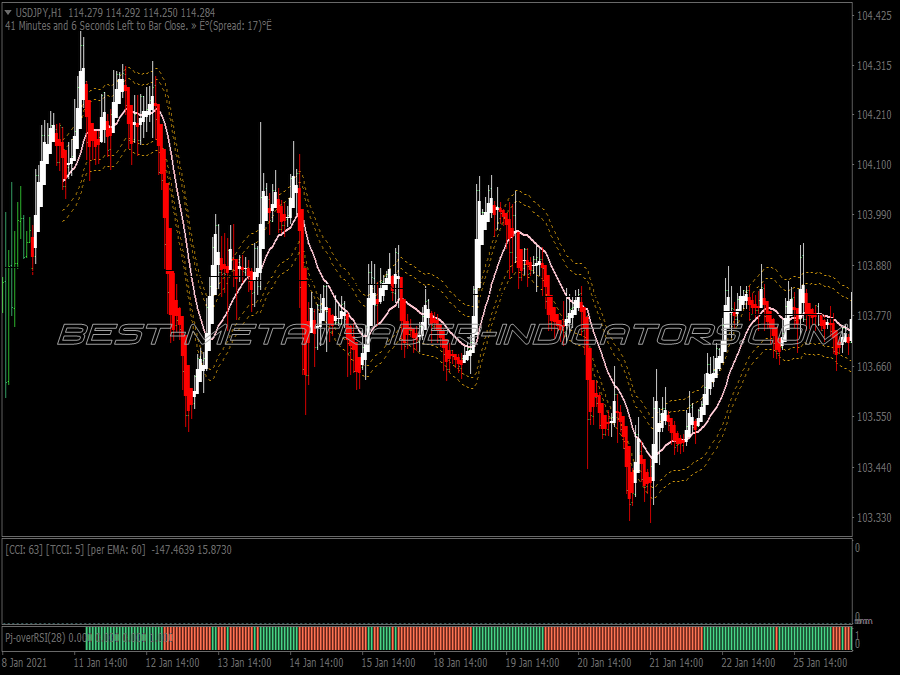

2. Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. An RSI above 70 typically indicates overbought conditions, while below 30 suggests oversold conditions, signaling potential reversal points.

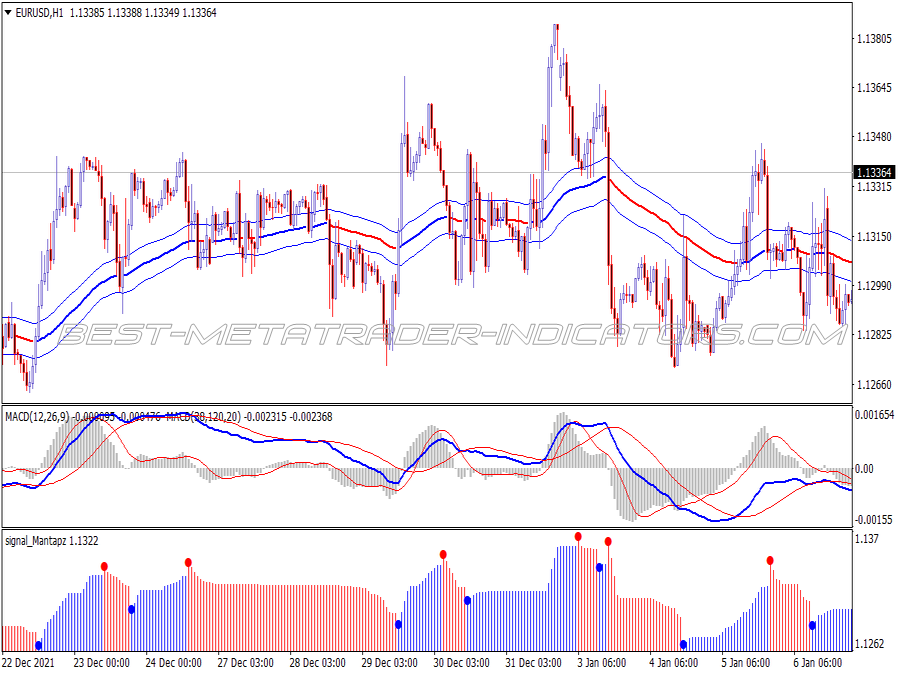

3. MACD (Moving Average Convergence Divergence): This indicator helps identify the strength, direction, momentum, and duration of a trend. Look for MACD line crossovers and divergences with price to gauge potential trend reversals.

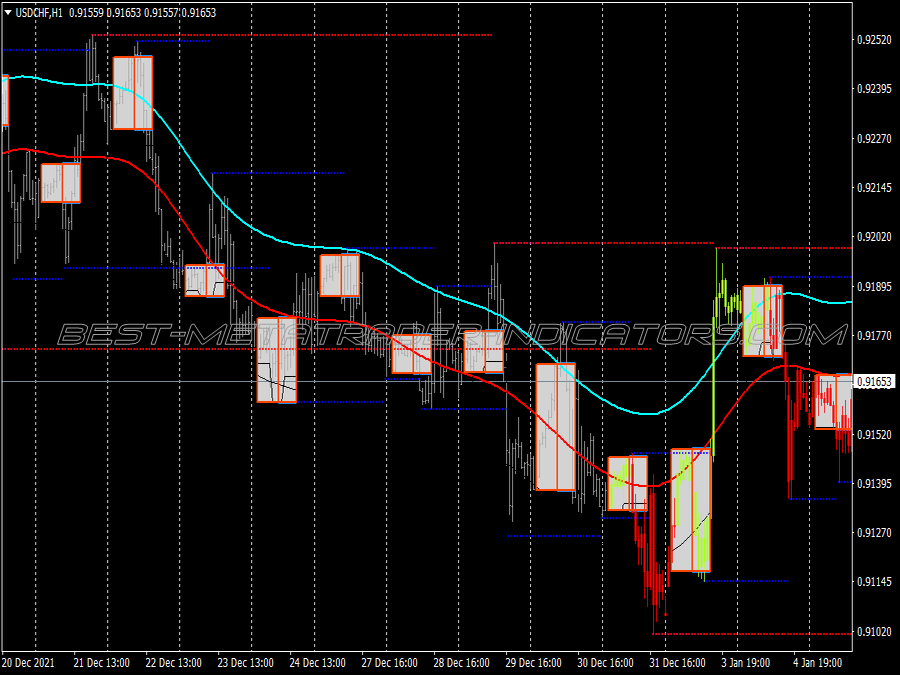

4. Bollinger Bands: These consist of a moving average and two standard deviation lines. When the price moves towards the upper band, it may be considered overbought; conversely, when it approaches the lower band, it may be viewed as oversold, presenting potential buy or sell opportunities.

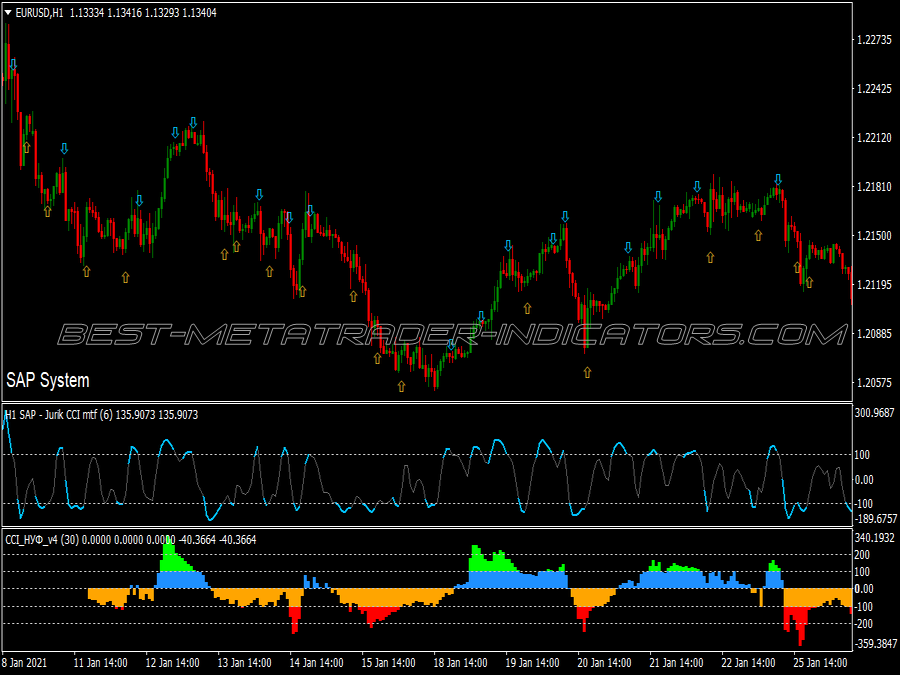

5. Stochastic Oscillator: This momentum indicator compares a particular closing price of a security to a range of its prices over a specific period. Values above 80 are considered overbought, and those below 20 are considered oversold.

Swing Trading Strategies:

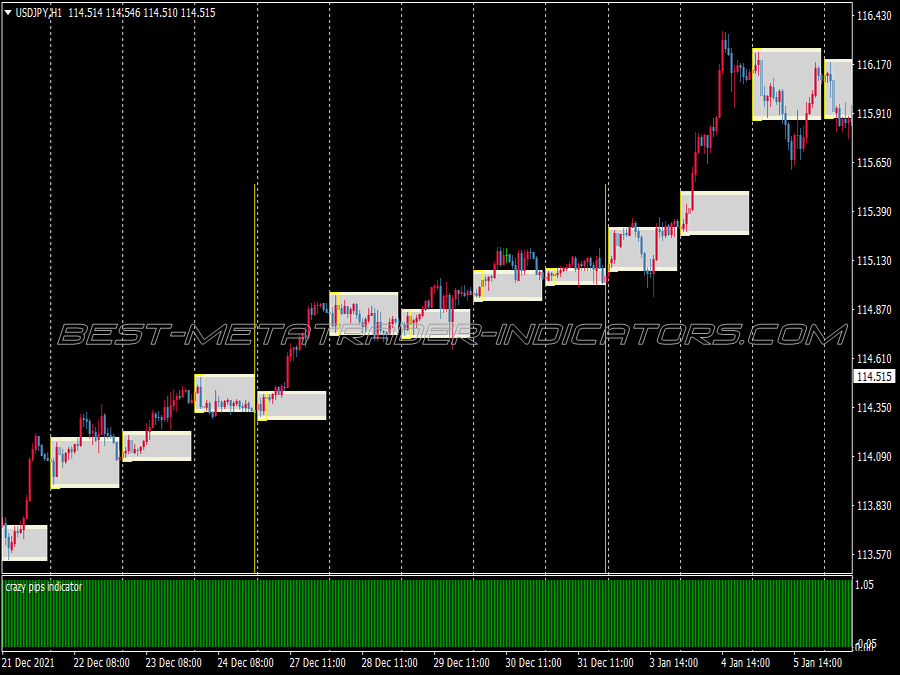

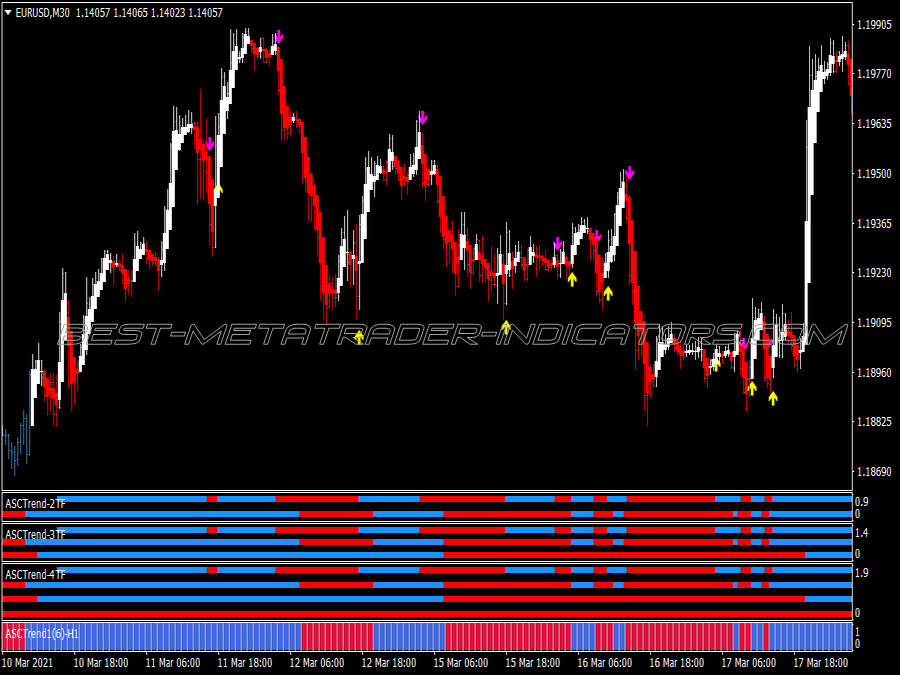

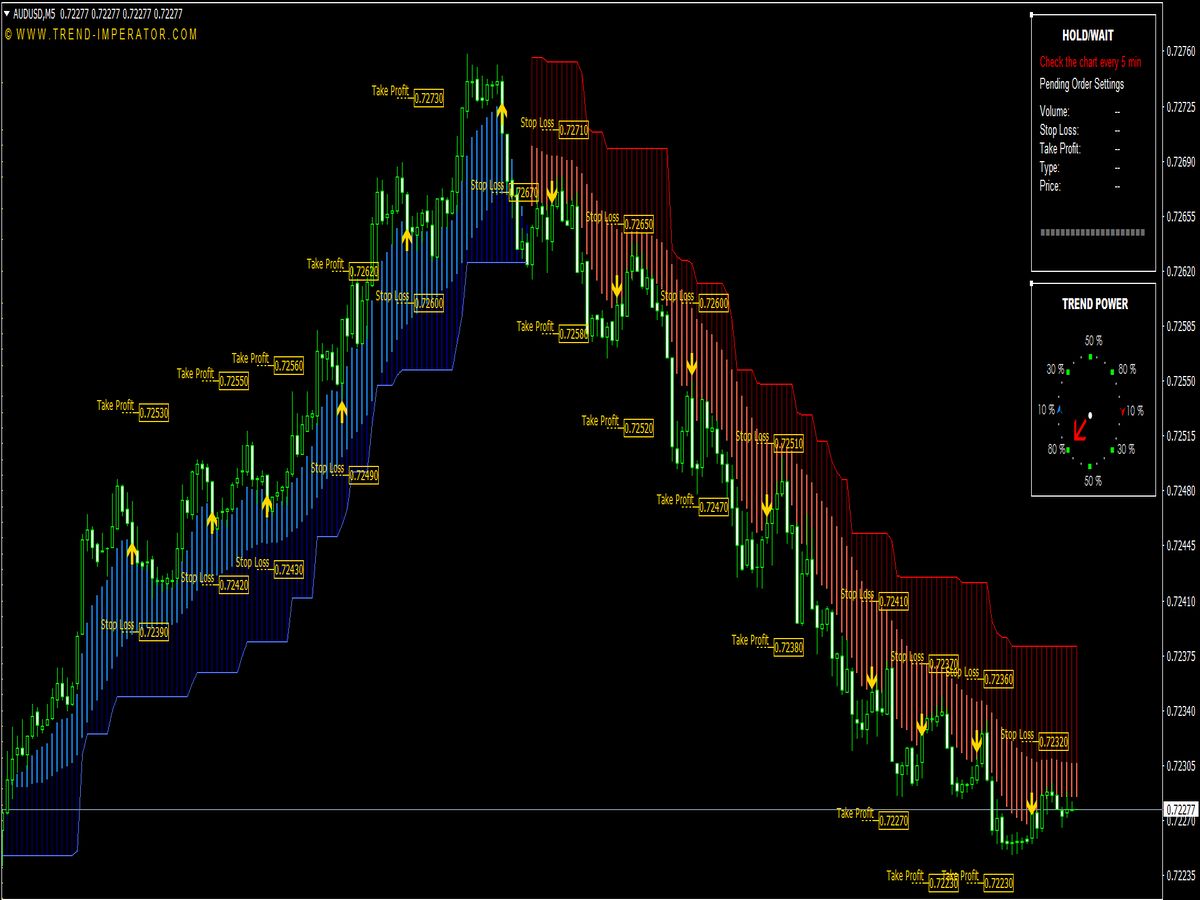

1. Trend Following: This strategy involves identifying the overall market direction and taking trades in line with that trend. Traders might use moving averages or trendlines to help spot the trends.

2. Reversal Trading: In this strategy, traders look for points where the trend is likely to reverse, relying on indicators like the RSI or Stochastic Oscillator to identify potential overbought or oversold conditions.

3. Breakout Trading: This involves entering a trade when the price breaks out from a defined range or level of support/resistance. Traders might use increased volume to confirm the breakout.

4. Pullback Trading: This strategy seeks to take advantage of temporary price retracements within a trend. After a trend move, traders wait for a pullback to an area of support or resistance before entering their trades.

5. Pattern Trading: Leveraging chart patterns like head and shoulders, double tops/bottoms, and triangles can help traders forecast future price movements. Understanding these patterns enhances the probability of success in trades.

Tips for Successful Swing Trading:

1. Keep a Trading Journal: Documenting trades helps analyze what strategies work and what doesn’t, improving your approach over time.

2. Manage Risk: Use stop-loss orders to limit potential losses on trades. Generally, it’s advisable to risk only 1-2% of your trading capital on a single trade.

3. Stay Informed: Economic factors can significantly influence markets. Stay updated with financial news and events that could impact market movements.

4. Use Position Sizing: Adjust your position sizes based on market conditions and your current capital to maintain a balanced risk/reward ratio.

5. Emotional Control: Swing trading can provoke emotional responses. Developing the discipline to adhere to your trading plan and avoid impulsive decisions is crucial.

6. Avoid Overtrading: Focus on quality setups rather than quantity. It’s better to take a few well-researched trades than to chase every potential opportunity.

7. Set Realistic Goals: Aim for small, consistent gains rather than expecting large profits from trades. Setting achievable targets can help sustain motivation.

8. Diversify Your Trades: Spread risk across different assets or sectors to minimize the impact if one position moves against you.

9. Use Technology: Leverage trading platforms that offer backtesting tools, alerts, and charting features to refine your strategies.

10. Continuous Learning: The financial markets are dynamic. Engaging in ongoing education through books, webinars, and mentorship can equip you with new insights and refined strategies.

In summary, successful swing trading relies on a combination of solid indicators, effective strategies, and strict discipline. By managing risk, remaining informed, and continuously learning, traders can improve their chances of capitalizing on market fluctuations. Always adapt your trading approach based on your experiences and market conditions for optimal results.