Submit your review | |

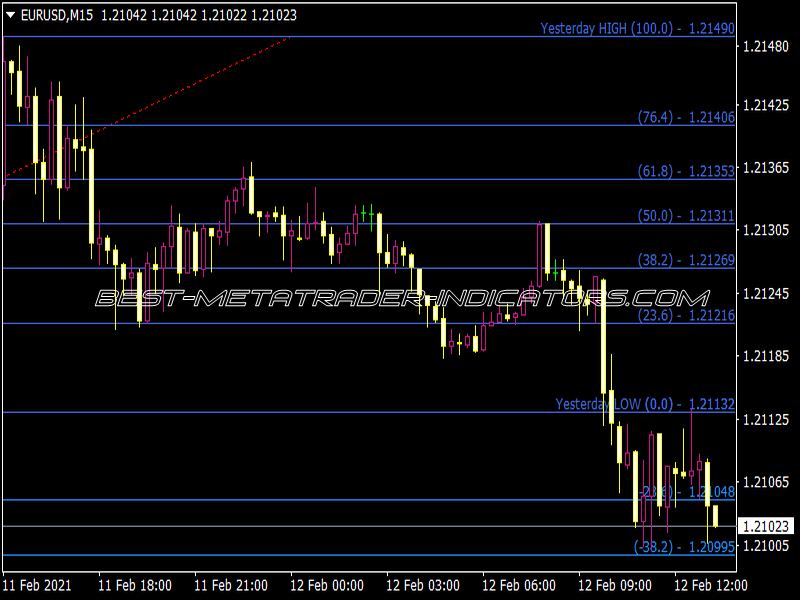

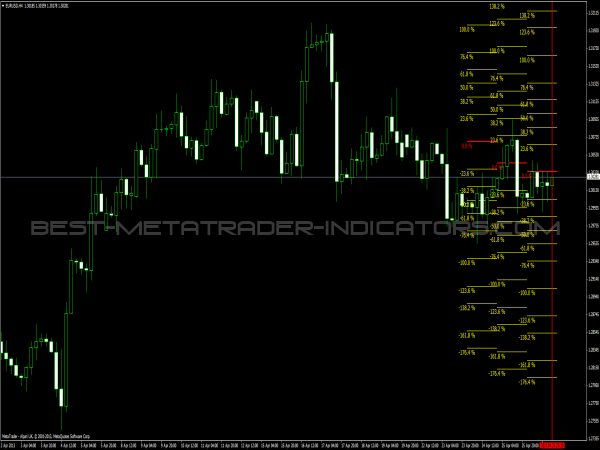

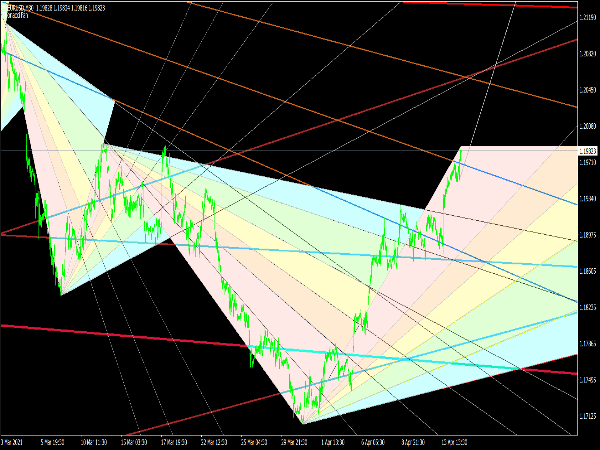

The Fibonacci Retracement Indicator for MT4 is a powerful tool that helps traders identify potential reversal levels on a price chart, utilizing the Fibonacci ratios to guide decision-making. Fibonacci retracement is based on the idea that markets will retrace a portion of their previous trend before continuing in the original direction. Here are some trading tips and rules to effectively use this indicator:

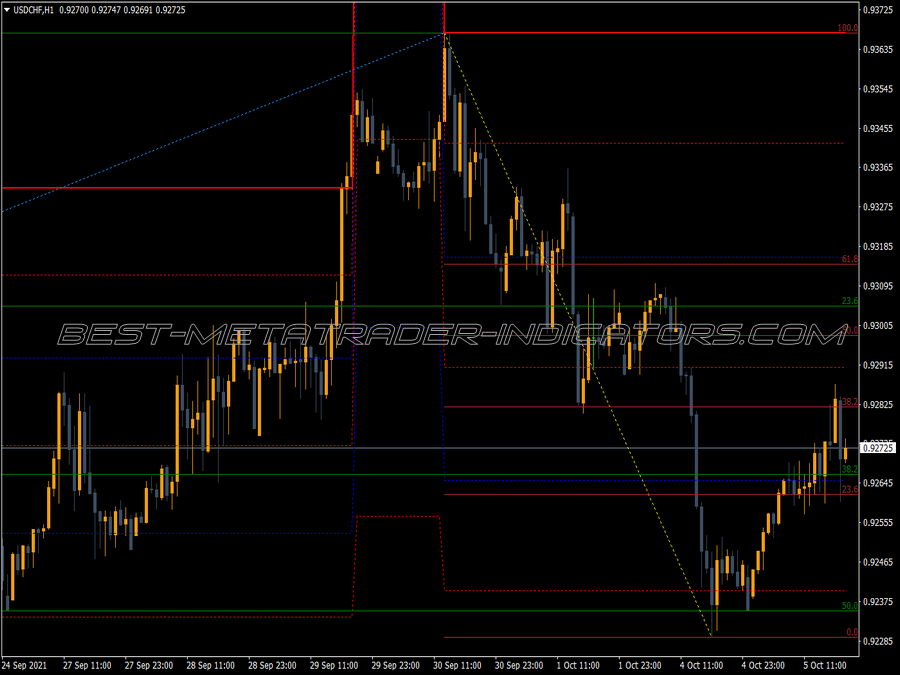

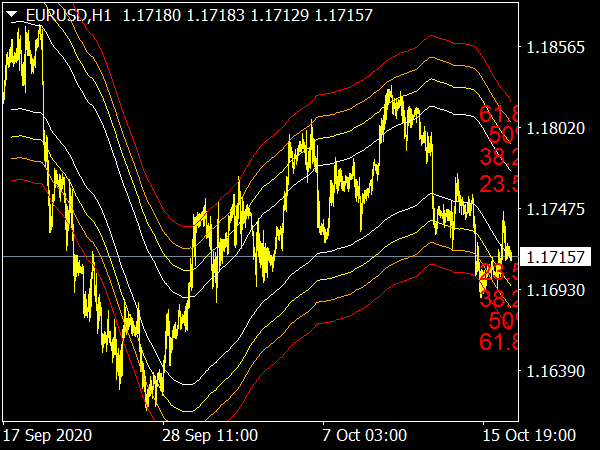

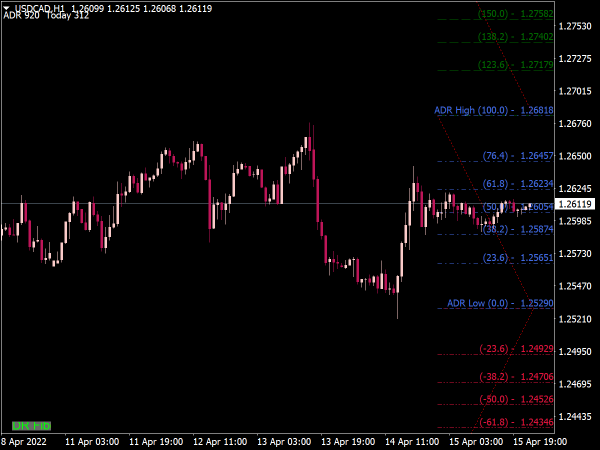

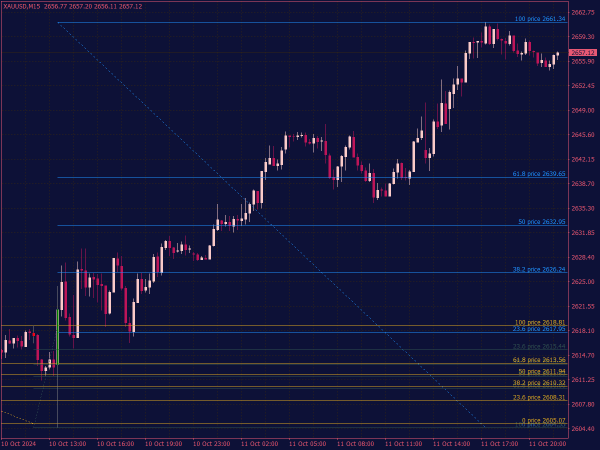

1. Understand the Basics: Familiarize yourself with Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 100%). These are derived from the Fibonacci sequence and reflect key levels where price may reverse.

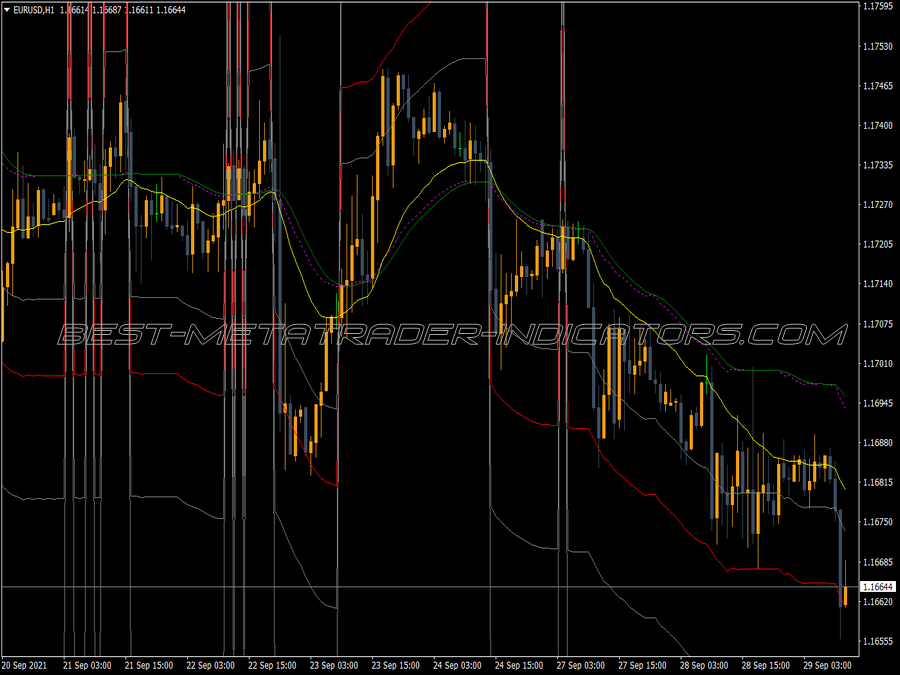

2. Indicator Setup: After installing the Automatic Fibonacci Retracement Indicator in your MT4, ensure it is configured correctly. Most versions allow for customizing the colors and styles of the lines to enhance visibility.

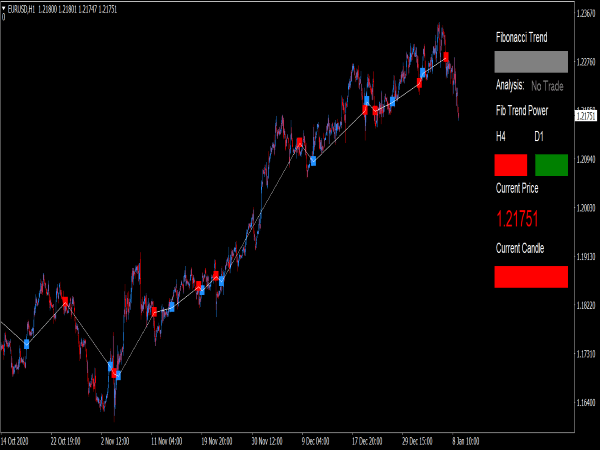

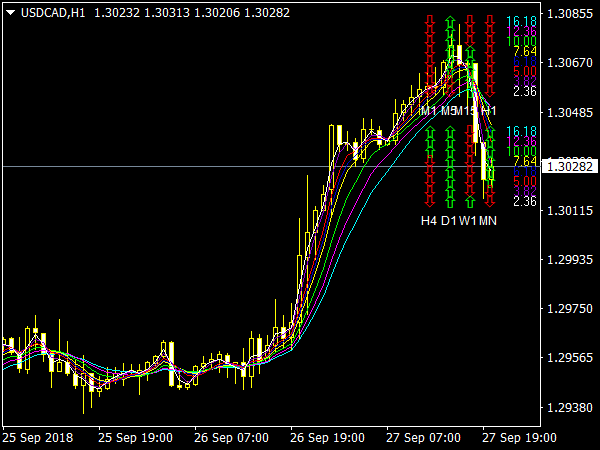

3. Identify Trends: Use the indicator in conjunction with trend analysis. Look for clear bullish (upward) or bearish (downward) trends before applying Fibonacci levels to enhance the accuracy of potential retracement areas.

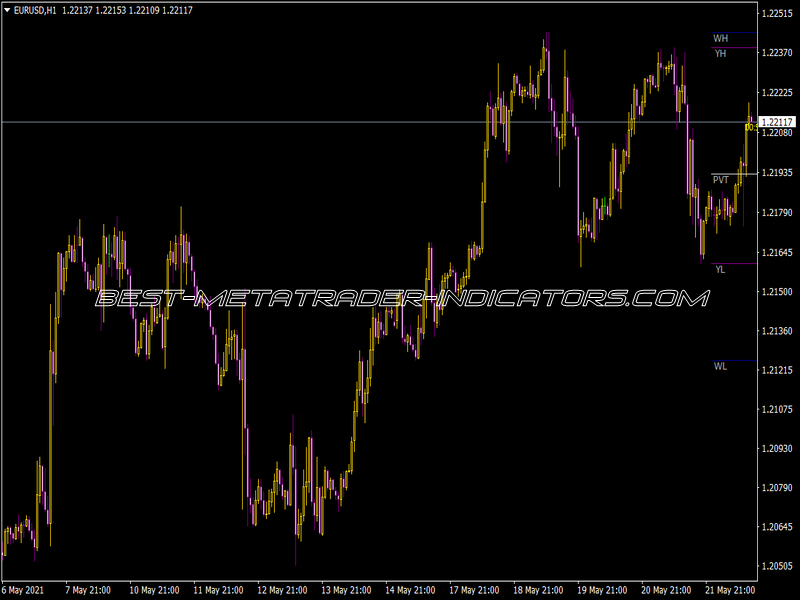

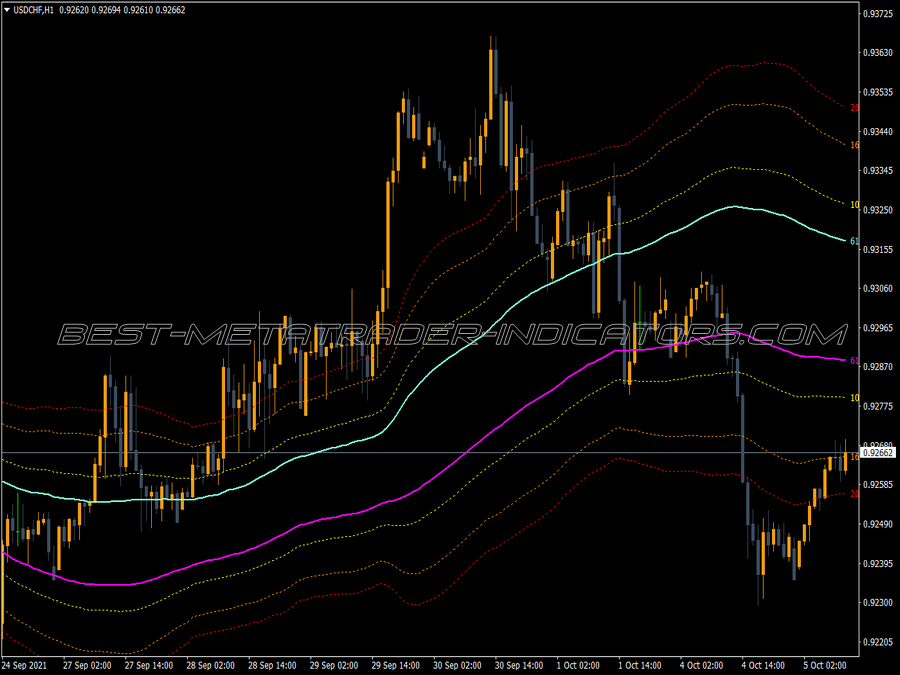

4. Look for Confluence: Identify areas where Fibonacci levels coincide with other technical indicators or chart patterns (e.g., support and resistance levels, moving averages). This confluence can strengthen the validity of the retracement prediction.

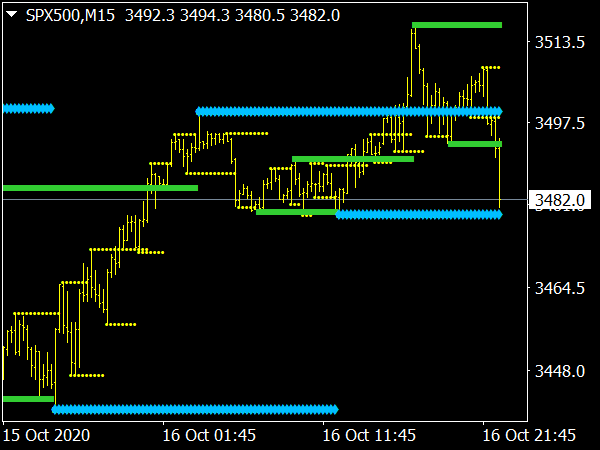

5. Entry Points: Consider entering a trade at or near Fibonacci levels, particularly at 38.2% and 61.8% retracements, where price is likely to reverse. Use other confirmation signals such as candlestick patterns or oscillator signals to enter trades with more confidence.

6. Stop Loss Placement: Manage risk by placing your stop loss just beyond the nearest Fibonacci level beyond your entry point. For example, if entering a long position at the 61.8% retracement level, place your stop below the 78.6% level.

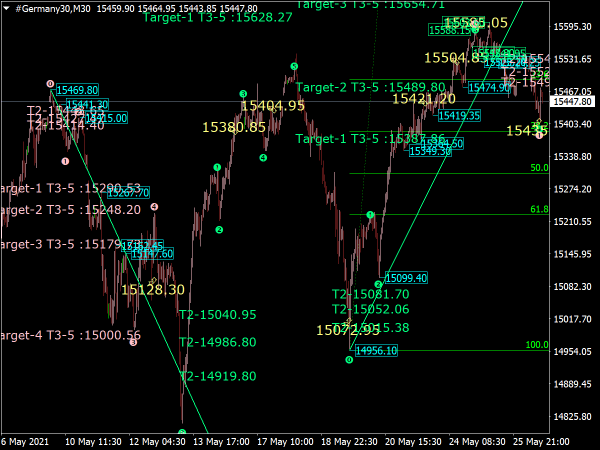

7. Take Profit Targets: Set profit targets at the next key Fibonacci level (e.g., if you enter at 61.8%, aim for the 38.2% level of the next upward move). This strategy helps to maximize potential gains while minimizing risks.

8. Use Multiple Time Frames: Analyze Fibonacci levels on various time frames. A retracement that looks significant on a 1-hour chart may not carry the same weight on the daily chart. Higher time frames often provide stronger signals.

9. Practice Patience: Wait for price action to convincingly show a reaction at Fibonacci levels before executing your trade. Jumping in too early can lead to false signals and increased losses.

10. Avoid Relying Solely on Fibonacci: While Fibonacci levels are helpful, they should not be your only trading strategy. Combine them with other technical analysis tools to create a well-rounded trading plan.

11. Backtesting: Conduct backtesting on historical data to see how the Automatic Fibonacci Retracement Indicator performed in different market conditions. This can enhance your understanding of its effectiveness and refine your strategy.

12. Market News Awareness: Economic news and events can significantly impact price movements. Be aware of upcoming news releases that could affect the asset you are trading, modifying your Fibonacci analysis accordingly.

13. Continuous Learning: Stay updated with market trends and patterns to refine your use of Fibonacci retracement. Explore educational resources, webinars, and forums to share insights and learn from other traders.

14. Emotion Management: Trading can be emotionally taxing, particularly after losses. Stick to your trading plan and avoid letting emotion dictate your actions. Discipline is key to long-term success.

15. Regular Review: Regularly review your trades and outcomes to assess what worked and what didn’t. Learning from successful trades and mistakes will help improve your trading approach over time.

Integrating the Automatic Fibonacci Retracement Indicator into your trading strategy can enhance your ability to predict potential price reversals and optimize trading entries and exits. By following these tips and rules, traders can navigate the complexities of the market with greater confidence, ultimately leading to improved performance and profitability. Always remember that no single indicator can guarantee success; the key is to utilize a comprehensive trading plan tailored to your individual risk tolerance and goals.

I have always been a staunch advocate of any type of indicator which includes Fibonacci trading. I feel Fibonacci levels are the most accurate way to enter and exit a trade.

Isaac can u teach me how to use the fibo indicator?

Great tool to spot fibonacci cluster 👍