Submit your review | |

Scalping is a trading strategy that involves making numerous trades throughout the day to profit from small price changes, and successful scalping relies heavily on using the right indicators and effective entry techniques. Here are several tips and indicators to improve your scalping strategy:

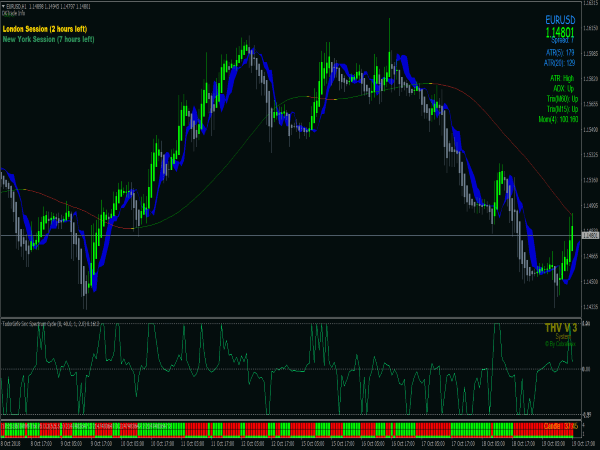

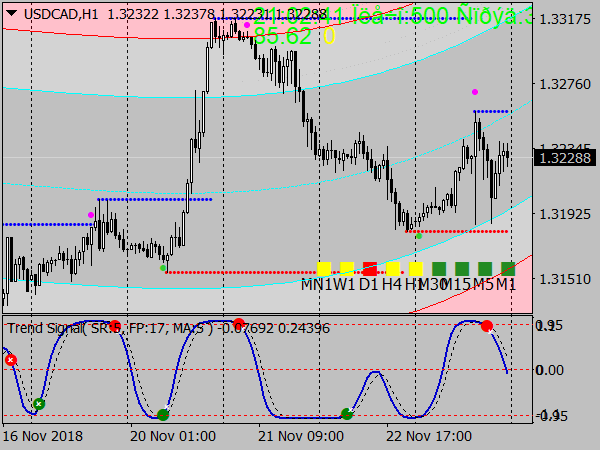

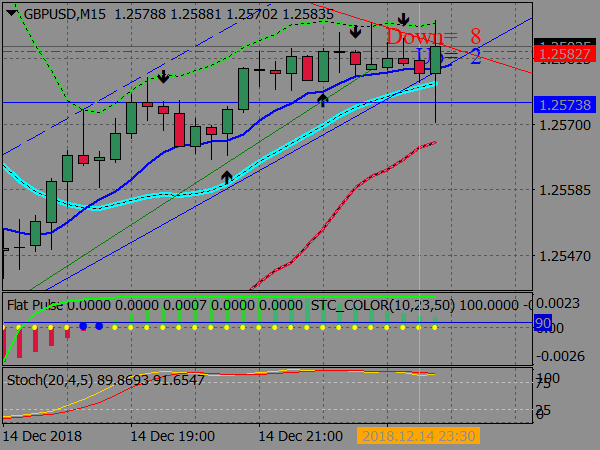

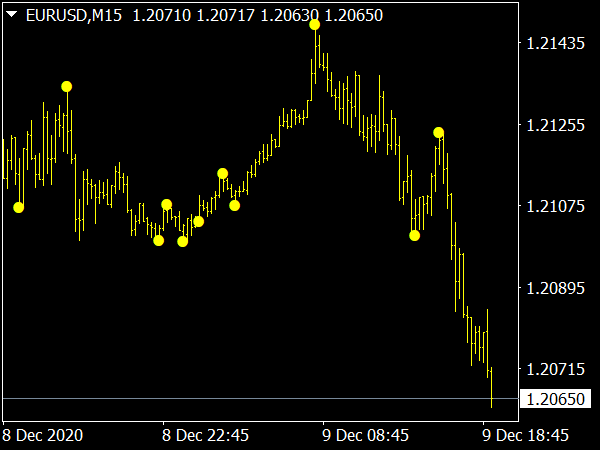

1. Select the Right Time Frame: Scalpers generally work on lower time frames such as 1-minute, 5-minute, or 15-minute charts. This allows for quick decisions and fast execution.

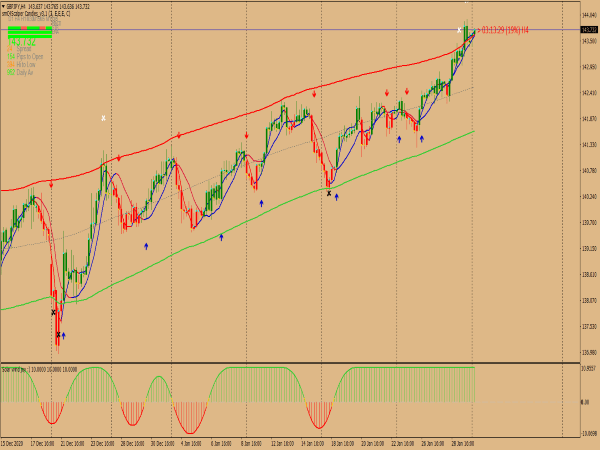

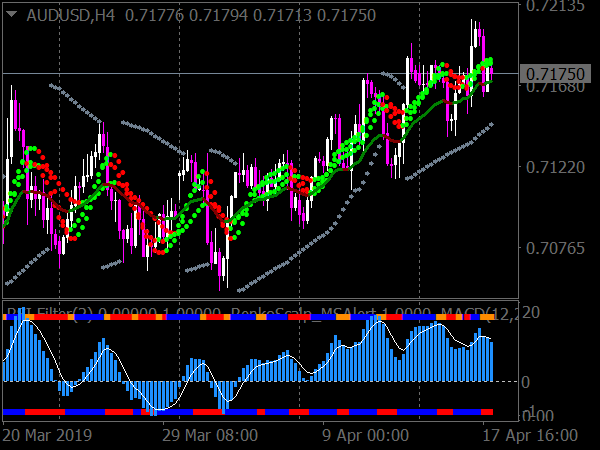

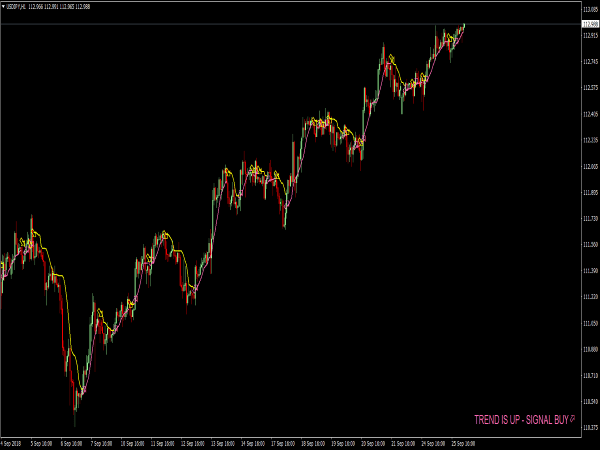

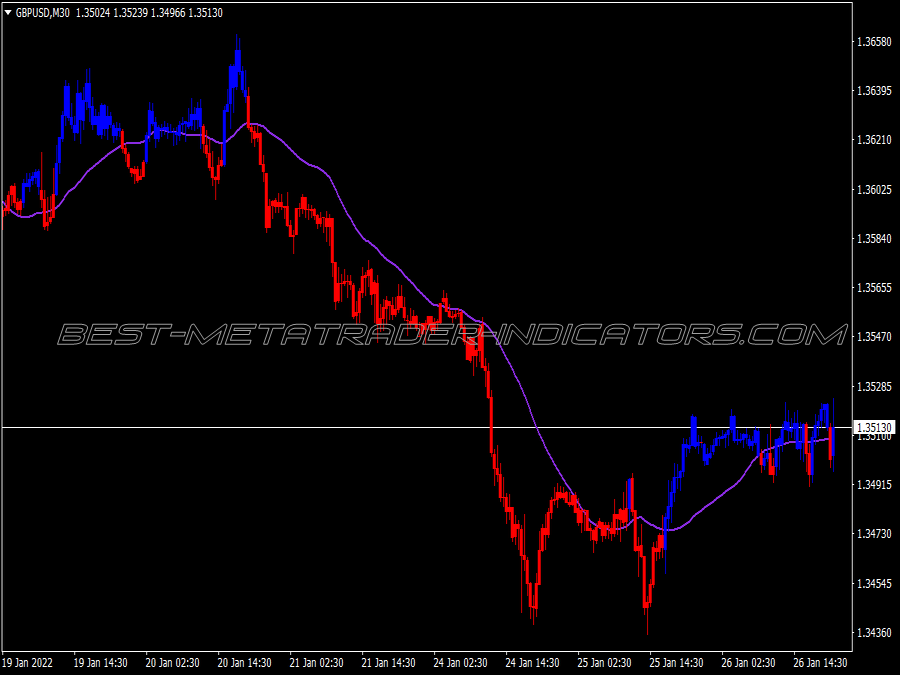

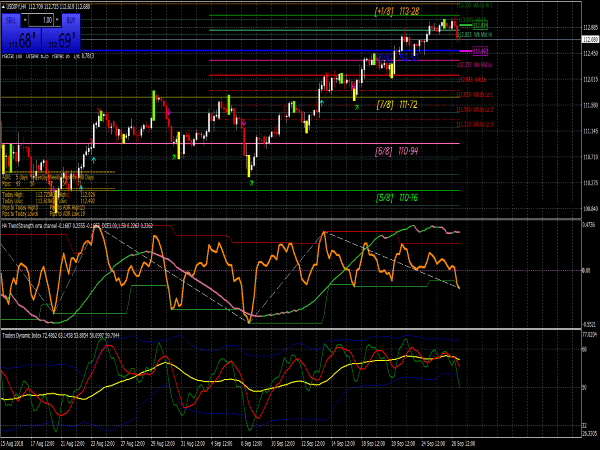

2. Use Simple Moving Averages (SMA): A pair of SMAs can help identify trends. For instance, using a 20-period and 50-period SMA can signal entry opportunities when the shorter SMA crosses above the longer SMA (bullish signal) or below it (bearish signal).

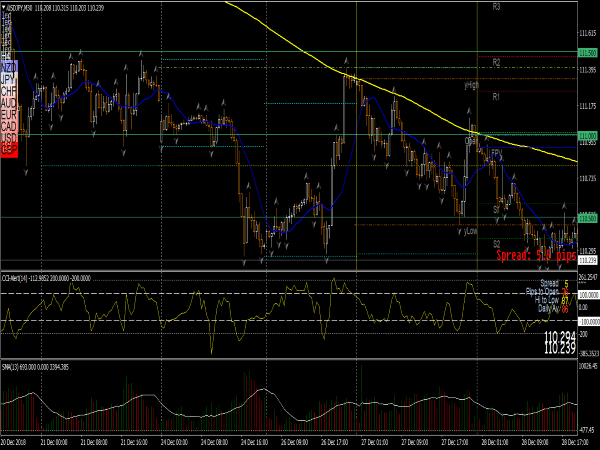

3. Relative Strength Index (RSI): The RSI is an invaluable momentum oscillator. When the RSI crosses above 70, the asset might be overbought (indicating a potential sell signal), and when it crosses below 30, it may be oversold (indicating a buy signal). Scalpers can look for divergences for entry points as well.

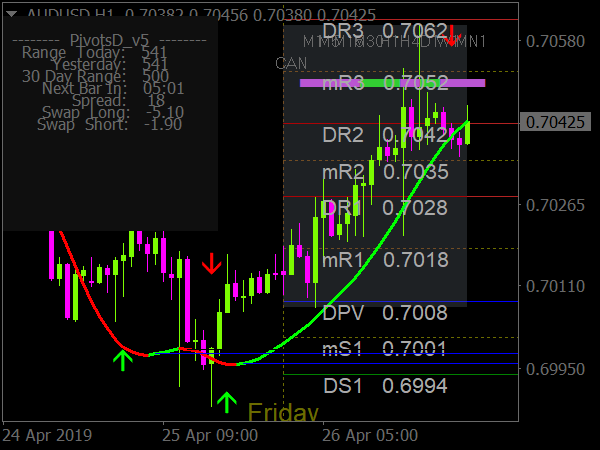

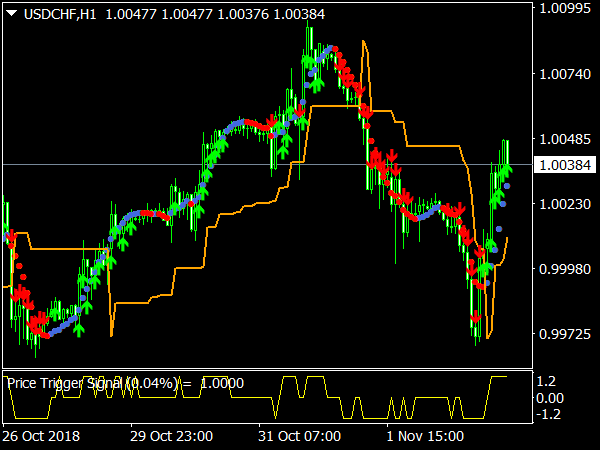

4. Bollinger Bands: These bands consist of a middle line (SMA) and two outer bands that represent standard deviations from the average. When the price touches the lower band, it may signal a buying opportunity, whereas contact with the upper band may indicate selling.

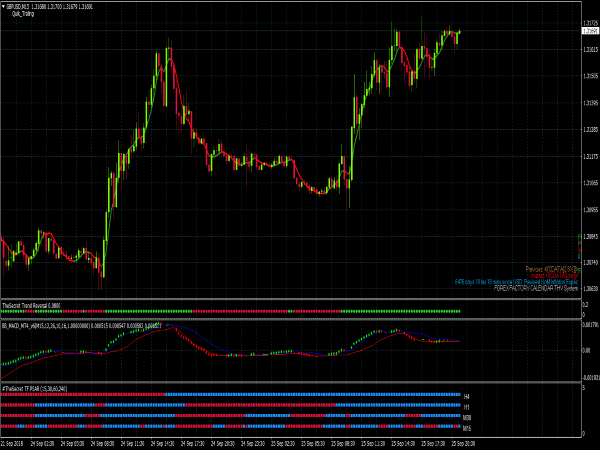

5. MACD (Moving Average Convergence Divergence): This momentum indicator helps indicate changes in trend direction. Look for crossovers - when the MACD line crosses the signal line, it can present potential entry points.

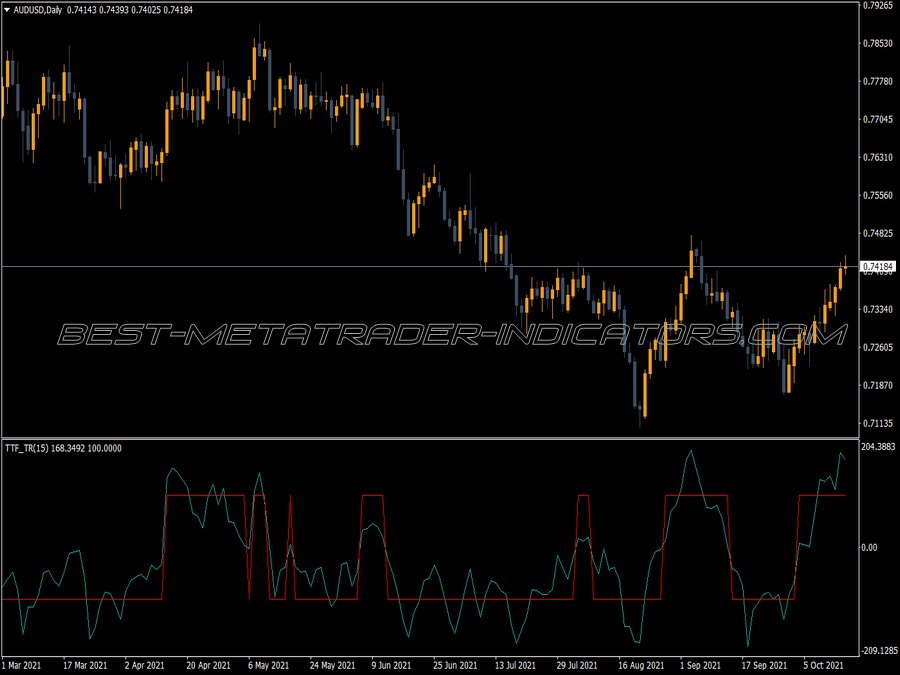

6. Volume Indicators: High trading volume often precedes price movements. Use indicators like the Volume Weighted Average Price (VWAP) to determine optimal entry points when the price trades above or below this average, suggesting a price trend.

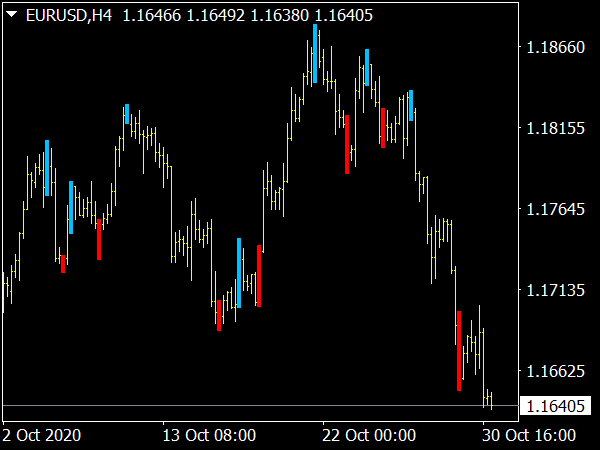

7. Candlestick Patterns: Familiarize yourself with patterns such as pin bars, engulfing candles, and doji formations in lower time frames, as they can provide insight into potential reversals or continuations.

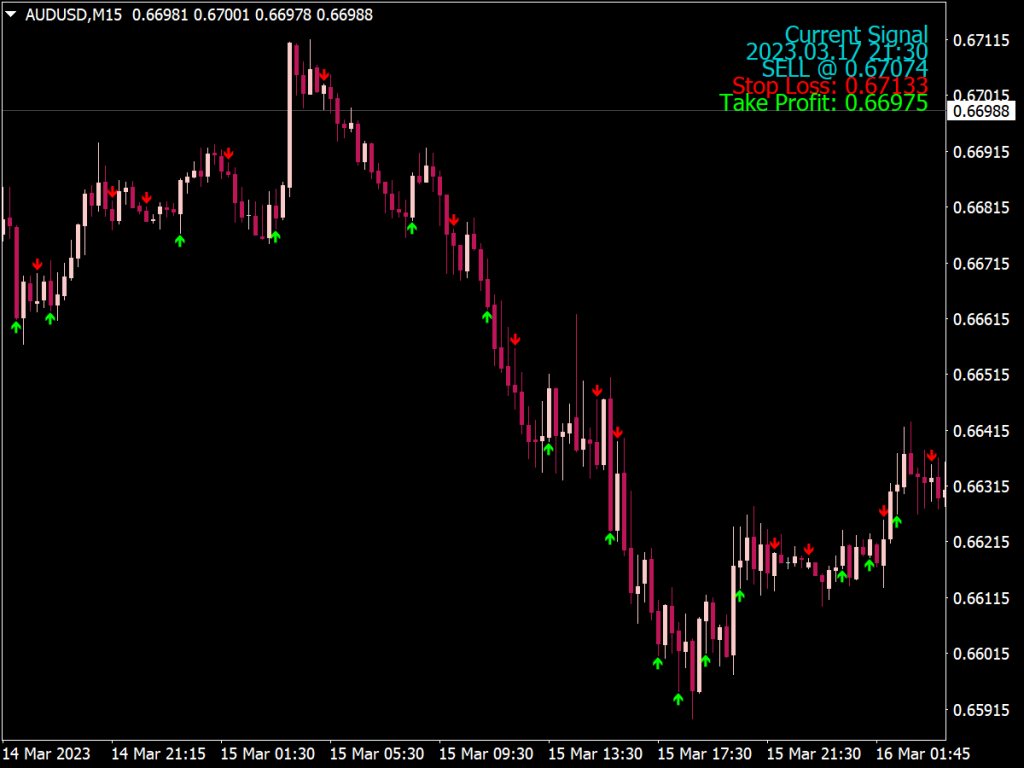

8. Set Risk Management Parameters: Always establish clear stop-loss and take-profit levels to protect your capital. A typical scalping strategy might aim for a risk-to-reward ratio of 1:2 or higher.

9. Market News Awareness: Stay updated on financial news and economic announcements. Major events can cause quick price swings; knowing when to trade or avoid trading around those times is crucial.

10. Practice Discipline and Emotional Control: Scalping can be stressful due to the quick pace of trades. Stick to your strategy and avoid overtrading or revenge trading after losses.

11. Demo Trading: Before committing real funds, practice your strategies on a demo account to refine your skills and gain confidence without financial risk.

By incorporating these tips and indicators into your scalping strategy, you can enhance your ability to make fast and informed trades, leading to more successful outcomes in the market. Always remember that continuous learning and adaptation are key to mastering the art of scalping.