Submit your review | |

ℹ️ What are Bid, Ask, Lot and Spread?

Learning about the bid, ask, lot and spread of a pair is one of the first baby steps that every trader has to take. Fortunately, it is not difficult to learn. Let us first know the definition of the following terms.

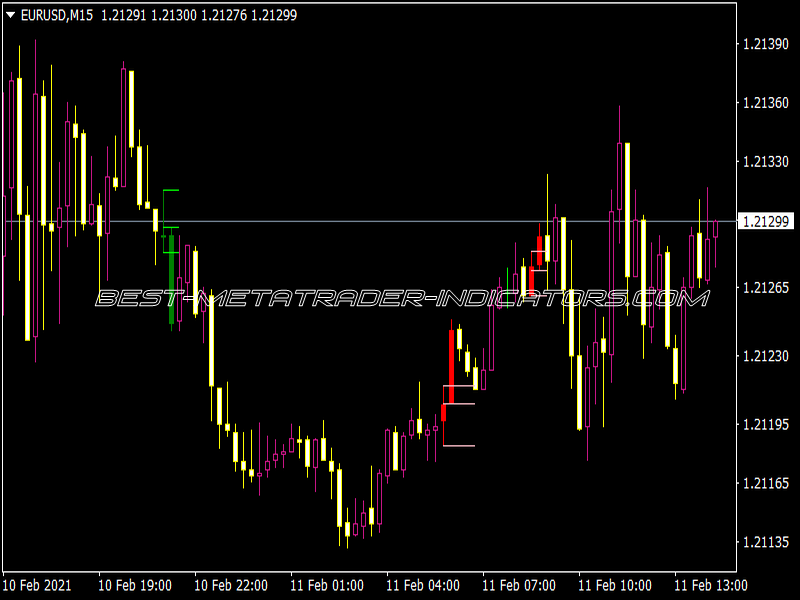

Bid Price: The highest price any buyer is willing to pay for a given security at a given time. Quoted bid is a maximum price that a market maker will pay for a security.

Ask Price: The price a seller wants for his/her security. Ask price is also called as offer price, offer, asking price, or simply ask. Ask price is always a little higher than the bid price.

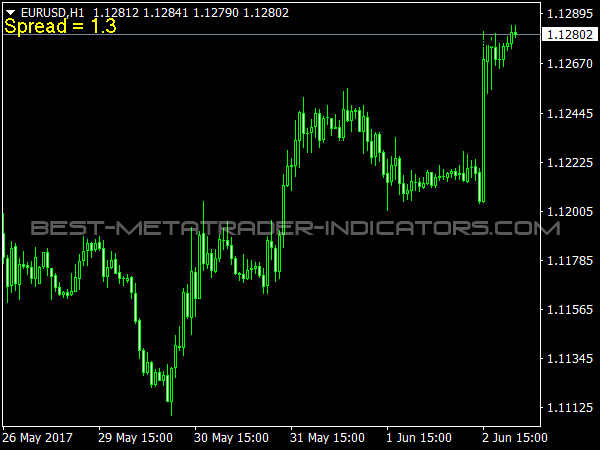

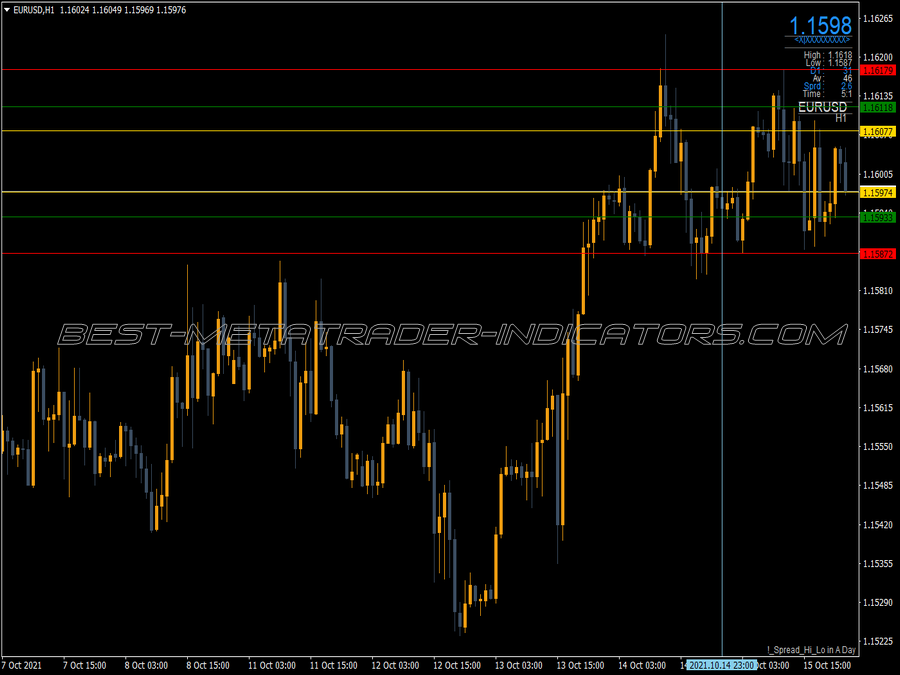

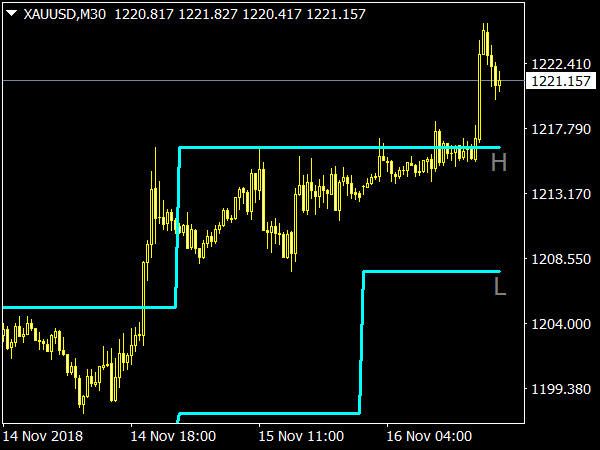

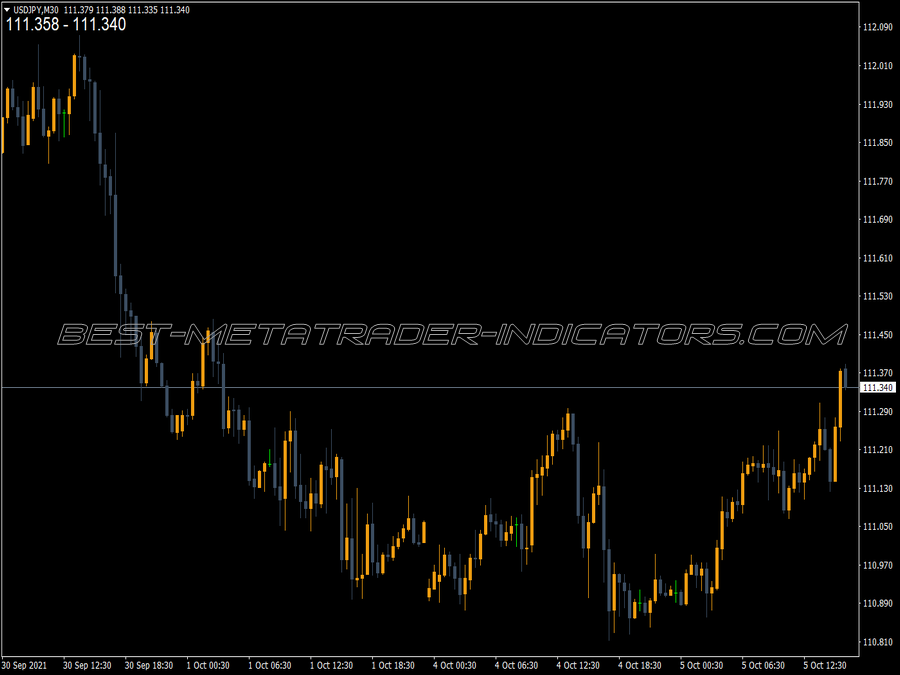

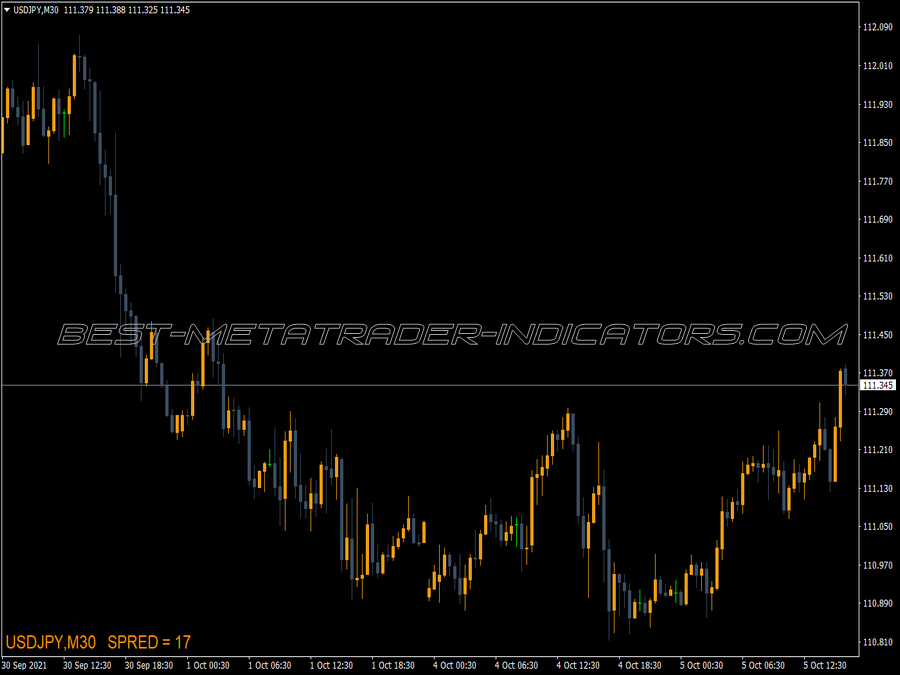

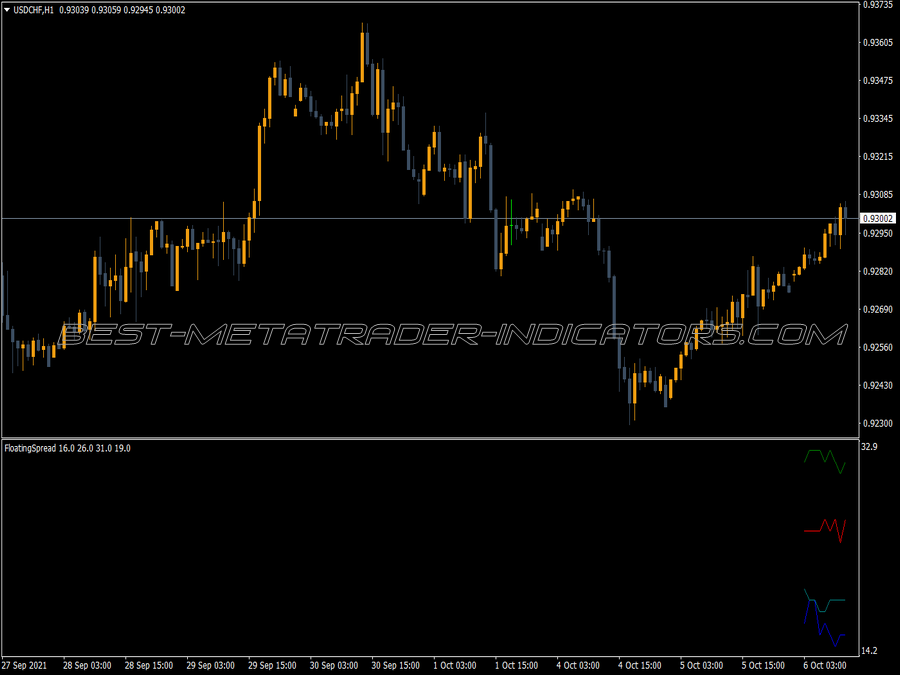

Spread: The difference between the bid price and the ask price is called as "the spread". This difference represents a profit for the broker.

Lot: The standard transaction size in a forex transaction. Usually this is 10,000 currency units, but it can be 1,000 in case of mini-lots. Although the lot size usually varies depending on the broker.

Factors that affect the Spread Value

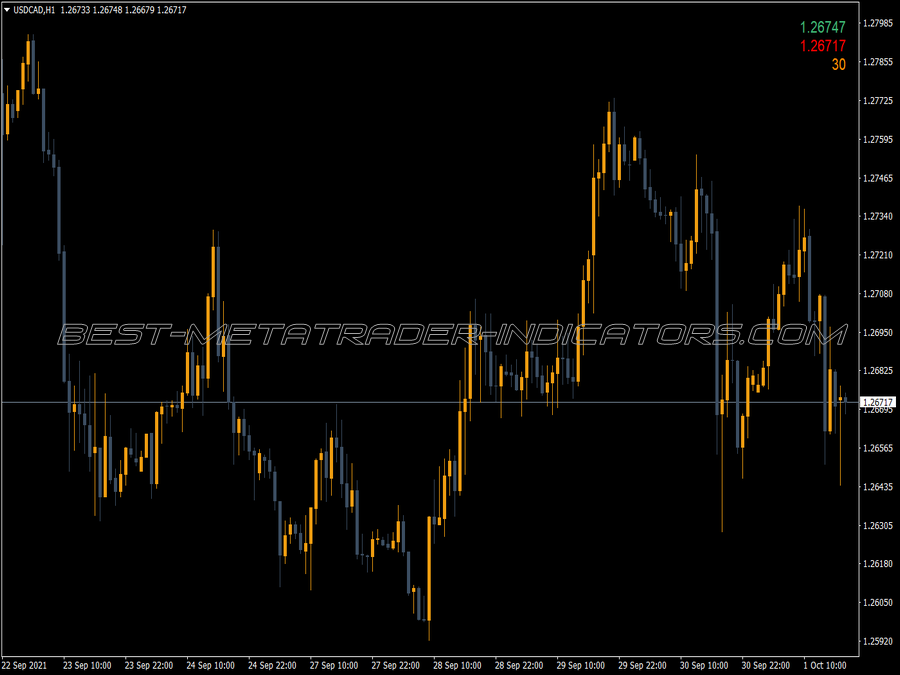

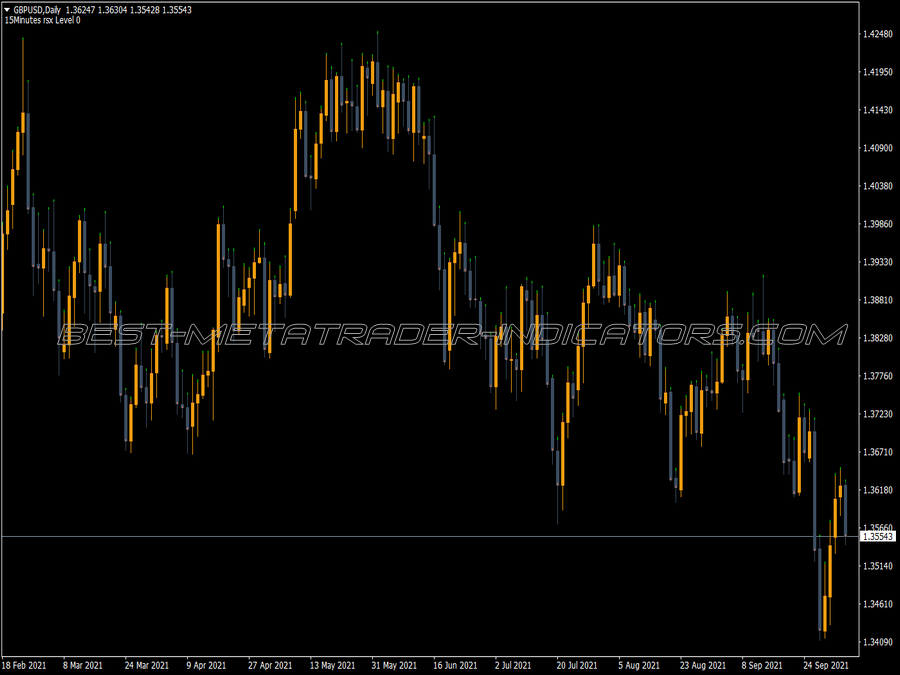

The spread for a particular pair is defined by several factors. The most evident factor is a pair's liquidity, which means the volume or amount of transactions that are traded for the pair on a daily basis. This concept is very similar to the brokerage applied on a particular stock. Some stocks are traded regularly, while others are only traded a few times a day.

The stocks and indexes that have large trading volumes will have narrower bid-ask spreads than those that are infrequently traded. This makes sense because when a stock has a low trading volume: it is considered illiquid. And as a result, a broker will require more compensation for handling the transaction, accounting for the larger spread.

Another important factor that affects the spread is volatility. Volatility usually increases during the periods of rapid market decline or advancement (such as major economic releases). At these times, the bid-ask spread is much wider because market makers want to take advantage of volatility and profit from the change. When volatility is low and uncertainty and risk are at a minimum, the bid-ask spread is narrow.

The spread can say a lot about a pair and, therefore, we should be aware of all the reasons that are contributing to the bid-ask spread of a pair we are following. The investment strategy and the amount of risk that you are willing to take on may affect what bid-ask spread you find acceptable.